[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

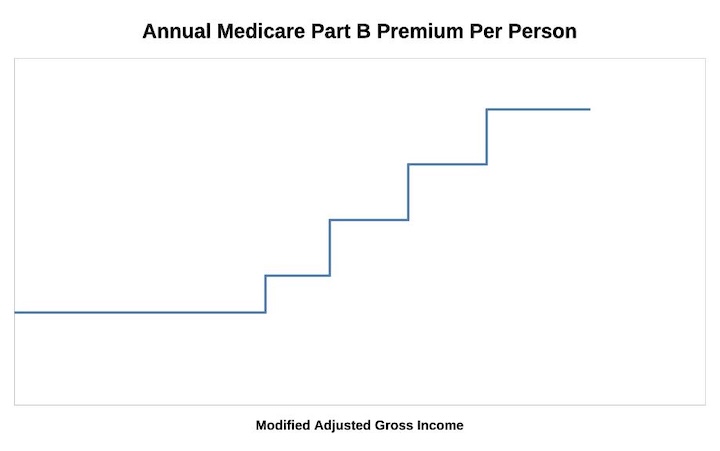

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dave Retiree says

Social Security Cola is based upon the CPI-W index comparing the average of the third quarter of 2020 CPI with the average of the third quarter of 2021 CPI. Most predictions are in the 5-6% range, with two months left to report.

The IRMAA Cola is based upon CPI-U, and compares the CPI number for September 2020 to August of this year, which will reported shortly. In the IRMAA calc, it appears that quarters are not used, just comparison of single months year to year. The ratio of the number CPI number for August 2021 compared to the number for September 2020(260.28) will then be the basis for the IRMAA adjustment. So, 11 of 12 months have been already been reported, and through July 2021, the CPI number is 273.003. If there were no inflation at all from July to August, the yearly increase would be 4.8%. If August increases the same as July, the yearly increase would be 5.8%.

In effect, these indexes although not the same, and the methodology is different, they give results that run pretty close together. Also, looking at the IRMAA COLA’s for 2020 and 2021; they tracked pretty closely to the Social Security Cola’s for those years. So, I still believe my earlier comment projecting 5.5% is closer to what we will see, recognizing that the IRMAA amount is rounded to the nearest thousand. I did not use seasonally adjusted information, but used the following table, link below for CPI-U data:

Consumer Price Index Historical Tables for U.S. City Average : Mid–Atlantic Information Office : U.S. Bureau of Labor Statistics (bls.gov)

I thank commenter Bob for the detail he provided, but I do not believe that a 12 month average should be used.

The real good news about this spirited discussion is that we will find out within a couple of weeks.

Rob says

I guess the good news here is the 2021 high CPI numbers will carry forward into the 2023 bracket increase calculation, as a lagging monthly index is used!

Harry Sit says

August 2021 inflation release came out today. All numbers for 2022 are final. No changes from the previous projections. Official numbers will come out in late October or early November. Also added projections for 2023 if inflation is 0% through August 2022.

BMG says

Hi Harry,

Thank you for these estimates, but why would there be any increase in the IRMAA thresholds for 2023 if there is no increase in inflation over the next 12 months? Thanks in advance for clarifying.

Eric says

Because 12 months frozen at the August, 2021, level would be higher than the average of the previous 12 months.

Jim says

Eric’s reply is partially correct, but in reality the comparison is not with the previous 12 months (Sep 20-Aug 21), but with the 12 months Sep 2017-Aug 2018. See Harry’s reply to comment #79, dated Oct 7, 2020. This would still be any increase in the 2023 IRMAA bracket amounts.

Jim says

Good afternoon,

I was a ong time widower that remarried earlier this year. Prior to my marriage I had an additional IRMAA amount as a single STD*2.6.

I appealed because of marriage , using my expected 2021 joint income.

SS reduced my IRMAA amount to the married STD*1.4 and sent me a refund. Nice!

Question: Since I used my 2021 expected income for this year’s IRMAA, what will SS use for 2022. Will they still use my (and my new bride’s) 2020 income?

Harry Sit says

I’m guessing they’ll use your 2020 tax return filed as single and you’ll have to appeal again when you receive their letter in November or December.

roger says

Projected thresholds for 2023 with no inflation after Aug-21 would be higher than 2022’s thresholds because the thresholds are based on AVERAGE CPI-U for the prior Sep-Aug. With no inflation from Sep-21 to Aug-22, that average would equal the Aug-21 CPI-U. The 2022 thresholds are based on average Sep-20 to Aug-21 CPI-U, which is lower than the Aug-21 CPI-U. (Inflation adjustment is described in 42 USC 1395r .(i)(5) )

Marty Yeager says

I’m not sure I am following the calculations. Regarding the 2023 Coverage (based on 2021 income), are those numbers for each category guaranteed (based on available data) to be the lowest number for each category, but could be higher if there is inflation after August 2021? Thank you for your help. In other words, can I count on them to adjust my AGI for 2021?

Harry Sit says

September inflation number released this morning prompted a slight increase in the 2023 projections for the first two tiers.

Allan R. says

What amount of income would you stay below in 2021, so that I don’t jump to the next IRMAA bracket for married 1.4* for 2023 MAGI projection of $236K? I would hate to go over the bracket by $1 and end up paying an additional $2400/yr in Medicare premiums.

I guess because your calculation is a minimum with no inflation for 2022 baked in, you would suggest to go right up to the $236K projection limit and still be safe.

Thank you for providing these projections.

SC says

I’ve never heard anything about the IRMAA from AARP. What is their position on this?

Ed Fogle says

Years ago I wrote AARP, AMAC, my Congressional delegation (I’m from Oklahoma so you would think my Senators and Representatives would be very receptive) laying out my objections to both the concept and implementation of IRMAA. Not a peep from any of them except boilerplate responses. I even wrote to the airline pilot unions since many of their members will be hit with IRMAA. Again nothing. You would think all of the above entities would be opposed to IRMAA but, sadly, they don’t seem to care.

Rosemary says

Updated December 24, 2020

From an article from AARP–

https://www.aarp.org/retirement/social-security/questions-answers/income-affect-medicare-premium.html

Steve says

Harry, thanks a bunch for the revised 2023 IRMAA estimates. I can use those for 2021 late year tax planning.

Marty Yeager says

You should be able to update up to the November CPI-U number released in December, assume no deflation through August ‘22.

AnnaC says

Jim

yes, SSA will let you appeal two years in a row for the same life changing event

Rosemary says

Yes thank you very much. For some reason I did not understand the info to get the new figures. I have shared the link with friends.

Giri says

This is very useful for tax planning for 2021.

You have given the brackets for 2023, assuming 0% inflation through August 2022. Does this mean that I will be safe to use these numbers, as in reality they will be higher?

Marty Yeager says

I’m guessing that is correct unless we have deflation, which is probably unlikely.

Paul says

Harry, thanks for publishing this info. I’ve been trying to figure out if I can adjust my IRA withdrawals at the end of this year to avoid pushing us over the first bracket threshold in 2023.

I read back through the comments about how you calculate it, and had a heck of a time replicating it until I looked at the actual law and had my “aha!” moment: each year the brackets are recalculated based on the increase from the average CPI-U over the 9/17-8/18 period (which is 249.28).

(1) Calculate the average CPI-U over the past 12 months (265.447 from 9/20-8/21).

(2) Subtract 249.28 from that average (resulting in 16.167 this year).

(3) Divide the remainder by 249.28 (resulting in 6.49%).

(4) Increase the 2019 brackets(s) (the first tier ends at $85,000) by that percentage.

(5) Round each to the nearest $1,000.

To reiterate for anyone reading this far: the CPI-U average (249.28) from 2018 and the brackets from 2019 are reused every subsequent year, except for the top bracket. And starting in 2028, the same algorithm will be applied to the top bracket.

Marty Yeager says

Well put, I got into the weeds myself, to understand how this works. Tedious, basic math involved. I think the closest we can get to the likely “floor” of the 2023 brackets, before Dec 31 of this year, is as follows: take the CPI-U values for each of Sept 21, Oct 21, and Nov 21 (last one not available not until early December 21), then multiply Nov 21 value by 9 to represent future unknown values from Dec 21 thru Aug 22 thereby assuming no inflation or deflation after Nov 21), add the values for the 12 months (3 plus 9 assumed), get the average, then follow your directions above. What do you think?

Paul says

Marty, I just picked an annual inflation rate, then increased each monthly CPI-U by 1/12th of that, until Aug-2022. As data becomes available, I’ll enter the actual monthly CPI-U’s.

By playing with various inflation rates, I found that up to 2.2%/year, the 2021 threshold for 2023 remains $94,000 (single). So, it’s close enough for me to make a decision this year to defer 2022 AGI into 2023.

Marty Yeager says

Got it. Nice to know we can get a grip on this mystery calculation!

Tom P. says

Technically, this is the correct method, but you can also do it year-to-year, which takes into account the previous changes in the CPI-U.

1) 2018-2019 compared to base year 2017-2018 is an increase of 1.0190 (254.016/249.280);

2) 2019-2020 to 2018-2019 is 1.0146 (257.721/254.016)

3) 2020-2021 to 2019-2020 is 1.0300 (265.447/257.721)

4) Multiply 1.0190 x 1.0146 x 1.0300 = 1.0649, or 6.49%, same as your result.

This way one doesn’t have to know the base year brackets, just the previous year brackets to make an informed estimate of future brackets.

The key thing for married filing jointly is the single bracket is adjusted and rounded to the nearest thousand first, then doubled to get the married filing jointly.

Example: new 2022 married lower limit is ($176,000/2)x1.030=$90,640 rounded to $91000 x 2 = $182,000

Pat says

The algorithm for the top bracket starting in 2028 will be slightly different in that it will use the average CPI from Sep 2025 through Aug 2026 as the base year instead of the CPI average of the year ending Aug 2018 that is used for the other brackets.

Tom P says

So Pat, what you are saying is the top (5th) adjustment bracket, currently 500,000+/750,000+, rather than being fixed, will now start to index starting in 2028 based on the 2026-2027 average vs 2025-2026 “base” average? If so, then that would also affect the top of the 4th bracket. Hmmm, wish I had to worry about that!

Harry Sit says

That’s correct. The $500k/$750k will stay fixed through 2027 (2025 income). When it goes up in 2028 (2026 income), it will use the CPI average in 2026-2027 over the CPI average in 2025-2026. We will add that wrinkle in 2026.

Tom says

Thanks Paul. Your explanation was the key to helping me figure this calculation out. If feels good to be able to duplicate Harry’s calculations exactly. Gives me a lot of confidence in these numbers.

sjm says

Thanks. I finally got a spreadsheet that is working perfectly.

Starting out, I made a few mistakes before I got it right.

The first big mistake I made, when using the cpu-u data, was to average the small monthly percentage increases rather than the actual absolute data value. I did this because I could only find monthly percentage increases. However, on the BLS site giving CPI data, I found out I could format the displayed data table to show “original data value” rather than the default monthly percentage increases.

The second mistake I made when calculating the new bracket thresholds was to use the previous years’ threshold rounded value rather than the calculated unrounded value. The only exception was when I used the 2019 base published thresholds. This meant my spreadsheet went from tax year 2019 to in progress year 2024 calculation.

Bev L says

This is way too complicated for the average bear. I am hoping someone in the know will just reply with what they “think” the Tier limits will be for 2021 for your 2023 subsidy. Many thanks!

Paul says

Harry has provided an estimate in the article. Look for the title “2023 IRMAA Brackets”. I think it’s safe to say that’s the minimum tier limits, as it assumes there will be no inflation in the next 12 months.

If you want to see the effect of various CPI-U increases in the next 12 months, the algorithm I detailed above can be used. That’s what I wanted to do, and why I took the time to figure it out.

Steve says

I have seen a lot of discussions about predicting the IRMAA tiers for 2023 but very little on the risk versus reward of contributing the extra $1000 or $2000 that a higher bracket would allow.

For me, the risk of going into the next IRMAA tier is that I would need to pay about $1800 extra for Medicare in 2023.

The potential reward for taking this risk is that I would be able to convert an extra $2000 from a traditional IRA to a Roth IRA this year. This money would be taxed at a 22% marginal rate now versus what may be a 28% rate later when I am required to take minimum distributions. This would potentially save me 6% of $2000 or $120.

So in essence, I am risking a $1800 expense in 2023 to save $120 at some later date. Am I thinking about this correctly?

Marty Yeager says

I think you are correct to take a holistic approach to your particular tax situation in weighing how much taxable income is best. Barely stepping over the threshold feels very painful the higher the AGI and for a couple. Perhaps the marginal tax brackets are more important, one just needs make the calculations.

Ros says

I convert to a Roth every year since I was able to but stay within the same tax bracket. The tax brackets usually come out in the last quarter of the year.

Are you bringing into the scenario if you should become a widower and the higher tax brackets at that time? Also if you have children are you thinking about the taxes they would have to pay when the money would have to be spent within the 10 year span.

I am a widow and converting to a Roth for the children who are near retirement age themselves. A Roth is not included in the IRMAA if they are paying for Medicare.

Tom P. says

Today I sent my local SS office SSA-44 forms for my wife and I. We’ve been paying IRMAA the last two years, however I retired mid 2020 so now my 2021 income will be below the $182,000 lower limit for 2022 instead of Tier 3 based on 2020 income. I hope I filled these out correctly as I input year 2021 and my estimated AGI (which should be quite accurate since I’m not making any more withdrawals this year). I also estimated my 2022 AGI, which will be even lower than 2021.

Based on this we should not need to pay IRMAA in 2022, but will we also get a partial refund for 2021? Based on the published 2021 brackets our income for 2021 will be in the Tier 1 range instead of the Tier 3 we are paying now.

Tom P. says

Ok, I’ll answer my own question. If your income goes down or you have another qualifying circumstance that would reduce your IRMAA surcharges, IRMAA for the affected year will also change, not just the immediate follow-on year.

So, for me, my income dropped in 2021 due to a work stoppage in mid 2020, so I’ll be getting a refund on the amount paid thus far this year. To confirm, today I logged into “my Social Security” and checked the upcoming Medicare charges and SS has reduced IRMAA for November (payable in December) from the 3rd tier to the 1st tier. Wish I’d have known about this last month as I would have withdrawn a bit less from my 401(k) then to stay below the 2021 threshold. Oh well, I can’t complain as I’m still saving a lot this year and next.

Mark says

IRMAA is in fact a tax. Taxes are intended to incentivize certain behaviors. My gripe with the IRMAA is it fails to incentivize the right behaviors, which for us olders is to take better care of ourselves (maintain the proper weight, don’t smoke, drink little or none, exercise, eat right). There is no premium reduction for those efforts or penalties for bad practices, even though better health practices would mean less costs for Medicare. It only measures income and penalizes those who have saved. Our IRAs and paid-off mortgage were built by a lot of frugal living and deferred gratification during our working years. Hence we intend to respond to the government’s wishes as signaled by its disincentive — we are going to reduce our MAGI in any way we can. Prime example: as soon as we turn 70-1/2, we will donate our RMDs directly to charity. You should also look for tax shelters and other avoidance schemes, which I applaud. As for the lawmakers, I’m sure that they will be surprised once again by the “unintended consequences.”

Karen says

Thanks for this estimation – I guess :-). My rough estimate for taxes this year is $118,017. Now I have to bet whether the 2023 income levels will go up from your estimate, or decide it will be no higher that $118,000 and transfer more money out of my IRA to have the earnings be taxed at capital gains in the future. Guess I’ll go flip a coin….

Really appreciate the Information,

Tom P. says

Karen, the $118,000 figure for the upper end of the 1st tier surcharge bracket is based on inflation numbers through September 2021. This yields a current multiplier of 1.033 for the 2022 brackets. Numbers for October and November will be available about mid December, at which time we’ll have a slightly better idea of how the brackets might shift.

If the eventual multiplier changes from 1.033 (the highest since IRMAA inception) to 1.060 that would increase the bracket limit to $121,000 for 2023, so I don’t think we’re looking at a huge difference from the estimated number.

If you can, you might hold off on anymore IRA withdrawals until more data is available in December. Hopefully, the brackets will shift enough so your current estimate of AGI doesn’t tip you into the next higher bracket.

DrewMcG says

Karen: Did you include in your 2021 AGI estimate the continuation of the $300 charitable gift deduction even for those who take the standard deduction that Congress extended to 2021? If not, you could donate $18 to a charity and avoid the second-level bump in IRMAA for 2023 that way (e.g., even if inflation stays @ 0.0% through next August, which seems kinda unlikely ….).

Steve says

I was playing around with TurboTax tonight and noticed that for 2021, the charitable gift deduction does not appear to reduce the AGI like it did in 2020. It still reduces your taxable income, but not the AGI that is used to determine your IRMAA level.

Harry Sit says

Steve – That’s correct. 2020 was an exception. The charity contribution deduction doesn’t affect MAGI for 2021. See 2021 $300 Charity Deduction For Non-Itemizers $600 Married.

Tom P says

Well, charitable not lowering AGI kinda sucks… wish I had known that earlier, but if my math is correct we’ll still squeak in under the $182,000 limit for MFJ in 2022, but by only $452 now! [our 2022 IRMAA is going to be based on 2021 income since I retired in 2020 and filed SSA-44 in October; we rec’d a refund of our 2021 IRMAA within 2 weeks, and my local office told me this week they would adjust our 2022 IRMAA based on that info].

The above assumes that IRA contributions are still “above the line.” I withdrew a bit too much from one of our accounts to stay below the new limit, but since I received payment this year from my former employer for an incentive plan payout, I contributed that amount to my wife’s Rollover IRA to hopefully be below the 1st surcharge tier for 2022.

Don G says

This site seems to be “best on the web” for projecting the IRMAA brackets ahead of their official announcements. Many thanks to Harry Sit.

What are some sites that reliably predict what the Medicare Part B and Part D premiums and IRMAA adjustments will be?

Tom P. says

Don, if you are familiar with spreadsheets it’s really quite easy to do your own predictions… you just need the data and methodology:

1) CPI-U data is at https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm

For 2022 you just take the average of the Sep 2020 to Aug 2021 numbers (265.447) and divide by the Sep 2019 to Aug 2020 average (257.721) to yield a multiplier of 1.030. The monthly CPI data is published around the 10th of the following month. Oct data will be available Nov 10 and Nov data on Dec 10, so at that time we’ll have three of the 12 data points for 2023, which will give some indication of how things will go.

Multiply each single income bracket ($88,000 from 2021, etc.) by this number (1.030) and round to the nearest thousand, which yields $91,000. Do the same for the other tiers. To get married filing jointly, double these amounts.

2) The IRMAA Part D adjustment is based on the Part D Base Beneficiary amount, which for 2022 is $33.37 (this is on the CMS website; Google “medicare ratebooks & supporting data for the link), it’s published the end of July each year). Multiply this amount by the following factors for 1st thru 5th tier: 0.3725, 0.9608, 1.5490, 2.1373, and 2.3333. The first tier number is calculated as (35.0-25.5)/25.5. For the other tiers the first number is 50.0, 65.0, 80.0 and 85.0, meaning you pay 35% thru 85% of the cost. Thus, the Part D 2022 adjustment for the 1st tier is $12.40 ($33.37 times 0.3725, rounded to the first digit)

Enjoy 🙂

GeezerGeek says

Thanks Tom P.

I could not find that Part D calculation on any other site. I’m sure it is out there somewhere but Google isn’t telling.

Harry Sit says

The second data point for 2023 came out this morning. It increased the 2023 0% inflation baseline numbers slightly in the middle tiers. I also added a new table with 5% inflation for 2023. I will update again next month.

Still haven’t seen the 2022 Part B premium yet.

Paul says

Harry, CPI-U is out for October, and it’s up 6.2% from a year ago. It’s the highest since the year ending November, 1990.

I plugged it into a worksheet I built to project the IRMAA brackets for 2023, and found that while the projection is still $188,000 for the beginning of the second tier if you assume inflation is 0% from now until August, 2022….

If I assume the annual inflation for the remaining months is 0.8%, that’s enough to boost the beginning of the second tier to $190,000. Before the October, 2020 CPI-U was released, the minimum remaining inflation to bump it to $190K was 2.3%.

A further increase of remaining average inflation to 3.5% will bump the beginning of the second tier to $192,000. I’m planning to use this for my AGI limit in 2023.

(Edit to note that Harry posted a comment while I was composing this!)

Paul says

Apologies for a late correction to an error I didn’t notice until now:

I’m planning to use $192,000 for my AGI limit in 2021 (current tax year), not 2023.

It will affect the IRMAA brackets in 2023, and I transposed the dates.

Becky G says

Please let me know if I am understanding this correctly. My 2021 MAGI should not exceed an estimated $94,000 to avoid incurring any surcharge in 2023. The threshold to be applied to my 2020 MAGI is $91,000. Is that right?

I wish to make a Roth conversion in 2021 without going over the IRMAA standard threshold for a single person. Thanks in advance for your response.

Tom P. says

Becky, you have this correct. The way inflation numbers are currently running the $94,000 for 2023 (2021 income) will most likely be higher by a few thousand, but $94,000 is certainly a safe number to use.

Dave says

And is it still $182,000 max in 2021 for 2023 for married couples?

Ros says

It is double over singles for married. If you think single will be $94,000 then married should be double. But you should wait to make sure what Harry says.

Jeff in delRey says

I started converting my and my wife’s IRA’s to Roths in 2018 and managed to the top of the 24% bracket. I was proud of myself until the school of hard IRMAA knocks hit me in 2020 and this year. I over-corrected last year and left $15k on the table. Do I understand the 2023 IRMAA (2021 tax year) correctly? That the cliff for the 2.6 tier is $354k?

Tom P. says

Jeff, you have it correct. Wish I had your problem of trying to stay under $354K,ha, ha. In reality it will probably be a bit higher as inflation doesn’t appear to be going away anytime soon.

Tom P. says

I have my own spreadsheet to compute the IRMAA brackets and for 2023 I have the same as Harry except I can’t get $119,000 for the 2nd single bracket… I get $118,000, which is the 2019 bracket multiplied by the overall CPI change from 2017-2018 to 2021-2022 (Sep & Oct), which is currently 1.105 (275.450/249.280).

Anyone else computing this on their own?

Giri says

Tom,

I believe Harry assumes 0% inflation from Oct 21 to Aug 22. which means the average Sep21-Aug 22 is (Sep 21 + 11* Oct 21)/12, which comes to 276.573. That will push it to $119,000.

Tom P. says

Thanks Giri. That does push the 2nd bracket to $119,000 ( but note that the correct average is 276.399).

Harry Sit says

Medicare announced the 2022 Part B premiums. The standard premium will be $170.10/month in 2022 (up from $148.50/month in 2021). All 2022 IRMAA brackets in this post matched the official announcement 100%.

bev l says

OMG…that is a 14.545% increase! That must not be factored in the inflation rate of 6% given to social security recipients. Seems highly out of whack.

Paula Thompson says

Yep. Highly out of whack. I guess we could pay the government back by all signing up for Medicare Advantage, which costs the gov’t about 100.30 for every 100 spent by traditional (Medigap) plans.

Don G says

Official CMS press release with the 2022 Medicare Part B and Part D premiums and IRMAA add-ons are at https://www.cms.gov/newsroom/fact-sheets/2022-medicare-parts-b-premiums-and-deductibles2022-medicare-part-d-income-related-monthly-adjustment

Paul says

Bev, Medicare premiums are based on projected medical costs for the next year. Inflation is only one of the factors.

If you follow the link provided by Don G (currently the last comment, just above this one), you’ll find an explanation. One factor is potential coverage of a new Alzheimer’s drug that was just approved by the FDA.

RobI says

The new Alzheimer drug is not yet approved and has some efficacy concerns. The 2022 increase is a precautionary budgetary buffer, whihc i hope they dont use.

IMHO congress need to intervene here and not let one drug dictate the premium cost for 50m+ medicare retirees

calwatch says

So many Medicare Advantage plans are now rebating to their policy holders. Even SCAN, Anthem, Humana, and AARP are doing give backs, up to $125 a month per policy holder. If one is not a heavy consumer of health care and doesn’t have any non-treatable chronic conditions this could be an option.

Marty Yeager says

Yes, Medicare Advantage premiums have been falling, not surprising, since these managed care plans function as gatekeepers but hopefully do not sacrifice quality of care as access and referrals for care are restricted and or limited to their network. The problem is, you never know when you will get that serious diagnosis, and want treatment by some specialist/surgeon/facility that is outside the network. Waiting for open enrollment to switch to original Medicare may not be possible. Everything I have read says if you can afford it, original Medicare is the better option. I agree.

Tom P. says

Until the “era of COVID-19” is over I’m keeping traditional Medicare plus my Regence Plan F. Most of the Advantage plans are crap, and once you switch and stay in for 12 months there is absolutely no guarantee you can switch back as Medigap plans can refuse to insure you.

That said, the hospitals must make more money with Advantage plans because all my local facilities are pushing them, probably because they can “cheat the system” and overcharge Medicare by manipulating illness codes.

Medicare is actually quite reasonably priced. When I was working my employer paid 3X for group coverage compared to what Medicare + Medigap costs me.

GeezerGeek says

Wow, I am very happy to have found this site with all of its valuable information, albeit it would be better without the political commentary. I’ve been doing Roth conversions since 2011 to help reduce the expected RMD I’ll have in a couple of years. Initially, I was taking a large enough Roth conversion to take me to the top of tax bracket I was in. However, after the Trump Tax cuts (The Tax Cuts and Jobs Act of 2017 to use the lesser known name of the law), it made sense to take the Roth conversion up to the first IRMAA bracket. Figuring out what the number will be has been problematic until I found this site. At least now I have some basis of figuring out what that number might be. Thanks to the valuable information on this site, I now have a spreadsheet that has all of the information I need to estimate the IRMAA brackets.

This year I’m considering taking a Roth conversion into the first IRMAA bracket all the way up to the second bracket. That would cause almost a 4% tax increase on the incremental income in the bracket (counting the IRMMA as a tax) but that may be better than the tax rate caused by the RMD and the loss of the Trump tax cuts. Of course I will be a bit conservative in my estimate since being $1 over can cost you over $2,000 in taxes (Not fair but that is the way it is.)

So, THANK YOU, Harry Sit, for this valuable site and thanks to the commentators (Paul, Tom P, and others) who have helped clarify the calculation process.

Tom P. says

I guess I need to do some research on Roth conversions because I don’t understand how it will save paying taxes since in retirement I expect to always be in the same tax bracket year after year.

Paul says

I’m responding to both Tom and Geezer in this thread. I apparently missed it when it was posted.

Tom, even if you pay exactly the same tax rate year after year, there can be some benefit to a Roth conversion — you will get tax-free growth between conversion and withdrawal. But, that is offset by the growth opportunity lost by paying the income taxes earlier.

However, there is another consideration: Roth IRA withdrawals are not counted in the modified AGI used by IRMAA. So, you can easily lower your Medicare premium in the future by converting assets to Roth before you begin paying Medicare premiums — especially if required minimum distributions from traditional IRAs will force an unwanted increase in your AGI.

Even if you are already paying Medicare premiums, you may find there is some “room” for you to increase your AGI in the current tax year without pushing you into the next IRMAA bracket two years later. But, it’s hard to do so safely unless you can predict the future IRMAA brackets with some certainty. And, that’s why Harry’s post is so popular!

Geezer, I originally went down the rabbit hole to project IRMAA thresholds to determine if we could do a small Roth conversion in 2021. When I realized how close we were, I instead skipped some IRA withdrawals at end of 2021 (and postponed starting in 2022) to be sure we remained in the lowest tier.

But although it’s too late for 2021, I wanted to warn anyone considering the same in 2022 and beyond: be sure you take all taxes into account. In 2020, we did a large Roth conversion because we were concerned about tax increases, and I inadvertently subjected us to the Net Investment Tax (3.8% on certain income, if AGI > $250K). I didn’t realize my mistake until our accountant gave me the bad news.

GeezerGeek says

Paul, Good point about the Net Investment Tax. Having encountered it after accepting a buyout that inflated my income one year, I was aware of the tax. I added extra income brackets to my LT-Cap-Gains/Divdnds table to account for the tax.

The really bad part about the Net Investment Tax is that the threshold is not indexed. In just a few years, the Net Investment Tax threshold will be lower than the IRMMA threshold, being expedited by the higher inflation rates.

When I did the spreadsheet on the cost of taking a Roth conversion into the first IRMMA bracket, the Net Investment Tax threshold was above the threshold of the second IRMMA threshold so it didn’t have an impact. However, since that second IRMMA threshold is projected to be at least $240,000 (for 2021 income) with just a 1% inflation rate, it is probable that the Net Investment Tax threshold will be below the second IRMMA threshold for 2022 income if inflation remains high. So, so for future Roth conversions above the second IRMMA threshold, the Net Investment Tax probably will be a factor.

Pat says

When doing a large Roth conversion that would boost your Adjusted Gross Income considerably, you should find out what the thresholds are for other hidden taxes that might get triggered. In addition to the Medicare tax and the 3.8% Net Investment tax there could also be limits on your deductions. Depending on the state you live in, it may also have many hidden taxes that kick in if your AGI exceeds the thresholds they have set. There is also an Alternative Minimum Tax than can apply to some people, though from my limited understanding of how it works, a Roth conversion might actually reduce that tax if you are subject to it. It is a very complicated tax. I knew someone who had to pay it one year. When they were audited a couple years later and the IRS disallowed a $5000 deduction they had taken, instead of owing more in taxes, they received a refund. Good luck in modeling that tax in a spreadsheet.

GeezerGeek says

As Pat points out, the AMT is convoluted but I was able to model it in a spreadsheet using a blank FORM 6251 as the framework and completed FORM 6251’s that were created by my tax software. (If you already know the answers, it can help you to figure how the calculation works). There are a lot of twists and turns in the calculation, such as if this number is greater than that number but less than this other number then do this but if not then…. Look through the forms your tax software creates and you can probably find a completed FORM 6251.

I’ve only had to pay the AMT two years: Once when I accepted a relocation package and again when I accepted a buyout offer. The Tax Cuts and Jobs Act (Trump Tax cuts) increased the exemptions so that not as many people are subject to the AMT but like other parts of the Act, those changes expire in 2025 so the AMT may become more of a factor in the future.

Marty Yeager says

I’m guessing hospitals that push Advantage plans have negotiated higher reimbursement than what they get from CMS. If you are comfortable with managed care, you may save on premium costs. But old age is when the serious diagnoses are likely to appear, and I will keep by original Medicare/medigap with freedom to choose providers and no gatekeepers.

Paul Thompson says

Can you reconfirm that you have a 12-month period to bail back in to Medicare/Medigap, if you try out Medicaree Advantage? With this whopper increase in Part B for 2022 (mainly caused my a v unhelpful drug approved by Medicare for Alzheimer’s), I have to find funds somewhere. I find Medicare/Medigap (Plan F for me too) just too expensive.

Tom P. says

Paul, please see page 78 of the “Medicare and You Handbook 2022.”

Marty Yeager says

My understanding is that when you initiall qualify for Medicare B and Medigap, there is no medical underwriting. Guaranteed issue at that time for Medigap or Advantage. Basically, you choose the insurer you like with the price you like. But if you choose to change Medigap policies, as my husband and I did after 3 years (chose Plan N to save on premiums), you are subject to underwriting questions from the Medigap companies, and they may not issue you a policy. So, switching from an Advantage plan to a Medigap policy is not a slam dunk, depending on your health history.

Marty Yeager says

Roth IRA conversions save on taxes, after the first hit when you convert, because capital gains are tax free thereafter. According to the current law. However, I am not jumping on this bandwagon after Congress eliminated the “stretch” IRA. I do not trust Congress to keep their word on the Roth, especially with our current deficit and BBB spending plans.

GeezerGeek says

Yeah, you can never trust Congress. The tax on Social Security was implemented with what looked like a high threshold in both the 1983 law (50% taxable) and the 1993 law (85% taxable) but neither threshold was indexed so more SS recipients every year move over the thresholds as the COLAs increase their benefit.

I do think it is possible that Roth distributions will be added to the MAGI for IRMAA since they are already including non-taxable muni interest income. I think Congress would have a harder time justifying any tax on Roth distributions since the funds have already been fully taxed. I would not be surprised if Congress eliminated the back door Roth or curtailed future investments in Roths. However, the more popular Roths become, the harder it is for Congress to change them.

It was easy for Congress to justify the 50% tax on SS benefits since SS participants only contribute 50% of their already taxed income to SS and the company they work for contributes the other 50%. It was a bit harder to justify the tax on 85% of the SS benefits since 35% of that had already been taxed. Of course, Congress could justify that on the basis that the SS benefit is more than what the recipient paid into the fund, not that Congress has any need to justify anything they do.

Ros says

You never know what bracket you may be in during retirement. SS goes up and you either pay tax on 50 or

85% of your SS check depending on your taxable income. If you are married your tax bracket will change if your spouse dies before you. Congress can change rates. RMD’s change every year and it goes by your age and your balance of your IRA’s from the previous 12/31 and or other retirement plans. All income like Roth IRA’s do not count as income. Even the IRMAA law may change. You have to take advantage of the laws when they are in effect if you think they will benefit you.

Tom P says

Ros, your key statement is “You have to take advantage of the laws when they are in effect if you think they will benefit you.” Taking a quick look at my situation I don’t see a monetary benefit if I have to pull from my accounts to pay the tax on a $90K Roth in-plan conversion. If I do a smaller conversion and pay the taxes with cash on hand then I’m ahead. But either way the Roth would provide some added flexibility, so I will consider it next year after more spreadsheet modeling. I’ll need to decide before my first 1040-ES payment in April as that would need to be adjusted to cover the expected taxes.

CapeRetiree says

Tom P,

I have done a spreadsheet for a large ($128K) Roth conversion this year, then $40k per year after that, and the tax free money I can accumulate in the Roth using a lower investment return rate than I am averaging now, while only paying 22% Fed tax rate once for the conversions, and us both paying the IRMAA bump on Medicare in 2023 for our 2021 return MAGI being in the 1.4 surcharge is more than covered with all the tax free money that will build up in the Roth account, while giving me flexibility to use the Roth $$ if needed to stay within brackets on future returns when needed to avoid IRMAA or Fed bracket creep. Next year starts my RMD years, so I will need to do the big one now, to make more money available for the conversion.

GeezerGeek says

Hopefully, the SECURE Act 2.0 will soon get passed by Congress and you will get another year of Roth conversions, age 73.

I will consider continuing Roth conversions even after I start RMDs. Will need to run the numbers at that time. May consider a qualified charitable distribution to adjust where I fall in the tax brackets and IRMAA brackets.

If you plan to leave an inheritance, the Roth funds would also benefit the inheritors. There has been talk about eliminating the inherited step-up in basis on capital gains so I would think that Roth inheritances may be a safer way to pass a tax free inheritance.

Tom P. says

Thanks Cape. Considering the money I would need to pay the in-plan Roth conversion taxes would probably come from a withdrawal from my 401(k), I don’t really see how it would be that beneficial. Say I withdrew an extra $24K next year to cover a $100K conversion, that $24K won’t be making any (hopeful!) return, and all that extra “income” will push me into a higher tax bracket and require an IRMAA adjustment, something I avoided for 2021, 2022 and 2023 by filing the SSA-44 after I retired in July 2020 and my income dropped considerably this year.

Guess I’ll put together a spreadsheet to see if it might make sense in the long run… Lord knows I have spreadsheets for everything else, LOL. The good thing (I guess) is what little money I did put into my 401(k) as a Roth contribution in 2017 will hit the 5 year mark January 1, 2022, so whatever I choose to convert next year would be immediately qualified. Ain’t retirement fun!

GeezerGeek says

Tom P, you are right. Roth conversions are a wash if you remain in the same tax bracket but are an advantage if you move to a higher bracket in the future. However if you have to pay the taxes with funds from tax sheltered funds, IRA or 401k, then you also have to pay the taxes on money you withdrew to pay the taxes and, as you pointed out, you lose the future potential earnings of all of the money you withdrew to pay the taxes. A Roth conversion that would have been a wash can become a net loss when using tax sheltered funds to pay for the conversion. So the general rule is don’t use IRA/401k funds to pay for a conversion unless you were required to withdraw those funds because of an RMD. However, I say “general rule” because under some circumstances, it can make sense. You might have to do that spreadsheet to figure out what make sense for your situation: A smaller conversion or no conversion at all.

Excel is my friend. I created a spreadsheet that projects my future income over the next twenty five years including the RMDs that are going to put me in tax and IRMAA brackets where I don’t want to be. That is the reason that I’m trying to do Roth conversions as large as I can afford to do. However, everyone’s financial situation is different. You just have to figure out what make sense for your situation and it sounds like you have got a pretty good handle on that.

Tom N. says

Tom P, you wrote: “The good thing (I guess) is what little money I did put into my 401(k) as a Roth contribution in 2017 will hit the 5 year mark January 1, 2022, so whatever I choose to convert next year would be immediately qualified.”

By “qualified,” do you mean immediately available without another 5-year waiting period? I am new to all this and thought, perhaps incorrectly, that each Roth conversion amount has a 5-year no-withdrawal period associated with it, which needs to be tracked. Can someone clarify?

Tom P says

Tom N asked about the Roth 5-year taxable period. I don’t know how this works for an IRA but for my former employer’s 401(k) plan, of which I am still a participant, I have a table that outlines the scenarios. For source type: “In-plan Roth Conversion made within the last 5 tax years (including current tax year)” the table column for “> 5 yrs Roth participation & > 59.5 or other exception” the earnings are a “qualified distribution, no tax and no penalty. Qualified is 5 years of Roth participation AND paid after 59-1/2 or due to death or disability.”

There’s a footnote at the bottom of the table regarding participation: “The five taxable year period begins on January 1 of the first year in which you made a Roth contribution or a Roth conversion…”

You need to confirm how your own plan works.

GeezerGeek says

Tom P, I can’t predict the future but I don’t expect the Trump Tax cuts for individuals that expire in 2025 will be renewed. For the past two years, US deficit spending as a percent of GDP is higher now that it has been any time since WWII. A large part of that was due to COVID 19 but with the Infrastructure Investment and Jobs Act and no additional sources of revenue, that trend may continue.

Then there is the US national debt, which as a percent of GDP, is higher now than it was during WWII. The only thing that made such a huge debt more manageable is the historically low interest rates the US Treasury is paying. Now with inflation kicking, how much longer will those low interest rates be sustainable? If the Treasury rates return to the level they were in the early 2000’s that cost of serving that debt will double. If the Treasury rates return to the level they were in the 1990’s that cost of serving that debt will triple. Hopefully, the rates will never return to the level they were in the early 1980s, but if they did, the cost of serving the debt would be more than 5 times the current cost.

Then there is Social Security, which we all have know for years is under funded.

Then there is the continuing problem with supporting the costs of the Affordable Heath Act, which continue to rise.

So where will the money for these future needs come from? Many think it can be fixed by raising the tax on the one percenters but if you think that then read the following article. (I’ve seen this analysis by others but this is the first one I found now by Google.)

https://www.crfb.org/blogs/can-we-fix-debt-solely-taxing-top-1-percent

To me, it seems inevitable that tax rates are going up in the future, and not just for the one percenters. Just the expiration of the Trump tax cuts in 2025 alone will cause future rates to increase.

Vincent J Pellettieri says

This is all very frustrating to try to plan for those who have worked hard and saved all their lives. It seems like if you goof off the government has a bailout program for you. Any popular ideas that are used to try to limit excess taxation are criticized and then they try to eliminate it.

Ros says

Tom P,

I have done my Roth conversions since it was allowed and never have I used IRA money to pay the taxes. I always over pay my income taxes so I do not have to worry about owing at tax time.

I believe that is the only way that the conversion makes sense. I am not wealthy so I stay under the number to make my Medicare premium go up as I am retired. I am doing this for my kids as they are near 60. I want them to have a choice of money to use that is not taxable if they need it and it could delay the IRA distributions and perhaps Social Security if they retire early.

Larry L says

I can readily see Congress including T-IRA and R-IRA earnings, gains and distributions as part of a “means test ” for Social Security in the not so distant future when the program “runs out of money” (whatever excuse that means). Roth conversions make sense now for me and I’m continuing onward…

Jane J says

How risky it is trying to gauge the 2023 IRMAA brackets when they are not calculated/announced for another 12 months! Ordinarily, my MFJ tax household will qualify for no IRMAA premium, but for this tax year 2021, we have decided to substantially raise our AGI and move into x1.4. I turn 63 in 2022 and so IRMAA in 2023 will only affect my spouse. Thank you to Harry for creating this website and to the other contributors for the subsequent discussion. I feel confident that I have a plan for year-end which neither goes (just) over a threshold nor leaves too much money on the table.

GeezerGeek says

Jane J, If you know how the brackets are calculated, then there is very little risk. The data to calculate the brackets that will be announced in November 2022 will be the CPI-U from September 2021 to August 2022. We already have the CPI-U for September and October 2021. Next month we will get the data for November 2021 so we will have the data for 3 of the 12 months that will be used to calculate the brackets for next year. You can take that data, assuming there is no inflation at all for the other 9 months (unlikely), and calculate what the brackets will be. Assuming that there is no inflation for the next nine months is very conservative estimate so there is very little risk. I think the only real risk is if Congress changes the law about the IRMAA. That is possibility but I don’t think it is a probability since I have not heard of any discussion from either political party to do so.

Marty Yeager says

Deflation is the other, but unlikely, risk. And what Congress will do, retroactively, never ceases to surprise me.

Peter G says

I received an IRMAA notice for 2022, using my 2019 income, not 2020. (In 2021, I believe they used my 2018 income, presumably due to COVID.) I’m reluctant to appeal because my 2019 income situation did not meet any of the life-changing events they list. Do I have grounds to appeal anyway, given they are going back 3 years not 2? Thank you!

Harry Sit says

SSA says you should call or visit their local office if they used stale information. It’s not the same as appealing based on life-changing events.

https://www.ssa.gov/benefits/medicare/medicare-premiums.html

Tom P says

We also received our SS COLA and IRMAA letter for 2022 online today. SS really screwed up as they said we need to pay IRMAA based on my 2020 income, but we already filed a SSA-44 form October 15th due to retirement and major reduction in income this year, and we have already received a refund of our 2021 IRMAA based on our estimated 2021 income, which will be below the MFJ lower limit for 2022. So, why did the SSA say we have to pay IRMAA at the 3rd tier level based on 2020 info when they already had newer information? The whole point of filing the SSA-44 was to correct IRMAA for 2021 (which SSA did), but also to prevent IRMAA for 2022. Guess I need to call my local office Monday; might be a case of these auto-generated letters not taking into account newer information?

AnnaC says

I believe you need to file a new SSA-44 form for the 2nd year as they don’t carry it over to the next year. Once they review it you’ll be back on track with IRMAA being reversed for 2022.

I filed a form due to job loss and had to do it two years in a row to stick. While you would think it’s in your file & would be taken care of they must need to confirm it each year on an individual basis.

If being billed I would only pay the standard premium as the IRMAA will be reversed. If collecting SS with an auto deduction you will need to wait for their reversal for the excess charge.

Tom P says

Anna, could you be a bit more specific about having to file SSA-44 two years in a row? I don’t see what information we would change on the forms. On our forms for “STEP 2: Reduction in Income” I filled in Tax Year 2021 since that was the first year after retirement and drop in income, and SSA approved that reduction for 2021 based on my estimated income and we received refunds for 11 months two weeks after receipt of the forms by our local office… so pretty quick action.

It may be that the online SSA letters we received Saturday were generated before receipt of our SSA-44s. The reason I say this is the form says, “We ill use your estimate provided in Step 2 to make a decision about the amount of your income-related monthly adjustment amount the following year until: IRS sends us your tax return information for the year used in Step 2.” Based on this statement we should not have to pay IRMAA for 2022 as our income for 2021 is below the MFJ lower limit in 2022.

I’m going to call my local SSA office Monday and see what they say as I would like to get this cleared up before the end of the year.

AnnaC says

The 2nd year had to fill in new estimated income for the current year (would be 2022 estimate for you now) so they can use that number vs. actual MAGI on tax return as of 2020.

The life changing event was the same; the #s changed based on a new year.

When you filled out the form Oct 15th did that reflect estimated income for 2022? If so then things may have crossed in the mail. If this is the case then booking an appointment for a call re the topic is all that may be necessary. If call the general 800# they will create an appointment with your local office; if call the local office they too will book an appointment as the folks who do the review not the same as who answers the call and/or need a one-on-one appointment to discuss.

The first year I went in person (pre-pandemic) and the 2nd year I did a one-on-one call via appointment with my local office. If I recall correctly I had to fax the form in advance of our call. Regardless of what I filled out the rep reviewed every data piece on the form & the IRMAA reversal was done.

Hope this helps!

AnnaC says

Since you retired in 2021 your MAGI on your 2020 tax return falls into being assessed IRMAA.

They review income each year to make their excess premium charge decision.

If you fill out a new form of life changing event with the current numbers (estimated income for 2022) you should be ok.

Since its a two-year look back you go through the exercise two years in a row for the same life changing event.

Definitely book an appointment for guidance.

Tom P says

Thanks Anna. Actually, I officially retired July 1, 2020, but my retirement was also coincident with a layoff, so my income in 2020 was actually higher than 2019 because I was paid 26 weeks of severance pay in addition to many weeks of UI payments, so my income didn’t actually drop until this year.

I did provide an estimate on the form for my 2022 income, which was lower than my estimated 2021 income, however, I’m now thinking of making a 2022 in-plan Roth conversion which will raise that estimate.

I think I’ll wait a bit before calling the SSA to see if I get an updated IRMAA notice.

Bill C. says

Tom, I couldn’t find a way to reply to your reply to message 207 and this comment has nothing to do with your post 195. It has to do with your IRMAA spread sheet. I also use a spreadsheet to track CPI U and predict the future IRMAA amount. One thing that I have wondered about is something back in the foggy part of my memory. I seem to recall that the future amounts as calculated by SSA don’t start with the rounded published amounts for the previous year but rather the exact amounts for the previous year (as calculated). So, the previous year amount could be plus or minus up to $500 different from the published amount and we don’t get to see that number. It of course doubles to $1000 in the MFJ amounts. I therefore create a projection based on the lower rounding limit of the previous year and another based on the upper rounding limit. It helps me in making a judgement about what value to plan on. It also could be argued I’m putting too fine a point on the process. Your thoughts?

Paul says

Bill, IRMAA brackets are not calculated year-to-year. They start with the base CPI in the year ending August 2018, or rather the average CPI from September 2017 to August 2018, which was 249.28.

The new average CPI is used to calculate a percentage increase since August 2018. The resulting percentage increase is then applied to the IRMAA brackets for tax year 2018 (The first tier was $85,000).

Finally, that’s rounded to the nearest $1,000 for single, and the married bracket is 2X the single bracket.

Ruffles says

This is just a precursor to the day when rich people no longer receive any Social Security. Which is as it should be when you live in a bankrupt country.

powderriver says

I am realizing that it isn’t so much that the country is bankrupt, but that the people who inhabit it are.

Rosemary says

I am near 80 and have everything I need or want. I add everything up in Jan or Feb that I spent the year preceding year and I have only gone over $20,000 once and that is when I spent $4500 on a dining room suite and only hit $22,000 that year. My taxes are $5700 a year and my medicare that pay for everything is $6300 a year. I live in Michigan and heat a 2100 square foot home with a heated walk out basement on the budget plan for $37 dollars a month. I have a big freezer and averaged $9.77 a week last year for groceries. I pay for mowing and snow plowing cuz my doctor won’t let me do it anymore, but may try to use the leaf blower on the driveway and sidewalk this year. I eat salmon and rib eye steak and buy when it is on sale and freeze it. I always have a full 30 foot freezer and only buy on sales and or coupons and when I am low on something and only go to the store to purchase fresh fruit, milk or bread and that is only 2 month and sometimes less. I even freeze grapes when they are on sale. I use steam fresh vegetables. This week I bought a 20 lb turkey 23 lbs of sweet potatoes, cheese it crackers for my grandson 5 lbs of russet potatoes and 2 pkgs of creme cheese for the potatoes for $3.57 after the sales and coupons. I have more money but just add up the following year to see what I spent. I no longer travel and do not care to as we traveled a lot when my husband was alive. We and now I continue to gift both boys every Jan 2 the limit the gov allows without more tax forms and I convert to a Roth since 2011 or 2012 and still pay the lowest for Medicare premiums. I think we live and die by the choices we make and I get pleasure in hiking, walking 3 miles a day and do it in the house during the winter and going to the free concerts at the colleges in town, and in the several parks in our city and in the cities all around us within 20 miles or less in the summer, in reading, and for the last week raking 5 hours a day and just bought an electric blower that blows 220 miles an hour. Wish I had it the first of the week. Just yesterday I now have a 50 foot line about 4 feet wide of leaves after bringing 19 tarp loads to the woods just from the side yard. Hate oak leaves.

We never made over $60,000 a year and my husband was put on 100% disability in 1995. We paid for both boys to go through college but they had to have a 3.5 in high school and college, never get in trouble, no car and stay on campus. If they could afford a car or an apartment they could afford to pay for college. Once in graduate school they could have a car. Once worked 96 hours in the summers and other worked 105 hours during the summer.

Rosemary says

Should have said property taxes are $5700 a year.

AnnaC says

Kudos Rosemary!

PS I have oak leaves too…..& acorns more…..

Stay healthy!

AnnaC says

meant hate oak leaves…..