When you have an account with a bank or a brokerage account, usually you can designate a beneficiary (or multiple beneficiaries with split percentages) for your account. The beneficiary gets everything in your account in case you die. It works differently when you have I Bonds in a personal account at TreasuryDirect, where your secondary owner and beneficiary are set separately for each holding, not for the whole account.

When you have paper savings bonds from many years ago, the co-owner or the beneficiary (or lack thereof) is printed on each bond itself. If you’d like to make a change, you need to open an online account with TreasuryDirect and deposit your paper savings bonds to your online TreasuryDirect account. Then you can make changes to the secondary owner or the beneficiary by following the same steps below in this post. See How to Buy I Bonds for how to open an online TreasuryDirect account and How To Deposit Paper I Bonds to TreasuryDirect Account.

Registration at Time of Purchase

Within the same TreasuryDirect account, you can own some bonds by yourself without any secondary owner or beneficiary, some bonds with Person A as the secondary owner (“you WITH A”), some bonds with Person B as the secondary owner (“you WITH B”), some bonds with Person C as the beneficiary (“you POD C”), and some bonds with Person D as the beneficiary (“you POD D”). POD stands for Payable On Death. Most people probably don’t need this much granularity but it’s an option.

Whether you name them as a secondary owner or a beneficiary, it doesn’t affect their annual purchase limit. They can still buy $10,000 in their own account. For more on the difference between a secondary owner and a beneficiary, please read I Bonds Beneficiary vs Secondary Owner in TreasuryDirect.

You designate the secondary owner or the beneficiary at the time of each purchase. The granularity compensates for the lack of designating multiple beneficiaries by percentages at the account level. While you can’t designate 50:50 between your two children as beneficiaries for the whole account, you can enter two orders every time you buy $10,000 worth of I Bonds: one order for $5,000 with Child A as the beneficiary and another order for $5,000 with Child B as the beneficiary.

If you didn’t place separate orders at the time of purchase, you can still split an existing I Bond into parts and name a different beneficiary for each part. See How to Split an Existing I Bond for Multiple Beneficiaries.

Each ownership combination — you alone, you WITH person X as the secondary owner, or you POD person Y as the beneficiary — is called a registration. You can have as many registrations as you’d like and you can associate any one of your registrations to any bond in your account.

The registration for a bond you set at the time of purchase can be changed post-purchase. If you didn’t set a secondary owner or a beneficiary when you first bought the bonds or if you change your mind at a later time, you can add, remove, or change the secondary owner or the beneficiary at any time.

Only a Person, Not a Trust

These options are only available in a personal account. An entity account for a trust or a business can’t have bonds with a secondary owner or a beneficiary. A trust or a business also can’t be designated as the secondary owner or the beneficiary. The secondary owner or the beneficiary must be a person.

One Person for Each Bond

You can name only one person as the secondary owner or beneficiary for each bond but different bonds can have different persons as the secondary owner or beneficiary. It’s not possible to have two or more people as secondary owners or beneficiaries on the same bond.

It’s not possible to name a contingent beneficiary in case the named beneficiary dies before the owner. The owner has to remember to change the beneficiary if the beneficiary dies first.

Review Current Registrations

Before you make any changes to the registration on any of your bonds in the account, you should review how they’re currently set and see which ones need to be changed. After you log in to the account, click on “Current Holdings” at the top.

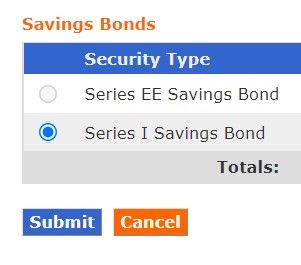

Then scroll down to the bottom and select Series I Saving Bond.

You will see a list of your bonds grouped by your existing registrations. Take notes on which bonds you’d like to make a change.

Create Your Desired Registration

Now, you need to create a registration with the ownership combination you’d like to have. Say you originally bought the bond with your name alone and now you’d like to add a secondary owner, or you’d like to elevate your beneficiary to a secondary owner, you should create a registration for you with this person as the secondary owner (“you WITH X”). Or if you’d like to change your beneficiary to a different person, you should create a registration for you with this new person as the beneficiary (“you POD Y”).

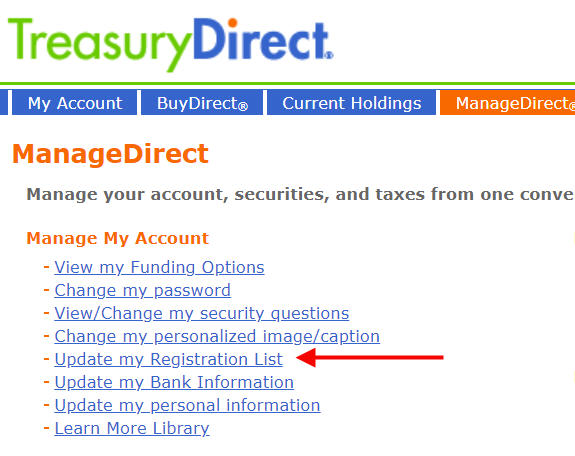

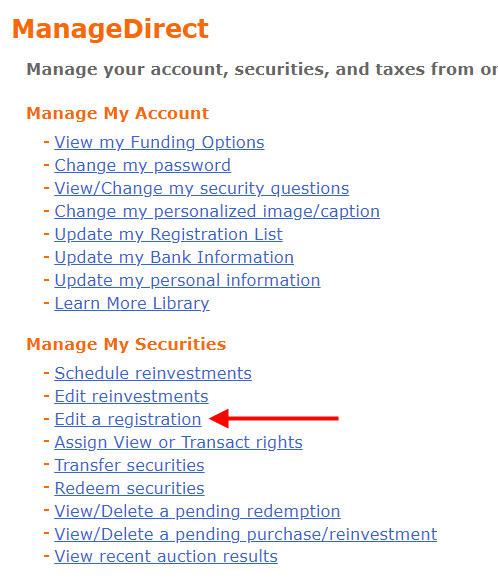

Click on “Update my Registration List” under ManageDirect.

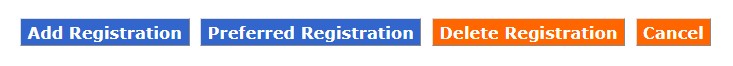

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

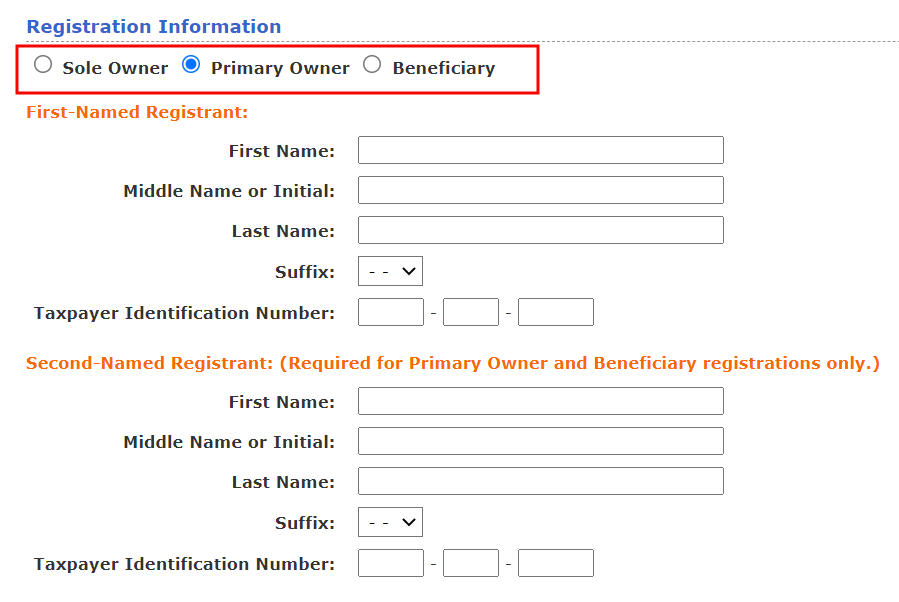

The radio buttons at the top show the registration types. Sole Owner means you alone, without a secondary owner or a beneficiary. Primary Owner means you with a secondary owner. Beneficiary means you with a beneficiary. If you choose Primary Owner or Beneficiary, enter yourself as the First-Named Registrant and the secondary owner or the beneficiary as the Second-Named Registrant.

The new combination will be added to your list of registrations. It’s not associated with any bonds yet. If you’d like to use this new registration for all new bonds you buy in the future, select it from the list and click on the “Preferred Registration” button.

Associate New Registration to Existing Bonds

Making a new registration your preferred registration only affects the default for new bonds you buy in the future. To change the registration on your existing bonds, click on “Edit a registration” under ManageDirect.

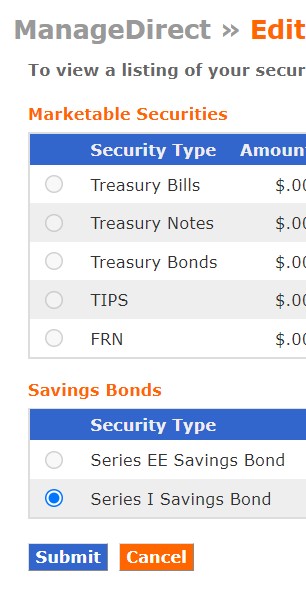

Scroll down to the bottom and select Series I Savings Bond.

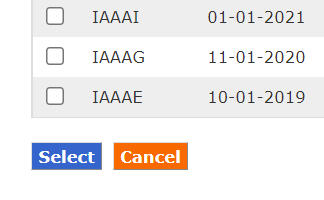

You will see a list of your I Bonds. Check the box for the ones you’d like to change. Or check all of them if you’d like to change the registration for all existing bonds.

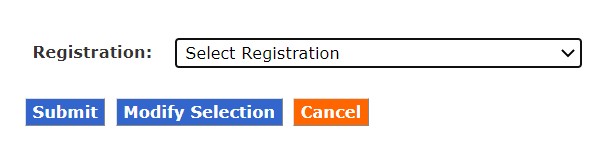

Choose your desired registration in the dropdown. The bonds you selected will change to this new registration after you click on Submit. As long as you’re still the primary owner, changing the registration doesn’t trigger taxes.

Grant Transact or View Rights

If you granted Transact or View rights to the previous secondary owner or beneficiary, those rights will be canceled automatically after you change the registration. You’ll need to grant Transact or View rights to your new secondary owner or beneficiary if you’d like. For more on why you may want to grant Transact or View rights and a walkthrough of how to do it, please read How To Grant Transact or View Right on Your I Bonds.

Deposited Paper Bonds with Joint Ownership

If you have bonds in your account that originated from paper bonds (see How To Deposit Paper I Bonds to TreasuryDirect Online Account), those bonds may have been issued to two owners jointly (“you OR X”).

This “OR” type of ownership is different than the “you WITH X” type of ownership in that the two owners are equal. There’s no primary owner or secondary owner in the “OR” type of ownership. One owner can’t kick out the other owner without the other owner’s consent. The “OR” ownership is preserved when paper bonds are deposited into the TreasuryDirect account. These bonds become “restricted securities,” and you can’t change the registration online.

If you still want to edit the registration of these restricted securities, you’ll need to fill out Form 5446. Both owners must sign in front of a bank officer.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jeff says

Thanks for posting this–it certainly is not at all intuitive. I had been trying to find “add a beneficiary” like every other financial web site has.

Sheri says

is it possible to add a beneficiary to an i bond in my gift box?

Harry Sit says

It’s not possible to add a beneficiary to an I bond in your gift box. The gift recipient can add one after you deliver the gift.

craig says

My parents are in their upper 70’s and are interested in buying I bonds for the first time but are concerned about how to structure them so that they can maximize how many they can buy BUT also make sure that these funds are properly transferred to the surviving spouse upon death of either of them as well as to my brother and I upon both of their deaths (which unfortunately is bound to happen when you are that age).

It doesn’t look like you can add multiple beneficiaries to solve this inheritance issue, so would the best solution be to purchase $10,000 with my dad as primary and my mom as secondary owners, purchase a 2nd $10,000 with my mom as primary and my dad as secondary owner and then if either of them dies, have the remaining owner add my brother or I as a beneficiary or new secondary owner at that time so that it doesn’t fall into probate?

Next question would be if they purchase $5,000 with their tax refund (joint filers) this year, will that paper bond be issued as a joint bond? How can we make sure that bond doesn’t fall into a probate situation in the future? Can you add a beneficiary to a paper bond in the future if 1 of the 2 original owners dies after being issued? Thank you!!!

Harry Sit says

That’s correct — you can have either a second owner or a beneficiary but not both at the same time. After the bonds go to the second owner or the beneficiary when the original owner dies, the new owner can add their own second owner or beneficiary. If the two parents are of similar ages and health and these bonds don’t represent a large percentage of their wealth, they can also consider listing children as the beneficiary directly to avoid having to process ownership change twice.

As mentioned in the last section of the post, if they use Line 4 on the bond purchase form (without naming names), they will receive bonds in “OR” ownership form. The “OR” bonds can’t be changed online. There must be an offline process to change it after one owner dies. If that sounds like more hassle than it’s worth, consider using Line 5 to make only one of them the owner. After the owner deposits the paper bonds to their online account, they can make those match the rest of their bonds.

jay e moss says

Excellent article. Thank you! I have some ibonds I inherited from my father. Can I add my grandson as second owner now (no taxes?) and he can cash when needed for college and pay taxes on his lower income?

Harry Sit says

You can add a second owner but you’re still on the hook for taxes at your tax bracket when the second owner cashes the bonds.

Phillip says

Thanks! Very useful reminder. Just updated my registration to add a beneficiary.

Jack says

Congradulations! I just tried 4 times to add a POD to a prior bond, and it fails to show up when I hit submit. No idea what I have been doing wrong.

Casey says

Harry, thanks so much – perfect step by step process. Just did it for me and my wife.

Rebecca Webster says

Super helpful article – thanks, Harry!

Lee says

I’ve searched all over treasury direct to find a way to update the beneficiary of an I bond. Now that I’ve found it, it won’t take any input. If there is a help key, I don’t see it. What inn the heck am I supposed to do?

Lee Bee says

I still have the same problem 1 week later. I don’t have an “account” or “registration”. I have a paper bond, in my hand. The beneficiary listed on the bond has passed. I need to assign a new beneficiary. The local bank won’t cash I bonds.

Lee

Harry Sit says

If you only have a paper bond, they want you to open an online account, deposit the paper bond to your online account, and make the change in the online account by following the steps here.

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ireplace.htm#reissue

See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Fred Faul says

Re: Lee’s comment on Jan.12, 2022. I have the same problem, can not figure out how to change a beneficiary on I bond. Follow all directions, when finished nothing has changed. What are we doing wrong?

Harry Sit says

Fred – Lee was trying to change the beneficiary on a paper I Bond. Are you trying to do the same? Which steps did you follow and finish? Where’s your I Bond now?

Tom Lundy says

I have IBonds in my own treasury direct account with my wife as the POD beneficiary. I want to change the beneficiary to our marital trust but the “change beneficiary” interface only has the option of changing to another person not to trust.

I also want to change the default beneficiary for future purchases to the trust.

Am I permitted to make the above changes? If so, how?

Thanks for any light you can shed on this.

Harry Sit says

It’s not possible to have a trust as the beneficiary.

E. Andrews says

I purchased an I Bond via Treasury Direct, and registered as sole owner. Now, I want my spouse added as co-owner or second owner. Do I make change by clicking “add registration” and proceed to add his required information. Thanks.

Harry Sit says

Please follow all the steps in this post.

Steve says

Harry – Thank you so much for your article. It was so easy to follow your instructions. Thank you!

Conrad Ottenfeld says

This was a very helpful site for me to buy a couple of I-bonds for my wife and myself – excellent instructions with screen shots from the Treasury Direct site – thanks!

Barbara Mueller says

May joint owners of I bonds designate one or multiple beneficiaries?

Harry Sit says

No. The primary owner can add either one second owner or one beneficiary but not both at the same time. The second owner can’t add any.

RG says

Awesome post, Harry – thank you!

If a person with I bonds as sole owner dies, would the I bonds not pass directly to that person’s estate and the will of that person define beneficiary’s, etc? In other words what is the benefit of adding co-owners or beneficiaries?

Second question: can a parent be placed as secondary co-owner of I bonds purchased to a minor son (as primary co-owner) and be able the parent to cash the I bond years later, even if the son is by then an adult?

Thanks!

Harry Sit says

Passing to the estate requires probate through the court, which takes time and costs money.

Being listed as a second owner doesn’t automatically give you the right to cash out. The primary owner has to explicitly grant that right, which they can revoke at any time. They can also unilaterally remove you as the second owner altogether at any time.

Linda says

Can a elder parent buy 4 i bonds with 4 children being secondary owner or should it be beneficiary as all children are over 50 years old

Harry Sit says

Each I Bond can have a different second owner or beneficiary. A second owner can be granted Transact right but it’s not automatic. A second owner without the optional Transact right isn’t any different than a beneficiary.

Marilyn Linhardt says

We are in our eighties and have 3 adult children and have the same question as Linda. Also, can these three children be co-owners of an I bond if they have purchased one in their name already in the same year since we are limited to $10,000 purchase per person?

Harry Sit says

Each I Bond allows only one second owner or beneficiary. If you’d like to name three children, make three separate purchases of say $3,300 each and name a different child on each purchase. Being named a second owner or beneficiary doesn’t affect their purchase limit.

DanB says

Hello and thank you for what you do to inform and answer peoples questions. I wish that I had found your site before I purchased gift I bonds for my grandchildren as I believe I may have made an error. From memory what I think I did was registered my son as the first registrant as the primary owner and his children (my grandkids all under 18 years old) as the second named registrant. I am currently holding them in my gift box as I await my son to set up his own TD account and adds his children so that I can then deliver them to each individual grandchild. Is what I did incorrect, and if so can the first registrant and second registrant names be flip flopped to make the purchase for my grandchildren as I intended? If not what have I created? Thank you so much for your advice in helping me to understand what I may have done wrong.

Harry Sit says

You can see how the gift bonds are currently registered by clicking on the Gift Box link on the top right after you log in. However, the names can’t be swapped if it isn’t what you intended. After you deliver the gift bonds to your son, he can transfer the bonds to his children with separate FS 5511 forms. That requires a trip to a bank to get signature guarantees. As an alternative, he can also keep your gift bonds for himself and buy new bonds for his children with his own money.

DanB says

Harry, thank you very much for your reply. I understand what you wrote but I’m still unclear how I should set up any future gift I bond purchases for a grandchild. Should the grandchild/minor be named as the first Registrant/primary owner using his or her SS# if my intentions are to have my grandchildren the owner of the I bond and then have my son as the second registrant/beneficiary as their parent? In addition, in your reply you stated that I could deliver the gift bonds (there are four @$10K each – totaling $40K that I registered as the second registrant using the children’s SS#) to my son and that he could transfer them to each of his children using the form you referenced. I briefly scanned the form, but was curious if their are any tax obligations or any additional cautions in doing that or if it is simply a re-registration process using that form? Thanks again for the valuable information!

Harry Sit says

If you intend to have your grandkids own the bonds, you list them first. Their dad can be the second owner or the beneficiary. Please read Buy I Bonds in Your Kid’s Name: You Can, But Should You? on the pros and cons of making a kid the primary owner. It’s written for parents but some of it applies to grandparents as well.

If you already listed your son first, although officially you can’t change the gift recipient after you buy the bonds, please contact customer service to see if they can make an exception and swap the names for you. If the names can’t be swapped, you can only deliver them to your son. Your son can decide to keep them for himself or transfer them to your grandkids. If he transfers them, he’ll owe taxes on the interest earned before the transfer, but if he transfers soon enough the bonds won’t have earned much interest anyway.

If the names can’t be swapped, your $40k purchase also exceeded the annual gift tax exclusion amount ($15k in 2021 and $16k in 2022) because the gifts are all for your son. You’ll need to file a gift tax form 709. You don’t pay any gift tax when you use up some of your estate tax exemption amount but you still need to file the gift tax form. It’s due April 15 this year if you bought the bonds in 2021 or April 15 next year if you bought them in 2022.

I really hope customer service can do you a favor and swap the names.

mary says

thank you so much. i used your directions and successfully switched from me to my 3 grandkids in 3 separate moves. super easy after 1st go around. the tbond peope cannot help you do this.

waran says

we need a beneficiary to our recent purchase of I – bonds. We checked the primary owner button and entered our individual names in the first box. To add a beneficiary we have to enter the individual’s name in the second box and what is the next step once we do that?

Will the bond automatically transfer to the beneficiary upon our passing on?

Thank you

Harry Sit says

The next step is to grant View right to your beneficiaries so that they know which bonds they are a beneficiary of. See How To Grant Transact or View Right on Your I Bonds. They’ll receive the bonds after they send in your death certificate.

DanB says

Thank you for your further clarification on my issue involving buying and properly registering I bonds for grandchildren. I will contact customer service to see if they will be able to make the changes for me.

Steven Gilbert says

Are there tax consequences upon death of the sole owner or primary owner when the bond passes to either the co-owner or beneficiary? Are the bonds automatically retitled either making to co-owner or beneficiary sole owner after the Treasury has been notified of the death of the primary or sole owner? Lastly, is a co-owner with transaction rights identical to a joint owner in a respects?

You perform a great service in an area where information is sorely lacking. Kudos to you!

Harry Sit says

By default the second owner or the beneficiary will pay tax on all the interest since the original purchase when they eventually cash out. See Taxes on I Bonds Get Complicated If You Go Against the Default for some more complicated ways to handle it. The second owner or the beneficiary will become the sole owner of the bonds after they present the death certificate. They can add their own second owner or beneficiary afterward.

A second owner with transaction rights is more like a beneficiary with a power of attorney. They don’t have true ownership. The primary owner can revoke the transact right or remove them altogether at any time without consent or notice.

Greg says

Harry, Great information! Although my mother’s situation is slightly more complex than some of the topics discussed, if would further clarify. My mother has Paper I-bonds titled as “OR” with my father (Primary – now deceased ~ 10 years). She would like to Convert the paper to electronic form and add me as her Beneficiary.

However, we are unclear how to enter the conversion information into “ManageDirect » Add a Conversion Registration” for the following:

• First-Named Registrant: (The paper bonds reflect my deceased father’s name) … Do we now enter her name?

• If my mother is now named Primary First-Named Registrant, is this when we add me as “Second-Named Registrant”?

• Realizing we have not yet registered given the above First-Named ambiguity, how/when do we assign the Second-Named beneficiary?

• Is it only after selecting the Second-Named/beneficiary that an additional screen then opens for the beneficiary designation you have discussed elsewhere: “you POD Y” ?

• When sending the signed manifest along with her bonds…do we sent a copy of my Father’s Death Certificate?

• Are there other requirements for removing my Father’s name?

Thank you!

Harry Sit says

Your mother first needs to remove your deceased father and get the bonds into her name only (sole owner). Please contact customer service for the exact procedure and required documentation. Once the bonds are in her account, she can go through the steps here to add a beneficiary.

Carolyn says

This was such a helpful post–thank you!

For a couple with no children, what is the best way to set up our I-bond registration so that in the event we are killed together in an accident or something, it is clear who gets the bonds? I don’t see how we can be co-owners and name someone as our joint beneficiary.

The rest of our estate planning involves our trust as a beneficiary; even our property is in the trust. Since that is not possible with I-Bonds, what is the best way to register our bonds? It looks like if we co-own them (Primary and secondary owners), they would be dropped into probate if we died simultaneously.

Karen says

When you change the I Bond registration to add a co-owner, are there ramifications as far as yearly purchase limit of 10k pp? MFJ, purchased 10k each name 2021, 2022, plus 5k jointly on tax return 2022.

Harry Sit says

The purchase limit is only counted toward the primary owner. Being a second owner or beneficiary doesn’t affect the person’s purchase limit.

Steven Gilbert says

Is there a way to export one’s bond portfolio to a spreadsheet in order to be able to allocate bonds to heirs and subsequently add beneficiaries in Treasury direct? Definitely missing Treasury Wizard.

Harry Sit says

Not a direct export but you can click on Current Holdings in the top menu to view a list of your bonds. Copy the list by dragging your mouse over the list. Copy and paste into a text editor such as Notepad. Make a minor edit to the first row to match the other rows. Copy and paste again from the text editor into a spreadsheet.

Jay says

If you use form 8888 to buy ibonds and you file a joint return but buy ibonds in only one spouse’s name as recommended, is there any reason not to list a beneficiary or co-owner on the form?

Harry Sit says

Listing a co-owner will make it a restricted security again. The spouse owner won’t be able to make changes easily. Listing a beneficiary is OK.

Preat says

Hi Harry,

Thanks for putting this together, very helpful. My wife and I are planning on purchasing I-bonds with our tax return this year. You mentioned using line 5 and alternating the $5K each year between you and your spouse. Is there a reason to do it that way vs. just $2,500 to each via lines 5 and 6?

Thanks

Harry Sit says

Handle fewer bonds – 12 bonds for $5,000, 18 bonds for $2,500 each. Fill out one manifest versus two. Mail back in one envelope versus two. No chance of mixing up his bonds with hers or mismatching with the manifest.

Preat says

Just FYI, not sure if they are changing this going forward or if it was just this year, but I received my paper I-bonds in the mail a couple days ago and it was just a single $5,000 I-bond instead of multiple denominations.

Michael says

My wife and I filed a joint return and were limited by the $5000 dollar limit. This year we are incresing our witholdings and doing Married filing separately next year so that we can each buy a $5000 dollar I bond. This year we filed electronically and we were given the option to purchase the savings bond but we were not directed to the Form 8888 for registration and ownership. Is this something that we have to fill out by hand and mail in?

Harry Sit says

The option you were given to purchase I Bonds already generated an electronic version of Form 8888. Some software automatically assumes the bonds will be in the same names as the taxpayers. They don’t give you the option to put different names on the bonds. You don’t have to fill out Form 8888 separately on paper if you already chose the I Bonds option when you e-filed.

Ed says

I inherited I-Bonds from my Mom several years ago. I now hold old those in a Treasury Direct account where I am the Primary Owner and my wife is the second owner. I recently set up a living trust with my wife. Is it possible to create a new Trust account within Treasury Direct and transfer the inherited I-Bonds to it?

Also, since both myself and my wife are Trustees, would the annual purchase limit of I-bonds under this Trust account be $20,000?

Harry Sit says

You can create a trust account. The annual purchase limit for a trust account with two trustees is still $10,000. Please read Buy More I Bonds in a Revocable Living Trust on keeping both the personal account and the trust account versus transferring.

Bill says

If looking to purchase $10,000 of an ibond and having two children as beneficiaries, is it best to split up Into two $5000 purchases naming each of them separately? Furthermore, Is it possible to do this if having purchased $10,000 in years past or would that bond only be able to have one beneficiary indefinitely?

Harry Sit says

A bond can have only one beneficiary at any time. Make separate purchases if you’d like to name multiple beneficiaries.

question says

Is it still possible to buy the paper I-bond after the IRS has already deposited a tax refund into a filer’s bank account or the opportunity for the purchase of the paper I-bond has gone ?

Harry Sit says

It’s gone this year.

question1 says

Does choosing the POD beneficiary mean the beneficiary will receive the money while the second owner with the optional transaction right will automatically become the new primary owner after the original primary owner dies?

Harry Sit says

No, both will become the new owner when the original owner dies. They can decide to keep the bonds or cash out. The only difference is the optional transact right.

gary goodman says

Is a death certificate required to change a POD designee to one that is now living

I bonds where the mother was the beneficiary and she has now passed . How can I change the beneficiary to my brother. ??

Harry Sit says

The owner can change the beneficiary at any time for any reason. If the I Bonds are already in the online TreasuryDirect account, follow the steps in this post. If the I Bonds are still in paper form, first deposit the paper bonds to your online account and then follow the steps in this post. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

George J. McDermott says

HELLO, MY WIFE AND I BOTH HAVE A REGISTERED $10,000 I BOND BOUGHT JAN.7TH,2022. NOW WE WANT TO BUY EACH OTHER OTHER A $10,000 GIFT IBOND TO HOLD IN OUR GIFT BOX WITH EACH AS BENEFICIARRY. OR, SHOULD SECOND OWNER DESIGNATION BE USED. WE WANT MY DAUGHTER TO BE HEIR . THANK YOU. JOHN

Harry Sit says

Sorry I can’t read all caps. Please try again after fixing your keyboard.

Ask says

A is a primary owner and bought I-bond with B. The registrar is A with B. The money source is from B’s bank. The primary owner A does not have bank account. Can A redeem the I-bond in B’s bank or let B redeem the I-Bond? Thank you for your answer.

Harry Sit says

I’m not sure TreasuryDirect lets A link B’s bank account, but if they did, the same bank account used for purchase can also be used for redemption. It’s not possible to purchase I Bonds without a linked bank account. If A grants B Transact rights, B can also redeem the bond. See the “Grant Transact or View Rights” section.

Matt says

What happens if a savings bond owner dies and I am named the co-owner/ secondary owner? Do I need to fill out certain forms to get the bond transferred to my name?

Is the transfer process/ form to fill out the same if I am the beneficiary instead of the co-owner?

Harry Sit says

TreasuryDirect asks you to contact them and they’ll give you specific instructions. It’s the same after the owner’s death whether you’re named as the second owner or the beneficiary. The only difference is whether you can be granted Transact rights when the owner is living.

ray says

Hi! When opening TD account, can one provide second owner’s bank account info with the second owner name on the bank account or the bank must be the primary owner’s own bank account? In other words, how can the primary owner buy the I-bond though the different person’s, for example, family member’s bank account? Thank you for your answer.

Harry Sit says

I would avoid doing that, but if you must, you can try it and see what happens.

coody says

Hi! If the registrar chooses X with Y to make a purchase during the first time registration, can the primary owner X later delete the second owner or change the second owner Y’s transact rights? Thank you for your answer.

Harry Sit says

Yes, the primary owner can change everything with regard to the second owner or beneficiary by following the steps in this post.

coody says

I read your article “Grant View or Transact Rights.” You wrote “If you put a second owner or beneficiary on the bond at the time of purchase, the second owner’s or the beneficiary’s name and Social Security Number will show up automatically. You need to enter their TreasuryDirect account number.” There is only ONE TD account number during the registration when the registrar chooses the account type X with Y. How to enter the second owner’s TD account number? Thank you for clarification.

Harry Sit says

The second owner needs to open their own TreasuryDirect account in order to be granted Transact rights even if they’re not buying any bonds for themselves. The Transact rights are exercised through the second owner’s account.

Stan says

I purchased an I Bond and registered my wife as the POD. I want to change her POD status to be the secondary owner. I went through the process as you have laid out above, but adding a “second owner” option does not come up. The Treasury Direct website says that I can make this change, but after waiting on the phone for over an hour, I was told I can’t. Is it possible to add a secondary owner on an I Bond?

Harry Sit says

Follow the process to create a new registration. Choose the “Primary” radio button. Put your information under the first-named registrant. Put your wife’s information under the second-named registrant. This will create a “You WITH Wife” registration. Now do the second part. Check the boxes for the bonds you want to change. Associate those with this “You WITH Wife” registration. Then grant the Transact rights if you’d like.

Pat says

With bank accounts it is possible to have insured deposit amounts greater than the FDIC insurance limits for a husband and wife by having multiple ownerships, such as each single name plus joint accounts. Is there a similar combination of registration selections that would allow a husband and wife to purchase more than $20,000 in I bonds in a single calendar year?

Harry Sit says

With a trust, a business, for a minor child, or as a gift. See How to Buy I Bonds.

Robert G says

Hello, hopefully someone can help. I purchased 2 $5000 i bonds recently and am registered as Sole Proprietor. I want to add a beneficiary but “Update Registration List” is not visible under Manage My Account and therefore I cannot designate a beneficiary. I followed the instructions exactly as posted. What am I missing? Thanks.

Harry Sit says

An entity account for a business or a trust can’t add a beneficiary. You can do that only in a personal account.

Robert G says

Thanks Harry. I did not register as a business but as an individual, unless I made a mistake at the time of registration… I don’t see any way to edit this registration.

Robert G says

I now see where I erroneously opened a business account instead of an individual account. Thanks.

joe says

I have several paper bonds and a treasury direct account with a couple electronic bonds. If I convert the paper bonds to electronic form, can I then change the registration or will they become restricted. How long will it take for the paper bonds to show up in my treasury direct account. What happens if my paper bonds get stolen or lost in the mail?

Harry Sit says

If your paper bonds have only one owner or an owner and a beneficiary, you can add a second owner or change/remove the beneficiary after you deposit them. If the paper bonds have two living owners, they’ll become restricted. It took about a month when I deposited mine in April. If they’re lost or stolen in the mail, you use FS Form 1048 to have them replaced.

Phil says

Recently purchased a $10,000 ibond. Would like to make my 2 children beneficiaries. I know registration only allows one. However, is it possible to split the bond into two $5000 bonds and then name one child as beneficiary on each bond?

Harry Sit says

I don’t see any way to split an existing bond yourself. Customer service may be able to split it for you but they’re quite busy these days. The easiest way is probably buying a $10,000 bond next year and naming a different child on that second bond.

Harry Sit says

I figured out a way to split an existing bond to name a different beneficiary on each part. See How to Split an Existing I Bond for Multiple Beneficiaries.

Richard says

I’m single..the sole owner of (2) Ibonds and I would like to add beneficiaries but I don’t know their SS numbers and don’t want to ask them. Are SS numbers a requirement to add beneficiaries? If I wanted to instead add them as second owners, would their SS numbers be required? Thanks!

Harry Sit says

A social security number is required either way.

Thad says

I plan to purchase a $10K I-bond with my wife as secondary owner, and she’ll be purchasing her own $10K I-bond with me as secondary owner. Both of us are joint owners on our checking account with our bank. Will we have any problems paying for these bonds individually on the Treasury Direct website using the same bank account as the source of funds? Thanks for your time.

Harry Sit says

Using the same checking account in two separate accounts under different names won’t be a problem.

George J. McDermott says

THANK YOU.

Lynn says

What is the difference between a beneficiary and a secondary owner.

Harry Sit says

See the linked post at the end of the third paragraph.

Beverly gladd says

Under Manage Direct the edit registration option does not exist. All other options are listed including View Funding, Change Funding, etc. so I still can not add a beneficiary? What am I missing?

Harry Sit says

The option exists only in personal accounts. See comment #39.

Scott Salone says

What a great site! I learned more here than anywhere else – thanks

We have over 80 paper I bonds bought in 2001 to 2003 either in my name as owner and my wife as co-owner and vice versa. I have a trust and these Ibonds would be the only thing to have to go to probate (over $10,000.) I’m assuming that I would have to get two signaures at the bank (mine and hers) for two separate manifests where I can convert many bonds on one manifest. Can we transfer all to the trust as the primary owner or secondary owner? If we can’t transfer to a trust, what is the best way? We both have our existing electronic accounts so I assume we could transfer our respective bonds there. Thanks again

Harry Sit says

Depositing paper I Bonds into an online account doesn’t require a signature guarantee at the bank. The two co-owners are equal on paper bonds. It doesn’t matter whose name is listed first. The paper bonds can be deposited into either co-owner’s account. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Co-owned bonds don’t go to probate when one owner dies. The surviving owner becomes the sole owner and they can name a second owner or beneficiary again.

Mike says

Harry:

If i want to purchase a $10k I-bond for each of my kids, what is the best way to do that? Can i do that through my account or should i have them set up their own accounts and write them a check to put in?

Harry Sit says

Assuming you’re talking about adult kids, either way works, and they’ll need their own accounts regardless. Writing them a check is easier. Buying as a gift in your account also works but it can trip you up when you aren’t familiar with the exact steps.

Sue says

When my brother in law passed away recently his daughter found several EE bonds purchased by a family friend many years ago naming her father as beneficiary. The friend passed away several years ago, and now her father has passed also. Her father did not leave a will and his estate is now in probate. How will the bonds be distributed?

Harry Sit says

They go to the estate of the person who died last (your brother-in-law). See Death of a Savings Bond Owner from TreasuryDirect.