Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

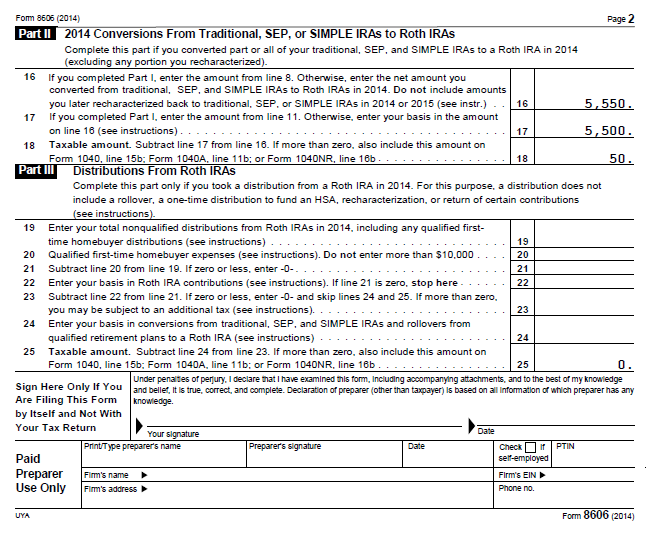

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

Excellent article! I would like to see a graphic though. I know they are a lot of work to make.

Enonymous says

Hmm

I have been doing this so far

But in 2011 doesn’t the income limit on Roths disappear…?

Enonymous says

Sorry!

I meant for conversions but this is exactly how effectively anyone can contribute to a Roth

Thanks for your guide. I decided to just convert all Iras in 2010 spread taxes over 11-12 and then every year doing the nondeductible to Roth conversion

nickel says

Just did this myself, including the Vanguard SEP-IRA to Fidelity Solo 401(k) bit. Excellent summary.

sc1 says

If I skipped step 1, but already did Step 2 & 3, is it too late? Can I go back and do Step 1 if I do it before December 31?

Harry Sit says

@sc1 – In theory you should do Step 1 before you do Steps 2 and 3. In practice, I think you will be fine if you complete Step 1 before Dec. 31. Hurry up.

zany says

Thanks for explaining this so well – while I have been doing this already, I am sure a lot of people will get help from the well written article.

Another relevant question – Roth is strictly better than a brokerage. Still any suggestions to what are the best assets to keep in that? I know you are a vanguard fan (like me) so it would be great to hear exact funds and ETFs.

And that said, ever thought about making your asset allocation public (sans the actual numbers)? It may help a lot of folks get some ideas.

CTG says

In Step 1, please explain why the pro-rata rules don’t apply to the rollover. So if you rollover $24K to the employer sponsored plan, why is all $24K deemed pre-tax and not 24/34ths?

Also, I assume there is no need to make a non-deductible contribution in Step 2. You could simply rollover the after-tax amount left after Step 1 to the Roth, correct?

Harry Sit says

@CTG – Because the tax law says so. In IRS Publication 590 (p. 23 in the 2009 version), the IRS writes:

“Ordinarily, when you have basis in your IRAs, any distribution is considered to include both nontaxable and taxable amounts. Without a special rule, the nontaxable portion of such a distribution could not be rolled over. However, a special rule treats a distribution you roll over into an eligible retirement plan as including only otherwise taxable amounts if the amount you either leave in your IRAs or do not roll over is at least equal to your basis. The effect of this special rule is to make the amount in your traditional IRAs that you can roll over to an eligible retirement plan as large as possible. ”

In Step 2, although it’s not required that you make a non-deductible contribution, if you have earned income and you have the money, it’s better to do it before converting the traditional IRA to Roth. You will have more money in the Roth IRA that way.

Harry Sit says

@KD – Graphics? I will have to charge you extra for that. 🙂 Thank you for the suggestion. I added some graphics plus a sample filled-out Form 8606. How do they look?

Harry Sit says

@zany – I shared my asset allocation some time ago.

KD says

TFB, I think you have made quite a bit of money through my clicks on the amazon referral links. Graphics help understand this so much more quickly. Thanks!

Harry Sit says

@KD – I was wondering who bought a LCD TV off my Amazon referral links. Thank you.

nbollin says

My wife has a SIMPLE IRA at work that she is currently contributing to; its value is about $10k. We are converting $8k from non-deductible iras ($4k each); and $3k from an old 401k (Trad IRA rollover) to roth IRAs this year. My question is the amount of tax due. Is the $10k from her simple ira factored in? Or do we just owe taxes on the $3k from the old 401k?

thanks

Harry Sit says

@nbollin – It depends on who owns the $3k rollover IRA. IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you own it, you will pay tax on that $3k. If she owns it, her SIMPLE IRA is factored in. The $7k conversion will have (3 + 10) / (4 + 3 + 10) = 76.5% as taxable. She will pay tax on $7k * 76.5% = $5,353 instead of $3,000. But then she will owe less tax from the SIMPLE IRA when she eventually takes money out of that or converts it to Roth.

Eric Forest says

I still have a question regarding the solo 401k. can I set up a solo 401k purely to move IRA? I don’t think I will have any income from the self-employed category

Eric Forest says

another question. I understand for 2010 the income limit for rollover to Roth is removed. But for 2011, is there an income limit for rollover to Roth?

Thanks

Eric

Harry Sit says

@Eric – No, to both questions. You must create some self-employment income or move the pre-tax money in the IRAs to an employer plan. The income limit for Roth conversion is permanently removed, unless they reinstate it again in a new law.

Eric Forest says

Thanks. I can not move the IRA to employer plan as I am currently unemployed. I guess my only options for converting IRA to Roth are 1) pay tax for the pre-tax money in IRA, or 2) find some self-employed income to create a solo 401k

If you have other ways, please let me know

Thanks

Eric

Harry Sit says

Or just wait until you become employed again.

Eric Forest says

sorry for the spam, but I have another question regarding the solo 401k. I decide to find some income from SE next year to do the IRA conversion. However, last night when I review the application forms for the solo 401k (from fidelity), I didn’t see there is a requirement to have some SE income to open such account. There is no mentioning of things like checking “pay check” for opening account (analogous to apply mortgage loan). I also can not find (although with quite minimum searching) any IRS restrictions regarding the need of SE income for solo 401k. can you point me to some links for those info?

Thanks again

Eric

Harry Sit says

@Eric – Everything you read about 401k plans, including IRS publication 560, talks about an employer. A solo 401k plan is still a 401k plan. It just has only owners and their spouses as participants. Only an employer can set up a 401k plan, solo 401k included. The Fidelity solo 401k plan page says at the beginning:

“Self-Employed individuals and owner-only (and the owner’s spouse) businesses and partnerships can save more for retirement through a 401(k) plan.”

It doesn’t ask for proof but you have to put down an Employer on the adoption agreement. If you don’t have self-employment income, who’s the employer? How can you be an employer without income?

You don’t have to make a net profit but you must generate some income, at least in the year when you set up your plan. You can idle your business later and keep your plan but that’s another story. You want to be legit when you set up these things.

Eric Forest says

Thanks for your great response. I think I can generate some income next year

Eric

JDB says

The first step involves rolling over existing traditional IRA, SEP IRA or SIMPLE IRA but what if I already have a Roth IRA? I guess I don’t understand how I won’t avoid paying taxes twice if I convert my Roth IRA (which was funded using after tax money) to a 401K (which will be taxed when I make withdrawls later in life)? Thanks.

Harry Sit says

@JDB – Your Roth IRA is not an “existing traditional IRA, SEP IRA or SIMPLE IRA.” You do nothing to it in Step 1, as shown in the chart.

Wait until Step 3, when you convert the new/remaining traditional IRA with non-deductible contributions to the same Roth IRA account.

JDB says

I see, so in my situation all I would need to do is open a traditional IRA, make a contribution, and then convert it to a Roth? Then repeat because next year I wouldn’t have a traditional IRA since I converted it to a Roth. Thanks.

Harry Sit says

@JDB – Yes, amazingly easy, isn’t it?

AB says

My 8606 is identical to yours! (Except my investment gain is $100 rather than $20 🙂 I guess we did the same thing: opened traditional IRAs ahead of 2010 and funded them to the max with non-deductible contributions. (No other IRAs of any kind.) Net result: a good Roth balance able to grow tax-free forever. Looking forward to the 2011 conversion.

dP says

Can rental property income be considered “self income” for this purpose of opening a solo 401k?

Harry Sit says

@dP – In general, no. The IRS says if you provide substantial services to your renters, you can count rental income as self-employment income, but that also means you have to pay Social Security and Medicare taxes on your rental income. It’s not the best way to create self-employment income for this purpose.

anita says

For step 1, I thought you had to have a ‘conduit ira’ to move money back into an employer plan. I.e. regular iras to which you made direct (pretax) contributions aren’t allowed for these kind of rollovers, right?

Harry Sit says

@anita – No, that was the old rule before 2002. Laws have changed.

Jay says

TFB –

Great Post! Recently started reading your blog and found it to be very informative. No recycled posts and mostly original articles. Good Job!

I was regretting not contributing to Roth IRA when I started my career and the income was well below the limits. This post is a great solution.

I don’t have an IRA. Only 401(k). You dont have any timings in your post. Can you do this at any time of the year? Is there a limit on how long you need to have the IRA open before you can convert it? So for 2010, I can open an IRA, put $ 5000 in cash or money market and next day convert it? Are there generally any fees associated with it? Can I still do this for 2010 year?

I opened a deductible IRA for my wife couple of years back when I could. Now i am not able to contribute to that due to income limitations. Unfortunately I cant roll over to anything since we dont have any self income yet. But If I am willing to pay tax on the deductible IRA, can I still do this for my wife as well?

Last question. After conversion, the Roth IRA is the same as a “normal” Roth IRA?

Thanks

Jay

Harry Sit says

@Jay – You asked great questions. Use this as the FAQ for this article.

> Can you do this at any time of the year?

Yes. Step 2, making a contribution has to be done April 15 of the following year, as usual.

> Is there a limit on how long you need to have the IRA open before you can convert it?

No. I converted mine the next day.

> Are there generally any fees associated with it?

Depends on the provider of course. In general, no. Many places don’t charge annual custodial fees either.

> Can I still do this for 2010 year?

Yes. You have until April 15 (or actually April 18) next year to make contributions. Conversion in 2011 counts as a 2011 conversion but it doesn’t matter. You just report the conversion on 2011 tax forms, instead of 2010 tax forms (contributions for 2010 are still reported on 2010 tax forms).

> If I am willing to pay tax on the deductible IRA, can I still do this for my wife as well?

Yes. After you pay the tax once, you get to do this for her every year thereafter.

Jay says

Thanks for the quick answers….So if I understood you correctly, I can contribute say 5k in Jan for the 2010 year and 5K in Feb for the 2011 year, then convert the total 10K and claim the conversion in the 2011 tax form 8606. the 2010 tax form 8606 will only show contribution and no conversion…there is no limit on conversion so you can do that whenever you want (though you would not want to take the risk in case they change the rules on conversion)

Thanks

Harry Sit says

@Jay – That’s correct. If you have the money, you can also contribute $5k for 2010 and $5k for 2011 on the same day in Jan. 2011, and then convert that $10k the next day. I forgot to answer your final question in the previous comment.

> After conversion, the Roth IRA is the same as a “normal” Roth IRA?

You can use the same account. The converted money has its own 5-year holding period. For normal contributions, the 5-year holding period starts when the very first contribution was made. For converted money, the clock follows each conversion. If you are investing for long term, this 5-year thing doesn’t matter.

Brian says

TFB, great article. I’ve already kicked off the process for step one to move my IRA money into my employer 401(k). Question about the Step 5….seems like if I did this for 10 years I’d end up with 10 Roth and have to open a new IRA each year or can I just roll-over the IRA funds I contribute for that tax year into the same Roth account I opened in year 1 and not close out the IRA account?

Lucy says

Regarding hiding roll-over IRA’s before doing the backdoor Roth conversion–Must this be done if you just open a new non-deductible IRA account? I was thinking I could leave my roll-over IRA alone, open a new IRA account, fund that for 2011 and then convert just that account to the Roth. Would this work or would I still be taxed on every non-Roth IRA account I have?

Thanks for your excellent site!

Harry Sit says

@Brian – You can use the same traditional and Roth IRA accounts. Every year you add money to the traditional IRA you used last year and you convert it into the same Roth IRA you already have.

@Lucy – Step 1 must be done if you already have a traditional (including rollover) IRA and you want to minimize taxes. Otherwise your conversion will trigger the pro-rata rule and you will pay taxes.

Allen Anderson says

I would like clarification on this subject. If a person makes a non-deductible contribution to his traditional IRA on January 18, 2011 (for tax year 2011), can he convert it to a ROTH IRA on January 19, 2011. In other words does the money need to stay in the traditional account for a specified time period before it can be converted?

Matt says

Thank you for the informative article as always. I want to perform your steps now but I have a question about the timing of Step 1. If I rollover my pretax IRA money to my current employer 401k, I need to understand the timing. If I plan to make a $5k T-IRA contribution in Feb. 2011 (to count for 2010), what are the dates I need to commit the pretax IRA money rollback? If I understand correctly, Dec. 31st 2010 is the only date the IRS is concerned about so I could rollback to my 401k Dec. 30th and roll-in to my T-IRA Jan. 1st. If this right, did I miss the opportunity?

Harry Sit says

@Matt – No you didn’t miss the opportunity. You can rollover the pretax portion of the IRA to your 401k at any time, whether before or after you make the traditional IRA contribution. The only requirement is that you rollover (step 1) before you do the conversion to Roth (step 3). Between steps 1 and 2, it doesn’t matter. Doing it as outlined here, step 1 before step 2, makes it more streamlined. It’s also easier to understand because step 1 is one-time and steps 2 to 4 are repeated annually.

Matt says

Thanks for the info. Step 6 on Form 8606 is confusing then. Step 6 reads:

Enter the value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2010, plus any outstanding rollovers (see instructions)

That statement would make it sound like Dec. 31st 2010 is the only date that matters. When I read the instructions for Form 8606, this is the only comment I could find that might explain why I can roll my pre-tax IRA money back to my 401k at any time. Is that right?

Form 8606 Line 6 instructions (excerpt)

Note. Do not include a rollover from a traditional, SEP, or SIMPLE IRA to a qualified retirement plan even if it was an outstanding rollover.

As far as step 1 being one-time, this would mean I would have to stay with my 401k investment choices once the pre-tax money was rolled back in. I was hoping to roll it back to my T-IRA so that I can use the IRA investment choices. Of course, I would need to repeat this every year along with steps 2-4.

Harry Sit says

@Matt – When I wrote the article, it was still 2010. The sample filled out 8606 form I provided was for all steps completed before 12/31/2010. If you are filling out the form for 2010 now, not having done the Roth conversion in 2010, you would answer ‘No’ to the question after line 3 and skip the rest of part I as instructed. By the time you do the 8606 form for 2011, line 6 will change to December 31, 2011 and you answer will be zero because you cleared out your traditional IRAs already.

Yes if you are going to do this, your pretax money will stay in your 401k. Rolling it out to an IRA will defeat the backdoor Roth. You will have to decide if you can live with the investment choices in your plan.

Matt says

I now see your point about skipping the rest of Part 1. Here is my tentative plan:

-Contribute $10k Feb. 2011 ($5k towards 2010 and $5 towards 2011).

-Anytime before Dec. 31st, 2011, roll all my pre-tax IRA money to my employer 401k

-Anytime after Jan. 1st, 2012, roll my pre-tax IRA money back to a T-IRA

-Repeat steps contributing $5k during the tax year for that tax year.

This keeps the pre-tax money non-taxable for Form 8606 and allows you to use your IRA during the year. This is a hassle but allows me to contribute to the R-IRA while still utilizing my T-IRA for pre-tax money. Please correct me if I am missing something.

Harry Sit says

@Matt – Provided your 401k lets you roll out money you previously rolled in, your plan will work but I wouldn’t do it if I were you. Rolling into and out of a 401k plan has to be in cash. Every time you do it, you will have to sell the investment and redeploy the cash when the rollover is complete. I don’t think it’s worth doing it back and forth every year just for the investment options. If you don’t like the investment options in your 401k plan, take a serious look at creating some self employment income and setting up your own solo 401k plan, as I mentioned under step 1.

Matt says

@TFB – I am 27, in the 28% Fed. tax bracket and living in CA. Based on your articles and most of what I have read, I should contribute to a traditional retirement accounts rather than Roth. If I try to keep all my trad. assets in my current T-401k, my only IRA assets are R-IRA from the after-tax non-deductible contributions (including any previous Roth investments). This means most of my retirement portfolio will be utilizing whatever options I have in my T-401k through my employer. It doesn’t allow me to follow a ETF portfolio by Paul Merriman for example. I want to avoid opening up the solo 401k since I don’t currently generate side income. If I follow my method, I also have the possible ETF transaction fees twice/yr for moving to my T-401k and back. I’ll look more into the pros/cons of these various methods. Thanks again for your advice and educational articles!

christy says

Great article. I have slightly different twist to the question. I received from 1099-DIV for my taxable investment account which I would have to report as taxable income on my return. Now if I were to open a Roth IRA now and move my money from the investment account into the Roth IRA with the purpose to count as my 2010 contribution, could I technically avoid reporting the dividend as income on my 2010 tax return ? I don’t have IRA of any kind at all, just my 401k.

Harry Sit says

@christy – No.

Cheri says

I am curious how an inherited IRA would factor into a conversion, if at all? I am considering this option for 2011, but if I need to include the value of the inherited IRA for conversion, It wouldn’t be viable option.