[Updated on January 26, 2026 with screenshots from FreeTaxUSA for the 2025 tax year.]

TurboTax and H&R Block are the two major tax software programs for filing personal tax returns. A low-cost alternative to TurboTax and H&R Block software is FreeTaxUSA. FreeTaxUSA isn’t only for simple returns. It can still handle more complex transactions, such as the Backdoor Roth.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA, then converting from it to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth in general, please read Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report the conversion to Roth *during* that year.

For example, when you are doing your tax return for year 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report the conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years. Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2026 in 2026 and convert it in 2026. Contribute for 2027 in 2027 and convert it in 2027. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026, or if you recharacterized a 2025 Roth IRA contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth contribution to Traditional in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year.

Here’s the scenario we’ll use as an example in this guide for a clean Backdoor Roth:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted from Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

Convert From Traditional IRA to Roth

The tax software works on income items first. We enter the conversion first, even though the conversion happened after the contribution.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until January 2027. Please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 1 now, and come back next year to follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

In our example, by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

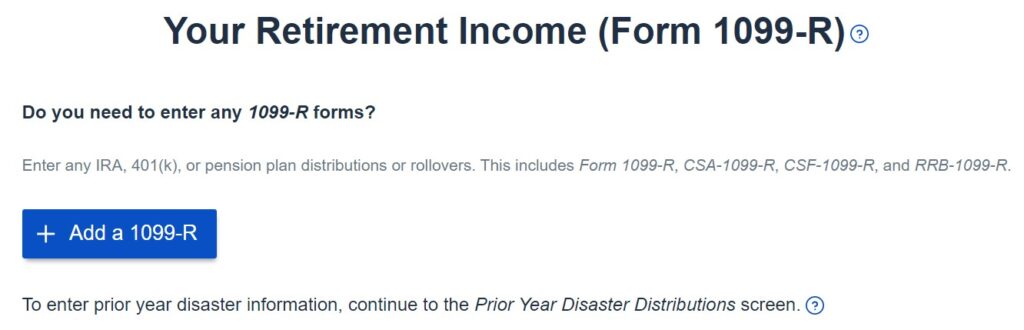

Find the “Retirement Income” section in FreeTaxUSA. Click on “Add a 1099-R” if FreeTaxUSA didn’t copy a placeholder from last year. Upload a file if you’d like. I’m showing how to enter one manually.

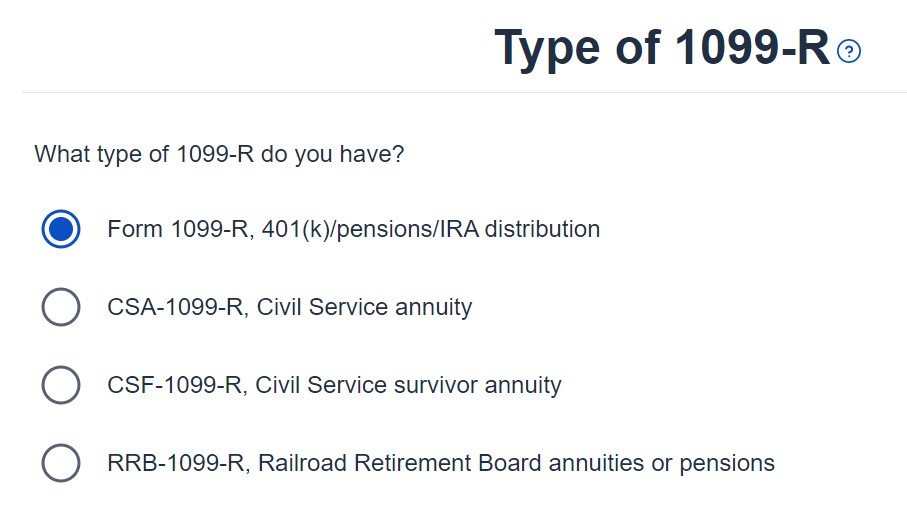

It’s just a regular 1099-R.

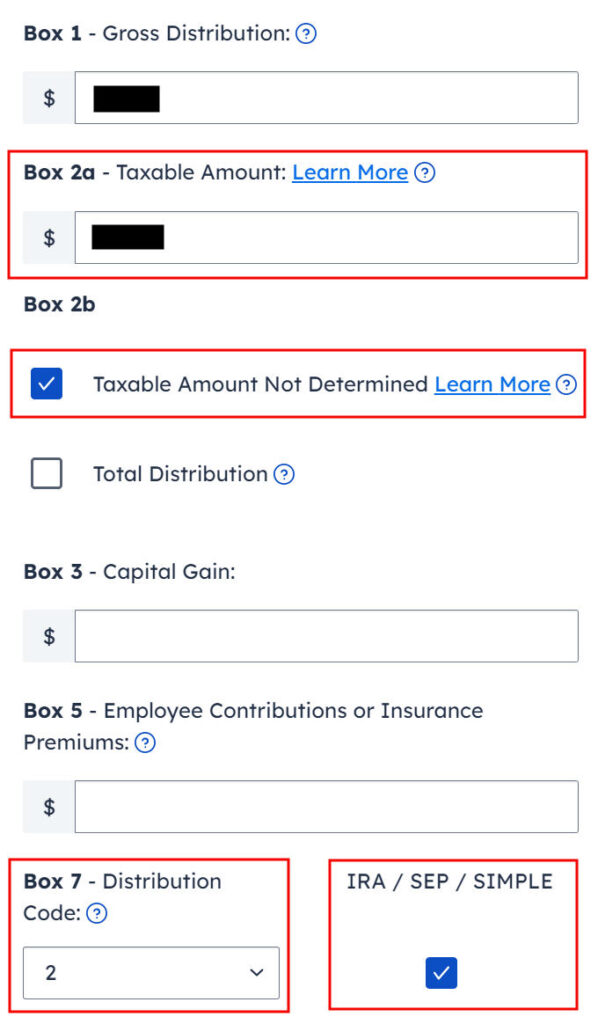

Enter the 1099-R exactly as you have it. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” It doesn’t matter whether the “Total Distribution” box is checked or not. Just copy what’s on your 1099-R. Pay attention to the distribution code in Box 7. It’s code 2 if you’re under 59-1/2 and code 7 if you’re over 59-1/2. The IRA/SEP/SIMPLE box is also checked.

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

We did not inherit this IRA.

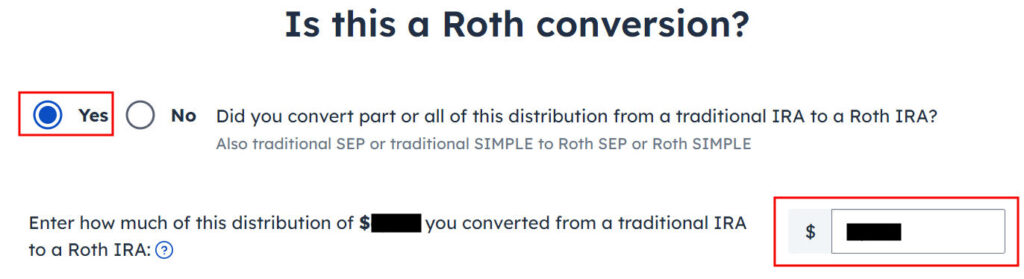

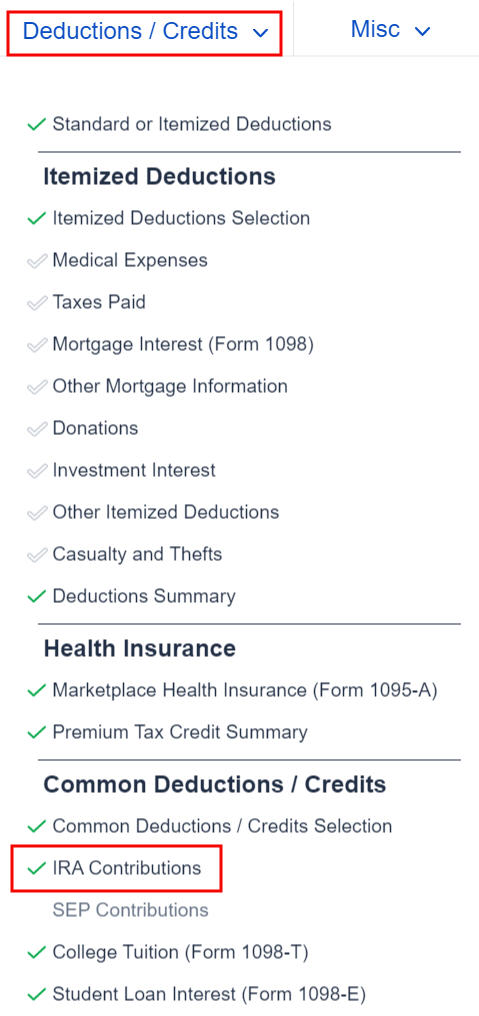

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. It’s $7,200 in our example.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

Click on “Continue” when you’re done with all the 1099-R forms.

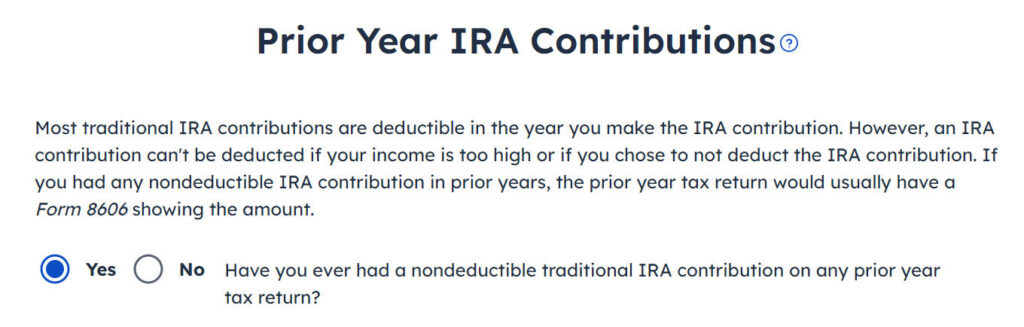

It asks you about the basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, you can answer “No.” Answering “Yes” and entering all 0’s on the next page has the same effect as answering “No.” If you have gone back and forth before you found this guide, some of your previous answers may be stuck. Answering “Yes” here will give you a chance to review and correct them.

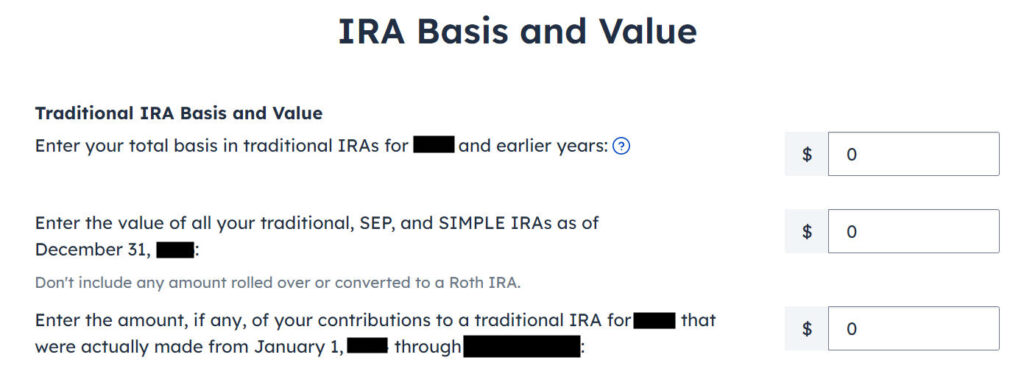

The values should be all 0 if you did a “clean” planned backdoor Roth every year. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, enter it in the first box. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you left it there, enter the account’s value in the second box from your year-end statement.

We didn’t take any disaster distribution.

Continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

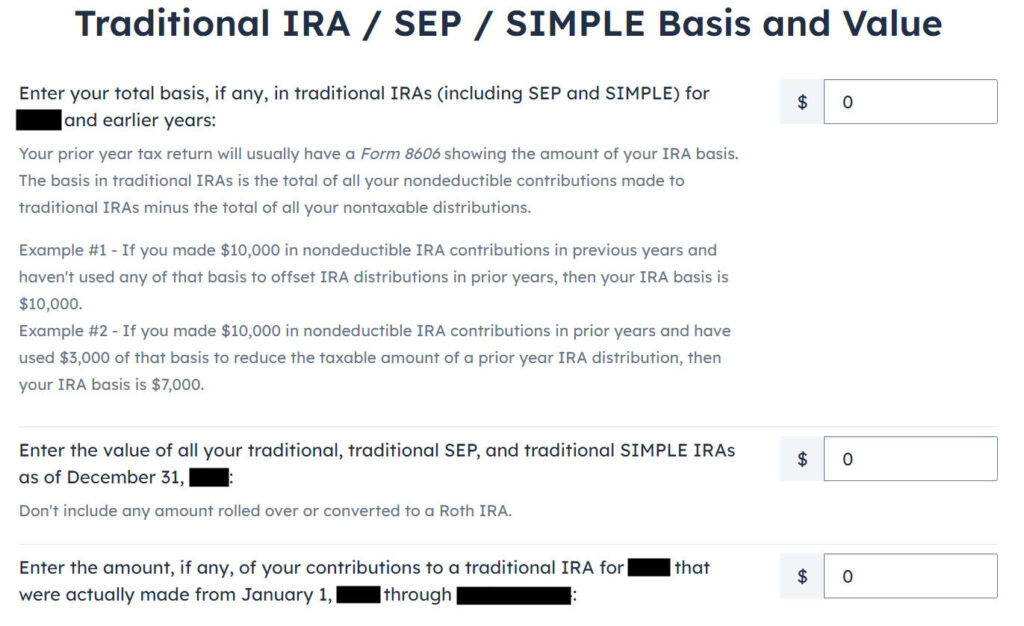

Find the IRA Contributions section under the “Deductions / Credits” menu.

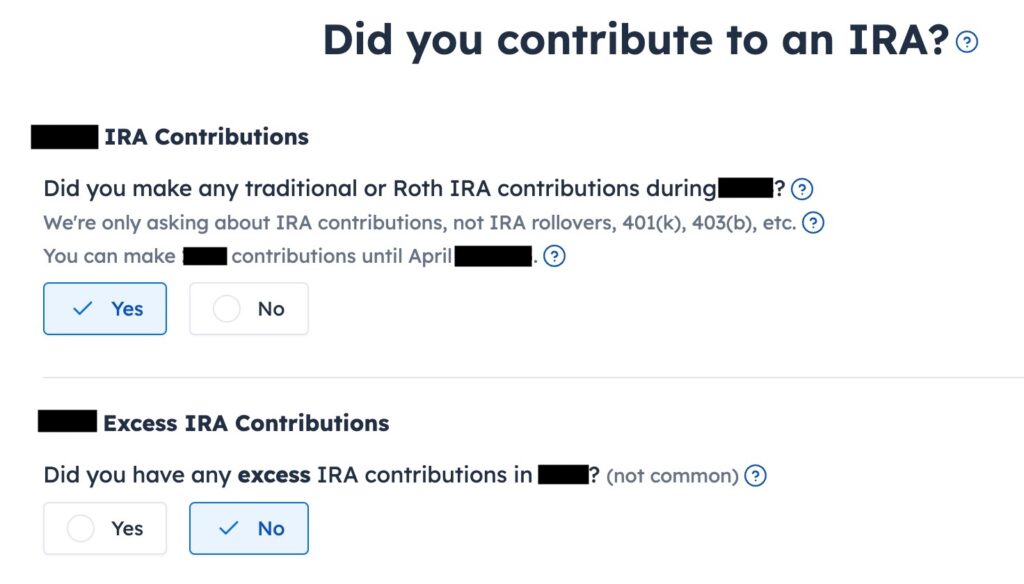

Answer Yes to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

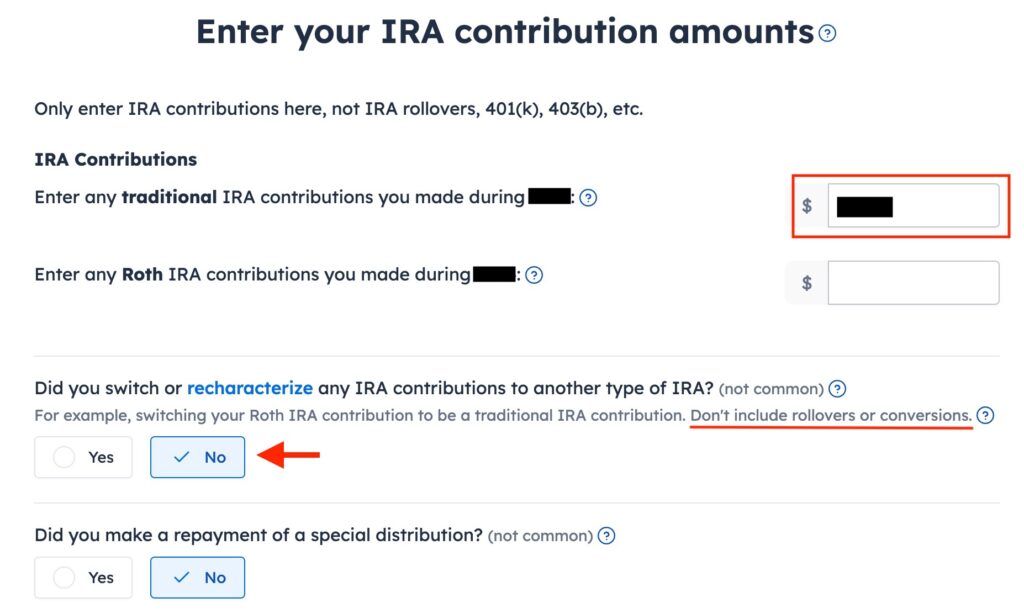

Enter the amount you contributed to the Traditional IRA in the first box. A contribution is money that went into the Traditional IRA from your bank account. It’s $7,000 in our example. Leave the answer to “Did you switch or recharacterize” at No. We converted. We didn’t recharacterize. We didn’t repay any distribution either.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot, and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

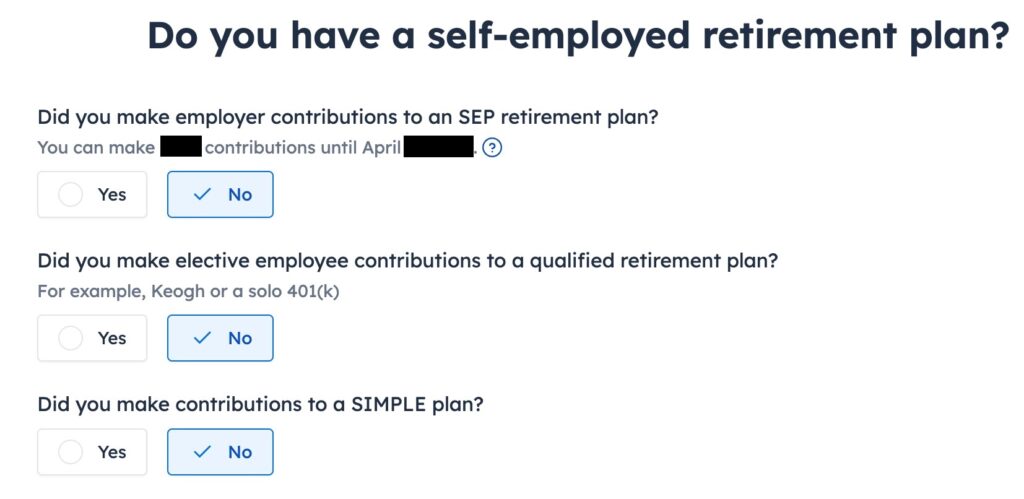

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

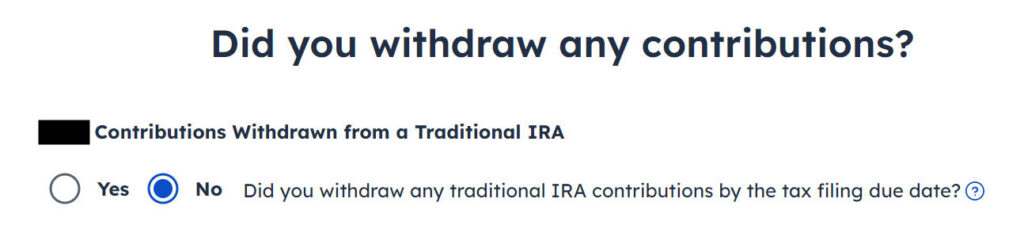

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No‘ here.

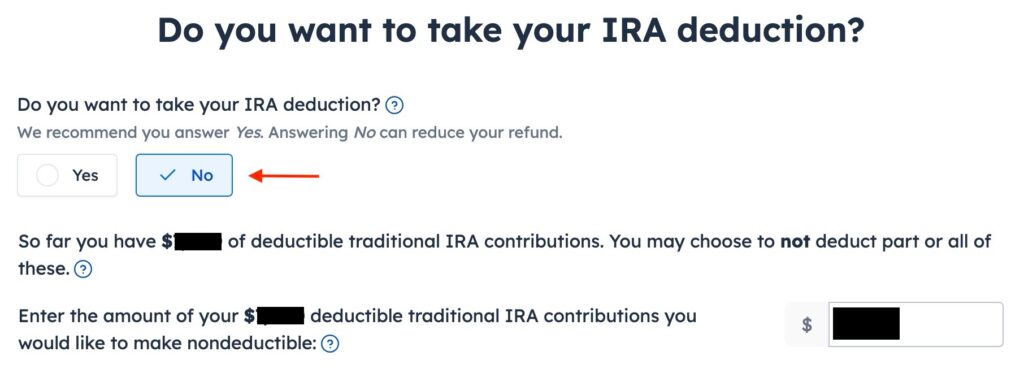

You see this screen only if your income falls below the income limit that allows a deduction for your Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible, but it will also make your conversion taxable. Although it works out to a wash in the end, it’s less confusing if you answer No here and make the entire amount that could be deducted nondeductible.

All values are zero when you did a “clean” planned Backdoor Roth every year. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, enter it in the first box. If you had a small amount of earnings posted to your Traditional IRA after you converted and you left it there, enter the balance of your Traditional IRA from your year-end statement in the second box.

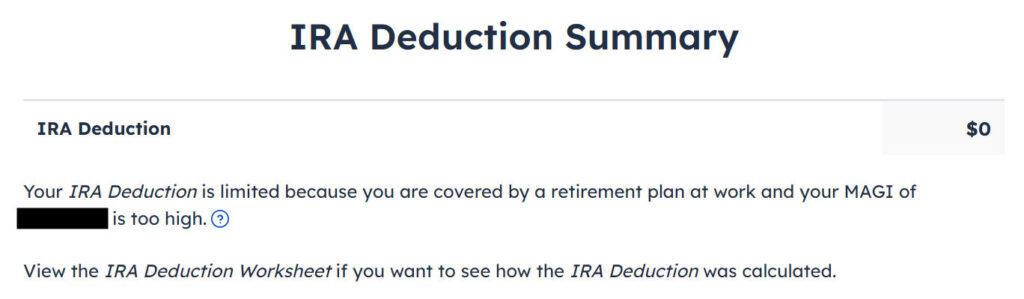

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

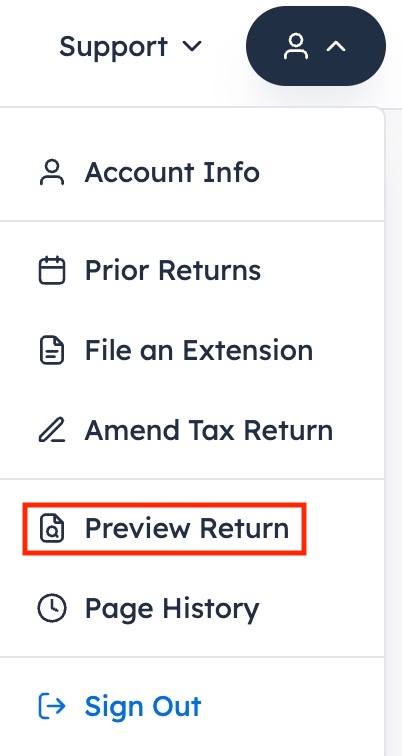

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth. Click on the head icon at the top right, and then click on “Preview Return.”

Look for Line 4 in Form 1040.

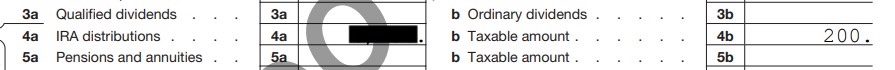

It shows $7,200 in IRA distributions in line 4a and only $200 is taxable in line 4b. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

The Entire Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the option to take a deduction when it sees that your income qualifies. Taking the deduction makes a corresponding amount of the Roth conversion taxable. Answering “No” in the “Do you want to take your IRA deduction?” page will have you taxed only on the earnings in your Roth conversion.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Cori says

It would be awesome if you could review this software compared to your experience with a more expensive program like TurboTax☺️

Harry Sit says

It appears it’s not able to import W-2s from payroll providers or 1099s from financial institutions. If you don’t mind typing in the numbers, I think the software works just fine.

Pramod says

Thank you very much for this post!

michael says

Thanks for the review! Based on your recommendation I just completed my taxes on FreeTaxUSA. It was very user friendly and saved me lots of money vs Turbotax in taxprep fees.

Sam says

I have run into a snafu where I didL

1. Contributed to Roth

2. recharacterized to traditional

3. backdoor roth from #2

The software can’t seem to comprehend this because I input 5500 into my roth ira contribution summary, NOT the traditional. Is there a work around?

Sam says

Adding on, could I just say I contributed to a Traditional IRA instead of a Roth, it fixes the issue if I do this because the software then realizes it is non deductible.

Harry Sit says

I don’t see an obvious way to enter the contribution as Roth and then say it was recharacterized to Traditional. Of course you still enter the 1099-R for the distribution from the Roth IRA for the recharacterization. Since a recharacterized contribution is as if you contributed to Traditional to begin with, I guess it’s OK to enter the contribution as Traditional. Please confirm with FreeTaxUSA support.

Chuck says

Thank you for this article. I got a little freaked out when I couldn’t figure out where everything goes, but this was clear and easy, and I ended up paying tax on $3.

Tim says

I notice you left Box 2a on the 1099-R blank?? Whereas on my 1099-R from Vanguard its shows $5500 in 2a (taxable amount). I contributed to my Traditional then recharacterized the next day, per the Backdoor Roth protocol.

Here’s my question, am I to leave the 2a BLANK in FreetaxUSA or follow my actual 1099-R and insert the $5500? Does either way affect the auto-generation of the 8606 form in the software?

Harry Sit says

You should enter your actual 1099-R. The protocol is to convert the money from the traditional IRA to a Roth IRA. I hope you actually converted, not recharacterized. They are different.

Ryan says

Tim, if your 1099-R has box 2b (“Taxable amount not determined”) checked, it’s fine that box 2a has a non-zero value.

If you look at the IRS instructions for form 1099-R [1], you will see this: “Box 2b. If the first box is checked, the payer was unable to determine the taxable amount, and box 2a should be blank, except for an IRA. It’s your responsibility to determine the taxable amount”

Assuming you actually did “convert” and not “recharacterize”, then this indicates the value of 2a is bogus and can be ignored.

See also: https://www.bogleheads.org/forum/viewtopic.php?t=88861

[1] https://www.irs.gov/pub/irs-pdf/f1099r.pdf

Tim says

Harry, Ryan, thanks for taking the time, that really helps!

Harry Sit says

I replaced the screenshot with box 2a filled in. It still works the same. Thank you for bringing it up.

Mike says

FreeTaxUSA workaround for inherited IRA minimum required distribution (MRD) with backdoor Roth (2018 tax year returns):

If you have an inherited traditional IRA with NO BASIS and an owned traditional IRA nondeductible contribution converted to a Roth IRA, FreeTaxUSA will not correctly generate form 8606. You can work around this by deliberately omitting the IRA/SEP/SIMPLE “X” in box 7 of your 1099-R, which I discovered by trial and error and an educated guess.

If you don’t do this, FreeTaxUSA incorrectly includes your MRD on form 8606, causing an incorrect prorated allocation of taxation between the MRD and Roth conversion. My total taxable distribution forwarded to form 1040 line 4b was correct as was my tax owed, but my form 8606 was incorrect, as data from inherited and owned IRAs should not be included on the same form 8606. MRD from an inherited IRA with NO BASIS gets added directly to form 1040 line 4b without generating a form 8606 of its own, and should not be co-mingled with a form 8606 for an owned traditional IRA to Roth conversion.

RothIRAGuy says

Lifesave man! I was going crazy … the backdoor ROTH had me paying thousands more. You just saved me $2k! 😉 Go you!

Nathan says

My backdoor Roth conversion for 2019 was a little more complicated because I had $3 in profit on the initial contribution from the money market account before I did the Roth conversion. My issue with FreeTaxUSA is how the software is filling out my Form 8606. It leaves lines 8-11 blank. Still gets to the correct total on line 13. It also is still doing 16-18 properly and showing $3 as the taxable amount (line 18). I’m wondering if I did something wrong or if there is a tax software issue. Will those lines being blank cause some sort of issue in an audit situation? White Coat Investor’s site is where I find that lines 8-11 should be filled in.

Harry Sit says

Lines 8-11 are interim steps. When you convert 100%, you are allowed to skip some interim steps.

Nathan says

Thanks so much for the quick response! Great tutorial.

Bob says

There’s a new screen for 2019.

In the deductions section, after the IRA Contributions screen

“2019 IRA Withdrawal Information”

“2019 Contributions Withdrawn from a Traditional IRA”

“Did X withdraw any traditional IRA contributions by the tax filing due date?”

“Enter any 2019 traditional IRA contributions X withdrew”:

Since I converted my entire Traditional IRA to a Roth IRA (which I indicated in the Income section) do I need to fill out info here?

Full help text below

What is a withdrawal of 2019 traditional IRA contributions?

If you made traditional IRA contributions in 2019, you can withdraw them tax free by the due date of your 2019 return (or, if you filed an extension, by the extended due date) as long as you didn’t take a deduction for the contribution and you withdraw any interest earned on that contribution.

Any withdrawn interest is considered taxable income and should not be treated as part of your contribution withdrawal.

Generally any contributions withdrawn after the due date (or extended due date) will be considered taxable distributions and will be reported to you on a 1099-R. If you haven’t reached age 59 1/2, the 10% additional tax on early distributions may apply.

Harry Sit says

You answer ‘No’ to that question. Converting to Roth is not a withdrawal. I added a screenshot to the post.

Bob says

Thank you!

JD Scott says

Extremely helpful article. Last two years I filed with different more expensive software that did not generate the 8606 form for the Roth backdoor. FreetaxUSA is the best and cheapest tax software I have used. Thanks for the info!!!

PanTaras says

Great Article!

However, I followed the instructions and checked the output of form 8606. FreetaxUSA vesrion left lines 6 -12 blank (no values at all). I compared it with other manual 8606 filling instruction https://www.whitecoatinvestor.com/backdoor-roth-ira-tutorial/ – this example has values in lines 6-12.

Does anybody know if thats an issue?

Thanks!

Harry Sit says

It’s not an issue. Those lines are interim steps, which the software is allowed to skip when you converted 100%.

Matt says

Performed a spousal backdoor Roth in 2019; however, our AGI fell within the phaseout range ($193k-$203k) so now my spouse’s contribution is partially deductible. Is there a way to force the software to make this contribution non-deductible? I was able to do that in TurboTax, but have not been able to figure it out with FreeTaxUSA.

Harry Sit says

If you converted during 2019, it’s not necessary to force it. The partial deduction makes your conversion partially taxable, which is offset by the partial deduction. You get the same end result. If you converted in 2020, having a lower AGI in 2019 isn’t necessarily bad. It may qualify you for some stimulus money.

Derwin says

Great post! Saved me over $2k trying to figure this out!

Thank you

Hao says

Thank you so much for this article and many others. I use FreeTaxUSA to prepare our federal & CA state tax, so your instructions help.

Justin says

I use freetaxusa. I know you aren’t covering this situation, but should I be able to do the following…

My wife and I each contributed $6000 to Roth IRAs in 2019. Our income was too high so in early 2020 we recharacterized those contributions (and associated earnings – let’s say $7000 each by then) to traditional IRAs and then a month later (why brokerage made us wait a month I have no idea) converted to Roth IRAs again. Let’s say we converted $7200 each. The recharacterization we had to explain on our 2019 tax return. We have no other traditional IRAs (basis?). Now we have to capture the conversion on our 2020 tax return. Should I expect about $2400 taxable income from all that?

Harry Sit says

That’s correct. You will have $1,200 taxable income from each 1099-R. The $6,000 contributed for 2019 recharacterized in 2020 becomes your basis carried over from 2019. In the “IRA Basis and Value” screen, you enter $6,000 in the first box (repeat for each of you).

Jason says

Thanks so much for pointing me to Freetax USA. I can’t quite understand how to do this scenario in freetax: In 2020 I made a contribution of $8500 to an IRA. $2500 counted for 2019 (because I had only contributed $3500 in 2019) and $6000 counted for 2020. I convert these to a Roth immediately so there was no growth. Vanguard’s 1099-R has $8500 in box 1. I think I know how to enter this on 8606 if I do it by hand but I can’t get it right in Freetax. Can you help? I know the 8606 is filled out correctly for 2019 ($3500) but perhaps I need to resubmit 8606 for 2019 as well?

Harry Sit says

Assuming that both your $3,500 and $2,500 for 2019 were nondeductible, your 2019 Form 8606 should’ve shown $6,000 in contributions, including the $2,500 you contributed for 2019 in 2020. In that “IRA Basis and Value” screen, you should enter $2,500 in the first box as your basis carried over from 2019.

Jason says

thanks! They are both nondeductible. The 2019 8606 had $3500 in box 1 and that is what I reported because at the time when I filed that was all we had contributed. Only after filing 2019 taxes was the remaining $2500 put into the account, so it looks like the 8606 just needs to be resubmitted with an explanation. I’ll put 2500 as my basis as I don’t think that should bring up the pro rata issue since at the end of both 2019 and 2020 the amount in the IRA was $0

Ravinatha Reddy Buchupalli says

Hello,

Due to high income, I am not eligible for deductible/tax benefits towards IRA contribution.

On 1/20/2021 I created my first traditional IRA account and deposited after tax dollars of $6000 from my checking account.

12 days later – On 2/2/2021, I transferred those funds into Roth IRA. This is also referred as backdoor Roth IRA as mentioned in this article. I choose this contribution amount towards 2020 ( as per the rule to contribute until Apr 15 2021).

Do I need to report this in this year’s tax return? I do not have Form 1099-R yet. I tried the steps mentioned in the article. However Form 5329 is generated and shown as excess contribution. How do I generate form 8606?

Harry Sit says

You report the conversion part next year when you have the 1099-R but you do need to report the contribution part for 2020. Make sure you already entered your W-2, which shows you have compensation eligible for an IRA contribution.

Ravinatha reddy buchupalli says

Harry,, can you please clarify your below comment. Are you referring to form 8606 to report the contribution? Thanks in advance.

“Make sure you already entered your W-2, which shows you have compensation eligible for an IRA contribution.”

Harry Sit says

You need compensation income (W-2 or self-employment) to be eligible for a traditional IRA contribution. If you followed all the steps after the heading “Traditional IRA Contribution” but you didn’t enter any eligible compensation income before you entered the IRA contribution, the software would generate Form 5329 showing the contribution as excess contribution. That could be one reason you got a Form 5329 and not a Form 8606.

Backdoor Conversion Question says

I have a situation where there is literally enough small “interest” that accrued after my conversion was complete for the year.

As a result, my technical account balance is enough to round to $1 by the end of 2020 (the $1 was converted over in this year’s backdoor conversion)

From following this guide, it seems this makes the non-taxable portion $5999 instead of $6000.

Would you wait until 2021 taxes to show that $1 so that it’d keep te amount reported in line 13 equal to the contribution made for the year?

Harry Sit says

Whether your balance in the traditional IRA was $1 or $1,000 at the end of the year, you enter that balance in the second box in the “IRA Basis and Value” screen. If that results in $5,999 non-taxable and $1 taxable, so be it. You pay tax on $1. No big deal. You’ll have a value on your Form 8606 line 14. That’s your basis carried over to the following year. Next year you enter that basis value in the first box in the “IRA Basis and Value” screen. The software will take care of the necessary calculation.

Backdoor Conversion Question says

Hi Harry — thanks for the prompt reply. So if I’m following, what you mean is what I’m effectively doing is establishing my end of 2020 basis as $1 since I’m rounding up to the nearest dollar by the end of Dec 31, 2020.

That way, once adding my $6000 contribution for 2021, the conversion of the full account would be for $6001 in 2021 taxes since the full $6001 was converted to zero the account back out (which I recently just did for 2021)?

Harry Sit says

Your end of year balance is on your account statement. Your broker will also report it to the IRS on Form 5498. You can’t change that number. Just enter it from your account statement as a matter of fact. Your broker will report the conversion amount in 2021 to you and to the IRS on Form 1099-R next year. You can’t change that number either. Again just enter it as a matter of fact. You don’t have any other choice. The software will work out the calculation. If it makes you pay tax on $1 this year, you pay tax on $1. If it makes you pay tax on $1 again next year, you pay tax on $1. Just let the software do its job and follow along.

Alex says

I am using FreeTaxUSA for the first time, and I did a standard backdoor Roth in 2020. (In 2020, I made a nondeductible contribution of $6,000 to a traditional IRA, I converted the $6,000 to a Roth IRA, and I had $0 basis in traditional IRAs for prior years.) FreeTaxUSA produces Form 8606 with $6,000 on lines 1, 3, 5, 13, 16, and 17; $0 on line 21; and blanks everywhere else; AND on line 13 there is an asterisk (*) which states “*From Worksheet 1-1 in Publication 590 B.” I think the end result is correct, but the $0 on line 21 and the reference on line 13 is throwing me off. Does this seem ok?

Harry Sit says

That’s OK. Worksheet 1-1 is an alternative to working through lines 6-12. A $0 on line 21 will be treated as blank.

Steve says

I keep going through the steps as listed above but despite having an income that phases me out of IRA deductions, FreeTaxUSA keeps giving me a $6,000 IRA deduction. However, it also keeps 1040 line 4b as $6,000 so they cancel one another out and the final refund appears correct. Looking at form 8606, lines 1-15 are blank. Lines 16 and 18 read 6000.

While I know the math is right, I’d rather not have my return flagged for this… Any help would be greatly appreciated.

Harry Sit says

Double-check your W-2 box 13. If the software thinks you’re not covered by a workplace retirement plan and therefore there’s no income limit, it’s going to give you the deduction for your Traditional IRA contribution.

Steve says

That fixed it … except the problem is my W-2 box 13 is unchecked. I’m wondering if this is in error, because we in fact do have a self-directed 401k profit sharing program setup (which we fill to the ~57k max allowable). I’ll reach out to our accountant / payroll company about if we should correct our W-2 to reflect this (or if there’s a reason it’s unchecked…). Assuming it’s not an error, is there any problem with proceeding with filing with that box checked in the software even if it’s not in real life?

Your help is much appreciated, Harry. Thank you!

Harry Sit says

It sounds like an error on the W-2. I don’t think there’s any problem if you treat yourself as covered by a retirement plan even when you’re not.

Steve says

Update: The W-2 is incorrect (as suspected). Many thanks!

Sami says

Thank you very much for the walkthrough. I am running into an issue which is a result of my own mistake, but I’m hoping you can provide some guidance.

-discovered backdoor Roth IRA in December 2019

-contributed to traditional IRA (both for me and spouse) in December 2019

-funds did not settle immediately, so could not convert to Roth until January 2020. In addition, $2 interest was earned in the meantime.

-filed 2019 taxes with form 8606 which showed $6000 nondeductible traditional IRA contribution in 2019 with total basis of $6000

-did 2020 traditional IRA contribution followed by Roth conversion in 2020

Now, when trying to file with freetaxusa, I think I am doing something incorrectly.

-1099-R for both me and spouse shows gross distribution of $12002 each with taxable amount of $12002 (on each of our 1099-R forms). Taxable amount not determined is checked.

-I plugged in the 1099-R information into freetaxusa. It asks how much of the $12002 basis I converted to Roth. I converted both the 2019 contribution and 2020 contribution in 2020, so I put the whole $12002 (for each of us).

-Then it asks if I’ve ever had a nondeductible traditional IRA contribution on any prior year tax return. I entered yes because I made the original $6000 traditional IRA contribution for each of us in 2019 (although it couldn’t get converted till 2020 like I mentioned).

-Next screen asks for total basis, if any, in traditional IRAs for 2019 and earlier years. I entered $6000 here per form 8606 from 2019 return.

-Repeated this for spouse

-Then I went to IRA contributions under common deductions.

-Enter any traditional IRA contributions Sami made during 2020: I entered $6000 for each of us.

-Then it shows the screen where it says “IRA deduction summary”. Here it is showing IRA deduction of 12000. I was under the impression that this should be 0? And the refund appears to decrease during the process, and then partially increase but not back to the number it was before entering the IRA information.

I know not converting 2019’s contribution till 2020 made this messy, but do you know what I am messing up here? Thank you so much for your time.

Harry Sit says

It sounds like you entered them correctly. The software thinks your IRA contributions are deductible. Make sure you already entered your income that exceeds the income limit and double-check your W-2 box 13. See comments #23 and #25.

Sami says

Thank you very much for your reply. I checked retirement plan on one of the W2s and now the IRA contribution no longer shows as deductible. It seems correct now.

Ondrej B says

This is my first time doing anything IRA-related. I contributed to IRA and rolled over to ROTH in 2021 and now I’m confused about how to report it. (I know – should have done it in time..)

After going through all the steps (skipping 1099-R) I can see a $6000 IRA deduction but I don’t believe that is right. It never offers me the “IRA Basis and Value” screen. Is that because of the missing 1099-R?

Also, I’m over the income limit for the IRA to be deductible. However, W2 box 13 is unchecked (employer offers 401k but I did not contribute in 2020)

Am I really allowed to have this deduction?

Any help would be appreciated!

Harry Sit says

See what the IRS says about “covered by a retirement plan”:

https://www.irs.gov/retirement-plans/are-you-covered-by-an-employers-retirement-plan

If you didn’t contribute and your employer didn’t/won’t contribute to your account for 2020 either, your W-2 box 13 is correct. If you’re not covered by a retirement plan and you’re single or your spouse isn’t covered by a retirement plan either, your contribution to the IRA is always deductible. So you will take the deduction in 2020 and pay tax on the conversion in 2021.

Edwin says

I’m so glad I bookmarked this page when I found it in Q1 2020 while working on my 2019 tax. Thanks for updating it to reflect the 2020 tax year Harry!

Ted says

You are a hero. Thank you thank you thank you. I hope you have a warm feeling in your heart from helping so many strangers.

Ally says

Hi Harry,

Thanks for this informative article, it’s super helpful! This is also my first year with a mega backdoor in-plan conversion, is there a work around for Freetaxusa or should i switch over to turbo tax? I been using freetaxus for the past 5 years, i really hope i do not have switch over. Thanks in advance for your response!

Regards,

Ally

Harry Sit says

I just tried it. It’s quite straightforward. You don’t have to switch to TurboTax. Here’s the walkthrough:

https://thefinancebuff.com/mega-backdoor-roth-freetaxusa.html

Ally says

Thank you so much Harry! I followed your instructions and it worked perfectly! I really appreciate the effort.

Kaitlin says

THANK YOU, you are a life saver!

Would be forever grateful if you could help re: how to complete the state tax return in relation to the backdoor Roth (filing in Arkansas). For context, I did a planned Backdoor Roth of $6k.

In the State Pension & IRA Income section it says:

“Most pension and IRA distributions are eligible for a $6,000 exemption from the taxable amount. However, premature distributions from IRA accounts and certain annuities are not eligible. Annuity income is only eligible if it is from an employment-related pension plan.

Question 1: Do you have any nonqualified premature IRA distributions? YES or NO

Enter the amount of your pension and IRA distribution income, if any, that isn’t eligible for the Arkansas $6,000 exemption.

The amount of your taxable premature IRA distributions on your federal return is $0. Add any IRA distributions with a code 2 in Box 7 of your 1099-R unless they were due to death or disability. If you have any annuity income that isn’t from an employment-related pension plan, then add that amount to the number you enter below.

Question 2: Your Gross Ineligible Distributions

(Amount of gross distributions NOT eligible for the $6,000 exemption): $__

Question 3: Your Taxable Ineligible Distributions

(Amount of taxable distribution income NOT eligible for the $6,000 exemption): $__

Hoping for help re: whether to select yes or no and what numbers to put in Questions 2 and 3 if I select yes.

Harry Sit says

It looks to me 1. Yes 2. 6000 3. 0. The amount you converted is ineligible but it’s not taxable because it was after-tax money.

Kaitlin says

Thank you very much @Harry

Plicy P. says

Hi Harry,

Thanks so much for this post! It’s so helpful. I also just want to confirm I am doing this correctly.

I contributed $6000 to a traditional IRA in 2020 and immediately converted it to a Roth IRA. At the end of inputting all of my information as you advise, my taxable amount on form 1040 line 4b is “0”. I think this is correct since I made the contribution with non-deductible after tax dollars, but I just wanted to confirm.

Thanks!

Emy says

thank you so much for this article! it was extremely helpful.

i was following the steps provided. however, when i clicked on my 1040 form, it showed lines 4a and 4b (IRA distributions & taxable amount) as being the same. i’m not sure how to get it to deduct the $6000 in the taxable amount.

thank you so much!

Harry Sit says

Check your W-2 entries. Box 13 should be checked if you’re an active participant of a workplace retirement plan. See comments 23, 24, and 25.

KP says

Hello,

I could use some last minute assistance with figuring out how to help my SO properly report a late contribution for 2020 through freetaxusa. I convinced her to start doing a Backdoor Roth this year, so she made a contribution for 2020 in February 2021, and has since rolled it over into a Roth. I understand that she doesn’t have to report the rollover until next year, but I’m having trouble getting freetaxusa to generate the Form 8606 correctly to report her late contributions for 2020.

I only see two places to input this information. There is a space in the Income section, but that requires more info from a 1099 which she did not receive this year, since she didn’t make the 2020 contribution until February 2021. I found the IRA Contributions page under Deductions/Credits, and have input all of the information the same as in the guide above, with the exception that I input $6,000 where it asked “Enter the amount, if any, of your contributions to a traditional IRA for 2020 that were actually made from January 1, 2021 through May 17, 2021.” Despite doing this, the form 8606 which is generated as part of the Form 8606 in her federal tax return on the Summary page lists box 4, for contributions made in 2021, blank.

For the life of me I can’t figure out why that is happening, and am not sure if it would cause her a problem. Any help would be greatly appreciated!

Harry Sit says

The IRA Contributions page under Deductions/Credits is the right place. If her Form 8606 correctly lists her non-deductible contribution in line 1, read the instructions on line 3. When she answers No, she’s instructed to skip to line 14 and not complete lines 4-13.

Heidi says

Hi Harry,

Thank you for the detailed information! For the line 8 (Enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to Roth IRAs) on the Form 8606, does this amount include only the contribution that’s converted? or also include earnings?

Harry Sit says

Also include earnings. As the example shows the converted amount was $6,200 from a contribution of $6,000.

Stephanie says

Hi Harry,

Thanks for this article very helpful. I’m noticing for 2022 there is a question under ‘Did you contribute to an IRA – Did XYZ recharacterize any IRA contributions’ – when I click yes and follow the prompts – it makes my refund go back down again. I’m not sure what I’m doing wrong? Do I not click this? Which then leaves me with my original refund amount? Any guidance would be great! Thanks!!

Blake says

I’m having the same issue as Stephanie. I’m wondering if the software has a glitch, as I’m following the above instructions to a T, and it’s considering it to be taxable income.

Harry Sit says

I just went through the 2021 edition. It’s pretty much the same as in 2020. The default answer to “Did you recharaterize any IRA contributions?” is No. Leave it as that. You converted, which you already entered in the income section. A conversion isn’t a recharacterization.

Blake says

I just figured that out earlier, and that did get the tax return back to where I started, so it worked.. thanks!!

Stephanie says

I figured out the same Blake! Thanks for the response Harry! Really this walk through is fantastic!

Chris K. says

I have an interesting scenario:

My wife and I were planning on filing married separately due to her being in a student loan forgiveness plan that was an income-driven repayment plan. Since her debt has been wiped out after completing 120 payments successfully (thank you forgiveness waiver), we will be filing jointly for 2021 tax year.

In 2021, I performed 2 separate transactions.

1. I converted a traditional IRA to Roth in the amount of $1,367. $800 of this amount was originally contributed in 2017 to a 401k plan from an internship. I rolled it into a Traditional IRA later on in 2017, and eventually invested this and it grew to $1,300. Fast forward to 2021, I converted this into a Roth IRA and I expect to pay taxes on the amount.

2. Due to expecting to file separately with my wife, I performed a Backdoor Roth for $1,000. I contributed $1,000 to a Traditional IRA and immediately converted it to a Roth IRA. Regardless of income limitations, I don’t believe I will have to pay taxes on that amount.

Total Roth Conversion for 2021: $2,366

Total IRA Contributions for 2021: $1,000

Currently on my 2021 1040, Form 8606 shows the $2,367 and lines 16 and 18. Page 1 shows the $2,376 on line 4a and 4b. I also currently show a $1,000 IRA deduction on Schedule 1 line 20. Net, my taxable amount is $2,367 1040 Page 1 Line 4b – $1,000 1040 Page 1 Line 10 (adjustments to income from IRA deduction) = $1,367.

I believe this is the correct preparation and presentation. I would love to hear other peoples feedback.

Harry Sit says

Double-check your W-2 entries and see if Box 13 should be checked for having participated in a workplace retirement plan. See comments 23-25 and 31.

Chris K. says

I input a fake w-2 and it course corrected. Also took a deep dive into Publication 590-B and Worksheet 1-1. I’m actually a CPA and this shit is confusing as hell.

My form 8606 is doing some weird stuff, Lines 6-12 are not populating, instead it is being calculated on Worksheet 1-1 from Pub 590-B and the amounts are input on lines 16 -18

Line 16 = 2367 -> flows to Page 1 4a

Line 17 = 1000

Line 18 = 1367 -> flows to Page 1 4b

Following the instructions, I believe this is the correct presentation. I’m happy with the end result. Thanks for bringing that up since it made a huge difference.

Michael says

Harry,

Is there a way to buy i bonds with refund using freetaxusa? I haven’t found a way to recieve a refund other than direct deposit.

Thanks for all of your tutorials they are very helpful.

Harry Sit says

Off topic, but other readers reported that FreeTaxUSA doesn’t support buying I Bonds with the tax refund. H&R Block does, and it isn’t that much more expensive ($10 without state, $20 with state) when you know how to get it.

https://thefinancebuff.com/overpay-taxes-buy-i-bonds-better-than-tips.html#comment-28260

ERdoc says

Hey Harry,

I need help with how to correctly input the information into free tax USA for the error i made in my first completed backdoor ROTH. I contributed every year $6k x2 (wife) into our ROTH IRAs, i realized only later in the year that my annual income MFJ would be too high and thus re-characterized the contributions into a traditional IRA in december (noting growth on the initial contribution, $6.9k , $7.1k). Unfortunately the ERROR i made was then converting the traditional IRA amount back into the Roth account after 2021, completed in early january 2022.

From other forums / help i’ve been told that i need to report the 2021 non-deductible contribution on form 8606, and then report the conversion for 2022 tax filing (both conversions as i plan to do the backdoor roth again – but correctly ).

My question is how do i do this in the FREETAXUSA software, deluxe, that i am using. Fidelity-who i have the accounts in- sent me a 1099-R and 2 separate 5498 form (for my wife and i separately). Trying to figure out how to form 8606 reporting correctly into the free tax usa software.

Appreciate your help always, read many of your posts!!

Harry Sit says

Enter the 1099-R’s as-is. Code R in box 7 tells the software it was for recharacterization. In the IRA contribution section, put $6,000 in the second box for Roth IRA. Answer “Yes” to “Did you characterize?” and say you recharacterized the full $6,000. Repeat for spouse but make sure both the 1099-R and the IRA contribution are attributed to the right person.

ERdoc says

thanks harry,

the 1099R from fidelity has a “N” value in box 7 currently, it gives me an error message when trying to put “R” into the tax software saying – “you would only enter a 2022 form 1099R with redistribution code R on your 2021 tax return.”

Also when you mention “put 6000 into second box for Roth IRA,” do you mean put that in box 2a? after the box 1 gross distribution is noted as $6900?

thanks!

Harry Sit says

My mistake. Code N is correct for same-year recharacterization. Don’t change anything to the 1099-R. By “second box” I meant this screenshot:

https://thefinancebuff.com/wordpress/wp-content/uploads/2022/01/11-contribution.jpg

I had $6,000 in the box for Traditional IRA and I answered no to the “Did you recharacterize?” question. Your $6,000 goes into the next box for Roth IRA and you answer yes.

Jason says

I’m thinking about using FreeTaxUSA for the 2021 tax filing season. I typically owe balances due on my Federal and State taxes, how does the software handle that? Do I just mail in a 1040-V with a check for Federal tax due, and the similar form and check for state? Thanks.

Harry Sit says

When you e-file you give a bank account for direct debit. Printing the forms and mailing with a 1040-V and a check also works but expect a long delay in processing.

Blue says

I have a question about the “Enter the value of all traditional, SEP, and SIMPLE IRAs as of December 31, 2021” question in the “IRA Basis and Value” screen. I have a SEP IRA plan going for a couple of years and it is non $0. So, even if the Traditional IRA total value is $0, the value in this box is non-$0 for me. If I put a non-$0 value for this question I get taxed for the $6,000 conversion.

Harry Sit says

That’s correct. You don’t have a clean backdoor Roth when you have a SEP-IRA. You get taxed on a [big] part of your conversion but a corresponding part of your SEP-IRA is now non-taxable. You pay less tax when you withdraw from your SEP-IRA in the future or when you convert your SEP-IRA to Roth. You’ll have to remember to carry this part in your SEP-IRA. You’ll pay tax twice if you forget.

Blue says

Thank you! How do I carry forward the tax I pay for this “dirty” backdoor Roth? On which form doe it get reported now and on which form I report it in the future?

Harry Sit says

Your non-taxable basis in the SEP-IRA is carried on Form 8606 line 14. When you withdraw from your IRA or convert to Roth again, remember to enter this number. Part of it will be used to offset the tax on the future withdrawal or conversion.

Blue says

One year forward, same situation, will I pay less taxes in the $6,000 Roth conversion because I was taxed last year?

Harry Sit says

If you still have your SEP-IRA, enter the balance as of 12/31 as you did last year and enter the basis from the previous year in the box above that using the number on line 14 of your last year’s Form 8606. The software will calculate how much of your conversion will be taxed. It should be less this year.

Susan says

I’ve used FreeTaxUSA for a few years. In March 2020 I made a $7000 contribution for 2020 to my Roth IRA (I’m currently 57).

Found out in March 2021 while doing taxes that this was ineligible due to good performance of my husband’s investments.

Called Vanguard and they walked me through taking out the contribution plus extra to cover earnings, plus I prepaid $200 in taxes.

Now I have a 1099R 2021 and need to amend my 2020 return to add it.

Question, line 7 shows codes JP. After that, the IRA/SEP/SIMPLE box is not checked, but FreeTaxUSA gives a message that I need to check it in order for them to figure my taxes. I looked on the IRS site under directions for 1099R and it says NOT to check the box for a Roth IRA. Help — should I check the box or not? I hate to check it when the IRS site specifically makes it sound like I shouldn’t.

FreeTaxUSA shows a $200 refund without it checked; $353 tax liability when unchecked.

Thank you! So glad I found this site; very helpful.

Harry Sit says

Your withdrawal from the Roth IRA isn’t the same as the one described in this post. You shouldn’t change anything on the 1099-R when you enter it. Don’t check any box if it isn’t checked on the actual form.

Alex P says

It appears that FreeTaxUSA still does not treat inherited IRAs correctly for the purposes of Form 8606, similar to the issue described in Post No. 8. I had a total distribution from an inherited IRA, and it got commingled into Form 8606 even though it should not have (as far as I understand). While the ultimate tax calculated was correct, the numbers on the generated Form 8606 did not make sense. As suggested in Post No. 8, omitting the X for box 7 appears to resolve the issue. Would this work-around cause any issues?

JC says

I agree this is still broken and it very much does not calculate the correct result for me (adding thousands in incorrect tax burden). I contacted them but they do not seem to be able to fix it for this year.

John says

I am unable to get to the IRA basis and value screen, despite selecting every option in line with your instructions. Line 4b treats the entire $6K contribution as taxable. It also allows me to deduct the traditional IRA, which is incorrect, because I am above the income limits. I ran my info through Turbotax and it correctly handled the roth conversion. I’d really like to avoid turbo tax. Any suggestions about what I’m doing wrong? I do have a second 1099-r, but it was a trustee-to-trustee rollover from a traditional IRA to a traditional 401k and unrelated to the conversion.

Harry Sit says

See the section on W-2 Box 13. It allows you to deduct the traditional IRA contribution when it doesn’t know you’re covered by a workplace retirement plan.

John says

Got it! Employer didn’t check the box. Thanks!

Kaila says

Hello, I did a simple backdoor conversion in the same year and followed the steps above. My 1040 appears correct with 4b blank, but was wondering how form 8606 should look. I though 15-18 should be blank. I have 6K on lines 16 and 17, and line 9 is blank.

Harry Sit says

Lines 16 and 17 should have numbers.

ERdoc says

Hey Harry,

Any idea how to force the software to report Traditional IRA contribution as non-deductible, when the software is forcing the deduction?

Briefly, I contributed to Roth early 2021 for wife and I as always, then later in 2021 was concerned we would be over the limits for contribution, so tried to do backdoor Roth for the first time ever (screwed up a bit).

$6000 (his), and $6000 (hers), recharacterized into Traditional IRA (~$6900 each respectively after gains) in December 2021. Then on 1/3/22 converted back to Roth, before learning that the T-IRA should be $0 on 12/31/21.

After all deductions, our income is under the limits actually, and then entering all of the information into the FREETAXUSA software, it gives me a $484.00 IRA deduction. My friend (CPA), briefly reviewed by return before filing and recommended that I just treat the traditional IRA contributions as non-deductible , to avoid future pro-rata since I plan to do backdoor Roth again..

I cant seem to figure out in the software how to make the T-IRA contributions as non-deductible? at least by not doing anything incorrectly. Any thoughts. The “support pro” had no clue.

Harry Sit says

You can’t force it in this software unless you want to print out the forms, retype them with your edits, and file by mail. The $484 deduction doesn’t trigger the pro-rata rule though. The pertinent date is 12/31 in the year you converted. That’s 12/31/2022, not 12/31/2021. You’re carrying basis into 2022 anyway because you didn’t convert within 2021. Instead of carrying $6,000 each, you’re carrying $5,758 each (assuming the $484 is a combined deduction evenly distributed between two IRAs).

The only downside of taking the deduction is that you may be taking a $484 deduction when your tax rate is low in 2021 and getting taxed on $484 when your tax rate is high in 2022. Because $484 is relatively small, this effect is also small (worth ~$100 if your tax rate in 2022 is 20 percentage points higher than in 2021).

Next time remember to finish all you moves within the same year. Contribute, recharacterize if necessary, convert, all in the same year. Keep it clean and don’t let any part spill into the following year.

Ondrej B says

Hi Harry,

Thank you for your help last year, I have a follow-up question regarding my comment #25:

In January 2021 I contributed $12k to IRA (6k for 2020, 6k for 2021) and immediately rolled to ROTH. I took a $6k deduction (W-2 Box 13 not checked) and no form 8606 was filed with the return.

For this tax year, W-2 Box 13 IS checked and I have received a 1099R for $12k which I put into FreeTaxUSA but I’m unsure if I’m doing that correctly. This is what I did:

In the Income/Retirement Income section:

– Entered 1099r: $12k

– “Did you convert part or all of this distribution from a traditional IRA to a Roth IRA?” Yes

– “Amount”: $12k

In the Deduction/IRA contributions sections:

– Entered $6k as traditional IRA contribution in 2021

– In “IRA Basis and Value” entered 0 as IRA basis for 2020

This results in an IRA deduction of $0 and Form 8606 with a taxable amount of $6k. Looks right to me but can you confirm?

Thank you!

Harry Sit says

That’s correct. Your basis from 2020 was zero because you took a deduction in 2020 when you weren’t covered by a retirement plan at work.

Sean says

Hi Harry, would you kindly elaborate on the implications of your statement: “When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.” My 4(a) and 4(b) are both showing 6000, and having read through the prior comments, I infer that the reason is that my W-2 box 13 is unchecked. The W-2 is correct, as I am not covered by a retirement plan for my W-2 income. (I do have a solo 401(k) for my self-employment income, but I believe that is irrelevant.) Anyway, where does this leave me? Should I not have done a backdoor Roth in my situation? Would be grateful for your thoughts.

Harry Sit says

The solo 401k is relevant. If you made a contribution to your solo 401k, you’re covered by a workplace retirement plan, and the income limit for deducting your Traditional IRA contribution is much lower. You will see the change when you tell the software you contributed to a solo 401k. Sometimes it’s referred to as a Keogh plan in the software.

Sean says

Thank you, Harry. I opened the solo 401k in 2021 and didn’t realize Keogh encompasses solo 401k, so thanks for bringing that to my attention. When I entered my contribution in the freetaxusa field for Keogh, it did indeed reduce my 1040 4(b) value from 6000 to 0. However, the wrinkle is that I contributed to my Roth solo 401k only; I did not make a pre-tax contribution. The software is deducting my contribution as though I had contributed to the regular solo 401k. So obviously that’s not correct — I’m assuming I should remove the Keogh contribution entry. However, that will bring me back to where I was before on the backdoor Roth. So I’m still confused.

Harry Sit says

If you only contributed to Roth solo 401k, you answer Yes to “Do you have a SEP, SIMPLE, or other self-employed qualified retirement plan?” and leave the amount blank. The amount is for pre-tax contributions.