The IRS has new RMD tables effective January 1, 2022. See how much you are required to withdraw from your IRAs.

Latest Blog Posts

Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

You can buy another $10,000 in I Bonds per calendar year in the name of your business but they will be subject to judgments against the business.

Buy I Bonds in a Child’s Name: You Can, But Should You?

You can buy I Bonds in your kid’s name but you should first decide whether to add to their 529 plan or keep full control of the money in your own name.

How To Harvest Tax Loss Between an ETF and a Mutual Fund

Using a special order type will make your ETF order behave like a mutual fund order. This minimizes the price fluctuation when you harvest tax losses.

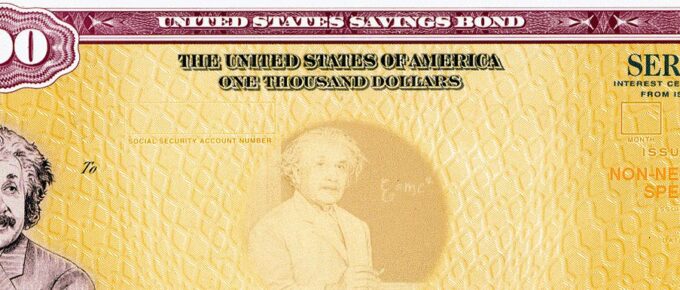

How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts

Series I savings bonds (I Bonds) are the best bonds you can buy at the moment. Follow this guide for a complete walkthrough from start to finish.

How To Deposit Paper I Bonds to TreasuryDirect Online Account

You can deposit the paper I Bonds from the tax refund to your TreasuryDirect online account. Follow these steps. It gets easier after you do it once.

How To Use a Securities-Based Loan to Manage Cash Flow

If you have large accounts with Fidelity, Schwab, TD Ameritrade, E*Trade, or Merrill Edge, you may be able to borrow at a very low interest rate.

Relocating for Retirement: Buy or Rent – Old Rules and New Rules

Some of the old rules for buying versus renting when you’re relocating are either outdated or don’t apply to everyone. Here are some new rules.

Create a Simple Revocable Living Trust with Software for I Bonds

It’s easy to create a simple revocable living trust with DIY legal books and software. You can buy additional $10,000 in I Bonds per year for each trust.

Roth Conversion and Capital Gains on ACA Health Insurance

Use this calculator to see the marginal tax rate on Roth conversions and long-term capital gains when you also receive a subsidy on ACA health insurance.