TreasuryDirect announced that I Bonds bought between May and October 2023 will have a 0.9% fixed rate plus a variable rate that changes every six months. This fixed rate is the highest we’ve ever seen in 15 years. I expect that the new fixed rate to be announced on November 1 will go up again, possibly to 1.5%.

Low Fixed Rate on Older I Bonds

If you bought I Bonds between May 2020 and October 2022, the fixed rate on those older I Bonds is 0%. This 0% fixed rate stays with the bonds for their entire life up to 30 years. If you cash out those older I Bonds to buy new ones, you will benefit from the higher fixed rate over the long run.

I Bonds bought between November 2022 and April 2023 are still in the 12-month mandatory holding period by October 2023. They can’t be switched to new bonds until their mandatory holding period is over.

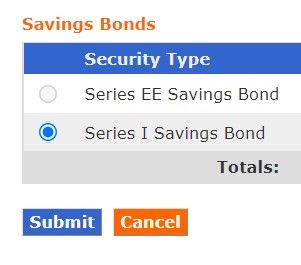

You see a list of your existing I Bonds by clicking on Current Holdings after you log in to your TreasuryDirect account. Then you choose Series I Savings Bond and click on Submit.

Here’s a reminder of the fixed rate on existing I Bonds issued since November 2010:

| Issue Month | Fixed Rate |

|---|---|

| 11/2022 – 04/2023 | 0.4% |

| 05/2020 – 10/2022 | 0.0% |

| 11/2019 – 04/2020 | 0.2% |

| 11/2018 – 10/2019 | 0.5% |

| 05/2018 – 10/2018 | 0.3% |

| 11/2017 – 04/2018 | 0.1% |

| 11/2016 – 10/2017 | 0.0% |

| 11/2015 – 10/2016 | 0.1% |

| 11/2014 – 10/2015 | 0.0% |

| 05/2014 – 10/2014 | 0.1% |

| 11/2013 – 04/2014 | 0.2% |

| 11/2010 – 10/2013 | 0.0% |

Look up the fixed rate for your existing I Bonds from the table above. If the fixed rate is 0%, 0.1%, 0.2%, or 0.3%, they’re all good candidates for switching to new ones.

Early Withdrawal Penalty

You’ll pay an early withdrawal penalty when you cash out I Bonds within five years but you can minimize the penalty if you time it correctly.

The early withdrawal penalty is the interest earned in the last three months before you cash out the bond. The variable rate will drop to a relatively low 3.38% annual rate in the coming months. If you wait three months after the bonds start earning 3.38%, you only give up three months’ worth of interest at 3.38% per year, which comes out to about 0.85%. You’ll make up for it in about a year from a higher fixed rate when you hold the new I Bonds for the long term.

I Bonds issued in the following months can be cashed out on these dates to keep the penalty low:

| Issue Month | After 3 months at 3.38% Variable Rate |

|---|---|

| January or July | 10/1/2023 |

| February or August | 11/1/2023 |

| March or September | 12/1/2023 |

| April or October | 1/1/2024 |

| May or November | 8/1/2023 |

| June or December | 9/1/2023 |

The 3-month period at the 3.38% annual rate doesn’t end until after November 1, 2023 for some bonds. We don’t know what the new fixed rate will be at that time but it doesn’t look like the fixed rate will drop.

Example: Suppose you bought I Bonds in February 2022. These bonds have a 0% fixed rate. They will finish earning the 6.48% rate on August 1, 2023. You cash out on November 1 as the table shows to buy new bonds. The 3-month early withdrawal penalty will be entirely at the 3.38% annual rate. You minimize the early withdrawal penalty while it looks like the fixed rate won’t drop and it may increase.

Take a look at the issue month of your older I Bonds. Set a calendar reminder to cash them out on the corresponding dates. TreasuryDirect makes the effective redemption date two business days after the date of your request. You see the redemption date and the redemption value on the review page. Double-check before you click on Submit.

New 12-Month Holding Period

The new I Bonds you buy will have a new 12-month holding period. It’s not a problem when you hold them for the long term.

If there’s a chance that you’ll need the money from I Bonds in 12 months, don’t switch. You will hardly make up for the early withdrawal penalty anyway if you hold the new bonds only for another year.

Pay Tax on Accrued Interest

You will pay federal income tax on the interest earned when you cash out I Bonds unless you chose to pay tax annually. See I Bonds Tax Treatment During Your Lifetime and After You Die.

The interest is exempt from state and local taxes. The 3-month early withdrawal penalty doesn’t count as interest earned because you never received it. You won’t pay tax on the early withdrawal penalty.

By default, TreasuryDirect doesn’t withhold taxes when you cash out I Bonds. If you’d like to have TreasuryDirect withhold taxes on the interest, please follow the steps in Voluntary Tax Withholding on Selling I Bonds at TreasuryDirect.

You will add the interest to your tax return using the 1099 form from TreasuryDirect. Remember to download or print the 1099 form from TreasuryDirect in January. It’s under ManageDirect -> Manage My Taxes.

TreasuryDirect sends an email notification when the 1099 form is available but they won’t send the form by mail. Set a calendar reminder for yourself to download the 1099 form on January 31 in case you miss the email notification or the email notification is mistakenly directed to the spam folder.

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to enter the interest from TreasuryDirect’s 1099 form into tax software.

Annual Purchase Limit

Buying new I Bonds after cashing out older I Bonds still counts toward your annual purchase limit. If you already bought I Bonds in 2023 or if you have more than $10,000 worth of I Bonds at 0%, you can’t switch all of them to new ones by buying new bonds directly but you can still buy them as gifts and hold them for delivery in the future.

Buying I Bonds doesn’t count toward the annual limit of the purchaser. It counts toward the annual limit of the recipient in the year when the gift is delivered to the recipient.

This works especially well for married couples. You can cash out all your old 0% fixed rate I Bonds, buy new ones as gifts to your spouse, and hold the gifts for delivery in the future. The new bonds start earning the higher fixed rate right away while they’re being held in the gift box. Then you deliver the gifts in $10,000 chunks to your spouse in the coming years. Your spouse can do the same in the opposite direction.

See Buy I Bonds as a Gift: What Works and What Doesn’t and Deliver I Bonds Bought as a Gift in TreasuryDirect for more details on how this works.

***

The 15-year high fixed rate represents a great opportunity to lock into a higher fixed rate for many years to come. If you plan to hold I Bonds for the long term, see which bonds you should switch over, when is the best time to cash out, and whether you should buy new bonds directly or via gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Pierre says

I know I bonds are longer term investment, but I wonder if it would be better to buy t bills for the time being instead of reinvesting in I bonds

Harry Sit says

It’s impossible to say over a short time frame. By definition, any small difference for only a few months doesn’t matter much anyway. The more important thing is to lock in a good rate above inflation for many years to come. If you cash out some May bonds on August 1 and you want to stay in Treasury Bills for a couple of months until late October, that’s fine. You risk losing the good fixed rate if you go beyond November 1.

Markie C. says

I don’t have to worry about any of this when I just invest in a Federal MMF. Maybe avoid some State taxes, too. Bond investing shouldn’t be this complicated.

Harry Sit says

The point of buying I Bonds is to get inflation protection. A Federal Money Market fund pays more than the new composite rate on I Bonds at the moment but it doesn’t offer inflation protection. Of course not everyone values inflation protection to the same degree and we don’t have to choose only one or the other either. I have money in a money market fund too.

Frank says

Government Agency Bonds as alternative to I-Bonds?

I have maxed out Ibond purchase this year. I bought iBond last February @7.1% so I will sell those bonds later this year unless the inflation picks up and the fix rate stays high.

I am considering buying FFCB bonds instead. Most are callable. A few bonds with 10 year maturity YTW is 4.105% so it is not bad. Any thoughts on that?

BTW, those numbers are quoted on Schwab, which I find has better quotes than Fidelity

FinancialDave says

Harry,

Did you consider that when you sell ibonds you “give up” an allocation that you can’t get back. So, if your goal is to build as large an ibond allocation as you can then I don’t think the math on selling any of them makes sense, since there is a limit on how much ibonds you can buy each year based on your situation.

In other words what I am saying is if you have plenty of money available to buy ibonds and ibond gifts then just do that at whatever time you think is best and leave your existing money alone because you can’t get it back in there.

If money is tight then sure selling some to free up funds for better ibond rates “may” make sense.

Great work you are doing! Still read what you have to say always and just sent your book to my boy to learn from.

Dave

Lorraine says

I’m also curious about the pros and cons of adding more if you have funds available than to repurchasing.

Harry Sit says

Dave – Thank you for the compliments. My goal isn’t to build as large an I Bond allocation as I can. It’s to get the best inflation protection, which can come from both I Bonds and TIPS. A unique feature of I Bonds is their flexibility. The holding period can be anywhere from one year to 30 years. However, I don’t need infinite flexibility. After I have enough in I Bonds for flexibility, the rest can go to TIPS for better inflation protection.

FinancialDave says

Lorraine & Harry,

The pros and cons seem pretty simple, but buried in that are choices of what you think is the best inflation protection for you.

“Pro” for not selling is simply if you don’t have your total allocation you want in ibonds (direct, including gift box) then you shouldn’t sell you should just buy whatever you need without selling. Harry, you said you aren’t there yet, so the risk is you might make the wrong choice now replacing some ibonds when you don’t need to, while taking longer to get a full ibond allocation. In other words, the money that is slated to fill the rest of the ibond allocation can’t be added until a later date so it’s return may be inferior to the ibonds you sell.

“Pro” to sell (Con to not selling) is just the opposite of the above, you have all the ibonds you need, or you have better uses for the money, so you sell some and either replace them with better rates or use the money for something else. Knowing that you will have to pay tax on any gains and may lose 3 months of interest.

Harry, I know you like TIPS and I have read your articles on why, I just don’t like the speculation involved, since I consider TIPS part regular bond and part ibond. In other words you aren’t getting 100% inflation protection like you do with ibonds. In 2008 or so, many people lost 8% or so of their money in a “safe” Vanguard TIP by not understanding the duration of the bond they owned. I know you understand that but – “just saying.” They are not as safe as ibonds, during their lifetime. If you plan on holding them to the endpoint then you will get what you paid for. Ibonds can be sold at anytime after 5 years with no loss to their inflation protection.

One other pro to not selling is the 5-year holding period, which of course takes “5-years” to replace, or 4,3,2,1 years to replace depending on the age of the ibond you sell and want to replace.

calwatch says

It’s fairly straightforward without too many shenanigans for a single person to buy $25,000 a year in I Bonds through a sole proprietorship and tax refund, and couples can use the gift box strategy. I am choosing to cash out five year plus old bonds now, starting with the 0% bonds but am waffling on the 0.1%, 0.2%, 0.3% bonds as I think the fixed rate can easily go back to that level.

Kevin says

Thank you for this article, Harry. It helped me firm up my plan.

Laura says

I’ve bought but haven’t yet sold I bonds. Can you sell and immediately buy again within treasury direct, without have to transfer the money elsewhere?

Harry Sit says

You can enter two separate transactions on the same day but you’re better off transferring through your bank. Because I Bonds pay interest monthly, it’s better to cash out on the first of the month and purchase on the second last business day of the month. Money staying in your bank account earns some interest during that month, which further reduces the impact of the early withdrawal penalty.

Jeff says

Hi Harry,

I’m wondering what the “breakeven” fixed rate would be considering taxes.

Assuming a 15% Capital gains tax rate + 3.8% NIIT tax and holding Ibonds at least 5 years (when one finally decides to cash out), my back of the envelope math would require a 1.0% fixed rate to come out slightly ahead after taxes and inflation. Do you think this is in the ballpark?

Thanks for your posts – J

Harry Sit says

Interest from I Bonds is taxed as interest, not capital gains. Paying 25% tax on a 1% fixed rate plus 3% inflation adjustment puts you back at 3%, which matches inflation. A 33% tax rate and 3% inflation will require a 1.5% fixed rate to match inflation after taxes. We may not come out ahead of inflation after paying taxes but we don’t have a better alternative.

SK says

If someone has already bought $10,000 worth of i-bonds this year, they can’t cash out older i-bonds (with lower rates) and buy another $10,000 worth in the same year, right?

Harry Sit says

That’s right. They can still use the gifting strategy in the Annual Purchase Limit section — buy a gift in October and deliver the gift in January.

Christian Walenta says

what is the timing for the 3 month penalty when the ibonds were purchased mid month? do i need to sell based on the purchase date or the issue date, ie first of the month?

Harry Sit says

The issue date.

Marc says

My wife and I maxed out our 2023 I Bond limit when we delivered 0% fixed rate Gift I Bonds from last year to each other in March. We then purchased another round of Gift I Bonds in April to lock in the 6.89% composite rate (with 0.4% fixed rate).

We plan to delay any redemption decision for the delivered I Bonds with 0% fixed rate until after the October CPI report and before Halloween. At that point, we won’t know the new November 1 fixed rate, but we will know the new November 1 inflation rate. If it comes in lower than 3.38%, we will wait until three months after that new lower rate apples to our 0% I Bonds which pushes redemption into early 2024. This will not only lower the penalty, but delay the tax payment on the interest until April 2025 which is another benefit of delaying redemption. If the inflation rate comes in higher than 3.38%, we will likely just hold onto those I Bonds.

Either way, we will probably buy a second round of Gift I Bonds in that October period to capture the 0.9% fixed rate for the long term. I have a T-Bill maturing in October for this purpose. There isn’t as much of a concern about loading up on Gift I Bonds and staggering deliveries multiple years ahead when there’s a fixed rate attached which provides the rationale to hold long term.

Joe says

Hi Harry,

Thanks for the article. I bought $10,000 in I Bonds for both me and my wife in 2014, 2016, 2019 and 2022. I didn’t use a gift to buy them for my wife – I just logged into her TreasuryDirect account and bought them. I hadn’t heard of the “gift box” option until recently. It seems like you are suggesting that we cash out all those I Bonds and immediately buy our allocations for this year, then use the gift box option to repurchase, as gifts to each other, the rest of the $60,000 I Bonds that were cashed out, plus purchase whatever else we can purchase with otherwise unneeded cash. Then we would “deliver” $10,000 to each other each year in the future for at least the next six years, plus as many additional years to be able to deliver the remainder in the gift box within the $10,000-per-year/person limit. Also, we will need to pay federal taxes for the cashout.

Is my understanding correct? If so, do you think that this approach will always or nearly always have more benefits than potential costs, like from payment of the cashout taxes? And I guess I have to ask — since my marriage has had some significant ups and downs, is this option perhaps too risky/complex for my situation? if something happens to my marriage, is it possible to ungift these gifts, or change the gift recipient?

Harry Sit says

It’s not possible to ungift or change the gift recipient after you buy the gift. It’ll be reciprocal both ways but if you’d like to avoid complexity, maybe gifting isn’t a good path for you.

In addition, cashing out and repurchasing works the best for people who got into I Bonds in the last two years. Taxes aren’t too bad because the bonds haven’t earned that much interest yet. The bonds won’t have to stay in the gift box for too long when you only repurchase $10,000 or $20,000. Older bonds bought as far back as 2014 and 2016 have accumulated more interest. Getting locked up in the gift box for six years reduces liquidity.

RobI says

Interesting and timely article for many of us that got into iBonds in that 0% window and I’d never really noticed the rate drop on older bonds until you pointed it out. One question is how iBonds are taxed. In particular does iBond interest count towards NIIT?

Harry Sit says

They’re taxed as interest income, which counts toward the Net Investment Income Tax, but they’re exempt from state or local taxes.

Mark says

I am planning to hold my I-bonds for 10-30 years until I will need the income in retirement, mainly in order to avoid sequence of returns risk. I bought $10K each for my wife and I in January 2022, and will probably buy the same this year. I am a little leery of the added complexity of I bonds in general, especially if I churn them as you describe here to get a better interest rate–I would have to sell my 2022 bonds and gift new ones, in addition to the 2023 bonds I was planning to buy. How much will I lose by if keep my 1/22 bonds and don’t sell and then gift to get the new rate?

Harry Sit says

The baseline: Buy $10k every year and hold until the money is needed.

Alternative: Swap out 0% fixed rate bonds for 0.9% fixed rate. Skip buying in a year when the fixed rate is low and deliver the gift. The money that doesn’t go into I Bonds in the skipped year earns an equal or better return when the fixed rate is low.

The difference: The swapped bonds earn 0.9% more each year until the money is needed.

Mark says

Thanks Harry. Do these steps look correct?

1. On 10/1/23, sell $10K in I-bonds that I bought and $10K in I-bonds that my wife bought in 1/22.

2. At any point in 2023, I buy $10K for myself and $10K as a gift for my wife, and my wife buys $10K for herself in I-bonds and $10K as a gift for me.

3. If a future year’s rate is better than a bond bought within a few years prior (so that the taxes from selling won’t be so great), then repeat steps 1 and 2. If a future year’s rate is worse than a bond that was bought as a gift, then instead of buying I-bonds that year, gift the one from a prior year with the superior rate.

Harry Sit says

1. Correct, although 10/1 is a Sunday. It’ll execute on Monday.

2. If you buy before 10/30, you will get the 0.9% fixed rate. The fixed rate may go up again if you wait but it may also fall. We just won’t know. Within the same month, it’s better to buy toward the end of the month but not on the last day of the month.

3. Correct but remember to find a better alternative for your money when you’re not buying I Bonds that year.

Art says

I just checked Treasury Direct and noticed they still haven’t credited my account for the ibonds purchased with my tax return in April. I have confirmation that they received my paper bonds, but they say it will take up to 13 weeks to process. I find the experience so cumbersome and rates have dropped, so I think I’m ready to give up on ibonds. This selling calendar is useful for planning purposes. Thanks, Harry.

Lori says

Your paper bonds will get converted eventually and will still have the rate they had when purchased.

Ozzi says

Thanks for the article. I bought I Bonds every January since 2021 and I would like to sell all in next few months. Could you direct me what month will be the good timing to sell? TIA.

Harry Sit says

October 1 for bonds bought in January in recent years. See the tables in the Early Withdrawal Penalty section.

Ustaad says

Hi Harry,

I am looking to redeem some of the 0% fixed rate ibonds that we bought in 2021-2022 with an aim to minimize the penalty. I have computed the minimum EWP as follows:

Issue Dt. Ideal EW Dt. Purchase AV B4 Pen. AV w/Pen Penalty $

6/1/2021 9/1/2023 $10,000 $11,500 $11,404 $96

1/1/2022 11/1/2023 $10,000 $11,332 $11,240 $92

4/1/2022 2/1/2024 $5,000 $5,666 $5,620 $46

5/1/2022 9/1/2023 $10,000 $10,940 $10,852 $88

6/1/2022 10/1/2023 $10,000 $10,940 $10,852 $88

9/1/2022 1/1/2024 $10,000 $10,940 $10,852 $88

10/1/2022 2/1/2024 $10,000 $10,940 $10,852 $88

I derived the estimated values using the following online calculator:

https://eworkpaper.com/ibond.php

As I understand it, because of the math quirk in how the interest is computed by TreasuryDirect folks, the minimum penalty is not necessarily the first three months after the lower rate change. My ideal redemption dates are off by a month or so than the one you have recommended. Is my understanding right or I am making a mistake somewhere? Comments form readers welcome.

Thanks.

Harry Sit says

The goal isn’t to minimize the early withdrawal penalty to the last $1. It’s to minimize the time the bonds spent earning a low rate. For example, for bonds bought in January 2022 (your second row), redeeming on 10/1/2023 gives you a penalty of $96 (versus $92 if redeemed on 11/1/2023) but the bonds would spend another month on the low rate earning only $32 during that time ($11,240 redemption value on 11/1 versus $11,208 on 10/1). The $11,208 redemption value on 10/1/2023 will earn more than $32 in a month elsewhere.

Optimizing a $4 difference makes you miss the big picture.

FinancialDave says

Harry is right of course, and I suspect he explains elsewhere that there are other things that weigh in on this decision.

1. What is your marginal tax rate that will add to say that $96 penalty for your line one bond?

2. Are you going to put the money elsewhere than ibonds, such that now the interest is taxable in the year you earn it? This is a complex question that can involve “non linearities” in the tax brackets depending on what other income is involved.

3. What is the purpose for selling in the first place? Since contributions are limited, selling $10,000 of one rate just to buy $10,000 of another rate is of limited value if your goal is to build a larger and larger tax protected space of inflation protection. Very few other investments offer this tax protected guaranteed inflation protection.

Ustaad says

Harry,

Thanks.

Backpacker says

Hi Harry,

Thanks for your always thoughtful articles. My question is with regard to minimizing the early withdrawal penalty. If my issue date is 01-01-2021, and the interest rate dropped to 3.38% on May 1, 2023, wouldn’t three months at the lower interest rate be August 1? Your chart recommends selling on October 1. What am I missing?

Thanks again for your excellent financial advice,

Backpacker

Harry Sit says

The rate doesn’t drop for all bonds at the same time. Every bond has its own six-month cycles depending on the issuing month. The rate for your bond dropped to 3.38% on July 1, 2023.

RobI says

Related question. What about bonds bought part way through a month, say May 15. Does the 3 month interest withdrawal clock start on that anniversary date?

Harry Sit says

No, it starts on the 1st because the issuing date is made retroactive to the 1st of the month. See the current holdings in your account.

Rick Whittington says

Thank you for this!

Question: I’ve got two years worth of 0% iBonds (maxed $20k in each of 2021 & 2022…. I’ve also maxed $20k in 2023). I intend to do the gifting strategy with my wife to upgrade 2021 and 2022 iBonds, but would that essentially max my annual purchase limit for two years into the future? (i.e. can I not add new money to IBonds in the next two years, after gift delivery in 2024 and 2025?)

Harry Sit says

Receiving a gift delivery counts toward the annual purchase limit of that year. If the rate is good and you still want to buy, you can buy another gift.

Lorraine says

Hi Harry. You mentioned that TreasuryDirect won’t withhold taxes when you cash out. Is that because by default the Withholding Rate is 0 unless you voluntarily set it on your account?I’m confused by that option in general though when it comes to I-bonds. If set TD will start withhold part of the interest for taxes each interest payment, but is that only when you redeem/cash out correct?

Harry Sit says

The tax withholding setting only affects marketable securities (bills, notes, bonds, TIPS, …), not savings bonds.

Edit: I was wrong. The withholding setting affects both savings bonds and marketable securities. Withholding is still optional.

Lorraine says

Hmm I do not recall where I read that the withholding rate can be set before redeeming savings bond, but I did and my account does show an amount for tax withheld under Taxable Transactions Summary for redeeming some Series I Savings Bond. So I’m confused by your reply that it doesn’t appy to savings bonds.

Harry Sit says

I thought it doesn’t apply but if it does, it’s something you have to go out of your way to set, which most people don’t do. When banks pay interest on savings account or CDs, they don’t withhold taxes either.

Kevin says

From TreasuryDirect:

“Paying taxes early through withholding:

If we hold your securities, we can ease your tax burden by withholding taxes for you during the year. Each time we pay interest, we can withhold part of the interest for taxes. The 1099 you get for that year will show what you earned and the amount we withheld for taxes.

We can withhold up to 50 percent of the interest you earn.

To withhold taxes:

• TreasuryDirect: In your TreasuryDirect account, tell us the percent to withhold.

• Legacy Treasury Direct: Call or write to us to tell us the percent to withhold. The phone number and address are in the section above.”

https://www.treasurydirect.gov/marketable-securities/tax-forms-and-withholding/

Kevin says

To set your withholding rate, log into your TreasuryDirect account.

Click on “Account Info” on the top menu.

Scroll down to “Account Status”.

Click on “Edit”.

Answer Security Question.

Scroll down to “Account Status”.

Edit “Withholding Rate” to your desired percentage.

Click “Submit”.

Art says

This makes no sense for an account in which you might defer tax for 30 years. I had assumed they’d withhold tax upon distribution ( that is, in the year you would actually receive $/owe income tax), not periodically throughout the year as interest accrues. Is it held in some type of escrow account for future tax bill? Or is this only applicable for accounts that pay interest and tax you along the way? I’m trying to see how this would work for the postponed interest accounts, but it’s puzzling ( unless you don’t change withholding % until you’re about to cash out?) If the latter, I can’t help but wonder how long it would take them to adjust the withholding settings ( I’m on week 12 awaiting confirmation re my converted bonds … they’re not exactly speedy!)

Harry Sit says

The accrued interest doesn’t get paid out until you redeem. There’s nothing to withhold from before that happens. You aren’t required to have tax withheld when you redeem either. So just pay tax as you normally do. It isn’t necessary to go out of your way to set a withholding rate.

Dave says

This requires further clarification from Treasury Direct.

At the very least they withhold money from your account and thus you don’t earn interest on it. At the very worst you just signed up to declare your interest every year and thus you lose the tax deferral advantage by needing to pay the tax every year.

Don’t do this without further research.

Dave says

After reading the section this thought came from, I believe withholding only applies to what TD calls marketable securities, like TIPS and regular bonds and NOT savings bonds (EE or ibonds). Savings bonds are non-marketable securities.

Christian Walenta says

When cashing in ibonds- should you wait to cash in on the 2nd of a month to get the previous month intrest rate credit or can you do already on the 1st of a month?

Harry Sit says

TreasuryDirect makes the effective redemption date two business days after the date of your request. When I requested redemption on July 28, the redemption date was August 1. The redemption value included the interest for July. TreasuryDirect shows the redemption date and the redemption value on the review page. Double-check before you click on Submit.

Marc says

After reading this, I logged into my TD account today because I wanted to redeem an I Bond on 9/2, but I didn’t take into account that the redemption timeframe is two BUSINESS DAYS and not two DAYS. So my I Bond redemption summary indicates that my I Bond will be redeemed on 9/5, which is indeed two business days from today when you take into account the Labor Day weekend, but 5 DAYS from today. It’s not that big of a deal because I don’t need the cash immediately, but if someone out there does, this is a cautionary tale to take into account weekends and national holidays.

Kevin says

Harry, this bit about being able to enter the redemption request early (prior to September 1) for a September redemption was extremely helpful. Thank you!

Kevin says

Harry, this little nugget of wisdom – to enter a redemption order two business days early – is worthy of its own (albeit short) standalone post.

In order to play the game right, when do I enter the order for an October 1 (effectively Monday, October 2) redemption? On Thursday, September 28?

Thanks, Harry!

Harry Sit says

Yes, September 28, and you’ll get the money on September 29 if your bank credits direct deposits early. See comments 27-30.

Ustaad says

You can cash out on the 1st. It takes Treasurydirect folks couple of days to execute the transfer of funds. The instruction to cash out should be initiated on the 1st because that is when you see the interest for the previous month credited into your account.

Christian Walenta says

good to know , thanks everybody

I also have a 5k in checks , can I cash them in at the bank on 9/1 as well or should wait a day for any reason?

Harry Sit says

It should work. Get the value of your bond as of 09/2023 from the Savings Bond Calculator. When the bank tells you how much the bond is worth, make sure it matches the value from the calculator.

Christian Walenta says

I know that this post is all about locking in a higher fixed rate for ibonds, just wonder what the best guess is how much fix rate might be after October ? is there a way to extrapolate?

Maybe only converting some amount now and see if rate gets even better could be a good strategy as well?

Harry Sit says

There’s no way to extrapolate but I expect that the fixed rate on new I Bonds to be announced on November 1 will go up from the current 0.9%, possibly to 1.5%.

Ustaad says

I would like to share my recent experience in cashing out 0% fixed rate ibonds. I was under the mistaken impression that I could not initiate the request for redemption earlier than the 1st of the month. After reading Harry’s response to comment #24, I initiated the request on 8/31/23 and received a confirmation from Treasurydirect for redemption on 9/5/23. I just checked my PNC account and the money is already there! Another redemption for the same ibond was scheduled for redemption to my Marcus account but the money is not there yet! Do different financial institutions credit customer accounts on different days even when they receive money from Treasurydirect on the same day?! Are they allowed to do that? I had similar experience with a t-bill that matured on a long weekend. In that case as well, I saw money in my PNC account but not in Marcus. At the time I questioned Marcus rep about it but the rep indicated that he did not see any money coming in!!! Can they legally place a hold on your money? It would be helpful if anyone can throw light on this.

Harry Sit says

You may have heard some banks advertise “getting your direct deposit up to two business days early.” When a payer submits an ACH file, the payer designates an “Effective Entry Date.” The receiving bank is only obligated to process the transaction on that date. It can choose to credit your account earlier if it’s a credit (push) but it can’t debit your account sooner if it’s a debit (pull). In your case, Marcus isn’t wrong when it adheres to the Effective Entry Date while PNC is doing you a favor by crediting your account early.

Please read ACH Push or Pull: The Right Way to Transfer Money for more on how ACH works.

Marc says

So, a similar thing happened to me. I posted earlier in my response to Post #24 that I intended to cash out an I Bond to receive the money on 9/2. I initiated the redemption on 8/31 and the confirmation indicated I would receive the funds on 9/5 (two business days, not two days).

Based on your post, I just checked my bank account and I was surprised to see that the money is there (with a status of pending which is normal for electronic deposits).

So, is Saturday considered a business day by either TD or the bank, in which case TD incorrectly stated I would receive my funds on 9/5 in the confirmation, or is Saturday not a business day, and they just don’t know how long it will take and want to under promise and over deliver?

Ustaad says

I want to clarify that on my bank account, it shows as a pending transaction and the pending amount is not reflected in the account balance but reflected in the “Available Balance”.

Ustaad says

Thanks, Harry! That makes perfect sense. So, Marcus is not doing anything illegal except that they want to enjoy the float on my funds which is perfectly legal. So, is it possible for me to change the redemption account that I chose at the time of purchase? Is it possible for t-bills as well as ibonds? When I initiated redemption for an ibond, the treasurydirect did not offer me an option to change the redemption account. If so, can I call them and have them change the account verbally?

Harry Sit says

Marcus isn’t enjoying the float on your funds. The receiving bank only has a data file at this time. The payer won’t pay until the effective date. PNC advanced the money to you early out of its own pocket.

TreasuryDirect has a dropdown to select the bank for the I Bonds redemption. You’ll see it when you know to look for it next time. You can change the payment destination of your existing T-Bills yourself under Current Holdings. You can also change your primary bank account designation under ManageDirect. The primary bank account will be your default payment destination for future purchases.

Ustaad says

Once again, thank you for correcting my misunderstanding, Harry. This information is really useful in getting a proper perspective of these transactions. Much appreciated.

Gloria says

I have an I-bond that is now worth about $12,000. Is it possible to partially cash it out, say take out 10k and leave the rest?

Harry Sit says

You can cash out a partial amount. It’ll be prorated between principal and interest.

Ustaad says

Harry, your response to my comment # 29 got me thinking again on this issue of my bank advancing me the cash before it receives it from TD. When I saw the pending deposit in my account, it did not increase my “Account Balance” but it did show increased “Available Balance”. Does that mean that I am not earning interest on the pending deposit but it is available for withdrawal should I choose to do so. Does that mean that my bank has to front the money only in case of withdrawal . If I don’t do anything, it does not add interest for couple of days of availability of funds. Is my understanding correct? Reflecting on your response got me curious. TIA.

Harry Sit says

You’ll have to ask your bank how it pays interest. At a bank I use, “Current Balance” is basically the balance as of last night. “Available Balance” reflects incoming deposits in the morning. Then Available Balance becomes Current Balance in the evening. The sooner an amount goes into Available Balance, the sooner it turns into Current Balance and the sooner it starts to earn interest.

Mark says

Thanks for clarifying all this Harry.

What happens when you’ve bought I bonds for several years, and rates go up? You can only switch out one year’s allotment per year–so you just sell the year with the lowest rate?

Harry Sit says

Several options:

– Sell all low-rate ones in one year to buy TIPS.

– Sell all low-rate ones in one year and buy as gifts for spouse.

– Switch out the lowest rate one year at a time and hope the fixed rate stays high.

– A combination of the above: buy some TIPS, buy some gifts, keep some for next year.

Lee says

Just to clarify-

There is nothing wrong with redeeming a month or two late, correct? Aside from losing out on some potential gains?

I needed to redeem 9/1 and 10/1 in a perfect world. I did neither and plan to redeem all of mine today, but I haven’t messed anything up, have I?

Harry Sit says

Nothing wrong with redeeming late. Some people prefer to postpone to January to push the interest income to next year.

Art says

Can’t imagine that there’s a downside other than losing a bit of potential interest. I decided to wait til Jan 2024 to cash mine out because I don’t want the extra income from ibonds to put me over another IRMAA bracket for 23 – I’m cutting it close this year, and there may still be unanticipated cap gains from an old mutual fund that messes up my calculations. Also thinking Jan will be a good time to decide whether to buy more ibonds since I’m maxed out for this year … it might not be worth it for me to tie up funds this way at this stage of my life ( tho I admit I very much enjoyed the 9+ % rate we had —very briefly—a few years ago! )

Christian Walenta says

I know this blog is about switching iBonds to a better fixed rate.

By going through the trouble of selling and buying again, I wonder if at this point in time it makes more sense to buy TIPS versus iBonds (in my case I dont have any TIPS yet). would that be a better play at this time?

Harry Sit says

Whether to buy TIPS for the long term or stay in I Bonds is covered in When to Sell I Bonds or Cash Out and Buy TIPS. When you don’t have any TIPS, the easiest way to buy them is through a mutual fund or ETF. I have a list of them in Better Inflation Protection with TIPS Than I Bonds. TIPS and TIPS mutual fund or ETF have interest rate risk. They can lose value in the short term. They work best as long-term holdings in a diversified portfolio.

Mark says

I sold my 1/22 bonds at the beginning of this month (10/23). Should I buy my annual allotment at the end of 11/23 (I read that I bond rates will most likely rise in November)?

Harry Sit says

If you’d like to stay in I Bonds, yes. We’ll see the new fixed rate next week. I’m hoping that the fixed rate will go up to 1.5%.

Harry Sit says

The new fixed rate is 1.3%. It’s not as high as I hoped but it’s still a good rate. I’m buying a TIPS fund for the long term.

Mark says

I have heard that I bonds protect from “interest rate risk.” Can you explain how that is so, if you have to annually compare and possibly sell old I bonds based on prevailing interest rates in order to optimize?

I read your excellent financial toolkit book. Can you please describe how you invest on the fixed income side of your portfolio?

Harry Sit says

“No interest rate risk” means the redemption value of your I Bonds doesn’t go down when the interest rate is up. You have an “upgrade” option to sell old I Bonds and buy something else. The cost of the upgrade is only the early withdrawal penalty within the first 5 years. It’s free after 5 years. You can choose to decline the upgrade and simply cash out to spend the money.

My fixed income portfolio is going into a TIPS fund now because I think it’s better for the long term but if I bought the TIPS fund in January 2022 and I want to go into I Bonds now or spend the money, I would have to sell the TIPS fund for a 13% loss since that time. That’s interest rate risk. I Bonds don’t have that risk.

Mary Ann says

Hi Harry, I’m getting up there in age and want to cash out my paper i bonds purchased in 07/2003 and put the funds in a cd at a local bank for my children to get easily after death. I would cash one per year $10,000.00 ($21,000.00 w/%) to stay in lower tax bracket. Do you see any negatives in doing this? And can I cash paper i bonds at local banks still?

Thanks, Mary Ann

FinancialDave says

Per Treasury Direct:

At a bank where you have a bank account: Contact them. Ask:

Will they cash your savings bonds

How much will they cash at one time

What identification or other documents do you need

With us:

Get FS Form 1522.

Fill it out.

Get your signature certified, if necessary.

(If the value of the bond(s) you are cashing is more than $1,000, you must have your signature certified. See FS Form 1522 for more about the signature requirements.)

Send the form and the bonds to us at the address on FS Form 1522.

Andrei says

I’m late to the party.

I have I bonds with the issue date of 09/01/21. I haven’t purchased any I Bonds this year. I ‘d like to keep them for a while as inflation protection but also would like to take advantage of the higher interest rate so I need to cash them out. I have a few questions:

– Re: Redemption date. My understanding is that I could have sold a few days earlier to time the redemption date as December 1st. So that’s no longer an option. Do I wait to time the redemption for Jan 1st, or it doesn’t matter that much?

– When I try to redeem I see this option “Select a payment destination to credit” Zero-Percent C of I option and my bank account. If I plan to cash out and use the same money to purchase new ones with higher fixed rate, which destination is best?

Harry Sit says

Requesting redemption a couple of days before 12/1 only gets the money sooner by a couple of days. Waiting to time it for Jan. 1 will delay it by many more days. Do it now if you want the money sooner. Choose your bank account as the destination. Stay Away from Zero-Percent C of I.

Panos says

Have purchased bonds on 11/21, 1/22, 4/22 and 1/23. The current rates displayed are 3.94%, 3.38%, 3.38% and 3.79% respectively. Planning to hold all those for long-term.

What would be the best strategy and timing to convert them to the new fixed rate?

Harry Sit says

The 11/21 and 1/22 bonds are ready to go. If you haven’t exhausted your 2023 purchase limit, you can sell now and use your remaining limit by the end of December. The 4/22 and 1/23 bonds will be ready on 1/1/2024. You’ll have a fresh purchase limit again in January 2024. If the amount you’re trying to convert to the new fixed rate exceeds your purchase limit, see if it makes sense to use the gift box.

Arzel says

I have I bonds purchased in August 2021 and two in March 2022 (one for me and my spouse). They are $10k each. Does it make sense to cash them all out now and buy I bonds for spouse and me for 2023 and buy a gift for spouse for 2024?

Harry Sit says

The deadline to buy for 2023 already passed. It makes sense to cash out and buy for 2024 and a gift for 2025 if you’ll hold the bonds long term.

Arzel says

plan to hold them for long term. thank you!

CO says

Hi Harry, do you have a prediction on what the fixed rate for May I-Bonds will be? I’m wondering if I should buy some now or wait until May.

Harry Sit says

It probably won’t change by much. +/- 0.1% doesn’t make much difference. I’m buying TIPS for the long term at almost 1% higher yield.

CO says

Thank you! I appreciate the quick reply.

Dunmovin says

Harry, I saw this on another post…any thoughts on what the answers are? Thanks

“A colleague noted that there are several TD postings whereby TD is “formally” waiving the 1 year holding period for noted disaster areas for Ibonds. Does anyone know if that also waives the 3 month interest penalty? And the APY for those being redeemed is reduced? “

Harry Sit says

If the announcement only says waiving the holding period, I assume the interest penalty still applies. Please call customer service to confirm.

Dunmovin says

With the soon to be signature by Mr. T on his B(cubed) legislation it’s time to adjust Ibonds accounts/portfolio and redeem some within the new $12K senior deduction, ie. “cover,” for no taxes due! Thanks Mr. T but only for that aspect coupled with the following 3 years of same! Luv managing by focusing on expenses!

Art says

It’s my understanding the extra “senior deduction” only fully applies to those making $75k ($150 joint) and it is phased out after that income level, ultimately disappearing. Those with a generous pension income or substantial earnings may get little or no benefit.

Also, be careful the accrued interest you earn from cashing out your bonds will not put you in the next tier for Medicare IRMAA calculations. When it comes to money, the government giveth with one hand and they taketh away with the other.

FinancialDave says

Nice, that’s a nice $2600 reduction in taxes for a lot of people.

Sam says

How did you calculate $2,600?

Art says

I’m guessing they calculated $12k deduction (if filing jointly with a sufficiently low income) taxed at 22% to determine savings. Income and tax bracket would be different for everyone so savings will vary. Some people mistakenly thought they’d get a $12k tax credit, but it’s a deduction ( thus, if you are eligible, it reduces your total taxable income by that amount)