[Updated on January 26, 2026 with screenshots from FreeTaxUSA for the 2025 tax year.]

TurboTax and H&R Block are the two major tax software programs for filing personal tax returns. A low-cost alternative to TurboTax and H&R Block software is FreeTaxUSA. FreeTaxUSA isn’t only for simple returns. It can still handle more complex transactions, such as the Backdoor Roth.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA, then converting from it to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth in general, please read Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report the conversion to Roth *during* that year.

For example, when you are doing your tax return for year 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report the conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years. Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2026 in 2026 and convert it in 2026. Contribute for 2027 in 2027 and convert it in 2027. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026, or if you recharacterized a 2025 Roth IRA contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth contribution to Traditional in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year.

Here’s the scenario we’ll use as an example in this guide for a clean Backdoor Roth:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted from Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

Convert From Traditional IRA to Roth

The tax software works on income items first. We enter the conversion first, even though the conversion happened after the contribution.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until January 2027. Please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 1 now, and come back next year to follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

In our example, by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

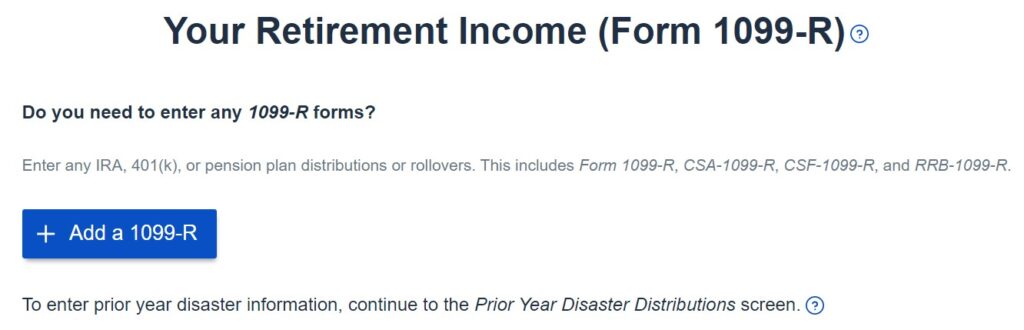

Find the “Retirement Income” section in FreeTaxUSA. Click on “Add a 1099-R” if FreeTaxUSA didn’t copy a placeholder from last year. Upload a file if you’d like. I’m showing how to enter one manually.

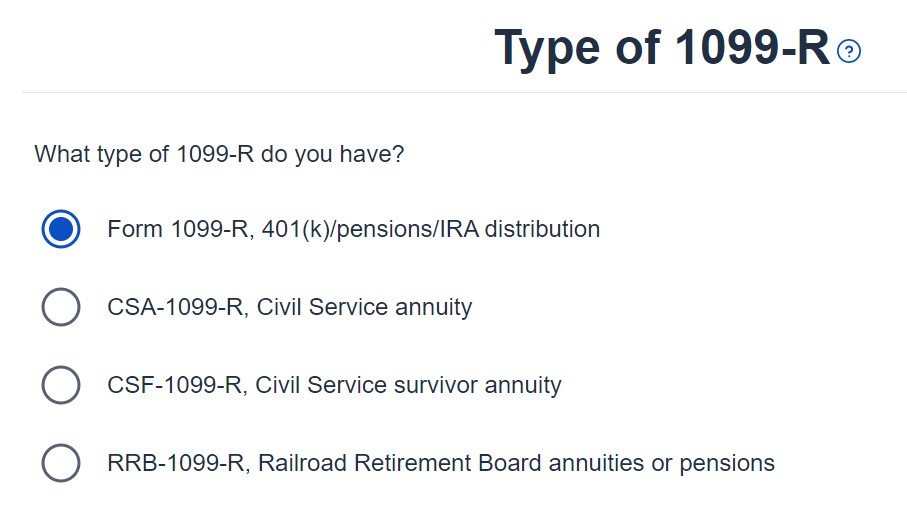

It’s just a regular 1099-R.

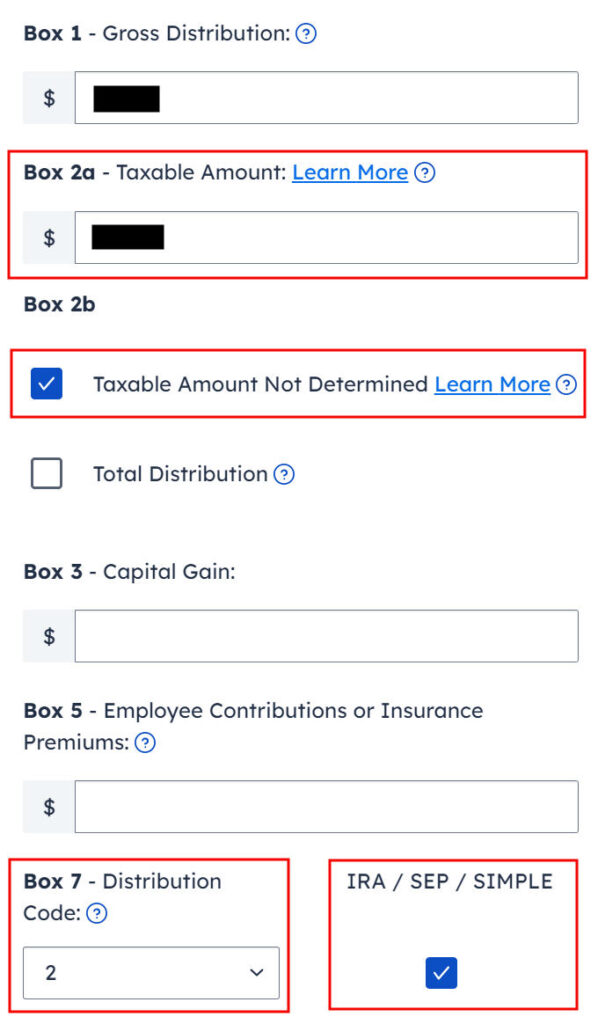

Enter the 1099-R exactly as you have it. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” It doesn’t matter whether the “Total Distribution” box is checked or not. Just copy what’s on your 1099-R. Pay attention to the distribution code in Box 7. It’s code 2 if you’re under 59-1/2 and code 7 if you’re over 59-1/2. The IRA/SEP/SIMPLE box is also checked.

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

We did not inherit this IRA.

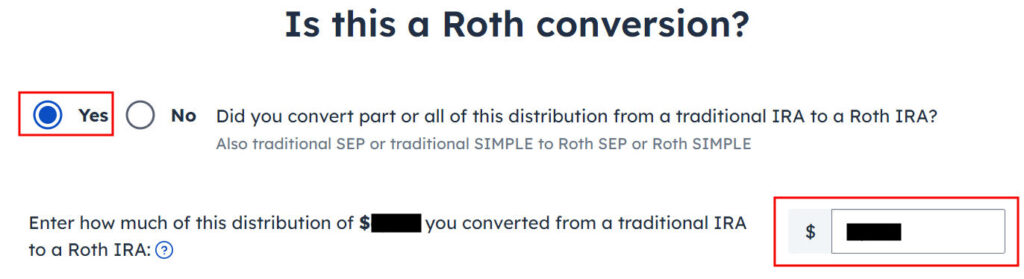

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. It’s $7,200 in our example.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

Click on “Continue” when you’re done with all the 1099-R forms.

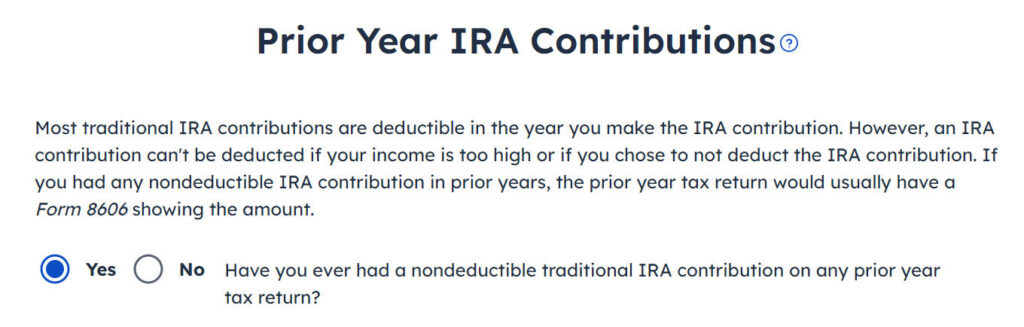

It asks you about the basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, you can answer “No.” Answering “Yes” and entering all 0’s on the next page has the same effect as answering “No.” If you have gone back and forth before you found this guide, some of your previous answers may be stuck. Answering “Yes” here will give you a chance to review and correct them.

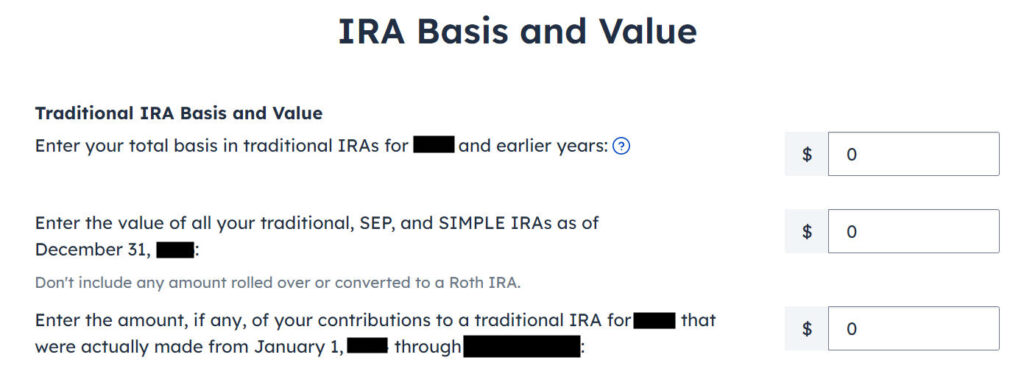

The values should be all 0 if you did a “clean” planned backdoor Roth every year. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, enter it in the first box. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you left it there, enter the account’s value in the second box from your year-end statement.

We didn’t take any disaster distribution.

Continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

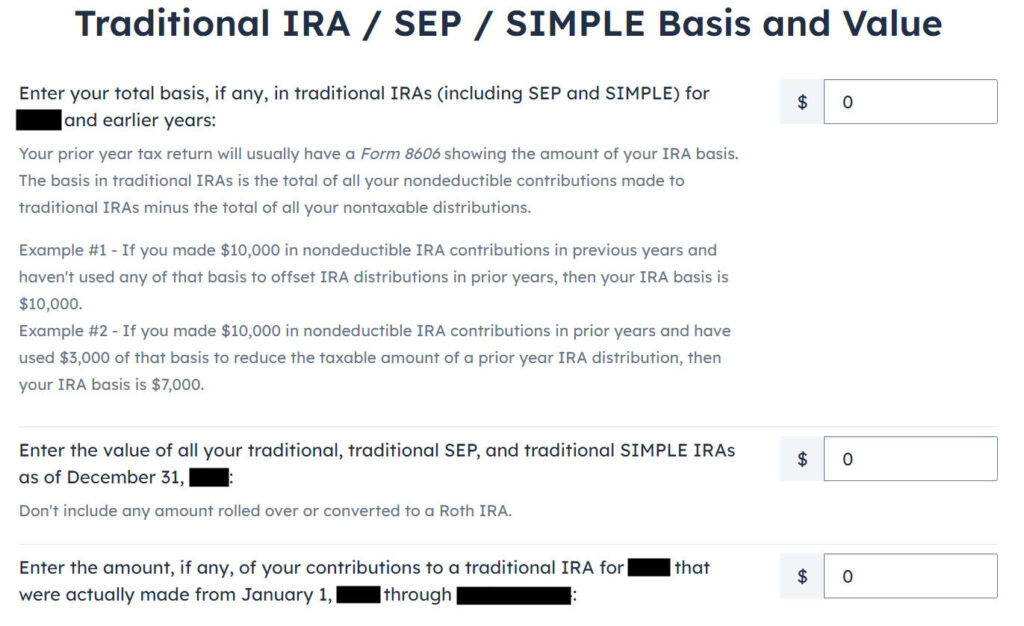

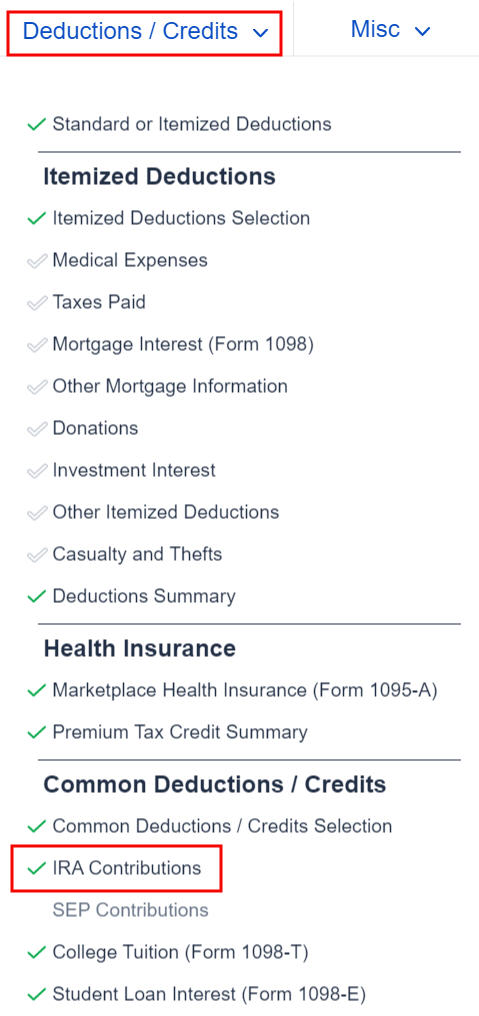

Find the IRA Contributions section under the “Deductions / Credits” menu.

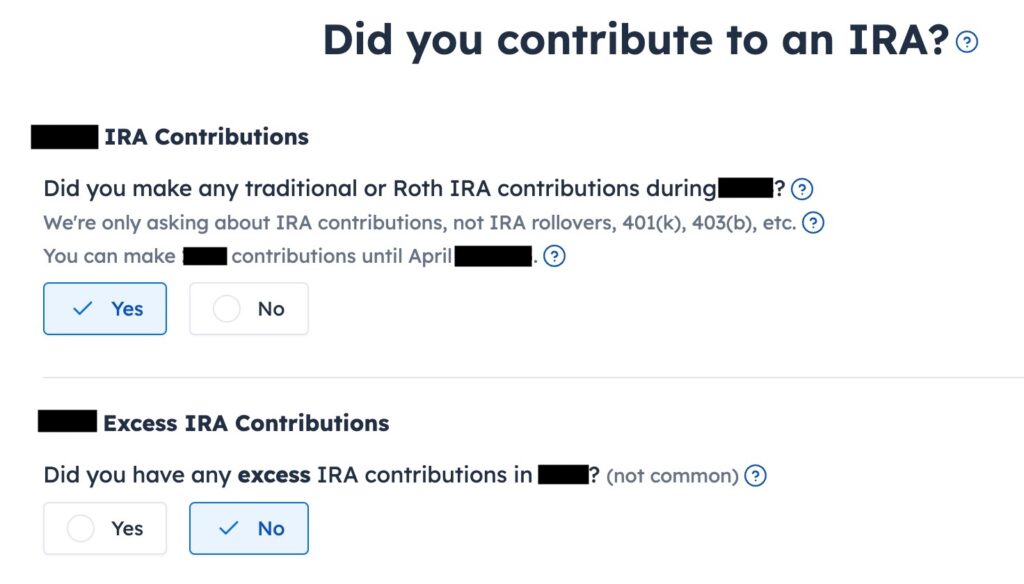

Answer Yes to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

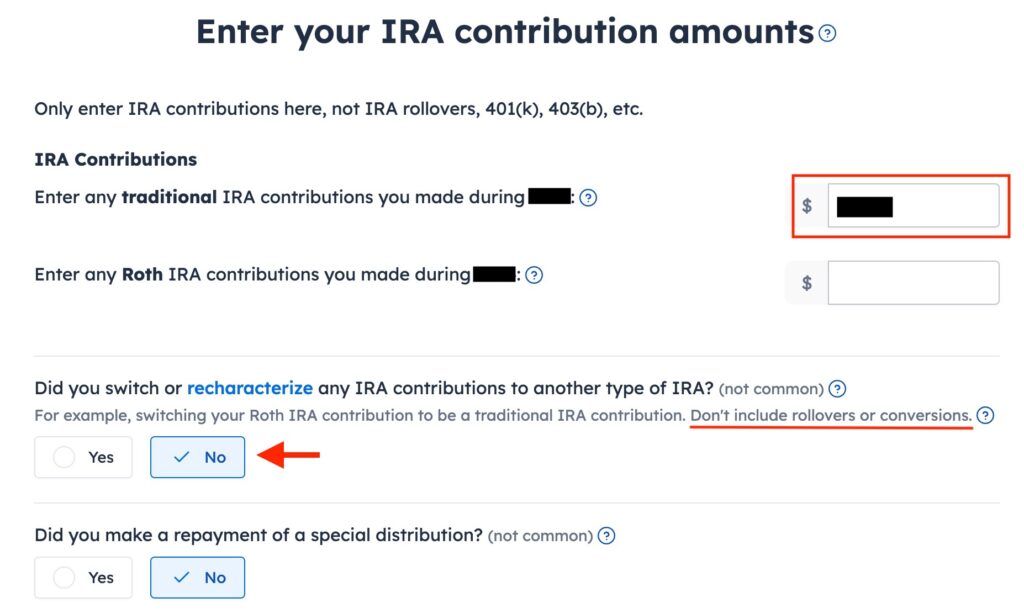

Enter the amount you contributed to the Traditional IRA in the first box. A contribution is money that went into the Traditional IRA from your bank account. It’s $7,000 in our example. Leave the answer to “Did you switch or recharacterize” at No. We converted. We didn’t recharacterize. We didn’t repay any distribution either.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot, and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

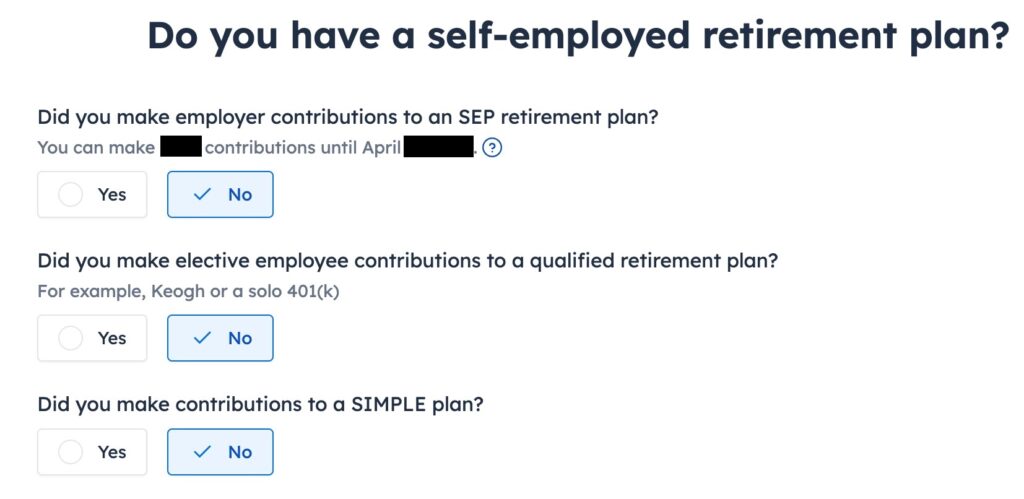

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

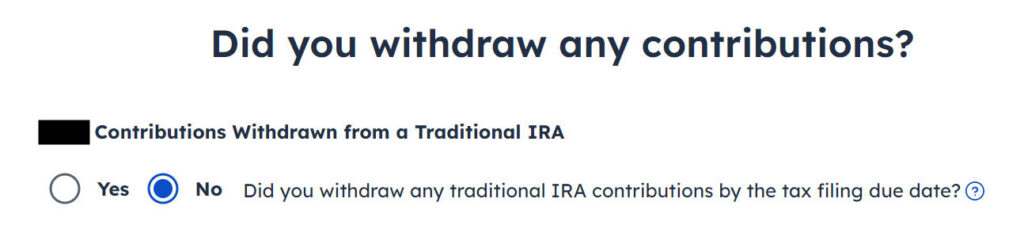

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No‘ here.

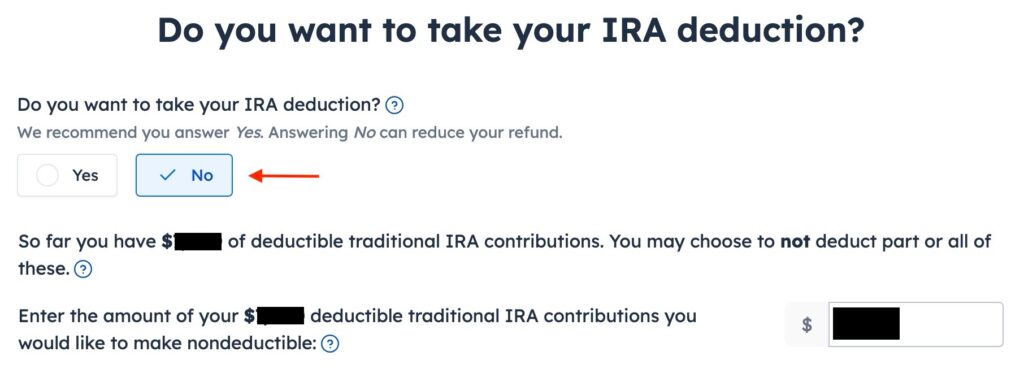

You see this screen only if your income falls below the income limit that allows a deduction for your Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible, but it will also make your conversion taxable. Although it works out to a wash in the end, it’s less confusing if you answer No here and make the entire amount that could be deducted nondeductible.

All values are zero when you did a “clean” planned Backdoor Roth every year. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, enter it in the first box. If you had a small amount of earnings posted to your Traditional IRA after you converted and you left it there, enter the balance of your Traditional IRA from your year-end statement in the second box.

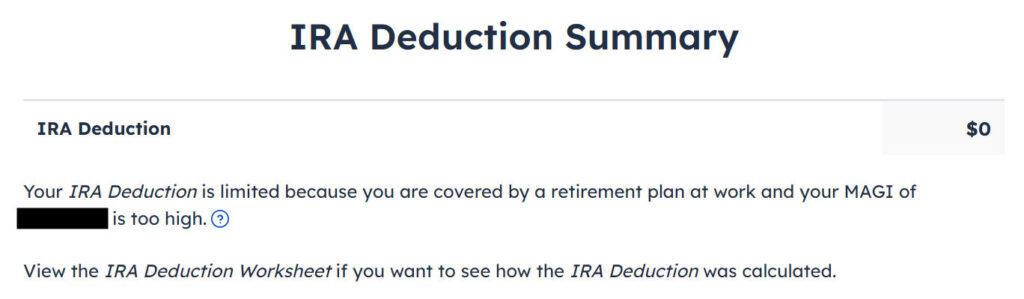

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

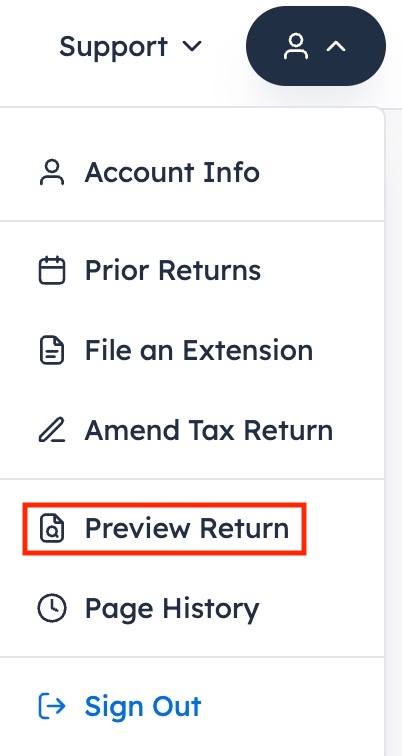

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth. Click on the head icon at the top right, and then click on “Preview Return.”

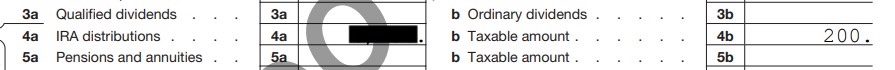

Look for Line 4 in Form 1040.

It shows $7,200 in IRA distributions in line 4a and only $200 is taxable in line 4b. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

The Entire Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the option to take a deduction when it sees that your income qualifies. Taking the deduction makes a corresponding amount of the Roth conversion taxable. Answering “No” in the “Do you want to take your IRA deduction?” page will have you taxed only on the earnings in your Roth conversion.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sean says

Problem solved! 4(b) value is at zero, and no incorrect deduction for the Roth 401k contribution. Many thanks, Harry. Hopefully this exchange will be of some use to others who have a solo 401k instead of W-2 workplace plan.

Ted S says

Hi guys, I do the clean “planned” backdoor Roth every year (as defined in this blog), but I wonder if my accountant (who isn’t working for me anymore) messed up in the form 8606 in prior years. He reported the cumulative sum of all my prior backdoor conversions on line 24 of this form (Part III “Distributions From Roth IRAs”). However, when I follow the steps in this blog, that line is zero. Was he not supposed to fill in that line? Many thanks in advance!

Harry Sit says

If only that line is filled out in Part III, it does no harm, and it’s not required either. It can serve as a friendly reminder that you have this cumulative basis in your Roth IRA from previous conversions. When you eventually take a distribution from your Roth IRA, this data point is right there on your prior year’s tax return, versus tracking it elsewhere off the tax return.

Tom says

Hi! First, the instructions above are very clear and the guidance provided in the comments section helpful as well. I didn’t learn about “backdoor” IRAs until this calendar year (2022) but for the tax year 2021. Through Vanguard I was able to easily and successfully convert $6,000 from traditional to Roth. I understand that during this tax filing year, I enter $6000 in the section “Enter the amount, if any, of your contributions to a traditional IRA for 2021 that were actually made from January 1, 2022 through April 18, 2022.” By filling in $6,000, I went from having a refund to owing the IRS for Federal taxes. I found that if I left the box empty, I would receive a refund.

Two questions I wasn’t able to decipher above:

1. Had I done the conversion prior to January 1, why would this matter in terms of going from refund to owing funds?

2. When filing my 2022 taxes, do I lower my tax burden because I filled that box in? And how does FreeTaxUSA track that?

Thanks in advance!

Harry Sit says

If you contributed for 2021 in 2022, and by definition you converted during 2022, you don’t enter the conversion in the “Convert From Traditional IRA to Roth” section. You do that next year when you have the 1099-R. If you already entered a conversion there without the 1099-R, delete it.

You must enter the contribution in that “January 1, 2022 through April 18, 2022” box because that’s what you actually did. I’m guessing your displayed refund changes because you had entered a conversion (maybe erroneously, maybe unrelated to this backdoor Roth). At first the software thinks you made the contribution in 2021, which it uses to reduce your taxable income from the 2021 conversion. After it learns you contributed in 2022, it can’t use it anymore.

Next year, you’ll have to remember to enter $6,000 in “your total basis in Traditional IRAs for 2021 and earlier years.” That will offset the conversion in 2022.

To get you out of this confusion in the years to come, do your 2022 contribution and conversion in 2022. Don’t do it after the fact in 2023. Make it a clean “planned” backdoor Roth.

Tom says

Harry – just wanted to thank you for the comprehensive answer to my back door Roth question from earlier. It was really helpful.

Jon says

Hi Harry, massive thanks for this resource. I have a question as I’m filling out my taxes on FreeTaxUSA this year for a Roth IRA to Traditional IRA recharacterization. I followed the instructions for the 1099-R, in my case I have $6,307 as a gross distribution/taxable amount. So $307 to pay taxes on.

However, I’m a bit confused as I come to the field “Enter the reason for the recharacterization” — should I just describe that I had a larger income mid-2021? Not sure if this field really matters, but it says it is necessary.

I have another question about this field ” Enter the total amount transferred in your Roth to traditional IRA recharacterization. This includes the amount recharacterized plus any related earnings and less any losses.”

Should I enter $6,307 which is the “Conversion (incoming)” number in my Vanguard IRA and also on my 1099-R, or $6,408 which is “Recharacterization (outgoing)” in my Vanguard account? My assumption is the former—$6,307.

Thanks!

Harry Sit says

I’m not familiar with the Vanguard description labels. It’s not clear to me why your outgoing is different than your incoming. Shouldn’t the amount be the same when you move money from one pocket to another?

I’m assuming you originally contributed $6,000 to your Roth IRA, and you recharacterized the full $6,000 when you realized you were going to exceed the income limit. If by that time the $6,000 had grown to $6,307, and therefore $6,307 went from your Roth IRA to your Traditional IRA, then your total amount transferred is $6,307. Your reason for the recharacterization is “Exceeded income limit for contribution” (or something to that effect).

Jon says

” Shouldn’t the amount be the same when you move money from one pocket to another?”

I looked in my account, and the trade date (05/07/2021) and settlement date (05/10/2021) for “Recharacterization (outgoing)” are different than the trade date (05/11/2021) and settlement date (05/11/2021) for “Conversion (incoming).” Do you suppose that would account for the discrepancy?

My 1099-R says $6,307 — should I just use that? as opposed to the $6,408 which is “Recharacterization (outgoing)” in my Vanguard account on 5/10.

Jon says

Thanks again Harry for the help. One more question — for my MA state return, I’m prompted with this on FreeTaxUSA:

“The potential Massachusetts taxable amount of IRA distributions from your federal return is $6,307. From this amount, subtract any IRA contributions that haven’t already been used to reduce any prior year IRA distributions. This reduced amount is the taxable Massachusetts IRA distribution you need to enter below.”

My assumption is I should put $0 in this field, as I’ve already used IRA contributions on my federal worksheet to reduce any prior year IRA distributions. Is this correct?

Many thanks! – Jon

Harry Sit says

I’m not a Massachusetts resident. It sounds like you should enter $6,000 or whatever your contribution was.

Jon says

Thanks for the reply, Harry. You’re awesome for helping everyone on here.

It may actually be $307 I should enter in this field, right? $6307 – $6000 = $307

“The potential Massachusetts taxable amount of IRA distributions from your federal return is $6,307. From this amount, subtract any IRA contributions that haven’t already been used to reduce any prior year IRA distributions. This reduced amount is the taxable Massachusetts IRA distribution you need to enter below.”

Per the language from that prompt, I haven’t used the $6000 original contribution to reduce any prior year IRA distributions. It would also make sense that I need to pay taxes on the $307 difference in MA, as well as federal, right?

Per FreeTaxUSA:

“How much of my IRA distributions are taxable for Massachusetts?

The amount of taxable IRA distributions for your Massachusetts tax return is the amount of conventional IRA distributions you received during 2021 minus any IRA plan contributions you made to the account, unless those IRA contributions have already reduced the amount of taxable IRA distributions on a previous tax return, and minus any qualified charitable IRA distributions you received in 2021 that are included in the distribution.”

They also recommend using Schedule X Line 2 worksheet: https://www.freetaxusa.com/taxes2021/formdownload?sid=5&form=ma_ira_wkst.pdf

Harry Sit says

The amount to be subtracted should be $6,000. If it’s asking for the result after the subtraction, then it should be $307. Do whatever that makes you pay taxes on $307.

Jon says

Thanks. Then I believe the correct figure to put is $307 — putting that increases my state tax in the FreeTaxUSA calculator by like $20. Putting $6000 in that field increases my taxes owed by almost $400 which seems wrong.

Mike says

Thank you for the article. I read the previous comments about form 8606 not filling correctly unless retirement plan is checked on the W2. I was not eligible for a retirement plan for 2021 so I leave those blank and only lines 16 and 18 populate on form 8606. My refund amount stays the same. I am wondering if it is okay to submit like this or if I should go ahead and check retirement plan on my W2s so the form fills out correctly.

Harry Sit says

When you’re not covered by a workplace retirement plan, the W-2 is correct to have the box unchecked and the 8606 is also correct. The previous comments were about the user not checking the box in the software when their actual W-2 has it checked or the employer not checking the box on the W-2 when the employee is actually covered by a retirement plan.

MT says

Hi – thank you for this article. For the first 3 years that I used freetaxusa is helped me fix the Roth conversion issue that I was having. In 2021 I opened a Self Employed 401K and contributed the max amount. My husband and I also each contributed to a traditional IRA which we immediately rolled over to a Roth IRA. I can’t figure out where to input my Self employed 401K contributions in the software. It’s a 401K plan so my contributions should be pre-tax and I should be able to do the roth conversion without getting taxed pro-rata. Do you have any suggestions?

Harry Sit says

Click on “Deductions / Credits” at the top and then “SEP Contributions” in the left column close to the bottom. Answer yes and enter your pre-tax contribution in the second box.

Willa says

Thank you so much! You made this far easier and less stressful than I was anticipating — I followed the screenshots and it was a breeze.

Andrew says

This was great, thank you! Made recording my first backdoor contribution easier. I love freetaxusa, wish they added a warning that the IRA contributions recorded later will impact the live refund total.

David says

Thank you first time using FreeTaxUSA (from H&R) and guide was simple to follow!

Question on the example; “By the time you converted it to Roth IRA, also in 2022, the value grew to $6,200” after you convert to Roth and only purchase $6k Roth IRA can you pull out the $200 before April 2022 and not get taxed on it? Thanks!

Harry Sit says

Only if you’re already 59-1/2 and you had your first Roth IRA at least five years ago.

Amy says

We made a non-deductible contribution of $6000 for 2022 (broker cashed the check & deposited the in 2023) and we converted $30,000 to a Roth IRA. Our carry forward basis was $9000 and the FMV on 12/31/xx was $45,000. I’m receiving this question: “Because XXX had a contribution to and distribution from one or more IRA accounts this year and your income is high enough, you’ll need to use Worksheet 1-1 from Publication 590-B to calculate the taxable portion of XXX’s IRA distribution. Y/N: Would you like to use the worksheet to calculate Peter’s taxable IRA distribution? (Recommended)”

8606 method (lines 6-12) results in $3544 nontaxable distribution reported on 8606, line 13. 590-B worksheet 1-1 method results in $6000 non-taxable distribution. 590-B includes the $6000 contribution in the percentage calculation even though that $6000 is not yet reflected in the “balance as of 12/31/xx” amount. Is the 590-B worksheet method optional or required? Why is there a discrepancy between the two methods? Advantages of one over the other?

Julie says

Hi, Thank you so much for this. I rolled over 5.9K from traditional to Roth IRA, but I’m seeing the 7K when I checked the Form 1040.

This 7K is the sum from my two 1099-R forms (I put this information in when the website prompted for the Retirement Income section). My first 1099-R form has an amount of 1K, which refers to a recharacterization in my traditional Roth (tbh, I don’t remember why or what the thought process was behind that earlier this year.) My second 1099-R form has an amount of 5.9K which eventually got converted to the Roth IRA. I’m comparing the amounts to my transaction activity in Vanguard, and I believe the 5.9K includes the 1K which later dropped in value.

I guess what I am trying to figure out is if reporting 1099-R in the (retirement income) section is correct? It makes it look like I contributed 7k? When I think I rolled over just 5.9K.

Harry Sit says

It’s not a problem if you only see the $7k on Line 4a but Line 4b shows zero. Depending on the timing of the recharacterization, you can be required to include it on Line 4a but it’s not taxable.

Julie says

In line 4b, it says 990. I think this is the 1K recharacterization that later dropped in value when I converted it over to Roth IRA. How do I fix this so it is not taxable?

Harry Sit says

You should sort out the facts first using account statements and transaction history. It’ll be impossible if you aren’t clear about the history behind these two 1099-R forms.

With regard to the $1k recharacterization:

– Which IRA did you originally contribute to, for which year, in which year, what amount?

– Which IRA did you recharacterize the contribution to?

With regard to the $5.9k conversion:

– Which IRA did you contribute to, for which year, in which year, at what amount?

Then you delete the two 1099-R forms and start over one at a time by the order of history. Enter one 1099-R and the associated contribution. Look at the 1040 form to verify it makes sense. Enter the second 1099-R and the associated contribution. Look at the 1040 form to verify it still makes sense.

Joob says

Hi, thanks for the guide. So I goofed up my 2022 contributions by contributing over my income limit for Roth IRA. This is my plan going forward:

– 2022, contributed $6000 to Roth for 2022

– 2023, recharacterize 2022 Roth to traditional and backdoor to Roth. Will also contribute $6500 to traditional and backdoor in 2023 to do clean backdoors from now on.

How would my 2022 return look like because of this? I’d report the recharacterization for 2022, but would I enter anything for IRA Basis and Value? Does the recharacterization count as a “contribution to a traditional IRA for 2022 that were actually made from January 1, 2023 through April 18, 2023”?

And for 2023’s return I’m guessing I’d report the traditional contribution for 2023 as well as the combined backdoor for both 2022 and 2023? And in addition, I’d have to report the “IRA Basis and Value” for the 2022 recharacterization as well as “Taxpayer Prior Year IRA contributions”?

Harry Sit says

You report your $6,000 contribution to Roth. Answer “Yes” to “Did you recharacterize …?” and say you recharacterized $6,000. This creates a basis to carry over in 2023. You don’t enter anything for IRA Basis and Value for 2022. The recharacterization doesn’t count as a “contribution to a traditional IRA for 2022 that were actually made from January 1, 2023 through April 18, 2023.”

When you do your 2023 return next year, you’ll do everything shown here except that (1) your conversion amount is ~2x higher; and (2) you enter $6,000 in “your total basis in traditional IRAs for 20xx and earlier years.”

Steve says

Tim, thank you so much for your walkthrough with screenshots. This is so helpful.

I have a question. When I get to the “IRA Deduction Summary”, for some reason I don’t get the $0 amount that you did. I get $6,000. I’m not sure what I did wrong. I went back and triple checked that I followed your instructions, but I can’t seem to figure out why mine is incorrect. Would you be able to help me figure out what I did incorrect?

Thanks so much

Harry Sit says

See comments 23, 24, 31, 36, and 45. You get a deduction when you didn’t tell the software that you were covered by a workplace retirement plan. If you really weren’t covered by a workplace retirement plan, the deduction is correct.

Steve says

Harry, (not Tim. Apologies!) thank you for your kindness to respond so quickly! Just to follow up, my wife is covered by a workplace retirement plan (which I marked in the W-2 section of FreeTaxUSA). I am not working so I did not receive a W-2. Because I am not working, does that mean the stated $6,000 deduction (on the “IRA Deduction Summary” page) would technically be correct? And if my Traditional IRA contribution is deductible, then my Roth conversion could be taxable (as noted in your Troubleshooting section)?

FreeTaxUSA also provided an IRA Deduction Worksheet on “IRA Deduction Summary” page. Going through the IRA Deduction Worksheet, the Publication 590-B Worksheet for me, states on Line 8 “Nontaxable portion of the distribution” is $6,000. My understanding is that this worksheet is clarifying that the conversion is not taxable.

Hopefully this makes sense. I just want to double check and be through.

Thank you for any further clarification you can provide.

Harry Sit says

When you’re not working you have a higher income limit for taking a deduction on your Traditional IRA contribution. The deduction that the software gives to you is correct when your income falls under that higher limit. If the worksheet says your “Nontaxable portion of the distribution” is $6,000, you may have entered $6,000 as your basis carried over from the previous year under “IRA Basis and Value.” This is not correct unless you have a basis carryover on Line 14 of your previous year’s Form 8606.

Dave says

We’ve had a hard time entering our backdoor ROTH conversions in TurboTax and Taxslayer as they don’t properly fill out the 1040 form or the taxable amount. FreeTaxUSA seems to calculate the tax correctly but we’re not sure how to record the recharacterization on form 1040 since our recharacterization is a little complicated.

My spouse and I fully fund our ROTHs in January and did so in Jan 2021 and 2022. When we did our taxes in March 2022 we realized we exceeded the income limit for 2021 ROTH contributions. So, in April 2022 we fully recharacterized our 2021 ROTHs to traditional IRAs and a few days later backdoor converted the tIRAs to ROTHs. Then, in September 2022 we recharacterized our 2022 ROTHs to traditional IRAs and a few days later backdoor converted the tIRAs to ROTHs.

In 2023, our IRA custodian sent out 3 1099-R forms for me and 3 for my spouse.

1. 2021 ROTH recharacterization to tIRA: line1=$6800 (gained value), line2=$0, line7=R

2. 2022 ROTH recharacterization to tIRA: line1=$4800 (lost value), line2=$0, line7=N

3. 2022 total tIRA contributions: line1=$11400, line2=$11400, line7=2

1. 2021 ROTH recharacterization to tIRA: line1=$7900 (gained value), line2=$0, line7=R

2. 2022 ROTH recharacterization to tIRA: line1=$5600 (lost value), line2=$0, line7=N

3. 2022 total tIRA contributions: line1=$13300, line2=$13300, line7=2

My expectation is that the recharacterization doesn’t affect our 2022 taxes ($0 taxable because the IRA lost money before conversion) but for 2021 we’ll owe money on the 1040-X because the IRA grew in size. Is that right?

For our 2022 form 1040 (MFJ) line 4a, do we report just the total 2022 recharacterized ($4800+$5600=$10400) and report the total 2021 recharacterized ($6800+$7900=$14700) on our 2021 1040-X or do we report on our 2022 1040 the total tIRA contributions ($11400+$13300=$24700)?

Harry Sit says

A recharacterization isn’t taxable. You don’t need to file a 1040-X. Report the four 1099-R forms for your recharacterizations with the corresponding codes in Box 7 separately from your backdoor Roth. The software will prompt you for the relevant information and eventually produce the necessary statement to explain the recharacterizations.

For your backdoor Roth, follow everything in this post except (a) Enter your $6,000 contribution to a Roth IRA instead of a Traditional IRA (because that’s what you originally did) and then say you recharacterized $6,000; and (b) Enter $6,000 in the first box under “IRA Basis and Value” (this was your contribution for 2021 recharacterized to Traditional).

The software will determine which amount to include on Line 4a and which amount to exclude. Ultimately you should be taxed on $1,300 on Line 4b ($13,300 conversion minus $12,000 contribution for two years).

Alex says

Hi Harry. Thank you for this guide. I did everything as you described in the post. The only concern I have regarding Form 5498. It say:

IRA contributions (other than amounts in boxes 2-4, 8-10, 13a and 14a)……….$6,000.00

Rollover contributions…………………………………………………$22,185.74

Fair market value of account………………………………………………..$0.00

IRA Type……………………………………………………………………IRA

$22,185.74 is what I rolled over from my traditional 401k (pre tax money), and $6,000 is what I put on traditional IRA (after tax money) and converted to roth IRA.

My question is the following. On the screen with “Did you contribute to an IRA?” should I put $6,000.00 or do I need to put $22,185.74 + $6,000.00?

Harry Sit says

$6,000. The contribution in that question doesn’t include rollover contributions.

Alex says

Thanks for answer. I still confused little bit about it. Let me explain why I have concern about those $22,185.74.

I had pre-tax funds ($22,185.74) in my traditional 401k that I transferred to a traditional IRA and then to a solo 401k. For some reason, FreeTaxUsa put $22,186 in both field 4a and field 5a.

1099-R forms are near identical.

For trad 401k to trad IRA it looks like:

1 Gross distribution: $22,185.74

Total distribution: X

7 Distribution Code: G

All other filed are empty

And for trad IRA to Solo 401k 1099-R looks like:

1 Gross distribution: $22,185.74

Total distribution: X

7 Distribution Code: G

IRA/SEP/SIMPLE: X

All other filed are empty

Did FreeTaxUsa put those rollovers in the correct places? I thought Box 5a of Form 1040 reports the taxable amount of your distributions but in my case those funds are pre tax.

Harry Sit says

Boxes 4a and 5a report gross distributions. Taxable amounts are in Boxes 4b and 5b.

TP says

Harry, thank you so much for walking us through the screenshots – the references helped immensely.

I’m troubleshooting some issueS with my clean backdoor ROTH IRA conversion for 2022 and was wondering if you could help please? When I get to the “IRA Deduction Summary”, I don’t get the $0 amount that you did, I get $1,880 and a statement below it saying “Your IRA Deduction is limited because you are covered by a retirement plan at work and your MAGI of $74,876 is too high.” I’m not sure what I did wrong. I’ve double-checked to make sure I followed all your instructions, including clicking on “covered by workplace retirement plan” in my W-2.

I’m trying to understand how to interpret this. Am I double-dipping for deductions or am I paying partial taxes twice, or something else? All this while, I was under the impression there is neither any additional tax nor deduction involved with backdoor ROTH conversion wherein I put in post-tax money into a traditional IRA and immediately converted to ROTH. I probably didn’t make enough to need a backdoor conversion for 2022 anyway?

Thank you for any insight you can provide.

TP

Harry Sit says

When your AGI is low enough, you will get a deduction (or a partial deduction) and a corresponding part of your conversion becomes taxable. The taxable amount and the deduction offset. The end result is the same as no deduction and not taxed on the conversion. This is normal.

TP says

Ah, I didn’t realize they offset each other in the end. Just noticed it via lines 4b and 10 in the 1040 form. Thank you for the clarification, this helps a lot.

TC says

This was exactly my problem as well. I couldn’t for the life of me figure out why my wife’s 8606 showed a $0 taxable amount, but mine had a ~$2200 taxable amount. Everything I did for both 8606’s were exactly the same. The only difference was that my wife has an employer retirement option while my employer doesn’t offer one. But as Harry mentions the taxable amount in 4b of the 1040 form is offset by the adjustment amount in 10 of the 1040.

This had been driving me crazy. Thanks again Harry the detailed description!

MT says

Thank you for this super helpful write up. I have a related question as I use Freetaxusa for my 2022 taxes. Basically, I made $1000 in net earnings my freelance business and my husband made $9000 as a W2 for the entire year. We then have investment income around $50,000 to report. My question is, I contributed my entire $1000 to my solo 401K. Husband contributed his entire $9000 to his Corporate 401k. Then I also contributed $4000 to my Roth IRA and husband contributed $6000 to his Roth IRA. Freetax USA is saying I have approx $900 in excess Roth contributions. So it looks like it’s allowing my entire freelance earnings to be in my solo 401K but essentially limiting my Roth contributions although between me and my husband we made at least $10000 in earned income and over $60000 including investment income. Is Freetaxusa limiting me because I clicked the wrong button somewhere?

Harry Sit says

Your questions aren’t related to the subject of this post because you didn’t do a backdoor Roth. Just so we don’t confuse others receiving notification of comments on backdoor Roth in FreeTaxUSA, I’ll email you separately.

Heidi says

Hi Harry,

Thank you for your super helpful explanation. I have a related question and was hoping you could help.

My husband had $7,848 cash sitting in a traditional IRA account that he contributed prior to 2021 at brokerage A. In 2022, he transferred that to a traditional IRA account at brokerage B and then converted to Roth IRA at brokerage B, along with backdoor Roth conversion of 2021 and 2022 non deductible contribution of total $12k. We converted 12k immediately so there was no earning on it before the backdoor Roth and we didn’t include $7,848 as a 2022 contribution amount in Freetax usa software.

In his 1099R from 2022, we see

Line 1 and 2a = 19,848

2b checked

7 = 2

IRA/SEP/SIMPLE = Checked

I think he reported $7,800 on tax return in prior years as deductible. In Form 1040, we see the $7,848 for 4b taxable amount. Wanted to double check that it is correct $7,848 should be taxable in 2022?

Harry Sit says

Yes, $7,848 should be taxable if he took a deduction on the prior contribution.

Ume says

Thank you for helping us Harry. I did a backdoor conversion with Fidelity because I was anticipating to be above MAGI but that did not happen in 2022.

My W-2 salary for reference is $62,000. I followed all of your steps but at the end “IRA Deduction Summary” comes out at $6000. 1040 4a shows $6000 and 8086 shows only Box 16 $6000, Box 18 $6000, Box 21 $0. Rest of the boxes on 8086 are empty. This is similar issue to few people above and I did double check that I was supposed to click on the W2 box 13. I suppose same at comment 71 it cancels out and I dont need to worry about it but I am worried that a lot of data on Form 8086 is not filled for me.

Harry Sit says

TP in comment #71 gets a partial deduction. You get a full deduction because your income is lower. The deduction offsets the taxable conversion. Your Form 8606 is correct.

Alex says

Thank you for writing this guide up Harry, I have a tricky situation myself and am trying to file my 2022 taxes.

– In 2021 I contributed to a Roth IRA, but unexpectedly ended up making too much money so I converted the 2021 contribution to a traditional IRA in April 2022. (I lost money during this time so no gains)

-I did not report any IRA or Roth IRA contributions for the tax year 2021.

-I then converted that traditional IRA 2021 contribution amount back into a Roth IRA in December 2022 (I also lost money so there was no taxable income)

I am confused as how to handle this since I went from Roth -> to Traditional -> then back to Roth during different years.

Harry Sit says

You “recharacterized” your 2021 Roth IRA contribution to a Traditional IRA contribution. You should’ve reported that Traditional IRA contribution on your 2021 tax return. You also converted from that Traditional IRA to your Roth IRA in 2022.

You report the conversion part (the 1099-R form with a code 2). When it asks you about “Taxpayer Prior Year IRA Contributions” answer “Yes” and give the amount you originally contributed to your Roth IRA in 2021. If you also made any 2022 contribution (Traditional or Roth), enter it in the IRA Contributions section.

Alex says

Wow! Thank you kindly for such a fast reply, I truly appreciate the advice given! I just have 2 follow-up questions which I hope you can help clarify:

1) I have two 1099-R forms for 2022 (one with distribution code 2 and the other with R), based on your reply does that mean I only report the form with code 2 for my 2022 tax return?

2) When you say “When it asks you about “Taxpayer Prior Year IRA Contributions” answer “Yes” and give the amount you originally contributed to your Roth IRA in 2021.” I am unclear on what amount to put since I originally contributed the max roth IRA amount of $6,000 in early 2021 and bought stocks with it. However by the time I converted the stocks to a traditional IRA in April 2022 the stocks declined and were worth only $2,400 (this is the rounded amount found in box 1 Form 1099-R with code R). Then in December 2022 when I converted it to a Roth IRA it had declined further to only $1,300 (this is the rounded amount found in box 1 and 2A on Form 1099-R with code 2). So what amount should I input? (I rounded the $2,400 and $1,300 amounts for simplicity’s sake in my explanation)

Again, thanks so much for your replies Harry they are truly invaluable!

Harry Sit says

You still go through the other 1099-R with the R code and answer the questions.

If the original amount you contributed for 2021 was $6,000, that’s the amount you enter.

Alex says

Thanks again Harry! One last question, would any of my transactions be considered rollovers?

Harry Sit says

They’re not considered rollovers.

Greg says

Hi, thank you for this post!! Are you going to update it for 2023 year? Best, Greg

Harry Sit says

Yes, I’ll update it where necessary. Please check back after Feb. 1.

SomeGuy says

Directions appear to still be good, thanks for doing this! You’d think they’d be more interested in documenting their own software. Apparently not.

Justin says

In April 2022, I contributed to a traditional IRA and converted it but reported it for tax year 2021 as it wasn’t April 15th yet, making it a split year conversion. I followed your instructions for such a conversion last year when I filed for 2022, and I did a clean conversion in 2023. My question is on the carry forward basis. Is that something I continue to do on each year’s tax filings because of my “dirty conversion” in 2022 or is that something I only do once on last year’s return and, provided future conversions are clean, never worry about again? Thank you.

Harry Sit says

You have nothing carried into 2023 if you started 2023 with a zero balance and you didn’t contribute for 2022 in 2023. You’re clean from this point when you keep it clean every year — contribute for the current year and convert within the current year.

Gregory Mueller says

Hi, nice summary but you dont address what happens when you convert prior year nondeductible contributions. In this example, you are converting nondeductible contributions made in the same year, which is how the “enter the traditional IRA contributions made” prompt under “Did you contribute to an IRA” section catches the difference.

Harry Sit says

Prior year contributions create a basis carryover, which confuses people. That’s why you should do it “clean” each year. If you have basis carried over from prior years, you enter it in the first box on the “Traditional / SEP / SIMPLE Basis and Value” page.

Josh says

Thanks for your great guide! I filed my 2022 tax return without any issues. Unfortunately for 2023, I did the same thing again but it only work for myself (W2 with 401k) but not my wife (unemployed). We filed jointly like last year. Every step is the same. But only her part still shows $6500 taxable. Anyone notice the similar issue? Thank you.

Harry Sit says

Your unemployed wife has a higher income limit to take a deduction on her Traditional IRA contribution. The income limit went up in 2023. Your joint income qualifies her for the deduction (but not you because you have a 401k), which also makes her conversion taxable. The taxable conversion and the deduction offset each other and create a wash. This is normal. You can see the IRA deduction in Schedule 1 Line 20.

Josh says

Thank you! You are totally right. The major difference is the different AGI. I made less income in 2023 than 2022. So the final report were different but like you mentioned, it is totally offset each other!

Jt says

great pic by pic guide. I’m following it line by line and have checked 10x but I’m still getting 6500 as an incorrect taxed amount in line 4b on 1040 when I double check and part I of the 8606 is not populating. Any idea what’s going on? I’m entering 1099-r exactly with the code 2 in box 7 and checking sep/IRA and checked 2b taxable amount not determined and the total distribution box as check marked

what am I messing up? everything else I’m doing by the guide

Harry Sit says

I rewrote the Troubleshooting section. Please see if it applies to you.

Jt says

Yes Harry, I forgot to update but I was fiddling and it was exactly as you rewrote in the above troubleshooting as I’m not covered by a retirement plan at work. At this point, I checked off I am covered (even though my W2 says I’m not in box 13) and it came up with all the examples of what a proper 8606 with backdoor roth is supposed to look like. Since you said it’s all a wash anyways with the deductible vs non-deductible and conversions with situations if you do/aren’t covered by work retirement plans, can I just leave as is with it saying I’m covered by a retirement plan at work although I’m not actually? I just don’t want to go back to fix it again and it looks like all the “Correct” 8606 examples I’ve seen now

Harry Sit says

Either way works. By saying you were covered by a retirement plan at work when you weren’t, you effectively decline the Traditional IRA deduction. That’s perfectly fine. The IRS doesn’t require you to take every deduction you’re eligible for. It’s a software limitation that FreeTaxUSA doesn’t give you the choice to take or decline the deduction. TurboTax offers that choice.

Olivia says

Hi Harry –

Just read through all the comments, but didn’t see any that applied to my specific case. Apologies if I missed something!

I did a clean backdoor Roth in 2023, that lost value between contributing $6,500 to my Traditional and moving it to my Roth. The value dropped to $6,445.

My 1099-R has $6,445 as the distribution amount (box 1) and $6,455 for the taxable amount (box 2). Box 2b “Taxable Amount Not Determined” is checked.

In the IRA Contribution section I reported $6,500 as the amount of traditional IRA contributions made in 2023. I put $0 for the Traditional IRA Basis and Value. My IRA deduction is $0 due to exceeding the income limits.

The end result is my 2023 8060 form showing a value of $55 on Line 14 (the total basis in traditional IRAs for 2023 and earlier years). This is the amount of value the Traditional IRA lost before I could recharacterize.

Is this correct? Or did I miss something? How will this affect my tax return next year?

Thank you for the awesome article! I’ve been going round in circles with FreeTaxUSA all morning and your article really helped me.

Olivia

Harry Sit says

You didn’t miss anything. That $55 carries over to next year as “basis.” If you have gains between contributing and moving to your Roth next year, the carryover basis reduces your taxable gains.

Matt says

Hey! Great article. I just want to verify, doing first backdoor for 2023 in 2024.

-We contributed 6,500 each (one was a spousal contribution) in 2024 for 2023.

-It is deducting the 13,000 on this years return for Traditional IRA contribution, (assuming we are under the threshold ie: didn’t need to do a backdoor)

My question is, when we report the conversion on our 2024 tax return, are we going to owe the same tax next year that was reduced this year from the 13,000 deduction? (Making it a wash?)

Thanks!

Harry Sit says

Not necessarily the same tax. You will have $13,000 as taxable income in 2024, taxed at whatever your tax rate is in 2024. You will pay more if that rate is higher than your rate in 2023, or less if it’s lower.

Matt says

Right. Essentially what I meant was I’m “reducing tax this year” and “increasing tax next year” which in a vacuum, if all the numbers are the same, it would be a “wash”

Then for 2024, because it’s all completed on the same return, it evens itself out.

Chase says

Hi Harry,

I read through the comments and troubleshooting sections but did not find anything matching my goof up and apologize if I missed it. I contributed $6,500 to a ROTH IRA in January 2024 for 2023. About a week later I contributed an addition $7,000 to the ROTH for 2024. I began doing our taxes and realized that my spouse and I are over the income contribution limit.

In February 2024 I recharacterized both the 2023 and 2024 contributions for myself (separately) to a tIRA. I then converted the entire tIRA back to ROTH. I then opened a ROTH and tIRA for my spouse and did theirs “cleaner” by contributing to the tIRA and then conversion to ROTH so no need for the recharacterization there.

“Did you contribute to an IRA?” – Yes – For myself I entered $6,500 into the ROTH IRA contributions and for my spouse $6,500 into tIRA contributions.

“Did (Me) or (Spouse) recharacterize any IRA contributions?” – Yes

“Tell us about your IRA recharacterizations” – I entered in the 2023/$6,500 information for myself only.

“Did (Spouse) recharacterize any of the $6,500 to a Roth IRA?” – No

Here is where I’m confused since all of these contributions and recharacterizations were in 2024 for 2023.

“IRA Basis and Value” – Do I leave all of this blank/$0 for myself, since “technically” I did not make any contribution to a tIRA, but rather a recharacterization?

For my spouse I entered $6,500 in “Enter the amount, if any, of (Spouse) contributions to a traditional IRA for 2023 that were actually made from January 1, 2024, through April 15, 2024:”

Thanks!

Harry Sit says

Recharacterizing made it as if you contributed to the Traditional IRA in the first place. You can put $6,500 in the “January 1 through April 15” box in “IRA Basis and Value” for yourself as well.

Jon says

Hi Harry, I have a few questions as I got to the part where it asks me if I have a basis carried over from prior years, hoping you can help.

As I’m now starting to file this year’s 2023 backdoor Roth IRA in FreeTaxUSA, I noticed the tax software wants to import a $6,000 total basis, as that’s what I had (a $6,000 basis) on my 2022 and 2021 form 8606 Lines 2 and 14.

2021 tax year was my first backdoor Roth IRA. That year I had to recharacterize my $6,000 initial Roth contribution to Traditional, in order to then convert it to Roth, because I realized mid 2021 I would be making too much money for a pure Roth IRA contribution. This all happened in May 2021. I had to pay $306 in taxes on this.

2022 tax year I did a backdoor Roth IRA, and retained the $6,000 basis that I had put on Form 8606 (erroneously, or not, hoping you can clarify!) in January 2022.

My questions:

1. Did I screw up my 2021 8606 form by putting a $6,000 basis on line 2 and 14, instead of $0? Or is there some reason from the recharacterization from Roth to Traditional (and subsequent backdoor conversion) that I did in 2021 that would explain it?

2. If I did screw up, do I have to correct this error for 2021 Form 8606? What about 2022 8606 (since it kept the same $6,000 basis). How might I correct these, if I have to?

3. Does it even matter that Line 14 of Form 8606 has a basis of $6,000 (i.e. does it have any tax implications now, or will it later) as lines 15c and 18–the “taxable amount” lines are 0?)

Thank you so much for any help.

– Jon

Harry Sit says

1) Line 2 and Line 14 on your 2021 Form 8606 should’ve been 0. This error also flowed into your 2022 Form 8606.

2) You correct them by abandoning the incorrectly claimed basis in 2023.

3) It doesn’t affect your taxes but you don’t want to knowingly make a wrong claim on your tax form.

Steve says

Harry,

My wife and I did our Backdoor Roth for 2023 and 2024 in January 2024. I followed all your helpful instructions and when I clicked on “Preview Return” there are no values on Line 4a and 4b in Form 1040. Is that because next year I have to finish the conversion part in order for the values to show up? I wanted to make sure that this is correct.

Thank you for any clarification you can provide.

Harry Sit says

You’re only doing 2023 taxes now. For 2023, you only contributed to the Traditional IRA (in January 2024), which is allowed but it’s more confusing when you do it that way. You should see the amount of your contribution on your Form 8606, lines 1, 3, and 14, and nothing else. You don’t see anything on Form 1040 lines 4a and 4b because you didn’t convert in 2023. Your 2024 taxes will have a wrinkle because you converted two years’ worth of contributions in one year, but since you caught up in 2024, it’ll become easy starting in 2025 when you contribute for 2025 in 2025 and convert in 2025 and contribute for 2026 in 2026 and convert in 2026.

Braden says

Hi Harry,

I’m in the same exact situation as Steve – contributed to a traditional IRA for 2023 and 2024 ($6.5K and $7K respectively) in January 2024 and subsequently converted to my Roth. This was my first time doing a backdoor Roth and I’ve learned my lesson about the importance of doing the “planned” backdoor conversion to avoid additional tax form confusion.

Your article was immensely helpful, as are your replies in the comment section. I’m all clear on filing 2023 taxes, but just want to confirm one thing for my 2024 taxes – when I get to the “IRA Basis and Value” section in the process, will I put $6,500 in the field that will say “Enter your total basis in traditional IRAs for 2023 and earlier years”? Based on my previewed tax return for 2023, it would appear that this is the case (per line 14 of Form 8606).

Thanks for your help!

Braden

Harry Sit says

That’s correct. FreeTaxUSA should also auto-populate it for you next year when you did 2023 correctly.

Ellore says

hello Harry, thanks for your wonderful site. I contributed to traditional IRA in 2023 for year 2022 to do backdoor later in the year. now it’s 2024 and realized that I did not convert. can I still convert this 2022 money to Roth? if yes, then can I still do backdoor for 2023 and 2024?

Harry Sit says

Yes, you can still convert the money from 2022 (plus earnings since then), and you can still do backdoor for 2023 and 2024 as Steve and Braden did. You should do your 2023 taxes correctly to prepare for 2024. Your 2023 Form 8606 should show your 2023 contribution on line 1, 2022 contribution on line 2, the sum of the two numbers on lines 3 and 14 and nothing else.

Zach says

Harry, I’ve got a weird outcome from following these steps and I’m hoping you can help. My spouse and I each contributed $6,000 in 2023 for 2022 tax year and $6,500 for 2023 tax year. We converted both of these immediately after contributing, but both in 2023. My basis from 2022 is $6,000 and her’s is $8,151 (from an old, smaller conversion). I followed the steps here, but on her 8606 it’s showing nothing on Line 1. This ends up creating a 0.65198 ratio on Line 10 and $4,351 as the taxable amount. I can’t figure out how or why Line 1 on her 8606 would be $0 but mine is correctly $6,500 when all of the information is entered the exact same between our 2 1099-R’s and IRA Contributions under Deductions. I did qualify for a work retirement plan but she is unemployed, so did not. Thank you in advance!!

Harry Sit says

Having nothing on Line 1 of her Form 8606 and as a result making her Roth conversion taxable is normal when you also see a deduction on Schedule 1 Line 20. See the Troubleshooting section for an explanation.

Jon says

That makes sense. I’ll correct the basis this year. Really appreciate the help, Harry

minx says

I don’t seem to see IRA basis and value. In TurboTax, it asks when the contribution was made (e.g., 2024 for 2023 tax year) but I don’t see that question in freetaxusa. In addition, TurboTax allows you to answer the question if you want to make it nondeductible; however, based on what you’re saying, this shouldn’t even show up in the 2023 tax return as either contribution or classification to nondeductible until we get a 1099-R? Maybe I’m misunderstanding or trying to compare it to what freetaxusa does.

Scenario: Backdoor Roth was done in 2024 for the 2023 tax year. No company sponsored retirement plan.

Because of that, freetaxusa is showing a deduction for the $6.5k contribution in traditional IRA but there isn’t an offset because from what I can find in the freetaxusa community forum, the conversion to Roth isn’t triggered until a 1099-R is completed, but it also doesn’t have a section to say that the $6.5k was done in 2024 either (like TurboTax does). The table to adjust the IRA basis doesn’t pop up (is there a question that triggers this that maybe I answered incorrectly?). Is the solution not to even put the $6.5k contribution to traditional in 2024 for 2023 tax year and just correct the basis for Roth in the 2024 return when the conversion shows up in 1099-R for 2024?

Thanks for your guidance.

Harry Sit says

You did it correctly. That’s how FreeTaxUSA does it. If you qualify for a deduction, FreeTaxUSA makes you take the deduction. You have no choice to decline it. You see the deduction on Schedule 1 Line 20, which rolls up with other adjustments to your 1040 form. When you take the deduction, there’s no basis to carry over and it doesn’t matter whether you contributed in 2023 or before April 15 in 2024. Your conversion will be taxable when you do your taxes next year with the 1099-R. In a way, one can say this is better for you because you’re paying less now and paying more a year later but it does make the tax form more confusing. It stops being confusing when you get on track with a clean backdoor Roth — contribute for 2024 in 2024 and convert in 2024, contribute for 2025 in 2025 and convert in 2025.

Alex says

Hi Harry,

Could you please help me.

$6000 contributed/converted in Mar 2021 – for 2021

$6000 contributed/converted in Mar 2022 – for 2022

$7500 contributed/converted in Mar 2024 – for 2023 (turned 50 in 2023)

I have 1099-R forms for 2022, 2021, 2020, but not for 2023. Is this correct ?

I never entered 1099-R forms in previous tax returns (didn’t know about these forms).

My previous 8606 (for 2022 and 2021) have $6000 in lines 1, 3, 5, 13. Nothing taxable, no taxes paid.

Now I don’t need to enter any 1099-R, right? (because I don’t have it for 2023)

How should I answer the questions? (Free tax usa)

How should my 8606 look? Same way as previous years, but with all numbers $7500?

Harry Sit says

That’s correct. You don’t have the 1099-R form for 2023 and you don’t enter it because you don’t have it. You should’ve entered the 1099-R forms for 2021 and 2022 when you did your taxes in previous years. Every 1099 form shows income. It should be accounted for in your tax return even if you end up paying no tax on that income. You should do the contribution part in the “Traditional IRA Contribution” section for 2023. The “IRA Basis and Value” screen should show 0 in the first two boxes and $7,500 in the third box. Your 8606 should show $7,500 in Lines 1, 3, and 14.

Austin says

Hey, thanks for the awesome guide! I wanted to add another troubleshooting technique in case anyone else misses this like I did. In the “Enter the value of all ‘s traditional, SEP, and SIMPLE IRAs as of December 31, 2023:” make sure you don’t enter your traditional value but your Roth value instead. I wasted an hour troubleshooting but this fixed everything up for me!

bilibi says

Hello, I’m trying to file for a ROTH IRA conversion as I rollover my old 401k from work to an ROTH IRA. I couldn’t find a specific tutorial regarding my specific need and I am struggling to use freetaxUSA to file for that purpose. My family AGI is above the ROTH IRA contribution limits . I entered the 1099R portion, which put 0 taxable amount (?), I also entered the IRA deduction portion, but it doesnt’ seem right. Please help!

Harry Sit says

This guide isn’t for a conversion from a pre-tax 401k to a Roth IRA. Please remove everything you did when you followed this guide and start over by following the steps in How to Enter 2023 Mega Backdoor Roth in FreeTaxUSA (Updated) except that your 1099-R has a higher taxable amount and it doesn’t have a number in Box 5.

kp says

Hi Harry,

I read through all the comments, but I’m getting lost in them and wonder if you can help me. I made a Roth IRA contribution in 6/1/2023 of $6,500, and had to recharacterize it to a Traditional IRA in 3/1/2024 which was $7490. I then converted it to a Roth IRA (backdoor) 4/1/2024 of $7493. When I get to the IRA Basis and Value form, I believe I wait to enter the total basis next year. But what about the line that says; “Enter the amount, if any, of your contributions to a traditional IRA for 2023 that were actually made from January 1, 2024 through April 15, 2024:” – do I enter anything in that line for this year? If so, would it be $7490?

Thank you so much. This is a wonderful resource and I read it multiple times, but I can’t seem to figure it out.

Harry Sit says

You’re doing 2023 taxes now but you only converted in 2024. So you skip the conversion section (do it next year) and only do the contribution section for 2023. You first say you contributed to Roth, and then say you recharacterized all of $6,500. It will ask you how much was moved from Roth to Traditional. Then you say $7,490. This other post Recharacterize & Convert to Roth IRA in TurboTax, 1st Year fits your scenario. Although it’s using TurboTax, the process is broadly the same.

kp says

Thank you Harry!

Let’s say this year I want to get on track to doing a clean backdoor now. So April 3rd 2024, I contribute $7000 to a traditional IRA, and April 5th 2024, I do a conversion to backdoor Roth IRA of $7005 (assuming it increased by $5 in that time).

When it comes time to doing my taxes for 2024 in 2025, what would I put in each of the below lines? Would i need to add in my contributions i made in 2024 for 2023 too here somewhere?

Traditional IRA Basis and Value: Would this be $7493 (what i contributed for 2023 in 2024) or $7493+$7000 (what i contributed for 2023 in 2024 + 2024 contribution)?

Enter the value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2024: Would this be $0 since by that time the traditional would be down to $0 as the backdoor happened already.

Enter the amount, if any, of your contributions to a traditional IRA for 2024 that were actually made from January 1, 2025 through April 15, 2025: Would this now be $0 as i did it cleanly for 2024 so there would be no contributions made in 2025 for 2024.

Thanks so much!

Harry Sit says

When you’re doing 2024 taxes in 2025, you’ll have two 1099-R’s, one for the $7,490 recharacterization, and one for the sum of your two conversions ($7,493 + $7,005). The 1099-R for the recharacterization isn’t taxable but you still enter it into the software. You follow both parts in this guide to enter your conversion and contribution. The IRA Basis and Value will show $6,500, which FreeTaxUSA will auto-populate for you if you do it correctly now for 2023. The total value as of 12/31/2024 will be zero if you convert everything and don’t do anything else. The contribution made from January 1, 2025 through April 15, 2025 for 2024 will be zero because you’re not waiting until that time.

You didn’t contribute $7,493 or $7,490 for 2023 in 2024. You contributed $6,500 in 2023. Recharacterizing made it as if you contributed to Traditional in the first place. The additional $990 was earnings you would’ve made had you originally contributed to Traditional. You earned another $3 post-recharacterization. You’ll pay tax on that $993 plus the $5 earnings on the 2024 contribution next year.

kp says

Hi Harry,

I am now trying to do my 2024 taxes and am trying turbotax online this time. How do i report both my 2024 clean backdoor roth ira as well as the 2023 mishap backdoor? Turbo tax online only makes space for one IRA contribution. I need to report two. The mishap conversion that I cleaned up in March of 2024 for tax year 2023, as well as my clean backdoor roth contribution for tax year 2024 that i made in April of 2024.

Thank you again for all your help!

Harry Sit says

Split-Year Backdoor Roth IRA in TurboTax, Year 2 fits your scenario.

nando says

I didnt have any IRA contribution till 2022. In 2023, i did a backdoor Roth in Dec. I contributed $6500 and converted it to Roth. At end of Dec, i got $1.28 in dividends. In FreeTax i declared this in the field “Value by 31 Dec”. This is changing my basis to $1 (Line 14 Form 8606), even though i expect it to be $0 (basis is non deductible amount contributed right). It is also reducing my non taxable portion (line 13 in 8606) to $6499.

I believe im doing something incorrect

Harry Sit says

A $1 here or there is just rounding. It’s making you pay tax on $1 now and not pay tax on $1 next year. Don’t worry about it.

CH says

Hello. Thank you for the incredibly thorough write up! If you do not mind, I wanted to confirm a few things based on my specific situation. Here are the facts: (1) I made a contribution of $6,000 to my traditional IRA for the first time in April 2023 for the 2022 tax year, which I converted to my ROTH IRA in April 2023; (2) at the end of December 31, 2023 my traditional IRA account had a balance of $0.75; and (3) I will contribute $6,500 to my traditional IRA for the 2023 tax year before April 15, 2024.

1. The total basis entered in the question “Enter your total basis, if any, in traditional IRAs (including SEP and SIMPLE) for 2022 and earlier years:” should be $6K, yes? (My tax preparer forgot to file form 8606 for the 2022 tax year so I will be filing that separately in parallel).

2. The value entered in the question “Enter the value of all your traditional, traditional SEP, and traditional SIMPLE IRAs as of December 31, 2023:” should be $1, yes?

3. The value entered in the question “Enter the amount, if any, of your contributions to a traditional IRA for 2023 that were actually made from January 1, 2024 through April 15, 2024:” should be $6,500, yes?

Thank you!

Harry Sit says

Your (1) and (2) are covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year. Your (3) is covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year.

Please stop doing it this way for 2024. It’s too confusing. Contribute to your traditional IRA for 2024 in 2024 and convert in 2024. Contribute to your traditional IRA for 2025 in 2025 and convert in 2025. Then you only need to follow this post for a clean backdoor Roth.

JJ Smith says

Hi Harry hopefully you can confirm my thinking. Im doing backdoor because im over the MAGI. In tax year 2024 i opened a traditional roth I contributed 2000 but put it into a pretty agressive stock that has gone up to 2800. Can i still contribute $7000 limit? With interest rates so high im pretty sure if contribute an additional $5000 so I hit the contribution limit ill also make interest ~$5 plus say my gains of 800. Is my scenario the same as your above? I would be putting 805 as my difference that i would be taxed on?

JJ Smith says

should add will be doing all of this in 2024 to make it “clean” and i put it in a stock before i read up on the backdoor Roth option…live an learn otherwise i would not have done that.

Harry Sit says

It’s the same whether the gain was $8.05 or $805.

JJ Smith says

So you are saying a gain is a gain and enter the same way as your example above? Your gain was 200 in your example?

Harry Sit says

Yes, a gain is a gain. The gain is $200 in the example. This post will be updated for 2024 when the software is ready for 2024.

Dan says

The screenshot that comes after this sentence seems unrelated to what the guidance is talking about: “You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.”

I had to skip down to the “Traditional IRA Contribution” section because it wasn’t obvious to me where on the Freetaxusa site I was supposed to be at that point

It worked out, but I think there’s an issue with the flow of this article.

Harry Sit says

The “Prior Year IRA Contributions” page comes up when you click on Continue after entering all the 1099-R’s. I added a sentence after “You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.” to introduce the flow.

Dan says

Thanks Harry, that added sentence helps clarify.

Larrrik says

Thank you for such detailed instructions, Harry! This is my first time doing taxes after Backdoor Roth IRA conversion. I used Cash App Taxes before and it was hard to do Backdoor Roth entries there. It’s a lot easier with your instructions on FreeTaxUSA. I have few questions though:

1. My 1099-R form has X in Total Distribution box, not like your example. I had no interest that accrued in traditional IRA before the conversion. Should I enter it as is in my form?

2. Re “Enter your IRA contributions amounts” screen. You screenshot shows an amount only for IRA. The field for Roth IRA is empty. Is this because Backdoor Roth IRA is not a real Roth IRA contribution?

Thanks again for this page and responding to readers’ comments!

Harry Sit says

The total distribution box doesn’t matter. Entering it as-is won’t make any difference.

A contribution means sending money from outside of an IRA into an IRA. A conversion means moving money already in a Traditional IRA to a Roth IRA. In a backdoor Roth, the money moved into a Roth IRA came from a Traditional IRA. It was a conversion, not a contribution.

Larrrik says

Harry, I’m still a bit puzzled.

I did put the money first into traditional IRA ($8K). Once they settled, I moved all of them them to Roth IRA using backdoor conversion. When I’m at “Enter your IRA contributions amounts” screen in FreeTax, I’m putting $8K into traditional IRA contributions and $0K into Roth IRA contributions? Is this correct?

I’m concerned because Preview version of form 8606 Part 1 doesn’t look like I’d expect it to look.

Line 1 – $8000

Line 2 – 0

Line 3 – $8000

Line 4 – 0

Line 5 – $8000

Line 6 – 0

Line 7 – 0

Line 8 – 0 – this is for the amount converted from IRA to Roth which is $8K, but it’s empty. I would expect $8K to be here

Line 9 – 0

Line 10 – blank

Line 11 – 0

Line 12 – 0

Line 13 – $8000 – this is what I’d expect, but it’s not the sum of line 11 and 12.

The line has an asterisk with a footnote “from worksheet 1-1”

Line 14 – 0

Line 15a – 0

Line 15 b – 0

Line 15c – 0

Part 2 of the form 8606 looks OK

Line 16 – $8000

Line 17 – $8000

Line 18 – 0

all of this is correct.

But line 16 is supposed to come from line 8, but it’s empty is the form 8606.

This is my first time doing this, and I’m afraid to screw this up

Harry Sit says

Those are all correct and expected.