[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

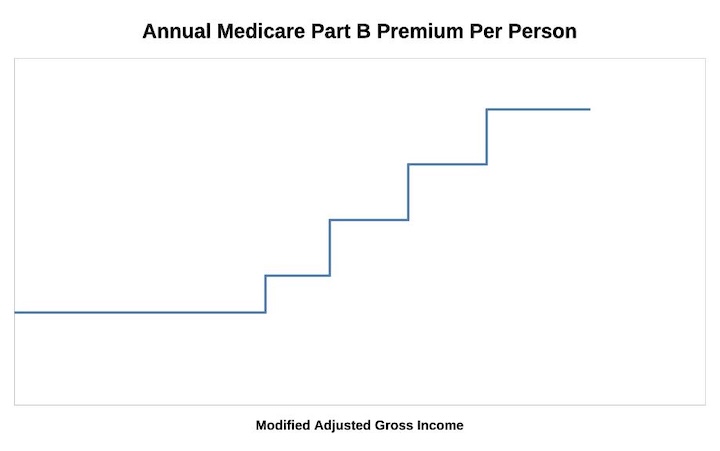

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

FinancialDave says

Harry,

Nice article.

One of the major reasons for many investors problem with IRMAA resides with the size of their taxable account and the investing strategy they use there. Also, in most cases, the first time this shows up is 2 years after they decided (or someone decided for them) it was a good idea to put all their high dividend-paying stocks in the Brokerage account not even realizing that there is an “IRMAA,” let alone that it will add thousands of dollars to their expenses if they go over it.

dennis says

how is the irmaa figured if you were married in 2018 but will be single in 2020? income will be less in 2020 with only person get social security and pension

Harry Sit says

Death of spouse and divorce are two of the qualifying events to appeal the IRMAA assessment. See link in reply to comment #2 below.

Tanya says

Question: In 2019, my husband and I took a large amount from a 401K to purchase our house in cash, so we wouldn’t have a mortgage now that we are retired. We retired in 2016. As a result, we are now in our 2nd year of IRMAA charges, totaling over $800 a month together. Our total income for 2020 was below the threshold for an IRMAA surcharge, and it will also be below the threshold for 2021. Do we have a case to appeal?

Tanya says

I forgot, we also took money in 2018 to pay for a family event. Yes, yes, I know; we did not know about IRMAA, and ignorance is no excuse. But 2 years of this?

Coral King says

Why do people think they want “Medicare for All”? They must not know that Medicare is very expensive by the time they collect here and collect there, and has big holes in the coverage. There is no out-of-pocket max and you can go broke on Medicare. It is so bad that most folks have to take out a policy to cover what Medicare doesn’t.

Drewmcg says

Coral King: Assuming ur not just trolling, then:

—there are still millions of Americans with no health insurance ,

—there are plentiful Medicare Advantage plans with zero additional premium with annual out-of-pocket caps (nb: I’m not recommending them if you can afford original Medicare + medigap),

—@ 64 with private (non-group) “high deductible” insurance, I’ll pay at least $150/mo. less for original Medicare + medigap with far, far better coverage/exposure, and

—logically, adding younger people to Medicare should REDUCE senior’s Medicare and medigap premiums, b/c they are healthier as a group. Its the hospitals/doctors who hate the idea, b/c lower reimbursements associated with Medicare ….

Hope this helps.

Charles Romer says

A very good analysis of this (the tone of the introduction is especially welcome)

BTW if you find yourself about to go over one of the bracket cutoffs and can not reduce enough, go the other way and make an additional distribution to get near the next higher cutoff. This will greatly reduce the marginal cost and reduce your IRA balance in the future. (Assumes IRA required distributions are what drives this).

DrewMcG says

Agree (and thanks).

Ralph says

I think the reason IRMAA exists is to hide the simple fact that it is an income tax. Most voters are too busy working and dealing with life to understand how their own government is setting them up for a future shakedown. Everyone who votes for bigger government will get what they deserve, but by the time they wake up it will be too late. This is one more reason to get as much as you can into a Roth IRA.

KK says

Harry;

Recent COLA has been announced to be 5.9%. Does this mean the first IRMAA cutoff for 2023 (based on 2021 income tax filing, MAGI, and MFJ status) will be $188,000 X 0.059 = $11,092 added to the $188,000 you consider to be the number for 0% inflation? Thus ending up be a total amount of $199,092? Please let your readers know if this is correct.

Thank you.

Paul says

KK, IRMAA is not calculated from the same COLA used for Social Security. See my post #164 below for a description of the algorithm.

BONYC says

Very needed and helpful detailed information.

This IRMAA is real pain to manage. I wish the cutoff points – brackets were set up in advance If I am adjusting my income now before years end, I would like to know what threshold not cross that will haunt me two years later.

Nobody can see two years ahead. We are forced to play conservative and leave few thousands on the table just to be safe.

Income taxes could be quite difficult without this added complication.

Larry says

Most of my income is from my IRA’s. I have found it a good idea to have a HELOC available. I track my income through the year and by Sep/Oct determine if I will be crossing an IRMA bracket. If so, I will take an advance from my HELOC for any required income and pay it back with next year IRA funds in January of the following year. It may cost a few hundred dollars in interest but way less than the $2000 my wife and I would pay if we crioss the bracket.

Cathy M says

Please explain the reason why “married filing separately” is treated differently. Why they should automatically jump to tier 4, again, just for going $1 over the limit. At least all others only jump 1 tier where the penalty isn’t that great. I’m barely over and my husband’s income is way below the limit.

Harry Sit says

> Please explain the reason why “married filing separately” is treated differently.

Congress made it that way when they passed the law many years ago. They don’t explain their reasons.

Peter Breger says

Does anyone know if the IRMAA uses seasonally adjusted or non seasonally adjusted CPI-U numbers?

Harry Sit says

IRMAA uses non-seasonally adjusted CPI-U numbers.

Paul says

Dave,

Great article. Very important but often misunderstood topic. Not fully understanding the rules can cause large errors and increased costs for Medicare as one attempts to do financial transactions such as Roth conversions while attempting to avoid large IRMAA impacts. I had one question for the 2025 IRMMA estimate in your article. 163 K multiplied by 1.03 would be 167.89 K. If this is rounded to the nearest 1k wouldn’t it be 168K. The article puts the IRMAA level at 167K. I looked and could not find the exact rounding rules in any official Medicare document. Hopefully if $500 or more round up to higher $1000, if not round to the lower $1000. Does Medicare clarify the rounding in any official document of theirs? I could not find it. If you know the link to their official discussion of their rounding rules, it would be nice to have it.

Your article did a great service to seniors.

Denise says

Agree. Where else do you have to ‘guess’ two years ahead what your income will be? Got burned once, now hyperaware, but as someone else mentioned most of us leave thousands on the table because we are so afraid of having IRMAA imposed. Got to be a better way.

This whole website is a true blessing, have learned a lot, thank you to all contributors.

Paul says

Denise, the reason for the delay in IRMAA calculation is that your AGI isn’t “official” until your federal income tax return is filed. Since filing can be delayed until October 15 just by asking (and paying your estimated tax due, of course), the IRS can’t report your modified AGI until after that.

The alternative would to use the IRMAA from the previous year, and recalculate once your tax return is filed, while accounting for what you have already paid. I believe that’s already done if you amend a return, but instead… almost every taxpayer paying IRMAA would be facing a recalculation mid-year.

Luis says

This IRMMA stuff is one of the most infuriating thing I have seem: if you are high income you pay more while working 2.9 % in all your income( no cap like social security), but then double penalized in medicare premium AND medicare part D, when begins in the Medicare plan, the final number could be incredibly high.Besides they go back two years( by contrast in Obamacare is enough your word regarding income). Good look when you call social security and medicare to explain that you retire and your income is well low. Everything thanks to the liberal politics to penalized the successful people.

Harry Sit says

If your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired, you can appeal the IRMAA assessment.

“You had a major life-changing event that significantly reduced your income” is listed as one of the reasons for appealing, and “work reduction” and “work stoppage” are two life-changing events among others.

https://www.hhs.gov/about/agencies/omha/the-appeals-process/part-b-premium-appeals/index.html

Roger says

Actually, the IRMAA law was passed in 2003, when Republicans controlled the House, Senate and Presidency. However, I agree with your point about tax rates. What makes it more confounding is that you probably had a bunch of tax lowering deductions while working, which are no longer available. To add insult to injury, if you contributed to your IRA (or other retirement plan) regularly, you may find that your retirement income is greater than your working income, with few ways to reduce it due to the Required Minimum Distribution rule.

Rosalie Thomson says

Just be glad you make enough to pay.

Bobby Fischer says

I appealed my IRMAA premium in late 2019 after the new rates were released because I had retired at end of 2018. Income in 2018 was very high but dropped well below the first IRMAA threshold in 2019. I filled out the paperwork, called the local SS office, got an appointment, met with the agent and won the appeal. The agent was nice and did a great job.

Blaming your problems for paying your fair share on those left wing liberals or the radical right wing-nuts doesn’t do anything but show your own ignorance and intolerance. Grow up.

David Karchensky says

Not exactly liberals doing. It started in 2007, when George Bush was president. That was for part B. It continued in 2009, under O’Bama, for part D.

ernie says

this is thanks to conservatives do not fool yourself. they think surcharges are great so they can say they did not raise taxes

powderriver says

At least “liberals” know how to spell.

Mario says

Question : Is the selling of your own personal home is considered as Income tours your MAGI ?

Harry Sit says

Mario – The gain from selling your own personal home that exceeds the $250k/$500k exclusion counts toward your MAGI. The gain also counts when you don’t qualify for the exclusion.

https://www.irs.gov/taxtopics/tc701

The Wizard says

The reason for the MFS thing is to keep rich people from gaming the system. Let’s say you have $1M AGI filing jointly. It might be possible to split that to split that income to $920k for one spouse and $80k for other spouse, thus saving a lot on IRMAA.

But Congress said no…

Tom P says

Paul asked about the 2025 IRMMA projection with 3% inflation. The projected 2025 number with 3% inflation is not computed from the projected 2025 number with 0% inflation. Each bracket is adjusted from the Base Sep-Aug 2017-2018 CPI-U average, which was 249.280.

If inflation is 0% from now through Aug 2024, and each month has the same CPI-U of 305.109 from Jun 2023, then the 2023-2024 average CPI-U will be 305.109. Then (305.109/249.280) x $133,500 (2017-2018 base number) equals $163,399, which rounds to $163K, the same as Harry shows. You can calculate the 3% increase by increasing each month’s CPI-U by 0.25% from the previous month… or you can just take Harry’s word for it 🙂

For rounding, anything 500 and up gets rounded up and < 500 gets rounded down, which is what the Excel formula =ROUND(,-3) provides.

Ed Fogle says

It’s difficult to come up with the most ridiculous bureaucratic concepts but IRMAA has to be at the top of the list. Not knowing until a year is over what you can budget in that year to avoid IRMAA ranks as beyond ridiculous. Only a bureaucrat would come up with the concept. They don’t think like normal people.

Jon says

IRMAA is pathetically complicated. Only by raising awareness can the public learn what is being done to our elderly who have worked hard to save and invest in order to fund their retirement. IRMAA is a well hidden cost to until one approaches retirement. Each Presidential candidate should be individually questioned and tested on their detailed knowledge of what IRMAA is and how it is calculated. That way voters can determine if each candidate understands what the policies of liberal politics have done…or if the candidate is simply ignorant which is the likely situation. What a wake up call this would be!

FactsPlease says

Liberal Politics? You shouldn’t be allowed to vote. This was part of a Republican (Conservative) bill passed in 2003 and signed into law by George HW Bush:

Medicare Prescription Drug, Improvement, and Modernization Act

Tom Terwilliger says

Yes, it was enacted under the Bush administration, but it wasn’t nearly so bad as long as the threshold was being indexed. That stopped in 2011 when we all know who was in the White House and who had ironclad control of Congress. And “W” was hardly the model conservative; no, anytime the liberal press and others barked, he jumped, and this was one sad example.

But the really immoral aspect of this is the idiotic way “married filing separately” are treated. There is no conceivable reason why they should automatically jump to tier 4, again, just for going $1 over the limit. At least all others only jump 1 tier where the penalty isn’t that great.

d says

indeed a liberal policy; person was correct that this started under Bush (also responsible for Medicare part D) – but if you think Bush was a conservative instead of a flaming liberal you are sadly mistaken!

I pay IRMAA, and as bad as this policy and tax is, wait and see how bad it gets when the liberals take charge.

Read history — when SS started under Roosevelt, the Progressive argued that we “needed” it, and that it was only a 1% tax — now it is a 15% tax!

Laurel says

I’m all in favor of both presidential candidates being “questioned and tested on their detailed knowledge of what IRMAA is and how it is calculated.” Does anyone seriously think the current incumbent has a clue about IRMAA, or that he even cares if you have Medicare coverage?

Patti_G. says

$$$$ rip offs like IRMMA is the least of it for decent older Americans. The only way doctors can keep their Medicare designation is that Medicare forces these doctors to prescribe pills and medical devices to keep Big Pharma in business. If a Medicare doctor is trying to keep their patients well, that is not the goal of Medicare, and they are kicked off. It is beyond diabolical. But, yes, Democrats scour doctors notes moreso to kick them off.

Kenneth Setter says

Patti G. : This has to be one of the most uninformed posts I’ve seen in quite a while. Medicare DOES NOT push prescribing pills and medical devices. Medicare physicians DO NOT get “kicked off” for trying to keep their patients well. And Democrats DO NOT have access to medical records to scour them for anything. This is pure rubbish.

Patti_G. says

To Kenneth,

You must be a Democrat or else not old enough to be on Medicare yourself. Another thing Big Pharma in connection with medical scoring is doing is decreasing the range of what is deemed in the ‘healthy range’ when getting blood tests….just so they can give you a pill for your cholesterol. And now with corvid, the whole medical field has become totally corrupted.

Kenneth Setter says

To Patti_G.: I am old enough to be on Medicare for over 5 years. Yes, I am a Democrat, and judging from your unfounded criticism of Democrats in your original post, I assume you are a Republican. That should not matter if we are discussing differences of opinion, not alternate sets of facts. My concern was that you were making statements about Medicare that are not true.

I am also a physician and I can tell you that the changing of normal ranges for blood tests is something that happens all the time. It is not due to a conspiracy by “Big Pharma”, but part of changes that occur in medicine all the time as additional research refines our knowledge. I have my share of criticisms for the pharmaceutical industry but this is not one of them,

Patti_G. says

To Kenneth,

Have you ever been a Medicare provider? Then you would know. And no, I do not consider myself a Republican. But alas, this thread is about IRMMA and we’ve strayed OT.

John Endicott says

Um, factsplease, Bush the elder (HW) was not in office in 2003. It was Bush the younger (W).

Frederick and Salma Hayek says

My take is – if you have $190k in income, you can afford the extra premium. How much would your health insurance premium be if you did not have Medicare? Just ask any random 64 year old. If you look it up, the “average” premium is $600. That does not include a $2500 deductible and copays that will happen which Medicare plus a supplemental policy do not have.

Don’t tell me you paid into Medicare and so you “paid your fair share”. You didn’t. You are being subsidized heavily. Health care costs have gone up dramatically since you started paying Medicare taxes. In 2010, the maximum Medicare tax you could have paid is $3100 and that assumes you were self-employed and paid both the employer and employee costs. If you were employed by a company, you paid half that.

Add this to the fact that the number one reason for bankruptcy in the US is medical expenses (62% of all bankruptcies is a common number quoted), and that the average family income in the USA is under $70k, and you want to complain about an extra $1600 on your $190k income? Please. Spare me the outrage.

Many may disagree with my assessment. I respect your difference of opinion. But if you want to have some fun, post your complaint about the extra IRMAA cost and why you have to pay it on social media and see what happens.

Terry says

Frederick, I agree 100% with your entire post. That being said, I see nothing wrong with trying to minimize one’s Medicare premium. I am fortunate that my income is such that I am able to shift some income/expenses between years and I always try to keep my MAGI below the the income points where the premium increases.

Burt P says

Frederick and Salma,

I agree with your overall assessment.

Unfortunately, you are mistaken about the maximum Medicare tax payment in 2010.

The cap on wages for the Medicare tax was removed by The Omnibus Budget Reconciliation Act of 1993 (or OBRA-93).

GeezerGeek says

I also agree that the wealthy should pay more, but it is misleading to say the wealthy are being “subsidized heavily”. In addition to the removal of the Medicare tax income caps in 1993, after 2012, there is the Medicare Net Investment Tax of 3.8% which is not capped. The threshold for the NIT is reasonably high at $250,000 but that threshold is not indexed to inflation so each year, more tax payers are subject to the tax as inflation raises income. It would be difficult to determine the level of income that an individual switches from being subsidized to being a subsidizer, but with the wealthy paying up to 3.4 times the base premiums for Medicare, the 3.8% NIT, and the uncapped Medicare income taxes, that level of income is unquestionably reached and exceeded for some individuals.

Vince says

It’s sad that 50 years ago people who worked hard and made a good living were applauded.

Now those who don’t work hard want those who have been rewarded to pay for their laziness. Government support should only be used by the needy not by those who want to stay home and watch Netflix. There are help wanted signs everywhere because businesses can’t find anyone who wants to work. Taxing the wealthy has always been popular but it penalizes those who have worked hard and strived to live within their means. Many who post on this site feel entitled to special treatment at the detriment of those who worked hard all their lives. Obviously it’s much easier to be supported by the wealthy than to get off the couch and go to work. I’m sick of people who think anyone in the upper middle class is evil and should have their money taken.

GeezerGeek says

Vince, I would agree with you if all hard workers were wealthy and all wealthy people were hard workers. Since I’d prefer that posts on this site stick to the subject of the article, I won’t elaborate further.

Frederick and Salma Hayek says

Thanks to everyone for your responses.

To Terry, I am all for trying to avoid IRMAA. That’s just smart financial planning.

To Geezer – Same response as to Terry. I will, however, change my comment from “heavily subsidized” to “subsidized” as your comment is perfectly reasonable. On NIT – since $250k in income puts you in the top 10% of households, 3.5% on investment income is not going to cause you to struggle to pay your bills. As with IRMAA, I believe it is smart to arrange your investments to avoid the NIT. BTW, I pay some NIT and expect to pay IRMAA at 65.

Burt – I stand corrected. Thank you.

Look, I am an old line fiscal conservative. When times are good, you pay your bills and also pay the debts you ran up when times were bad. My only point to all of this IRMAA NIT discussion is those of us at the top of the income/net worth continuum should not receive any subsidy from a government program.

Medicare is wonderful but it does cost the elderly significantly less than they would have to pay for private insurance and it covers more. I know because my parents ran up big medical bills in their last few years and paid only for prescriptions due to Medicare and their supplemental policies. Just my 3 cents (inflation, you know).

Thanks to all the courteous conversation. This is sometimes rare online.

Peace

Erin Kraus says

Have you considered that politicians may not pass your test:-)

Ernie Kramer says

Gruels, this would be WAY down the list of any presidential candidate, note I have had to pay Irma’s a couple times. Get real, it affects very few people, hardly a major issue

Patricia says

I know your comment was from several years ago but I definitely agree with your comments. IRMAA is a racket. I’m severely handicapped and one thing I am able to do is go to the casino and push the slot machine button. Only if you have a handpay it increases your MAGI for IRMAA. They make you include all your winnings but don’t let you take the losses to offset it (for taxable income they do but not for IRMAA). Who can I write to about this? This is crazy. Anyone knows if you go to the casino enough you lose whatever you win

Lucy Yore says

This is a great article and I wish I’d had this information available to me when I started challenging my own IRMAA. The IRMAA premium “adjustment” came as a surprise to me, too. After working for fifty years, paying taxes, and never using unemployment insurance or disability benefits, I never expected that my reward for paying my way was to be assessed higher Medicare Part B premiums. I retired in 2018 and became eligible for Medicare in July 2019. In 2019, the “look back” income used to determine whether or not I would owe IRMAA was my adjusted gross income on my 2017 tax returns. Because I retired in 2018 and my 2019 adjusted gross income would be significantly less than it was in 2017, I appealed the original decision to raise my Medicare Part B premium. I am a firm believer in dealing, whenever possible, with matters like this face to face. I skipped asking for help by phone and went to my local Social Security office. The first person I met with didn’t use the correct amount of after-retirement income I expect in 2019, and my first appeal was denied. So I made a second trip to re-submit my appeal. The person I met with the second time recognized immediately the mistake the first person had made, corrected it and re-submitted the appeal. Within a week I received a letter from Medicare notifying me that my appeal had been accepted and that I would only owe the ordinary Medicare Part B premium. My perseverance has saved me over $200 a month. If you have been unfairly assessed an IRMAA increase in your premium, appeal the decision in person, and don’t give up until your appeal has been granted.

Kenneth Setter says

In 2020 with the COVID problems, the local offices are all working online – no face to face meetings. I retired the first of this year and made application to have IRMAA removed once I knew pretty closely what my 2020 income would be. The phone experience was MUCH better than going and sitting in the SS office half the day. The agent I dealt with was very knowledgable and told me exactly what they needed – mainly just the SSA-44 forms, documentation to establish that I had retired, and an estimate of what my 2020 income would be. They take your word for it but you have to send a copy of your 2020 tax return when it is filed to document that you were actually below the thresholds. I sent the documents and a letter of explanation. The approval of the removal of the IRMAA happened within 5 days (the agent thought it might take 1-2 weeks). I was due refunds for the 6-7 months of IRMAA we had already paid in 2020 and these were deposited in my checking account within another 2 weeks. All in all a very easy process. I hope they never go back to face to face meetings.

Lucy Yore says

Kenneth Setter – thanks for your thoughtful reply. My experience was pre-COVID. I initially tried to handle my situation by phone, and the person I spoke with was clueless, didn’t know the IRMMA appeal procees, and told me that I owed based on prior income. Not helpful at all. Once I spoke person-person at the SS office, the matter was settled quickly.

Roger says

I had a similar experience, but a phone call worked fine for me. One call to say my wife and I retired and they refunded the IRMAA that had already been collected.

Vince says

Geezergeek,

Since the subject of the article was someone saying anyone whose wages, social security, RMDs, and interest income is over $91,000 in 2020 should pay more in 2022 for Medicare I feel it’s ok to comment on that. I don’t think it’s difficult for someone who has worked hard to be in that bracket. I won’t elaborate further.

powderriver says

Vince — You already “elaborated further” in your initial screed. Such purposefully mis-informed, self-entitled nonsense; and freely advertised in public!!

A progressive tax structure has been in place here in America for quite some time, with support from both liberals and real conservatives. But it appears that self-styled conservatives feel put-upon by it, touting their own undocumented work ethic over over that of all others……surely no one gets rich in America without “hard work”, right?….and surely all those who do work hard get rich, right? Apparently any excuse will do to shout out some dog whistles.

Vince says

powderriver,

Harry Sit does a great job with this blog so maybe it would be better to stick with

discord that can help people with navigating the ways to minimize IRMAA instead of

insulting people.

powderriver says

Vince,

I agree, this is a nice and useful blog. And I personally don’t think it should be infected with unsupported rightwing dog whistles. I fail to see how that is insulting.

But at the same time, how can it not be INSULTING to many of the readers of this blog, as well as the working poor and middle class, to accuse them of being lazy, couch-bound, stay-at-home Netflix watchers who don’t want to work and think they are entitled to special treatment. I absolutely fail to see how an upper-middle-class person attempting to claim victimhood, while aimlessly slinging that kind of divisive mud, will help readers of this blog to — in your own words — navigate the ways to minimize IRMAA.

A behaviorally descriptive word comes to mind, but I will not elaborate further.

But I do congratulate you on your own hard work and hard-won wealth, and on your attempts to minimize IRMAA.

Ros says

To Ernie Kramer,

16.3% of retirees in 2023 pay IRMAA according to a healthcare site I read today

Harry Sit says

Ros – That’s not accurate. 7.4% of Part B beneficiaries paid IRMAA in 2022. See Tables II.B1 and V.E3 in the official 2023 Medicare Trustees Report.

Ros says

To Harry’s reply of April 30, 2023.

Thank you for your information. My information was from a link from a healthcare newsletter link. I read several from Beckers, Kaiser and many healthcare articles written from a google alert on IRMAA and Medicare. Actually from a google alert article is where I found your site. It was also for 2023 figures from people enrolled for the 2023 year with healthcare insurance companies paying Medicare and MA. I don’t know if this included the disabled and other or just seniors.

I have guests expected for dinner and do not have time to go through the details of your article right now. Thank you for your tables.

Your 2nd table said that 5.2 million are affected by this and this would be for 2022 figures.

On a chart for the month by month enrollment for all Medicare in April it was just under 64 million. I was astonished that it was 500,000 less than were enrolled in March.

IRMAA Needs to Go says

To be excruciatingly precise, can we state that the bracket amounts (when finalized) for calendar year 2020 will be used with the calendar year 2018 income amount to determine the amount of IRMAA, if any, a medicare recipient would be assessed by CMS/SS during calendar year 2020? Similarly, the CY 2021 bracket amounts would be used with CY 2019 income to determine IRMAA to be assessed/paid during CY 2021?

Harry Sit says

Yes your AGI plus tax-exempt interest reported on your 2018 tax return (filed in 2019) will be checked against the bracket numbers in the 2020 column to determine the Medicare Part B and Part D premiums you will pay starting in January 2020. My table only showed Part B. Part D uses the same brackets but different surcharges.

The Wizard says

“discourse”

Vince says

powderriver,

I read through everyone’s post on this blog since 2019 and you scare me the most.

Seems like you have a lot of anger. Maybe switch over to Twitter. I’m still hopeful everyone can work together to make things better for everyone without insults. Let’s stick to the subject and not make political statements going forward. Not fair to Harry to have people

insulting others.

Terry says

Vince & powderriver, Can both of you please shut up and post only comments that are beneficial. I’m getting tired of your back and forth drivel. I imagine that others are too. Harry Sit has a great blog and you two are posting too many worthless comments.

powderriver says

Vince – If you say that you are scared, that proves you probably should be. Another brick in the ‘victim’ wall.

Terry – I agree. Now you too can stop your own worthless comments and shut up.

sscrla says

Since the August, 2019 CPI numbers were announced on September 12 and the law says the inflation adjustment is based on “the percentage (if any) by which the average of the Consumer Price Index for all urban consumers (United States city average) for the 12-month period ending with August of the preceding calendar year exceeds such average for the 12-month period ending with August 2006 (or, in the case of a calendar year beginning with 2020, August 2018),” you now know all the numbers. Therefore, there is no need to use the word projected, unless you expect the BLS to revise an already published CPI figure.

Ken says

The ability to not take the 2020 RMD will also affect your IRMAA calculation for 2022.

Rob says

Looking at your 2022 projections you seem to assume bracket inflation of 3%. However latest July 2021 CPI is running at 5.4%. Do you expect the final brackets to increase further before end of this year?

Harry Sit says

Rob – The calculation doesn’t just use the latest month over the same month a year ago. It also includes lower numbers from the previous months. We’ll have the last missing number used in the calculation on September 14. Although we can always be surprised, I don’t think this last number will change the projections for 2022.

Vince says

Wizard, I chose discord because I didn’t think some can ever agree in harmony but I guess

we should hope for peaceful discourse. Different world than 50 years ago. I pray that people can work together in the future to make things better for everyone. Harry Sit is very helpful.

Vince says

Terry,

I apologize. You are right.

Sorry

Harry Sit says

This was posted on September 3, before the latest CPI release, which now confirmed all the numbers in the table.

Mary says

You should block any comment that has the words liberal, conservative, politics, etc. so those of us trying to understand the IRMAA and deal with it can make use of this site.

CHRIS KELLY says

What about the 2 years we went from 104 dollars to 136 dollars ? This is monthly. That is 32 dollars a month for 2 years. Do we get reimbursed.

gary says

i have seen 2 articles that used the cpi and have different results. another article used the same 1.7% and showed the first bracket increasing to 86,000 not 87,000 because 85,000 with a 1.7% increase is 86,445.xx so the nearest number rounded down. So it is already rounded up (87,000) or is it rounded to the nearest 1000 which would mean it shouldbe 86,000?

Harry Sit says

It is rounded to the nearest $1,000 but the 1.7% number used in the other article isn’t correct. The correct CPI increase to use is 1.9%. When you raise $85,000 by 1.9%, it rounds to $87,000.

gary says

I check the gov’t cpi website and it is showing annual for august of 1.7% is it a different month that is used sep 2018 cpi was 252.146 and aug 2019 256.558 which is 1.7%. is it a different indicator or timeframe?

Harry Sit says

See comment #6 above.

Marcia Mantell says

There is a typo in your bracket for single filers: second row. Should be above $85k up to $107 (not $170). That also throws off your 2020 estimate. Please correct. Thanks!

Harry Sit says

The table is correct. $170k is the threshold for paying 1.4x standard premium for married filing jointly. $107k is the threshold for paying 2.0x standard premium for single.

Bob says

I have been paying irmaa for three years and I understand the concept and I can manage my income. I file married/joint tax return. I am currently projecting MAGI of $212,000 for 2019 tax year. How much higher can I push my income before moving to the next irmaa bracket?

Harry Sit says

The next bracket starts at $218k in 2020. If you add 1.5% inflation, you get $221k for 2021. If you’d like to avoid surprises, you may want to stay below $220k.

Sammy III says

When will medicare come out with the final part b premiums and irmaa surcharge for 2020?

Harry Sit says

Hopefully soon. They announced on October 12th in 2018.

BobH says

We have kept my future wife income below 85K. She will be retiring in Jan 2020 because she has PPO time that will bump her above 85K so we delayed the retirement to Jan 2020. So, could I do a 70K Roth conversions in 2019 which would cause her income to be about 85+70= 155K. Then file the life changing event of not working SSA-44. Her IRA withdrawal in retirement will be about 60K a year normally. If they throw out her salary then we would be below 85K.

The Wizard says

Nothing wrong with higher income oldies paying a little more for Medicare; I always will be under current law. But it’s good to project your AGI into your 70’s and then not do Roth conversions in your 60’s that are TOO big for your present IRMAA bracket. I call this Levelizing your AGI…

John Sullivan says

It’s not about “higher income oldies” paying a “little” more – it’s a LOT more – up to 3.4 times the standard rate. Given it’s these people who have paid more into the program over their working years, it’s really insulting to be treated like this. Instead of being giving VIP treatment for helping fund the program, it’s a slap in the face.

Further – reading the author’s words “In the grand scheme, when a couple on Medicare has over $194,000 in income, they’re already paying a large amount in taxes. Does making them pay another $1,600 make that much difference? It’s less than 1% of their income”. Because they are already paying far more in taxes than others, is not a reason to make them pay even more. I fail to see that logic in that.

Rich Tedoni says

Approximately when will the IRS send the 2018 agi to medicare/SS to determine if there will be an IRRMA

Harry Sit says

No idea, but if by the time they charge you the Medicare premium for January they still haven’t figured it out, they will eventually bill you the difference when they determine you are subject to IRMAA.

Joe Pereira says

November 2020 I turn 65 I been getting social security pay from 62, my total income is lower than the normal threshold bracket, however in 2018 I received money from my 401K causing a high income for the year 2018. for 2019 I’m back to a normal income, according to social security my Medicare start in November 1st 2020, I’m a little confused if medicare irmaa

part B and D surcharge going to apply for the whole year 2020 or year 2021

Cynthia Siebert says

I was notified that I will be paying an IRMAA fee starting January 2020 due to us withdrawal from IRA… This was a one time withdrawal! Can I go to SS office in March and show them my income from 2019 is MUCH lower now and get rid of the IRMAA?

Harry Sit says

Just showing it was one-time IRA withdrawal isn’t enough. You need to show one of seven qualifying life-changing events:

– Death of spouse

– Marriage

– Divorce or annulment

– Work reduction

– Work stoppage

– Loss of income from income producing property

– Loss or reduction of certain kinds of pension income

MRO says

I recently started with Medicare and am paying IRMAA adjustments for Parts B and D. I am healthy and do not take any prescription drugs. My premium for Part D just increased as will my IRMAA for Part D as well I imagine. I do not believe in paying the IRMAA penalty (for Part D knowing that I have no choice with Part B) and only wanted to be compliant by taking Part D but am planning on dropping it as my premium increased and my tolerance decreased. My question is if I am not participating in Part D am I still responsible for paying the IRMAA penalty or does it go away as well?

Harry Sit says

Medicare Part D IRMAA basically means a higher price for Part D. If you drop Part D you don’t pay it any more. However, if you re-enroll in Part D at a later time, you may pay a permanent penalty based on the number of months you went without it.

https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/part-d-late-enrollment-penalty

IRMAAA Need to Go says

Maybe I missed it in the comments here, but doesn’t the “2020” table at the bottom of this web page https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance prove (finally) that the IRMAA threshold has been announced as $174K for the first bracket above baseline?

IRMAA Needs to Go says

Sorry, forgot to mention that you have to click on the Part D in the page to see the rest of the text which includes the tables.

Harry Sit says

Yes! All the other bracket cutoffs match what I had here as well. No idea why they buried them so deeply.

Robert Burger says

IRMAA is not just determined by AGI plus muni bonds. It is actually AGI plus all un-taxed income.

Harry Sit says

Not all untaxed income. Untaxed Social Security benefits are not included in the definition of Modified AGI for Medicare. See Table I starting on page 5 of this PDF document:

The Use of Modified Adjusted Gross Income (MAGI) in Federal Health Programs

Ann Brown says

If the CPI used to determine the percentage increase (CPI-U?) were to show a negative number, would the brackets stay intact or would they be adjusted downwards? I can manage my income but the underlying question is whether I can be assured that the $87K threshhold for single filers would at least remain the same in future years.

Harry Sit says

The law only talks about “increase” and “exceed.” I assume it means if the change is negative they will just freeze in place until inflation catches up. We haven’t seen a real example of negative inflation since IRMAA went into effect though.

Ann Brown says

Thank you for your prompt response. I agree we haven’t seen a real example of negative inflation since IRMAA but we are seeing other unexpected financial developments (increasing talk of negative interest rates in the US, for example). The fact that the thresholds are based on events 2 years in the past means that there could be an unpleasant surprise in store at some point.

We can rail against IRMAA (and I agree with all the comments) and it would certainly be frustrating to fall into the next higher threshold by a few dollars. On the other hand being impacted by IRMAA signals that we have some meaningful/above average level of income. As a 16 year old, I remember complaining to my father about the deductions and taxes in my first paycheck. His question to me: “Would you rather have the income and pay taxes on it or not have it and not pay taxes on it?” In my volunteer work I see seniors who are just keeping their heads above water (for various reasons) so I feel grateful to have an IRMAA concern.

Thank you again, I appreciate all the great information.

Han Ngo says

IRMAA is so confused.

I am paying IRMAA for my medicare part B. My wife will be eligible for medicare next year, will she pay the same amount of IRMAA as I do? I think for a married couple, they should only pay IRMAA once, not both husband and wife have to pay IRMAA because it counts and is calculated for a married couple. If both husband and wife have to pay IRMAA on each account, is it a double dip?

Thank you.

Harry Sit says

If you are married filing jointly, when the joint income exceeds the threshold, both of you will pay IRMAA.

Sharon Wallace says

Why can’t I find out ANYTHING about the Part D IRMAA surcharges for 2020?? I find all kinds of info for the Part B…but not Part D.

Harry Sit says

Click on the link in comment #19. Then click on the link at the bottom of that page for Part D.

Bob Land says

What happens if your MAGI drops 2 brackets? Will the tax brackets be lowered two steps at once or one at a time/year in the reduction of the additional insurance premiums?

Harry Sit says

At once. Whichever bracket your income two years ago belongs, you pay the corresponding premium.

Dave says

To clarify please.Is the 15% of my total SS that IS NOT TAXED,still included in my MAGI total along with the rest of my income to determine if I have to pay more for IRMMA?Thank you!

Harry Sit says

Dave – The portion of your Social Security that’s not taxed isn’t included in the MAGI for Medicare IRMAA. See comments 20, 73, 108, and 131.

John Tenfelder says

If I get married in Dec 2019 to a woman who earned less than $80,000 annually in 2017, 2018, and 2019, but I made enough to put me in the IRMAA B/D 320%/574% bracket in each of those years, will she still be charged zero IRMAA or will she be charged in my bracket retroactively for 2019 (based on my 2017 AGI) if we file jointly in 2019? What about 2020 and 2021? Are our then single incomes used?

Harry Sit says

Not retroactively. She will pay IRMAA starting in 2021 based your joint 2019 tax return to be filed in 2020, but your IRMAA in 2021 may drop a tier or two based on your married status.

Caught in the Middle says

One thing not mentioned here is if you are married but file separately (and are over the lowest bracket) you have to pay the 3.2 rate regardless of your individual MAGI.

Planning Stage says

What if you downsized in retirement and found selling your house left you with enough taxable capital gains to push you into the next IRMAA bracket? I don’t see any option in the appeals process link for such a situation. Would both my wife and I both be penalized for life?

Harry Sit says

Not for life. Your higher income in one year only triggers IRMAA for one year. When your income falls back down the following year, you will stop paying IRMAA.

Tony Frank says

Medicare is worse than private industry. Increase monthly social security payments by 1.6% versus 7% increases in Parts A, B and D medicare premiums.

No wonder so many retirees are or will be eating spam, assuming they can afford it.

A bunch of predators in dc.

Travis(FAIR TAX) says

The fact that this is how our countries leaders treat its elderly population is a shame and a disgrace, it is theft!

Linda Somma says

My husband died in May 2018 and We filed married that year. My Part B/D premium for 2020 will be in the second tier (twice as much as the standard tier) due to higher income.

In 2019 my MAGI is half of what my husband and I earned in 2018. When I file SINGLE for 2019, I’ll still be in the second tier. is there any reason I should appeal?

Anna Carlucci says

the first qualifying life-changing event listed to file an appeal of the IRMMA is death of a spouse……seems you can appeal

Thomas Schamp says

There are seven life changing events that can be the basis for an appeal. It’s not clear that you qualify for any of them…

Sherry Wiser says

I turned 65 in Oct 2019…I was charged an IRMAA because in 2017 I went over the $85000 AGI. However, that was because I withdrew $50000 to purchase a new vehicle which I had been saving for while I was working. The 2 years before and the 2 years after 2017 my AGI was/is approximately 45,000. Does the Medicare/Social Security Dept. look at your AGI each year? If you are accessed an IRMAA the first year you get Medicare, will you always be charged that IRMAA in the future years? Will my IRS Tax Returns be looked at again for the year 2018 for 2020 Medicare payments and the IRMAA not applied…Or do I need to go to the Social Security office and appeal?

Harry Sit says

Your income is looked at each year. When it comes down you will stop paying IRMAA.

The Wizard says

This is why it’s usually a good idea to “Levelize” your AGI from year to year in retirement, including withdrawals from tax-deferred for Roth conversion…

Sherry Wiser says

Harry

Thank you so much for taking the time to answer my question and all of the other questions as well.

SBW

Sherry Wiser says

The Wizard

Thanks for your input…I now realize that I should have done that…25000 in 2017 and 25000 in 2018…However, I was NOT aware that there was a additional charge (IRMAA) if you went over a certain amount. And had no idea that they would go back two (2) years for your AGI.

Thank you

SBWiser

Joe P says

You charged irmaa for 2019..did you received another letter from SS for the normal amount for 2020 since you income dropped to $45000..

I’m in the same situation they charge me irmaa for the month of November And December 2019, because I sold some stock in 2017 to buy a home..I hope they look again at my 2018 my income was around $60000 I dont want pay irmaa for 2020 since my income is $60000 ..any suggestions what to do..thank you

Sherry Wiser says

Joe P

I just read my letter from SS and beginning in Jan. 2020, my SS deposit will NOT have the IRMAA deduction. YAY!!! Everything is back to normal.

Joe P says

Great that’s good news

Richard Persram says

I would appreciate any guidance on IRMAA determination. Is the information SSA provided this morning correct?

I retired in April of 2019 and started Part B in May 2019. I was immediately hit with IRMAA which I expected and my initial determination was based on 2017 taxes. My income for 2017 through 2019 places me above the IRMAA MAGI limit.

I called Social Security this morning to gain a better understanding of the IRMAA appeal process.

I was told that since 2020 would be the first year in which my income falls below the IRMAA limits, I would have to wait for 2021 to file form SSA-44 and if my income was below the IRMAA limit, they would then retroactively credit me my IRMAA payments for the entire year of 2020.

I thought previous to my call, that I could file SSA-44 now or early 2020 and they would use my 2020 income estimate from SSA-44f for the 2020 IRMAA determination.

The Wizard says

That info sounds correct and was what I did. I had $35,000 of part-time W2 income in 2016 on top of retirement income which put me in a higher IRMAA tier for 2018.

I did my taxes for 2017 (with zero W2 income) in February 2018 and then sent in form SSA-44 with a copy of my 2017 form 1040. They accepted that and put me back in a lower IRMAA tier for 2018, refunding the overcharge for the first few months…

Winston Bowen says

Harry Sit writes that if your income drops to lower IRMAA brackets you will automatically be dropped into the new category and pay that rate for Parts B and D. I just got my 2020 earnings summary, and while they show the lower MAGI they have kept me and my wife in the previous, higher bracket and show our IRMAA payments at the higher amount. How do we appeal?

Ken says

I have purposely stayed under the MFJ $170k MAGI to avoid and IRMMA surcharges the past few years of retirement. In 2019, I want to make a larger than usual IRA withdrawal that will bring the MAGI into the IRMMA surcharge category, and I would like to come close to the ceiling for the first level (of 40% B, & D surcharge), which for MFJ has been $214K for several years. It is now dawning on me that there is no place to lookup what the IRMMA $$ brackets will be in 2021, since my reading is telling me that the 2019 one that is published, is not for tax year 2019 MAGI, but is being used for current 2019 year IRMMA surcharges on 2017 MAGI. Does it even make sense that we don’t know the ceiling that will apply in 2021 when they penalize us for our 2019 MAGI, or do I have this wrong???? IF that is true, am I safe, if I stick with the $218K that is announced for 2020 (to be used for 2018 MAGI brackets)? It seems that one should know the different ceilings prior to making a mistake in a current tax year that could bump you into an even higher bracket when assessed 2 years later, or make you go over the ceiling for no surcharge, which has been $170k for me the past few years. I guess I am just figuring out that it is more confusing than I thought. ANY THOUGHTS WOULD BE APPRECIATED!

Harry Sit says

Yes the 2021 brackets will be for your MAGI in 2019. The numbers should be slightly higher than those for 2020. If you keep your 2019 MAGI under the published numbers for 2020 you should be OK in 2021.

Erin Kraus says

Have you considered that politicians may not pass your test:- pigs get fat, hogs get slaughtered. Use the current Irma announced brackets instead of trying to sbcrztch out a few grand in income. Seems this would be wisest

brian birner says

I submitted the form SSA-44 to my local Social Security office about three weeks ago. Do you know how long it takes to process this form?

I had a recent reduction in income. This was in reference to my IRMAA.

Thank you

Bob L. says

I am curious that the incremental increase for the top bracket(>750,000) is significantly less the lower ones. I’m guessing that may be because the total amount cannot exceed the average cost of each program. Is that correct?

Harry Sit says

The shares of program cost paid in each IRMAA bracket are 35%, 50%, 65%, 80%, and 85%. Congress could’ve made the top bracket pay 90%, 95%, or 100% of the program cost but they stopped at 85%.

Songbill says

Yikes! I just learned about the existence of the IRMAA surcharge. We have had our joint MAGI stay under the IRMAA threshold every year since I retired over 5 years ago. However, this year we get to enjoy a one-time-only, unusually massive capital gains on a particular stock we’ve owned for the past 15 years. (Our NYSE-listed firm was bought out by a much larger NYSE firm that paid a total cash buy-out to shareholders rather than offering stock shares conversion, thus we’re experiencing the capital gains — whether we wanted it or not.)

I’ve looked at your chart and done some computations and can see that I and my wife’s monthly Medicare premiums (+IRMMA) will rise from the standard basic deduction from Social Security benefits ($135 per month per person) to at least $462 per month PER PERSON starting in 2021. Not happy with this discovery but OK, I understand that is what the IRMMA calls for. HERE IS MY CONCERN: After our annual AGI drops back down, for 2020, to the level of just a standard basic Medicare premium, how do I get the SS & Medicare folks to NOT keep taking out $462 per month out of each of our SS benefits during 2022? They do a “two year look back” in doing their calculations, not an annual one, so who should I talk to or what should I do after I file my Federal taxes in 2021, for year 2020, in order to prevent them from taking out the $462 each month for a second full year (2022)?

The Wizard says

They do the 2-year lookback thing Every Year.

So you should just have a single year of elevated IRMAA payments…

Doron Steger says

Do IRMAA Medicare part B charges apply to families in Medicare Advantage Programs?

Do IRMAA Medicare Part D charges apply to families receiving drug coverage in Medicare Advantage Programs?

Thanks!

The Wizard says

Yes and yes. This is exactly what I have and I will be paying IRMAA “forever”…

b. lolr says

I am so confused with IRMAA this year. I want to do a Roth conversion again in 2019, (next 2 weeks) which will put me in Tier 2 of IRMAA in 2021. I am trying to figure out what the MAGI cutoff is for my 2019 tax return so I can determine how much I can convert from Traditional to Roth without going into Tier 3 in 2021. Should I stop at $213,999 or 217,999?

Any help will be appreciated!

The Wizard says

We won’t know the tier thresholds for 2021 based on 2019 MAGI until 11 months from now.

But you can safely get your MAGI up to $218k, MFJ, which is this years threshold.

Any higher and you’re betting on what next year’s inflation percentage will be. Not good to lose that bet…

b lolr says

What does MFJ stand for?

Ken Fitzgerald says

b lolr, MFJ = Married Filing Jointly (for tax return)

Bev Lolr says

If I can safely get the MAGI to $218K for tax year 2019 and remain in Tier 2, that answers my question. Now instead of staying at $214K for Tier 2, they are going to be inflation adjusted, right? Thanks again.

Gail says

Can you explain why people collecting social security who are married but file separate returns are penalized with a substantially higher irmaa? For married filing separately, there is no tier 1-2-3, irmaa starts at tier 4? Isn’t this actual discrimination?

Harry Sit says

When they do something to collect revenue, they don’t want to see it easily defeated by couples rearranging their income and filing separately. Suppose a married couple’s income is $300k. If they file jointly, they will pay $376/month each in 2020. If the couple split their income to $80k for one and $220k for the other, they will pay $144.60 plus $462.70, which is already less than $376 * 2. If Congress didn’t make the higher income person go to tier 4, IRMAA will be defeated even more.