Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

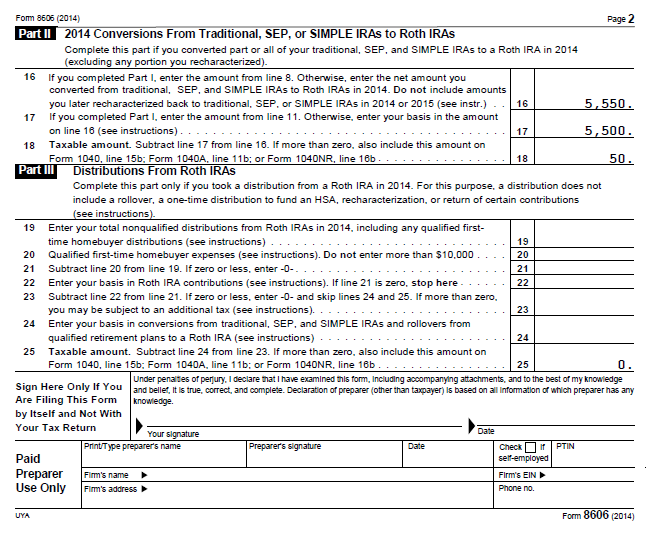

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Seth says

TFB,

Thank you for a GREAT article. I wanted to contribute to Roth but did not know how to handle my existing deductible contributions. Step 1 takes care of that.

One question though:

I checked Publication 590 on IRS website which talks about this special “pro rata” rule that you are taking advantage of BUT, this rule applies to –

“Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA”

and the definition of Eligible retirement plans is given as (listed below). It does NOT list 401K as an eligible retirement plan… so how can one hide their deductible IRA funds in 401K and still take advantage of this rule?

The following are considered eligible retirement plans.

-Individual retirement arrangements (IRAs).

-Qualified trusts.

-Qualified employee annuity plans under section 403(a).

-Deferred compensation plans of state and local governments (section 457 plans).

-Tax-sheltered annuities (section 403(b) annuities).

Harry Sit says

@Seth – A 401(k) plan falls under “qualified trusts.”

Seth says

Thank you, TFB. You have a great site !!

Mike says

Hi, quick question – why is step # 1 needed? Even if I have deductible contributions in my traditional IRA, if my preference is Roth over Traditional, why would I not want to convert all of my Traditional IRA to a Roth? I know this will result in paying taxes on that conversion for contributions (plus any returns) that were not previously taxed, but the benefit is that I won’t pay any taxes on the withdrawal (whereas if I left it in the traditional, I would need to pay taxes on the withdrawal). This is the same exact trade-off between roth vs. traditional in the first place, and if I prefer roth, I don’t understand why step # 1 would be recommended.

Harry Sit says

@Mike – Step 1 is needed for those who don’t prefer Roth over Traditional deductible contributions but prefer Roth over Traditional non-deductible contributions. If you prefer Roth regardless, you would’ve converted all your IRAs already and have no balance left when you come to this point. In such case, proceed to Step 2.

Mike says

Thanks! I don’t think it’s possible for anyone to prefer traditional non-deductible contributions over roth as that wouldn’t make any sense, right?

This article is about getting around income restrictions for roth ira contributions. If so, most ppl would not have converted all IRAs and had no balance left at this point – your article very well explains how to do so for those ineligible to contribute directly to a roth, but you may want to list step # 1 as optional for those who prefer roth over traditional deductible.

Harry Sit says

@Mike – I added a paragraph under Step 1. By any chance have you read my article The Case Against Roth 401k? It gives reasons why you might not want to convert your traditional deductible balances now. Of course if you still prefer to convert, step 1 would be optional.

David says

Thanks for the great article. I started this process a few days ago with Fidelity and I’m now at the point where I’m doing the conversion. It’s all very simple as you suggest but I do have one question: during the conversion, Fidelity is asking me if I want to leave the new Traditional IRA open or close it (since I’m converting my entire balance). Since I plan on doing this in future years, I was inclined to leave the Traditional IRA open. However, if I think I may want to rollover a 401k in the future due to a possible employment change, wouldn’t it make sense to close the Traditional IRA now, presumably leaving open the option (if necessary) of doing a rollover from my current employer 401k to a Traditional IRA in the future? Is there any reason why I can’t open and close a Traditional IRA every year (which is easy enough to do with Fidelity)?

Harry Sit says

@David – Just leave it open with nothing in it. You will need it next year. Leaving it open won’t affect your potential rollovers in the future in any way. You can roll into the empty one if you want, but read the paragraph under step 5 again if you plan to do this backdoor Roth every year.

David says

I assume the language in step 5 you’re referring to is this: “Remember not to rollover from an employer sponsored plan to an IRA when you are doing the backdoor Roth IRA. You can rollover from one plan to another plan, or to your own solo 401k, just not to an IRA.” Just to make sure I understand, let’s assume I leave the IRA open with nothing in it and that I plan to do this backdoor Roth every year. Let’s also assume that I leave my current employment to start my own business and want to roll over my 401k upon my departure. Do I then understand that I would need to roll the old employer-sponsored 401k to a a new 401k (perhaps a solo 401k) but that I wouldn’t be able to roll over into my Traditional IRA? I assume that’s what your language in step 5 means but that seems to be a bit in conflict with your last comment that I “could roll into the empty one” if I want.

Harry Sit says

@David – Not that you wouldn’t be able to, but you probably don’t want to if you are still doing the backdoor Roth. Once you have 401k rollover money in a traditional IRA, you are back to step 1 again if you are still doing the backdoor Roth. If you are done with backdoor Roth, however, say because the income limit is raised and you can go through the front door, then it won’t be a problem rolling into the empty IRA.

David says

TFB: Thanks as always. By the way, for those looking to do this quickly for the 2010 tax year, I just did this online via Fidelity and the whole process could not have been simpler.

Susan says

TFB: I just opened a Trad IRA with Schwab today for tax year 2011. I funded it with $5000 immediately. Now the money is sitting in MMF. Shd I convert the MMF or buy stocks and convert?

Thanks

Harry Sit says

@Susan – Convert the MMF. It makes your 8606 form clean. No gain or loss.

Susan says

Thanks so much TFB! Love your blog!!

Craig says

Great advice. My question is do you end up with several Roth IRA accounts if you take this approach? Once you convert the IRA to a Roth then repeat yearly, don’t you end up with a Roth IRA account for every year your convert? Seems like that would get complicated accounting-wise.

Harry Sit says

@Craig – When you convert, you convert into an existing Roth account. After you convert, you leave the empty traditional account open. Next year contribute and then convert. Just two accounts at all times.

Eyebeem says

Hi…I followed your process but screwed up on Step 1. I cut it a bit too close and did not leave enough in my traditional IRA. My total non-deductible contributions to my traditional IRA are $23,000. On the day I transferred all of my deductible contributions ($12,500) out of my traditional IRA into my employee sponsored 401k, my traditional IRA was only worth $22,869. I was short by $131.

What will the impact of this be come tax time? Is there anything I can do to fix this at this point? I have already converted my traditional IRA to a Roth IRA (step 3).

Harry Sit says

@Eyebeem – Most 401k plans allow rolling out what you just rolled in. If that’s the case for your plan, you can pull the rollover out, do the correct math, roll a smaller amount back in, and convert the remainder.

Eyebeem says

Thanks for the reply TFB. I was hoping that the tax implication of being off by only $131 would be minimal so that I didn’t have to go through rolling it back and forth again. Any idea how I would figure out what the tax impact would be of just leaving it alone?

Harry Sit says

@Eyebeem – If you’d rather not do it over, I’d think you will have to forfeit $131 basis. In other words when you file Form 8606 for your Roth conversion, you claim only $22,869 in basis instead of $23,000. Essentially you pay tax twice on $131. I’m not sure how IRS will view that discrepancy.

Eyebeem says

Thanks…that makes sense. I am not going to sweat paying taxes twice on $131. Appreciate the advice!

SK says

Hi – The information is great !! two questions:

1. I want to confirm that this backdoor option continues to be available for year 2011 i.e. I can non-deductible put $5000 in traditional IRA (I max out my 401k ) and then convert it to Roth IRA.

2. Do I have to wait for some time before converting the 5K in traditional IRA to Roth or I can do so the next day itself ?

Harry Sit says

@SK – Yes, it’s still available in 2011 and every year thereafter unless the law changes. You can do it the next day.

DG says

Great info! I recently left a company and had my 401K with both deductible and non-deductible contributions included over the years. In doing a rollover after termination, the large 401K company rep specifically didn’t recommend moving the non-deductible contributions directly to a Roth IRA in light of the IRS being unclear in this regard on it being taxable or not, so I basically moved forward and converted both the deductible and non-deductible contributions to a traditional IRA figuring I still had the non-deductible contributions growing tax-deffered.

In retrospect though, after reading various posted info on the web I believe I could have simply converted the non-deductible contributions directly to a Roth IRA and the pre-tax directly to the TIRA. In speaking with the 401K company two weeks after the conversion they indicated they cannot change it at this point. The non-deductible basis is only 3.5 percent of the total amount; however, the overall is too high so I surely don’t want to incur the pro-rata clause in any Roth IRA conversion but I am looking at my options as I do like the tax advantages of paying no taxes going forward on the earnings from the non-deductible contributions if in a Roth IRA.

So bascially the only options I have at this point is to to look to go to a new company and roll over the pre-tax contributions to a company 401K leaving behind the non-deductible as outlined in Step 1 or get some self-employment income and set up an individual 401K?

Harry Sit says

@DG – That’s correct, as explained in Step 1.

DG says

Thanks TFB, just wanted to confirm that there was no other option at this point. Do you also think I could have went directly from the 401K plan with the non-deductible contributions to a Roth IRA with the before tax to a TIRA without any concern for pro-rata tax consequences? If that is the case, it is frustrating that they advised against it and I now have to jump through hoops to make this happen. Thoughts?

Harry Sit says

@DG – There’s a rule that says if you do two distributions from a 401k plan account (one to traditional, one to Roth), both are deemed as having a mix of pre-tax and after-tax contributions. A plan administrator that strictly follows this rule can’t just split off your after-tax contributions and roll it over to Roth, although I’ve heard some administrators would do it. If your plan administrator knows the rules and insists on tagging the dollars as part pre-tax part after-tax, I wouldn’t blame them — they are just following the rules.

Andy K says

So here’s my situation: I have a Solo 401k from Fidelity which I max out, wife has 403b – also maxed. We both have a ROTH IRA the we contribute to monthly and no traditional IRAs.

As our incomes fluctuate by quite a bit, sometimes we hit the Roth IRA contribution threshold and sometimes we do not… often not knowing until the end of the year.

So – we will hit it this year and each have $4k already in a ROTH. How do we work this? Do I convert the money from the ROTH this year into a traditional non-deductible IRA and then 8086 it back into a ROTH again?

I’m not sure how to use your approach when we’ve already been contributing to this ROTH all year long? Either way, moving forward, I assume we ought to not dollar-cost-avg into these ROTHs from day one?

Thanks,

Andy

Harry Sit says

Andy – If you find yourself ineligible to contribute to a Roth IRA due to income but you already did, you will have to do something about it. The easiest way would be *recharacterize* your Roth contributions to a Traditional IRA. Contact your IRA custodian. They may do it for you over the phone or have you sign a form. After that, you can convert the Traditional IRA to Roth. In the future, it’s just easier to contribute to a Traditional IRA in one lump sum and then immediately convert it to Roth. That way you don’t have to worry about whether you exceed the income limit or not.

SS says

Great article. i do have a Traditional IRA with multiple Rollovers, deductible and non-deductible contributions and I have a question on Step 1.

My employer’s 401K allows incoming rollovers but here is my dilemma. My non-deductible contributions (a total of $13K) for previous years are across 2 different Traditional IRAs with 2 different companies. For eg: IRA 1 – $5K and IRA 2 – $8K.

But the current balance on IRA 2 account is only $5K due to losses over these years.

So when i implement Step 1, can I rollover less amount from IRA 1 to my 401K plan, so that I can compensate for the $3K loss that i incurred in IRA2 and effectively still try to Convert $13K to a Roth IRA Account?

Convert to Roth from IRA 1 – $8K ( Even though the non-deductible contrib is only $5K to this account)

Convert to Roth from and IRA 2 – $5K

I am trying to understand if there are any restrictions as to the amount that can be converted as Roth IRA specific to an account or as long as these were non-deductible contributions, we are okay?

Thanks

Harry Sit says

@SS – The IRS considers all your IRAs, regardless of custodian, as one big pool. As long as you keep $13k in your IRAs after rolling over to your 401k, you are ready for the next step.

David says

TFB: I did the backdoor Roth in early April of 2011 for the first time, depositing 10k into a non-deductible IRA and then converting. Due to some bad timing with investing the ROTH in Vanguard’s international REIT ETF (VNQI), I now show a 19-20% loss in that account. Does that change my strategy at all for this year? Is there any way for me to deduct those losses?

Harry Sit says

@David – Sort of, but it may not be worth it. Assuming you did it by the book and completed Step 1 before you made the contribution and the conversion, you can undo the conversion by recharacterizing it back to a traditional IRA. After that, you can take a distribution of the entire amount. If the distribution is less than your basis, you can deduct the loss.

However, the deduction is a miscellaneous deduction, subject to the 2% AGI floor when added to your other miscellaneous deductions. Unless you already have some other miscellaneous deductions, the loss is probably less than 2% of your AGI. That means you can’t deduct it after all. To me, it’s not worth it.

See Recognizing Losses on Traditional IRA Investments in IRS publication 590.

David C says

FYI there is an interesting debate back and forth over the legality of backdoor Roth IRA contributions: http://www.bogleheads.org/forum/viewtopic.php?f=10&t=89497

I doubt there will be a consensus unless the IRS issue a ruling… or Congress changes the law

Full disclosure: I’m “poor” enough that I can directly contribute to my Roth IRA so no worries for me 😉

Harry Sit says

Thank you David. I read the discussion. I have a solution for it. I will post it next week.

SS says

I have an IRA which contains a mixture of non-deductible contributions, deductible contributions and rolled over 401K monies from my previous employer. My current employer does accept incoming rollovers, but the incoming rollover form has a section, to describe the source of the funds being rolled over. The choices are, and i can only choose one of these.

1. Conduit IRA (Rollover IRA)

2. Non-Conduit IRA (Traditional IRA, Simplified Employee Pension plans (SEP-IRA), or a “SIMPLE” IRA distribution made more than two years from the date you first participated in the SIMPLE IRA)

I am not sure how to classify my IRA which is a mixture as. And dont want to do a rollover which will then be deemed illegal and have tax consequences.

@David…Thanks.. read your article and now not sure if this Roth conversion is even worth the risk.

Harry Sit says

@SS – That would be non-conduit. For existing non-deductible money, there is no risk. The concerns raised only talk about fresh contributions. There is an easy way out no matter whether the risk is real or not. Check back on Monday.

JLW says

I read through most of the comments, but may have missed it… let’s say I already have a Roth IRA (that’s the only IRA I have), but would like to DOUBLE my annual contributions using this method. Is that a possibility? It sounds like a great way to catch up a bit on missed years.

Thanks for the great article.

Harry Sit says

@JLW – No you can’t double your contributions because the annual contribution limit is shared between Traditional and Roth. That’s why the article said at the very beginning if you are able to contribute directly, this article does not apply to you.

Andrew says

TFB – Great how to guide. There are few guides like this out there and we all appreciate your patience with us mere mortals :-). Having said that, I have a few questions/comments after reading your article and having to search elsewhere for answers or confirmation of my understanding.

There is no limit on how much one may convert from a traditional IRA to a Roth IRA, correct?

The conversion only affects the tax return for the calendar year in which the conversion was performed, correct? In other words, If I made a 2011 traditional IRA contribution back in 2011, there is no real rush for me to do the conversion in the next week before I file my 2011 taxes since it is already 2012, correct?

Along these lines, there is no pressing need to convert sooner than later, correct? The only downsides I see are paying taxes on growth of the IRA and the possibility that the IRS will close the backdoor. For example, if my IRA is filled entirely from non-deductible IRA contributions (say $11k, $10k of that being non-deductible contributions and $1k being growth in the fund), and if I am going to contribute another non-deductible $5k this year, there is no real downside to contributing $5k for this year during February and waiting to convert the whole deal (now around $16k) after a six months lapse of time (per step 3).

Harry Sit says

@Andrew – You understood it well. There is no limit on how much one may convert from a traditional IRA to a Roth IRA. The conversion only affects the tax return for the calendar year in which the conversion was performed. There is no pressing need to convert sooner than later, other than the factors you already noted. If you wait, and the $1,000 earnings grow to $1,100, you just have to pay tax on $1,100 instead of $1,000. You didn’t ask but there is no limit on the number of conversions in a calendar year either. So if you decide to convert your existing money now and do a second conversion later this year for your 2012 contribution, that’s fine too.

Martha says

TFB, I have a SEP IRA and a Roth. This year we will be over the income limit to contribute to the Roth. I was considering the solo 401k, but then thought about this. Can I contribute each year to the SEP (20% of income, approx 18,000) each year and then convert it all to a Roth each year?

Harry Sit says

@Martha – You can but do you want to? A solo 401k would be more effective.

Martha says

I was considering the Roth IRA instead of the 401k because in the case of emergency, the contributed portion of the Roth could be withdrawn without penalties. (I hope I never need that, but it is comforting to have it as an option). If I opened a solo 401k or a Roth solo 401k, that money couldn’t be touched until retirement, right? I am weighing my options on both- solo 401k (Roth or regular) vs convert all the SEP to a Roth IRA each year.

Harry Sit says

@Martha – If you want an emergency fund, set one up outside retirement accounts. Use retirement accounts for retirement. Paying tax on $18,000 every year in order to deal with an off-chance emergency doesn’t make sense. It won’t work anyway. Unlike direct contributions, taxable conversions are subject to early withdrawal penalty unless certain conditions are met. See Roth IRA Withdrawal Rules.

Martha says

Thanks for pointing that out, I didn’t know that. I’m going to go with the solo 401k, thanks!

Jay says

After the first conversion would i continue roll the new tradition IRAs into the same roth account every year?

Harry Sit says

@Jay – Yes, the same. When you convert, the money moves but the accounts stay the same. After you zero-out a traditional IRA, you can contribute to it again the next time, and convert again to the same destination. Just keep using the same accounts on both ends. Picture two jugs: you fill jug A, pour from jug A into jug B, fill jug A again, pour into jug B again, …

JLynn says

I’m wondering if I need to wait to do the back door Roth until 2012. I made a nondeductible traditional IRA contribution for 2011 this week but I should be able to change that contribution to 2012.

You mentioned that you need to move your Traditional IRAs into your Single 401K. I did that last week. As of December 31, 2011 my balance in my Traditional IRA was 37,314.14. The form 8606 asks as of December 31, 2011.

Other pertinent facts: Max out Single 401K, 2011 AGI $450K, MFJ

Thanks,

Harry Sit says

@JLynn – Unlike contributions, which you can do *for* 2011 *in* 2012 before April 15, conversions go with the calendar year. If you convert in 2012, it will be a 2012 conversion, which you report on your 2012 tax return in 2013.

Greg says

Thanks for the article.

I have a an IRA with pretax money currently. If I roll that over to my companies 401k plan right now, do I still have time to do this process with a 2011 contribution? Or did I need to get the rollover done prior to Dec 31st 2011 to ensure that IRA is “hidden”?