When you have an account with a bank or a brokerage account, usually you can designate a beneficiary (or multiple beneficiaries with split percentages) for your account. The beneficiary gets everything in your account in case you die. It works differently when you have I Bonds in a personal account at TreasuryDirect, where your secondary owner and beneficiary are set separately for each holding, not for the whole account.

When you have paper savings bonds from many years ago, the co-owner or the beneficiary (or lack thereof) is printed on each bond itself. If you’d like to make a change, you need to open an online account with TreasuryDirect and deposit your paper savings bonds to your online TreasuryDirect account. Then you can make changes to the secondary owner or the beneficiary by following the same steps below in this post. See How to Buy I Bonds for how to open an online TreasuryDirect account and How To Deposit Paper I Bonds to TreasuryDirect Account.

Registration at Time of Purchase

Within the same TreasuryDirect account, you can own some bonds by yourself without any secondary owner or beneficiary, some bonds with Person A as the secondary owner (“you WITH A”), some bonds with Person B as the secondary owner (“you WITH B”), some bonds with Person C as the beneficiary (“you POD C”), and some bonds with Person D as the beneficiary (“you POD D”). POD stands for Payable On Death. Most people probably don’t need this much granularity but it’s an option.

Whether you name them as a secondary owner or a beneficiary, it doesn’t affect their annual purchase limit. They can still buy $10,000 in their own account. For more on the difference between a secondary owner and a beneficiary, please read I Bonds Beneficiary vs Secondary Owner in TreasuryDirect.

You designate the secondary owner or the beneficiary at the time of each purchase. The granularity compensates for the lack of designating multiple beneficiaries by percentages at the account level. While you can’t designate 50:50 between your two children as beneficiaries for the whole account, you can enter two orders every time you buy $10,000 worth of I Bonds: one order for $5,000 with Child A as the beneficiary and another order for $5,000 with Child B as the beneficiary.

If you didn’t place separate orders at the time of purchase, you can still split an existing I Bond into parts and name a different beneficiary for each part. See How to Split an Existing I Bond for Multiple Beneficiaries.

Each ownership combination — you alone, you WITH person X as the secondary owner, or you POD person Y as the beneficiary — is called a registration. You can have as many registrations as you’d like and you can associate any one of your registrations to any bond in your account.

The registration for a bond you set at the time of purchase can be changed post-purchase. If you didn’t set a secondary owner or a beneficiary when you first bought the bonds or if you change your mind at a later time, you can add, remove, or change the secondary owner or the beneficiary at any time.

Only a Person, Not a Trust

These options are only available in a personal account. An entity account for a trust or a business can’t have bonds with a secondary owner or a beneficiary. A trust or a business also can’t be designated as the secondary owner or the beneficiary. The secondary owner or the beneficiary must be a person.

One Person for Each Bond

You can name only one person as the secondary owner or beneficiary for each bond but different bonds can have different persons as the secondary owner or beneficiary. It’s not possible to have two or more people as secondary owners or beneficiaries on the same bond.

It’s not possible to name a contingent beneficiary in case the named beneficiary dies before the owner. The owner has to remember to change the beneficiary if the beneficiary dies first.

Review Current Registrations

Before you make any changes to the registration on any of your bonds in the account, you should review how they’re currently set and see which ones need to be changed. After you log in to the account, click on “Current Holdings” at the top.

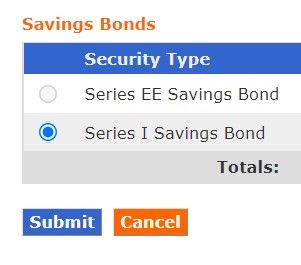

Then scroll down to the bottom and select Series I Saving Bond.

You will see a list of your bonds grouped by your existing registrations. Take notes on which bonds you’d like to make a change.

Create Your Desired Registration

Now, you need to create a registration with the ownership combination you’d like to have. Say you originally bought the bond with your name alone and now you’d like to add a secondary owner, or you’d like to elevate your beneficiary to a secondary owner, you should create a registration for you with this person as the secondary owner (“you WITH X”). Or if you’d like to change your beneficiary to a different person, you should create a registration for you with this new person as the beneficiary (“you POD Y”).

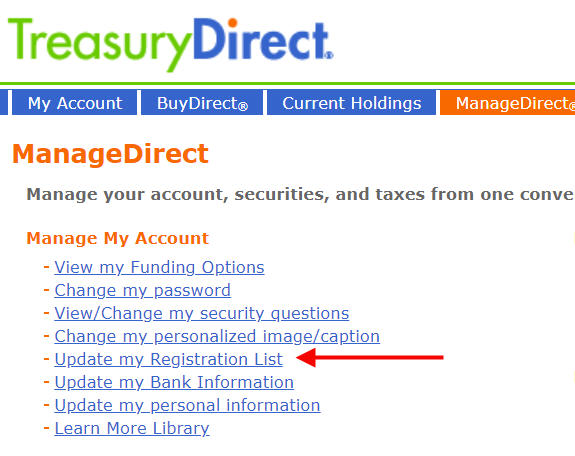

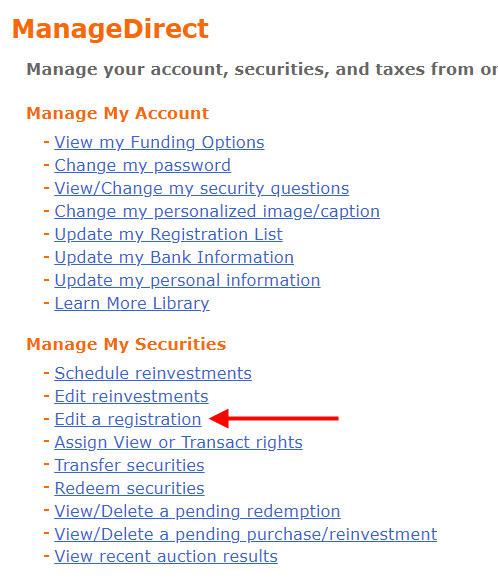

Click on “Update my Registration List” under ManageDirect.

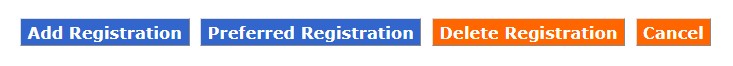

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

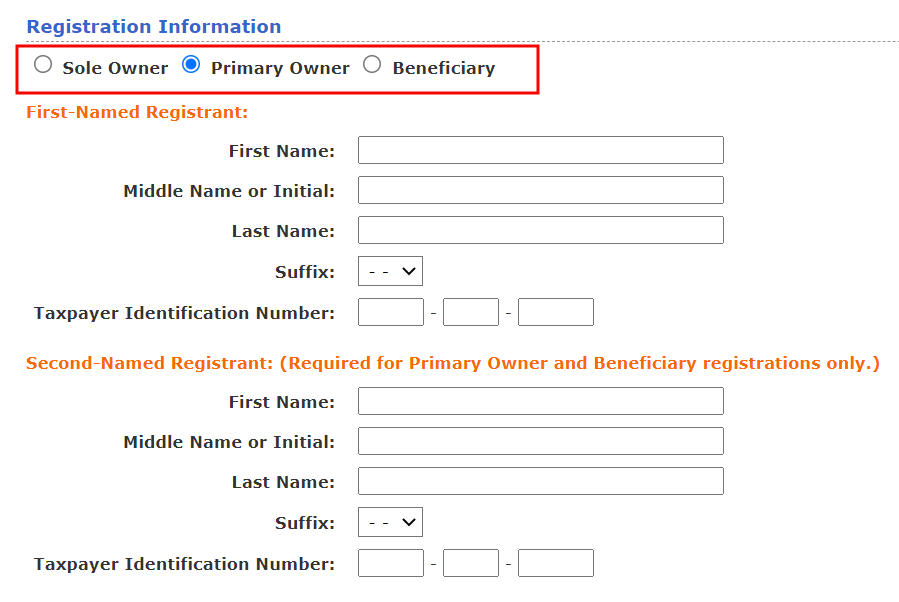

The radio buttons at the top show the registration types. Sole Owner means you alone, without a secondary owner or a beneficiary. Primary Owner means you with a secondary owner. Beneficiary means you with a beneficiary. If you choose Primary Owner or Beneficiary, enter yourself as the First-Named Registrant and the secondary owner or the beneficiary as the Second-Named Registrant.

The new combination will be added to your list of registrations. It’s not associated with any bonds yet. If you’d like to use this new registration for all new bonds you buy in the future, select it from the list and click on the “Preferred Registration” button.

Associate New Registration to Existing Bonds

Making a new registration your preferred registration only affects the default for new bonds you buy in the future. To change the registration on your existing bonds, click on “Edit a registration” under ManageDirect.

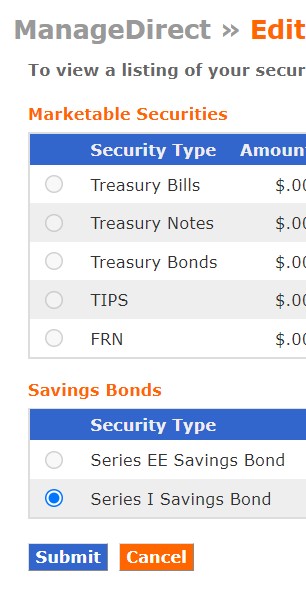

Scroll down to the bottom and select Series I Savings Bond.

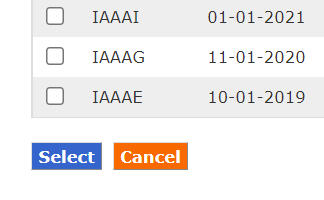

You will see a list of your I Bonds. Check the box for the ones you’d like to change. Or check all of them if you’d like to change the registration for all existing bonds.

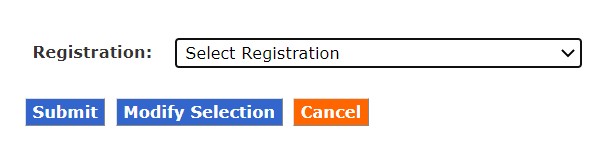

Choose your desired registration in the dropdown. The bonds you selected will change to this new registration after you click on Submit. As long as you’re still the primary owner, changing the registration doesn’t trigger taxes.

Grant Transact or View Rights

If you granted Transact or View rights to the previous secondary owner or beneficiary, those rights will be canceled automatically after you change the registration. You’ll need to grant Transact or View rights to your new secondary owner or beneficiary if you’d like. For more on why you may want to grant Transact or View rights and a walkthrough of how to do it, please read How To Grant Transact or View Right on Your I Bonds.

Deposited Paper Bonds with Joint Ownership

If you have bonds in your account that originated from paper bonds (see How To Deposit Paper I Bonds to TreasuryDirect Online Account), those bonds may have been issued to two owners jointly (“you OR X”).

This “OR” type of ownership is different than the “you WITH X” type of ownership in that the two owners are equal. There’s no primary owner or secondary owner in the “OR” type of ownership. One owner can’t kick out the other owner without the other owner’s consent. The “OR” ownership is preserved when paper bonds are deposited into the TreasuryDirect account. These bonds become “restricted securities,” and you can’t change the registration online.

If you still want to edit the registration of these restricted securities, you’ll need to fill out Form 5446. Both owners must sign in front of a bank officer.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

joe bardon says

can a second owner of an i-bond with transact rights immediately following registration redeem the bond or is there a waiting period.

Harry Sit says

No waiting period.

Jim O'Brien says

I accidentally bought qty. 2, $10,000 “I” bonds as a gift for my grand daughter (age 6) using her SS number. Treasury direct has taken the $20k. I did this not knowing the first purchase went through. Since there is a $10k limit per person per year, what can I do to get the second bond money back? My grand daughter’s mother hasn’t bought an I Bond yet, so could I transfer the child’s bond into the mother’s name and therefore pay the interest ?

Thanks for your assistance,

Harry Sit says

Assuming the two bonds are still in your Gift Box, you can just hold them there and deliver them to your granddaughter in two different years. The bonds will earn the same amount of interest whether they stay in your Gift Box or in your granddaughter’s account. See Buy I Bonds as a Gift.

Tyler says

Let’s say husband is primary owner and wife is secondary owner with transaction rights. If husband dies in 2022, can wife purchase bonds in husbands name & husbands account in 2023 in addition to her purchases in her own account?

Harry Sit says

The transaction rights are on specific existing bonds, not on the whole account, and not for buying new bonds. At any rate, you can’t buy on behalf of a deceased person.

Jim O'Brien says

Thanks for the quick response, but I would rather have the $10k back as I think it is illegal to buy more than $10k for any 1 individual in a calendar year and I thought the 2nd I bond couldn’t earn interest for her.

Is there anyway to transfer the 2nd one to her mother once her mother has set up a Treasury Direct account?

Harry Sit says

It’s legal to buy more than $10k as a gift to one individual in the same year. The limit is only on the gift delivery. Many people intentionally pre-purchased more than $10k for delivery in future years to take advantage of the current high interest rates. See the post on buying as a gift I linked in the previous comment.

If you really want a refund or you’d like to change the gift recipient, you’ll have to contact customer service and see whether they’ll do it for you.

Milton Zukor says

I bought some paper I-bonds via work 10-20 years ago. I am retired and the sole owner. I would like to Change the Beneficiary on these bonds. How do I do it?

Harry Sit says

You need to open an online account with TreasuryDirect and deposit your paper savings bonds to your online account. Then you can add or change the beneficiary by following the same steps in this post. I added links to how to open an online account and how to deposit paper bonds in the second paragraph at the beginning.

Tina P says

If I would like to puchase $10,000 in my name, co-owner with my Husband and vice versa ($10,000 with him as Primary and myself as Second owner), should I do it under 1 account with the 2 diff registrations or should I Open 2 entirely separate accounts? Thank you.

Harry Sit says

Two separate accounts.

Sharon says

Purchasing an i-bond with daughter as beneficiary. At my death, what is the process for making a redemption claim if she simply wants to cash out. Is it necessary for her to have her own Treasury Direct account to cash out the bond?

Harry Sit says

She doesn’t need a TreasuryDirect account if she wants to cash out. You need to tell her your TreasuryDirect account number and which bonds in your account she’s a beneficiary of. She will send a form listing those bonds and her bank information together with your death certificate.

Karen Young says

I split my I bond successfully to have 2 different beneficiaries, but when I transferred the split back to my main account and tried to add the beneficiary onto the split, the beneficiary was changed on both halves of the split bond. What am I doing wrong?

Kris says

Does a beneficiary have to have a TD account before they can be named on an IBond as a beneficiary.

Harry Sit says

No, you can name anyone. The beneficiary will need an account if you’d like to grant View rights for them to see which bonds they’re the beneficiary of.

Natalie Smith says

I have two questions: Can you buy an I bond as a living trust then cash in at 5 years similar to owning as an individual? Second question- what happens if I buy an I bond from my business but say 5 years in my business shuts down- what happens to the I bond since the business ceases to exist?

Harry Sit says

A trust can buy or sell just as it does with other assets in the trust. A business should dispose of its assets before it’s dissolved.

Natalie Smith says

That makes sense. Thank you!

Harry Bartnick says

Hello,

I currently have series I savings bonds, with my wife as POD, sole beneficiary. Is it possible to have a secondary beneficiary, in case my wife and I, let’s say, die in an accident?

Thank you

Harry Sit says

No, it only allows one person. If you’re concerned about simultaneous death, name someone who doesn’t live with you.

Betty says

– I bought ibonds with the intention of gifting them, but, mistakenly, did not designate at purchase. Is there any way to gift owned ibonds now?

– If not, would the best solution be to add my intended recipient as a joint owner?

– If I do that, will second owner be able to see the bonds in their account as well?

– Any tax consequences to consider?

Thank you!

Harry Sit says

You can try transferring the bond. Click on the ManageDirect link on the top after you log in, and then find the link “Transfer securities” under “Manage My Securities.” Or just keep this bond for yourself and buy a new gift bond the correct way.

You can add a second owner and grant transaction rights but you as the primary owner will still be responsible for taxes. If you don’t want to be on the hook for taxes, do the transfer.

Thomas Webb says

What is the practical difference between making someone a co-owner or making her the beneficiary of an I-Bond?

Harry Sit says

The optional rights to view or transact. See I Bonds Beneficiary vs Second Owner in TreasuryDirect.

Thomas Webb says

That was a really stupid question, Harry.

Sorry.

It was 4am. I was probably half-asleep.

Cheri says

My spouse and I each purchased $10K, listing the other as beneficiary (WITH).

Following the above directions, I am gifting my spouse $10K in the same year, listing myself as beneficiary (POD).

The system will not process this transaction. Any ideas?. Error: “The following error(s) have occurred:

Annual limit exceeded. Please edit the purchase amount or edit your pending purchases under ManageDirect, if applicable, and try again.”

Harry Sit says

Other readers reported the same change in behavior in recent comments under Buy I Bonds as a Gift.

joyce says

A warning about purchasing I bonds with a tax refund:

Last March I asked IRS to issue a $5000 Ibond and deposit the remaining $41 dollars to our bank. They put the whole $5041 in the bank. Customer service told me I had to write for an explanation. I did so and in August I found out that our return was pulled for a random audit -the delay held up the bond but not the cash refund so they decided to refund the entire amount. They apologized but would not change anything. Next year I will ask for a split between the I-bond and credit the remainder to my 2023 return instead of to my bank, and see if I have better luck.

Charlie says

Can I purchase a I bond in my name (my SSN) with a co-owner (with their SSN) without the co-owner opening a TD account? Can they open just open their own account somewhere in the future? How would the bond get linked to the co-owner future TD account?

Harry Sit says

The second owner or the beneficiary doesn’t need a TreasuryDirect account at the time of purchase. You grant the optional view or transact rights to the second owner or beneficiary when they have an account.

Gerry Cruth says

How do you add a beneficiary to an I-bond that is still in your gift box?

Harry Sit says

You can’t when you didn’t include a beneficiary at the time of purchase. The gift recipient can add one after you deliver the gift.

Lucan says

Thank you. There is no way I would have figured this out without your assistance. You should bill Treasury Direct for your services.

Taryn says

This was SO helpful!! I just couldn’t figure out how to add a beneficiary to a bond I bought earlier. I am so grateful you provided such excellent instructions!! Thank you!

Fred Faul says

Harry Sit,

You are an expert in a very difficult subject. Thank you.

Tom says

If you are the owner of a paper I-bond, are you able to assign the bond to another owner and remove yourself completely from the bond? Would this trigger any tax consequences? Or would you be forced to cash them in if you wanted to be removed as an owner?

Harry Sit says

You can request to have the bond reissued to another person. It’ll be added to the new owner’s online TreasuryDirect account. You’ll pay tax on the interest accrued to date but you don’t have to cash out the bond. Send your bond in with a completed FS Form 4000.

Tom says

Would that allow you to remove the original owner from the bond? Would you have to add a coowner first and then remove the original owner?

Harry Sit says

You can remove yourself when you request the reissue. Take a look at FS Form 4000.

Tom says

Thank you. When I looked at the Form, it appeared to transfer the paper I Bond, that it would require a judicial determination to allow.

Harry Sit says

You can also deposit the paper bond into your online account first (see How To Deposit Paper I Bonds to TreasuryDirect Online Account) and then transfer it to the new owner’s account. You may be required to complete FS Form 5511 for the transfer. Transferring for the purpose of making a gift is allowed.

Karen Wilson says

My husband passed away in December 2022. While going through all the paperwork I found a Series I Savings Bond. The problem starts with the person named on the bond (other than his name). It is one of the grand children that has had no contact with us for over 40 years (Her choice). What can I do with the savings bond? Do I have to trash it or is there a way to fix this?

Harry Sit says

Whoever’s name is on the bond owns it. I would think sending it to a family member, however distant, is better than donating it to the government.

Mike G. says

Hello,

I recently converted several paper I Bonds to electronic form. The reason is because the co-owner passed away, and I wanted a new co-owner.

The bonds now appear in a “My Converted Bonds” account that is a Linked Account. I have been trying to add a second registrant as a co-owner (Edit Security Registration, Add New Registration). The only Radial Button options are Sole Owner and Benificiary.

The Treasury Direct system does not seem to allow a co-owner on a converted bond. Is this because the I Bonds are now restricted, is this a Treasury Direct system issue, or is this ‘Operator Error’ on my part?

Do you have advice to resolve my issue? Thanks!

Harry Sit says

You can see how the bonds are currently registered and whether they are restricted by clicking on Current Holdings in the top menu. If a bond is restricted it will say “Restricted Security” under Status. It isn’t restricted if the Status column is blank. When you can’t do it in the “My Converted Bonds” linked account, you can transfer the bonds from the linked account to your main account and see whether that helps. Transferring makes it easier to see all bonds together in one account anyway. Here’s how to do it:

https://thefinancebuff.com/how-to-deposit-paper-i-bonds-to-online-account.html#htoc-transfer-to-main-account-optional

Mike G. says

Thank you very much! I was able to resolve my situation thanks to your advice. Treasury Direct should pay you !!

al says

Re EE Savings Bonds. I want to change from a POD to a joint owner with my wife. The new registration(primary owner or secondary) has been added and shows up on my current registration list but it’s not showing as one of the options in the drop-down menu right before you submit – when you’re associating registration to security. Next to the drop-down menu you have the option to “Add a new registration” which I selected but that only allows sole owner or beneficiary, no option for primary owner(or joint) registration! Does anyone know where I’m going wrong?

sps says

I have I-bonds issued in the name of my minor son (sole owner) in a minor-linked account. I would like to redeem these and transfer to my son’s existing 529 plan. Apparently I can redeem I bonds issued in my name and not pay tax if I transfer to my son’s 529 plan during a certain timeframe following redemption, but this is not the case if the I-bonds are issued in my son’s name. Is there a way to transfer or re-register the I-bonds in my son’s name to me without triggering taxes?

Harry Sit says

No, you can’t convert your son’s assets into yours. If your son doesn’t have much income from other sources, he will pay zero tax anyway when he sells to trigger just enough interest to be absorbed by his standard deduction.

Ronald Robinson says

I purchased $10,000 in IBonds in 2022. I only listed one sibling as beneficiary payable on my death. I have three more siblings I would like to add as beneficiaries. How do I get this done at Treasury Direct website.

Tyler says

Ronald, here’s another option for all your siblings to be beneficiaries. You could redeem your $10,000 I-bond now, then use the proceeds to purchase four new I-bonds and name a different sibling as beneficiary on each I-bond. Your new bonds will have a FIXED rate of 1.3%, whereas your old bond had 0% fixed rate if it was purchased in 2022 before November 1 (after November 1 fixed rate = 0.4%). Note that a redemption will cause a income tax liability on your interest earned for 2024.

Harry Sit says

See How to Split an Existing I Bond for Multiple Beneficiaries.

Tyler says

Ronald, you can change your beneficiary but, you can only have one beneficiary per I-bond. Instead of one $10,000 I-bond, you could have purchased four I-bonds of $2,500 each and listed a different sibling as beneficiary on each I-bond.

Ronald Robinson says

Is there some way I can change the one $10,000 I-bond into four I-bonds of $2,500 each with a different sibling as beneficiary on each I-bond without creating a taxable event? Would this be complicated to do?

Tyler says

Ronald, I think redeeming an I-bond with 0% fixed rate and replacing with a I-bond with a 1.3% fixed rate will more than offset the taxable event that redeeming triggers.

Shirley says

I have I Bonds with 1 child listed as beneficiary. How do I list 2nd and 3rd children as beneficiaries if the fist benefiary dies. Thank you.

Harry Sit says

Each bond allows only one beneficiary. It’s not possible to list a contingent beneficiary. You’ll have to remember to change the beneficiary by following the process described in this post if the current beneficiary dies.

JoAnne Balsimo says

If I am the owner of an I bond can I transfer to another person making them new owner and when they cash out they pay the interest ?

Harry Sit says

You can transfer but you’ll pay tax on the interest accrued up to the date of the transfer. The new owner will pay tax on the interest earned after the transfer.

Donald Fowler says

I have 6 I bonds with Treasury Direct in my name and my daughter as beneficiary. At (0 years old I want to now change my daughter as joint owner. Can and how do I do this has I 90 years old and want her immediate access to the bonds when I die.

Harry Sit says

You do that by following the steps in this post. First create a registration with the Primary Owner option, your information as the First-Named Registrant and your daughter’s information as the Second-Named Registrant. Then you associate this new registration with the bonds. Have her create a TreasuryDirect for herself if she doesn’t have an account now. Grant Transact rights on the bonds to her account.

Dunmovin says

Harry, very helpful

To clarity…if one transfers in whole or in part ownership to another, the “taxable” event for the transfer is time of transfer and to the extent thereof, a 1099 for earned interest to that point in time will be issued “to the transferring owner” and for the future earnings that is the transferee owner. Right?

And the transferee owner has no impact to his/her yearly cap of $10K purchase by being a transferee owner. Right?

Thank you!