Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in the H&R Block tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are completing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the money was contributed for 2025, 2024, or any previous year.

Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done in 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 or if you recharacterized a 2025 Roth contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to the H&R Block desktop software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted your Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

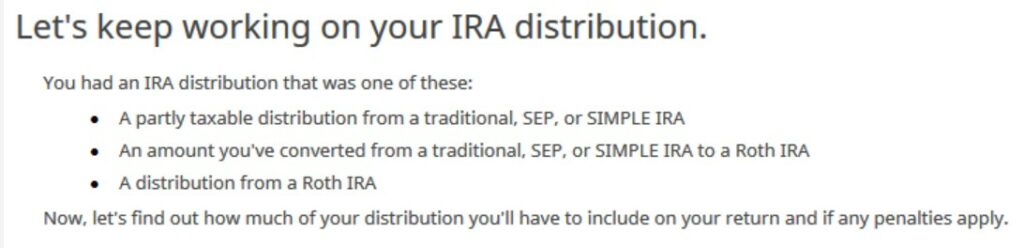

Convert Traditional IRA to Roth

Income comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-R

When you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now, and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

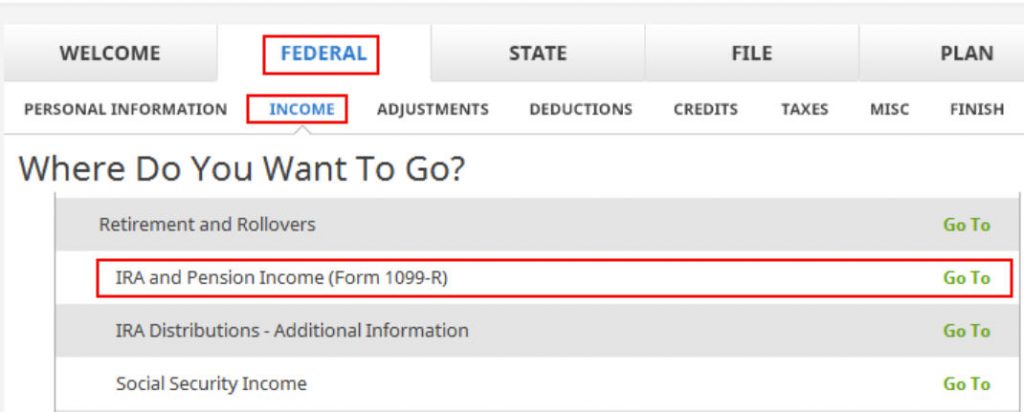

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

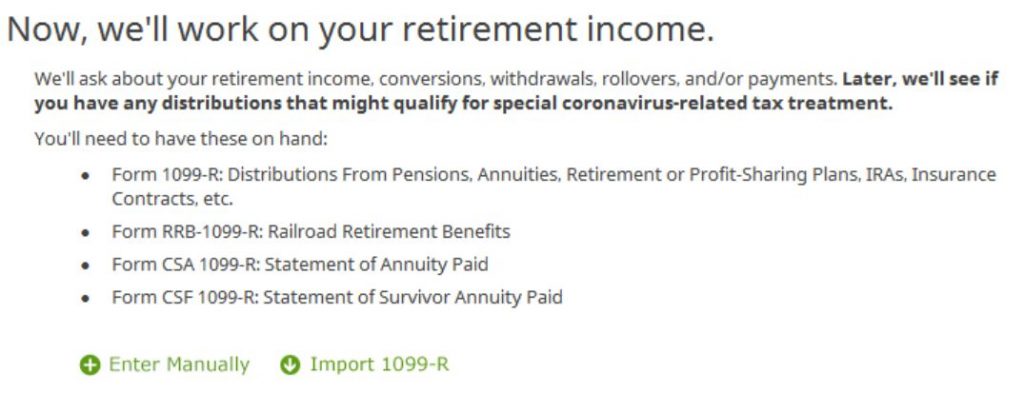

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

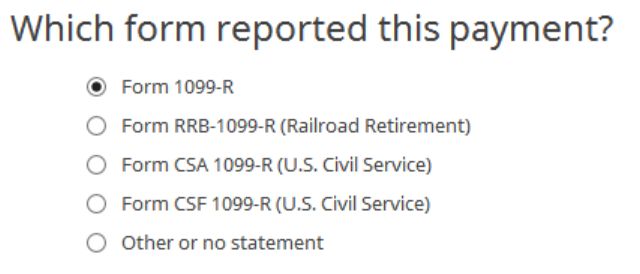

Just a regular 1099-R.

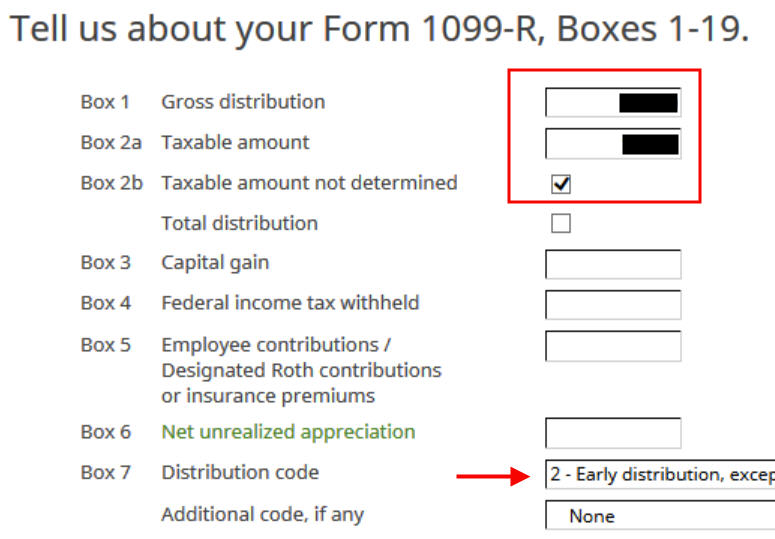

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, make sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

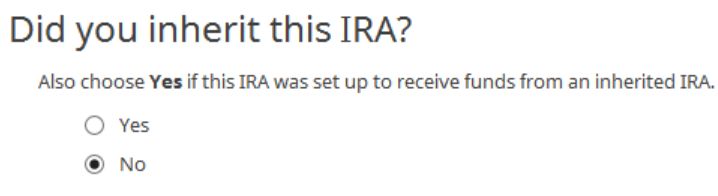

We didn’t inherit it.

Converted to Roth

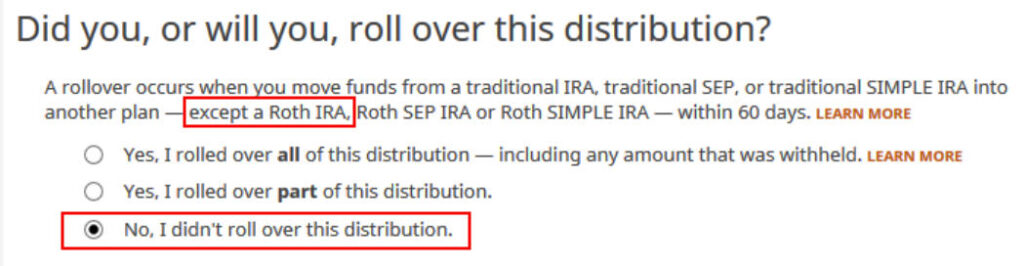

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these withdrawals treated as rollovers or basis adjustments.

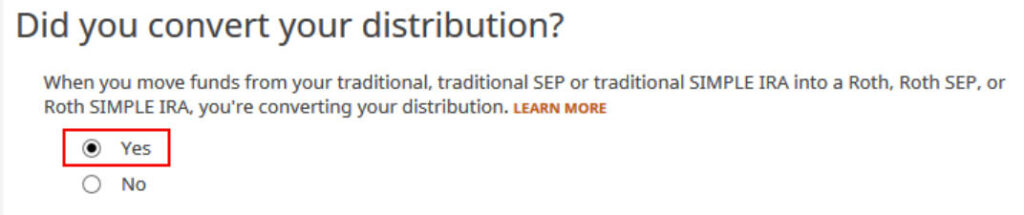

Now answer Yes, you converted.

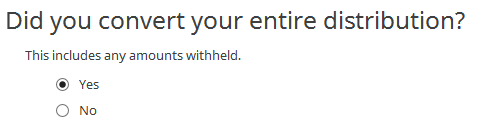

We converted all of it in our example.

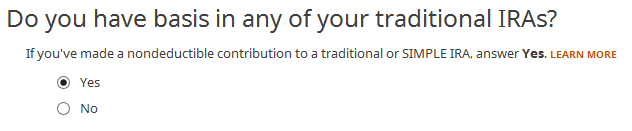

Answer Yes because you made a nondeductible contribution to a Traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section on IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

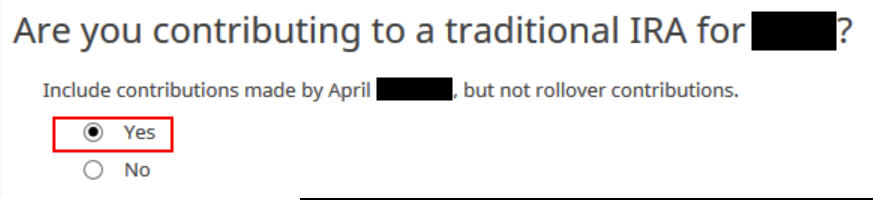

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRA

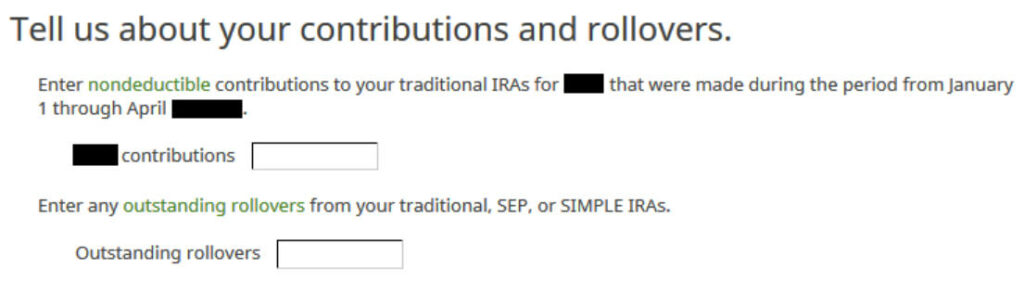

Now we enter the non-deductible contribution to the Traditional IRA *for* 2025 in 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

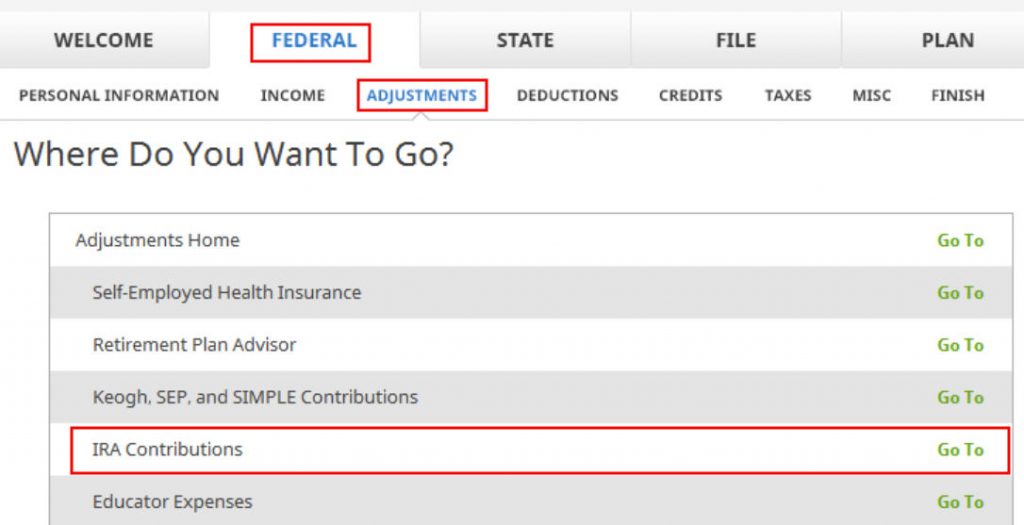

IRA Contribution

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

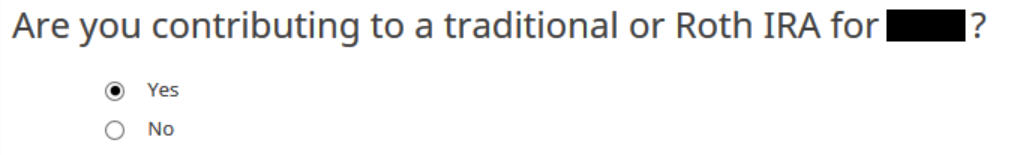

The question uses the wrong tense, but answer “Yes” because you contributed to an IRA for the year in question.

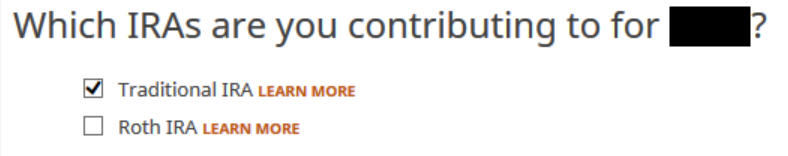

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

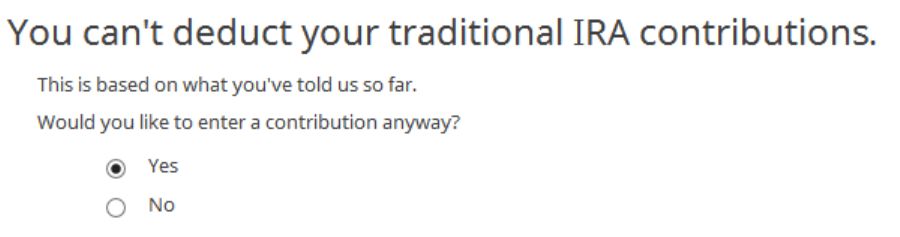

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

Conversion Isn’t Recharacterization

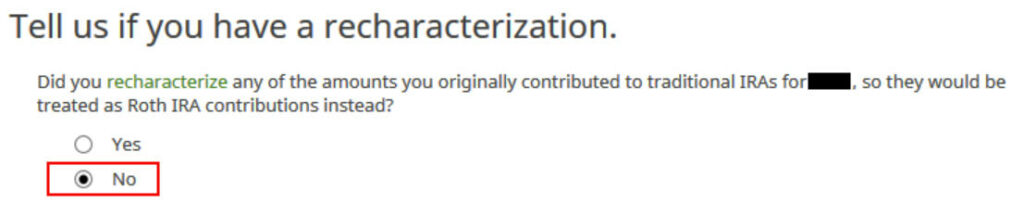

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

We don’t have any excess contribution.

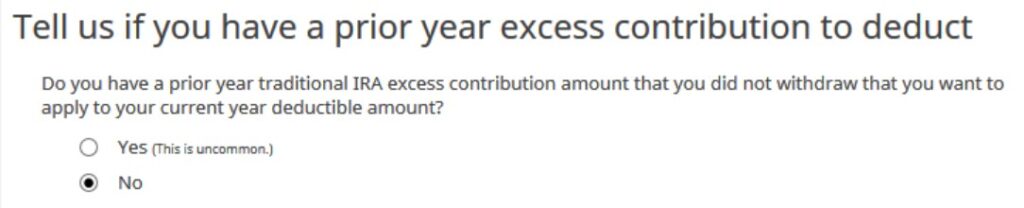

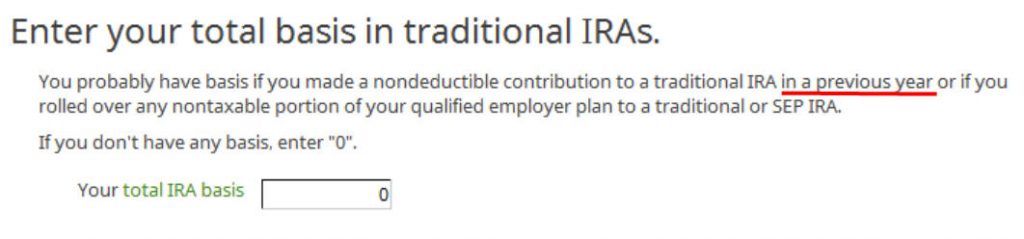

Basis From the Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

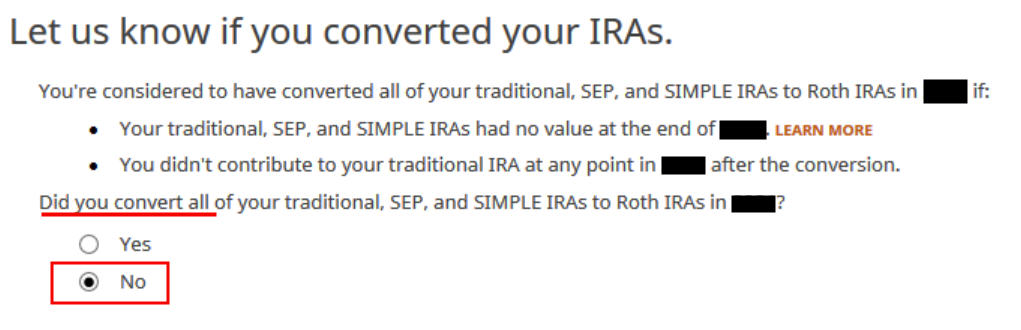

The Pro-Rata Rule

This is another important question. If you are doing it the easy way, as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have given some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

In a clean planned backdoor Roth, you contribute for 2025 during 2025. Leave the boxes blank.

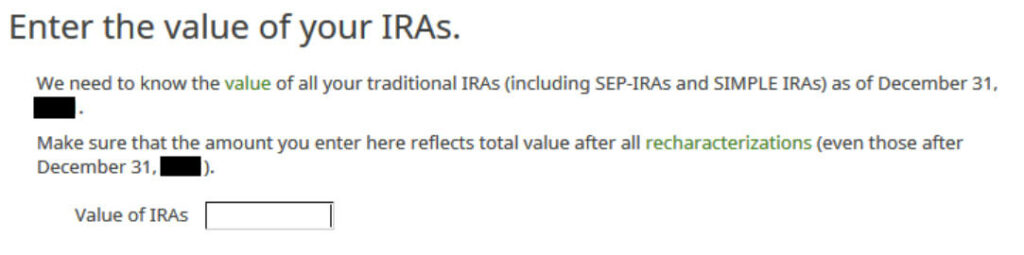

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

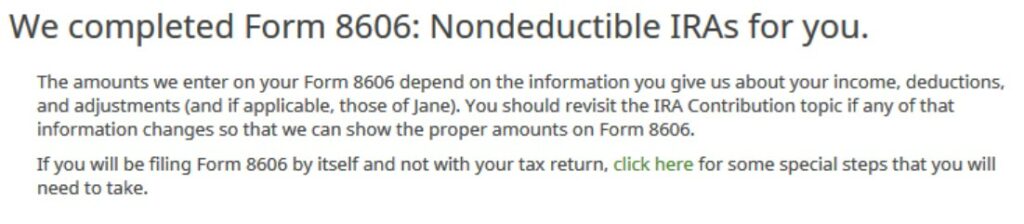

That’s great. We’re expecting it.

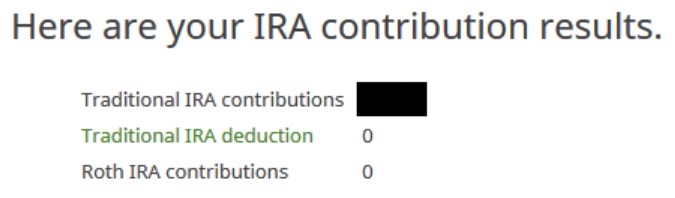

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Repeat this section for your spouse if you’re married and your spouse also did a Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

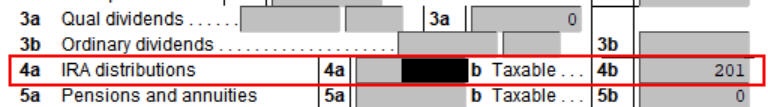

Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

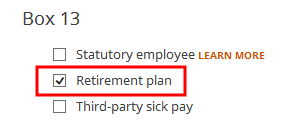

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

jcs94 says

Any chance we could get one of these guides for CreditKarma? (Ideally this year, but if not this year then can I put in a request for next year haha.)

Thanks!

Harry Sit says

Sorry, I’m not willing to give my SSN to Credit Karma. Use FreeTaxUSA if you want an inexpensive online service.

jcs94 says

I believe you can just type random numbers into the SSN field for CreditKarma, I’ve done that once when I wanted to simulate taxes in a different state when I was considering a new job.

Mike C says

Extremely helpful, thanks.

Raj says

Best walk through article on the internet. Comprehensive, clear, and well explained. This is my golden reference every year, especially when slightly different cases pop up. Thank you!

Randy says

Thanks so much for writing this article, it’s helped me a ton. I do have a question since my contribution and conversion years are out of sync. Can you see where I’ve gone wrong?

In 2020, I contributed $12,000 total to my traditional IRA ($6k for 2019, $6k for 2020) and also did the backdoor conversion to Roth for that $12,000 ($6k for 2019 Roth, $6k for 2020 Roth). My Traditional IRA balance at the end of 2020 was $0.

For 2019 taxes, I filed the $6,000 IRA contribution (made in 2020) that I put towards 2019. I did NOT file anything for the backdoor Roth conversion since that conversion happened in 2020. My basis on Form 8606 (line 14) was $6000. So far so good?

For 2020 taxes, my 1099-R shows $12,000, which, if I understand this form correctly, is the amount that left my IRA (distributions) and was converted to my Roth in 2020.

In the “Non-Deductible Contribution to Traditional IRA” section, I put

– $6,000 as my ‘Traditional IRA contribution’ (contribution made in 2020 for 2020 IRA)

– NO for ‘Recharacterization’

– $6000 for ‘Total Basis’ from 2019 8606 form (contribution made in 2020 for 2019 IRA)

Is this correct? I don’t put all $12,000 for my ‘Traditional IRA contribution’, do I? Even though all $12k was contributed in 2020, I already reported $6000 of it in 2019 taxes since that $6k amount was contributed in March 2020 (prior to tax deadline).

Then the other question is in ‘Let us Know if you Converted your IRAs’. Do I put NO for this since in 2020 I did a backdoor for my 2019 Roth? But then the follow up questions it asks me makes no sense since all my values are $0.

– I did not make any contributions to my IRA in 2021

– My outstanding rollovers is 0

– Value of IRAs is 0.

I think I’m doing something wrong but I can’t figure out what. I feel like I didn’t get to the “difficult” part of being out of sync between contribution and conversion. I can’t figure out where I’m declaring that I did the 2019 Roth Conversion in 2020. Also, when it asks for my IRA contributions for 2020, do I put all $12,000? Or do I only report $6000.

Thanks!

Harry Sit says

$6,000 basis from 2019 plus $6,000 contribution for 2020 is correct. Follow the screens in this post for the rest.

John Edwards says

Hi Harry, I contributed $6K to traditional IRA, then converted to Roth IRA. During the conversion I paid $800 in federal taxes and $200 in state taxes. This resulted in 2 1099-R statements. One 1099-R shows $5K as gross distribution and income with Distribution code “2” and the other shows $1K as gross distribution and income with Distribution code “1”. I followed your instructions for the first 1099-R but it is not clear how to tackle the second one, with distribution code “1” (this distribution went all towards federal and state taxes). My Roth IRA account has $5k, as I paid $1K in taxes. Please help.

Thanks, John

Harry Sit says

I tried it in my software. You enter the second 1099-R as-is with the numbers in the respective boxes and the distribution code ‘1’ in box 7. You answer the questions in the same way until it asks “Did you convert your distribution?” You answer ‘No’ there because the $1,000 didn’t go into your Roth IRA. Everything else follows the same way.

If your $6,000 contributions weren’t deductible, you shouldn’t have elected to have taxes withheld when you converted. Since you did, you’ll get the $800 and $200 back as a tax refund from the IRS and your state. It’s as if you only contributed $5,000 and converted $5,000. It’s not ideal but it’s not the end of the world either. Just remember to choose no tax withholding when you convert next time.

JM says

What is the procedure for just converting partial amount from traditional IRA into a Roth (and no contribution for the year)? Is it above? I followed along but my refund went down alot (ie, did not come back up) but i think that is because of the no contribution? I am using last year’ software to mimic how much I can convert this year without changing brackets.

Thanks

Harry Sit says

Because a straight conversion is taxable, it’s normal to see the refund going down unless you have existing nondeductible contributions in the IRA. The process is the same as the first part of this post under “Convert Traditional IRA to Roth.”

JM says

Do you know what boxes are applicable and their entries on the 1099-R would be for this conversion?

Harry Sit says

I have a screenshot of the applicable boxes in the post: 1, 2a, 2b, 7 (code 2, IRA box checked).

JM says

I thought that was for a back door and the money i am converting has been in the traditional for a long time. I am not contributing to the traditional any more and am beginning this year to convert the monies to a new Roth.

Harry Sit says

The 1099-R looks the same. The IRA custodian doesn’t know whether you took deduction or not.

Al says

I have an uncommon 401K backdoor contribution question. Can you tell me how to enter the following into HR Block. The transaction include an after tax 401K in plan conversion in November. Then my company decided to change investment houses, so I wanted to stay with the original investment house so I transferred most of my money from the 401K to personal IRA with the original investment house. (a direct transfer from 401K to IRA) I left some money in the 401K so that the accounts did not get closed.

I am older than 61.

I contributed 8000 in after tax money to my 401K IRA (non-Roth) in 2021.

In Nov 2021 did an in-plan conversion of 4000 from that IRA to Roth. (details show 200 taxable).

Here is a summary of the conversion and transfers.

November: in-plan conversion of After Tax to Roth: 4000 (transfer shows $200 taxable).

December:

After Tax Money moved from 401K to Roth IRA: 2000 (transfer shows $0 taxable)

Pre Tax Money moved from the 401K to IRA (non-Roth): 5000 (transfer shows $0 taxable)

Roth 401K money moved to IRA Roth: 6500. (transfer shows $0 taxable)

I received 2 1099Rs:

1099-r #1: Roth Transfer has Box 1 and 5 set to 6500, code H. (This presents little difficulty)

1099-r #2: Box 1 is 11,000, Box 2 is 200 Box 5 is 6000, code G. (excludes 5000 IRA Transfer)

Harry Sit says

Your transactions were all from a 401k. They’re unrelated to the topic in this post, but this other post should help: How To Enter Mega Backdoor Roth In H&R Block Tax Software.

Before you follow the steps there, break your $11,000 1099-R into two. One with $5,000 in box 1 and $0 in box 2, and $0 in box 5 for the pre-tax to pre-tax rollover. This should be straightforward with $0 tax. Follow the steps in the mega backdoor Roth post with the second one with $6,000 in box 1, $200 in box 2, and $6,000 in box 5.

Pat says

Hi,

Thanks for all the great information here. I am doing my taxes for 2021. What should I put in my Traditional IRA basis for 2021 if I contributed $5600 in a traditional ira in 2020 then converted all of it into a roth ira subsequently on the same year (2020)? In line 14 on my 2020 8606 form, the amount is $5600. So would my basis be for my traditional ira then be $5600 (as this was the amount that I have on line 14 of my 2020 8606 form), or 0, since I converted/recharacterized the whole amount to a roth ira? thanks in advance.

sean says

For your case, “basis” is ‘0’ since you already converted to ROTH IRA – you have a clean slate. If you didn’t convert and you left your $5600 in traditional and you contributed again $x for 2021, then converted the whole amount $5600 + $x to ROTH in 2021, your basis would have been $5600.

Pat says

Hi again,

I am still so confused in filling up the forms using H&R block for my backdoor roth. Any help is greatly appreciated.

For 2020 tax year, contributions from roth ira worth $5600 was recharacterized to traditional ira on 02/16/2021. The traditional ira didn’t have any funds prior; on 02/18/2021, the entire rechararacterized ira was converted back to a roth ira. For tax year 2020, I submitted form 8606 to indicate the recharacterized funds of $5600 as nondeductible contributions. For tax year 2021, I received two 1099-r forms, one indicating the recharacterization in the amount of $6117, and the other form for the conversion in the amount of $6092.

It is correct to assume the following:

– The $5600 which was recharacterized in will be my basis for my traditional ira?

– For tax year 2021, I am contributing to a Roth ira and not to a traditional ira?

– This roth ira contribution was recharacterized to traditional ira and later on converted to roth ira?

– so essentially I have zero traditional ira contributions but have $6117 roth contributions?

Thanks in advance.

Pat

Harry Sit says

Your description differs from your description in the previous comment. Assuming your latest is correct, your basis in the Traditional IRA as of 12/31/2020 was $5,600. If these are the only things you did in 2021, you didn’t contribute to either Traditional or Roth IRA for 2021 in 2021. You converted $6,092. You’ll pay tax on $492. You can still contribute to either Traditional or Roth IRA for 2021 before April 18, 2022 depending on your income eligibility but that’s separate from what you described here.

Pat says

Thanks for the clarification Harry!

So, after editing my data in H&R block, the summary that shows up on my IRA contribution results show

Traditional IRA contributions 0

Traditional IRA deduction 0

Roth IRA contributions $6117

Is this correct?

Also, on Form 1040 line 4a, it should show $6092, and 4b should show $492, right?

Thanks again for your kind help!

Pat

Harry Sit says

The $6,117 Roth IRA contribution shouldn’t be there.

Pat says

That’s weird… I imported the 1099-R from Vanguard that pertains to the recharacterization of $6117 (it had the R on box 7), followed your instructions, and that is what my summary ira contributions result to. On my 1040, I don’t see that amount anywhere; it is just on form 8606. What do you think could I have done wrong? I started ‘fresh’ twice already. Thanks again,

Pat

Pat says

Ok so I started ‘fresh’ again today and this time it shows :

Traditional IRA contributions 0

Traditional IRA deduction 0

Roth IRA contributions 0

Also, the recharacterized amount of $6117 does not show on the 8606; it is the amount of $6092 that shows on line 16 of form 8606.

I finally got it right thanks to your help!

By the way, I hope you can answer this, but also in 2021, I withdrew $3000 from my ROTH IRA, and so I received another 1099-r regarding this as an early distribution. I then went on to my ROTH IRA account, and after subtracting the recharacterization, I still have a Roth basis of $12483. Now going on to H&R block, in ROTH IRA distribution section, it is asking this:

In 2017-2021, did you convert a traditional IRA or roll over an amount from a qualified retirement plan into your Roth IRA?

Yes or No

Should I answer Yes, since in 2021, I recharacterized $5600 from ROTH to traditional, then subsequently converted it back to ROTH IRA? And if I answer yes, the next question is asking me if I have any Recapture amount in Form 5329, which I don’t, so it would be 0? Or should I answer ‘No’ to this question?

Answering yes or no does not seem to make any difference on my tax return.

Again, thank you so much in your guidance.

You are of great help to a lot of people.

Pat

Harry Sit says

Glad to hear you finally figured it out. ‘Yes’ and then 0 sounds correct. It’s trying to figure out whether your Roth IRA withdrawal came from your previous contributions (Roth basis) or a conversion. The withdrawal is tax-free when your Roth basis is large enough to cover your Roth withdrawal. If you can help it, don’t withdraw from your Roth IRA before age 59-1/2. Roth IRA withdrawals before 59-1/2 get quite complicated when you have a mix of contributions and conversions.

Pat says

Thanks again Harry! Yup I will defer from withdrawing from my ROTH IRA until I’m 60 at least; these tax forms can be quite complicated and confusing!

Al says

Thank you very much for your help!

Gidget says

Thanks for this article. Every year this is a headache for me, even though I do the “clean” backdoor conversion. And every year, H&R Block changes their UI and I am in misery again LOL. I made all the selections (0 cost basis, converted all 6k, etc.) but the summary shows a $6000 deductible under IRAs, which I shouldn’t have … *sigh*

Something with 8606 isn’t generating correctly.

Harry Sit says

It sounds like you’re using H&R Block Online. The H&R Block downloaded software works as expected. If you’re too far along this year, switch next year.

Gidget says

Just find out their online 8606 form will not be available until February 16 now…

Jason says

Thank you for the article! After going through the steps above and continuing through the software’s standard questionnaire, I eventually get to a screen in the “TAXES” tab called “Tell us about any additional taxes and penalties,” and the following box is automatically checked: “Excess accumulations (not enough withdrawn) from a retirement plan, Section 457 plan, or IRA in 2021.” I am not able to uncheck the box, and the software then brings me to questions asking for “required distribution” and “amount distributed.” Is this expected?

Harry Sit says

It’s not expected. Look into why the software thinks you must withdraw from one of those accounts. Did you tell the software you recharacterized your contributions to a Roth IRA when you should’ve said you converted?

Jason says

Thank you for the reply. I followed the steps closely again and everything looks right, but the interview box that comes up later for excess accumulations is still automatically checked. I’m not sure what’s causing it. The 8606 looks accurate though.

Harry Sit says

I just tried it. Those questions aren’t related to your backdoor Roth. If you don’t have an inherited IRA and you’re not yet 72 years old, you’re not subject to the Required Minimum Distribution. You can hit “Skip” when it asks you about Excess Accumulations or you can hit Next and enter 0 for the next two questions on your Required Minimum Distribution and the amount actually distributed to you.

AR says

I have a clean backdoor Roth for spouse and myself. Have been doing this successfully at H&R block for 2 years previously and this year I’m getting an error message “Since [spouse] contributed more than $6,000 (the maximum allowed) to your Traditional IRA, we’ll add a 6% penalty to your return…” I’ve checked both the 1099-R entries and the Traditional IRA interview multiple times with no luck. I spoke to H&R Block support and they weren’t able to figure it out. Furthermore, even if I play along and say she put too much in Traditional IRA in the penalties section, it doesn’t resolve the issue. Wondering if anyone else has had issues and this may be a bug.

Harry Sit says

See the troubleshooting section. Open the IRA contribution worksheet and see why the software thinks [spouse] contributed more than $6,000 to the Traditional IRA. Sometimes your previous answers are stuck in the worksheet you no longer see in the interview.

VL says

My 1099-R

1 Gross Distribution $6000

2a Taxable amount $6000

Taxable amount not determined (X)

Total Distribution (X)

7 Distribution code 2

IRA/SEP/SIMPLE (X)

My “Total distribution” is different than yours, its checked.

Please, advice what should I do different.

VL says

After I followed my 1099R (I did Total Distribution (X) as it shows in my form):

Traditional IRA contributions 6000

Traditional IRA deduction 6000

Roth IRA contributions 0

Please, advice.

Harry Sit says

Having the Total Distribution box checked is fine. See the section on W-2 Box 13 in Troubleshooting. The software thinks your Traditional IRA contribution is deductible because you didn’t tell it you’re covered by a workplace retirement plan.

VL says

Thank you for your reply, Harry.

But my W2 Line 13 Ret. Plan IS NOT checked…

Harry Sit says

If you indeed didn’t actively participate in a workplace retirement plan, you’re all set with no issues unless you’re married and your spouse actively participated in a workplace retirement plan.

Nick Kozdras says

I’m recording my wife and my previous years’ IRA and Roth IRA histories using H&R Block Premium Online.

Tell us about any traditional IRA contributions and distributions you had before 2021.

My wife and I each contributed to an IRA in previous years, and rolled our IRAs into Roth IRAs in 2010 and 1998, respectively. Should these rollovers be entered in the “Distributions” or “Rollover of after-tax contributions” section of the “Tell us about your traditional IRA one year at a time” page?

Tell us about any Roth IRA contributions and distributions you had before 2021.

My wife and I each rolled our Traditional IRAs into Roth IRAs in 2010 and 1998, respectively. Should these rollovers be entered in the “Total conversions” or “Nontaxable converstions” section of the “Tell us about your Roth IRA one year at a time” page?

Harry Sit says

I’m not sure why you were asked for contributions and distributions one year at a time. It’s not part of the normal flow for backdoor Roth. If there was a question on whether you want H&R Block to track history for you before these, you could say no.

Gina says

Harry, would you please provide some guidance on how to handle this situation? 1) I made Roth IRA contribution of $6,000 in Jan 2021 for 2021, but I just realized my 2021 income is over the Roth limit. 2) I opened a traditional IRA account in Feb 2022 to recharacterize all 2021 Roth contribution of $6,000 and its related gains (that is the only money in my traditional IRA account). 3) I did a backdoor Roth conversion to move all balance from traditional IRA to Roth in Feb 2022.

I am thinking 2021 Non-deductible contribution should be reported on Form 8606 in 2021 tax filing. What about the recharacterization in 2022 and the backdoor Roth conversion in 2022? Do I report them in 2021 tax filing at all or will I have to come back and finish the reporting when I file 2022 tax?

I know crossing years makes tax filing/reporting much more complicated, wish I had found out about that earlier. I read through your article and all other replies, but didn’t find solutions for my exact scenario. Thank you in advance for your help.

Harry Sit says

You tell it as it was. In the IRA contribution section, you say you contributed to Roth IRA (because you did originally). When it asks you whether you recharacterized, you say yes. Come back next year to do the conversion part. See Backdoor Roth: Planned vs Unplanned.

Gina says

Thank you so very much for your reply. So, when I report the backdoor Roth conversion in my 2022 tax filing, what is my basis carried over from 2021? I think the basis should be the original contribution $6000 with gain/loss, right? I had a loss at the time of recharacterization, therefore, the actual recharacterized and converted amounted is less than my original contribution.

Also, thanks for the link of the other article. It is very helpful for my future planning.

Harry Sit says

The basis carried over is just the original contribution without any gain or loss.

Gina says

Thank you so much, Harry!

Pritha says

Hi Harry,

I have a bit of a unique situation that I don’t see mentioned yet in any of these comments and maybe covered it in another article — but for tax year 2020, I contributed an excess amount of $ 1,004 to my Roth IRA (excess contribution was made in January of 2021) not realizing I was above the income limit, so this was then rolled over to my Roth IRA for 2021 tax year. I now no longer qualify to contribute to a Roth IRA, so I am having fidelity recharacterize the $1,004 to a traditional IRA, and then I will be doing the back door conversion to the Roth IRA before the april tax deadline. I am a bit confused on how to report all of this in the H&R block software. I received a 1099R form for the excess contribution which I have uploaded. When asked which IRAs are you contributing for 2021, do I click both the Roth IRA and Traditional IRA? and then when asked about traditional IRA contribution amount do I put 4996 as that’s what I’m contributing, but then will be converted to a Roth IRA? what would be my total IRA basis? 6,000? Then I would receive a 1099 form for tax year 2022 for the backdoor conversion? Any help would be appreciated!

Harry Sit says

You check both Traditional and Roth boxes and enter them separately. You contributed $1,004 to Roth in 2021 and recharacterized. You contributed $4,996 to Traditional for 2021 in 2022. Come back next year to do the conversion you will perform in 2022. Your basis will be $6,000.

Anish says

Hi Harry,

Thank you so much for the post! I have tried following the instructions multiple times and your suggestions for troubleshooting, but whenever I put in my information, it showed Traditional IRA contributions as 6000 and Traditional IRA deduction as 6000. In addition both lines 4a and 4b show 6000. I can’t figure out where I am making the mistake. Any help would be amazing! Thanks!

Harry Sit says

Your Traditional IRA contribution is deductible when you’re not an active participant in a workplace retirement plan such as a 401k. See the section on W-2 Box 13. If you indeed don’t have a workplace retirement plan, the software did it correctly.

Arun says

Regarding “Do you have any basis in any of your traditional IRAs?”, this article says “Answer Yes because you made a nondeductible contribution to a traditional IRA.” However, I believe that this is asking about existing basis from PREVIOUS taxes years (e.g. if filing for 2021, it’s asking if you have any basis from years through 2020, NOT including 2021), if I’m not mistaken. Therefore, the answer to this question depends on that, and is not just “yes.” In fact, I imagine that most people probably do not have basis and therefore should answer “no” (in most cases, depending on your personal situation). Does this sound right?

Arun says

Follow-up: Or, more precisely, I think that the question is asking about non-deductible traditional IRA contributions that have not yet been converted (which may include the current year?). Some confirmation and clarification would be appreciated.

Harry Sit says

When you answer “Yes” you’ll still have an opportunity to say it was zero when it asks what your basis from the previous year was. You don’t want to close the door prematurely.

Arun says

@Harry Sit, but why answer “yes” and then later say $0? What’s the point?

Harry Sit says

Because that question is vague and you don’t know whether it’s asking about the previous year, the current year, including the contribution, or not including the contribution. In other words, exactly why you asked how you should answer that question.

Pritha says

Hi Harry,

Thank you so much for the response — it was very helpful. My total IRA basis for the traditional IRA would be 0 for this year correct and then 6000 for next year? As this is the first year that I am contributing to a traditional and then converting back to a Roth?

Jerry says

Hi Harry,

– I contributed $2500 to my Roth IRA in 2021. Then, later in 2021, I recharacterized the entire original contribution to my traditional IRA, along with $435 in gains.

– I then contributed $3500 to my traditional IRA and converted the entire $6435 traditional IRA balance to my Roth IRA in 2021.

– I followed your instructions for how to enter this in the downloaded H&R Block software, but the taxable amount is still coming out to almost $4000 instead of the $435.

– I notice if I put $3500 as the total IRA basis then the taxable amount is $438 which seems a lot more correct, but I never contributed to a Traditional IRA before 2021 and never had to fill out a form 8606 before.

– I have a 1099-R for the backdoor Roth conversion where the $6435 is listed as a taxable amount.

– I also have a 1099-R for the $2935 Roth to Traditional IRA recharacterization where the taxable amount is blank.

Would you happen to know what the issue is?

Jerry says

I found out the issue was I accidentally stated that my original $3500 traditional IRA contribution in 2021 was also contributed between Jan 1, 2022 – April 15, 2022 which made the taxable amount ~$3500 than it should have been.

Jared says

My wife and I each contributed $6,000 to traditional IRAs and then converted those full amounts to Roth IRAs as we have done for the last several years. Although I entered the information for each of us identically, the software is showing my full conversion as non-deductible, but is only showing my wife as having $5,800 that is non-deductible and having an amount of $200 that is deductible. I am the only earner and have a workplace retirement plan. In the past, both of our forms showed the full amount as being non-deductible. Any ideas why the software is treating our contributions/conversions differently?

Harry Sit says

When she’s not covered by a workplace retirement but you are, she has a higher income limit for taking a deduction than you do. Your joint income must have been higher than her income limit in previous years but it was slightly lower than her income limit last year. Her $200 deduction offsets the income from the conversion. It doesn’t affect your taxable income.

Khrissy Griffin says

You are amazing – I was getting so frustrated trying to get the backdoor ROTH conversion to work in HR Block. Thank you so much for the thorough walk through with screen shots and explanations!!!!

George says

Hi, in my case, the software put the same amount in line 1 of f8606 on line 4, although I did make any contributions from January 1, 2022, through April 18, 2022. All contributions ($7000) was made in last April and converted to Roth IRA. What can I do?

Harry Sit says

Do you mean you *didn’t* make any contributions from January 1, 2022, through April 18, 2022? You must have mistakenly entered your contribution as having been made in 2022 before. Answer “No” to “Did you convert all of your IRAs?” in this screen and it will reveal your mistaken entry. Delete it.

https://thefinancebuff.com/wordpress/wp-content/uploads/2022/02/hrb-bdr-14-converted-all.jpg

Tom says

Hello Harry – thanks for this article. My problem is somewhat unique in that my wife and I each made $7k contributions to a tIRA, then converted it to Roth timely in 2021, for TY2020. For 2020, my 8606 had $7k in Boxes 1, 3 and 14 only. I think that’s correct. For TY2021, I made no further contributions (I retired in 2021), and received a 1099-R for the $7k. The way I have it entered, HRB shows only values in Box 16 and 17 of $7k, and $0 taxable amount for Box 18, so at the end of the day, it’s ok. It seemed like it should have been:

Box 1 $0

Box 2 $7,000

Box 3 $7,000, And “Yes” to in 2021 did you take…or make a Roth IRA conversion

Box 4 $0

Box 5 $7,000

Boxes 8, 9, 11, 13 $7,000

Box 14 $0 (Box 15 all $0)

Box 16 and 17 $7,000

Box 18 $0

Is HRB just taking a shortcut by using only Boxes 16 and 17 or am I answering one of the HRB questions wrong?

Harry Sit says

If the 8606 still comes out that way after you followed all the steps in the “Convert Traditional IRA to Roth” section with the exception of saying you didn’t contribute to Traditional IRA in the end and a $7,000 basis from the previous year, let it be.

Tom says

Thanks again, I’ll let it be, let it be, let it be, yeah let it beeeeee. Thanks for the words of wisdom.

Lynda says

My husband and I both did backdoor Roth last year ($6K for him and $3K for me). I used the online version and we were going to owe $7K in taxes. It was throwing an error I could not fix, no matter how many tries. I downloaded the software (per your advice) and redid the entire return, following your instructions. It showed a refund of $140. Thank you so much!!!

I am still flabbergasted at how much the online and desktop versions differ…

Larry says

With no other Trad IRA, in 2021 I made a contrib to a new Trad IRA for 2020, 2021 and then immediately converted all to my Roth, for a clean backdoor Roth conversion. I’m assuming nothing is taxed.

But my spouse has an existing trad IRA. I’m hoping that’s not counted when determining owed taxes??? We file jointly. But I can’t find the answer to this. I didn’t go through H&R yet, but will soon. Thanks!

Harry Sit says

That’s correct. Each person’s IRA contribution, conversion, and balances are tracked separately. The “I” in IRA stands for Individual.

Boubazzoula says

In Feb 2021, I opened ROTH and traditioonal IRA accounts.

By mistake I put 8000 into ROTH with 1000 for 2021 and 7000 for 2020.

The same day I realized my mistake and called vanguard who did a recharacterization and put the money back in IRA, I used backdoor convertion to put the money in ROTH IRA. and later in the year I added 6000 to traditional IRA and used the backdoor convertion to get it to the ROTH IRA account. I ended up with 7000 in ROTH for 2020 and 7000 for 2021 and zero dollars in traditional IRA.

My issue is I received 2 1099R documents and I am not sure how to report this in H&RBlock. However I enter the info I end up with having to pay taxes on this money which I don’t believe is correct since the money is already taxed and my work place provides backdoorconversions.

The ROTH IRA 1099R form has in box 1 Gross Distirbution 1000, box 2a: Taxable amount: 0, Distribution Code N

While Traditional IRA 1099R form has in box 1: Gross Distribution 14000.02, box 2a: 14000.02, box 2b Taxable Amount not determined (X), Total Distribution (X), box 7: Distribution COde 2, IRA/SEP/SIMPLE (X)

Below is the statement I received from H&R Block support:

“A Roth IRA conversion is a taxable event. The amount you choose to convert will be taxed as ordinary income. You must pay income taxes on any converted funds in the year of the conversion”

I believe this isn’ correct for backdoor conversions, I know taxes are owed on the growth of money in the Traditional IRA if/when converted but this isn’t my case.

First the money I am using was already taxed, second there is no growth and I am using the backdoor.

Would you please help me find the best way to report this.

Thank you

Harry Sit says

You recharacterized a 2020 contribution, which should’ve created a basis on your 2020 return, to be carried over to 2021. When it asks you about your total IRA basis, enter $7,000. All the other steps should be the same as in this post. The $7,000 basis plus the 2021 contribution of $7,000 offsets the $14,000 distribution.

Burak says

Thank you very much for the clear step by step description of this process. I was very stressed about how to handle this in my tax returns since this was my first time doing the backdoor IRA. I can get a good night’s sleep now.

Boubazzoula says

Thank you very much for all the explanations Harry!!!

Freda S says

I want to echo every single person in your comments who thanks you for your clear and follow-able explanations for the backdoor Roth using H&R Block. I was completely flummoxed earlier this year, took an extension, was flummoxed again – until i found your website and your section on this. Saved my financial sanity, Harry – thank you!! And now I’m a subscriber and am happy to get your advice all year long.

George S says

Here’s a heads up. I tried to complete the backdoor Roth BEFORE I entered my solo self-employed 401k data. No matter what I tried, the traditional IRA was listed as pretax and my 1040 line 4b listed my conversion as taxable. When I received my 1099 from my contractual position, I will try again. This will be after I list my 1099 income and list my 401k donation. Does this sound correct?

Harry Sit says

That’s correct. If your income isn’t high enough or you don’t show that you’re covered by a retirement plan, your Traditional IRA contribution is deductible. The software will make you take the deduction.

Tyler says

Hello! First off, thank you for all of your help. Is there a place to help support you? I have a tax question I am hoping you can help me figure out. I recharacterized my 2021 contribution of 6279.62 in February of 2022. I also contributed and immediately converted my 2022 contribution in the same month. I now have two 1099-R forms. One for the traditional IRA that 12279.32 in boxes 1 and 2a plus another form for the roth IRA that has just the 6279.62. How do I file this? Is this where entering the basis of 6000 comes into play? Thank you!

Harry Sit says

You enter the 1099-R for the Roth IRA as-is. The code in Box 7 tells the software it isn’t taxable. You enter the 1099-R for the traditional IRA in the same way as in this post except when it asks you about your basis from the previous year, you answer $6,000 instead of 0.

doyle says

I’ve been using these instructions for several years and it’s been very helpful. Thank you.

B WO says

Thanks for updating again. I’m sure I will be using this guide as long as you update it and so long as this is allowed.

Sharath says

is the hrblock 2023 (2022 tax return) software good to use. i have seen lot of reviews saying it has issues, is slow and errors. i always use the online software but was wondering if the download verison will help me better both price wise and ease of use? any advise. thanks

Sharath says

also thank you for this amazing, amazing blog. your insight here is the reason I am thinking about switching to software version after doing it online all these years.

Harry Sit says

Downloaded software works better than online software. The H&R Block downloaded software doesn’t cover some corner cases but its online software likely doesn’t cover those either. The software isn’t slow. It’s easy to use.

Sharath says

thank you very much!!

i am sorry what do you mean corner case

Sharath says

got it, thanks a bunch!!!

Sharath says

got it, thanks a bunch!!

Sharath says

thank you very much!!

i am sorry what do you mean corner cases?

Harry Sit says

Situations that affect only a small percentage of people, such as having more than $20,000 in foreign sourced dividends or deducting interest on a mortgage above $750,000.

pw says

I am having problem getting the right numbers for form 8606 using H&R online

Background: I contributed in 2022 for 2021 and 2022 (both converted right away).

On the 1099 G section, am I suppose to be 12000 or 6000?

Other things I did during the deduction section

Page 1: checked converted traditional IRA and contributed to Roth IRA

Page 2: Total 2022 IRA contribution, I put 6000 and check off cover by employer retirement plan

Page 3: Left withdrawn blank

Page 4: Total value of trad IR as of 12/31/22 was 0.55, so system forced me to click did not convert all trad IRA accounts

Page 5: No to recharacterize

Page 6: Traditional IRA contribution before 2022: Put 6000 for total and fed nondeductible for 2021 year

Page 7: No to excess trad IRA contribution in prior years (I don’t see form 5329 in previous return)

Page 8: total IRA basis, I put 0

Page 9: Roth contribution: I put 0 as everything was converted

Page 10: Roth IRA value as of 12/31/22: I put 12000 taken from form 5498

Page 11: no to recharacterize roth ira

Page 12: left blank for roth IRA contribution and distribution before 2022

Page 13: IRA basis as of 12/31/2021: 0 for contribution and conversions

End result form 8606: taxable amount 6000

Line 1, 3, 5, 13, 17, 18 is 6000

Line 2 is 0

Line 4 is blank

Line 16 is 12000

Please help. Thanks

Harry Sit says

The amount for the 1099-R section should match the actual 1099-R you received. It should be $12,000 if that’s what the form shows.

> Page 8: total IRA basis, I put 0

This should be $6,000.

pw says

Thanks. I think that fixed the problem. At least just taxable amount of $1. Do I need to do any adjustments for last year’s taxes?

Harry Sit says

If you didn’t include a Form 8606 last year, you can find the prior-year form on the IRS website. Fill it out and sign it. It only needs $6,000 on Lines 1, 3, and 14. Attach a letter to say you forgot to include it and it doesn’t change your 2021 taxes. The mailing address is on the last page of Form 1040 instructions.

Liana says

Hi, ,my husband and I did a backdoor contribution for 2022, where we each made a $6,000 traditional IRA contribution in calendar year 2022, but it wasn’t converted to the Roth IRA until April 2023 prior to the end of the tax year. I followed your steps in our HR Block software, and it all matched up until I got to your Pro-Rata Rule section. For me in the software it just it just says it finished out 8606. I’m concerned it’s not complete because it didn’t even ask about converting it to a Roth IRA. We just said that we made the $6,000 contribution, it wasn’t recharacterized, and we had a zero basis.

Harry Sit says

If you didn’t convert in 2022, that’s the end of it. You report the conversion next year but you’ll have some confusion at that time. Do everything in one year next time. Contribute for 2023 in 2023 and convert in 2023. Contribute for 2024 in 2024 and convert in 2024.

Liana says

God bless you you sweet tax advising angel!