Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in the H&R Block tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are completing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the money was contributed for 2025, 2024, or any previous year.

Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done in 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 or if you recharacterized a 2025 Roth contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to the H&R Block desktop software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted your Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

Income comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-R

When you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now, and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

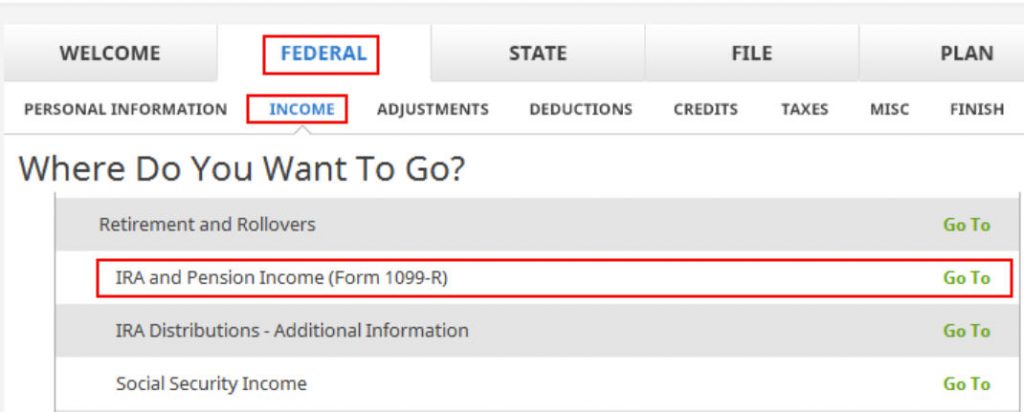

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

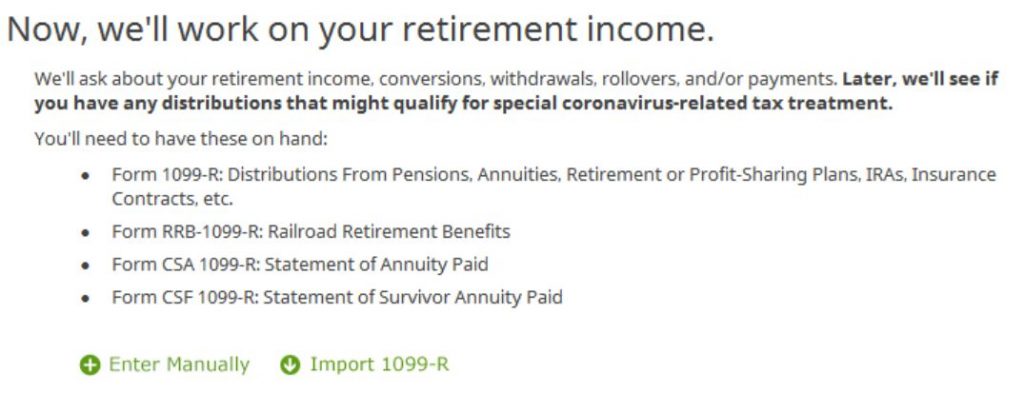

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

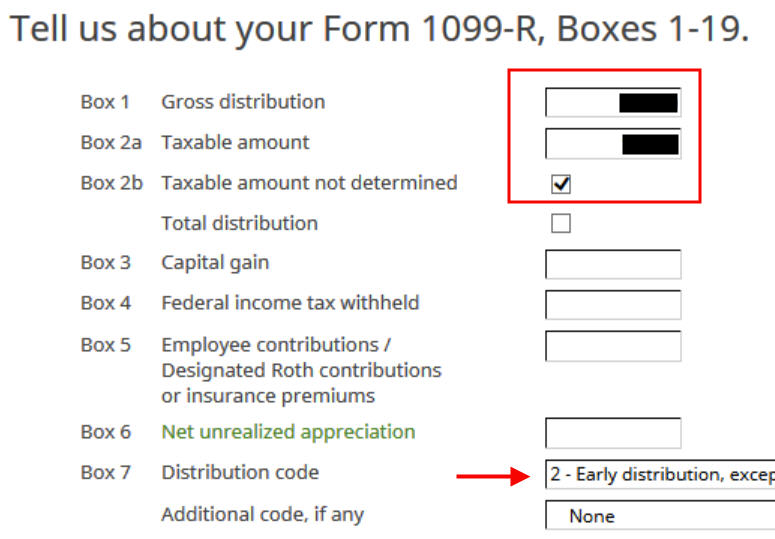

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, make sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

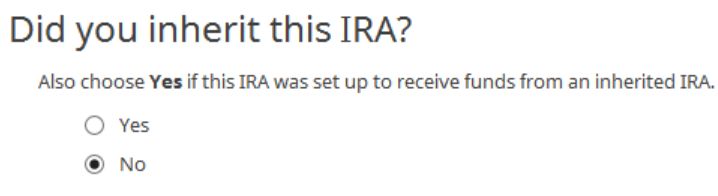

We didn’t inherit it.

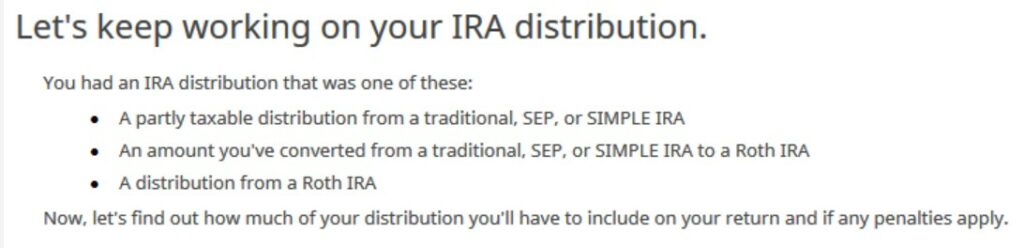

Converted to Roth

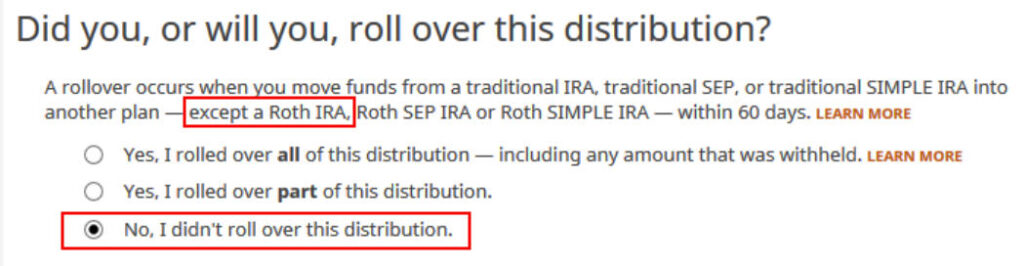

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these withdrawals treated as rollovers or basis adjustments.

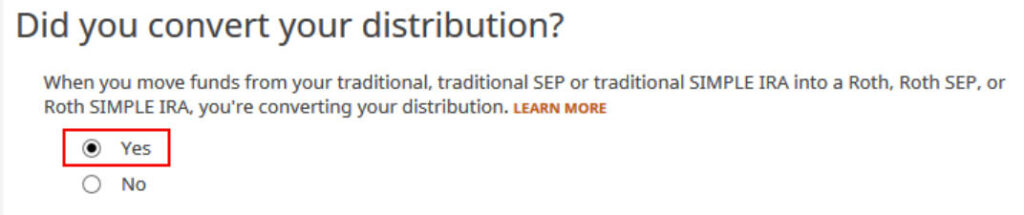

Now answer Yes, you converted.

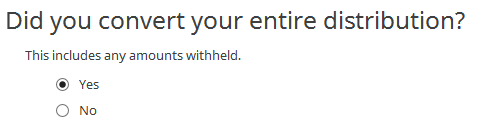

We converted all of it in our example.

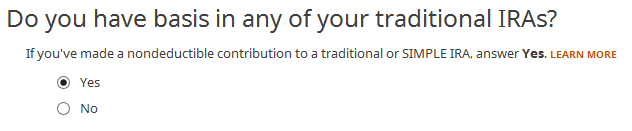

Answer Yes because you made a nondeductible contribution to a Traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section on IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

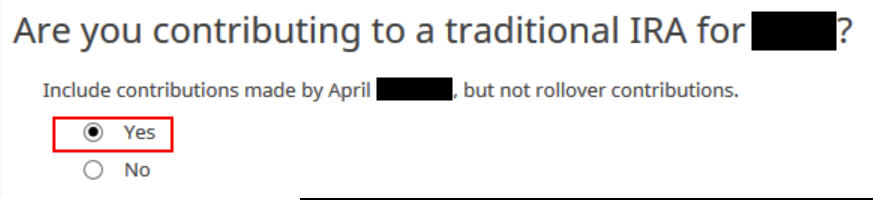

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to the Traditional IRA *for* 2025 in 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

IRA Contribution

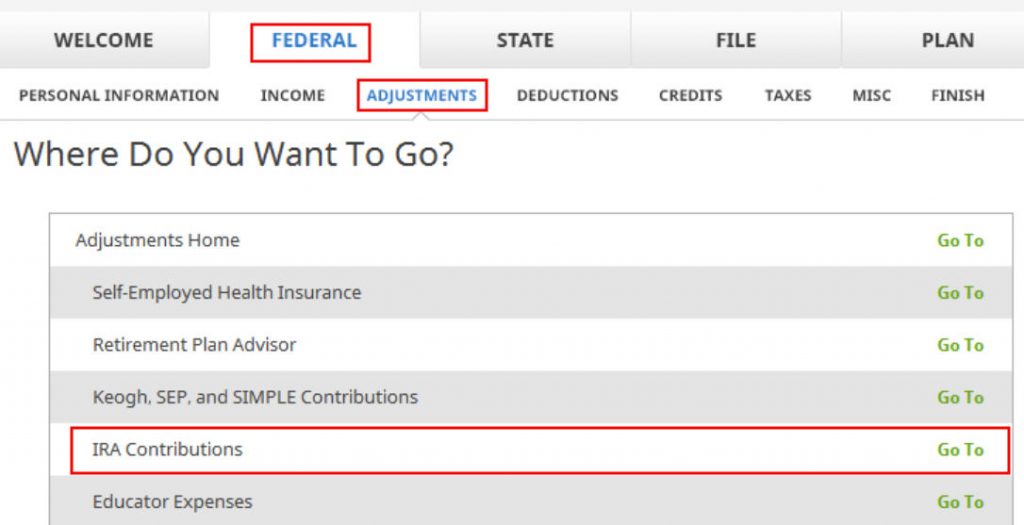

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

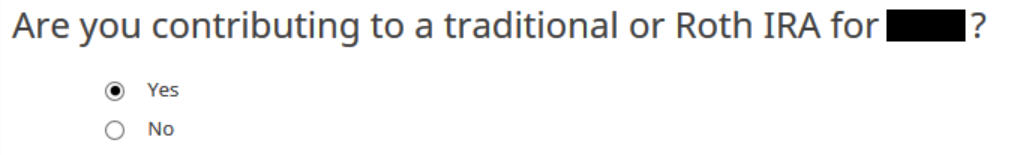

The question uses the wrong tense, but answer “Yes” because you contributed to an IRA for the year in question.

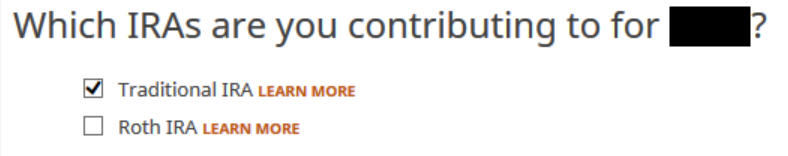

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

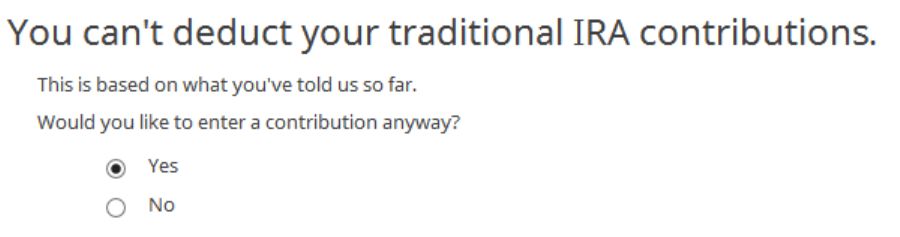

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

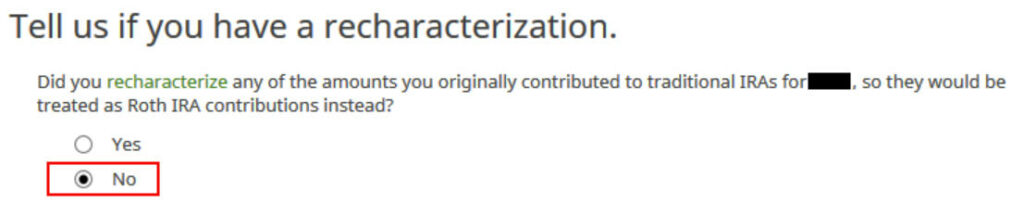

Conversion Isn’t Recharacterization

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

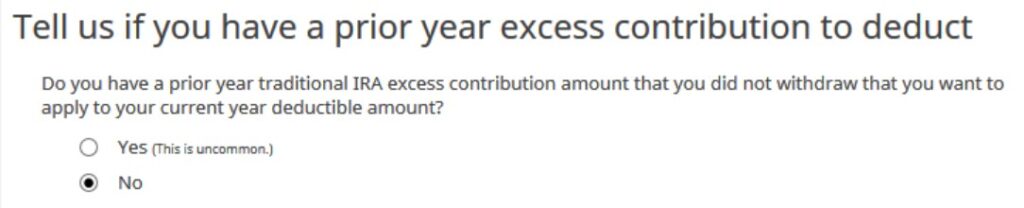

We don’t have any excess contribution.

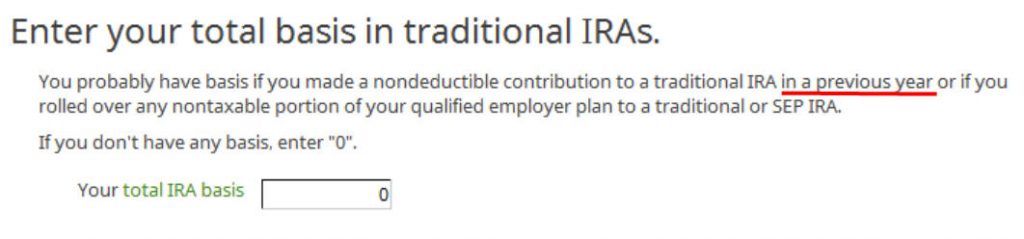

Basis From the Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

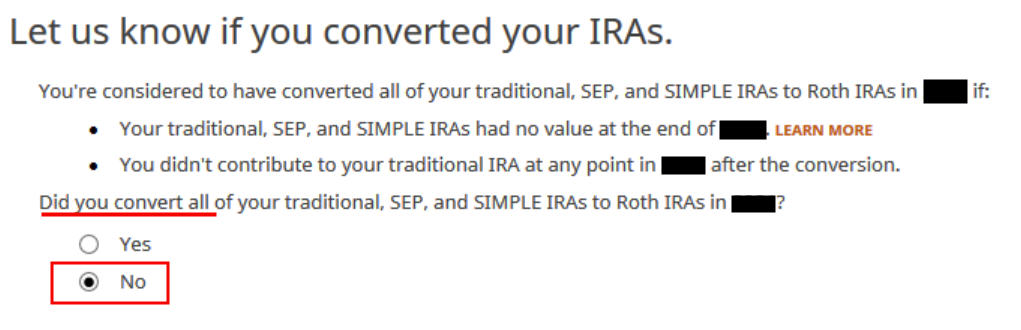

The Pro-Rata Rule

This is another important question. If you are doing it the easy way, as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have given some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

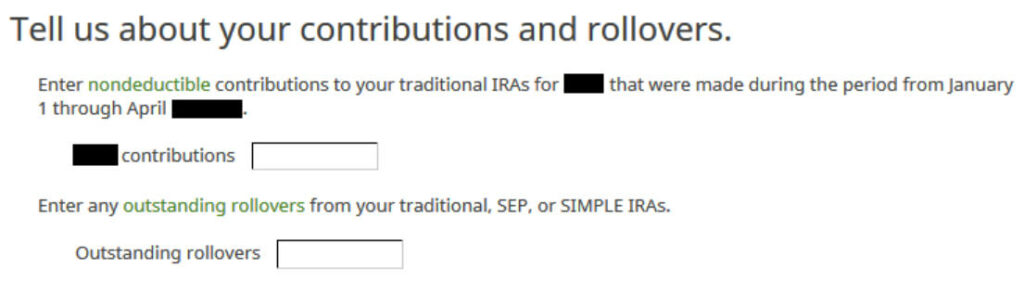

In a clean planned backdoor Roth, you contribute for 2025 during 2025. Leave the boxes blank.

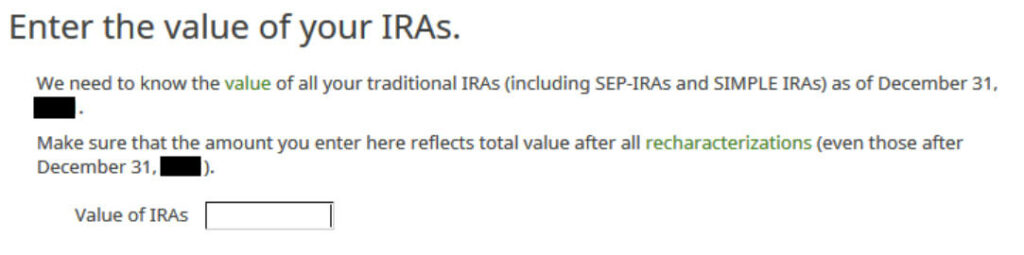

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

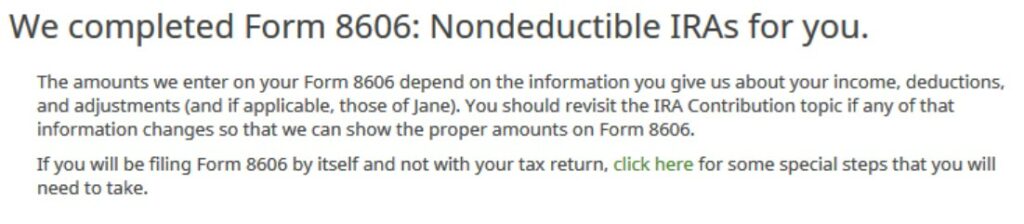

That’s great. We’re expecting it.

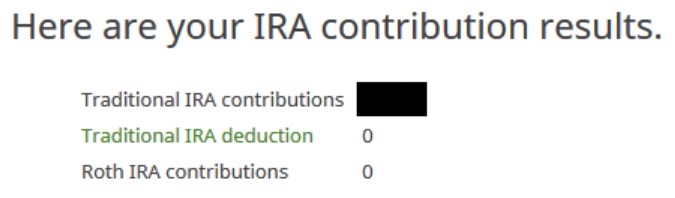

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Repeat this section for your spouse if you’re married and your spouse also did a Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

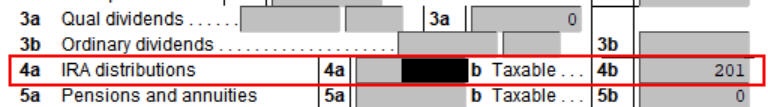

Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

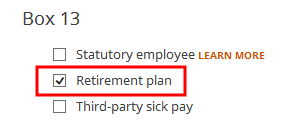

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

FinancialDave says

I am absolutely a TurboTax defector for just the reasons you state and saved me TWO upgrades in the process and saved almost $100. I therefore appreciate any articles on using H&R Block effectively and will pass them along.

Thanks,

Dave

Moni says

I have a question about filling “Total IRA Basis” in your instructions and will appreciate any feedback.

Is “Basis” to be used when I am converting IRA contributions from prior years? Will it only contain the amount that has not yet been converted but was reported in 8606 in prior years. E.g. if I have converted IRA contributions from 2013 and 2014 in 2014. So it looks like I’ll use basis to enter my 2013 contributions from 8606. But if I had already converted my IRA contributions from 2013 in 2013 itself, basis will be 0 even though I’ll have 8606 for non-deductible contributions made in 2013.

Thanks

Harry Sit says

If you contributed non-deductible for previous years (regardless when), enter the number on line 14 of your Form 8606 from last year. Assuming you did it correctly for 2013, if you only contributed non-deductible for 2013 but you didn’t convert in 2013, your 2013 Form 8606 shows the basis on line 14. Enter that number. If you contributed for 2013 and you converted it all in 2013, your 2013 Form 8606 had zero or blank on line 14.

Moni says

By the way, thanks for the great post.

Just a week ago I ran into your similar post about Turbo Tax and desperately was looking for same information using H&R Block software. That’s when I subscribed to your blog and got a pleasant surprise today when this post showed up.

ad says

I would love if you could give a walk through of how to do this in TaxAct. I’ve been using it for a while and am used to it, but would like to see how to properly file this.

Steven says

Oh wow, you are such a gem for publishing this. Thank you so much!!!

PARDEEP KUMAR says

Thanks..This is amazing, I did a silly mistake while doing it myself and couldn’t figure it out, searched online and there is this wonderful article with step by step instructions. Thanks 🙂

Peter says

Hi Harry,

Are the steps in the beginning of this (before entering the non-deductible contribution) the same steps needed to report a traditional 401(k) to Roth 401(k) conversion?

Thanks for all you do.

Harry Sit says

Only the starting point is the same. The boxes checked or unchecked and the Box 7 code on the 1099-R are different, which bring up different screens after that.

Ashley says

I would greatly appreciate any assistance you could provide for how to handle the following situation using H&R Block: 1) My wife and I each contributed $4500 to a Roth IRA in 2014/2015. 2) My wife and I realized our income was too high in 2014. 3) My wife and I opened a Traditional IRA and recharacterized our $4500 Roth IRA contributions (plus their earnings) as a Traditional IRA. 4) My wife and I then converted these Traditional IRAs to Roth IRAs a couple days later (the so-called “back door Roth IRA”. Thanks!

kp says

Ashley – we are facing the same situation as you but noticed no one responded. Can you please help us? Did you ever figure out a solution?

Travis says

I’m trying to do this in the HR Block web version of their software. I imported my 1099-R. The 1099-R lists the taxable amount in box 2a as the full amount of the withdrawal. When I go through the interview questions associated with this event in the software, it asks me if I converted the withdrawal to a Roth. I answered yes. Then, it later it gives me an error saying that the taxable amount must be zero since I converted to a Roth. Am I supposed to just override what is written on my 1099-R and put 0 instead? Does the 1099-R get filed with the IRS? If so, does my entry have to match what is written on the form. Any advise is appreciated.

Harry Sit says

Someone else also brought it up. Please report it to HRB support as a bug in HRB Online. Until they fix it, just delete the entry in box 2a (don’t put in zero). That will let you move on. The check mark in box 2b makes the number in box 2a not as important.

I don’t know what goes into e-file. The paper Form 1040 asks for 1099-R only if tax was withheld. The IRS has 1099-R from the issuer already. It’s best to match your entries to the form as you received, but what can you do if the software doesn’t let you continue?

Mike says

I need form 8606 because I made a $6500 non deductible contribution to a traditional IRA in 2014, then roll it into a Roth in 2014. H&R block skips part 1 and jumps right to Part II because it is checking the box right under the Part I heading, whereas the IRS instructions clearly state that I need to fill out part I. Why are embedded instructions in H&R Block form 8606 different than embedded instructions in IRS form 8606 ? Moreover, if I look at the H&R block worksheet that feeds into form 8606, there is a box in the worksheet that has $6500 and says that it is going to go to form 8606 part 1, line 1, which is where I expect it to go. Anyone else notice this or have an explanation ?

Harry Sit says

It’s reading the 3rd bullet under the Part I instructions as saying Part I is not needed if you converted all and the first bullet as saying complete Part I only if you contributed but did not convert. If you fill out Part I it just takes you through a series of circular calculations — divide by a number and then multiply back. You end up with some zeros and the full converted amount anyway.

Roger says

I’m having the same issues with H&R block, It’s saying I don’t need to complete Part I since I converted all of my non-deductible contributions. Is there any way to override that? It’s clear from the instructions that I DO need to complete Part I. I understand that I get to the same place in terms of taxable amount ($0), but I’d still like to complete the form properly.

Thanks for the great post! I couldn’t for the life of me get H&R Block to work before I read this post.

Harry Sit says

Roger – I don’t worry about it. I believe H&R Block’s interpretation is acceptable. If you’d like you can try answering No to that “Did you convert all …” question.

Roger says

OK, thanks for the reply.

Mike says

3 bullets from IRS version of 8606 shown below. Not sure why IRS would not have been more explicit if I go by your interpretation, or why H&R Block could not have been clear on the discrepancy so that people like me would not question the H&R Block apparent deviation from the IRS instructions. If I override the checkbox, part 1 will be filled out. I do agree that overriding the checkbox in H&R Block or sticking with it checked results in the same final taxes. However, I wonder if skipping part 1 negates the goal of informing the IRS that you made a non deductible contribution in 2014.

• You made nondeductible contributions to a traditional IRA for 2014.

• You took distributions from a traditional, SEP, or SIMPLE IRA in 2014 and you made nondeductible contributions to a traditional IRA in 2014 or an earlier year. For this purpose, a distribution does not include a rollover, one-time distribution to fund an HSA, conversion, recharacterization, or return of certain contributions.

• You converted part, but not all, of your traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2014 (excluding any portion you recharacterized) and you made nondeductible contributions to a traditional IRA in 2014 or an earlier year.

Mike says

I keep hearing words like H&R Block interpretation is OK for its behavior with not filling out part 1, but I think a simpler explanation is that it is a bug. I went the route of online support. I don’t think the agent knew there was a form 8606. Agent took my info anyway. Someone called me a few days later. You would think they would have had the appropriate person call me. This agent didn’t seem to understand either. Did not know how to compare IRS part 1 instructions to HR Block part 1 instructions and see that they are different. Agent told me that I would receive a survey and requested that I document the issue in the survey. Wasn’t that her job ? Anyway, I did explain things again in the survey and never heard back.

Harry Sit says

It could be. I also got tired of defending them. I will replace my examples elsewhere with a form produced by TaxACT, which looks more normal.

Naomi says

Thank you for this website. I did my taxes on H&R online with the best of both where a CPA reviews it. When I entered the amount my husband and I put into our traditional IRA ($5500 each), the next page shows our non-deductible contribution as $0 and cannot be edited. When I go through the rest of the conversion questions, the Roth-contribution is penalized as an excess contribution to Roth-IRA over the income limits and also adds $11K to our income. Is this a bug in the system or did I screw something up?

Harry Sit says

You screwed something up. Make sure you answer ‘No’ to whether you recharacterized your contribution to Roth, if you converted, not recharacterized. See Traditional and Roth IRA: Recharacterize vs Convert.

Greg says

I’m having the exact same problem with the H&R Block software, and the issue is not a mistake of clicking “recharacterize.” Naomi, were you able to get any help with this from H&R Block? I’ve been on the phone with a customer service rep for a half hour and it doesn’t seem like she has any clue!

Harry Sit says

I just tried H&R Block online with a test account. Except it didn’t like a number in 1099-R box 2a, I had no problems. Make sure you already entered your W-2 or self-employment income. No earned income = not eligible to contribute to IRA, which can make it see your contribution as excess contribution.

Gidget says

I’m having this issue. As of last week, they said it was because form 8606 isn’t generating. But now, I don’t know what the issue is. I show $6k deductible when it should be non-deductible. It seems like every year I go through this headache and have to tweak the forms.

Chicagoen says

Great job! Thank you very much.

Nancy says

Thank you for your very helpful instructions. I have gone through them twice and still have a problem with the H&R Block software. In Form 1099R both box 1 and 2a have $11,000 because contributions to 2013 and 2014 non-deductible IRAs were converted to a Roth IRA in 2014. Line 15b on Form 1040 now shows $22,000 where I believe it should show $11,000.

In attempting to fix this I followed your suggestion in a previous post by leaving out the $11,000 from the 1099R 2a box in my data entries. The H and R Block 1099R worksheet box 2a changed to $0 but the form 1040 line 15b continued to show $22,000.

H and R Block support said the amount on form 1040 line 15b comes from the 1099R worksheet Line 2A, which is really a box. The only suggestion they had was to right click on the Form 1040 line 15b total and change it to $11,000. However this is an override and their assurances that the return is accurate are no longer valid and one can’t electronically file.

Do you have any other suggestions as to how to tackle this issue?

Nancy says

Hi again,

I have just compared an IRS 1040 with the H and R Block form. The H and R Block 1040 is a bit confusing with the numbering. H and R Block has a box in front of 15a, a box after it with a b showing to the right of the second box and then the 15b line in the column of other entries. So what I thought was an entry in 15b is actually an entry in 15a which should reflect the actual distributions shown on the 1099R. I believe the entry in 15a should be $11,000 rather than the $22,000 currently shown in the 1040 as discussed in my previous post. Sorry for my confusion.

Harry Sit says

You didn’t say whether you were doing it with H&R Block online or installed software. If you are using installed software, just follow the exact sequence as shown here except you enter 5,500 instead of 0 in the screen “Your Total Basis in Traditional IRAs.”

Brian says

Thank you so much for posting this! These step-by-step instructions are extremely helpful!

jaime fernandez says

this is fantastic. You helped me out with RSUs and now i look for your web site before TaxCut, TurboTax or the IRS. Very clear explanations for a very complex transaction (its not hard to understand the concept, but getting it on the right forms is really tough)

thanks for all your time

Paul Arking says

This page has truly been such an incredible help! I had been going through the TaxCut IRA sections again and again trying to figure this out, but getting nowhere. I had reached out to my investment advisor who was helpful in theory, but couldn’t help much in terms of the software specifics, or even regarding the accounting specifics of how to file. In desperation, I googled some keywords and this page come up as one of the first results—and in a matter of less than 5 minutes, I was able to achieve what I was fumbling with for hours. THANK YOU!

(Side note: I forwarded this link to my investment advisor so that this might be useful to any of his other clients who might be utilizing Backdoor Roths and trying to file on their own!)

g says

My husband I are so lucky we stumbled across your article. Your instructions were exactly what we needed and they were easy to follow. Thank you so much!

BDS says

I performed a Backdoor Roth in 2014 with a traditional IRA basis of 0. After going through these steps, I took a look at my 8606 form. I see that line 1 (Nondeductible contributions to traditional IRAs for 2014) is blank.

Is this correct? Does it not count as a contribution if it’s converted right away?

Thanks very much for your helpful posts!

Harry Sit says

It’s correct. See comments 10 and 11.

BDS says

Thanks so much for the reply, Harry! Now I can rest at ease :).

These backdoor articles are super helpful; thank so much for doing them!

Tom says

Having the same problem as Naomi with the online program. H&R making it difficult as I can’t actually view the forms as far as I can tell. Any advice appreciated.

Tom says

Basically it seems it isn’t possible to have nondeductable contributions to a traditional IRA in the online software. It is zeroed out and no option to edit that.

Tom says

FYI Still could not figure out how to correct it in the online program. Even after trying to add an exemption to form 5329 section. I went to turbotax online which is much more straightforward and resulted in a several thousand dollar increase in refund.

Harry Sit says

I tried H&R Block online. The interface is different but it still works. If you can’t figure it out, maybe just buy the desktop software and follow the steps here, or use TurboTax and follow the steps in my other article.

Kendra says

Thanks so much for posting this. Very helpful! I wish I had known this earlier because now I will be off by a year. I plan to contribute *for 2014* IN 2015 and do the conversion for 2014 in 2015.

As you have pointed out, this will get me off cycle. To get on cycle, then I will also contribute *for 2015* and convert for 2015 in 2015. Can you do an example of what the 8606 would look like for someone who tries to catch up?

Based on what you posted, I think I understand how it should go for 2014 tax prep but given the catch up proposed in 2015, what would the 2015 8606 look like? Thanks again.

Harry Sit says

It will look like this one in a comment on the other article. That reader caught up in 2014. You just add one to the respective years.

http://thefinancebuff.com/backdoor-roth-tax-return-made-easy.html#comment-16569

T. J. Allard says

Mr. Sit,

Thank you for the very helpful information in this post and in your other posts.

I did my contribution and conversion the easy way, for 2015. Unfortunately, I did it the hard way for 2014. I’m in the same situation as Comment #29 under the Make Backdoor Roth Easy on Your Tax Return post.

Using the installed version of H&R Block Deluxe, I’ve carefully followed the information in this post (again, very helpful), but my Form 8606 Part I does not contain any entries. The entries in Part II are correct.

I did verify the contribution and conversion were handled correctly by looking at Line 15A on Form 1040.

Any suggestions would be appreciated.

Thank you,

T. J. Allard

Harry Sit says

T. J. Allard – If it’s otherwise correct, Form 8606 Part I being blank is not a problem. See previous reply to another reader.

http://thefinancebuff.com/backdoor-roth-tax-return-made-easy.html#comment-15106

T. J. Allard says

Thank you, Harry.

I previously read through those posts but I didn’t catch it at the time.

I appreciate the help and the help you’re giving so many others,

T. J.

CD says

So, I made tax prep hard and contributed $5500 to traditional IRA in March, 2015, for 2014 tax year. A few days later I converted it to a Roth IRA. I know now to never do this again and contribute and convert in the same tax year. Anyway, I entered the contribution as you stated in the “Nondeductible contribution” section. I have not received a 1099- R yet but will later in the year I am sure. So, I am confused as to what I should do. My tax owed went up, but do I just leave it and then report the 1099-R in 2015 even though it related to the contribution made for 2014 tax year? What are the steps I should do if this is the case?

Harry Sit says

Your tax owed should not go up if you just enter a non-deductible contribution. You should find out why. You will get the 1099-R for 2015 next year.

Jeff says

Hi–thanks for the article!

I spent an hour with the HR block folks on the phone and still can’t figure it out.

My situation is that I contributed $1400 in 2014 but stopped because I changed jobs and my income exceeded the limits for a Roth contribution.

This year (2015), I converted that original $1400 contribution to a non-deductable traditional and then contributed an additional $4100 for a total of $5500, which I converted back to a Roth.

How do I account for this in HR Block online?

thanks!

Harry Sit says

Read “What to Report” section again. Tell it the way it happened. You contributed $1,400 to a Roth IRA. You recharacterized the contribution (not converted). You contributed $4,100 to a traditional IRA, but the contribution was made in 2015.

Jeff says

Thanks–so I recharacterized the $1400 and converted the $4100? Since I recharacterized the $1400 into the traditional, would I report that I converted $5500 of the traditional to the Roth?

Harry Sit says

Not on 2014 tax return. Read “What to Report” section again.

CD says

I contributed $5500 to a traditional IRA in 2015 for 2014. I then converted it to a Roth a few days later in March 2015. So, in the section where I enter in my total basis for traditional IRAS (in your nondeductible IRA section above) , do I put $5500 as my basis in my traditional IRA since I am not reporting the convert until 2015 when I get my 1099-R?

Harry Sit says

Read the on-screen instructions. It’s asking about previous years (years before the year for which you are doing the tax return).

Steve says

When I follow this(unfortunately I made non-deductible contributions in 2013 in april 2014, and then converted past april 15), it adds the IRA distribution to my income. Should I set the basis to 0 or what?

Steve says

Figured it out-forgot to enter a basis for last year’s contribution.

Brittany says

Great article! I am actually in a situation where I already had a traditional IRA in 2014, converted all of it to a Roth IRA in 2014, and then recharacterized part of it in March 2015. It should be simple to report this recharacterization, but I’m using HR Block deluxe online program and it keeps giving me an error! After 6 hours on the phone with them they don’t know how to fix it because none of them even know what a recharacterization is!! Do you have any idea how to report this in their software? (I realize this is ridiculous that I am asking you instead of them, but I am desperate!!)

Harry Sit says

Brittany – Your scenario has little to do with the subject of this article. Sorry I can’t help you.

Joanne says

I am online doing my taxes free with H and R block and one of the tax questions that I am stumped about is Value of your Traditional IRA. Do I have to give the total amount that I have in my IRA? Please help!

Harry Sit says

Yes, the total value of all your traditional, SEP, and SIMPLE IRAs from your end-of-year statements.

Anu says

Fantastic … thank you very much for taking the time to explain how to do back door Roth contributions in H&R. I will also follow your advice about making future back door contributions and conversions in the actual tax year.

Masha says

This was so very helpful, thank you so much for publishing this guide.

Jen says

Thank you very much for posting this. It was extremely helpful.

Dan says

Thanks for this very helpful guide. I contributed $5000 to traditional IRA in June of 2015, and then had to withdraw all deposited funds a couple of months later to pay for unexpected expenses. (I made $3 in interest by that time, also withdrawn.) Bank sent me 1099-R, with code “1” (not qualified withdrawal…). How do I convince HR Block tax form that this is just a reversal, and is not to be considered an IRA deposit/withdrawal at all? (According to pub. 590A, IRA contributions which are withdrawn the same year they are deposited are not considered as IRA contribution/withdrawal at all…).

Thanks for any ideas,

JenG says

Do you know how to do these same screens for the State of New Jersey?

Yag says

Did you get answer on how to do this for NJ state? I am still struggling where program is calculating hefty taxes on it.

Jackie says

Yag,

Not sure if this is the right way as the questions don’t make much sense but I got it to show up as excludable IRA withdrawals on my NJ return, thus got the correct tax treatment.

** NJ State IRA Input:

Retirement Plan and Pension Income:

Your IRA value as of 12/31/2015: 0

First year of IRA distribution: yes

IRA contribution: $5,500

Your IRA Result: tax free for NJ

On NJ-1040: this shows up in line 19B :”Excludable Pensions, Annuities, IRA Withdrawals”: $5,500

Cynthia says

Hello, I tried to follow the same instruction steps for 2015 tax year using HRBlock deluxe, however, it does NOT show me the question for IRA->Roth IRA conversion in the interview steps, I used to see that in 2014 HRBlock deluxe, but for 2015, the conversion related question seems gone from the 1099-R interview steps as well as the IRA contribution steps. May someone please help here? Thanks!

Harry Sit says

I just went through it in the 2015 software. The screens are more or less the same. In the “Distribution Rolled Over” screen, still answer “I didn’t rollover this distribution.” The conversion related questions come up next.

Cynthia says

Thanks for the reply. You are right. I missed the step to check box 7, “is the IRA/SEP/SIMPLE box checked”, once I checked that as yes, the conversion questions show up as demonstrated in your flow. Thanks.

KG says

Thank you so much for this. I got so scared when I received a 1099-R showing a taxable distribution (taxable amount unknown) for what I knew to be an after-tax contribution and thought “Great…I tried to save a few $ extra for retirement and hurt myself in the process.” I couldn’t tell when I did the transactions in HRB whether I had done them correctly, and was about to throw in the towel and hire an accountant. Right before I closed the laptop, I decided to google the question and came across your article. I deleted my previous entries (which had actually been correct), wrote down the tax figure, and then followed your steps, watching the tax bill go up and then back down, just like you said it would.

Gana says

Just wanted to post in case anyone else runs into this problem using the Deluxe Software:

Even with following all of the steps above, my Part I on Form 8606 remained blank, and I was being taxed again on my $5500 non-deductible IRA contribution/conversion. I went through the steps in this post again and again, and I couldn’t figure out how to fix it and get the software to recognize that this was a nontaxable contribution. Eventually, I tried unchecking the box at the top of Form 8606 (right above Part I). The form does allow you to manually uncheck it. Once I did this, the software finally recognized that I had made a non-deductible contribution, and it filled out Part I (and the rest of Form 8606) correctly.

Jackie says

Gana,

You are one to fix my problem. Thanks a million! As I posted I have spent days on this one issue and only by unchecking the box you indicated everything all the sudden are good! can’t thank you enough !

The aggravation I had with HR Block for this one item every year makes me wonder if it is all worth it to save money to do my own return even though I am a CPA and know tax laws. The software is sometimes absolutely hard to work with.

Al says

Jackie, we also had irritation with H&R Block last year as well as this year. The program works fine – I think turbotax is a little easier for the first few years, then H&R Block seems easier as things get more complicated. Last year there was a state form not included. The “help” people didn’t know anything about it and basically blew me off after I had tried to chase it down for hours. This year I needed to go from joint filing to Married Filing Separately because of a single non-resident return, and the only way to do it is to delete one taxpayer entirely (the wrong one!!) or restart all new. I called to ask if there was a way to do it and the “help” person informed me that he didn’t know the technical details of the program or whether this was possible. Another blow off.

And that was after I spent 2 hours trying to figure out why my Trad to Roth conversion wasn’t filing correctly – one small box with lots of consequences! Finally got it.

We might go to TaxAct next year and see how it works. The screenshots look much more barebones, so hopefully simpler architecture for a complex problem.

Al

Alice says

Finally! An answer to my question. Thank you for this post! I spent hours trying to figure out why my non-deductible, converted distribution was showing as taxable on Form 8606 Line 18. It was that check-box! I had no idea you could manually uncheck the box. What a simple solution. This software bug is maddening. Thank you Gana!

Al says

Hi, thanks so much for posting & updating again! We use this guide every year!

Question: My 1099R has two lines of numbers in boxes 1 & 2a — what does that mean? Or, more correctly, do I enter two lines in H&R block when there is only 1 box entry for Box 1 & Box 2 #s?

For example:

Box 1 Box 2a

10 0 (G in box 7)

5500 5500 (exactly as you list above)

Al says

Doing more digging… looks like I enter the sum of box 1, the sum of box 2, and then there are multiple distribution code boxes. However, when I try to do this, H&R says that codes G & 2a are not compatible. I’m going to enter each line as a 1099-R so I can work through the part that isn’t a backdoor Roth on its own.

Jackie says

I just spent my entire today on making the backdoor IRA conversion to work and failed. It worked for me prior years but this year it is not working. The tax advisor worked with me for 2 hours and concluded that he needs to go back to tech support for me.

I have been reporting exactly like what Harry Sit instructed and I am myself CPA but it is not working this year. The worksheet line 12 for some reason didn’t transport to form 8606 line 1 and I have my entire return finished without form 8606 generated. Getting help from HR Block has been impossible after spending whole day going around circle.

Jackie says

After squaring away the Federal software bug , the conversion became taxable on NJ return. Give me a shout if anyone needs tips on NJ state return. I managed to make it appear as excludable IRS withdrawals on NJ return in the end.

Jay says

Hi Jackie – Thanks for the tips on the federal return. Now I’m struggling with NJ. Any tips?

Jackie says

Hi Jay,

Hope you get this on time.

Not sure if this is the right way as the questions don’t make much sense but I got it to show up as excludable IRA withdrawals on my NJ return, thus got the correct tax treatment.

** NJ State IRA Input:

Retirement Plan and Pension Income:

Your IRA value as of 12/31/2015: 0

First year of IRA distribution: yes

IRA contribution: $5,500

Your IRA Result: tax free for NJ

On NJ-1040: this shows up in line 19B :”Excludable Pensions, Annuities, IRA Withdrawals”: $5,500

Robert Redman says

HR Block Deluxe Online definitely has a bug. My $0 basis nondeductible IRA contribution, and full conversion to Roth were both in 2015, so this is the easy case. It doesn’t work, and I am charged taxes for the distribution. I’ll go through step by step since the screens are different than what is in this article.

Income -> 1099-R

Page 1: I input the 1099-R income with code 2 (early distribution, exception applies) on Page 2: Selected the “IRA or SEP” as my source

Page 3: Selected the “I converted or reconverted my IRA or SEP”

Page 4: Hit the same issue others mentioned, where it would not let me enter $5,500 in both boxes 1 and 2a even though that is what is on my printed 1099-R from the bank. So I leave 2a blank, check both 2b boxes, and check the 7 box

Page 5: Enter that I converted the entire $5,500 into the “amount converted” box, and click Yes for “Do you have a basis in your IRA” since I made nondeductible contributions.

Adjustments & Deductions -> IRA conversions

Page 1: No I didn’t recharacterize

Page 2: Yes I converted all of my traditional and SIMPLE IRA accounts to Roth IRAs in 2015 and I didn’t recharacterize any converted amounts

Adjustments & Deductions -> Traditional IRA contributions

Page 1: Enter $5,500 for the contibutions through April 18, 2016 and $0 for contributions between Jan 1 and April 18, 2016

Page 2: This “Your Nondeductible IRA Contribution Withdrawal” page has the “Nondeductible contribution” text box un-editable and forced to $0. THIS IS BUG #1. I should actually enter $5,500 here, and if I did maybe the software would correctly fill in part 1 of form 8606. In the “Amount withdrawn” textbox I go ahead and enter $5,500

Page 3: Enter $0 as the total value of my traditional IRA, since it asks for the value as of Dec 31, 2015 and the conversion was made before then.

Page 4: No I didn’t recharacterize

Page 5: Enter the history of my IRA contribution and distributions for previous years

Page 6: No I don’t have excess traditional IRA contributions from prior years

Page 7: This “Your IRA Basis” page has incorrect information on it, THIS IS BUG #2. The page asks you to enter the basis only for prior years, and specifically says to look at 2014 or earlier. Since my account started with $0 I enter that, but that causes the software to fill in part 2 line 17 with a $0, and then I get charged taxes. The real IRS form 8606 line 17 simply tells you to “Enter your basis in the amount on line 16”. If I was filling out this form by hand I’d read that, enter $5,500 on both lines 16 and 17, and owe no taxes. The 8606 instructions page 8 is even more specific that this value should be $5,500 https://www.irs.gov/pub/irs-pdf/i8606.pdf quote “If you did not complete line 11, enter on line 17 the amount from line 2 (or the amount you would have entered on line 2 if you had completed that line) plus any contributions included on line 1 that you made before the conversion.” Those are terrible instructions, they should have just said enter on line 17 the amount from line 3… but it’s still the same. Line 1 $5500 + Line 2 $0 = $5500

HRBlock is wrong, they have 2 bugs. Enter the total amount you contributed to your IRA as the basis they ask for on page 7, and then you won’t get charged tax. The final tax return is still incorrect though since only Part 2 is filled out. As previously mentioned by others, if you followed the instructions for the 3 stipulations at the top of form 8606, you actually should have also filled out part 1. But the final results are the same.

Harry Sit says

Did you have a W-2 entered already, with a large enough income and the retirement plan box checked? Maybe it thinks you are eligible for a deductible contribution to your traditional IRA. If you are indeed eligible for a deduction, the taxable conversion washes out your deduction.

Harry Sit says

Also on your “Page 2: Your Nondeductible IRA Contribution Withdrawal” you shouldn’t enter anything. You didn’t withdraw your contribution if you converted. When I have the right box checked on the W-2, a box for “I was covered by an employer retirement plan in 2015” on the previous page is automatically checked, and the non-editable amount correctly shows as $5,500.

Anyway, I find the installed software much better than the online one. If you can’t make it work with online, buy the installed software. It’s both less expensive and easier to use.

JR Behun says

I am still having the issue and hoped the software would have been updated for 2015.

I made the $6500 contribution to the Traditional IRA (I am over age 55) for each myself and my spouse. I am retired and this put the $6500 into a deduction mode. My spouse is working and this put that $6500 in non-deductible mode.

We converted both to a Roth (all this was done in 2015). No distribution was taxed.

Summary: the $6500 was deducted (not sure if it should have) for the retired spouse. Of the $13,000 converted to Roth, none was taxed.

In tax year 2014, no deduction was taken for any IRA and non was taxed (which was correct).

What is wrong here …. should that $6500 for the retired spouse shown in the ‘deductible IRA’ zone? and if so, why doesn’t the 1099-R data showing the distribution get taxed to essentially void this out?

Harry Sit says

Because you are retired and therefore don’t have a retirement plan at work, if your spouse has one at work, you have a higher income limit for taking a deduction than your spouse. If your income falls in between the two limits, it explains why your contribution is deductible but your spouse’s isn’t. You must have entered the distribution for your conversion wrong, thinking yours was nondeductible and you had a basis when it was actually deductible and you don’t have a basis.

David Haught says

Harry:

Background: I have been doing BDRs for my spouse for several years using HRB home edition software. So far, there have been no issues until now when attempting to do a BDR for tax year 2016.

Situation:

– I am the sole income earner; married filing jointly.

– I am covered by a retirement plan; my wife is not.

– I made a $6,500 ND contribution to my TRAD IRA on 1/5/16.

– I made a $6,500 ND contribution to my wife’s TRAD IRA on 1/5/16. This IRA had no balance or basis.

– I converted my wife’s TRAD IRA to a ROTH IRA on 1/7/16. There was no growth/earnings between contribution and conversion.

– Received 1099-R reflecting the distribution of $6,500.

– I followed your very helpful instructions from the 2015 Blog on BDRs using HRB software. Everything was consistent with your instructions except the software says the contribution to my wife’s TRAD IRS is deductible. Is that right? Do I get the benefit of a TRAD IRA deduction AND the ROTH conversion? If so, do I have to go back and change the ND contribution to deductible?

Thanks in advance for your help.

Harry Sit says

Depending on your income, the contribution to your wife’s traditional IRA can be deductible. Make sure you have all your income accounted for. If you will receive more 1099 forms, by the time they come hers may no longer be deductible.

Assuming hers is still deductible, if you take the deduction, the tax on the conversion will wash it out. Depending on her age and which state you live in, there may be a benefit on your state income tax. See Deduct-and-Convert: Save Hundreds in State Income Tax on Roth IRA Contributions. If that doesn’t apply to you, it’s just a wash either way: take deduction, pay tax on the conversion; don’t take deduction, no tax on the conversion.

However, if her contribution was deductible, you have the choice of recharacterizing her Roth conversion and putting the money back into her traditional IRA. This way when you take the deduction you will reduce your taxes this year.

David Haught says

Thanks for your quick reply, Harry. I think it makes sense in the long run to keep the conversion in the ROTH, without re-characterization back to the TRAD IRA. Since I declared the contribution as ND when I made it, am I required to go back to my custodian and declare it deductible (so it matches what I’m doing on the tax return?

Harry Sit says

You didn’t declare it was non-deductible when you made the contribution. The IRA custodian does not know or care whether it’s deductible or not. If the software treats it as deductible because she can, make sure you don’t say she has a basis. See comment 45.

John says

I used this procedure last year to file my 2015 taxes using the installed version of H&R Block software successfully. However, using the installed 2016 Edition for this year’s return and using the same procedure above, I can’t seem to figure out how to get the program to not enter my converted ROTH amount as taxable on line 15b on Form 1040. I’m wondering if others are experiencing this same problem and that this could be a bug in the software?

Harry Sit says

I used the same procedure in the installed 2016 Edition. It worked as expected.

John says

Thanks Harry. I meant to be entered as “non-taxable”on line 15b. I must be doing something wrong.

I had to monkey around with the Form 8606 to get the correct taxable amount to show on line 15b of Form 1040 which is $28 due to the increase of value between the short time I funded the traditional IRA ($6,500) to the date of conversion ($6,528).

The software automatically entered the amount of $111 for the cost basis that was imported from my last year return. I’m not sure if I should set the cost basis to $6,500 + $111 or leave it at just $6,500.

jessica hughes says

I was delinquent in contributing to our IRA’s for 2016 and didn’t do it until February 2017. If I am reading this correctly, i do NOT report the ROTH conversion I just did in 2017 with my 2016 traditional contribution monies. I will report this in 2017? along with the conversion i will do later this year with my 2017 contributions??

Harry Sit says

Correct. You do report the contribution though.