[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

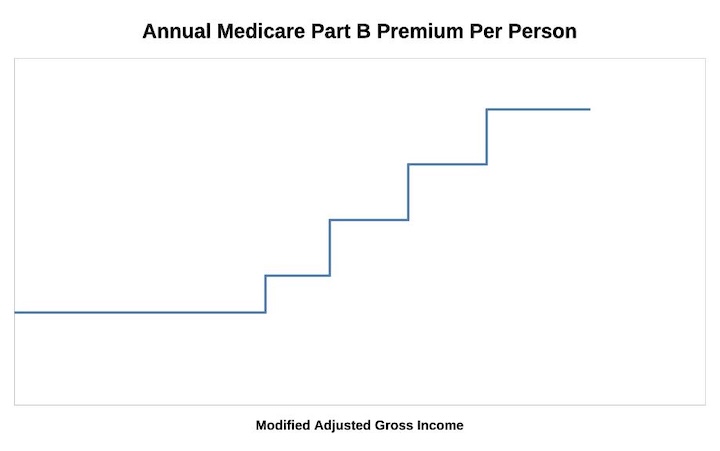

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Gail says

In my case, i was over the limit by 4000.00, I asked that be used to pay irs taxes on a roth conversion. When they wanted to add almost 400 per month to my medicare costs, i was angry. I do understand your explanation, but I don’t agree. My spouse barely made 50000. So we filed an amended return jointly whech fell well below the limit.

Thus, instead of collecting an additional 4665.60 (388.80/month) from me they ended up getting no irmaa at all.

I wish to add that if they had fairly assessed the irmaa at 66.50 per month, I would have paid without question. Social security has always been based on individuals, earning etc, never before has my marital status been used against me.

There are reasons for filing separate returns that have nothing to do with avoiding taxes. So, I still feel that the assessment of excessive payments to people who file separately to be severely discriminatory.

The Wizard says

Looking forward, it’s generally better to withdraw amounts from tax-deferred each year to keep your AGI just slightly increasing and below the next IRMAA tier threshold. As opposed to withdrawing a lump in one year for a large purchase like a new car.

Good news is, your additional IRMAA amount is for only the twelve monthly payments in 2020, after which it should go away, assuming your 2019 MAGI was low enough…

IBM says

Don’t forget to thank President Obama for adding in the Part D IRMMA

Harry Sit says

See reply to comment #3. IRMAA came about in 2003, as a part of the law that created Medicare Part D. President George W. Bush signed it.

David Taylor says

In their booklet “Medicare Premiums: Rules For Higher-Income Beneficiaries” the Medicare folks claim that only 5% of Medicare recipients quality for IRMAA. But every independent survey of personal income that I can find claims that at least 20% of all seniors make more than $87,000! So, is the government just lying to us, or am I missing something?

Kenneth Fitzgerald says

Perhaps many of the over $87K retirees you have seen cited in those counts have a spouse who is not in the same category (in the other 80% of retirees), and together they stay under the now $174K Married Filing Jointly limit before IRMMA affects them?

The Wizard says

I’m not sure how this matters. My AGI is way over the starting point for IRMAA and always will be. So I pay a bit more for Medicare than lower income folks do.

I’m perfectly okay with that…

Ed says

I’m not. Let’s make it voluntary for all you people who feel good because paying IRMAA means you earned more.

Marilyn Hitesman says

Big difference between “way over” and “barely over”.

Thomas R. Williamson says

Great to get the irma brackets, but for some odd reason, they did not include the cost for each backet…. Who the hell knows why.

GeezerGeek says

Thomas R. Williamson, the cost for the bracket is a multiple of the Part B base rate which is set by CMS near the end of the previous year. CMS announced on Sept 27, 2022 that the Part B base rate for 2023 will be $164.90. The multiplier the first bracket is 1.4, the second 2.0, the third 2.6, the fourth 3.2, and the top 3.4. If you multiply the base rate by the multiplier for the bracket, you will get the cost for each bracket. The base rate changes (or can change) every year but the multipliers for the brackets are set by law.

David Taylor says

You might be right. On the other hand, you shouldn’t be. Those counts just say “individual” income, and to me that means unmarried. If they are indeed including individual incomes within married couples, then that is very confusing. Sigh. That’s the trouble with the three-word data descriptions you find on-line. You are never quite sure what assumptions they are making.

The Wizard says

The monthly cost for each IRMAA tier isn’t known until October of the previous year, so next October for 2024 tiers.

But the multiplicative factors are known…

David Taylor says

To The Wizard: If the percent of seniors affected by IRMAA is really 20% rather than 5%, then the government should admit it. A government that lies is not a good thing. The IRMAA booklet almost apologizes for IRMAA by implying that it is not a big deal because “only” 5% pay it. Is this Truth? Or propaganda? Or imaginative accounting? I’d like to know.

Ed says

Doesn’t matter what the percentage is, it’s an abomination of a success penalty. Standard government garbage. Does anyone think a private business could charge wealthy people extra for their product?

The Wizard says

Yes, I completely agree that we want truthful info. The lower IRMAA tiers are x2 for MFJ vs Single so not so hard for them to report.

But my impression is that Medicare is underfunded, rather than generating a surplus each year. So an IRMAA-like scheme for higher income oldies seems to make sense…

Larry Burdick says

I have had a two-year stepdown in terms of retirement and income reduction. I have filed requests for IRMMA reconsideration a couple times and after some hassle, have had both approved. Here is my problem, I filed the paperwork in early 2019 so my wife (the only one of us getting Medicare that year) would have here IRMMA based upon an estimated 2019 income instead of our much higher, preretirement income from 2017. Well, my estimated was between the $170,000 and $214,000 bracket. I was sloppy last year relative to income, and when I did my taxes last week, my 2019 income was $214,023!! Now, not sure what to do. Do I report this or just let it “catch up” to me in the future for the expected payback for the IRMMA required for the next higher bracket. And, I just got them to adjust our premium for 2020 for the estimated much lower income we will have, which I worry will be all fouled up again. Ugh.

Larry Burdick says

From Harry (above):

Yes the 2021 brackets will be for your MAGI in 2019. The numbers should be slightly higher than those for 2020. If you keep your 2019 MAGI under the published numbers for 2020 you should be OK in 2021.

So Harry, am I okay? Is the $214,000 or $218,000 what is used for 2019 AGI? So confusing . . .

Harry Sit says

In late 2020, Medicare will announce a new number, which will be used to measure against your 2019 MAGI, to determine how much you will pay IRMAA in 2021. If the inflation is positive, which is usually the case, that number for the second tier should be slightly higher than $218,000. If the inflation is negative, it can also be lower. We don’t know what that number will be until later this year.

Tom K. says

More lame fake news from the right. It was during W’s reign, not Obama’s that IRMAA was added. With Trump driving us further into debt, and Congressional republicans too afraid of him to find their spines, be prepared for even more increases in the future, and not just to IRMAA. True facts matter…

Marilyn Hitesman says

True facts do indeed matter. Trump followed Obama’s lead, to be sure, and dramatically raised the national debt by trillions due to the China virus. Now we have Unemployment as a career, wide open borders, massive “bailout” programs that further the dependence upon government, and nothing to look forward to but the demise of a once great Democratic Republic. This is bigger than politics.

The Wizard says

I’m not sure we care about when or under whose admin that IRMAA got started.

It’s a good way for us wealthy folks to help the poor people.

What’s wrong with that?

Ria jensen says

I personally worked hard to put as much income away as possible in my 401K. I’m a single parent and tax status is the same. My retirement income from former employer plus social security has my earnings at less then 40% of my pre retirement income. I never asked nor received any government assistance, etc during the 48 years I worked. But now that I can fix my home, make travel plans etc I find Im going to pay the IRMAA because I was smart in saving. The amount I’m going to pay has taken away a good portion of my plans. So yes, I have a problem with paying this. I’m not rich, I saved and now I cannot live as I planned in retirement. Not fair to middle class citizens like myself I also pay for supplemental insurance and a drug plan Based upon calculations, I’ll be paying over $700 a month for insurance; that’s insane.

Ed says

Do you really think this helps poor people? You’re fooling yourself.

Kenneth Fitzgerald says

Tom K- I think the earlier poster ‘s comment was that that Obama added the newer Part D surcharge to (the already existing) IRMMA, and not that Obama created IRMMA.

David Walton says

I retired in 2019 at 65. I am married and my wife and I had enough income to be affected by IRMMA. My wife is younger and continued to work until mid year 2019 when she retired but she is not 65 and is not eligible for Medicare. Our income for 2019 was more than in 2018 due to significant bonuses. In 2020 however we will have significant reduction in income. If I appeal IRMMA now, because of our retirements, would I likely be eligible for a reduction in the premium? In other words would my Medicare premium for 2020 likely be adjusted based on our estimated 2020 income?

Ken says

My brother had the same problem when he retired in Jan 2018, and it straddled two tax years, in terms of high income in 2017, and again in year he was was retired for 11 months at age 70. He appealed it two times, (for 2019 and 2020 surcharges) and got relief on both. I don’t think you can appeal it until you get the letter telling you that IRMMA has kicked in. For him, it was December of the year before the hike was taking effect, so for you, I guess your first letter will be in Dec 2020, for 2021 IRMMA surchange based on 2019 tax return income. If they already assessed a surcharge for 2020 Medicare cost, based on your 2018 income, before retirement, you should certainly appeal that now, and should have gotten a letter about Dec 2019. No expert here, just going on what I read and heard about it.

CathyKate says

I agree with Tom T.

I don’t understand why married filing separate jumps from the Part D first tier to tier 4. If you make a dollar over $85,000 you are put in a category that goes up to $415,000. If someone could explain that I would surely appreciate it.

Thank you

sscritic says

There is an ACA subsidy. When you make too much, you lose your subsidy. No one calls it a surcharge.

IRMAA is no different; it is a reduction in your subsidy. All you have to do is read the law:

“(i) Reduction in Premium Subsidy Based on Income.—

(1) In general.—In the case of an individual whose modified adjusted gross income exceeds the threshold amount under paragraph (2), the monthly amount of the premium subsidy applicable to the premium under this section for a month after December 2006 shall be reduced (and the monthly premium shall be increased) by the monthly adjustment amount specified in paragraph (3).”

V.F. says

My spouse died from Covid 19 this year but I will file joint tax return. If I convert a large sum from IRA to Roth IRA it will make my MAGI approach 213K. What will my premium surcharge be in 2022 when I will file as single? Is it $60 if my income as a single taxpayer is less than $109K in 2022 or is it $144.60 because 2 years earlier joint income was 213K, assuming Medicare premiums and surcharges don’t change between 2021 and 2022?

Ken Fitzgerald says

I found this article had a lot of info about IRMMA. It may help you. Note the IRMMA APPEAL section that may work for you once you get the surcharge notice.

https://thefinancebuff.com/medicare-irmaa-income-brackets.html

Vince Pellettier says

Was your column updated for new cpi-u figures on August 12,2020? You said 2021 brackets should be $88k/$176k because of rounding up each $1000 but I’m thinking there maybe won’t be an increase from $87/$174. Someone said they are now using chained (c-cpi-u) instead of cpi-u. Do they also use seasonally adjusted cpi? I guess there’s one more month of figures so nothing is definite but we are at $174,174 for income 2019 so I’d like to see a little increase. I wish it wasn’t rounded up by $1000 because they may not adjust anything is there is just a small increase.

Harry Sit says

The July CPI released on August 12 didn’t change the projections. Even if the August CPI goes back to the low seen in April, the first bracket for 2021 will still be $88k/$176k.

MJM says

When during the year do IRMAA adjustments occur (January 1 or based on my initial Medicare sign-up date)?

Ken says

The IRMAA surcharges are by calendar year starting in January. Tha date you started is immaterial.

Eric says

Is the non-taxable portion of social security benefits included in MAGI? I see contradictory information on the internet.

Harry Sit says

The non-taxable portion of Social Security benefits is not included in the definition of MAGI for Medicare. See reply to comment #20.

Vince says

The CPI-U figures came out an hour ago at 1.3% so can you know calculate exactly what the new high income brackets will be for 2021? Would you take $87,000 x 1.3% = $1131 and $88,131 ($88,000 rounded down)? And thus $176,000 for joint?

Or do you have to wait for more info from the government? Thanks Harry

Harry Sit says

The latest CPI data point confirms the numbers in the blog post. The first tier for IRMAA in 2021 will be $88k for single and $176k for married filing jointly, based on income in 2019.

vince says

I was reading about this on another blog and they said something about comparing the 12 month August 2020 inflation figures released on 9/11/20 to a different 2018 baseline for the true income tier levels that will be released next month. Harry do you know about the inflation adjustment code they are referring to? Are you 100% confident on your $88k/$176k figures?

Harry Sit says

I’m confident in the numbers. See comment #6 for the calculation method.

Carl Widerquist says

So will the MFJ 2020 income bracket of $272000 definitively go to $27200 X 1.3% = 275536 and then be rounded up to $276000 for 2021? Thxs

Harry Sit says

It’s not exactly calculated that way, but yes the limit for the third tier in 2021 will be $276,000 (based on 2019 income), as shown in the table.

Regina C. says

Why are IRMAA surcharges based on cliff thresholds, rather than going along the lines of IRA marginal tax rates? Just because you went over $1 and now you are in the next IRMAA bracket for Medicare Part B as well as Part D Premiums is TOTALLY shocking. even though it is for one year!

Any chance of this being changed in the future?

Songbill says

It’s because you are wealthy and can afford it. Politicians who passed the IRMAA law demand that you pay your “fair share”. Very, very few people are affected so that’s why the cliff is “fair”. My wife and I (in our 70’s) are having to fork over 40% of our total Social Security payments this year (through automatic deductions) because we just missed an IRMAA cutoff level. If the Federal Income Tax rates had these cliffs, taxpayers would go bezzerk. But Congress would never enact them because they’d get run out of office.

Will Congress get rid of the IRMAA cliffs? No.

Terry says

As a Medicare broker, I consider this a penalty to those who’ve worked hard, saved, invested and provided a wonderful lifestyle for themselves and their families.

It’s so hard to explain to people that it’s anything other than a “good job!” penalty.

Ed says

How true. Nothing like penalizing success.

Walt says

Good points, other than the “working hard” part. People here in Houston who put roofs on houses in the hot summer sun work as hard, or harder, than people who make considerably more money. It is definitely not a tax on “working hard.”

Ed says

The whole IRMAA thing infuriates me. The concept is just so much bull excrement and the execution (the $1 trigger) just adds insult to injury. Only a government bureaucrat could have dreamed that one up. If a person is subject to IRMAA they probably had high earnings while working and therefore paid far more than average in a Medicare taxes. Seems like double taxation or a good imitation of it. The only silver lining is when you turn 70 1/2 you can make your charitable contributions with Qualified Charitable Distributions, QCDs, from your IRA. They don’t increase your MGI. My great conservative Congressional delegation isn’t interested in doing anything about it. Neither is AARP or AMAC. So much for supporting their membership. Nor is my former union which has a lot of members who will ultimately be subject to this ridiculous law/theft. For those who are happy to pay it as it means they had a high income my tax accountant friend had a stronger term than bull excrement.

Carl says

Thank you for the response to #75. You stated that the number $276000 is correct but the calculation used was not correct. Since I will likely be going through this exercise every year, would you please give me the correct calculation. FYI, I reviewed point 6 several time but frankly I still do not understand what I did wrong. Thanks in advance.

Harry Sit says

Get 12 monthly CPI-U numbers (not seasonally adjusted) from September last year to August this year. Add them up and divide by 12 to get the average. Get monthly CPI-U numbers from September 2017 to August 2018. Add them up and divide by 12 to get the average. Find the increase between the two averages. Find the 2019 IRMAA thresholds for single – $85,000, $107,000, $133,500, $160,000, $500,000. Adjust those (except the last tier) upward by the increase. Round the numbers to the nearest $1,000. Double the numbers for Married Filing Jointly (again, except the last tier).

Vince says

So if you calculate the 9/17-8/18 average it’s 249.28 and the 9/19-8/20 average is 257.72 the difference is 8.44 which is 3.38% increase. $87,000 would increase 3.38% doesn’t seem right. It would be nice to see the proper calculation using this year’s numbers so we know what to expect next month when they release the written statement.

Harry Sit says

$87,000 is the first tier threshold for 2020. You need the numbers for 2019.

Vince says

So you would use the $85,000 from 2019 and multiply it by 3.38% which gives $2873. That means rounding up to $3000 and adding it to $85,000 gives $88,000 for 2021 not your figure of $87,000.

Carl says

Harry,

I got it now! Thank you very much for taking the time to explain this. It will make future years much easier to forecast and plan.

Vince says

Harry I’m sorry you had $88,000 for 2021. My fault.

Vince says

Does anyone know when the government will officially announce the lowest brackets will be $88,000/$176,000? And also, when they will announce what the 2021 medicare premiums will be? Last question, does anyone know if the brackets could ever go below $85,000/ $170,000 in the future with deflation?

Debbie says

I am relatively new to Medicare. I understand it to be a National Health care program for people over 65. Single or married should be the only two factors in determining the monthly fee. Apparently either the govt or Medicare decided that people over 65, who make over a certain salary must get sick more often, therefore, are being charged an addl fee called IRMAA. This is a disgrace. Someone’s salary should not even come into play when determining the cost for health care. Would love to know what medical Dr. made that decision (ha)!!! Basically the Medicare book should read that people making over a certain salary are required to help pay medicare costs for others since that is what is actually being done.

Grumpy says

IRMAA is assessed on your income tax filing. If you file married/ joint then the income threshold is 2X the single threshold. So if one spouse has 90K of income, and the other has 84K (or less) then neither hits the IRMAA; as on average each has an < = 87K income.

vince says

Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 would be above the 2021 brackets $88,000/$176,000.

Very frustrating not knowing the figures until it’s too late to adjust income.

Vince says

One financial advisor said the 2022 brackets could vary from $168,000- $178,000 for joint filers. That’s a big difference and makes it hard to plan income this year (2020).

Harry, can you provide any input to this? Is $170,000 the floor and brackets can’t go lower?

Harry Sit says

Right now we only have one data point out of 12 to calculate the brackets for 2022. It’s way too early to have an accurate projection. If I must guess, the range for the first tier will be between $88,000/$176,000 (no change) and $90,000/$180,000, with the most likely scenario in the middle, i.e. $89,000/$178,000.

Eric says

Is it possible for the brackets to go down from one year to the next?

Harry Sit says

It’s possible to go down if we have bad enough deflation. If inflation is lower than -3%, the 2022 numbers will go down from the 2021 levels.

Songbill says

In reading about the COVID-related “hold harmless” provisions for new Medicare premiums for 2021, as enacted by Congress and signed by the President last month, my understanding is that premium annual adjustment is limited to 25% of what it otherwise would have been for 2021. However, I can’t find any articles that answer the question of whether this applies to all brackets, including the IRMMA ones, or just the basic premium tier. Anybody know?

Harry Sit says

The 2021 Medicare Part B premiums for different brackets are here:

https://www.medicare.gov/your-medicare-costs/part-b-costs

I suppose these published numbers already took the new law into account. In other words, the premiums would be higher otherwise. Because the premiums for higher tiers are a multiple of the standard premium, when the standard premium is lower, the premiums for the higher tiers are also lower proportionally.

Wizard says

This probably means that Medicare premiums for 2022 will be going up 75% more than normal.

Tighten your seatbelt a year from now…

Songbill says

@ Harry,

Yes, looks that is the case. Basic tier is rising 2.8% and IRMMA brackets are also at 2.8%. Before the “hold harmless” enactment last month, the increase was going to be $20 instead of $4 at the basic tier. That a 75% reduction to your rate increase for 2021.

Rick Craven says

Advise needed – In Sept. of 2018 I retired and started taking social security benefits. In 2019 I took out a large amount of money from my mutual funds that I had saved throughout my working career to put a down payment on a house to live in when I retired. Before that I was living with my sister. My taxes return for 2019 of course reflected an inflated amount of income which in turn flagged Social Security that I must pay The IRMAA Medicare B and IRMAA Medicare Drug costs (Approx. $270 additional charges being deducted out of my social security check each month). This additional amount will start being deducted in Jan. of 2021 for a full year. This has caused a large financial hardship on me that jeopardizes me from keeping my newly purchase home. My true income is really approx. $51500 gross per year. Wanted to know if I can have them waiver this IRMAA from being charged to me because of the one-time purchase of a home to live in? This seems so unfair and unethical of what the government are imposing on me. Thank you so much for your help in this matter.

The Wizard says

Sorry, you’re SOL on this one.

It would have been much better to have taken out a modest mortgage on the property instead…

Songbill says

If it’s any consolation, you are not alone. I think there are probably many retirees with modest incomes who get unexpectedly smacked by a huge IRMMA because they experience a one-time only large gain event. Sometimes the gain was built up over a period of a life time. I had never even heard of IRMMA. My wife and I live on income from Social Security and a modest monthly pension. Last year, a company in which we had owned stock for several decades was bought up by a large conglomerate. We bought shares years ago when the stock was very cheap and the firm then had great success. Unfortunately, the conglomerate paid out cash in a lump-sum rather than issuing equivalent shares in their firm. We had no say in the matter. Now we are faced with losing over $700 PER MONTH in Social Security next year. I don’t think Congress intended for modest income retirees to have a life time of saving get whacked by IRMMA….. but that is exactly what is happening to a number of us.

Harry Sit says

Think of it as part of the capital gains tax. $270/month for 12 months is $3,240. It’s 4% on say $80k worth of capital gains. If you borrowed extra $80k in your mortgage you would pay about that much interest in the first year. If you had to pay that $3,240 as part of your capital gains tax, maybe you would’ve been OK with it. You pay the tax after realizing gains from many years of investing. Framing it as an additional Medicare premium two years later just makes people mad.

Roger says

It can’t hurt to file with the SSA for an appeal. In the year (2018) we retired, our income put us in an IRMAA bracket (by getting paid for a lot of unused vacation time). We appealed and explained it was a one-time “bump” and our income was below the IRMAA limit without it. They agreed and refunded the IRMAA overage. This year, thanks to the elimination of the Required Minimum Distribution, we lowered our income to below the IRMAA limit. So, I guess we’re safe until 2022.

Katherine says

Hello, I had a higher income in 2019 because I sold a rental house. I reported on my 2019 income tax and I submitted to IRS before April 15, 2020 (even though the IRS extended deadline due to COVID). As of today, Nov 11, 2020, I haven’t received any notification of my IRMAA premium increase for 2021. I also looked on line at Social Security site and it did not have my 2019 income. Is IRS behind in reporting and processing? Can this IRMAA increase for 2019 income not be reflected until 2022 instead of 2021?

Harry Sit says

If you filed on paper, the IRS is backlogged. You can check the IRS Where’s My Refund site to see the latest status. Eventually, they’ll catch up and bill you. They won’t push it to 2022.

Katherine says

Hi Harry,

I did TurboTax and filed 2019 electronically. I did not have a refund coming. I did over estimate my 2019 taxes but ask that the overage be applied to 2020 not refunded. I still am not understanding why I haven’t received IRMAA notification because in TurboTax it says my return was accepted by the IRS just a day after it was filed back in April 2020.

I guess I don’t want any surprises and thought I would have been notified by now about the increase in the premium that will come out of my social security starting Jan 2021 for both part B and D.

I am like many people, I feel this is an injustice to the hard working people who have scrimped and tried to save….never had a vacation because could not afford it. Tried to take care of what money I made and prepare for the future. Never on the government dole and now penalized for trying to be responsible and take care of myself. Never made over $48k a year when working. Sorry for the soapbox but I am very unhappy with this unfair tax on seniors.

Harry Sit says

Even though you aren’t getting a refund, you can still use the “Where’s My Refund” tool to check on your tax return processing status. You can also use the IRS Get Transcript tool to confirm the return they received matches the one you filed. I filed in April and I have 2019 income in my Social Security earnings history already. Something went wrong if you don’t have yours.

The Wizard says

Perhaps don’t think of IRMAA as a tax on us, but rather, as a discount system for poor seniors.

Are you ok with giving low-income seniors scrimping by mostly on SS a discount?

I pay around $380/month for Part B and am ok with it…

Katherine says

Mr. Wizard, I would rather have the option to opt out of Medicare all together. I would like to be able to make my own decisions on how I handle my healthcare. Yes, I believe in helping those less fortunate but when I see the abuse and corruption of the system, it makes me sick. Clean it up and get those off the system that are exploiting it.

Ed says

“ I am like many people, I feel this is an injustice to the hard working people who have scrimped and tried to save….never had a vacation because could not afford it. Tried to take care of what money I made and prepare for the future. Never on the government dole and now penalized for trying to be responsible and take care of myself. Never made over $48k a year when working. Sorry for the soapbox but I am very unhappy with this unfair tax on seniors.”

I agree, both in what it is and especially the way it is implemented. $1 of income can trigger the entire penalty premium. What can be fair about a system with taxes over 100% of marginal income?

ed 2 says

Just looked at my 2021 benefit statement. It says IRMAA was based on 2018 income tax form, not 2019 as you suggest. Why?

Harry Sit says

Log in to your Social Security account and see if they have your 2019 income. Also see comment #88.

Ken says

I downloaded my 2021 report yesterday, after getting email from SSA that it was ready, and it said 2019 income and quoted the income figures from that 2019 tax return. I am paying IRMAA in 2021, as I had expected.

CathyKate says

I agree with Katherine and Ed. I too am not poor, but certainly not rich. I filed Married Separate one year because my husband and I are both retired teachers in Missouri and our state tax break is better if we file separately. I was shocked when I was just a bit over the $85,000 limit and found myself skipping all of the tiers down to the last tier that put me in the same category as people making over $400,000. The explanation is that a couple can manipulate their income between the two of them, but we didn’t try to do that. We both have a set retirement. So now we file joint but have to pay more in state income tax. I wish that “file separate” would have the same incremental tiers as the other brackets.

Katherine says

CathyKate, it is very disheartening. If I had known about IRMAA I would have sold my rental house prior to going onto social security. That rental property was for my retirement and I was really surprised about the Part D IRMAA. I am not on any medications (and very fortunate that I am healthy) but feel penalized that trying to maintain a healthy lifestyle, so now I have my notice from Social Security that they will be taking 51.20 for Part D besides the Part B increase. I know that there are comments that we are helping the less fortunate, but there are many ways to help without taking our hard earned money. The waste and fraud is infuriating. For 2021 I am going to have to watch everything I spend because of the decrease in my Social Security. Someone suggested that I file an appeal for the one-time bump in our income, but my letter from Social Security said if it is capital gains, there will not be any adjustment made. So my husband and my income will be reduced total of $577.60 a month.

The government is slowing trying to do away with the middle class…..

Bev Lolr says

I am trying to figure out a Roth conversion amount for 2020 tax return. How high in AGI can I go and stay in the second tier for 2022? Thank you!

Harry Sit says

It’s not possible to have an accurate projection for 2022 at this time. It’s safer to use the 2021 levels as estimates for 2022 (even that isn’t 100% safe in case we have large deflation).

Bev Lolr says

Does the government provide these tiers by the 2020 tax year end? Sure makes tax planning a gamble. What were the 2021 levels that may or may not be safe. Thank you so much for any guidance you may provide. I’m not the only one in this pickle barrel. Thank you

Harry Sit says

The government provided the 2021 numbers only in early November 2020. The numbers are in the table in this post, and also in the link in the first sentence. The official 2022 numbers will come in late October or early November 2021. I’ll have a good projection for 2022 by summer 2021.

Ken says

I posted this link a while back as comment #70. It shows the brackets for 2021 surcharges from 2019 income levels. https://thefinancebuff.com/medicare-irmaa-income-brackets.html

Ed says

Aren’t 2022 numbers in 2021 of no use since we are trying to budget for 2020?

Harry Sit says

If you must have the precise numbers for 2022 before the end of 2020, no one can provide them. I see comments from summer 2020 when I had the projection for 2021 numbers. They must have found the numbers of some use.

Ed says

Ultimately the only thing that can be said is this is absolutely ridiculous? Only a damn bureaucrat could come up with IRMAA and it implementation.

The Wizard says

It’s true that we don’t know for sure if IRMAA thresholds can decrease in years with deflation rather than inflation.

SS payments cannot, so that gives me a bit of hope.

Anyhow, in reply to Bev on figuring how much to Roth convert for this year, 2020, I’d recommend looking at the threshold amounts for next year, 2021, based on 2019 income.

2nd tier goes from $88,001 to $110,000 for 2021, so I would be comfortable Roth converting up to a MAGI of $108,000 this year, about $2000 less than the threshold.

This is basically what I’m doing for the tier I’m in…

RL says

My problem is that due to a one-time capital gain in 2018 we paid a large IRMAA this year…..Our income returned to normal and we filed a 2019 paper return in July, but since it’s still not processed and is missing from our transcript, the IRMAA is still based on the 2018 return….How hard will it be to appeal without the processed return?