[Last updated on January 28, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving the money to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. If you’re looking for the regular backdoor Roth, where you contribute to a Traditional IRA (not a 401k-type plan) before converting to Roth, please see How To Report Backdoor Roth In TurboTax (Updated).

A mega backdoor Roth is a great way to put additional money into a Roth account without paying much additional tax. Not all employer plans allow non-Roth after-tax contributions, but some estimated that 40% of people can do it.

Suppose your employer plan allows it, and you executed a Mega Backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return. Here’s how to do it in TurboTax.

Use Desktop Software

You should do it in TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

If you use other tax software, please see:

- How To Enter Mega Backdoor Roth In H&R Block Tax Software or

- How To Enter Mega Backdoor Roth in FreeTaxUSA

Convert Within the Plan or Roll Over to a Roth IRA

You can do the Mega Backdoor Roth in two ways: convert within the plan or roll over to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Rolling over to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within the Plan or Out to a Roth IRA? for some minor differences between the two approaches.

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). Your contributions earned $200 before you converted to the Roth account within the plan or rolled over to your Roth IRA. You converted $10,200 to your Roth account.

I’m using 401(k) as shorthand. It works the same in a 403(b).

Split Rollover

A split rollover means rolling over the money to two different destinations. A split rollover is useful only when the non-Roth after-tax contributions generate substantial earnings before you convert to Roth. Most people don’t do a split rollover because the earnings are insignificant or zero when they convert soon enough.

You can skip this section and go directly to 1099-R entries if you converted entirely within the plan, or if you rolled over both the contributions and the earnings to a Roth IRA without splitting.

If you did a split rollover by rolling over non-Roth after-tax contributions to a Roth IRA and the earnings to a Traditional IRA, and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R and enter two 1099-R forms in TurboTax. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block for how to split the 1099-R form.

If you imported the single 1099-R that covers both rollovers, delete it and manually enter two 1099-R forms. The first 1099-R shows rolling over the non-Roth after-tax contributions to a Roth IRA, for example:

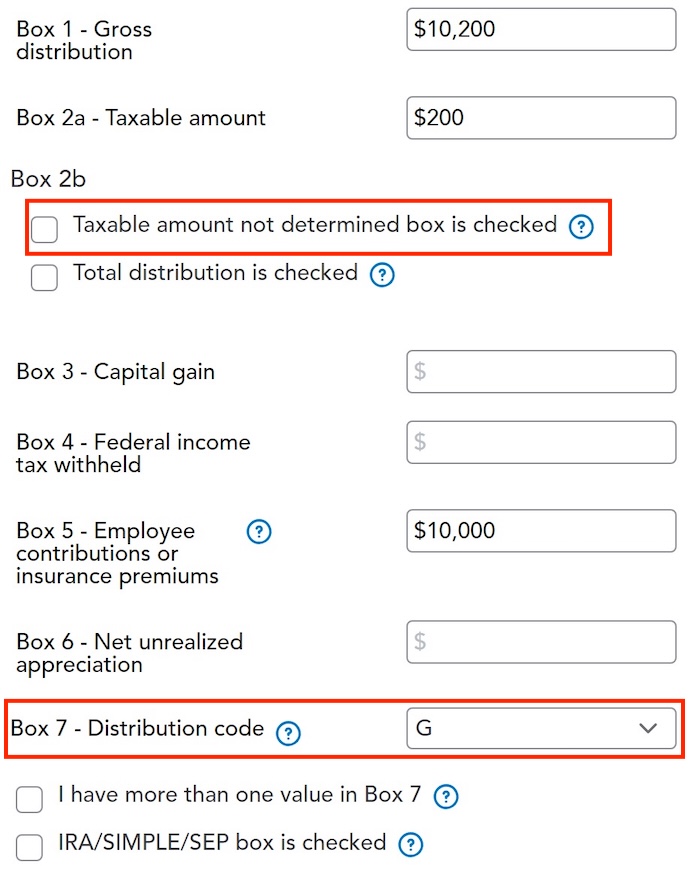

| Box 1 Gross Distribution | $10,000 |

| Box 2a Taxable Amount | $0 |

| Box 2b Taxable amount not determined | not checked |

| Box 5 Employee contributions/Designated Roth contributions or insurance premiums | $10,000 |

| Box 7 Distribution code(s) | G |

| Box 7 IRA/SEP/SIMPLE checkbox | not checked |

The second 1099-R shows rolling over the earnings to a Traditional IRA, for example:

| Box 1 Gross Distribution | $200 |

| Box 2a Taxable Amount | $0 |

| Box 2b Taxable amount not determined | not checked |

| Box 5 Employee contributions/Designated Roth contributions or insurance premiums | $0 |

| Box 7 Distribution code(s) | G |

| Box 7 IRA/SEP/SIMPLE checkbox | not checked |

The rest of this post shows what to do with the first 1099-R (after-tax to Roth IRA). The second 1099-R (earnings to Traditional IRA) is a straight Traditional-to-Traditional rollover.

You don’t need to split the 1099-R if you converted entirely within the 401(k) plan — everything to the Roth 401(k), or after-tax contributions to the Roth 401(k) and the earnings to the pre-tax 401(k).

1099-R Entries

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

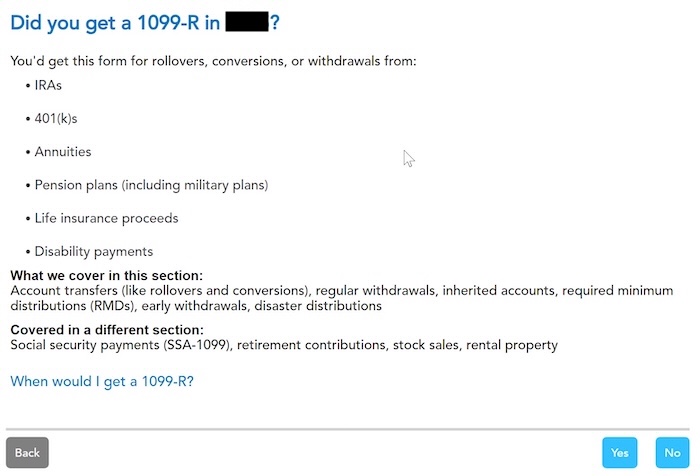

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan. Import the 1099-R if you’d like. I’m skipping import and entering it manually.

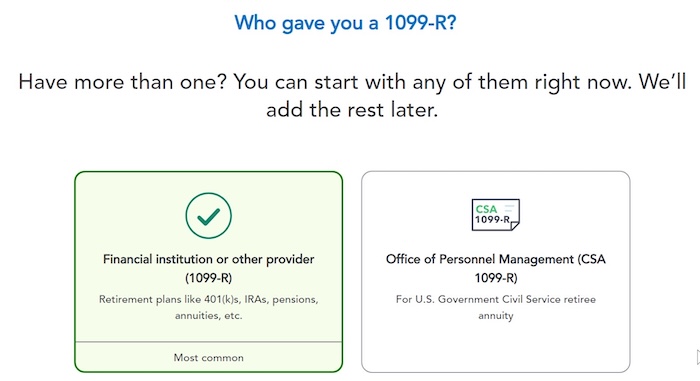

The 1099-R is from a financial institution. Enter the payer information as shown on your 1099-R.

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly.

The earnings portion should be in Box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The non-Roth after-tax contributions (the “principal”) should be in Box 5. Box 7 should show a code G. Finally, “IRA/SEP/SIMPLE box is checked” should NOT be checked.

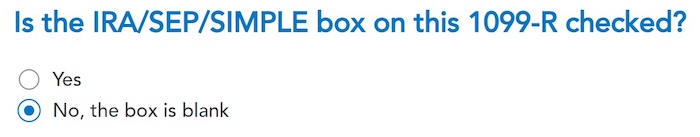

TurboTax wants to confirm that the IRA/SEP/SIMPLE checkbox is not checked.

Rollover Destination

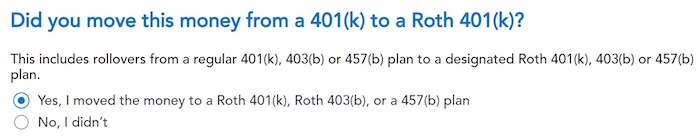

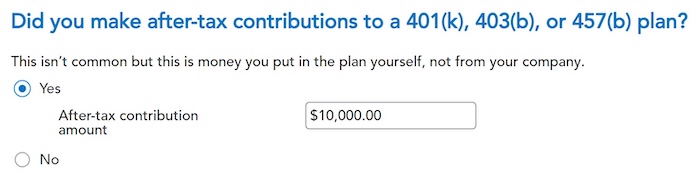

If you converted to Roth within the plan, answer Yes here. If you took the money out of the plan to a Roth IRA, answer No.

If you answered “No” to the previous question, confirm that the money went to a Roth IRA.

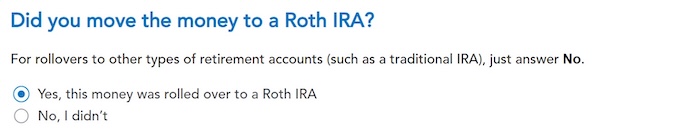

We don’t have any of these special situations.

After-Tax Contributions

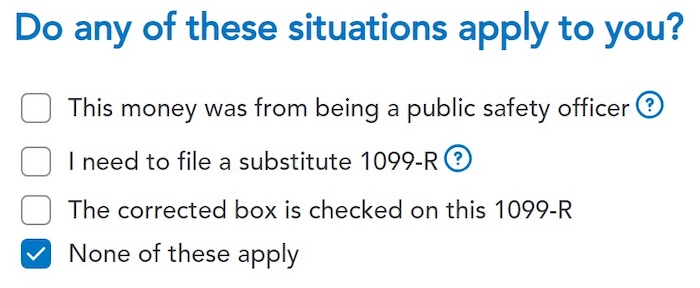

Answer Yes to confirm that you made non-Roth after-tax contributions to your plan. TurboTax automatically pulls up the amount from Box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

You’re done with this one 1099-R. Enter more if you have them. Click on “Done” on the 1099-R summary screen.

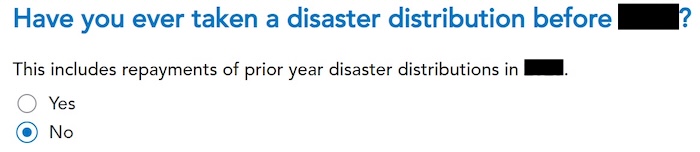

We haven’t taken any disaster distributions.

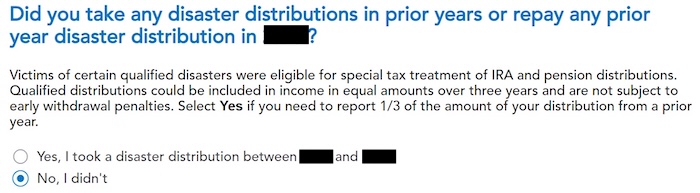

We already said no, but TurboTax wants to ask in a different way.

Verify on Form 1040

Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 non-Roth after-tax contributions.

Click on Forms on the top right.

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. It shows zero if you don’t have any earnings. The “Rollover” box in Line 5c may or may not be checked. TurboTax checks it when the taxable amount on Line 5b is positive. It doesn’t check it when it’s zero.

With a Mega Backdoor Roth, you put an extra $10,000 into your Roth account. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sangeeta says

Hi Harry,

Thanks a lot, you are a wonderful and knowledgeable teacher. But here you have mentioned only @ 401K plan –Mega door if it allows. While you were on vacation I had left you a question on another link on your spreadsheet calculations for Business income Mega door Roth amount.I am still waiting for an answer on that.

Thanks

Harry Sit says

Sangeeta – I answered it there.

Shane says

Hi Harry,

How does this work if you want to split the after tax contribution from the earnings so the after tax amount goes to Roth IRA and the earning goes to Traditional IRA?

Thanks.

Harry Sit says

You get two 1099-Rs.

K says

https://ttlc.intuit.com/community/retirement/discussion/1099-r-401k-after-tax-contributions-rollover-to-roth-ira-and-ira-account/00/1106072/page/3

Can anyone confirm that entering a single 1099-R as two in Turbotax (as described in link above) is the correct method? ie. totals in aggregate all the same but enter split into 1) values that were related to contributions that went to Roth and 2) amount related to earnings that went to Traditional. Thanks!

Alan says

Yes, that worked for me with TurboTax for the 2021 tax year

Specifically, the steps in the last post at:

https://ttlc.intuit.com/community/retirement/discussion/1099-r-401k-after-tax-contributions-rollover-to-roth-ira-and-ira-account/00/1106072/page/2

(macuser_22, February 19, 2022 9:29AM)

The same steps were described on Harry’s page at

https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html#comment-29218

Harry Sit says

That’s correct. If you receive only one 1099-R for two rollovers, you split the one 1099-R into two when you enter into TurboTax.

Brian says

Problem is when you roll your after-tax contributions to a Roth IRA and after-tax gains into a Solo 401k.

Turbo treats the gains as taxable and puts them into 16b.

Any solution for this?

Brian says

Also:

Fidelity only sent one “combined” 1099-R. I had extensive discussions with Fidelity and they claim this is correct. Fidelity claims it’s a Turbo issue.

The gains are a non-trivial amount of money, since I just quit my job and had gains from many years of after-tax contributions.

Harry Sit says

Try entering the 1099-R as two, one for the amount gone into Roth and another for the amount gone into traditional.

Brian says

Good idea. As long as the IRS computers aggregate all of my 1099-Rs and match against an aggregation of all of my 5498s, it will be correct (if they try to match one-for-one, it will get kicked out as not matching).

Thanks TFB, I’ll give that a shot.

I like that idea much better than Turbo’s suggestion that I alter Box 5.

Hongyan says

Hi Harry,

When I transferred my after-tax 401k to my Roth IRA account, they made a mistake and put my money into my traditional IRA account instead of my Roth IRA account. Then I transferred it to my Roth IRA account. Therefore I received two 1099-R with same amount of money (one from the 401k institution, and the other from the IRA brokerage firm). Based on your Turbotax walkthrough, what differences should I do to make sure both 1099-R are covered? Thank you very much!

Harry Sit says

It would’ve been best to correct the mistake when it happened as opposed to letting it stand and building up on the mistake.

Now, it depends on who made the mistake and how exactly you transferred the money to your Roth IRA. If the 401k provider processed your request to rollover to a Roth IRA as a rollover to a traditional IRA, which matched what actually happened, AND you did the transfer as a recharacterization (not a conversion), you don’t have any problems. You just enter two 1099-Rs separately. If you did the transfer as a conversion AND you don’t have other traditional, SEP or SIMPLE IRA that creates a pro-rata issue, you also don’t have any problems. If you did the transfer as a conversion AND you do have other traditional, SEP or SIMPLE IRA, you run into a pro-rata issue which makes you pay tax on the conversion.

If the 401k provider processed it correctly as a rollover to a Roth IRA but your IRA provider deposited the money into a traditional IRA, you have a mismatch between paper and reality. If you subsequently did the transfer as a conversion, you have a potential issue with paying tax twice. The 401k provider’s 1099-R says you should pay tax because you rolled over to Roth. The IRA provider’s 1099-R says you should pay tax because you converted from traditional to Roth.

See Traditional and Roth IRA: Recharacterize vs Convert.

Hongyan says

Hi Harry,

Thank you so much for the detailed response! My 401k provider somehow did not include my roth IRA account number when sending the check to the IRA provider so the IRA provider intuitively deposited the check into my traditional IRA. The transfer from traditional IRA to Roth IRA is done as a conversion (without pro-rata issue). May I ask how do I find out whether the 401k provider processed the check correctly as a rollover to a roth IRA or not? The 1099-R they sent to me has code G in box 7. Does it mean they did it correctly?

So if my case creates the “mismatch between paper and reality” situation, what can I possibly do? Sorry for my multiple questions and thank you for your patience and help!

Harry Sit says

If the 1099-R from the 401k provider looks like the one in this post, with a small taxable amount in box 2a and your after-tax contribution in box 5, the 401k provider did it correctly. It would be rare to have two mistakes on top of each other and end up matching the reality. Although the check didn’t include your Roth IRA account number, it likely included the word ‘Roth’ there. Contact your IRA provider and ask for a copy of that check. If it had the word ‘Roth’, that’s your proof the IRA provider made the mistake and it gives you reason to ask them to correct that mistake. In order to correct it, they may ask you to recharacterize your conversion first, which makes the money go back to the traditional IRA. Then the IRA provider can do whatever is necessary on their end to move it into the Roth IRA again the right way, where it should’ve landed in the first place.

Hongyan says

Hi Harry,

Thank you. I called the IRA provider and they only claims that they will send out form 5498 in May to show that the distribution amount in their 1099R is from a rollover, which should “offset” the taxable amount. I don’t know whether it is true and it did not help me with my tax return using turbotax at this moment either. I think I might go to a CPA instead.

Harry Sit says

It’s not true. Get the copy of that rollover check and show them they put it in the wrong account. Get them to correct it. A CPA won’t help if the IRA provider doesn’t correct it because the CPA can’t change reality. A CPA can help you with the paperwork to report the reality only *after* the IRA provider corrects it.

Harry Sit says

Also try contacting your 401k provider to see if they can send you a copy of that rollover check.

Hongyan says

Hi Harry,

Thank you for all the advice. I really appreciate it! It turned out the 401k provider forgot to mention anything about my Roth account. I will try to go to my IRA provider tomorrow and talk to them one more time to see if any correction is possible. My distribution is about 7k and double tax means paying ~2k more for me!!

Harry Sit says

In that case ask your 401k provider whether they can redo your 1099-R to make it a rollover to traditional because they didn’t mention anything about Roth to the receiving end. When they do a rollover to Roth they are supposed to say Roth.

Hongyan says

Hmm, it sounds quite doable. I will definitely try it tomorrow. But I guess I am still a little confused. After the 401k provider redo the 1099R to make it a rollover to traditional IRA, I assume this 1099R will not make me pay tax at all (for the entire distribution including the small amount of earnings, is it correct?). But for the 1099R from IRA provider, how do I make sure I only get taxed on the small earnings? This 1099R from IRA provider looks exactly like the one you would get by doing backdoor Roth as shown in your post “How To Report Backdoor Roth In TurboTax”.

Another question is, in this case can I still use turbotax for tax return or I will have to find a CPA to get it done properly?

Thank you.

Harry Sit says

Correct. The only difference is box 2a will show 0 for a rollover to traditional. You just enter the two 1099-Rs independently. On the IRA conversion one when it asks you about your basis, you put in the number in box 5 from the 401k 1099-R. TurboTax can still do it.

Hongyan says

Hi Harry,

I see. I think this will solve the problem. Thank you Harry for all the advice and quick response!

Future Proof MD says

Thanks Harry, great post! I have a question regarding my SEP IRA account. Do I have to “hide” that balance when performing a Mega Backdoor Roth IRA from my 403b account? In other words, do I trip the pro-rata rule if I have a SEP IRA when doing a Mega Backdoor Roth conversion?

Harry Sit says

Not if you go directly from 403b to Roth IRA. You trip it when you make an interim stop at a traditional IRA.

Rose says

Thank you for this great visual explanation!

I have a question about the step which asks for the after-tax contributions. In 2017 I contributed about $15k after-tax, but since my plan only allows quarterly in-plan Roth conversions I ended up only being able to rollover $12k to my Roth 401k, which is what is listed on my 1099-R in box 5. Do I keep this $12k as listed since that was what actually went into my Roth 401k, or list what my actual after-tax contributions were during 2017 ($15k)?

Thanks again!

Harry Sit says

Only the $12k as shown on your 1099-R. Please note for an in-plan rollover to Roth 401k you would answer ‘Yes’ to the question after the 1099-R entries and follow from there. The screens aren’t the same as a rollover to a Roth IRA shown here.

Sachin K says

Thank you for this detailed post. I did this for 2016 returns and did not see a Form 8606 being prepared by TurboTax. Is Form 8606 necessary in this case? If yes then probably I need to amend my 2016 returns.

Harry Sit says

You don’t need a Form 8606 when you go from the plan directly to the Roth IRA.

Hari S says

Thank you for the excellent articles on this site! It has really helped me learn a ton!

Back in 2016, when I first made the after-tax contributions to my 401k (about $5k), I wasn’t entirely sure on how to do the traditional/roth conversions – so I got scared and simply requested a withdrawal and encashed the check received. I didn’t have any earnings/losses from this – so I thought “since I had already paid taxes on the contributions (they are after tax contributions after all), there was nothing here for me to report on form 1040” – so I left boxes 16a and b on form 1040 blank. However, I just received a notice from the IRS yesterday, showing this $5k amount as taxable and ordering to pay back taxes of $2k. However, the 1099-R clearly shows the $5k in boxes 1 and 5 and box 2a shows $0. Is it enough for me to simply fax this copy of my 1099-R to them to remove the charge? Or do I need to offer more explanations? Or do I really owe taxes? FWIW, I am much much younger than 59.5 years.

Appreciate everything that you do!

Hari

Harry Sit says

You don’t really owe taxes. Call the number on the notice and ask them what they need. They will probably want a written explanation.

Hari S says

Called them up, they said all they want is the 1099-R’s showing the $0 in box 2a.

Peter says

My employer allows me to split my conversion sending earnings via trustee to trustee transfer to my traditional IRA. However, they insist on direct depositing the original contribution into my checking account. I then send the funds to Vanguard with a letter of explanation. For the traditional portion I receive a 1099-R with a distribution code G. All is good. But for the portion I send to my Roth (original non-Roth after tax contributions) I receive another 1099-R with a distribution code of 1 (early distribution with no know exception). Is my employer reporting this correctly?

walle says

Hello,

Please help. I am doing this exactly as shown. I transferred some 15k to Roth from my employers after tax account. The 1099B shows no tax withheld with box 1 matching box 5 and box 7 has code G.

After I answer yes to contributing on a After Tax basis to my 401k and confirm the amount on the next page my tax owed goes very high. I think they are taxing this 15k. Dont know what to do here now…! 🙁

Harry Sit says

If Box 5 matches Box 1 exactly, put 0 in Box 2a instead of leaving it blank.

Walle says

That was it! I figured it out by trial and error but you are correct, I was leaving it blank. My 1099R does have a zero so it was just me. Blank does not mean zero 🙂 Thank you for confirming and your post; it has been very helpful!

greg says

Just wanted to say thanks for the very detailed walk through.

first time reporting it and I found it a little confusing.

the “unless” bits helped greatly and the 1040 example was perfect.

Thank you.

Michelle says

Hi Harry – thank you so much for the visual explanations! I have some questions regards to 1099R forms. Sorry in advance for a long comment.

I received 2 1099Rs from Fidelity, which is my 401k provider and which I have Roth IRA with (do not have a TIRA). In 2018, I did both Mega backdoor Roth and Roth in Plan Conversion. After reading your post, I think Fidelity might have incorrectly filled out 1 of 2 1099Rs.

1) This 1099R is for the Roth in Plain conversion and I think this is correct

Box 1 15,300

Box 2a 89

Box 5 15,211

Box 7 code G

2) I think this 1099R is for mega backdoor

Box 1 10,896

Box 2a 0

Box 5 10,496

Box 7 code H

Q1. Shouldn’t box 2a be 400 (10,896-10,496) since earning is taxable for mega backdoor?

Q2. Also, should the code be G, not H according to your explanations above? (But H is a direct rollover from a designated Roth account distribution to a Roth IRA so that also sounds right…)

Q3. Form 5498 I received has different rollover contribution (12,095) from above numbers on 1099R. Is this correct?

Could you be able to tell if I received correct 1099Rs? Thank you very much!

Harry Sit says

A “designated Roth account” is the official name for what we usually call a Roth 401k. If you distributed from the Roth 401k account to the Roth IRA, that explains why box 2a is zero. If you distributed from the non-Roth after-tax account, code H is wrong, and box 2a should be box 1 minus box 5. I have no idea why the number on the 5498 is different.

Ryan says

This article was exactly what I was looking for! Even years after it was written, it’s still helping people. I’ve just started after-tax contributions to my 401k and plan on rolling over to my roth IRA; however, with the recent market activity, I would be doing it at a loss (just a couple hundred dollars). If I were to roll over now, would the loss be reported on the 1099-r and could be applied to compensate other short-term gains?

Thank you!

Harry Sit says

The loss will not be reported on the 1099-R. Some 401k administrators retain the loss within the 401k. If your next rollover has a gain, it can be offset by the loss. Some administrators simply treat the loss as zero gain. Because the assets can lose value again after you roll over, you are not any worse off by rolling over now versus if you had rolled over a month ago.

Ryan says

Got it. Thank you for your response. Very much appreciated!

Leah says

Hi Harry, this is exactly what I’m looking for! Just one quick question: I have both pre tax 401K and after tax 401K under the same plan and my plan allows in service distributions, when I convert after tax 401k to Roth IRA, do I have to follow pro-rated rule to recalculate taxable portion vs non-taxable portion? Or it’s just like that all after tax contributions are non-taxable income and earnings are taxable? Thank you in advance!

Harry Sit says

Most plans allow you to request in-service distribution only from the after-tax account. Make sure you make that crystal clear in your request. In that case, the pro rata rule is only applied within the after-tax account: earnings will be distributed together with after-tax contributions. The after-tax contributions are non-taxable and the earnings are taxable. However, some plans require pro-rated distribution across both pre-tax and after-tax accounts. They are rare but they still exist. You have to find out how your plan operates.

Rebecca says

Great summary, but I have one quick question: when asked “Did you make any after-tax contribution to your 401k plan? These would be contribution you made into the plan yourself, rather than being made by your company on your behalf.” Should I answer “yes” if I made after-tax contributions via payroll (i.e.: the same way my regular contributions are made, but after-tax (not Roth) – employer sends to 401k administer)? Thanks again for the great tutorial.

Harry Sit says

Yes, it’s included in the screenshots.

Loren says

Hi Harry – what an old post but really helpful today. On Turbo Tax it says that “this isn’t common, but this is money you put in the plan yourself, not from your company.” My after tax contribution which is then converted to Roth 401k, is from wages & income (payroll). Wouldn’t the answer be “No”, since it is from my company? Thanks!

Harry Sit says

It is from payroll but it’s out of your pocket, not the company’s pocket.

Joe says

Hi Harry,

My 401-k plan allows for mega backdoor Roth conversion and I plan to use it starting in 2021. However, my company wants me to convert my after-tax 401-k contribution into Roth 401-k the _following_ calendar year after I contribute to the after-tax 401-k because they want to make sure they pass the nondiscrimination test. Meaning if I fund the after-tax 401-k in 2021, they want me to convert in 2022 and this also means I will have to pay taxes on the gains up to the point of conversion.

I have also been doing backdoor Roth IRA on my own. If I do both the mega backdoor Roth conversion in 2022 and also do the backdoor Roth IRA in 2022 (contribute and convert in 2022), would I receive two 1099-R’s? And are there any complications when filing taxes, or just work through each 1099-R in the software?

Thank you!

Harry Sit says

Converting in the following year is fine. After you pay taxes on one year’s worth of earnings, the future earnings will still be tax-free. Yes, if you do both the regular backdoor Roth and the mega backdoor Roth, you will receive two 1099-R’s — one from your IRA custodian, and another from your 401(k) plan. They’re unrelated. You do them independently. I have walkthroughs for both.

Bob says

Hi Harry,

I am using TT Online, and I do exactly as you have described here for my Roth rollover ( did the same past few years). TT does everything correctly but does not put the word ‘ROLLOVER’ on line 5b. I have submitted a ticket with TT and waiting for their reply. Do you know about this issue with Online version? I have already paid for the TT and trying to see whether I can get a refund so that I can get the desktop version.

Thanks

Bob

Harry Sit says

I don’t know about it in the online version. Hope they’ll fix it in an update.

Ron says

I have the desktop software version and it doesn’t show ‘rollover’ either. Maybe is ok to leave it blank?

Harry Sit says

If you followed the steps exactly it should show, as in my screenshot. Check the code in box 7 in your 1099-R. Is it ‘G’?

Bob says

yes, the code is G. And yes, I followed your steps exactly as you have described. This is my 5th year I am doing this, so I double checked it to make sure I did it your way.

Here are the details of my 1099-R:

Box1: $27039.08

Box 2a: $0.00

Box 2b: Not Checked

Box5: $27039.08

Box 7: G

IRA: Not Checked

Harry Sit says

I tried in my copy. It seems if the Box 5 number exactly matches the Box 1 number and the taxable amount in Box 2a is zero, the word “ROLLOVER” doesn’t appear. If Box 5 is slightly smaller and there’s a small taxable amount in Box 2a, the word “ROLLOVER” appears, as in my example. I don’t know why TurboTax does it that way. Maybe that’s just how the IRS wanted and TurboTax is simply following the instructions.

bob says

I tried reducing Box 5 to $27000 and adding $39 to 2a, still the word ‘ROLLOVER’ does not appear, but it did calculate correct taxable amount.

Thanks for trying Harry.

Richard Sharon says

Bob/Ron – Did you find anything more on this. Looks like I am in the same situation. TurboTax Desktop doesn’t put “ROLLOVER” on line 5b for me as well, likely because 1099-R’s Box 5 number matches Box 1, and Box 2a is 0. Appreciate any input. Thanks

TT says

Don’t worry about the “ROLLOVER” text. It’s a turbotax bug. It seems like the text will only show up if the texable amount > 1, and box 1 and 5 difference > 1

Ron says

For a mega backdoor roth, will I need to fill out the ‘Traditional and Roth IRA Contributions’ section in the ‘Deductions and Credits’ section? Or just the steps you listed in this article is sufficient?

Harry Sit says

If you made the contribution to your 401k through payroll, as described in the example, just the steps here are sufficient. If you contributed to Traditional and/or Roth IRA on your own, that’s separate.

Michael says

Hi Harry, Thank you for your explanation. I’m using Credit Karma to file. Box 5a looks correct per your instructions although it doesn’t say “ROLLOVER” anywhere; however the taxable amount is showing up in 4b instead of 5b. Is this an issue?

Thanks,

Michael

Harry Sit says

If you did a transaction similar to the examples here, it’s clearly a distribution from a retirement plan, not from an IRA. The taxable amount should be on line 5b, not on line 4b.

Justin says

Michael, I’m having the exact same issue with Credit Karma. Did you figure out how to get the amount to go to line 5b?

Thanks,

Justin

Justin says

Looks like it can’t be done on Credit Karma Tax. Their support said: “We currently don’t support a taxable event for code G ‘Direct Rollover and rollover contribution’ in Box 7. So, if this is considered taxable for you we don’t currently support this situation.”

Harry Sit says

FreeTaxUSA can do it. It’s free for Federal and $13 for the state if you need it. See How To Enter Mega Backdoor Roth in FreeTaxUSA.

Leonel says

Hey Harry, great article! I have been trying to make sense of my taxes this year, where I converted an old employer 401K to a Traditional IRA which I then backdoor converted into a ROTH IRA. My financial institution told me that doing this over going straight from a 401K to ROTH would be best, since I would owe taxes on the amount but not owe any penalties for “over-contributing”. However, I am having a hard time reporting this on TurboTax without avoiding penalties, where I have a 401K 1099-R, IRA 1099-R, IRA 5498 and ROTH IRA 5498.

Harry Sit says

Your transactions have nothing to do with the topic here. It sounds like you entered IRA contributions with your two 5498 forms. Delete them. A rollover or a conversion isn’t a contribution.

CL says

Hi Harry,

Thanks for your guidance on this. Have you tried this with H&R Block software? I get the exact same answers, except that the word ROLLOVER is not printed on line 5. I can’t get the word to show regardless of rollover into a Roth IRA or designated account. Any thoughts? Is it critical?

Harry Sit says

I tried it in H&R Block software. The process is similar. The word “ROLLOVER” doesn’t print on line 5 for me either. The 1040 instructions say it should be there. I don’t know how critical that is.

“Enter on line 5a the distribution from Form 1099-R, box 1. From this amount, subtract any contributions (usually shown in box 5) that were taxable to you when made. From that result, subtract the amount of the rollover. Enter the remaining amount on line 5b. If the remaining amount is zero and you have no other distribution to report on line 5b, enter -0- on line 5b. Also enter “Rollover” next to line 5b.”

mervinj7 says

Thanks, Harry. Are you going to post similar screenshots for H&R Block?

Harry Sit says

I wasn’t planning to, but I might as well for completeness. Please check back next week.

Arunodoy Saha says

Hi Harry,

Thanks a lot- it was so useful. 2 things:

1. I have 1099-R type G and type – H both.

Now, according to your example, I am contributing 10000$ from paycheck which converts to roth 401k – and may be it gained 200$ before the conversion happened (I recieved type G form for the above) which shows 200$ taxable income.

Now the same 10200$ is again being converted to an outside IRA. and I receive 1099-R type H form- it shows 0$ taxable.

My problem is when I add these 2 forms in turbo tax, it shows up as 20200$ as pension distribution.

Pros: I do see “ROLLOVER” which is same as you described and taxable income is also 200$

cons: IRS will see I rolled over 20200$ – whereas I actually contributed 10000$ which got converted twice and hence showing double.

2. I was first using turbotax online and did not see as many questions as u mentioned- so I bought a turbotax deluxe pc download version. I see same number of questions for type -G form but for type-H form, it does not ask for whether this money was moved to a roth IRA which is very important and I think that is the reason behind double of 10000$

Any advice?

Harry Sit says

If you actually did two rollovers, first from the after-tax account to the Roth 401k account, and later from the Roth 401k account to a Roth IRA, it’s normal to have the sum of two gross amounts on Line 5a. 1099-R code ‘H’ means “Direct rollover of a designated Roth account distribution to a Roth IRA.” It’s clear enough the software doesn’t need to ask more questions.

It’s not necessary to do two rollovers if this is with your current employer. If you intend to move the money to your Roth IRA, you can rollover directly from the after-tax account in the 401k to your Roth IRA. But maybe you first rolled over to the Roth 401k, and you moved the Roth 401k to your Roth IRA after you left the employer.

Arun says

Thanks for a very quick reply!!

I am still with the same employer- just that I am doing it in 2 steps as mentioned. Now will I be in trouble as it looks like due to this ‘double down’ of same money, I am recording an extra value with IRS for record keeping?

For mega backdoor conversion, the total allowed amount is 57k per year (401k + employer + post tax converted amount) – I think I am crossing the limit of 57k if they count the ‘doubled’ rollover.

Harry Sit says

Doing two rollovers won’t get you in trouble but it created extra work and extra worry. If the plan makes it convenient to rollover within the plan and you like the convenience, do that and leave the money in the Roth 401k account until you change jobs. The $57k limit counts contributions, not rollovers.

Erik says

Great article. I’m having an issue with TT related to this. I have an in-plan rollover, and in the “review” at the end, it’s telling me that in Line 6a, “Taxpayer elective deferrals to individual 401k plans and to roth 401k plans should not be greater than 19500.” Apparently it’s summing my individual contribution ($19.5k) and my backdoor roth ($31k) and flagging the sum for being over the limit. Is this a TT issue? Or should I not enter the backdoor roth amount as a contribution when TT is asking me what retirement contributions I made during the year because it’s not a “normal” Roth contribution?

Harry Sit says

You should not enter the non-Roth after-tax contributions when TurboTax asked you what retirement contributions you made for the year.

Erik says

I wish my plan administrator replied as quickly as you do, thanks Harry. 🙂 So basically, I should change my elective deferral for the Roth 401k from $31k to 0, and that will solve the issue, correct? As a follow-on question, my administrator sent me a 1099-R that has box 2b checked and nothing in box 5 – is that correct? Seems to contradict what you have here.

Harry Sit says

Try it in TurboTax and see what difference it makes. I don’t know whether that’s an equally valid way to do the 1099-R when your administrator doesn’t know how much non-Roth after-tax money you contributed (and therefore “taxable amount not determined”). I only know my 1099-R doesn’t look like that.

Erik says

Yeah, the difference seems to be Box 2b. If it’s checked and I then say I moved the money from a 401k to a Roth, my small refund turns into me owing $11k. If it’s unchecked, the only way I can keep my refund from changing into me owing is if I say “no I didn’t” when it asks if I moved the money from a 401k to a Roth 401k. I don’t know if that’s technically accurate but this should nevertheless not be a taxable event so I’m trying to get to the end result (and the correct one) I desire. Waiting to hear back from my plan administrator on the 1099-R. The fact is they know exactly how much after-tax money I contributed because I sent them a signed form that attested to the deposit.

Erik says

As a follow-up, yep, administrator was mistaken. They fixed it and I was able to submit everything. Thanks for your help!

Loren says

Thanks Harry. Whenever TurboTax says it’s an uncommon situation, I tend to default my response. Based on your logic I would have thought it would be uncommon for the company to make an after-tax contribution Not the other way around, but I must be wrong. Appreciate the clarification.

Leah Y says

Harry,

A quick question: if I contributed $20,000 to After tax 401K in 2020 but only rolled over $15,000 to Roth IRA later in the same year, what contribution amount should I put in box 5? The total contributions of $20K made in 2020, or the contributions of $15K shown on 1099-R? Thanks!

Harry Sit says

Your 401k plan provider tracks the earnings on the after-tax contributions. They allocate part of the distribution to your after-tax contributions and the rest as taxable earnings. Suppose your $20,000 contributions grew to $25,000 before you requested to roll over $15,000. 80% of the after-tax account was your contributions ($20k / $25k). Therefore 80% of the $15,000 distribution was your contributions. Your 1099-R will show $15,000 distribution, $3,000 taxable, $12,000 in box 5.

Leah says

Thanks for your quick response! No realized gain occurred as I invested in money mkt funds. So here $20K and $15K are purely contributions. So my question really is: If we contributed more than what we rolled over to Roth IRA, what contribution amount should we put on tax return? The total 2020 contributions of $20K or the contributions of $15K that was rolled over to Roth IRA? This is a question to a scenario where conversion and contributions didn’t line up. Thanks!

Harry Sit says

Box 5 shows the non-taxable portion of the rollover. If you had zero earnings, it’s equal to the rollover amount.

Leah says

Thank you!! So box 5 will show the contributions from 1099R. What about the following question after I answered that I made after tax contributions to this 401k. It is asking to input After tax contributions to 401K or 403B. Should I put the same amount as box 5 or the total contributions that was made in 2020? ( say $20K contributions in total and $15K contributions converted to Roth IRA)

Harry Sit says

All the questions pertain to the distribution. Of this distribution, how much were your after-tax contributions. Your total contributions not in this distribution are not relevant.

Leah says

Very helpful!! Thanks so much for sharing your tax knowledge on this matter!

Shawn says

Hi Harry

1 Such contribution check for In Plan Roth conversion, should go out from Employee or Employer a/c

2 If mega backdoor Roth contribution bring down Net pay close to zero, will that cause any issue

3 How does it reflect in W2. Net pay close to zero and contribution goes in 12 D value AAA

Jane says

This was really useful, thank you!

Wayno says

There’s an additional question in this sequence for MI. My contributions earned $200 as per your example and $0 was withheld to the state. The question asks me to select “The source of this distribution and enter any other MI information”. There are a few possible answers I can select but am unsure which. These include 1. Current year conversion from traditional IRA to a Roth IRA (doesn’t seem applicable) 2. Pension/IRA distribution received before retirement age 3. Other qualified IRA distributions and private-source pensions 4. None of the above.

I’m thinking it’s #2 above but would like to get confirmation or correction. Thanks for the help!!

Harry Sit says

Sorry I’m not in MI. Try both 2 and 4 and see what happens to the state form. Print the state form to compare.

Nilesh says

Hi Harry – I am using TaxAct and am stuck – there does not appear to be a way to account for after-tax 401k amount that was rolled over to Roth IRA. Whole amount is deemed taxable. I am using premier, downloaded version.

Thanks!

Harry Sit says

Sorry I don’t have TaxAct. TaxAct changed its business model after its ownership changed. Consider switching to TurboTax, H&R Block, or FreeTaxUSA.

Nilesh says

Thanks!

Nancy says

Hi Harry, thanks lot for the detailed instructions!

Do you know if there was a difference between where the “mega back-door Roth” is captured in 2020 vs. 2021 tax returns? After reading your instructions, I checked on my 2020 1040 form and saw that the amount was under Line 4a with the word “Rollover” marked there, but not under Line 5. I did the same mega back-door in-plan Roth-401K conversion in 2020 as in 2021, so theoretically they should all be under the same line, I think. Does this mean I made a mistake on my 2020 tax return? Thanks!

Harry Sit says

No difference. Should be on the same lines in both years.

Theodore says

Harry,

Thank you for this. I have an interesting one related to the Roth conversion. My wife had an old 401k that we wanted to convert to a Roth IRA. I worked with the plan to have a check issued in early December 2021 (this was the only method they allowed for a distribution), and was told that the check would be sent to us within two weeks, well before the end of the year. The check went out mid month and was slated to arrive at our home in mid-December. Unfortunately, the post office lost 😡 the check, and we had to have it reissued, so we didn’t actually receive the check (and make the conversion) until January 2022. I know that (a) the IRS allows an extension of the 60-day conversion deadline for issues related to “equity” one of which is Postal error and that (b) Pub. 590-A illustrates this exact same example (different calendar year distribution and conversion) but for recharacterization purposes, treating the date/year of distribution as the operative one for tax purposes. However, I also understand that the deadline is technically December 31st.

Any advice here? Can we just pay the tax this year with an explanation and then report in 2023 that we paid the tax in 2022? We have everything documented, including the USPS Uniformed Delivery notification of the check arrival in December 2021 (of course, postman mis-delivered) and a letter from the 401k plan provider that the check had been returned to them as misdelivered.

Thank you

Harry Sit says

So the plan issued a check, got it returned by the USPS, and reissued another check. Whose name was on the check? Your name or the IRA custodian FBO your name?

If the check was made out to the IRA custodian FBO your name, 60-day rollover deadline doesn’t apply. The money was never yours. Your role in delivering the check to the IRA custodian isn’t any different than the USPS mail carrier. You go by the 1099-R issued by the plan. If you have a 2021 1099-R, you add the income to 2021. If you’ll get a 2022 1099-R in 2023, you add the income to 2022.

Theodore says

Thank you, Harry.

Apologies for any confusion. I was aware that the 60-day rule doesn’t apply. I was only using it as a reference for the “equity” exception (I.e., postal error) permitted by the IRS.

The check was FBO, so a Trustee-to-trustee transfer. And, yes, the distributing plan issued me a 2021 1099-R. But the Roth conversion didn’t occur until 2022.

Am I correct, then, that this is taxable as 2021 income? And that there is no additional tax burden in 2022? I had an ancillary concern that the 2021 distribution would cause a pro rata rule issue, as we also executed a Backdoor Roth conversion in my wife’s name last year. But I take it that this would only be a concern if we placed and left money in a traditional IRA in 2021, which we did not do.

Thank you again. Hope this is clear, but please feel free to inquire if not.

Theodore says

I should add that the “Gross Distribution” is the full amount (line 1) but the “Taxable Amount” is $0 (line 2), so it seems like we would get another 1099-R for the conversion in January 2022.

But if that is right it seems absurd that we would get hit by a higher tax bill (higher marginal rate, pro rata rule (?)) because the post office lost a check.

Harry Sit says

If the reissued check went out in 2021, you won’t get another 1099-R for 2022. The plan doesn’t base the 1099-R on when the IRA custodian receives the check. They did the distribution. They issued the 1099-R. They’re done with their part.

If you marked in your distribution request that the pre-tax money was going to a Roth IRA, you should ask the plan for a corrected 1099-R with the correct taxable amount in Box 2a.

Theodore says

***sorry January 2022 should be January 2023

Here is an article that discusses, which seems to indicate that the tax would be paid in 2021: https://www.irahelp.com/slottreport/rolling-over-last-year’s-ira-distribution

Theodore says

Thank you so much for this, Harry. This is extremely helpful.

To recap, then: (1) Have the 1099-R reissued with the amount in box 2a (and box 16) equal to the full amount in box 1. (2) Pay taxes (ordinary income) on the full amount in boxes 1/2a of the Corrected 1099-R.

Taxes are now paid in full on the 401k to Roth conversion with no additional tax liability in 2022. (I will, however, receive a 5498 in 2023 from the Roth IRA plan sponsor, documenting the Roth conversion in January 2022.)

Am I missing anything here? Thank you again.

Harry Sit says

Theodore – That’s it.

Theodore says

Harry,

Are you certain that I need to have the 1099-R corrected? I took a look at Pub. 575, and I do not see 2a mentioned in the section for reporting taxes owed:

“How to report. Enter the total amount of the distribution before income tax or deductions were withheld on Form 1040, 1040-SR, or 1040-NR, line 5a. This amount should be shown in box 1 of Form 1099-R. From this amount, subtract any contributions (usually shown in box 5 of Form 1099-R) that were taxable to you when made. Enter the remaining amount, even if zero, on Form 1040, 1040-SR, or 1040-NR, line 5b.”

So, wouldn’t I report the full amount as taxable at 5b (since a pre-tax contribution initially) irrespective of the value in box 2a?

Harry Sit says

Here are the 1099-R instructions from the IRS to the plan administrators:

“For a direct rollover of an eligible rollover distribution to a Roth IRA (other than from a designated Roth account), report the total amount rolled over in box 1, the taxable amount in box 2a, and any basis recovery amount in box 5. (See the instructions for Box 5, later.) Use Code G in box 7.”

https://www.irs.gov/pub/irs-pdf/i1099r.pdf (page 5, upper right-hand side)

The 1099-R from your plan administrator showing zero taxable amount is clearly wrong. Can you override it and report the correct taxable amount especially when you’re reporting more income? Sure. I would think you want all your paperwork to be correct and consistent.

Joe Bousquin says

Hi Harry,

I contributed to my Solo 401k plan in the voluntary after-tax bucket (i.e., NOT the 401k Roth bucket).

I then immediately did a mega backdoor Roth rollover to my Roth IRA (i.e. no earnings).

Should Box 7 on my 1099-R be Code G or Code H?

Harry Sit says

Code G. See link to 1099-R instructions above.

Morris says

If I do a partial rollover, for box 5, should I report the total amount I contributed for after-tax 401k or the amount I actually rollover to Roth IRA?

Say I contributed $10k after-tax to 401k in 2021, but only rollover $8k. Should box 5 be $10k or $8k?

Harry Sit says

If your $10k after-tax contributions grew to $12k with earnings, rolling over $8k to a Roth IRA will put $8,000 / $12,000 * $10,000 = $6,667 in box 5.

Morris says

Hi Harry, thanks for getting back to me.

Turbotax also asks about after-tax contributions to 401(k) later on, and if the amount in box 5 is incorrectly reported. In your example, we should enter $6,667 in box 5, but should we enter $10K for after-tax contributions to 401(k)?

Harry Sit says

Your 401k provider is responsible for calculating the correct number for Box 5 and putting it there. If the box is blank or the number is wrong, you should ask your 401k provider to correct it. You shouldn’t enter $10k there on your own. The question from TurboTax may not be worded precisely. It’s always about the after-tax contributions within this distribution. The amount not yet distributed isn’t relevant.

Nun says

When I got to the end of this TT Premier asked “Any nondeductible contributions to your IRA?” It’s not a hard question, but it was missing from your instructions.

Thanks for the instructions and spelling everything out with pictures!

Nun says

I just realized it probably asked me that question again because I had entered a regular backdoor earlier.

Harry Sit says

That’s right. Nondeductible contributions to your IRA aren’t relevant to a mega backdoor Roth.

suji says

Hi , My situation is

1) I contributed 100$ to AT 401K and then did in plan conversion of that amount to Roth AT 401K ( Got 1099-R with Code G )

2) I then moved money from Roth AT 401K ( 100$ that I contributed and 10$ gains ) to Roth IRA ( Got 1099-R with Code H )

When I enter these details in TT premium online, I see in form 1040 ,

line 5a contains 210$ and line b contains ROLLOVER.

Is that right , I some how feel that it should be 110$ as that is the net amount that went into Roth IRA. Can some one help please?

Harry Sit says

That’s right. Line 5a shows the sum of your two rollovers. It doesn’t matter when an amount moved twice.

TT says

Is it normal that this amount *counts* toward your total income in TT?

Tho it’s not taxable and TT didn’t tax it; but in the Federal Review (Detailed Tax breakdown), this conversion amount is added to total income (as ‘Other Income), even though it’s after tax and should already be included in the wages already.

If I remove 1099G, then the amount is deducted from the ‘Other Income’

Ron says

Hi, Thank you for a great tutorial that’s still relevant 6 years later!

I have a follow-up question on the answer you gave for Brian’s question (JANUARY 26, 2017 AT 11:12 AM) The Administrator for my Traditional 401k separately tracked the after-tax contributions and the earnings on those contributions. The after-tax contributions were made 20 years ago.

In 2021 I did a direct rollover of all of the after-tax contributions into a Roth IRA and the (pretax) earnings on those contributions to a Traditional IRA. This was done in one transaction and the Administrator issued one 1099-R:

Box 1 contains the total distribution (sum of the after-tax contributions + earnings on them).

Box 2a has $0.00

Box 3 has $0.00

Box 4 has $0.00

Box 5 has the after-tax contribution portion of the distribution.

Box 7 has code G

none of the tick boxes are checked.

You suggested that Brian

“Try entering the 1099-R as two, one for the amount gone into Roth and another for the amount gone into traditional.”

Would one of those 1099Rs have

box1 = box 5 = aftertax contributions

while the other 1099R have

box1 = amount rolled over in the Trad IRA

box 5 = $0.00

with all the other boxes containing the original values of the 1099R the Plan Administrator sent out?

Since the rollover was not of the *entire* contents of the 401k account (only the “After-tax Source” = aft.tax contributions + the earnings on them) would any “proportional” rules apply? ( the aft-tax contributions that were rolled over to a Roth IRA in their entirety were only 7% of entire the 401k Balance, but 21% of the “AftTax Source” money.)

Thanks and apologies for the long description.

Harry Sit says

That’s correct. The rollover to the traditional IRA is just a straight pre-tax to pre-tax rollover, as anyone else would do when they leave an employer and roll over their 401k to a traditional IRA. You follow the steps in this post for the rollover to Roth IRA.

The 401k administrator already applied all the necessary rules. You don’t have to worry about which rule applies or doesn’t apply. You have the combined 1099-R. You’re splitting it only for the tax software. The amounts from your two “sub”-1099R’s will get added together on your tax return.

Ron says

Thank you. My main worry was the rollover of the aft-tax contributions to a Roth IRA.

Trying to interpret Notice 2014-54 and Notice 2014-74, it seemed that any rollover of aft-tax contributions (to a Roth IRA) that was accompanied by rolling over (to a Trad IRA) anything less than the *entire* balance of pre-tax money in the 401k account (not just the pre-tax earnings on the aft-tax contributions) would suffer the application of proportional rules that would designate as taxable income some of the rollover to the Roth IRA.

It sounds as if you are saying that the above interpretation is incorrect and that the rollover of the aft-tax contributions to a Roth IRA should not result in taxable income.

Harry Sit says

It’s not your job to interpret the IRS notices. The 401k plan administrator already interpreted them and applied them correctly when they issued the 1099-R.

Ron says

Thanks again.

dsci says

Why do you need to specify “ROLLOVER” on line 5b for mega backdoor Roth but no “ROLLOVER” on line 4b for backdoor Roth? What exactly is the distinction? Are there any IRS documents that mention about this? Thanks!

Harry Sit says

The IRS requires the word for both 4b and 5b in Form 1040 instructions. Search for “rollover” (with quotes) in the PDF.

Nan says

Thanks Harry, that’s very helpful. Can I ask 2 questions? First, I am in the 2nd situation: withdraw the aftertax 401k and put the principal into Roth IRA and gains into traditional IRA. I got 2 1099-R. When I enter the Roth IRA 1099R I followed your instruction but TurboTax seems to have a bug and “Rollover” was not shown in 1040 line 5b. I tried the 1st method (in plan conversion) and “Rollover” was correctly shown in line 5b. I wonder if I can report as in plan conversion though I had a withdraw? Or is that OK to not have “Rollover” in line 5b?

Second, could you please also instruct how to report mega-backdoor Roth IRA in Deductions and credits? I got the message that I have excess contribution based on $6000 limit.

Harry Sit says

You shouldn’t misrepresent where the money went. If the word “rollover” doesn’t show up, so be it. For the regular backdoor Roth, please read How To Report Backdoor Roth In TurboTax.

Ravi says

Hi Harry,

I have been contributing max allowed to Roth IRA for last few years. I just realized that for 2021 I don’t qualify for regular Roth IRA contribution for and need to use backdoor Roth IRA to do max allowed contribution of $6000 for 2021. Question I have is – if I open a traditional IRA now and make a non-deductible contribution of $6000 for 2021 and then immediately covert full balance of $6000 from traditional IRA to my Roth IRA – I believe it is doable before tax day on 4/18/22. How do I report in 2021 tax return in Turbotax in the absence of 1099-R for 2021?

Thanks

Ravi

Harry Sit says

You split your reporting into two years. You report the contribution now for 2021. You report the conversion next year for 2022 when you have the 1099-R. See the link in the previous reply on the regular backdoor Roth.

Nan says

Hi Harry, thank you so much. I understand how to report the regular backdoor Roth, but I’m still not clear about how to report mega-backdoor Roth IRA in Deductions and credits. I tried to report as what I believed should be right, but TurboTax showed that I have excess contribution. Apparently something wrong happened. I appreciate if you could give some hint. Thanks!

Harry Sit says

All the steps on reporting the mega backdoor Roth are in this post. You don’t do anything in Deductions and Credits.

Shaina says

Hi, I requested my 401k plan administrator move “post-1986 after tax dollars” (with earnings) to existing Roth and Traditional IRA accounts at another brokerage firm. At their suggestion, I also requested future “post-1986 after tax dollars” coming into the 401k account be re-invested into my 401k to prevent future rollovers from it. This was ~Dec 29th and on Dec 30th a small amount of money (~$1150) came into the account through my paycheck (I think before all other transactions fully completed or were in progress..). It’s unclear why, but their system ended up cutting me a check directly for that $1150 amount (in addition to the 2 other checks made to my broker on my behalf for the IRA accounts that I had to mail on for deposit). I waited 2 months to try to resolve the $1150 check made out to me directly and ended up just keeping the distribution, assuming I’ll get a 10% tax penalty on the taxable amount.

When it comes to reporting my Traditional IRA basis, or even the amount into the Roth, it seems I need to capture this through separate 1099-Rs, yet they only sent ONE for the amount directly to me (Boxes 1 and 5 are the same ~$1150, coded G).

– TurboTax hasn’t indicated a tax penalty for the 1099-R form, so I’m not sure if there is more I need to do to capture that properly?

– It sounds like my 401k plan administrator should provide 2 other 1099-Rs for the other two IRA rollover amounts, correct?

Thanks in advance, as I work to wrap my head around this!

Harry Sit says

If those two other checks for the IRA accounts came out before December 31, you should have a 1099-R or at least have the gross amount reflected in Box 1 on the same 1099-R you already received for the $1,150. If they came out after January 1, you’ll get it next year. Because the $1,150 check was made out to you, it shouldn’t have code G in Box 7. Having code G made TurboTax skip the 10% penalty thinking it was rolled over.

Harry Sit says

Sorry, when your box 1 equals box 5, the taxable amount is zero. Because the 10% penalty is only on the taxable portion, 10% on zero is still zero even if the Box 7 code isn’t G.

Mark Atwood says

I am doing a rollover from megabackdoor to my Roth IRA instead of to a Roth 401(k). Do you have screenshots of how to do it in turbotax?

Harry Sit says

Screenshots start from here: https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html#htoc-withdraw-to-roth-ira