Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in the H&R Block tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are completing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the money was contributed for 2025, 2024, or any previous year.

Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done in 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 or if you recharacterized a 2025 Roth contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to the H&R Block desktop software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted your Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

Income comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-R

When you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now, and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

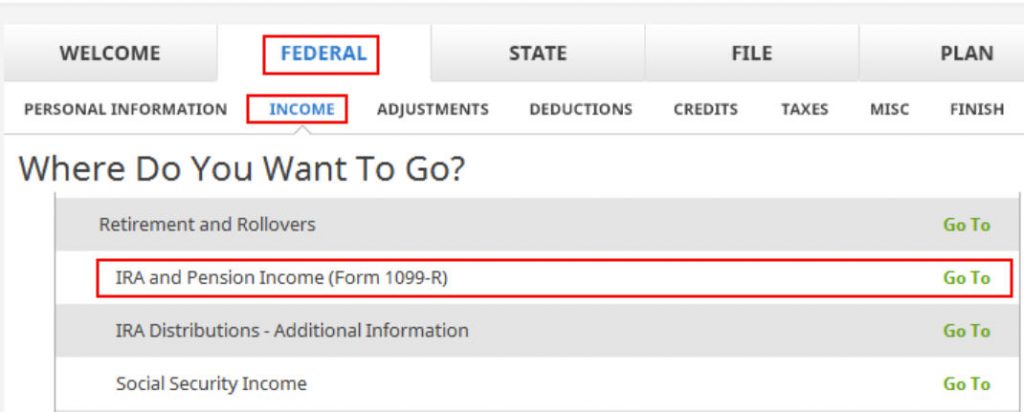

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

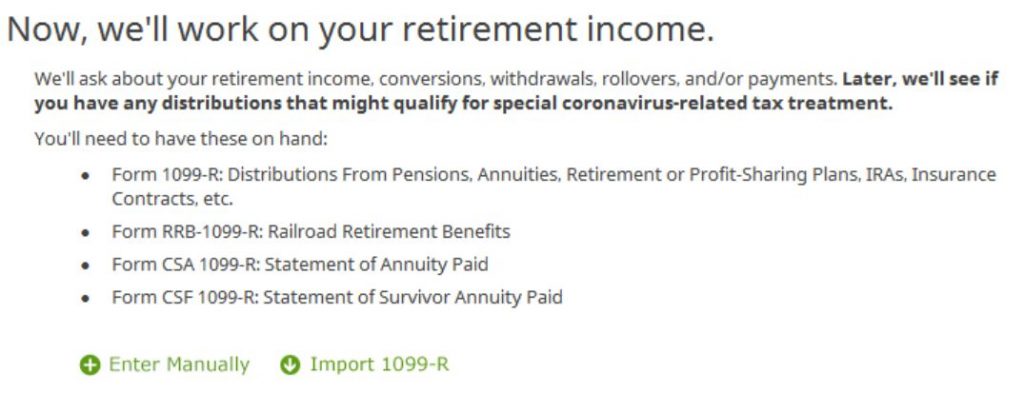

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

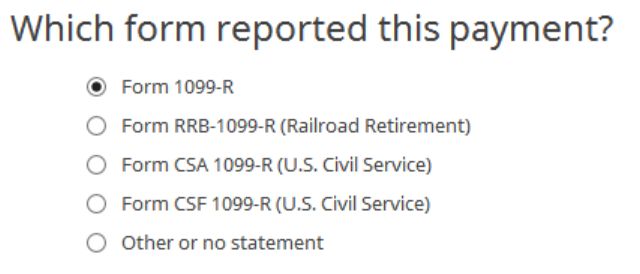

Just a regular 1099-R.

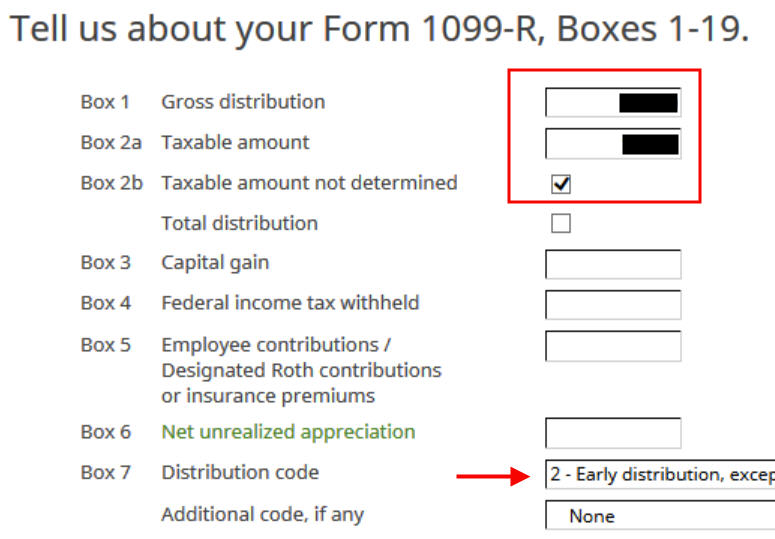

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, make sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

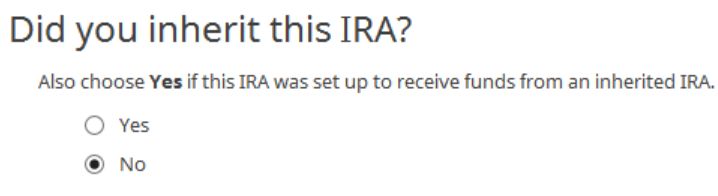

We didn’t inherit it.

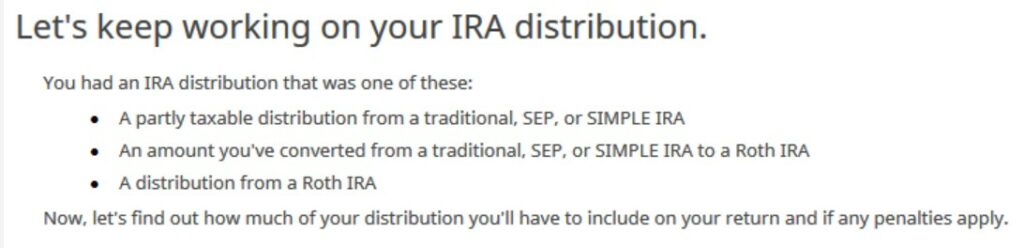

Converted to Roth

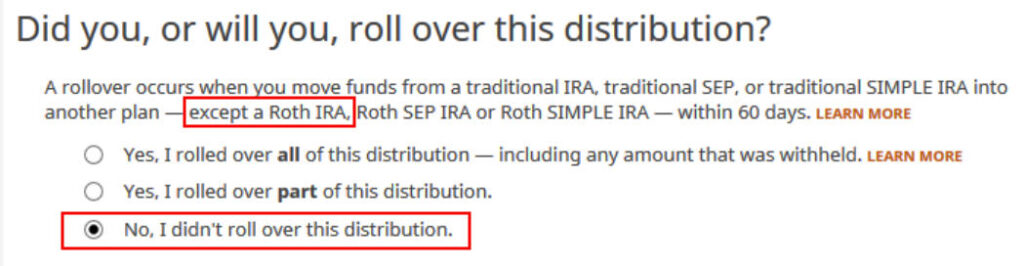

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these withdrawals treated as rollovers or basis adjustments.

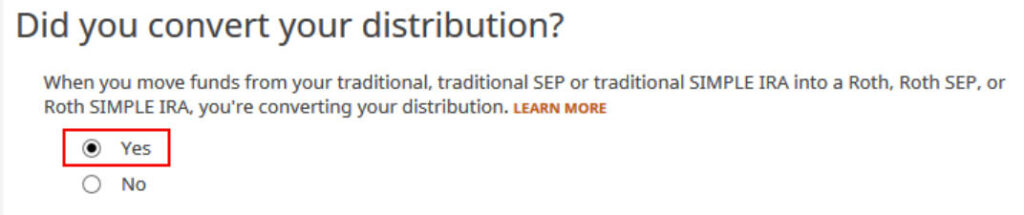

Now answer Yes, you converted.

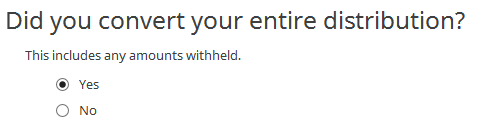

We converted all of it in our example.

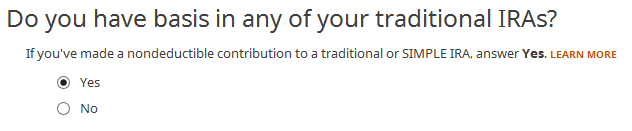

Answer Yes because you made a nondeductible contribution to a Traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section on IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

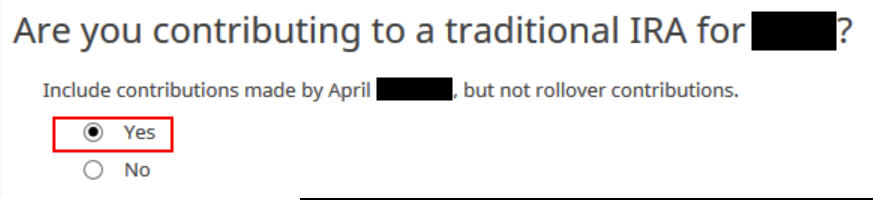

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRA

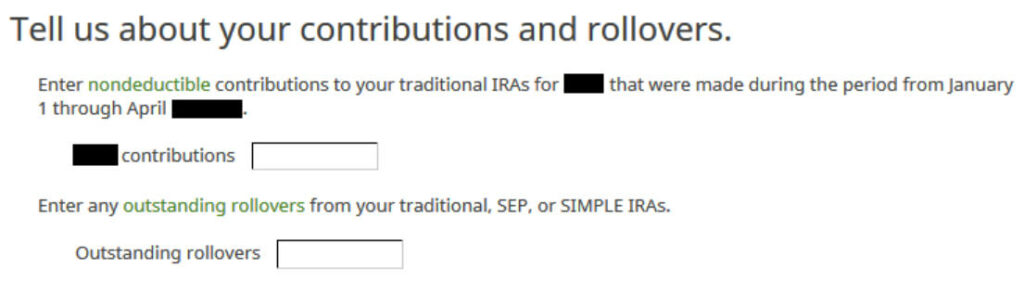

Now we enter the non-deductible contribution to the Traditional IRA *for* 2025 in 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

IRA Contribution

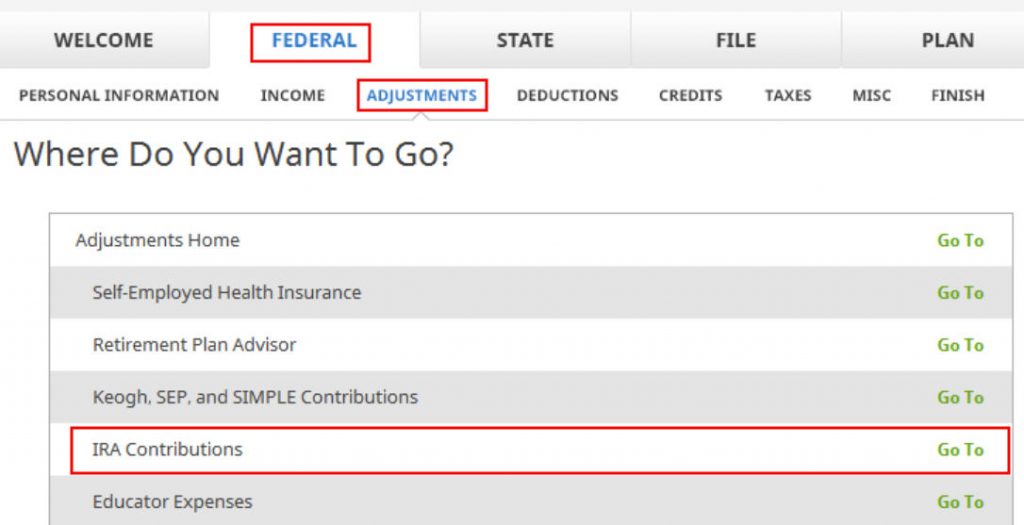

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

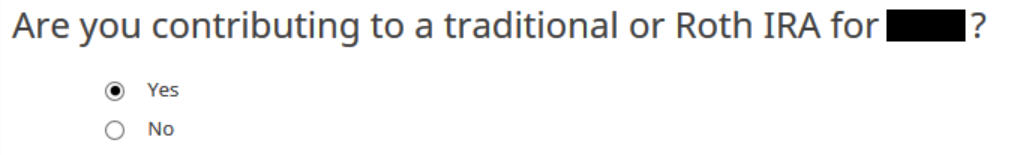

The question uses the wrong tense, but answer “Yes” because you contributed to an IRA for the year in question.

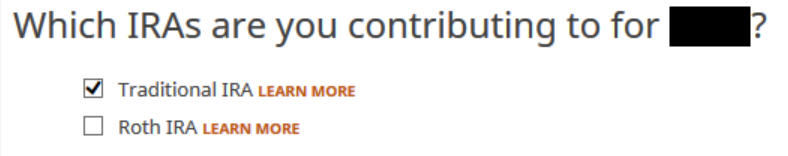

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

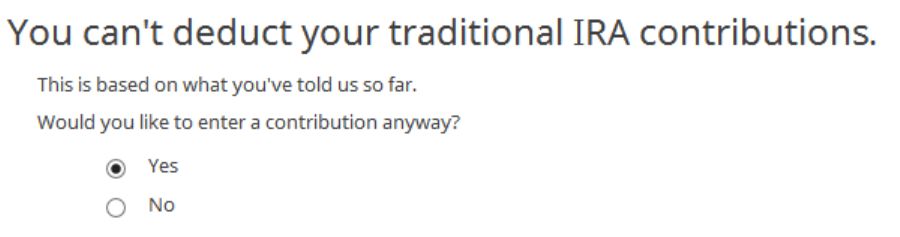

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

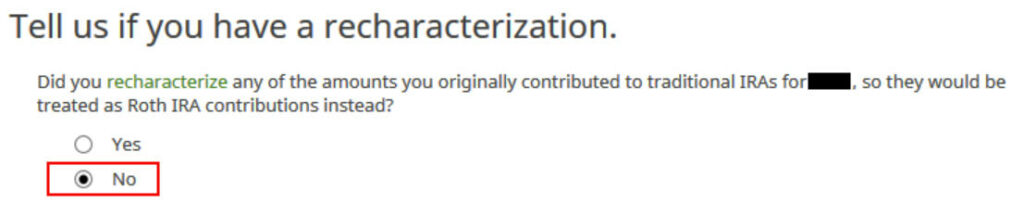

Conversion Isn’t Recharacterization

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

We don’t have any excess contribution.

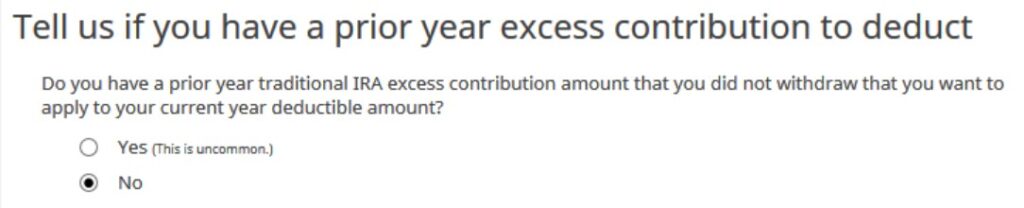

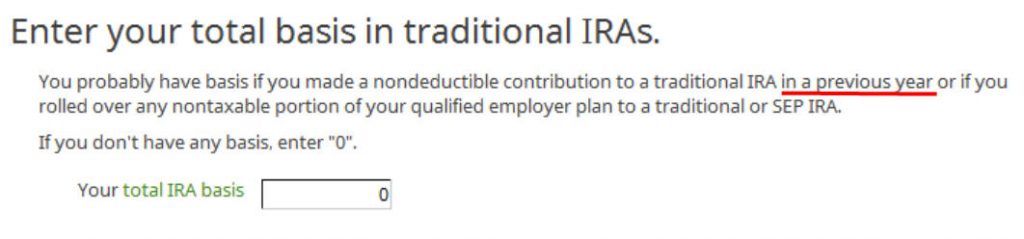

Basis From the Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

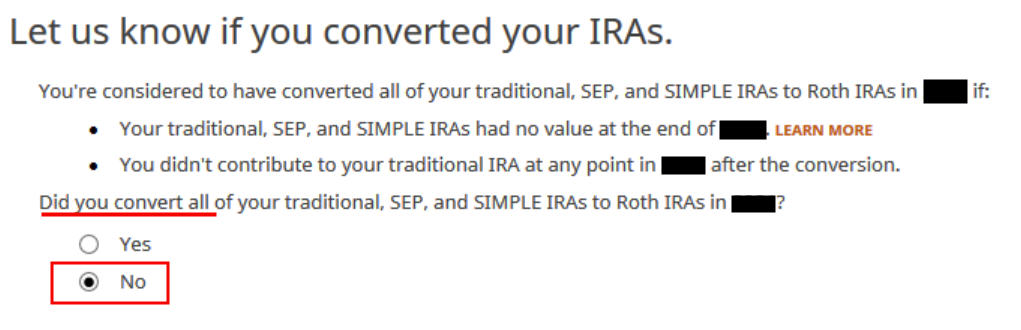

The Pro-Rata Rule

This is another important question. If you are doing it the easy way, as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have given some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

In a clean planned backdoor Roth, you contribute for 2025 during 2025. Leave the boxes blank.

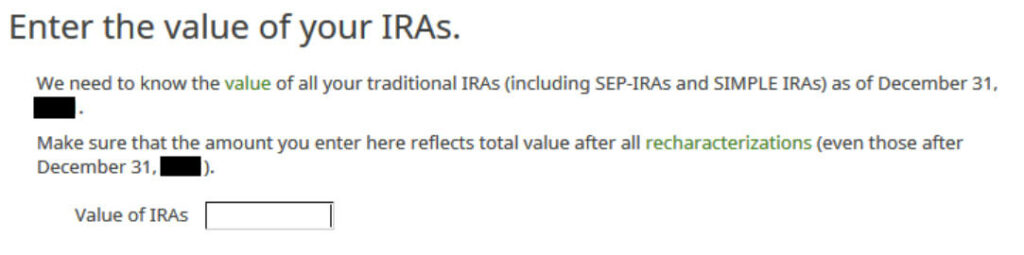

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

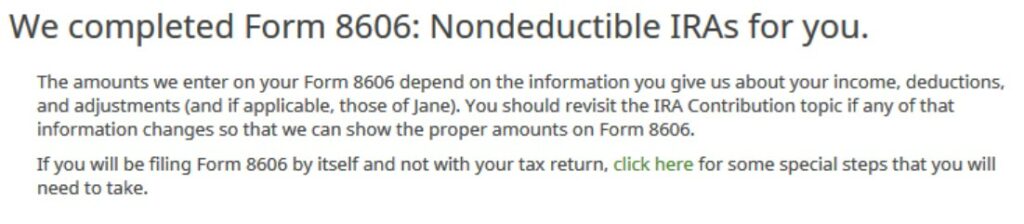

That’s great. We’re expecting it.

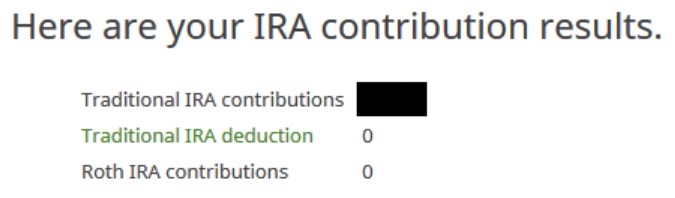

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Repeat this section for your spouse if you’re married and your spouse also did a Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

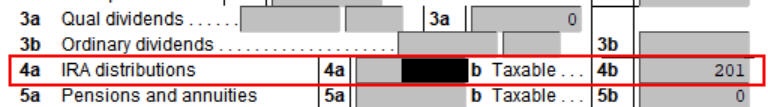

Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

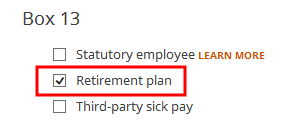

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jessica Hughes says

That’s what I did–many thanks!!

Miale says

Using H&R Block online to do my son’s taxes and he transferred his small ($2,544) 401K funds from Transamerica to a Roth IRA at another company. He got a 1099 from Transamerica showing code G in box 7 and nothing in line 2a. The 1099R from the receiving company shows code 2 in Box 7 and the Box 1 and 2a shows $2,544. The problem is when we put this information into H&R Block, it shows there may be duplication and it only gives us the option of calling the 2nd 1099R a regular distribution or an indirect rollover. It doesn’t ask us if there was a Roth conversion. I really don’t know what to do at this point.

WS says

Same here. Very frustrating.

Jay says

Great article Harry.

I have never contributed towards a Traditional or Roth IRA. I or Spouse dont have any IRA accounts.

I have yet to file my 2016 tax return. To catch up, I plan to open a new Traditional IRA (for both myself and spouse, for 2016 year); I will likely convert to Roth IRA shortly but likely after filing my 2016 return.

I will later this year also contribute for the 2017 year and convert to Roth before 2017 ends.

On the 2016 return –

(a) i just need to report my and spouse’s 2016 T-IRA contribution.

On the 2017 return –

(a) i need to report my and spouse’s 2017 T-IRA contribution

(b) report/import the 1099-R provided by the institution for the 2016 and 2017 T-IRA to R-IRA conversion

Does this sound correct theoretically? I am looking at the 2016 HRBLOCK tax software now and doing a mock 2016 and 2017 return just to feel things out.

Melanie says

This is a great article!

My problem is that I lost money during the year, so I contributed $5,500 in 2016 and converted in 2016, but I had to pay a brokerage fee. At the end of 2016, I only had $5,172 available to convert. Therefore, when Form 8606 is generated, it shows that I have no taxable amount, but now have a total basis in traditional IRAs (line 14) of $328. Not sure how that can be when my traditional IRA account is $0?

Harry Sit says

It’s OK. Don’t worry about it. The software will deal with it next year.

Vera Dovirak says

Hello and thank you for a great article. I’m really hoping you can answer my question, since I spent hours researching with no results in sight.

My scenario: contributed to traditional IRA (first time) this year for 2016 and 2017 and immediately converted. I don’r have a 1099R. This is the first year I’m using back-door conversion to ROTH due to income limits. Since I had no basis in traditional IRA for last year (since I didn’t even have traditional IRA to begin with), I answered “0” in HR Block software and it told me I wasn’t eligible for Form 8606 because I had no conversions. My 15a and 15b lines on 1040 are blank after I went through inputing my IRA contributions.

Question: what am I doing wrong and what is required of me to file with IRS.

Any feedback would be greatly appreciated!

Harry Sit says

Just do the second part starting with “Non-Deductible Contribution to Traditional IRA” for 2016. Some questions won’t come up when you didn’t have a 1099-R for 2016 (you will do that next year).

Moe says

Thank you for posting this

Dan says

Hi there, I am working on the free software available online. I attempted following your tutorial although the free software apparently has different prompts and screens. Still, after completing it I am getting the following summary which I believe is incorrect:

-Traditional IRA

-Traditional IRA contributions – deductible – $5500

-Traditional IRA contributions – nondeductible- $0

-Excess traditional IRA contributions – $0

I am wondering if I went wrong somewhere. Any advice is appreciated.

Thanks

Harry Sit says

If your income isn’t over the limit, making the Traditional IRA contribution deductible and making the conversion taxable will offset each other. If your income is over the limit, make sure you correctly entered your W-2 with the retirement plan box checked.

Dan says

I notice that if I enter in that I had a total 2017 contribution of $5500 and then change the amount I withdrew on the next screen to $0 , the final screen summary reads different than before:

-Traditional IRA

-Traditional IRA contributions – deductible – $0

-Traditional IRA contributions – nondeductible- $5500

-Excess traditional IRA contributions – $0

I wonder if that is enough and in any case as long as the 8606 is filled out correctly I am good? This form apparently will not be available until later this week. I’m also wondering why after entering the same info in, I am getting a better return from TT than from using H&R Block software (free due to being below income limit). I suppose I am entering info in in error somewhere as they both should be churning out similar return estimates.

Harry Sit says

You should enter the numbers truthfully according to what actually happened. Don’t only try to make it look a certain way. Make sure you understand what each action means:

Contribute – put money from your bank account into the IRA

Withdraw – take money out of the IRA back into your bank account

Recharacterize a contribution – change a contribution from one type to another (assets moved as a result)

Convert – move money from Traditional IRA to Roth IRA without any change to the type of the original contribution

To compare results between different software, print out the forms and compare line by line.

Julia says

I’m using H&R 2017 Deluxe. I followed the instructions – entered the 1099 IRA distribution as income and the IRA non-deductible contribution in the adjustments. It’s not zeroing it out on the 1040. I contributed 5500 to an IRA and immediately converted to a Roth…no earnings or anything special to deal with. Is there something different in 2017 that I need to do?

Harry Sit says

Nothing different in 2017. If your income exceeded the limit, make sure you had the retirement plan box checked on your W-2. When you say it’s not zeroing out on the 1040, what does the 1040 show in lines 15a, 15b and 32?

Julia says

15a and 15B are both $5500. 32 is 0. I noticed that form 8608 didn’t have the top section completed. If I manually updated line 17 (one of the only things you can update directly) to $5500 then it all seemed to work as expected. Am I OK making that change on 8606 – saying my basis is $5500? I didn’t have any prior funds in that IRA so I had entered 0.

Harry Sit says

It’s better to delete everything related to your IRA and start fresh. Sometimes your previous incorrect entries get stuck. Delete your 1099-R, 8606, and any related worksheets. Start over by following the steps here.

Masha Sapper says

Hi! I contributed $5,500 for the 2016 tax year to my traditional IRA and immediately converted in early 2017. I then contributed $5,500 for the 2017 tax year to my traditional IRA and immediately converted in late 2017. When I try to follow the instructions you so kindly provided above, I am running into two issues:

1) It seems to me that I should be able to denote half the contribution for the year (my 1099-R shows a total of $11,000) as applying to 2016, but I cannot seem to figure out how to do this.

2) Line 15 of my 1040 shows the full $11,000 as being taxable, when I believe that none of it should be.

Can you help?

Harry Sit says

If you really followed you should at least get the 15b amount down close to $5,500, i.e. having taken care of 2017. After that, just enter $5,500 in the Your Total Basis screen for your contribution for 2016. That will take care of the rest.

Masha Sapper says

Julia, I worked with H&R Block’s support on this, and they had me go into the 8606 form and under Part I and before line 1 there’s a box that says to check it if you meet both requirements. H&R Block support told me to uncheck that box and then it worked properly. They said they thought it was a bug.

Harry, thanks, updating the total basis fixed the other half of the issue!

Julia says

Thank you so much. That worked perfectly.

ABC says

I seen to have screwed up … but I guess this is how you learn.

Until 2016 we did not hit the Roth Income limit and there was no complication.

After stting down to do our doing our taxes, I found out that the AGI for 2017 falls inside the MFJ income limit where benefits are phased out.

So I proceeded to do a backdoor Roth that I have been reading about in this and other forums for years.

Last month, (February 2017) I contributed $5.5K + $5.5K to IRA for 2017 for both of us.

A week after that (February 2017) I converted both the IRA’s to Roth’s.

As I sat down to file 8606, I realized we don’t have the 1099-R because the IRA contribution for 2017 was made this year (2018).

It was only after speaking to Vanguard, my mistake became apparent. The backdoor Roth conversion that I did last week (Feb 2017) applies to 2018 and not 2017.

In effect, I made an IRA contribution for 2017 and a Roth contribution for 2018.

Maybe this can be fixed next year when Vanguard sends me the 1099-R for 2018?

Meanwhile, since there’s no 1099, I can’t even report the non deductible contribution this year on my online tax software.

What should I do?

(In addition to the e-Filed returns) should I mail the IRS a hand entered 8606 for 2017 showing $5500 non deductible contribution in 2017 for each of us?

Any help will be appreciated.

Harry Sit says

Contribution and conversion are two separate actions. You can and should still report the contribution even though you won’t report the conversion until you get the 1099-R next year. Just skip to the second half of this post starting from “Non-Deductible Contribution to Traditional IRA.”

Will says

What if I did a conversion of my 2016 traditional IRA contributions in March 2017 prior to filing my 2016 return?

I initially reported it as converted on my 2016 return, but now I have a 5498 for 2017 that shows the distribution. Looks like I need to amend 2016 to show the traditional contribution (which results in a deduction), then report the 2017 conversion of the entire basis (no earnings involved). I would think this would result in my deduction from 2016 being reversed, but it looks like there’s a penalty or some other tax involved.

Will says

Correction…I have a 1099 for 2017

Harry Sit says

You should report the conversion on 2017 return. If you used software, without a 1099-R, I don’t know how you could’ve reported the conversion on 2016 return. Your contribution for 2016 may be deductible or non-deductible depending on your income in 2016 and whether you participated in a workplace retirement plan.

Dani says

OMG!! You are AMAZING! Thank you sooooo much for this info!!

Really really really appreciate it!

Sea Marie says

Any advice for what to do if the software appears to have a rounding error in the pro-rata calculation?

I contributed $5500 (non-deductible) in 2016 and 2017, for a total of $11,000. Converted $11,007 to Roth afterwards.

Line 10 is 0.999 in H&R Block, which leaves me with 10,996 on lines 11 and 13, and $4 on 14.

If lines 10 used 0.9994 (4 decimal places), I’d have a -0- on line 14, as expected.

Did I do something wrong, or is this just the software? If I efile as-is with the $4 basis (and resultant $11 taxable gain) can I correct this later without paying any additional fees?

I know that $4 is practically nothing, but it’s going to be annoying to carry this forward to next years return

Harry Sit says

Not worth worrying about. If you forget about the $4 and you don’t carry it forward, you pay tax on $11 versus $7. That makes your tax go up at most by $2.

Sea Marie says

Thanks!

I’m always trying to reduce my audit risk (because I lost some documentation for my deductions from a few years ago), so the possibility that I’ll forget to carry forward the $4 scares me, but the IRS probably doesn’t care as much if I make a mistake in their favor. Not to mention that I’ve spent enough time worrying about it this year that I probably won’t forget 🙂

Chris says

Why is H&R block software not letting me put 0 as 12/31 balance in Traditional IRA’s? 0 is what’s accurate. Is it how I answered a prior question? Need to get line 6 on 8606 to say zero. Thanks for any input

Harry Sit says

I don’t see the question for 12/31 balance in the series of screenshots here. If you had 0, maybe answer ‘yes’ to Convert All Your IRAs?

Archana says

Hi Harry – many thanks in advance for any help you can provide here. I’ve been trying to figure it out for a couple weeks now and am at the point of repeatedly jamming my head into my keyboard until it starts to make sense (proving unsuccessful thus far).

My situation:

– Contributed $5500 to a Roth IRA in May 2017 for Tax year 2017

– Contributed $5500 to a Roth IRA in January 2018 for Tax year 2018

Upon receiving my W2, I realized that I am within the phase-out limit for Roth IRA’s for 2017 and likely will be for 2018.

In February 2018, I converted (or recharacterized?) $4500 of my 2017 Roth IRA contribution to a Traditional IRA and converted it back to a Roth IRA within a few days. Since I’m within the $118-133K income, I was allowed to contribute $1000 directly to the Roth IRA.

I also converted (or recharacterized?) $5500 of my 2018 Roth IRA contribution to a Traditional IRA and converted it back to a Roth IRA within a few days.

I’m using HR Block online to file my taxes. Can you please help me figure out how to approach my 2017 tax return given the conversion from Roth IRA -> Traditional IRA-> Roth IRA? The retirement box on my W2 was checked as well, since I contribute to a 401k through work.

Harry Sit says

You recharacterized in both question marks. Do the second part starting from the “Non-Deductible Contribution to Traditional IRA” heading. Check the Roth IRA box because that’s how you originally contributed. When it asks whether you recharacterized, say yes and give how much you recharacterized. You will jam your head more next year but you have at least a year to prepare for it.

Ralph says

I’m in a similar boat this year:

– Contributed $5500 to a Roth IRA in Jan 2018 for Tax year 2018

– Contributed $6000 to a Roth IRA in Jan 2019 for Tax year 2019

Discover in Feb 2019 that I’m over $130k in 2018 and will be in 2019 as well. Since I had a old TradIRA I first transferred then entirety of it to 401k. Then opened a new blank TradIRA. Then I did a recharacterization in Feb for both amounts from Roth to that new TradIRA and immediate converted them back to RothIRA.

Since I did both in 2019, what are my steps for filing in 2018 vs what I have to do for 2019? I expect a 5498 and a 1099-R next year about the recharacterization for the 2019 filing because of the gains of the 2018 funds before they were switched. So as far as 2018 filing…… do I only show the initial $5500 that was put into RothIRA at that time?

Harry Sit says

You show the $5,500 originally contributed to Roth and subsequently recharacterized as contribution to a Traditional IRA. This becomes the basis you carry over to the following year.

Archana says

Hi Harry! I’m the same Archana who posted a year ago with the dual recharacterization/conversions. You were right in saying “You will jam your head more next year.”

I’ve been dreading doing my taxes because of the complicated nature of this backdoor Roth situation. I followed your advice last year and now, I received two separate 1099-R’s from Vanguard this year – one for my Roth IRA for $10,650 (that I initially contributed to and then recharacterized) and one for my Traditional IRA for $10,800 (that I then converted back to a Roth).

I’m using H&R Block’s online software to do my taxes again. I uploaded the 1099-R for my Trad IRA and selected the distribution code 2 (“Early distribution, exception applies”). I selected “IRA or SEP” as the source of my distribution or rollover and then stated that “I converted my IRA or SEP.”

When asked “How much of your distribution did you convert or reconvert within 60 days of receiving the distribution?” I stated $10,800. Do I also say that I have a basis in my IRA?

Then, when I got to the adjustments section, I checked both “I converted a traditional IRA.” and “I contributed to a Roth IRA.” I stated that my 2018 IRA contribution was $5500. I am then prompted to answer “Tell us about any withdrawn nondeductible contributions.” with a box for my nondeductible contribution and another box for the amount I withdrew, if any. What would I put for this?

Lastly, what do I do with the 1099-R for my Roth IRA? It currently has Distribution code R written in box 7. (“Recharacterized IRA contribution made for 2017 and recharacterized in 2018”).

A debt of gratitude to you for any help you can provide here – it is most appreciated!

Harry Sit says

Archana – Your basis in the Traditional IRA from the previous year is the $4,500 you recharacterized. “Withdraw” means taking money out of the IRA to a taxable account. You didn’t withdraw any. Enter the other 1099-R with the R code as-is as a separate 1099-R and just follow the prompts.

Archana says

Thanks, Harry. When I initially recharacterized from the Roth IRA to Traditional, the value was $10,650. By the time I converted this back to the Roth, It had grown to $10,800. How do I represent this?

Do I say that I contributed $5500 to my traditional IRA for 2018? Or higher than that?

Harry Sit says

Archana – Both numbers are represented by the two 1099-Rs respectively. Enter them as-is. You don’t say you contributed $5,500 to your traditional IRA for 2018 because you didn’t do that. You contributed zero. You contributed $5500 to a Roth IRA in January 2018 for tax year 2018 and you recharacterized the entire $5500 to traditional IRA later in 2018.

Alice K says

Hi Harry,

I have a 1099-R form from my employer associated 401K plan. I had contributed post-tax money to the 401K and converted the majority of it to a Roth 401K. So the money that I had already gained as interest is taxable and reported in line 2a. However the distribution code is listed as G. Per H + R online, this is a sticking point and can be in error, so I can’t proceed to e-file and must mail the return. Looking at the instructions for forms 1099-R says that a direct rollover of a distribution from a 401K plan to a designated Roth account in the same place, the amount rolled over in box1 $10,029.17, taxable amount in box 2a $184.03, basis recovery amount in box 5 $9,845.14, and use code G in box 7. So it seems that the form is correct. Is there any way around this or is my only option to mail it?

Thanks so much for your time and help,

Alice

Harry Sit says

I don’t know about restrictions on efile. I always mail mine anyway.

Travis says

Hi,

Desperately need some help! In July of 2018 I rolled over an old 401K, from a previous employer, into an IRA. Then one month later, I converted that $2500 IRA to a Roth IRA. Fidelity sent me a 1099-R form for the rollover. Shouldn’t I also have a 1099-R form for the conversion into the Roth IRA since that is what is taxable? I’m using H&R Block online to file my taxes and I feel stuck at the moment. Any advice would be greatly appreciated!

Thank you,

Travis

Harry Sit says

You should have one 1099-R from the 401k plan for the rollover, and another 1099-R for the Roth conversion. If both the 401k plan and the IRA are with Fidelity, the 1099-Rs are posted in different sections of Fidelity’s website (employer plan and retail accounts).

Travis says

In response to the latest reply.

I believe I found both necessary 1099-R forms. One of the forms says:

Box 1. Gross Distribution: $2500

2a. Taxable amount: $0.00

2b. Taxable amount not determined: (box not checked)

Total Distribution: (box is checked)

Boxes 3, 4, 5, 6: all $0.00

Box 7 Distribution Code: G

Box IRA/SEP/SIMPLE (box not checked)

The other 1099-R form I have says:

Box 1. Gross Distribution: $2500

2a. Taxable amount: $2500

2b. Taxable amount not determined: (box is checked)

Total Distribution: (box is checked)

Boxes 3, 4, 5, 6: all blank

Box 7 Distribution Code: 2

Box IRA/SEP/SIMPLE (box is checked)

Is the first 1099-R I described the rollover from my 401K to an IRA and the second 1099-R described the conversion from the IRA to a Roth IRA?

And lastly, do I just need to enter both of these forms under the income section of H&R Block’s online filing system and then I’m done with the IRA stuff? (I never actually touched the money, no checks, no deposits into my personal bank account. I did the rollover and conversion all online through Fidelity’s website).

Thank you for your help!!

Travis

Harry Sit says

That’s correct. The first one with code G in box 7 is for the rollover from the 401k plan to the Traditional IRA. The second one with code 2 in box 7 is for the conversion from Traditional IRA to Roth IRA. Yes you just enter both in the income section and answer the associated questions. Your Roth conversion isn’t the same as a backdoor Roth (the subject of this post).

Jedi M says

Really confused for 2018 tax reporting.

I’m using the H&R Block online, Premium version.

I uploaded the Traditional IRA 1099-R to the software. Now I go to the deductions section (adjustments in your guide), and it wants me to select both Traditional and Roth instead of just traditional.

Any updates for 2019 that I’m missing? I recall it was painful last year and I got through it, but I don’t know why it’s roadblocked this year.

Harry Sit says

I just checked the 2018 H&R Block software (installed, not online). No changes from the process shown here. Can you simply unselect Roth in the contribution part? Or if it has to be selected, answer ‘No’ or enter ‘0’ when it asks you whether/how much you contributed to Roth? Installed software usually works better than online. See Tax Software: Buy Download Or CD, Not Online Service.

GMon says

I rolled over all deductible money from a Traditional IRA into my 401k in order to clear the deck for backdoor Roth. I then contributed $5500 to my Traditional 401k and several weeks later converted it to Roth ($5501). I followed your article exactly, but I still end up with $5501 taxable on Form 1040 Worksheet box 4b. I would expect that to be only $1. I’ve also removed the “Taxable” amount from the 1099-R just to see what would happen, and nothing is different. Any idea what might be wrong? Any known bug in the 2018 software?

GMon says

I found it. I was answering “Yes” to this question:

“Did you convert all of your traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2018?”

When I changed this to “No” it worked fine. I had converted in the middle of a month, and at the end of tht month $3 of interest posted so at year end 2018 the traditional IRA still contained that $3.

Eliza says

I contributed for the 2018 year traditional IRA in January 2019 and then converted to Roth. I thought this would be ok because the amount of money in all my simple/SEP/traditional IRAs was $0 on December 31st 2018. It sounds like my situation is going to be complicated because I also converted a ton of money from my traditional IRA to my Roth IRA in July 2018. Now I do have to calculate basis because of the contribution made in January?

Harry Sit says

Your contribution for 2018 in January 2019 does not affect your conversion in July 2018 when your balance as of December 31 2018 was zero. If the contribution was a non-deductible contribution, you will carry it as basis to 2019.

Phil says

The HR Block steps for 2018 software are not accurate. I’m trying to do a backdoor Roth conversion for my wife for $5500 and yet again this year it is not working properly. I’ve used your site in the past, but you are not displaying the extra page telling me how to “correct” the 2018 excess contribution, yet there are no options I can see to fix this and now my taxable amount has jumped up $2k. There is nowhere that it is allowing to fix this. Any advice is appreciated as always, I love this site each year for this very purpose!

Harry Sit says

These screens were taken from the 2018 H&R Block software installed on my computer. If your scenario matches the example used, following the same steps works, as the screens showed. I didn’t skip any extra pages. Check line 4a on your Form 1040 to confirm how much you are taxed. If it’s not correct, delete all 8606 forms and 1099-R worksheets and start fresh by following these steps.

Phil Spanninger says

Sorry, to confirm it is the 2018 version. Here’s what i had to do to make it work for a ROTH conversion (thats what isnt working in the instructions, as the 8606 didnt produce as it should):

1. I followed all the same steps as your Traditional IRA, and kept getting fully taxed on the $5500. So i tried a couple other methods, still with no luck.

2. I started over as a “traditional” and when i got to the part about whether it was “recharacterized” i said YES, and entered some Roth info. That ALSO didnt work, kept telling me i was going to be taxed for it. So i clicked “Back” a couple times, said “no” for recharacterization (and left that other info in the system), and then followed the remaining steps… and it somehow magically worked.

3. What i still dont understand is exactly WHEN the system is applying the rule. It doesnt seem to work when i followed your exact steps… and plus, its not really a traditional IRA, but doing it as a Roth doesnt EVER work for this backdoor method… it was saying we owed money every single time since my wife already contributed to a work Roth IRA.

I am 95% sure i had to do it this way in 2017 too so it would force the system to do it properly. I wanted to avoid editing the 8606 manually since it would invalidate the filing. Any further thoughts on this? I dont fully trust it but it looks ok now… just a major pain that they dont give you this option in the software as a simple question!! I literally had to do this 6 different times to make it work; the software was not playing nice.

Harry Sit says

It’s better to follow the steps fresh in one pass. If you already put in some wrong answers and you go back and forth to correct them, some of the wrong answers may get stuck somewhere you no longer see.

I’m not sure what you meant by “its not really a traditional IRA.” In the scenario used in this post, you contributed to a Traditional IRA and then converted the money from the Traditional IRA to a Roth IRA. The money ended up in a Roth IRA but it went into a Traditional IRA first.

Dylan says

Can confirm there’s a problem with H&R block 2018. Line 4a is refusing to calculate properly. I followed your steps precisely. 4a.a was $5500, but 4.b was also $5500 (instead of $0). Redid several times.

Harry Sit says

Did you see the “No IRA Deduction” screen? Make sure you didn’t inadvertently make yourself eligible for a deduction for contributing to the traditional IRA (forgot to check the retirement plan box on W-2; didn’t enter a high enough income yet to put you above the income limit; etc.).

Dylan says

Harry- My error – Your instructions were spot on. My mistake was importing from Vanguard (I double imported, once for the 1099DIV and once for the 1099R, but H&R copied all statements twice). Once I followed your instructions to delete and start again, then I manually entered the 1099R data, everything tallied.

Once additional note – In Pennsylvania, you’ll need to manually correct the adjusted basis. The H&R software prompts you; if you don’t complete correctly, you’ll see your state taxes owed jump.

Nikhil Kothari says

I spent an hour. H & R software was showing $330 (6%) penalty. Finally, I searched the web and came across your screenshots. They are accurate and they work. Thanks very much

Prasad Ram says

Hi Harry,

Your article is the clearest out there and have been referencing it for the past couple of years when entering my taxes. My question is on how to report the removal of excess contribution. I by mistake made the $5500 contribution twice in 2018 and converted both of them from IRA to Roth IRA. I realized this last month and had fidelity remove the excess contribution from Roth IRA. But there was a gain/earning of $427 during that period. The 1099-R that I received earlier has $11000 in gross distribution and taxable amount boxes. How do I report the removal of excess contribution in 2018 H&R Block 2018? Please help if you can.

Gearhead says

Awesome, clear, succinct advice!!! I don’t think I would’ve gotten this right without your post. Thank you!

Jim says

YOU ARE AWESOME! This helped me soooo much and I learned in the past to do this the easy way as you explain, but walking us through step by step on how to properly enter this in H&R block software was a HUGE help. Thank you so much!

Alan Greer says

Thanks very much for this. I contributed $13k easy way and converted it all. I received a combined 1099-R for me and my wife. The software is current reflecting half ($6,500) as taxable. Any ideas?

Harry Sit says

IRAs are all in individual names. Never heard of a combined 1099-R for two people. Either take a closer look at the forms you received or contact the IRA provider and ask why they didn’t issue a separate 1099-R for each person.

Jpohn says

Wow! It worked following your steps exactly. There is no way I would have figured how to report the backdoor Roth on the HR Block Software. Thanks so much for sharing and including screenshots. Awesome! GOD Bless your efforts

Garrett says

Does anyone know to fix things, if you converted to Roth IRA (accidentally), had to recharacterize it to Trad IRA, and do a backdoor conversion of that recharacterized Trad IRA to a backdoor IRA?

Sue says

I started out this adventure by realizing that I needed to recharacterize my ROTH over contribution and reading about backdoor ROTH here. I think I did it all wrong and now my 8606 is not what I expected. Any advice or insight would be extremely appreciated. Below are the details.

3/22/19: SEP & pre-tax IRA conversions to Roth IRA completed ($1,426)

April 2019: Due to income limitations, Roth recharacterization for tax year 2018 to Traditional IRA. Form 8606 filed for post-tax portion. NIA (net income attributable) amount is also in that IRA.

At the end of 2019, there is 1 remaining Traditional IRA account that holds post-tax and a small amount of taxable (from NIA and earnings) money. Yes, I failed to convert it to a ROTH in 2019.

Roth IRA: 2019 Conversion from 2 IRA Accounts: $1,426 (not taxable going forward)

Traditional IRA:

Recharacterization $3,720 (post-tax)

NIA $163.16 (taxable)

Earnings $55.19 (taxable)

April 2020: Roth recharacterization. The original $6,000 Roth contribution for 2019 was made on 1/2/19 before I was aware that I was starting to hit the contribution ceiling. So this year, I will need to recharacterize $4,240 plus the NIA.

I expected the full $1,426 amount from the pre-tax IRA conversion in March 2019 to be fully taxable (line 4a of 1040) for 2019, but the H&R Block 2019 software I am using is showing $874 of it as taxable and the remaining $552 is used to reduce the basis of the post-tax amount in the Traditional IRA where the recharacterized money was moved (via completion of Form 8606).

At the end of the day, I think it is sort of a wash. What confuses me is why the tax on the $552 would be deferred (since ultimately, it increases the taxable portion of the Traditional IRA).

Sue says

Mr. Sit,

I realize my situation above is a little convoluted, but do you know why H&R block is reducing the basis of my post-tax instead of just fully taxing me on my pre-tax IRA conversion? Is this right? I tried calling H&R block, but all they can tell me is to update the software which is of no help. Thanks, Sue

Rob says

OK, I know you said “You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion during the same year. Don’t wait until the following year to contribute for the previous year.” But I did it before I read it. So did it in early January so didn’t get any official tax document on the contribution or conversion. If I enter everything per you guidance, says I can’t file electronically. So still think I am doing something wrong. Or should I submit with out the 1099 & 8606 and send those in later?

Richard says

Thanks this is exactly what I needed. The online help was useless.

Chunkai says

Hi,

Thanks so much for this awesome guide! It really helps a lot.

I’m still preparing my 2019 tax return (I’ve postponed it) using H&R Block and got some issue on filling my backdoor conversion data.

So I’ve done a backdoor conversion in 2019. It’s my first year having IRA account and I don’t have any other traditional IRA basis. I deposited 6000 to my traditional IRA and then converted all of it to my Roth IRA one day after that. And it is until recently that I found out my MAGI is lower than the deduction limits. But I’ve already done the backdoor conversion and I’m happy to stick to that and make it non-deductible contribution. However when I follow your steps, the software just automatically mark my traditional IRA as deductible and the didn’t fill in any information in part 1 of form 8606.

Could you give me some advice how could I deal with this case?

Thanks a lot!

Harry Sit says

If you go with the output of the software, your IRA contribution is deductible and your Roth conversion is taxable. The deduction offsets the taxable conversion. You end up in the same bottom line as making the contribution non-deductible and not pay tax on that part of the conversion. You can try to override the software and make it do it your way, but because the end result is the same, maybe just go with how the software does it now.

Chunkai says

Hi Harry,

Thanks so much for your reply, and yes I think your suggestion is simpler and better!

Just want to confirm that my Forms were correctly generated: if I let my contribution to traditional IRA as deductible and then have the conversion to Roth IRA as taxable, I will have:

on Form 1040: box 4a, 4b, 8a, and Schedule1 box 19 all filled with 6000. (I don’t have other adjustment items)

on Form 8606: Part 1 left blanked. Part 2 box 16 and 18 both filled with 6000.

That would correctly make my conversion taxable, right? Have I missed any of the related boxes?

Harry Sit says

That’s correct. Line 4b makes the conversion taxable (which copies from Form 8606 line 18). Line 8a takes the deduction for the contribution (which copies from Schedule 1). 4b adds to income. 8a subtracts from income. You should also have it on Schedule 1 line 22, which is the sum total of lines 10-21.

Chunkai says

Hi Harry,

Got it! I was confused about many IRA-related questions asked on H&R Block and afraid that I might put wrong numbers in some of the fields.

Thanks so much for all your help! Really appreciate it!

Dan Blackledge says

Thank you, Finance Buff.

You saved me 20 minutes on hold from the whistling H&R Block cuckoo bird song.

Deleting saved forms…who knew? Certainly not their help system.

Dan B

DoctorO says

Thanks for this helpful post! One question about earnings: I accidentally contributed $6k directly into my Roth IRA in January 2020, and made $2k in earnings in my Roth before I recharacterized the $6k + $2k earnings into a traditional IRA this month. When I reconvert these back into my Roth IRA, do I have to pay tax on the $2k in earnings from the initial Roth contribution? I don’t have additional earnings from when my money was parked in my traditional IRA. Thanks!

Harry Sit says

You have to pay tax on the $2k in earnings transferred from your Roth IRA to your traditional IRA when you recharacterized. Recharacterizing makes it as if you originally contributed to the traditional IRA. The $2k would’ve been earned there.

Jessica Boyd says

Thank you for this post. I unfortunately contributed to Roth in 2019 then recharacterized and then did the backdoor conversion in 2020. I received 1099s for both the Roth and traditional IRA accounts. Why in this scenario do you indicate to skip over the first set of instructions that has you record the 1099 activity in the tax software and start with the Non-Deductible Contribution to Traditional IRA section? Thanks again.

Harry Sit says

“If you only contributed for the year in question but didn’t convert until the following year, skip all the way to the next section …” The year in question now is 2020. If someone contributed for 2020 in 2021 and converted in 2021, they should skip over the first section when they do their 2020 tax return. You would’ve skipped the first section when you did your 2019 tax return last year. You shouldn’t skip again now for your 2020 return.

SATYA SWAROOP says

Guide me on this please.

I had my old 401k rolled over to traditional IRA in 2020. I was also contributing to my Roth IRAs. I then converted my rolled over IRA to Roth IRA in 2020

On my spouse, I had originally contributed for 2020 in Traditional IRA, and then converted the whole Traditional IRA to Roth IRA.

How do I go about with this.

MFMeow says

Thank you! This was my first year doing a backdoor Roth and I was perplexed; was unclear on the “Do you have a recharacterization?” question. Your very clear instructions were exactly what I needed. Appreciate the advice.

dac says

I used the instructions above and the backdoor Roth is now reported correctly on my federal return, but it’s still showing as taxable on my state return (Massachusetts). What am I missing? How do I adjust this in the H&R block software so it’s not reported as a taxable IRA distribution on the state return?

Harry Sit says

You probably need to enter somewhere in the state Q&A to say how much of the distribution was contributions already taxed by MA.

“For Massachusetts purposes however, distributions made are excluded from gross income if these distributions equal your Massachusetts previously taxed contributions.”

https://www.mass.gov/service-details/view-non-government-pensions

Anthony Grover says

Extremely helpful article but I still have a major issue. Scenario: Both my wife and I contributed $14K to new traditional IRAs in 2020 (including $7K each for 2019). Additionally my wife had a $2909 IRA she rolled into her new IRA. We then converted the totals for both traditional IRAs to Roths (my $14K and her $16,909). The software went back to our 2019 return and retroactively added the total of $14K for that year (which we paid in 2020). Strange but true (2019 Forms 8606 show $7K contributions for each) and helpful for this year. My problem is this: after working through your process, $9909 of our total $30,909 IRA distributions still show as taxable income. The $2909 rolled over, and another $7K assigned to either me (age 62) or my wife (age 57). IRA contribution results follow: Traditional IRA contributions – $7K for both of us. Traditional IRA deductions – $7K for wife, $0 for me. Any suggestions for how I can solve this incorrect taxable income assignment would be greatly appreciated.

Harry Sit says

If your income allows your wife to get a tax deduction for her IRA contribution because she’s not an active participant in a workplace retirement plan, the $7,000 deduction will offset the $9,909 taxable income, making you pay tax on net $2,909. The bottom line is the same as making the contribution non-deductible and only pay tax on the $2,909 converted to Roth.

Shawn says

Hi Harry, here’s my situation-

-I began contributing to my roth IRA in 2020 ($1,200). I realized I would have come close to the income threshold for roth contributions, so I recharacterized this amount to a new traditional IRA I opened (did not have a traditional IRA prior to this). The value of the $1,200 was ~$980 by the time I recharacterized to the traditional IRA, so I do not have to pay any taxes on gains.

-I maxed out the remaining 2020 contribution of $4,800 to my traditional IRA (kept it all in cash to avoid any gains) and then converted the entire amount of $5,780 ($4,800 + $980) to my roth IRA.

-I subsequently rolled over an old 401k to the traditional IRA.

-I entered the 3 1099-R’s (recharacterization of 980, conversion of 5,780, and rollover) correctly. I then filled in the IRA contributions (1,200 roth IRA contributions which I recharacterized to traditional, 4,800 traditional IRA contribution). I followed your steps and correctly entered the in the conversion. I believe I also entered the roth recharacterization correctly.

However, my 2020 contribution of $6,000 appears as a deductible traditional IRA contribution. The issue could be that I’m using the online version? Is there a way to manually fill out form 8606 so that the system knows that the amount is non-deductible? Thanks in advance for your help – much appreciated.

Harry Sit says

Did you already enter your income (see the heading ‘W-2 Box 13’)? If the software sees your income as under the limit for taking a deduction, it’s going to make your traditional IRA contribution deductible. Did you also enter your year-end IRA balance because you rolled over an old 401k to the traditional IRA? Having a balance at the end of the year triggers the pro-rata rule. It makes your conversion partially taxable even when your contribution was non-deductible.

Shawn says

Thanks for the prompt reply, Harry.

I already entered my income. I think the system is deducting the traditional IRA contribution because box 13 (retirement plan) is unchecked on my W-2. My employer does not have a 401k plan. We do, however, have a discretionary profit sharing plan, in which the employer makes discretionary contributions at year-end to a retirement account. If profit sharing plans do not count as employer retirement plans, I suppose I can take the full IRA deduction? Note – I’m a single filer.

Thank you for pointing out the pro-rata rule. It looks like I made a mistake by rolling over the old 401k into the traditional IRA. Do you know how I would calculate the total basis in the traditional IRA? Would it just be the total contributions that I made to 401k (excluding any gains earned on the contributions)? For example, if I contributed 25,000 to the 401k and rolled over 30,000 (5,000 being investment gains), would the total basis in the traditional IRA be 25,000? I really appreciate your help – struggling with this.

Harry Sit says

Profit sharing plans count as employer retirement plans. If you receive a contribution for plan year 2020, you’re considered an active participant.

https://www.irs.gov/retirement-plans/are-you-covered-by-an-employers-retirement-plan

Basis refers to after-tax contributions. If your old 401k only had pre-tax contributions, your basis in the $30k rollover is zero.

Shawn says

Got it – thank you. I guess my employer made a mistake on the W-2 by keeping section 13 unchecked? Am I required to have them anend this?

Harry Sit says

You can ask them why it wasn’t checked. Maybe when they generated the W-2, the employer hasn’t made the contribution for 2020 yet. Have they already made the contribution by now or made any announcement on whether they will make a contribution? If they decide to skip it in 2020, you’re not an active participant. If you’re an active participant but the employer doesn’t show it on the W-2, you still have to represent on your tax return truthfully that you’re an active participant.

Shawn says

A coworker told me that employees only begin receiving contributions to the profit sharing plan after serving x amount of years at the firm. I will have to confirm this.

If I am considered an active participant, I will not be able to deduct the 6,000 IRA contribution. I will then have to pay taxes on 80% of the 6,000 (6,000 non-deductible contribution / 30,000 IRA value), and file form 8606 to show this. Note, I do not have any other trad IRA accounts. Is my understanding correct for this scenario?

If I am NOT considered an active participant, I WILL be able to deduct the 6,000 IRA contribution. I then have to pay taxes on the entire 6,000 I converted to my roth IRA. Would I still need to file form 8606, considering I would not be making a non-deductible IRA contribution for the year?

Thank you again for your help! You’re a life saver.

Harry Sit says

Definitely find out whether you’re eligible to receive discretionary profit sharing for 2020.

You can see the effect in the software by checking and not checking W-2 box 13. If you’re covered by a retirement plan, your $6,000 contribution is non-deductible, and 1/6 of the conversion is from after-tax dollars: $6,000 / ($6,000 + $30,000). You pay tax on $5,000. Your remaining $30,000 is now $5,000 after-tax, $25,000 pre-tax. If you’re not covered by a retirement plan, you get a deduction for your $6,000 contribution, and you pay tax on your $6,000 conversion. The two offset each other. You don’t pay any extra tax.

Either way Form 8606 will be needed because you converted but the software will take care of it.

Devin says

Hi Harry,

Great article, very helpful! I am married filing separately (due to the Income Based Repayment method on student loans) and just completed my 2020 taxes yesterday via HR Block’s online Deluxe package.

In my case, I have backdoor Roth IRA setup at Edward Jones such that twice a month I auto-deposit money into a Traditional IRA, and that money is then converted to a Roth IRA a day or two later. At the end of 2020, the balance in the Traditional IRA was $0.

Per your article, when doing my 2020 taxes, I first reported the 1099-R info regarding the Traditional IRA distributions, which went fine. The amount on the 1099-R form ($5000) then showed as income.

However, in the Adjustments section, the “nondeductible contributions” field was greyed out as $0. I could not edit this amount. Per some of your responses to other comments, I gather this is because I don’t have an employer plan? I would still think that I made nondeductible contributions since I have no need to claim a deduction due to converting those funds to the Roth IRA, but I guess this is just how the IRS does it? Or maybe just how HR Block does it?

That being said, the $5000 now shows as an adjustment (deducted from total income), so basically I am not being taxed on it. It was added as income, then subtracted as an adjustment. As long as I’m not paying taxes on it, I’m fine with it, but I wanted to make sure that this is the legitimate way to do it for my situation, and that it will be okay with the IRS.

FYI, when I downloaded my forms after completing my taxes, Form 8606 only shows Part 2 completed. Line 16 = $5000. Line 17 = $0. Line 18 = $5000.

And on Form 1040, Line 4a = $0. Line 4b = $5000.

Thank you!

Harry Sit says

That’s just how the software does it. If you qualify for an adjustment (“above-the-line deduction”), it’s going to make you take it even though the bottom line is the same. Please note when you’re married filing separately, you’re eligible for the adjustment only when both of you aren’t an active participant in a workplace retirement plan. If that’s not the case, when you tell the software your spouse has an employer retirement plan, the software will make your IRA contribution not deductible.