[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

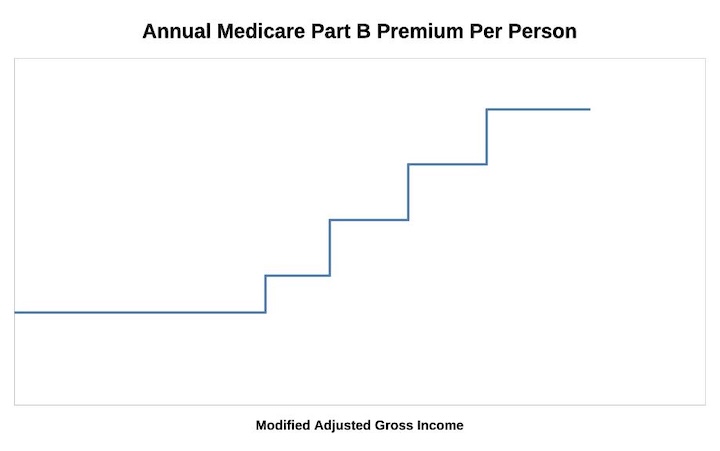

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

The Wizard says

Very easy to appeal with SSA-44, just include a copy of both sides of your 2019 form 1040…

TwoGeezz says

Harry Sit:

In post 21 you state “The law only talks about “increase” and “exceed.” I assume it means if the change is negative they will just freeze in place until inflation catches up. ”

In post 61 (and subsequent posts) you state specifically that deflation can result in a reduction in the tier thresholds.

Did you come upon more recent information that indicates a reduction in the tiers with negative CPI?

Thanks for a great thread!

Harry Sit says

My interpretation of the wording in the law is that they can go down year to year but they can’t go below the 2019 IRMAA thresholds, from which all the increases are calculated. See comment #79. If there’s deflation, as long as the numbers are still higher than those in 2019, it’s still an increase from the base levels. Of course because we haven’t seen deflation no one knows how the government will do it when it really happens. Maybe they won’t let them go down year to year. I say prepare for the possibility the numbers will go down. If they don’t, be pleasantly surprised.

TwoGeezz says

Great explanation! Didn’t catch that baseline number.

bev lolr says

IRMAA is so confusing. Can you please tell me what the 2019 tier numbers are for me to safely use in calculating a Roth conversion to take now for tax year 2020. The deflation scare is real. I looked at #79 but still unsure. Thank you.

Harry Sit says

The 2019 numbers were:

Single: $85,000, $107,000, $133,500, $160,000, $500,000.

Married Filing Jointly: $170,000, $214,000, $267,000, $320,000, $750,000.

Ken says

Harry,

I think Bev is asking for advice on her current tax year 2020 with an eventual 2022 surcharge, and wants you to relist the recently announced (which you estimated in July and were correct as I recall in your post 79?) tax year 2019 and IRMAA surcharge levels for 2021 medicare year came out from Soc Sec, which are the newest real levels to go by when guessing what they will be for the year 2020 in advance. These figures you just quoted look like 2017 tax year and surcharge levels for 2019 medicare year. I thought level 1 surcharge peak (in 2021 for 2019 income) for MFJ category was $222K as one example, and not $214K. I could be wrong.

Harry Sit says

The 2021 numbers are already in the main body of this post. The very purpose of this post is to keep track of the numbers for next year. The 2021 numbers are probably good enough as a floor for 2022 but you never know how inflation or deflation plays out. The 2019 numbers are the baseline from which all future increases are calculated. If someone wants to be extra safe, use the 2019 numbers.

Ken says

https://www.medicare.gov/your-medicare-costs/part-b-costs

Bev says

Are these from the 2017 AGI numbers on income tax return s for the 2019 IRMAA subsidy, or, are these the 2019 AGI income tax numbers for 2021 IRMAA. Are you saying that the tiers are the same as 2017 used for 2019 IRMAA? That is my question. Thank you.

Ken says

Bev,

If you click on the link I posted above in #105, it lists the levels by year, noting the tax year and the related surcharge for Medicare year. Pick the one you want to review. I think it is the second table, with the green 2021 (surcharge year) for 2019 income tax returns.

bev says

Thank you so much Ken. I checked it out. Here is another relevant link but still confusing. https://www.investmentnews.com/medicare-irmaa-surcharges-to-be-adjusted-for-inflation-in-2020-81325

David JOEL says

You didn’t mention that IRMAA MAGI includes untaxed social security income. In our case that is over $6000 per year so one needs to be careful not to cross a IRMAA bracket because of that MAGI add-on

Eric says

What do you base that on? I don’t think that is accurate.

Harry Sit says

The MAGI for IRMAA does NOT include the untaxed Social Security benefits.

Ed says

I think the confusion comes from there being more than one MAGI. The Medicare one is different from the one used for the Affordable Care Act. ACA uses the untaxable SS income but Medicare does not. It would help help if when they are discussed it would be stated as “Medicare MAGI” or “ACA MAGI”.

Ken says

Thank you, Harry! That put a scare into me after making a year end withdrawal that took me up close to max of MFJ surcharge level 1. I used the same logic of what is said in this 2020 SSA doc last year to compute MAGI for 2019 tax year, when I also did year end withdrawal that took me close to the max on surcharge level 1 on my 2019 tax year return. This SSA website page restates method I used for MAGI calc for 2019 and 2020 tax years.

https://secure.ssa.gov/poms.nsf/lnx/0601101010

George says

if 2020magi would mean you be in a higher irmaa bracket for 2022 year because of a gambling one that put you just over the limit. but if taxes are filed really late for example in November, would medicare still use the 2019 return and if so, once the 2020 was filed (for example in december of 2021) would medicare still adjust for irmaa for 2022?

The Wizard says

Bobby!

Long time no see!

How’s chess going lately?

Good times with Boris or this new guy Magnus?

Let us know; we’re cheering for you as always!!!

Vince Pellettieri says

Glad for your comical response. My response would have been different but I made a New Year resolution to eliminate political statements.

Ed says

Bobby Fischer, please define “fair share”.

Seattle Sue says

Thank you for a terrific and informative column. I retired in 2019 and appealed

our IRMAA income for 2020 and again for 2021 due to the drop in income due to retirement. Both appeals went smoothly (the first was an in-office visit and second was by mail this past December) and were granted. The 2020 appeal was based on our declaration our income would be under the 2019 threshold of $170,000. Although I carefully controlled taxable income to fall under that level, I forgot a taxable state tax refund that raised it to just over $170,000. Although we can use an IRA contribution to lower our joint income below $170,000, I’m trying to figure out if the government will use 2020’s newer $174,000 threshold for confirming we really qualified? Or whether we still have to stay under 2019’s $170,000 threshold which was used for the appeal? Any thoughts on this? And again, thanks for a great column and further support of your readers.

Paul says

Does anyone know of some good IRMMA calculators that will allow me to include all income and assets that will cause an increase in Medicare cost; one that gives me a total estimate to say age 90?

The Wizard says

It depends partly on your present age.

I’ve just been using a spreadsheet, customized to my own situation, which projects my AGI year after year. I update my spreadsheet with actual numbers each January.

I expect to be in the middle of the IRMAA tiers forever…

The Wizard says

Wait. Watch out!

We could be dealing with a Republican here!

Gaey says

Folks stop acting like children. What nonsense on a finance thread. Just unsubscribed to this post because of all the bs. Both are right and wrong as both are corrupt parties that act like cults. And you just proved it

The Wizard says

Replying to Tanya, your 2018 withdrawal set your IRMAA tier for last year and your large 2019 withdrawal set it for this year.

So it’s quite possible you will revert to a lower IRMAA tier next January.

Be smart and learn how to play the system. Taking a mortgage and paying it off over four years might, I say MIGHT, have been a better idea…

Art says

I retired in the middle of 2019, but an accrued annual leave payout + partial pension meant my income didn’t drop significantly that year. The WEP (“windfall profit”) penalty kicked in when my pension started, so I also lost 56.5% of my social security in late 2019. Should I include both of these as 2019 “lifetime events” when submitting a request for recalculation of my IRMAA ? I believe the monetary recalculation should be based on my 2020 MAGI ( which is approx 20k less than 2018’s, and approx 13k less than 2019’s MAGI).

I started medicare B in Jan 2020 and paid the IRMAA based on my 2018 (working) income. Now, even tho my 2019 income is lower than 2018, it appears my 2021 IRMAA assessment has gone up by approx $600 … not sure why, as I’m still in the same tier. I was about to inquire about this discrepancy, but realized it may be moot since my 2020 income — the first to significantly reflect my retirement— is low enough to put me into the next lower tier. I think I need to ask them to base my 2021 IRMAA on my 2020 MAGI … but my “life events” took place in 2019 — even tho they didn’t significantly affect my IRMAA income until the following year. I’m confused about whether I should submit proof re retirement from the year prior to my filing for Medicare, or if I should submit 2020 info, since it was the first year my income dropped me to a lower tier. I also don’t know if the drop will affect 2021 IRMAA only, or if it will be retroactive to 2020 and generate a refund . My estimated 2021 income will be slightly lower than 2020’s, but not enough to move me to an even lower tier).

Hard to get SS on the phone, and I find the form confusing, so any pointers you can offer would be appreciated. I’d like to have info prior to speaking with SSA , so as to have a better idea as to whether they’re telling me the right thing.

Very helpful column, thanks!

Art W says

Just an update: reached my local office by phone and after a few attempts, ended up speaking with a specialist who was able to take my updated 2020 MAGI info over the phone ( after I had to swear I wasn’t lying!). I didn’t need to submit forms, just a copy of my 1040 tax return for 2020. There was some confusion about a part D IRMAA ( I don’t have part D medicare coverage, so ultimately medicare said it didn’t apply). All told, it was a relatively painless process and I’m very impressed by their efficient and speedy resolution. Within 10 days I got a refund of the overpayments in 2021 and the calculated adjustment to the IRMAA will save me approx $90 a month.

Thomas Settefrati says

I’ve been retired for 8 years and my wife is still working. I spend all day at a local Casino to play slot machines with the “Free Play Cash Coupons” they send me, out of boredom. So, many times during the 2019 year I hit Jackpots of several thousand dollars but never left the Casino with the money. I always put it back in until it’s gone. An example is , if you win an average of a thousand dollars a day like I did, but played it all back in everyday and lost it, My IRMAA shot up to the $365,000 AGI bracket. After deducting my losses, which exceeded my winnings shown on the WIN/LOSS report you get at the end of the year from the Casino , my income was just social security, 18,000 a year. Now my MEDICARE costs are over $1,250.00 a month, not including an additional $400.00 a month for supplemental Insurance., (my wife gets penalized too ) which is much more than we have coming in. Tried to appeal it, SS / Medicare denied it. Never knew that playing Slot Machines would affect Medicare Premiums. They shouldn’t go by your AGI, they should look at your income AFTER DEDUCTIONS. I’m going to have to refinance my home just to pay Medicare B and D premiums.

Calwatch says

Since you play enough and try to advantage mailers you might be considered a professional gambler. You would have to pay SE tax on your net winnings but you could have those deductions done above the line. Look into the qualifications and see if that works for you.

The Wizard says

Wow, this is a neat one!

You’ll need to contact your Congressman and have them change the law on the definition of Medicare MAGI.

Or the definition of net gambling income. Should be a slam dunk, I think…

Harry Sit says

A mid-year update. With the latest CPI number, it looks like the first tier IRMAA in 2022 will go up to $90,000 single, $180,000 married filing jointly.

Paula Thompson says

Any newer info for 2022, oh great procrastinator? I’m just a retired biologiy teacher, but I watch this stuff.

Harry Sit says

I gave an update on April 17 in comment #120. I also updated the post under the heading “2022 IRMAA Brackets.”

Ken Fitzgerald says

I think you meant to say “prognosticator”!

Harry Sit is surely that to me and others who follow this thread.

Ken

BARBARA CARSWELL says

What is the impact for filing your return on extension?

I have a client who is convinced their IRRMA is based on the incorrect year because they filed their return October 15th.

Harry Sit says

Normally Social Security has the tax return information already by the time they send out letters in December for the following year even if you filed in October. 2021 was special because the IRS had a huge backlog in processing paper returns filed in 2020. Filing the return on October 15 shouldn’t affect 2022 IRMAA, especially when the return is filed electronically.

BARBARA CARSWELL says

Thank you!

Thomas N. says

With the June inflation numbers in, do you have estimate for the range of the IRMAA tiers for 2022?

Harry Sit says

I updated the post with projected numbers for 2022.

Sha says

Thank you for your June 14, 2021 post providing the 2022 IRMAA estimates based on 2021 income.

So, here we are in 2021 wondering what the 2023 IRMAA cutoffs will be based on our 2021 income, which we may be able to control.

You wrote: “Now in 2021, you don’t know where exactly the brackets will be for 2023. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points.”

Aw, come on Harry, help a guy out. What are your reasonable estimates for 2023?

🙂

Sha says

First sentence corrected to read “2022 IRMAA estimates based on 2020 income.”

Harry Sit says

Using 2022 numbers for 2023 will be reasonable estimates. You will have a buffer of a few thousand dollars.

Steve says

Sha, Check out comments #140 and #141.

Thomas N. says

Typically, I use the “buffer” each year (the difference between the two-year-old IRMAA estimate and what it actually turns out to be) to make a year-end Roth conversion, paying the taxes out of another account. This not only keeps us below the AGI level for the next IRMAA tier, it also slightly reduces the traditional IRA balance for RMD purposes, and allows us to manage AGI above or below the 22% or 24% income bracket. To be specific, I am using $180-224k as the first IRMAA tier in 2022, $180-226k in 2023, and $182-228k in 2024. (Yes, I have already modeled my 2024 taxes!)

bev lolr says

With inflation growing so much, surely this is a conservative estimate.

Certainly would like to see this annual estimate available earlier in the tax planning year. ObamaCare S__ks.

Drew M. says

You write that untaxed social security benefits are not included in income used to calculate irmaa. Is this right?

Irmaa is based on magi (modified adjusted gross income), nor AGI. Per this (perhaps dated?) website, http://www.healthreformbeyondthebasics.org/wp-content/uploads/2013/12/Modified-Adjusted-Gross-Income-FAQ.pdf ,

“ How are Social Security benefits counted in Modified Adjusted Gross Income (MAGI)?

Social Security benefits received by a tax filer and his or her spouse filing jointly are counted when determining a household’s MAGI. For people who have other income, some Social Security benefits may be included in their AGI. One of the modifications to AGI to get to MAGI adds in any Social Security benefits that have not already been included in AGI.”

Can you confirm one way or the other? Thanks.

Harry Sit says

There are many flavors of MAGI for different purposes. The one you quoted refers to a different flavor of MAGI, not the MAGI for IRMAA.

Drew M. says

Here’s another indication that MAGI includes untaxed SS benefits: https://www.healthcare.gov/glossary/modified-adjusted-gross-income-magi/

Harry Sit says

That’s MAGI for ACA health insurance, not MAGI for IRMAA. Medicare is not run by healthcare.gov.

Drew M. says

Got it. So you say that “untaxed” SS benefits are not included, right? To determine what percentage of one’s SS benefits are taxed, the following “MAGI” definition applies, as I understand it:

“Modified AGI is AGI plus nontaxable interest income plus income from foreign sources plus one-half of Social Security benefits.”

If THIS magi puts you over $25k but under $34k (filing single), then 50% of your SS benefits are taxable (and therefore that same 50% are included in the IRMAA magi calculation). If your magi under this definition is over $34k, then 85% of your SS benefits are taxable, and therefore included in the IRMAA magi also.

So, for many with substantial SS benefits and other income (dividends, pensions, capital gains, side hustle), 85% of SS benefits will be included in IRMAA . . . .

Thanks, again, for you insight and help.

Harry Sit says

How much of your Social Security benefits are taxable is determined separately by its own rigmarole. By the end of that exercise, an amount goes into the AGI. You see the AGI on your tax form two years ago. When you go from AGI to MAGI for IRMAA to determine whether you have to pay a higher amount for Medicare, you don’t have to do anything *extra* with regard to Social Security to modify your AGI further. That’s all.

Ed says

Where did you read about the “one-half of Social Security benefits”?

Chazz Jones says

I’m a retiree who’s just been introduced to Premium Bracket Shock. In April, my wife decided to retire from a job with a health insurance plan that covered me, and we both applied for Medicare Part B. It took SSA until now (late June) to process the enrollment and inform us that the $148.50 premium we thought each of us would be paying was now $207.90 each based on our 2019 MAGI. We would have paid that much extra anyway because our 2020 MAGI, though lower due to not having to make my IRA RMD, also exceeds the $176k threshold. But the two-year lag apparently means another full year at what looks like a $1,500 premium on top of what we’ll be paying for the rest of this year. Since we’re allowed a special enrollment because of the loss of employment income, I’m wondering if we shouldn’t terminate the current Part B enrollment, postpone my wife’s retirement until early 2022, and re-sign up for Part B afterward at a non-adjusted rate because her loss of income should get us below the 2020 threshold. Or is there a better way to avoid the hit? I know most of Harry’s readers wouldn’t sweat a year or two of $1500 hits, but not all of us are in that position.

Harry Sit says

“Work stoppage” is an eligible life-changing event for appealing IRMAA. Read the paragraphs under “IRMAA appeal” again and follow the links there.

Carl says

Hi Harry,

We communicated last year and you shared how to calculate the annual IRMAA changes – for which I am still very grateful. So for a 2022 forecast I used the US city average, all urban consumers, not seasonally adjusted data.

I averaged Sept 2018 to Aug 2019 monthly numbers and did the same for Sept 2020 to Aug 2021 ( I assumed the May 2021 number stayed the same for Jun, July, Aug). Doing this the percentage increase I calculated was 4.149% which seems to be higher than what you are forecasting? I believe you number is around 2.7%. Just wondering if you can shed some light on where I went wrong? Thanks again for all you do helping us navigate these uncertain waters!

Harry Sit says

Carl – That was comment #79. The base year doesn’t shift. You still compare with the 2019 numbers and the CPI-U numbers from September 2017 to August 2018.

Rosemary says

I found your site and this column from a google alert. Found it fascinating reading the comments, thought I have not read them all as yet. Grandson wants a sleep over. Cannot believe that the supposedly republicans don’t know at least some of tax law, at least some of Medicare law. Making a big decision to retire you would think they would find out about it before they made a decision. Can bet they decided to retire and let some other person make their decisions for them and then are stuck with what was done and just signed papers. My cousin has a son who is a financial planner and after the Medicare law was passed. He retired early, took a cash out on his pension told his son that he needed $110,000 a year to live on and every year he complains cuz he cannot change anything without penalties. You would think that a financial planner would know about Medicare.

I worked 2 jobs and took care of my disabled husband for 23 years and stayed at one for 30 years and had to retire at 65 when my husband needed even more care. I taped C-Span Washington Journal on a VCR and listened when cooking or doing bookwork on the weekends at home for the township or the bank for extra pay. I knew about Part D and also did google alerts since the 90’s and read about Judge Brody and her decision in the AT&T case. I think it was in Ohio and took on my husband place of business when they wanted to stop healthcare for all under and over 65 year olds that were disabled or on Medicare. I took a week of vacation off work, wrote a 5 page letter, was able to get addresses of 500 people to mail it to. Paid to have it copied at Office Max and stuffed the envelopes and put the postage on the envelopes then was told I could only write and send out letters even though I was POA if it had to do with an election. So I wrote vote on the 500 letters cuz luckily one of the people on the board forgot to pay his dues and was kicked off the board and an election was called for. Was able to have them make labels for the letter but could not do it myself. They wanted to put the labels on the letters. So on so the day I brought the letters in and took the labels in, I brought 5 other people with me and said I have helpers you don’t have to do it. I also threatened a class action lawsuit in that letter for those losing their benefits and said I was sure we could win it and surely a lawyer would take it on for all the publicity. I also put the home and cell phone numbers of everyone making the decision to take our healthcare away from us and asked them or their spouse to find the time to call each person at least once every day. It is now 2021 and we still have healthcare, that includes dental, prescriptions, physical therapy, medical appliances, hearing aids, mental treatments. Expensive but good benefits. The workers negotiate and vote for one of 3 plans the elected board chooses and the one with the most votes win. The workers play for 50% for retirees and we pay the rest.

I was told even though I was POA I could not send out a letter unless it had to do with voting on an election. Luckily some one on the executive board lost his seat because he did not pay dues. So I wrote VOTE on 500 envelopes in red. Then when I was told they would make labels for the envelopes if I bought the labels and I could not have the addresses. They were expensive and I bought cheaper ones and dropped them off. They said the would put them on and mail them. When I went to take the envelopes in I brought 5 other people with me and some of them were retirees and the disabled ones that would lose their benefits to help me. They let us put the labels on and then they said they had to take it down the street to the post office and I said why can’t the office lady that my husband had hired years earlier go with me. So they could not say no as she got up from her desk and said she would love to help me. So that was taken care of. I also in that letter asked everyone to call the cellphone and home phone number of everyone on the list at least once a day. We still have our healthcare.

I have 2 questions. 1. I do Roth conversions every year since the first year that we could. I also funded my husband’s IRA since 1978 or 79. Then my husband died and I cannot do as much now. I live on $20,000 a year since 1995 and so far it seems like it is enough. I have savings and money coming in each year that I do not spend. I use a part of it to pay the income tax on the conversions. I have a heart disease that I inherited and won’t live forever and my 2 children are near 60. Their wives are about 8 years younger so will perhaps continue to work perhaps after the husbands retire. One is a doctor and I want him to use the Roth so it won’t have to be included in their income. The other one is single but a professional also.

What I want to do it sign a 100% conversion paper that can be mailed before I die or shortly after and also the RMD be taken out for that year of death. Can this be done? Is it legal? The other question is I see that next year your projected the income may go up to $90,000 before the Medicare premium goes up. Is there any way to know if and by how much I can have convert this year and still stay below the amount so my premium will not go up in 2023? If it goes to $90,000 for next year can I plan on 2% increase at a minimum for the income ceiling over $90,000 in Dec before the Medicare premium will go up in 2023?

I think I know the answer for the second question. Should I just stick with the amount that is for this year? I think it is $88,000?

Carl says

Harry

Per post 133 thank you for the clarification. I believe I have it finally!

MARY WHITEHOUSE says

Thank you so much for posting potential 2022 IRMAA limits – Very helpful!!!! I just wanted to tell you about my situation. I am married (a second marriage), and my husband and I keep our finances separate as much as possible. His estate will go to his kids and my estate to my kids. We filed jointly as long as he was age 70 1/2 and I was under, but when I turned 70 1/2 in 2019 we started filing separately to make figuring taxes less complicated. I then received a letter from SSA that my premium was going up to $475.20 PER MONTH BECAUSE MY AGI WAS $88,264!!!!!!

Maybe I missed it, but I don’t think you have mentioned this provision that only applies to married filing separately. Luckily, I filed reconsideration with Social Security and was able to stop the increase by telling them I would not go over 88,000 in 2020 because I would be giving my RMD to charity and filing jointly with my husband.

DreeMcg says

I could be wrong, but I don’t think the charitable donation affects MAGI. It just focuses on the income side; not deductions.

Mary Whitehouse says

When you have your financial institution take out a Required Minimum Distribution (RMD) from your IRA and they send it directly to a charitable organization, you are not taxed on the RMD. If you are trying to keep your income below a certain level for IRMAA purposes, this is a good way to do it. Instead of giving my church a monthly donation, I have my financial institution send money once a year from my IRA that counts as an RMD, and I do not pay taxes on it.

From the IRS website:

Required minimum distributions – Qualified charitable distributions

What is a qualified charitable distribution?

Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA (other than an ongoing SEP or SIMPLE IRA) owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity. See Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs) for additional information.

Can a qualified charitable distribution satisfy my required minimum distribution from an IRA?

Yes, your qualified charitable distributions can satisfy all or part the amount of your required minimum distribution from your IRA. For example, if your 2018 required minimum distribution was $10,000, and you made a $5,000 qualified charitable distribution for 2018, you would have had to withdraw another $5,000 to satisfy your 2014 required minimum distribution.

How are qualified charitable distributions reported on Form 1099-R?

Charitable distributions are reported on Form 1099-R for the calendar year the distribution is made.

How do I report a qualified charitable distribution on my income tax return?

To report a qualified charitable distribution on your Form 1040 tax return, you generally report the full amount of the charitable distribution on the line for IRA distributions. On the line for the taxable amount, enter zero if the full amount was a qualified charitable distribution. Enter “QCD” next to this line. See the Form 1040 instructions for additional information.

Ed Fogle says

If a taxpayer is 70 1/2 they can make charitable contributions from their IRA (I don’t know if this applies to 401(k)s) buy making Qualified Chartible Distributions (QCD). They are subtracted from the amount reported on your 1099R when reporting income on the tax form so AGI is not affected.

AnnaC says

Hi Harry,

While the final #s aren’t due to be announced till Oct am seeing articles the projected 2022 COLA may be 5.2% for SS benefits based on CPI data.

Today I see Garamendi/CA introduced the Fair COLA for Seniors Act of 2021 to switch from CPI-W to CPI-E to more accurately reflect the cost for seniors.

Any idea if this goes through (doubtful but we can dream…) how this may change the projected increase to 2022 SS benefits?

Thx, Anna

Steve says

I just did some spreadsheet calculations and was able to match your numbers. A couple of interesting observations from this exercise:

First, since the threshold values are first calculated for a single tax payer and then doubled, the threshold values for a married filing jointly will always be divisible by $2000.

Also, my calculations show that even if there is absolutely no inflation in the future, and the CPI-U remains unchanged from where it was for June 2021, the threshold values for 2023 would still increase to $93,000/186,000.

Harry Sit says

Agree with your numbers. We had high inflation numbers three months in a row. Now the 2022 numbers have a good chance to push to $91,000/$182,000 in the first tier.

Thomas N. says

Steve or Harry:

With your assumption that under a no-inflation scenario the first IRMAA tier in 2023 would begin at $93,000/$186,000, what would the upper end of that band equate to?

Steve says

My calculations show the second IRMAA tier starting at $117,000/$234,000 in 2023 (based on 2021 income) assuming the CPI-U remains unchanged through August 2022. I should note, however, that a slight decrease in the CPI-U of just 0.1-0.2% would be enough to drop these thresholds by $1000/$2000. If you remind me, I will try the update these calculations after the November CPI-U numbers are released.

Eric says

Why would 2023 brackets increase if there is “no inflation in the future?” Isn’t it the inflation data from Sept 21 thru Aug 22 that determines any 2023 adjustment from 2022?

Harry Sit says

Eric – Because if inflation is 0%, the average from Sept 21 thru Aug 22 will be frozen at the latest number, whereas the average from Sept 20 thru Aug 21 is dragged down by lower numbers in previous months.

Rosie says

I convert some to a Roth every year and am in late 70’s and my children are near retirement. I want to leave my IRA’s to them tax free. Should I try to stay below $88,000 or $90.000 in the 2021 filing in 2022?

Harry Sit says

The 2021 filing in 2022 will be compared to the 2023 threshold values. Unless inflation turns negative, the 2023 value for single will be at least $93,000 in the first tier. See comment #140 from Steve. Of course it’s still possible to have negative inflation. So leave some margin of error just in case.

The Wizard says

Yes!

Harry Sit says

Updated the 2022 projection for the first tier from $90,000/$180,000 to $91,000/$182,000 following the release of the inflation number in July 2021. The other tiers didn’t change from the previous update.

Bob says

Harry-

Could you please clarify exactly how the bracket inflation numbers are calculated. Some websites suggest that it is simply the annual CPI- U (adjusted or unadjusted??) increase over the prior year as measured at the end of August. If so, one would only need 1 number (the annual CPI-U increase) for the calculation, and the increase for 2022 would be on the order of July’s 5.4%. Your comments seem to suggest that an average of 12 CPI-U numbers is employed…one for each of the prior months. If one took the average CPI-U for the past 12 months, the increase would be on the order of 4.1% or so. Your numbers suggest that the first two brackets will increase on the order of 3.4% and 2.7% (which would include rounding errors, of course). So I’m confused!! Could you please explicitly clarify how the bracket inflation numbers are calculated, and give an example of the 12 CPI-U numbers (adjusted or unadjusted???) and how they would be employed for your bracket estimates for 2022. Thanks!

Harry Sit says

The calculation method is in the reply to comment #79.

Braden says

Are questions and replies numbered? Am I the only one having to count each one to get to what I want to read ?

If they are not numbered could this be an added compliment to your column?

Ken says

Braden, Your comment is number 145. To the left of your name above. You have to scroll back to find #79, and Harry’s reply.

Harry Sit says

Please use a desktop browser to see the comment numbers. The numbers don’t show up well on my iPad or phone. I’ll see if I can fix that.

Braden says

The only computer I use is a desktop Mac. IOS and use Safari with Google Chrome as the browser.

Thank you for trying to help. Where near the comment is the number? I would assume it is by the name

Ken says

#79 comment was by CARL and dated October 7, 2020 at about 5pm. Harry’s reply is after it.

Harry Sit says

I fixed the comment numbers. They show up on my iPad and phone now. Please delete browser cache and refresh if you still don’t see the comment numbers.

Thank you for bringing it up. I learned that Safari on Mac behaves differently from Chrome on Windows because Safari uses a different rendering engine.

Keith says

Until now, MAGI (for IRMAA surcharge threshold purposes) has been calculated as AGI + tax free interest.

Going forward, will Paycheck Protection Plan (PPP) loan forgiveness amounts be added to the MAGI calculation?

Harry Sit says

No. PPP loan forgiveness doesn’t add to income.

Braden says

Thank you so much. I see some of the numbers now. I really appreciate your help.

Thomas N. says

So I will be 72 next year and therefore taking my first RMD, 1/12 each month.

If I also wish to convert some of my traditional IRA balance in 2022 to a Roth, it is my understanding that I must first withdraw the full amount of the RMD before taking that conversion action.

My question is, is this also true for the qualified charitable distribution? Or can I donate to our church via the QCD process at any time throughout the year, regardless of how much of the RMD has been withdrawn?

Thank you.

Harry Sit says

If you’d like to have the QCD count toward your RMD, it needs to be within the first $X that comes out of the Traditional IRA. Say your RMD is $20,000 and you’d like to donate $5,000. You can do $15,000 RMD followed by $5,000 QCD and then your Roth conversions. Or you can do $5,000 RMD, $5,000 QCD, another $10,000 RMD, and then your Roth conversions. Of course you can continue with additional QCD throughout the year after you complete your RMD.

Retiree Dave says

I am questioning the 2022 Projection, which was in an August 11, 2021 update of the article. I was only looking at the IRMAA Bracket that would apply to me; specifically married filing jointly in the Standard*2 that lists the 2021 IRMAA as $276,000, and the projected 2022 IRMAA as $284,000. Virtually all recent projections of the COLA for 2022 are between 5% and 6%. However, this article appears to be using a 3% projected Cola for 2022. I assuming that all brackets use the same projection COLA percentage.

A more realistic projection would be an IRMAA for this bracket of $291,000 based upon 5.5% COLA for 2022.

As an aside, I have been managing my income to stay just within the 2X cost IRMAA by converting regular IRA’s to Roth IRA’s before the Required Minimum Distributions kick into my income stream. Sure, I am paying the extra taxes now, but reducing them in the future.

Harry Sit says

Social Security COLA uses a different inflation index and a different comparison period.

Bob says

Retiree Dave-

I sympathized with your question (see comment 144 above). Here are my numbers and methodology calculated for your bracket:

All the calculations for brackets are based on the CPI-U (not seasonally adjusted) numbers, which can be found at https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm

1). Average the numbers for the period Sept 2019 thru Aug 2020 (257.721)

2). Average the numbers for the period Sept 2020 thru Aug 2021 (265.513 assuming an Aug 2021 CPI-U of 274.368..an increase of .5% from July)

3). Divide to get the increase ratio for the brackets (265.513/257.721 = 1.030)

4). Multiply the 2021 threshold for singles for your bracket (138,000) by this number (1.030) to get 142,173.

5). Round to the nearest 1,000 (142,000).

6). Double this number for married couples (142,000*2= 284,000). Note that this bracket estimate is the same as Mr. Sits. The only uncertainties are associated with the August 2021 CPI-U number, which will come out in mid September, although the number has to be substantially off my assumption to affect the calculations due to the averaging effects.

You can make various assumptions going forward for 2023 as to how the CPI-U numbers will increase, and calculate the 2023 bracket to help determine how much income you should take this 2021 year.

I hope that these comments and this example are helpful for you and others.