Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in the H&R Block tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are completing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it in 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the money was contributed for 2025, 2024, or any previous year.

Therefore, a contribution made in 2026 for 2025 goes on the tax return for 2025. A conversion done in 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 or if you recharacterized a 2025 Roth contribution to Traditional in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2025 Roth contribution to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to the H&R Block desktop software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2025 for 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other Traditional, SEP, or SIMPLE IRA after you converted your Traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a Traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

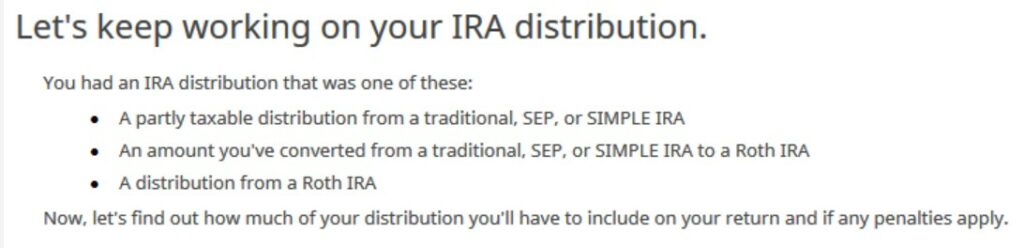

Convert Traditional IRA to Roth

Income comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-R

When you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted in 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now, and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

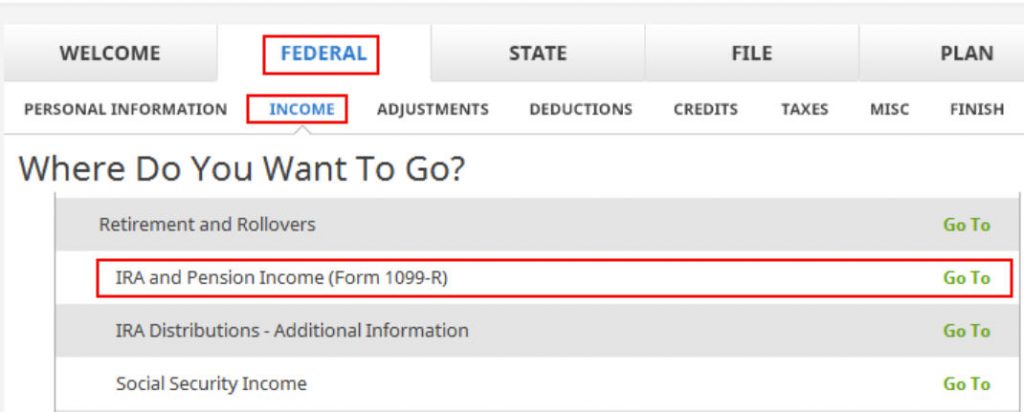

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

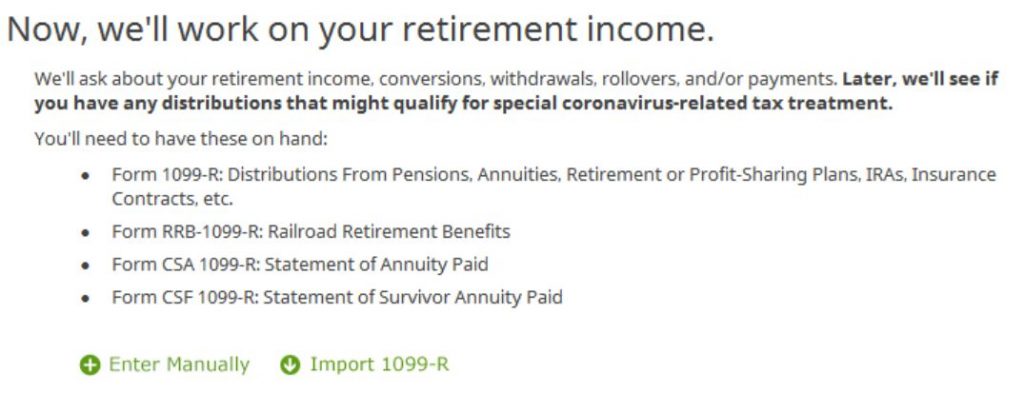

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

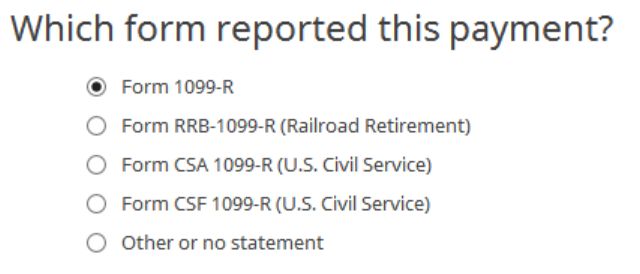

Just a regular 1099-R.

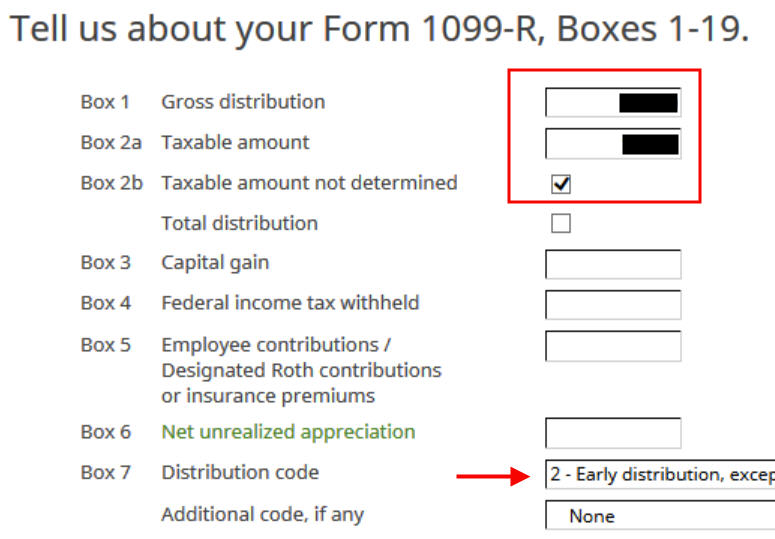

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, make sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

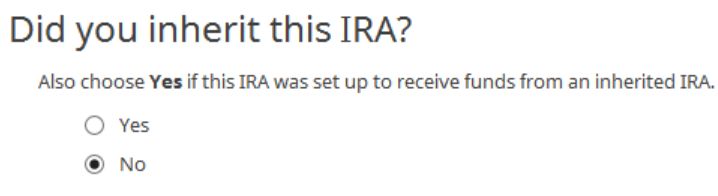

We didn’t inherit it.

Converted to Roth

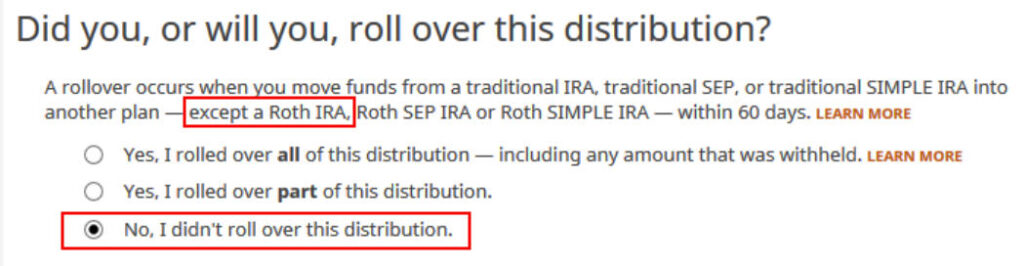

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these withdrawals treated as rollovers or basis adjustments.

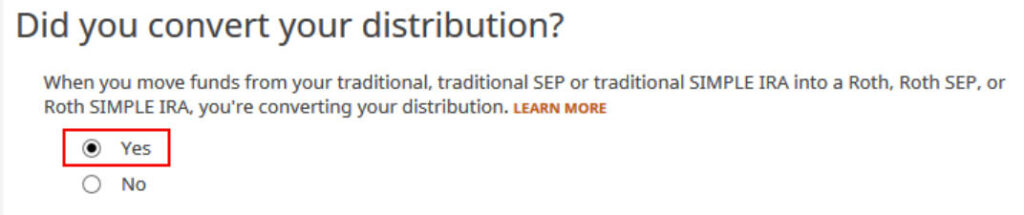

Now answer Yes, you converted.

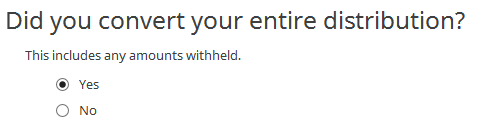

We converted all of it in our example.

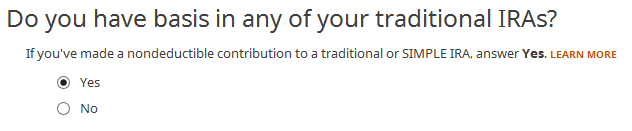

Answer Yes because you made a nondeductible contribution to a Traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section on IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

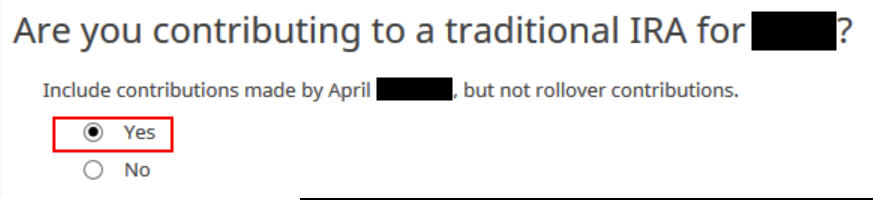

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to the Traditional IRA *for* 2025 in 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

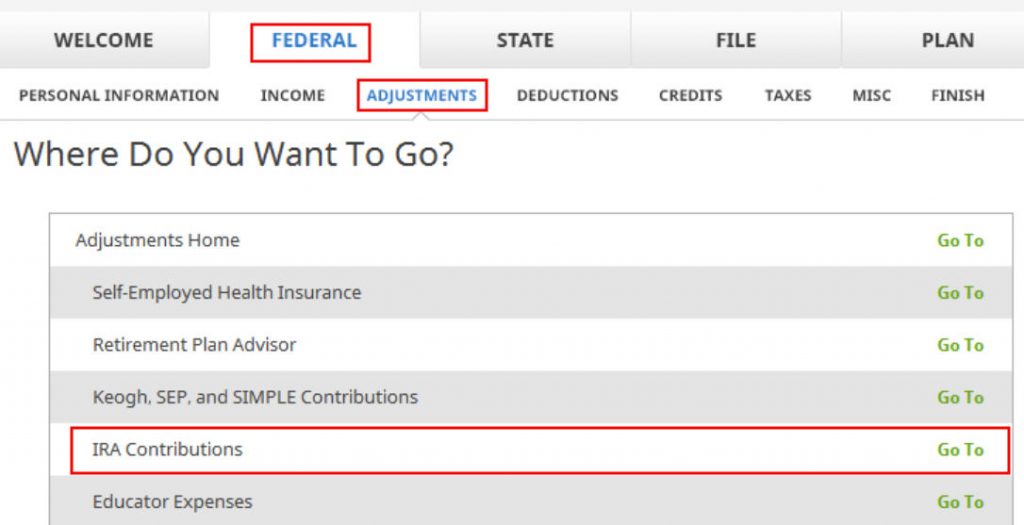

IRA Contribution

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

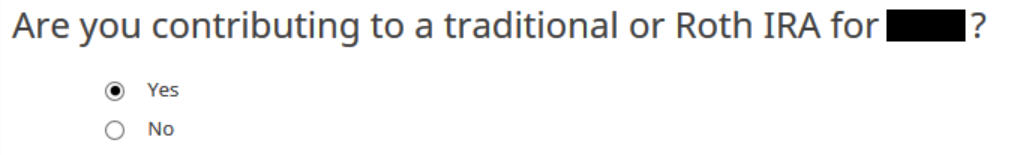

The question uses the wrong tense, but answer “Yes” because you contributed to an IRA for the year in question.

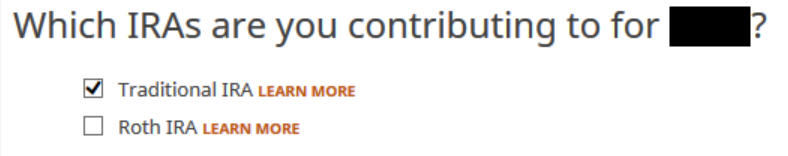

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

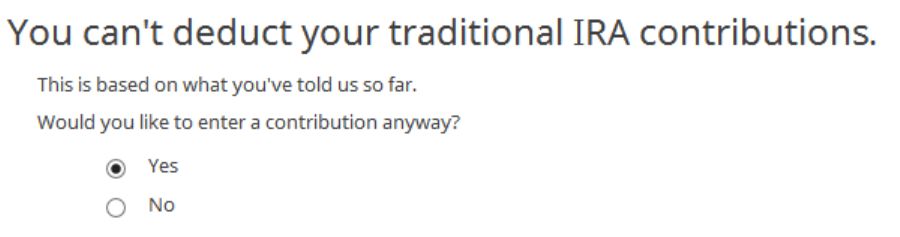

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

Conversion Isn’t Recharacterization

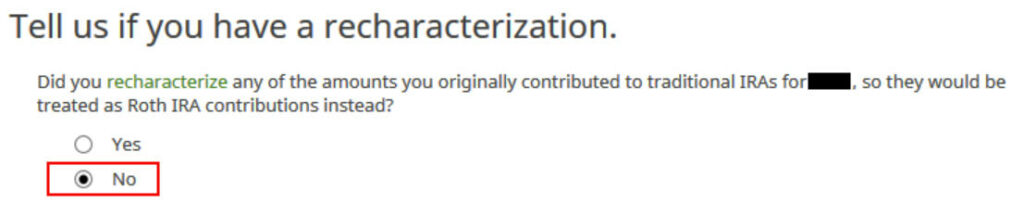

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

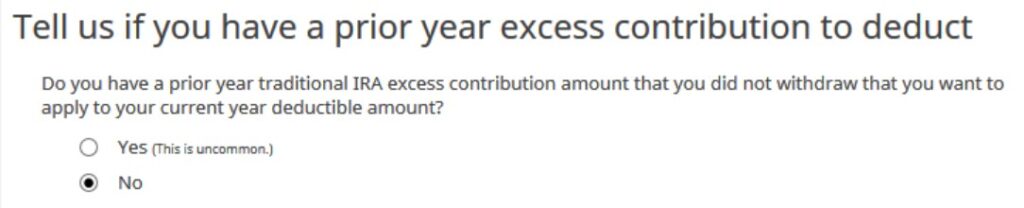

We don’t have any excess contribution.

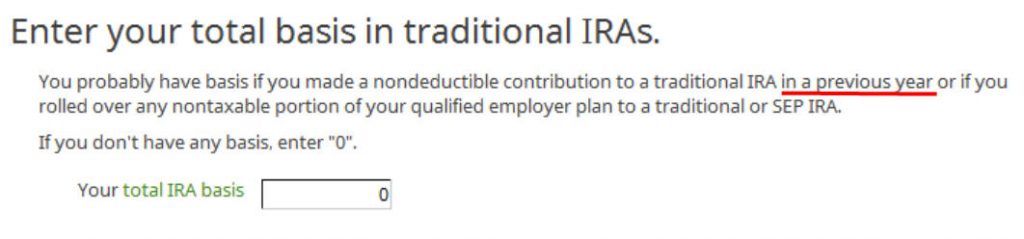

Basis From the Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

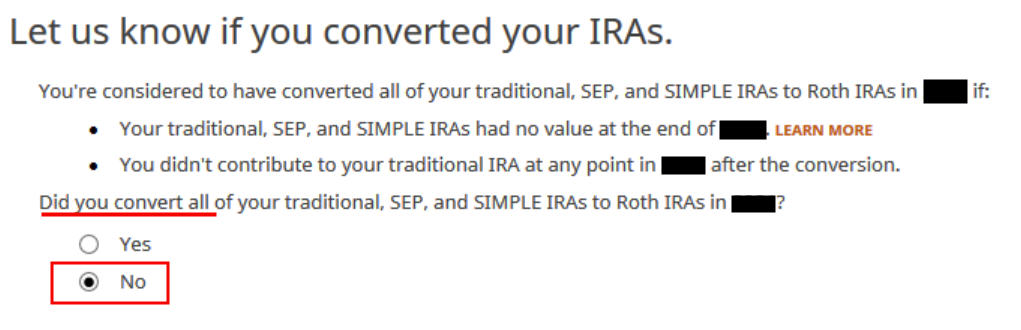

The Pro-Rata Rule

This is another important question. If you are doing it the easy way, as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have given some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

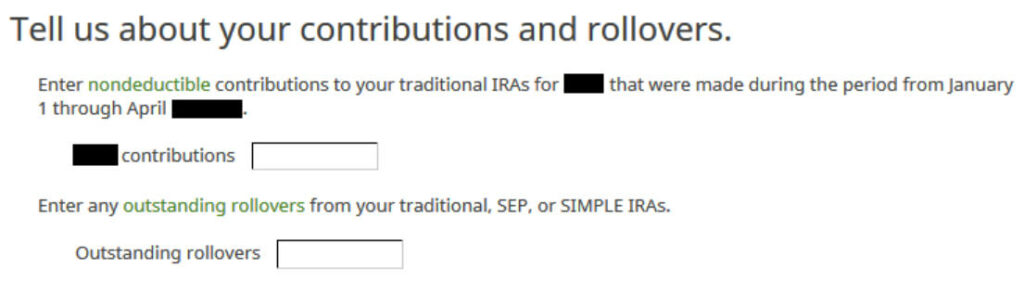

In a clean planned backdoor Roth, you contribute for 2025 during 2025. Leave the boxes blank.

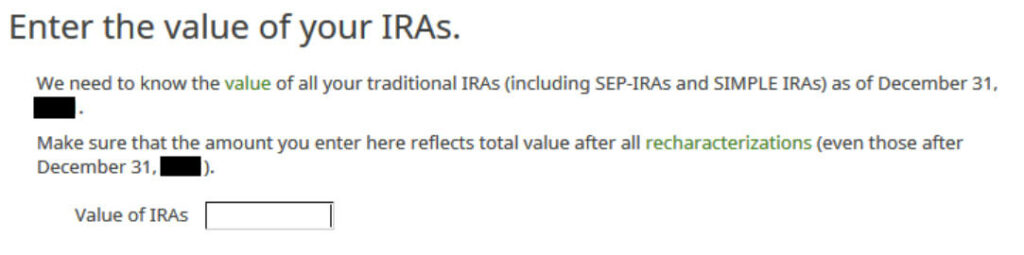

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

That’s great. We’re expecting it.

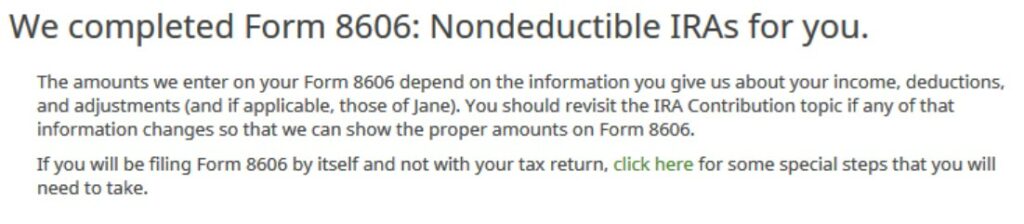

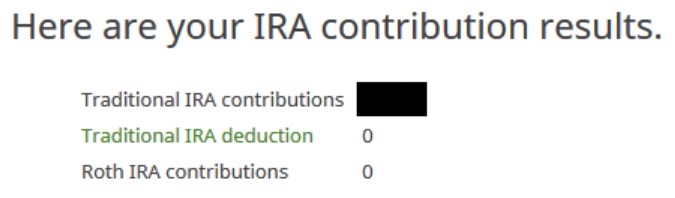

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Repeat this section for your spouse if you’re married and your spouse also did a Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

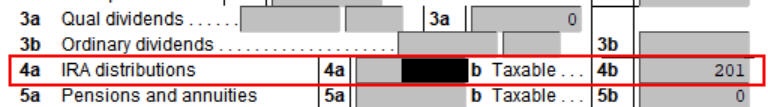

Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

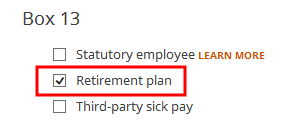

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Randy says

This guide is so incredibly helpful, thanks so much for this! I had a clarifying question about my backdoor Roth entry in HRBlock.

I did a clean backdoor roth in 2022: contribution and conversion in 2022. I received my 1099-R form and followed your HRBlock instructions just fine.

But my wife didn’t contribute to her 2022 IRA until March 2023, and did the backdoor conversion around the same time. So, she got no 1099-R form because the conversion happened in 2023.

So when filling out her numbers in HRBlock, after it asks about her 2022 IRA Contributions ($6000), it does not ask me about any distributions. Is that because HRBlock software does not see any 1099-R form for her uploaded in the system?

At the end of the IRA Deductions I see this below. Is that right? Should both our numbers look the same?

ME WIFE

Traditional IRA Contributions 6000 6000

Traditional IRA Deduction 0 0

Roth IRA contributions 0 0

I am aware that for next years taxes I will have to account for her 2022 conversion happening in 2023, and I will make sure that she gets all caught up. But just wanted to make sure that my numbers look good.

Thanks!

Harry Sit says

The numbers should be the same for the two of you in the contributions part. The difference is only in the conversion part. You did it in 2022. Your wife didn’t.

VA says

Thanks for this info. I used these steps successfully last year with HR Block online but this year I am having an issue with HR Block online (should have purchased the software). I did a clean backdoor roth (contributed to traditional IRA then converted in 2022 for 2022). The issue I am encountering is that the software is including a $200 IRA deductible amount (probably because my spouse and I were just under the income threshold). I entered the 1099-R and entered the IRA contribution and included that I converted the full amount to a roth IRA so I’m not sure why it is attempting to give us a $200 deduction. Do you have any suggestions on what to look at that I may be missing? Thank you!

Harry Sit says

That’s fine. A corresponding taxable amount offsets the deductible amount. The bottom line ends up being the same as no deduction and no taxable amount.

VA says

That’s what I thought but the 1040 shows an IRA taxable amount of $2.00 and the adjustment to income shows a reduction of $200 for the IRA deduction so I’m not really seeing the $200 added to taxable income. Also, the IRA Deduction Worksheet item number 6 says Stop because we cannot deduct amounts contributed to an IRA but then has $200 on line 12 so I’m starting to think it could be a software issue. Thanks again for the info.

Harry Sit says

Did you lose money when you converted? Say you contributed $6,000 but by the time you converted the value dropped to $5,802? When your income is in the phase-out range, it’s possible to get a $200 deduction and have $5,800 as the non-deductible portion. When you convert $5,802, the amount above $5,800 is taxable.

VA says

No. I contributed $6000 and converted a day or two later so there was $6002 (a $2 gain). Any other thoughts?

Harry Sit says

The IRA Deduction Worksheet has two columns, one for you and one for your spouse. If it says Stop for both of you on line 6, it shouldn’t continue to line 12. Just for kicks I would increase and decrease an income item (interest or dividends for example) by $50,000 to force the worksheet to recalculate. Maybe that will make it really stop at line 6.

Vanessa Alfaro says

Thanks for the suggestion. I tried it and it did not change; the $200 IRA deduction remained. Interestingly enough, the deduction only goes away when I delete the entire 1099-R entered on the income side even though the the IRA contribution is still entered on the deduction side.

JPS says

Hi Harry, thx for uploading this helpful post – and apologies if this was already answered but wanted to share a scenario, which I’d think would be fairly common especially for high earners but can’t get seem to find a definitive answer. If you only have a single traditional IRA completely funded with non-deductible contributions over the span of many years, and then decide to perform a Roth conversion, and since earnings are taxable even with all contributions being made with after-tax dollars – how do you effectively keep track of your cost basis for future Roth conversions on this account if you decide to do Roth conversion over a period of years – for example, if I decide to perform a Roth conversion on 50% of the IRA balance based on the cost basis in year 1, then how should the cost basis be calculated for subsequent Roth conversions in the years after – assuming the balances shrink over time due to repeated yearly conversions? Reason being, it would be easiest to do a Roth conversion of the entire balance in year 1 but don’t want to take the high tax hit.

Harry Sit says

If you don’t want to take the tax hit, the best way is to roll over the bulk of the earnings to a workplace retirement plan like a 401k. Most employer plans accept incoming rollovers from IRAs. The rollover amount is assumed to have come 100% from earnings. You just make sure to still leave a small amount of earnings behind. For example, if you have $50k basis and $25k earnings in the IRA, roll over $24k to the employer plan and you’re left with $50k basis and $1k earnings. Convert $51k and pay tax on $1k.

If you don’t want to go that route and you only want to convert over multiple years, you follow the pro-rata rule that everyone talks about. Conversions are assumed to have occurred on 12/31. Add the conversion amount to the ending balance on 12/31 to come up with the pre-conversion balance. Calculate the percentage that was converted and reduce the basis proportionally. For example, suppose you had $50k basis and $25k earnings before you converted $20k. The remaining $55k grew to $60k by the end of the year. It’s assumed that you had $20k + $60k = $80k before you converted and you converted $20k / $80k = 25%. Therefore you’re left with 75% of the original $50k basis in the remaining IRA.

TurboTax makes this calculation for you. That’s why it asks about your IRA balance as of 12/31. It puts the remaining basis on Form 8606. You’ll use it when you convert again next year.

JPS says

Thanks again Harry – would you say TurboTax is better in assisting with this calculation than H&R Block? I’ve been using H&R Block for many years but it just seems as of late that it can be “lazy” with doing some of the required calculations for Roth conversions and also things like calculating the proper mortgage interest deduction since the Trump tax cuts went into effect.

Harry Sit says

It’s lazy in some areas but not this one.

JPS says

Hi Harry, is there an existing blog post that details reporting a Roth Conversion (taking funds from a Traditional IRA and converting them to a Roth IRA) on your tax return using HR Block or is the procedure the same as this post – i.e reporting a Backdoor conversion?

Harry Sit says

It’s the same as the part under the heading “Convert Traditional IRA to Roth” except answering “No” to “Do you have basis …?” and “Are you contributing to a Traditional IRA …?” if you never made nondeductible contributions.

JPS says

Hi Harry, from a tax reporting perspective in H&R Block, is there a difference between doing a backdoor Roth conversion (contributing to Traditional IRA and then converting to Roth soon after) and also doing a planned Roth conversion (converting existing non-deductible contributions in Traditional IRA to Roth) in the same calendar year?

Thanks!

Harry Sit says

The backdoor Roth has two parts, the contribution and the conversion, as you see in this post. When the contribution is for the same year as the conversion, the conversion picks up the basis from the contribution. No basis is carried over from one year to the next. When you add another conversion, you don’t have another contribution. You’ll need the basis carried over from the previous year when you had existing non-deductible contributions in your Traditional IRA. The steps are the same. You do the conversion part twice if you have two separate 1099-R forms. You do it once if you have only one 1099-R form covering both conversions.

Satya says

Hi,

I am doing the 2023 tax return. The steps seemed a little different in the terms of the sequence this year. I think the IRA deduction under my wife should be 0 too, however that is not reflecting. I tried to delete the forms and redo, but twice the below results shows up

ME WIFE

Traditional IRA Contributions 6500 6500

Traditional IRA Deduction 0 6500

Roth IRA contributions 0 0

Please guide me

Harry Sit says

If she doesn’t have a retirement plan at work, she has a higher income limit for a deduction. Taking a deduction and making her conversion taxable offset each other to a wash. That’s not a problem. If she does have a retirement plan at work, check her W-2 and make sure the retirement plan box is checked in Box 13.

Curtis says

Having problem with the percentage on form 8606, Box 10. Box 10 says Divide line 5 by Line 9. In my tax return that would be $6,500/$6,502 = .999692 (The tax software is showing 1.00). Box 11 should be $6,502 * .999692 = $6,500 (Since the percentage is 1.0 in the software Box 11 incorrectly is shown as $6,502. When you follow it down the form there should be the $2 tax and it is showing 0. I have called H&R Block about the error and they are escalating the issue.

Harry Sit says

I think the instructions say to round to the nearest three digits. The software is doing it as instructed. Don’t worry about the $2.

Curtis says

I was thinking of overriding the percentage to .999 and then modifying the amount to the correct $6,500 so the $2 is properly reported. I would then have to mail in the return and could not file electronically. I have heard that turbo tax carries the decimal out 5 places on line 10 which results in a more accurate computation. (Just worried that the amount converted is over the $6,500 amount and the $2 is not being taxed which may raise a flag at the IRS if I just use what the software calculates). Then the 8606 forms going forward would be incorrect and I would have to make override corrections every year if the situation arises.

Curtis says

Received the following advice from someeone on the Ed Slott group: (Does this make sense?)

Ed Slott Group Response

You might consider entering a year-end value of $2 instead of $0. This will result in rounding down to 0.999, causing $4 to be treated as taxable and carrying forward $2 of basis. No overrides needed. The $2 of basis carried forward will help avoid the problem happening on your 2024 tax return.

==========================================================================

My Response

Thanks for your help with this: Per the software: (Form 8606)Box 1. $6500Box 2. $0Box 3: $6,500Box 4: $0Box 5: $6,500Box 6: $2 addedBox 7: $0Box 8: $6,502Box 9: $6,504 (Includes the additional $2)Box 10: Shows .999 Box 11: $6,496 ($6,502 * .999) I guess the software is rounding up $1 from what you showBox 12: $0Box 13: $6,496Box 14: $4 ($6,500 – $6,496)Part IIBox 16: $6,502Box 17: $6,496Box 18: $6 (Which is carried forward to 1040 as taxable)Not sure how to get to the $2 taxable unless I answered a question wrong.

=======================================================================

Ed Slott Group Response

The result with $2 of year-end value looks good. A net $2 taxable results from $6 being taxable in 2023 and $4 of basis carrying forward to 2024 that will reduce the taxable amount of future traditional IRA distributions and conversions. The $4 of basis carried forward will help deal with the same issue if it occurs in 2024.

==================================================================

Harry Sit says

I wouldn’t perform math gymnastics about this $2. Rounding 0.9996 to 1.0 works just fine.

Chris says

Hi Harry, very helpful article, thank you!

Question: In 2022 I made a non-deductible traditional IRA contribution for 2022 and Roth converted few days later. The trad. IRA balance went to $0 after the conversion but at the end of the month my bank posted ~$1 interest into the trad. IRA account. I kept this balance into 2023 when I made another trad. IRA contribution for 2023 and Roth converted few day later. While preparing 2023 tax return with H&R Block, I entered the $1 starting balance for the trad. IRA in the “Enter the value of your IRAs” (on 12/31/2023) question. Now the software is giving me a Data Verification caution highlighting the $1 on line 3 of the Additional Questions for Form 8606 and saying “Be sure the total value that you enter reflects total value after all recharacterizations (even those after December 31, 2023)”. What do you think the problem is? Should I have entered the $1 in the “Enter your total basis in traditional IRAs” question instead, or in both places?

Harry Sit says

$1 was the starting balance but the software was asking about the ending balance. Don’t use the starting balance as the ending balance. Get the actual ending balance from the year-end statement. If Data Verification caution still highlights that, you already entered the correct value when you got the number from the year-end statement and you didn’t do any recharacterizations after 12/31.

Curtis Meusel says

Thanks I think I will keep with what the software calculates.

Since .9996 does round to 1.0 and the IRS says round to the 3 digit I should be good if the IRS tries to come back for the $2….

Curtis

Chris says

Sounds good on taking the account value from the Dec 2023 statement. I am just having hard time understanding how to factor in that $1 interest that was received the year before (2022) and that I converted along with my 2023 contribution of $6,500 (converted $6,501 total) in Jan 2023. I wondered if the $1 interest from 2022 could be the basis the software was asking for but I don’t think it is considered basis. The 2023 1099-R does show $6,501 for both gross and taxable distribution amounts, taxable amount not determined and total distribution boxes are checked.

Harry Sit says

When you did this last year, the software asked you about the ending balance. If you put in $1, it would’ve calculated the basis as of 12/31/2022. A $1 ending balance probably made the basis round down to $0 but a $10 ending balance would not. When the software asks you about the basis this year, you get that value from last year’s tax return (the software also probably remembers it when it imported last year’s return).

Dave S says

Great article! I wish I new all this earlier. I learned about the backdoor Roth in 2023 and that it would available to me (my income is above Roth contributiuon limits).

My situation: In Apr 2023 (before tax deadline) I contributed $7,000 for 2022 and $7,500 for 2023 for myself and my spouse (both over 50, catch up contributions included) as nondeductable traditional IRA contributions. A few days later I a converted the full contribution amout of $14,500 from our trad IRAs to our Roth IRAs (via same trustee conversion, Vanguard). (For simplicity, I’ll omit discussions of my spouse since everything will be the same and I’ll just do everything twice, once for me and again for her.)

As of 12/31/23 the ending balance on each trad IRA was $11.76. (The trad IRAs were opend in Apr 2023 and these are our only trad IRA accounts. Ending balance on 12/31/22 was $0 because the trad IRA accounts didn’t exist then.)

I do not have a 1099-R for 2022. My 5498 for 2022 has $7,000 in box 1 (rest is blank). I did file a 8606 for 2022 showing the $7,000 as a nondeductible contribution.

My 2023 1099-R has $14,500 for lines 1 and 2, with code 2 in box 7. Vanguard doesn’t issue 5498s until May, so I won’t have it until after taxes are due, (I assume it isn’t needed for tax filing.)

For my 2023 taxes, I reported the amounts of lines 1 and 2 of my 2023 1099’s in the 1099-R Retirement Plan Income section of the H&R Block online program (too deep in, but will buy the download next year). For “How much of your distribution did you convert within 60 days of receiving the distribution?” I entered, $14,500; For do you have a basis in your IRA, I said Yes ($7,000 entered later, from 2022 contribution in 2023).

My question: since I didn’t have a 1099-R to report for my 2022 taxes, does reporting the $14,500 converted in 2023 take care of the conversions for both 2022 and 2023 or do I need to amend my 2022 tax return? If amendment is needed, how do I report the distribution since I don’t ahve a 2022 1099-R?

(I now understand the benefits of a clean backdoor Roth and will ensure that happens in future years.)

Harry Sit says

Not having a 1099-R for 2022 is normal when you converted in 2023. Reporting $14,500 converted in 2023 is correct because it matches what you actually did. You don’t need to amend your 2022 tax return.

TaxNoob says

Thanks for this very helpful tutorial, I’d never get through this process without it! I have a few questions regarding my situation and the numbers getting spit out: This is the first year (2023) that we’ve done a backdoor roth IRA for my wife and myself. I did a clean conversion for myself but unfortunately we did my wife’s 2023 contribution and conversion in February 2024. We have no employer funded retirement accounts for 2023, though are fairly high income earners.

1) On my form 8606, line 1 for nondeductible contributions is blank and line 18 for taxable amount is the 6500(which was expecting to be zero). My wife also has blank line 1 but blank line 18. Is it most likely that we are getting a deduction due to not having employer funded retirement plans (mine canceling out with a taxed conversion as I’ve seen alluded to in other posts)?

2) Regarding my wife’s late contribution for 2023, I’m a little confused regarding basis. All the questions/instructions in the software refer to money left in an IRA at the end of December 2023 or earlier (which we had none), but reading other sources I feel like we should be entering her 6500 as basis to show up on line 14 of form 8606 to be used for next year when I “fix” this mess after making all clean conversions going forward. So should her $6500 contribution for 2023 be entered as basis on the 2023 return?

Thanks so much in advance for any help!

Harry Sit says

If both of you don’t have a retirement plan at work, your Traditional IRA contribution is deductible, which makes your Roth conversion taxable. That’s normal. See the Troubleshooting section.

Her Traditional IRA contribution is also deductible, which doesn’t create any basis. You’re taking $13,000 deduction in 2023, getting taxed on $6,500 in 2023, and will get taxed on your wife’s conversion in 2024. Yours cancel out in 2023. Hers cancel out across two years.

amending2022 says

Hi, I found your blog while looking up how to fix my Form 8606 from 2021 tax return. In 2022 March, I did the backdoor IRA — contribution to T-IRA and converted it to Roth IRA — for the first time in my life. In 2021 tax return, I filled 6,000 on line 1, 3, and 14 in Form 8606, since I only contributed in the 2021 tax year. I did not do backdoor IRA in 2022, no contribution, either. Then when I was filing 2022 tax return, I forgot to include the “conversion” part. I can’t find any Form 8606 that “only” does the conversion, though. Could you please help me how I should amend this? In my opinion I should fill lines from 8 to 14 (I am not sure what to do with line 15) and part 2’s line 16, 17, 18. Am I correct? Also, would this make tax refund amount by any chance decreased? I did use H&R Block for 2022 tax return, and making this change is making me owe tax to Fed nearly 2k… (I’m surprised the IRS did not come after me for this yet, my tax return was actually accepted!)

Harry Sit says

Add the 1099-R. Say you have basis. Keep going after the 1099-R summary. Enter $6,000 when it asks you what the basis was from the previous year. H&R Block will produce Form 8606 with only lines 16-18.

amending2022 says

Thank you so much for your prompt reply! Doing this “Enter $6,000 when it asks you what the basis was from the previous year. ” really brought the tax refund amount back! But could you explain why? The H&R Block page said

“You probably have basis if you did one of these:

– Made a nondeductible contribution to a traditional IRA in a prior year

– Rolled over any nontaxable portion of your qualified employer plan to a traditional or SEP IRA.

Total basis in traditional IRAs:[ ]”

So I did make the nondeductible contribution to a traditional IRA in a prior year, but from what I’ve read that “total basis” is the balance in T-IRA on December 31st of the prior year. But the conversion was already done in 2022 March, so on December 31st, there was nothing left in my T-IRA (but 1 cent of interest…) How is this really defined?

Harry Sit says

“Total basis” isn’t the balance in Traditional IRA on December 31 of the prior year. Your 2021 Form 8606 Line 14 says your basis as of 2021 was $6,000. Therefore that’s the number you use when you’re amending 2022.

It stops being this confusing when you start doing clean backdoor Roth as this post suggests. Contribute for 2024 in 2024 and convert in 2024. Don’t go across different years.

SPS_1981 says

thanks a lot Harry!! really appreciate your input and help!

KT says

Great article, thank you! I did have a question/concern.

I made Backdoor Roth conversions in 2021 and 2022 due to my income being over the limit. Both were clean conversions, no money was left in the Traditional IRA and no issues when filing those years.

I made a Backdoor Roth conversion of $6500 in January 2023 for the 2023 tax year. (Contributed $6500 to Traditional IRA and then converted to Roth IRA the same day).

However, when I’m completing Form 8606 for 2023 taxes on H&R Block, Part I is entirely empty. Part II shows $6501 in Line 16, $0 in Line 17, and $6501 in Line 18 for the Taxable amount. When I completed the tax returns in 2021 and 2022, Part I was filled out and Line 18 showed $0

I followed the steps you outlined in the article. I’m wondering if something is wrong because of one of the following below:

I did get laid off by my previous employer and had a W-2 showing a small severance amount received in January 2023. Box 13 “retirement” is not checked on that W-2. **Note – I did NOT do anything with my 401k from the prior employer. It’s still in that same 401k account as of today. It was not rolled over.

With my new/current employer, I also received a W-2 (Box 13 is checked). However, my income for the 2023 tax year ended up below the limit. So, looking back I actually didn’t need to do a Backdoor Roth conversion and could have just put the money directly into my Roth account.

On the “Adjustments” screen within H&R Block it says “Here are your IRA contribution results”:

Traditional IRA contributions: 6500

Traditional IRA deduction: 6500

Roth IRA contributions: 0

If it helps, this is what my 1099-R shows from Vanguard:

Box 1: 6501

Box 2a: 6501

Box 2b: Taxable amount not determined X Total Distribution X

Box 7: 2 Box 16: 6501 (I’m in MN)

On my 1040: Box 4a: 6501 4b: 6501

I’m trying to figure out why the system is showing 6500 as a deduction and as a taxable amount, and why the system is showing my Form 8606 entirely blank in Part I and showing 6501 in line 18. Normally for a Backdoor Roth you fill out both Part I and Part II of the 8606 form. So I’m wondering if H&R Block is thinking my traditional IRA contribution is deductible. My AGI is lower than $68,000 in 2023.

Someone told me that the Traditional IRA deduction subtracts $6500 from my taxable income and the $6501 from line 18 of the 8606 form adds $6501 back to my taxable income, resulting in $1 extra of taxable income (that $1 is from interest earned between the contribution and conversion). So in theory, they cancel each other out and does not impact the taxes I pay.

Is that true? And is it ok to e-file the tax returns on H&R Block as stated above? Want to make sure I’m doing this correctly.

Harry Sit says

If you have a W-2 with Box 13 checked but your income is sufficiently low, you’re still eligible for a deduction to contribute to a Traditional IRA. The software will give the deduction to you when it sees you’re eligible. This is the same situation addressed under “Conversion Is Taxable” in the troubleshooting section. The taxable conversion and the deduction offset each other to create a wash. It’s normal.

David Johnson says

Love the tutorial I have used it for the past few years. This year I have run into a situation that I did not see previously. I did a simple backdoor roth with a contribution of $7500 and conversion of $7504 ($4 in interest due to the few days it took for Vanguard to allow me to make the conversion).

The H&R Block software is showing that I have a small basis of $3 in line 14 that will need to be reported in subsequent returns due to what appears to be rounding in the H&R block software for line 10 which stops at 3 decimal places at .999. Using the .999 factor x 7504 = 7497 which is $3 less than the $7500 contribution and represents the line 14 basis). This doesn’t make sense for those of us that do the simple contribute and convert in the same year with the intent to have no basis to report in subsequent years. I can’t seem to manipulate the software to rectify this situation.

My question – does it create any kind of problem filing with the $3 basis if I plan to do a backdoor in FY24? I really don’t want to fill out the forms by hand and submit my return through the mail which seems like the only option available if I want to eliminate the $3 basis from line 14.

Harry Sit says

It doesn’t create any problem. If you don’t want the $3 basis when you do your taxes next year, you can abandon it and just answer $0 when it asks you about the basis at that time.

E. J. says

Boom. Accounting prowess. This was really awesome. Step-by-step with screenshots. (Yeah, I decided to try HR Block this year instead of TurboTax . . . I think I will go back to TurboTax . . . and worse, unfortunately got down the path of the online version . . . live and learn).

You saved me a lot of time and energy. thanks.

Alan says

My parents are over 70 and tried to do this backdoor method. They got a 5329 form with

a penalty after walking through this process. For their 1099 R, their box 7 is code 7 instead of code 2. Any thoughts on how to get rid of 5329 in the software?

Harry Sit says

Code 7 is correct when they’re over 59-1/2. They need “earned income” (W-2 or self-employment) to contribute to an IRA. The software generates a 5329 if it doesn’t see any earned income. If they only converted to Roth but didn’t contribute to a Traditional IRA, it was only a normal Roth conversion, not a backdoor Roth. Delete the Traditional IRA contributions from the software if they didn’t really contribute. If they did contribute without earned income, do the paperwork with the IRA custodian to remove the “excess contribution.”

Alan says

Thanks Harry for the response. My parents have been doing this for years, and this is the first year they got this form. They did a textbook backdoor every year, which is why this year it is confusing. Where on the form (1099-R?) or the software would it indicate earned income and/or show that it is an “excess distribution” so I can remove it?

Harry Sit says

Many people mistakenly call a straight up Roth conversion “backdoor Roth” and now we have the added difficulty of communicating second-hand. You have to clarify with them what they really mean by “doing this” and “textbook backdoor.”

– Did they have income from a job or self-employment?

– Did they contribute to an IRA? “Contribute” means putting new cash from outside an IRA into an IRA.

– Did they tell the software that they contributed to an IRA?

We can only guess without knowing what actually happened. Telling the software they contributed to an IRA while not showing enough income from a job or self-employment generates a 5329 for an excess contribution. There could be several reasons why they didn’t have a 5329 in the past:

(a) They had income from a job or self-employment, contributed to an IRA, and told the software that they contributed. No 5329 because they were eligible to contribute.

(b) They didn’t contribute to an IRA and didn’t tell the software that they contributed. No 5329 because they didn’t contribute to an IRA.

(c) They didn’t have income from a job or self-employment, did contribute to an IRA not knowing they were ineligible, but they didn’t tell the software that they contributed. No 5329 because the software didn’t know that they contributed when they weren’t eligible.

Ryan N says

I have a question. I currently have a traditional IRA that has an initial deductible contribution I made 20 years ago and two 401k rollovers in it. I’m planning on rolling this into my company 401k by the end of 2024. I plan on opening a different traditional IRA to contribute my 2023 contribution and 2024 contribution and do a backdoor roth on both on my 2024 returns with the other traditional IRA rolled back to avoid pro rata. Will this work?

Also, I’m working through H&R Block right now and it asks my “Basis”. I haven’t had any non deductible contributions to any IRAs yet. But it also says “plus nontaxable amounts included in rollovers made to your traditional IRA from 1987-2022.” All the rollovers were pretax or tax deductible, but they will eventually have taxes taken out. Am I right to exclude those from my basis? I.e. my basis for 2023 will be 0 because I haven’t had a non deductible contributions and in 2024 I would have a $6500 basis plus the 7000 contribution I would do the back door roth on and received a 1099 R for both to make the numbers right.

Thank you BTW, your walkthrough is by far the best I can find!

Ryan says

Also, when I get to the step where you say “This is another important question. If you are doing it the easy way as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.” for the pro rata, I never get that question to come up. Is this because I don’t have a 1099-R for 2023 put in? I did no conversions in 2023, so will the question be there next year for 2024 since I will have the 1099-R’s for both years.

Harry Sit says

Those questions come up only when you converted to Roth during the year. You’ll see them next year.

Harry Sit says

You can open a different traditional IRA to contribute your 2023 contribution and 2024 contribution but I suggest holding off converting until you’re done with rolling over your existing traditional IRA into your company 401k. Your 2023 contribution must be made before April 15 but there’s no deadline for converting. You want to make sure the rollover of your existing traditional IRA into your company 401k completes successfully as planned. It would be messy if you already converted but the rollover to 401k runs into an unexpected road block.

When H&R Block asks you about your basis, it’s asking about it as of the end of the previous year, i.e. 12/31/2022. You don’t have any basis as of 12/31/2022 when all the money in your traditional IRA is pre-tax. After you finish the part for your 2023 traditional IRA contribution, you’ll have a basis of $6,500 as of 12/31/2023. The software will auto-populate it with that number when you do your taxes next year.

Ryan says

Harry, thanks for the quick reply and good advice on the reverse rollover going through first.

One follow-up, all of my kids will be in school this fall and my wife currently does not work. My income last year made it so I couldn’t do a front door Roth, but due to a poor bonus and OT wages decreasing due to hiring, my income this year should be low enough to do the front door Roth. That said, my wife may go back to work this fall and put us over the limit for the front door. Rather than wait for that decision, are there any issues with doing the backdoor Roth earlier so I can get growth in the market, rather than wait and see what happens beginning of 2024?

Harry Sit says

If your transfer from the traditional IRA to the 401k completes soon enough, there’s no penalty for doing a backdoor Roth even though it turns out later that you qualify for a direct contribution. If there’s a long delay and your contribution earns a meaningful amount, you may be better off by recharacterizing the contribution as Roth if your income ends up below the limit.

Suppose you contribute $7,000 now, your transfer to 401k only completes in July, and your $7,000 grows to $7,400. If you convert at that time, you pay tax on the $400 earned in the traditional IRA. If you take a chance and wait to see how your income situation becomes clear until November, suppose your $7,400 grows further to $7,700. If your income qualifies, you recharacterize the contribution to Roth, $7,700 goes into Roth and you won’t have to pay any tax (versus paying tax on $400 if you converted in July). If your income is over the limit, you convert $7,700 and pay tax on $700. So it’s a gamble to pay less tax but you’ll pay more if the gamble goes against you. Waiting is only worth it when your $7,000 earns a meaningful amount. If it only earns $50 when you’re ready to convert, you just convert and call it a day.

Ryan says

Sorry this may show up twice.

I have a traditional IRA that I started 20 years ago with a deductible contribution and have since rolled two old employer 401ks into. It is all pre-tax dollars and my current employer will allow me to do a reverse rollover to get it into my current 401k by the end of 2024. In the mean time, I plan on opening a different traditional IRA and contributing for 2023 prior to April 15th and later for 2024. So by the end of 2024 I will have 0 traditional IRA balances because of the reverse rollover and Roth conversion. Will this work to avoid pro rata?

Also, when I am figuring out my “Basis” for 2023 what should I be using? I looked in HRB notes and it says it generally includes any non-deductible contributions from 1987-2022 (which would be $0 for me), Plus nontaxable amounts included in rollovers made to your traditional IRAs from 1987 through 2022. All of my contributions and 401k rollovers to my current traditional IRA were pre-tax dollars, which to me is taxable at somepoint. If I’m thinking correctly then my basis should be $0 for 2023 and $13500 for 2024 (when I will roll both to a Roth). Is that correct?

JPS says

Hi Harry, just to circle back on my question from Nov, and based on your response, when doing a straight Roth conversion using previous multi-year nondeductible contributions from a Traditional IRA to a Roth IRA, shouldn’t the answer be Yes to the Question: do you have basis in HR Block? Isn’t the basis the total amount of made nondeductible contributions up until the tax year of the Roth conversion (2023)? This is the first Roth conversion done (2023) on the Traditional IRA account FYI.

Harry Sit says

I wrote a new post Split-Year Backdoor Roth IRA in H&R Block, 2nd Year. It’s more specific to the case of converting contributions made for the previous year. Think of it as the Nth year instead of the 2nd year when you’re converting contributions made for multiple previous years. Yes, the basis is the cumulative nondeductible contributions not including earnings and not counting the contribution made for the current year.

Devin says

Hi Harry,

Very helpful article! In doing my 2023 taxes, I think I discovered a mistake in my 2019 taxes. As background, I am married filing separately (due to the Income Based Repayment method on student loans).

I originally had a traditional IRA, but at the end of 2019 I converted the entire traditional IRA into a new Roth IRA account. Since then, I’ve been making bimonthly deposits into a traditional IRA, which are then immediately converted to the Roth IRA. I never have any standing balance in the traditional IRA.

Annual Roth IRA conversions:

2019: $7574 (single conversion of entire traditional IRA into Roth IRA)

2020: $4893 (bimonthly deposits into trad IRA, immediately converted into roth)

2021: $6000 (bimonthly deposits into trad IRA, immediately converted into roth)

2022: $5592 (bimonthly deposits into trad IRA, immediately converted into roth)

For my 2023 taxes, I am using the H+R Block online software. At one point it asks what is my “Basis of roth IRA contributions as of 12/31/2022”. I responded $0 because I didn’t make contributions to the roth IRA, only conversions. Then it asks what is my “Basis of roth IRA conversions as of 12/31/2022”. I responded $24,059, which is the total of all conversions listed above.

However, the H+R block software said this is an error because “You told us your Roth conversion basis, but the sum of your prior-year conversions in History of Roth Activities is less than the conversion basis.”

I then checked my past tax returns, and in 2020, 2021, and 2022 the HR block software filed form 8606, which shows the total Roth conversions for the year. However, my 2019 tax returns do not include the form 8606. My 2019 1040 section 4B does show the $7,574 as an IRA distribution, but it appears that the Roth conversion itself is not reported.

I don’t know the reason for this, as I’m sure I was following all the steps of the HR Block online software. I also don’t think that I underpaid or overpaid taxes because the Roth conversion itself doesn’t add or remove any tax burden. But it does impact my Roth conversion basis, which is how they determine which money is taxed when I start to make withdrawals in the future (or at least this is my understanding).

I am wondering how I should proceed. (A) Can I just ignore the error and file the $24,059 basis since I know this is accurate, or is that going to get me audited or otherwise create a headache in the future? Or (B) do I need to amend my 2019 tax return? I am not clear if there is a quick/easy way to do this. Apparently If I had used the downloaded HR Block software, I could easily amend, but I used the online software. Is there another path to amend my 2019 taxes? Or finally (C) should I just let this go and enter a Roth conversion basis of $16,485? I will end up paying some extra taxes down the road, but not sure what else to do if the above two options aren’t viable.

Feeling very frustrated and would greatly appreciate your insight here. Let me know if you need any other info.

Thank you!

Harry Sit says

Tracking Roth contribution and conversion basis is only for the off chance that you’ll withdraw from the Roth IRA before age 59-1/2. If you swear you won’t do that — Roth money should stay in a Roth account well past age 59-1/2 — you don’t need to track your Roth contribution and conversion basis. I don’t know what my Roth contribution and conversion basis are and I’m perfectly OK with it. See Roth IRA Withdrawal After 59-1/2.

The Roth conversion basis is only tracked in the software. It’s not filed with your tax return. Whatever you enter in the software about your Roth conversion basis won’t get you audited. The deadline to amend a 2019 return already passed anyway. I don’t use H&R Block Online. I suppose there must be a place where you can see or edit your “History of Roth Activities.” What if someone comes to H&R Block Online after using some other software? They have a longer history and a higher Roth conversion basis than the software knows. The software has to either accept the higher basis or offer a way to populate history. Look for it if you still want the software to track your Roth conversion basis. If there’s a way to opt out of tracking Roth basis, I’m inclined to opt out because I see it as extra work with no value.

Ben says

Hi Harry,

I am over 50, I deposited 7500 in my IRA account, when I converted to roth IRA (using backdoor) the amount was 7516 dollars how do I report this discrepancy in H&R Block.

I assume I will have to pay taxes on the 16 dollars. How do I enter this.

Thank you,

Harry Sit says

Look for a 1099-R from the IRA custodian if you converted in 2023. Follow this post to enter it. If you only converted in 2024 and you don’t have the 1099-R, please follow Split-Year Backdoor Roth IRA in H&R Block, 1st Year.

Dee says

Great info, thank you. Do you have this same write up for the HR Block online version or are you planning on making one similar to this?

Also if I was to switch to software version, do my previous years returns port over with my login?

Thanks

Harry Sit says

I don’t have the same for H&R Block online version and I have no plan to create one because it’s too difficult to do different scenarios with online software. Please ask H&R Block how to get your data from its online software to the download software.

eric moore says

Is anyone experiencing issues with the 2024 H&R Block downloadable software? I have been following The Finance Buff’s guide for reporting Backdoor Roth IRA transactions without any problems since it was posted, but the new version of the software seems to have an issue. It is incorrectly categorizing my $7,000 traditional IRA contribution as both a deductible contribution and a $7,000 traditional deduction. This appears to be a glitch or error in the software. Has anyone else encountered this problem as of January 23, 2025?

Harry Sit says

I’m not clear on what you meant by “as both a deductible contribution and a $7,000 traditional deduction.” They sound the same to me. If you meant that the software is making your contribution deductible and your conversion taxable, it’s normal when your income isn’t above the income limit or it could be caused by not having entered all your income yet or missing to check a box on your W-2. See the “Conversion Is Taxed” section toward the end.

eric moore says

Meaning it will put the 7000 on line 4a and the 7000 on 4b. This didn’t happen last year when my income was under the cut off limit. Just keeps putting it in part 2 line 16 and line 18 and the rest of the form is blank. Now i haven’t put all the income in yet so ill give that a try but it will still be below the thresh hold. I just do back door method due to my fluctuations in pay to be safe.

Harry Sit says

That’s normal when your income is below the limit to take a deduction on the Traditional IRA contribution, which then makes your conversion taxable. The income and the deduction offsets each other.

David Shan says

Thank you for the amazing post! It is easy to follow.

My income is above the limit and did backdoor Roth in 2024. When reporting my 2024 IRA contributions on HR Block software, it told me that I need to “correct my excess $7000 contribution to my traditional IRA to avoid penalty.” I ignored this warning and proceeded. The software did say that it prepared the Form 8606 for the nondeductible contribution, but when I looked at “federal owe” on the sidebar, it clearly included a 6% * $7000 = $420 tax penalty for excess contribution. Did I miss anything here, or will the penalty be automatically removed when the final tax forms are generated? Thanks!

Harry Sit says

You need income from a W-2 or self-employment to contribute to an IRA. If you haven’t entered such income, your contribution will be seen as excess. It’ll go away after you put in your employment income.

eric moore says

I’m trying to figure out how to report the $3 in interest earned during the conversion as taxable. I contributed $7,000 and my wife contributed 7000. Then, we moved everything to our Roth IRAs, leaving our traditional accounts at $0 then the account earned $2 in interest for me, and my wife earned $1 in interest then we moved that into the roths —all within the same year. How do I get the software to recognize that $3 as taxable?

Harry Sit says

The $2 and $1 are included in the 1099-R as the $200 is in our example.

Eric Moore says

Yes the 1099-r is 7002 and 7001. But at the end when everything is done line 4b says 0. Everything else seems to be right but it should have a value in 4b correct for the 3$?

Harry Sit says

The $2 and $1 may be too small to show up when they are buried by rounding. H&R Block doesn’t use as many digits after the decimal point as TurboTax when it calculates rounding.

Kate says

Amazing article, thank you! Do you know why after following all instructions, HR Block generated form 5329 for me (in addition to 8606)? Form 5329, part III questions 15 and 16 have $1. This $1 should be shown under 1040 4b instead. Currently 1040 4a show $7,001 and 4b shows $0. Also 8606 page 2 question 18 should say $1, but shows $0. Thank you!

Harry Sit says

Maybe you entered $7,001 as your contribution? The maximum is $7,000. You would have $1 excess contribution if you said you contributed $7,001.

Kate says

Under Income section, I put $7001.01 and under Deductions I put $7,000 and yet the tax return is still producing form 5329 and 1040 4b still says $0. I’ve spent another hour or so with the online agent today and have an escalated ticket. Next year I’ll use downloaded version of the software instead of online. what a mess

Harry Sit says

Form 5329 Line 15 says “Excess contributions for 2024.” The desktop software has an “IRA Contributions” worksheet, which shows how the excess contribution is calculated. If you can find the same worksheet in the online software, it may offer some clues where went wrong. I agree it’s much easier to troubleshoot in the downloaded software.

Kate says

I went ahead and purchased the software version of HR Block through Amazon. I followed your instructions to the T. Yet form 8606 is not quite correct as it should be. Please help!

Form 8606 I show line 8: 7,001 line 9: 7,001, line 10 1.000 (instead of 0.999) line 11. 7,001, line 13 7,001, line 16: 7,001, line 17: 7,001, line 18 still shows zero, but should be $1. This $1 should flow to 1040 line 4b but currently showing $0.

How do I make the correction? Should I override the numbers manually? Thank you in advance!

Harry Sit says

You’re good when the 5329 is gone. The $1 discrepancy on Form 8606 Line 18 and Form 1040 Line 4b is caused by how H&R Block does rounding. 7,000 / 7,001 = 0.99985716. The IRS instructions say “rounded to at least 3 places.” H&R Block software rounds to exactly 3 decimal places. 0.99985716 rounds to 1.000. Rounding to more places would make it more accurate but the method in the software is perfectly legal.

D says

Hi – Just completed filling out information into HR Block and it produced a 8606 form. In part 1, # 9-12, those fields did not populate. Skipping ahead to part 2, 16-18 did populate and is showing my taxable amount to be 0. Is this the desired outcome when filing through HR Block or should 9-12 be populated? I went pick and checked all my entries and they seem to be correct. When watching tutorials of people entering these manually via YouTube, they completed 9-12.

Thanks

Harry Sit says

Lines 9-12 are intermediate steps. Software is allowed to skip them in certain cases. Let the software do its thing.

d says

No earnings. I funded from brokerage to traditional to roth during the same business day, Fidelity was able to complete it over the phone. The 1099 is correct and does not show any interest earned. From a few google searches it looks like as long as lines 16-18 are correct, specifically line 18 shows 0 taxes owed, that’s all that matters. I was just curious to know if others had same behavior when using the hr block online software.

Thanks

Nicole Horton says

Hello! I contributed $7000 to traditional and rolled over $7001.01 to Roth due to the interest made in the settlement account. When I follow the above guidance, my 8606 form is only populating numbers for lines 15, 16, and 18. It’s accurately reflecting a taxable amount of $1 but the earlier lines are blank. Am I doing something wrong?

Harry Sit says

You should have more lines filled out in Form 8606 if your case matches the example used except for the dollar amount and you followed everything in this post exactly.

Chris says

Hello Harry, awesome post! Thanks for your time to maintain it each year.

Question: after clean 2024 non-deductible traditional IRA contribution and Roth conversion, all in the beginning of 2024, while on the last step checking how am I taxed, I see $14,004 in box 4a but $0 in box 4b. Each of our traditional IRA accounts earned $2 by the time we converted. Why is box 4b not showing $4?

Harry Sit says

Rounding. The same reason the $200 in the example comes out to $201. Also see the reply to comment #36 on February 11.

JR says

Fantastic article appreciate you. Question on this.

I went thru your steps, all went well. I filled in the first section to enter your 1099-R information.

Then jumped to Federal > Adjustments > IRA Contributions

Followed your steps on that part.

I then went back to basically the healthcare questions that would come after entering the 1099-R initially and continued the wizard.

Eventually I got to:

Tell us about any additional taxes and penalties

Tried unchecking:

Excess accumulations (not enough withdrawn) from a retirement plan, Section 457 plan, or IRA in 2024. NOTE: If you have a 1099-R in your return you can uncheck this box.

OK so I unchecked it. Message comes up:

Unchecking this box will not delete any information. We’ll take you into this topic to delete any unneeded information.

Then it’s checked again. I don’t really see anything it specifically asks me again about the IRA. Get to entering my drivers license info and nothing. Is this normal?

Harry Sit says

That’s normal. The software goes through some checks for excess accumulations. It didn’t find any.

JR says

One other item, when I get to the verification step it complains that in my case I checked that I converted ALL of your IRAs. I put for the first time $8,000 (over 50) into my IRA and then within the hour transferred the full $8,000 with no interest accrued into the Roth IRA. So figured I’d check that. Is this wrong? Sounds like something I can ignore and it want’s me to check.

Harry Sit says

The verifications are just friendly reminders to double-check. It’s like saying “Did you turn off the stove?” It doesn’t mean it knows you didn’t.

JR says

I believe this is the case, but over 50. I put $8,000 into an IRA and then immediately into my Roth. OK all good just finished the taxes. In 2025 if I do the same I assume it’s the same process for reporting taxes? Read various things where people talk about the “first” year doing this vs the rest but no context. May have more to do if you don’t do a 100% conversion from a traditional IRA to a Roth and impact there next year?

Harry Sit says

It depends on whether you did it for the previous year or the current year.

If you put $8,000 into an IRA [for 2024 in 2024] and then immediately converted into a Roth IRA [in 2024], you did a clean backdoor Roth. You’ll have the same process next year when you continue this pattern by putting $8,000 into an IRA [for 2025 in 2025] and then immediately convert into a Roth IRA [in 2025].

It’s different when you split up the years, such as contributing for 2023 in 2024 and immediately converting in 2024 or contributing for 2024 in 2025 and immediately converting in 2025. All the confusions come from splitting up the years. Don’t go there, or stop if you already did.

Tom Herr says

This page saved me! I couldn’t figure out all the questions and was being charged tax on my backdoor conversion. My problem was the I chose Roth Ira in adjustments instead of Traditional IRA.

I was going to hire an accountant for the first time in my life otherwise.

Lucy says

This was the most helpful article i’ve seen on the internet about this so far – thank you!

An error has been coming up that I earlier inaccurately entered this information so I followed your advise to “start fresh” and I think I need to reanswer the questions that come in the “additional questions” section. However, using the online software (made note that next year I will use the downloadable software), even after starting fresh, I’m struggling to find the place where I can reanswer these questions. where would you reconnect I head next?

Harry Sit says

Sorry, I don’t know how it works in the online software.

Daniel says

Thank you so much for posting this! It was easy to follow and made my life a lot easier.

F Blank says

Thank you very much for posting this. Worked great!

Kunhee says

I contributed after tax money of 1,000$ in January 2024(through Fidelity). Quickly after, I realized I’ll exceed income limit for a Roth IRA.

So I re-characterized 1,000$ asset to T-IRA with a bit of earning(84$). Then I contributed an additional after tax money of 6,000$ into T-IRA and converted the entire money(7,084$) into Roth IRA. The entire process happened in 2024. So I received two 1099-R. One for R -> T-IRA re-characterization(1,084$), and the other for T -> R-IRA conversion(7,084$). So it was a Backdoor Roth IRA with an extra step.

While I was working on taxes with HR block program, it kept considering 7,084$ as ‘Taxable amount’ as an ‘Income’, and only 1,084$ I re-characterized as ‘Deductible’. This causes so much headaches since now it increases my Adjusted Gross Income by 7 grand and reduces my deductions by 7 grand. How do I handle it with HR block program? I tried so many options inside the program and having a hard time to figure out what I missed. 4b from a from 1040 should be ’84$’ since I ‘contributed’ max amount for R-IRA(7,000$) and 84$ was an earning during re-characterizaion and conversion process. Line 4a shows the sum of my two 1099-R forms, and I put a little over 8 grand, which is a sum of 1,000$ I initially re-characterized and around 7,000$ I converted together. 4b should show an earning happened during the process only but somehow it shows 7,085$ of total asset I converted from T-IRA to R-IRA. I’d much appreciated all the help from smarter people than me.

Kunhee says

Also, thx for uploading this helpful post – and apologies if this was already answered but wanted to share a scenario, which I’d think would be fairly common especially for high earners but can’t get seem to find a definitive answer. Thanks Harry.

Harry Sit says

It’s covered in Backdoor Roth in H&R Block: Recharacterized in the Same Year except you only recharacterized $1,000, not $7,000 as in the example in that post. You check both Traditional IRA and Roth IRA boxes in the contribution section and enter $1,000 as Roth contribution (recharacterized later) and $6,000 as Traditional contribution.

Katie says

Thank you very much for posting! This was super helpful in crunch time. Do you have a post on how to do this if I contributed the past two years but converted both years in 2024? For example:

$6,500 nondeductible contribution for 2023

$7,000 nondeductible contribution for 2024

$13,507.27 total converted to Roth IRA in 2024

All but $7.27 of that was basis

I believe only $7.27 should be taxable on Form 8606

I need to update Form 8606 to reflect a $6,500 basis carried over from 2023 and the $7,000 contribution made in 2024, but I can’t figure out how to do it in the software. I’m using the online version but I found your instructions/screenshots easy to follow there as well.

Thanks!

Harry Sit says

It’s covered in Split-Year Backdoor Roth IRA in H&R Block, Year 2. 2024 was Year 2 for your 2023 contribution. Then you had a clean backdoor Roth on top.

Jim G. says

Hello!

I’ve used your backdoor Roth through HR Block software guide for – dunno – 8, 10 years now. I just noticed the comment section and I wanted to thank you for making the confusingly confusing code easier to navigate. You’re doing a huge service to us non-accountants!

Wanted to pass on the thanks!

–Jim G.