[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

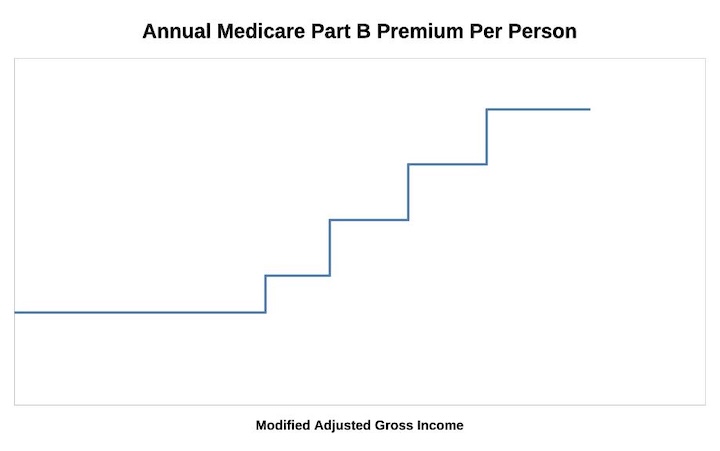

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Lynda says

I received an IRMAA notice basing my 2022 Medicare premium on my 2020 income tax, BUT I was not a Medicare beneficiary in 2020. I was not enrolled in Medicare until 2021…this year…which the tax year is not over yet. This cannot be right.

Tom P says

Linda, that’s the way the system works unfortunately. I didn’t sign up for Part B until I was 73 since I was still working and covered by my employer’s group policy. After I retired and Part B became effective in August 2020 my IRMAA charges for the rest of the year were based on my 2018 income. IRMAA adjustments, if any, are always based on income 2 years prior unless you have one of the qualifying events such as loss of income due to not working, change of filing status, etc.

Tom P says

So Linda, if you first enrolled in Medicare this year are you paying IRMAA in 2021 based on 2019 income or were you under the limit this year?

Lynda says

Thank you very much for taking the time to respond to my message. I have been seriously stressing over this since I received the notice 5 days ago. I wasn’t even eligible in the tax year they are using. It makes me feel as though I’m paying Medicare premiums for a year that I wasn’t eligible, receiving, getting any benefit from, or paying premiums for. 😤 Your reply did help me to stress less about it though. I appreciate you.

The Wizard says

Assuming your income from two years ago while still working was way higher than it is now, just file form SSA-44 with a proper explanation and you should be good…

Larry says

Harry, In your post 172 you mention that you will recalculate in December after the inflation numbers are released. Would you have some idea as to when in December we might see the results of that recalculation? Personally, we are holding-off making the 2021 conversion pending a final best-guess of 2023 IRMAA. Thanks.

Harry Sit says

The inflation data point comes out on Friday Dec. 10. I’ll update on the same day or by Monday Dec. 13 at the latest.

Tom P says

Larry, if you are planning on making an in-plan Roth conversion in December you should check with your plan and find out the drop-dead date for a 2021 conversion. I know my plan has one after which the conversion won’t be effective until the following year.

GeezerGeek says

This site gives you the release dates: https://www.bls.gov/schedule/news_release/cpi.htm

Here is what site lists as the dates for the next few months

Mth Data (MMM-YY) Released (MMM-DD)

———- ———————-

Nov-21 on Dec-10

Dec-21 on Jan-12

Jan-22 on Feb-10

Feb-22 on Mar-10

Mar-22 on Apr-12

Apr-22 on May-11

May-22 on Jun-10

Jun-22 on Jul-13

Jul-22 on Aug-10

Aug-22 on Sep-13

Sep-22 on Oct-13

Oct-22 on Nov-10

Nov-22 on Dec-13

Larry says

Tom, thanks for the heads up on the last minute conversion cut-off timing. Its Vanguard, will confirm with them…

Jack B says

I understand from many websites that MAGI for IRMAA = AGI + exempt interest. With that said, I’m unable to find the root source of this information, such as an IRS or Medicare rule; or something on their sites along the lines of sample calculations or IRS Pub references. If someone knows where I can find the actual rule or official direction on this matter I would appreciate it.

Harry Sit says

Social Security Act, Section 1839.

https://www.ssa.gov/OP_Home/ssact/title18/1839.htm

Look for “(4) Modified adjusted gross income.”

Jim M says

I have read your article with great interest. Thank you for sharing it. I am especially interested in your estimates for the 2021 MAGI Income / 2023 Medicare Premium Year. I am pleased to see that you are planning to update your estimates sometime after the latest inflation adjustments are announced on Dec 10. I look forward to seeing them.

It amazes that you are able to provide inflation estimates for next year before the year has even begun. Can you point to a government document that describes how these inflation adjustments are actually calculated? I have been surprised that the government announces the IRMMA inflation adjustment in arrears as opposed to announcing the 2021 MAGI Income Brackets before year end so that people can plan for them with some certainty.

Tom P says

Jim, the calculations are pretty simple, you just need to know where to find the data:

1) Current CPI-U is here: https://www.bls.gov/news.release/cpi.t01.htm. You’ll find the Dec 10 update listed here first.

2) Historical table for CPI-U is here: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm. The data usually has a few days lag in publishing compared to 1).

The adjustment is based on the average of Sep through Aug numbers of one year compared to another, so to get an estimate of the 2023 adjustment you can look at the values from Sep 2020 to Aug 2021, which has an average of 265.447. Then for 2023 we can use 2 data points for Sep and Oct 2021 (so far), whose values were 274.310 and 276.589; the average is 275.450.

Divide 275.450 by 265.447 to get 1.038 (you could also extend the latest 276.589 for the rest of the months to get a bit higher average number, which would mean zero inflation going forward, and also zero negative inflation).

Technically, the adjustments are based on the current year calculations compared to the 2019 BASE YEAR brackets and inflation numbers, but you’ll get the same estimate for 2023 by applying the factor from this year compared to last year and applying that to the recently published 2022 SINGLE brackets, with the result rounded to the nearest 1000. Those adjusted single brackets are then doubled to get the MFJ brackets.

As an example, multiply $91,000 (2022 lower Single bracket) by 1.038 and you get $94,000 rounded to the nearest 1000 for 2023 estimate ($188,000 for MFJ). Continue for all the other tiers. You can extend this out as far as you want assuming future inflation numbers. Have fun!

Jim says

Tom P. Thanks for you very informative and helpful reply.

Marty Yeager says

Ya gotta scroll through comments above to see that Harry has taught us IRMMA wonks how to do the calculations! Never be in the dark again with this powerful tool.

Doug Miller says

Thanks for this very helpful article. I read a lot of retirement related stuff, but haven’t seen anything this good on IRMAA. Did not know that income from 2 years ago would be subject to current year IRMAA brackets. I have been managing current year income to current year brackets. So, I have more breathing room than I thought. I can safely take another $6K out of an IRA this year, for example. Mike Piper links to a lot of your articles from his Oblivious Investor e-mail, which brings me to your site on a regular basis. Anyway, thanks for a lot of good stuff.

Jim Eggen says

Understanding IRMAA would probably become a whole lot clearer if someone, like the government maybe, would do these two things:

1. NEVER use vague and undefined terms like “income”. Instead, always define it (eg total income, AGI, modified AGI, etc) and state clearly which specific line # it can be found on in any and all applicable tax return forms (1040 etc)

2. Tables are nice, but write them clearer and provide lots of footnotes such as: the “income” vaguely referred to here is defined as ….., and can be found and clearly picked off of your 1040 or other applicable tax return at line x, or maybe go to line y and subtract 85% of your SS income, or go to line z which is defined as … , etc. Get the idea?

Be assured that this IRMAA thing is very ANNOYING and CONFUSING, at least to some of us who are challenged (We can’t all be above average) However, that’s a nevermind. It should be clearer. Even my tax account couldn’t understand and explain it with any clarity. But he just puts numbers in his software and turns the crank. Getting IRMAA right is not in his job description. One thing I found doesn’t help but seems to sum up IRMAA best: “The beatings will continue until morale improves”. I am bruised.

Bick says

Following – Great thread, Thanks Harry and other contributors. Spent the last couple of hours building my spreadsheet as a way to nail down how it works. Looking forward to this weeks CPI-U number.

Harry Sit says

Last update before the end of 2021 with the latest inflation data point. Slight changes upward in the 0% inflation table for 2023. No changes to the 5% inflation table for 2023.

Paul says

Thanks for the tip, Harry!

I put the new CPI-U into my worksheet, and tried various average inflation rates for the remaining months (until August, 2022). If the average inflation rate is in the stated range, the first IRMAA threshold will be:

0.0% – 2.9% $190K

3.0% – 6.2% $192K

6.3% – 9.4% $194K

Of course, the second and third thresholds change at different average inflation rates.

Larry says

Thanks Harry for updating your tables quickly on this. We will probably use 0% and leave some room for surprise income to stay under our target AGI. We would have trouble sleeping going higher since the CPI-U inflation seems highly influenced upward right now by energy and its (sometimes volatile) commodities, and looks to be slowing.

EdFogle says

Just to confirm, these are the max your MAGI can be in 2021 before entering tier 1 IRMAA charges in 2023. Am I correct?

bickp says

I used the November number (277.948) for all remaining months as described in an earlier post which assumes no more inflation. I only track the lowest three categories and found that Level 1 grows to $95K with rounding, Level 2 stayed at $119, Level 3 grows to $149K with rounding. Other spreadsheeters, do you agree with those calc’s based on that assumption?

bp

Tom P says

bickp, the short answer is “yes” I agree with your numbers 🙂

I’m more interested in the 2024 brackets as 2023 is already fixed for me. I’m planning to do a Roth in-plan conversion next year and I want to stay within the 2nd tier bracket. Right now I’m looking okay for the amount I am planning to convert.

Bev Lolr says

bickp ~ Are these numbers for Single filers. If so, would they be doubled for married, filing jointly? Thank you for your guidance on this maddening IRMAA stuff.

Bick Pratt says

Hi Bev Lolr : Mike calc’s are for a single filer. I am not sure about whether you simply double for a married couple. Anyone else know the answer to Bev Lolr’s question?

bp

Tom P says

Bev asked about the MFJ (married filing jointly) brackets. All IRMAA adjustments are first applied to the single brackets, which are then rounded to the nearest 1000. The MFJ brackets are double the adjusted and rounded single brackets.

GeezerGeek says

OK, I’ve finished my spreadsheet and have decided that extending my Roth conversion into the first IRMAA bracket for 2021 probably cannot be justified with future tax reductions. Here is how I came to that conclusion. Please let me know if I’ve overlooked anything or I’ve got something wrong.

I’m treating the IRMAA adjustment as an additional tax and I’m assuming that I would be able to take the Roth conversion in 2021 up close to the limit of the first 2023 IRMAA bracket which I’m currently projecting to be from $190,000 to $240,000, a span of $50,000. Since we don’t know what the 2023 Parts B & D costs will be, I used the 2022 numbers as a basis, knowing that they will probably go up in 2023. This scenario also has the taxes for the conversion being paid without using any tax-sheltered funds (IRA/401k) which would make the numbers for the conversion even less favorable. I’m also assuming that there wouldn’t be any major tax increase in the present 22% income bracket other than the demise of the Trump tax cuts, which changes it to the 25% bracket.

The future (2023) cost of exceeding the lower IRMA for a joint filing in 2021 is ($238.10 minus $170.10) times 2 (for two people) per month for the Part B and $12.40 times 2 per month for Part D. For the year, that would be a total of $1,928.60 for a couple. If you spread that cost across the bracket of $50,000 (assumes first bracket begins at $190,000 and ends at $240,000), you get an incremental tax rate of 1,928.6/50,000 = 3.86%.

That’s kind of a best-case scenario because the cost of Parts B and D probably will increase in 2023 and the limits of the bracket may be different than what is estimated which would mean that the cost would be spread over a span of less than $50,000. Also, for some couples, taking your income up to $238,000 this year can cause a change in your tax bracket from 22% to 24%. It would not for me because of the deductions I have and the amount of non-taxable muni income that would keep me below the 24% rate.

An increase of 3.86% wipes out the Trump tax cuts so it is best for me to stay below the IRMAA limits. That doesn’t leave much room for a Roth conversion this year because I took a capital gain earlier in the year. Looks like I will continue my strategy of taking Roth conversions only up to the IRMAA limit. At least now, thanks to this article and all the commentators, I have a better idea of what that limit will be.

In the future, if I’m ever forced into IRMAA by a RMD or other unexpected income event, I would probably do a Roth conversion up to the top of the IRMAA bracket I’ve been forced into. That may help me avoid future incursions into IRMAA. The worst-case scenario is exceeding the IRMAA limit by a dollar and incurring the full penalty of IRMAA for one dollar of additional income. (Ouch!) Taking a Roth conversion to the upper limit softens that blow.

Since the costs of Part B & D seem to be increasing faster than the IRMAA brackets, the IRMAA tax as a percent of income will probably continue to rise, which would suggest that doing a Roth conversion into the IRMAA will become even more costly in the future.

Tom P says

I’ve been looking at a Roth in-plan conversion for next year since my current Roth funds will become fully qualified on January 1, 2022, making any addition funds also fully qualified. For my situation it only makes sense to put more funds into Roth as a hedge against the tax bracket and IRMAA shifts that will ultimately occur when one of us “meets his maker,” or perhaps to protect against running up against an IRMAA bracket when for whatever reason we decide or need to withdraw some extra money one year and could use the tax free Roth funds.

calwatch says

That’s a good strategy. Blow the limit up to the next bracket if you miss a checkpoint.

Bill C. says

Question regarding your spread sheet. How are you calculating the third tier test < amount to determine if you are forced to pay at the third tier level. The second level is also called the (Standard*1.4) amount and in my case the MFJ amount which is $228,000 in 2022. Looking back at previous years, the upper limit of the second tier appears to be about 1.25 times the test amount for the second tier. For some reason 2021 (1.26) but perhaps is the result of rounding. Would appreciate hearing how your spreadsheet handles this calculation.

Paul says

Bill, while the premiums for each bracket appear to be some multiple of the base premium, the AGI thresholds are calculated by applying the CPI to to each AGI limit for tax year 2018, then rounded to the nearest $1,000.

In 2018, the start of each brackets was:

$0

$85,000

$107,000

$135,000

$160,000

$500,000

There’s an exception to the last one: it is not adjusted for CPI each year, until 2028.

For married, double all but the last one: it’s $750,000.

For married filing separately, it’s a different schedule, but I won’t belabor that.

The relevant CFR is here: https://www.ssa.gov/OP_Home/cfr20/418/418-2115.htm

GeezerGeek says

An additional factor that Paul mentioned in a different comment (183): the Net Investment Tax which can add an additional tax of 3.8% for investment income if a married couple filling jointly modified AGI exceeds $250,000. In the analysis I did above, the Net Investment Tax was not a factor because the Net Investment Tax threshold was higher than the second IRMMA threshold. However, since the Net Investment Tax is not indexed, the Net Investment Tax threshold will soon be below the second IRMMA threshold. So that is a factor you should consider in any intrusion over the IRMAA threshold, even if you are forced above the threshold. The Net Investment Tax is only applied to investment income so it may or may not be a big factor, depending on your income sources.

Just to make things more confusing, the modified AGI used for the Net Investment Tax threshold isn’t the same as the modified AGI used for the IRMMA threshold. The following URL to the IRS site explains how the modified AGI used for the Net Investment Tax is calculated. https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax

Bill C. says

Paul, I can’t say thanks enough for your assistance in understanding the calculation of the IRMAA brackets. I do still have a question about how the higher income brackets are calculated. It seems to boil down to either using the base 2018 bracket amounts you noted for individual filers and inflating those amounts to the current year calculation, or.

$0

$85,000

$107,000

$135,000

$160,000

$500,000

Reading paragraph (e)(1) of CFR “418..2115. What are the modified adjusted gross income ranges?” “In each year thereafter, CMS will set the modified adjusted gross income ranges by increasing the preceding year’s ranges by any percentage increase in the Consumer Price Index rounded to the nearest $1,000 and will publish the amounts for the following year in September of each year.” This seems to me to say, “start with the previous year’s published bracket, end of year values, and apply the CPI inflation for the new year.” I’m reading the guidance as applying to all the previous year’s bracket values except the $415,000, $500,000, and $750,000 values. In other words, no look back to 2018. I guess they believe any rounding gains or losses in the base year will average out in the long run.

In either case, I take it that MFJ bracket amounts are always taken as double the appropriate “individual filer” amount. I note that MFJ amounts are always in even numbered thousands. So the process must be round the individual bracket amount first, then double.

Thanks again, Bill C

Paul says

Bill,

As usual, federal regulations can be unclear or even contradictory. The CFR from Social Security is SUPPOSED to be derived from the US Code, but they obviously weren’t paying attention. It took me a while to find the US Code again, but it’s here:

https://www.law.cornell.edu/uscode/text/42/1395r

You’ll have to scroll down a bit, but it’s easier to search for “Inflation Adjustment”. This is what they actually follow (I’ve removed the paragraph labels, and combined it into one sentence):

Subject to subparagraph (C), in the case of any calendar year beginning after 2007 (other than 2018 and 2019), each dollar amount in paragraph (2) or (3) shall be increased by an amount equal to such dollar amount, multiplied by the percentage (if any) by which the average of the Consumer Price Index for all urban consumers (United States city average) for the 12-month period ending with August of the preceding calendar year exceeds such average for the 12-month period ending with August 2006 (or, in the case of a calendar year beginning with 2020, August 2018). If any dollar amount after being increased under subparagraph (A) or (C) is not a multiple of $1,000, such dollar amount shall be rounded to the nearest multiple of $1,000.

I once tried it the “other” way, increasing each year based on the annual CPI, using the previous year as the base. But, I found it didn’t match the actual brackets. The reason was: rounding. By rounding up or down to multiple of $1,000 each year, a value is either reduced or increased for that year. If you use that as a base for the next year, you are introducing an error into the calculation, either raising the bracket amount too high or too low. So, they start with a consistent base (average of September 2017 – August 2018) and use that each subsequent year, applying the CPI change since then.

The Social Security COLA is calculated by comparing the current year to the previous year when a COLA became effective (note that might not be the previous year!). But, that’s a percentage that is applied to the wide range of benefit amounts. If there is any rounding, I think it’s to the nearest 10 cents. Perhaps whoever drafted the CFR didn’t realize the US Code was different.

Tom P says

I agree with Bill C’s comments today. Reading the CFR each new year’s IRMAA ranges are just modified from the previous year’s ranges; you don’t have to go back to the so-called base year and modify those by the cumulative inflation adjustment factor. You can if you want… as you’ll get the same answers through at least 2022. However, at some point the rounding to the nearest thousand each year versus one time over several years may create a difference.

And yes Bill, the MFJ ranges are just double the adjusted and rounded single ranges (except for the $750K top bracket).

Paul says

Tom, I posted a comment to Bill, but I’m not sure it became public before you replied.

The CFR is apparently wrong, and I didn’t notice until Bill pointed it out. I subsequently cited the US Code, which specifies the algorithm that I described. And as I noted, I originally tried to calculate the brackets from year to year as you advocate, and found I was getting slightly wrong answers for some brackets. When I found the US Code, I corrected my error and everything matched up.

Tom P says

Paul, I’ve made tables for both year-to-year and year-to-base year. I get the exact same ranges through 2022, but in 2023 I see a $1,000 difference in the 1st and 4th tiers (one higher, one lower). In my career as a Propulsion Engineer at Boeing we used the CFRs for all certification work, so my opinion would be that the CFR is the correct resource… but I’ll continue to track both methods. Also, the “code” you reference doesn’t say anything about adjusting the top brackets, but the CFR does. The published 2023 brackets should confirm which method is correct. FWIW, I’m using the ROUND function, not ROUNDUP or ROUNDDOWN to get the nearest $1,000. For example, =ROUND(*,-3).

Paul says

Tom, the US Code section does include adjustment of the top brackets, now and beginning in 2028. Search for “Treatment of adjustments for certain higher income individuals”:

(C) Treatment of adjustments for certain higher income individuals

(i) Subparagraph (A) shall not apply with respect to each dollar amount in paragraph (3) of $500,000.

(ii) Adjustment beginning 2028

In the case of any calendar year beginning after 2027, each dollar amount in paragraph (3) of $500,000 shall be increased by an amount equal to—

(I) such dollar amount, multiplied by

(II) the percentage (if any) by which the average of the Consumer Price Index for all urban consumers (United States city average) for the 12-month period ending with August of the preceding calendar year exceeds such average for the 12-month period ending with August 2026.

I’ve also repeated my calculations using the year-to-year methodology you advocate, and I cannot replicate your results — there are variances from the bracket thresholds actually published. So, we will just have to agree to disagree on that point.

With regard to resolution of a conflict between a regulation (CFR) and statue (USC), that’s beyond the scope of this discussion. You can search for “Chevron deference” and find many articles about it, but if unless a statute is ambiguous, the statute supercedes any agency’s interpretation.

Bill C. says

Paul, thanks yet again for posting the link to the Code. Even with your simplified expression of the two paragraphs which describe the process of for projecting future IRMAA bracket amounts, I still had to see it for myself and I read it the same way you do. Unfortunately clarity didn’t seem to be one of the goals. Had it been submitted in the technical writing class I took about 60 years ago it would have been returned with a big red X over it.

Tom P please do continue to track both calculation methods, since that may be the only way to determine what is actually programed into the computer.

Tom P says

Paul, here are the numbers I am using to calculate either year-to-base or year-to-year. You should be able to get the exact same results for the 2020 thru 2022 brackets using either method. Things start to deviate in 2023:

2020 2021 2022 2023

1.01900 1.03386 1.06485 1.11085 Year-to-Base

1.01900 1.01458 1.02998 1.04319 Year-to-Year

Year 2023 only includes the data we have through Dec 2021, so the average CPI-U for 2021-2022 is currently 276.913. I rounded the above numbers to 5 decimal places because the CPI-U data contains 6 digits.

I agree the US Code (I pulled up another version at uscode.house.gov) specifies the year-to-base method (but curiously doesn’t say anything about adjusting the $750K bracket in 2028 whereas the CFR does), but the way the US Code may have been implemented by Social Security is the CFR year-to-year method. At this point either one seems close enough for planning purposes. Later this year we’ll know which method is actually implemented in computer code.

Paul says

Tom, you have to look back further in the US Code I cited. It doesn’t directly specify the AGI thresholds for joint returns, but instead says this in clause (i)(3)(C)(ii):

Joint returns — In the case of a joint return, clause (i) shall be applied by substituting dollar amounts which are twice the dollar amounts otherwise applicable under clause (i) for the calendar year except, with respect to the dollar amounts applied in the last row of the table under subclause (III) of such clause (and the second dollar amount specified in the second to last row of such table), clause (i) shall be applied by substituting dollar amounts which are 150 percent of such dollar amounts for the calendar year.

For context, the inflation adjustment is described in paragraph (i)(5).

Paul says

Bill, if you want to see some really convoluted language, try to follow the calculation of the “Monthly Adjustment Amount”, which is paragraph (i)(3) in 42 USC 1395r. It’s used to calculate the Part B premium for each tier.

However, I’d recommend that you don’t, unless you want a headache. I have instead derived a set of multipliers applied to the “tier 0” Part B premium, but who knows if they will work next year.

Burt says

Harry (& posters), this is super helpful!

I’ve created my own spreadsheets for these and am now much more comfortable with what the bracket thresholds are likely to be in 2023.

I am thinking about the chance for some who may be able to impact 2021 MAGI on 4/15/22 (IRA contributions) and wondering whether you’ll update the bracket projections when the March ’22 figures are released by BLS on 4/12/22. Or perhaps 3/10/22 when February figures come out as 4/12 is so closer to 4/15.

Ann Myers says

I have an aunt whose finances I manage. In 2019 she had a much larger than usual income due to the sale of her home. The IRMAA was deducted from her SS check each month in 2021. We have now received the determination letter for her 2022 SS amount and deductions. It is showing that she will be charged the IRMAA again this year and that it is based on the 2019 tax return. Why has this not been updated using her 2020 return? She does not come under any of the “Life-changing” events listed as basis for an appeal so what’s the best way to get this fixed?

Tom P says

Ann, if your aunt’s 2020 tax return hasn’t been processed by the IRS yet that could explain why SS used her 2019 income. Although you can’t file an SSA-44 form you can file an online appeal, but I would just call your local SS office first and see if they can help…. which might resolve this faster.

RobI says

I also had similar situation with incorrect use of 2019 return. I filed a case submitting my 2020 tax return using the link on the notice letter. Haven’t heard back yet but its only been few weeks.

Kind of annoying they can’t get the latest tax return data from IRS automatically.

Ann Myers says

Did you use the appeal form SSA-44?

Thanks for your prompt response. I will give it a try and hope we both have good outcomes!!

RobI says

I used this link to file the appeal. Just got the adjustment letter after about 4 weeks

https://secure.ssa.gov/iApplNMD/start

calwatch says

It’s going to be interesting for a lot of people whose 2020 returns have not yet processed due to the ridiculous IRS backlog. I am not in an IRMAA situation, submitted my tax return prior to the end of my extension on October 15, and have not even received an acknowledgment from the IRS that it has begun processing, although the USPS shows delivery. Other people in the Bogleheads forum report the same thing. Does Medicare charge the IRMAA in arrears if the income is exceeded? What if they base it on 2019 income but 2020 income was actually less and put them in a different IRMAA bracket – do they get a refund?

Harry Sit says

It’ll be adjusted automatically when Social Security eventually gets your tax return information from the IRS. If you don’t want to wait, send them your tax return now.

Jim M says

It can take several years for Social Security to make such adjustments. My wife and I efile our joint tax return which means we have the same Modified Adjusted Gross Income. For the past 2 years my wife has been charged the correct IRMAA and I have not been charged any IRMAA at all. Go figure. This same thing happened 4 or 5 years ago. Eventually Social Security caught up and deducted the unpaid IRMMA that I owed in a lump sum from my social security check. I now keep a spreadsheet to track of my social security receipts, paid Medicare premiums and the unpaid IRMAA that I know I owe. If I were being overcharged IRMAA I would call Social Security and request a correction to the amount of IRMMA being charged. As I recall, the last time I looked at my social security awards letter, there was a time limit to appeal the amounts being charged. My wife and I receive our awards letters with different formats at different times, which may explain why the IRRMA calculations are not the same. She has received her SS awards letter for 2022 and I have not.

Tom P says

Jim M, if you don’t already have an online login to your SS account I highly recommend you get one, and then set your notification preferences as you wish. I have mine set so SS does NOT send a paper copy and I get notified of a new SS message via email and text. My 2022 SS benefit letter was posted on 11/20/2021.

Randy says

Testing my understanding of the IRMAA rules. Assume the following:

Older spouse turns 65 in July 2023, and the younger spouse turns 65 in October 2023.

2021 MAGI (married filing jointly) is in the first surcharge tier (approx. $190K – $238K)

The above assumptions will result in:

Older spouse pays the Tier1 surcharge for 6 months in 2023.

Younger spouse pays the Tier1 surcharge for 3 months in 2023.

Tom P says

Randy, you might want to download the Medicare and You 2022 handbook as it has valuable information on signing up, etc. Of course, things could change by 2023, but probably not the signup info and when Parts A, B and D are effective.

Both spouses could potentially save 3 months of IRMAA by delaying signing up for Part B. You can sign up 3 months before you turn 65, the month you turn 65 or anytime 3 months after you turn 65. However, unless you have other coverage such as COBRA or private insurance you may be without medical insurance for up to 3 months if you delay.

For Part D (assuming you choose traditional Medicare), you need to signup within 63 days after your initial enrollment period is over. When I retired (well past age 65) we had company paid COBRA coverage for 3 months, which ended the end of October 2020. Since we were on 90 day prescriptions we had enough to extend past the end of the year so we did not sign up for Part D to be effective until January 1, 2021, and this saved both of us 2 months of Part D IRMAA, for a total of $280. Bottom line: if you can play the system to your advantage… do it 🙂

Jim M says

That sounds right, assuming you sign up for Medicare at age 65.

Jim M says

The last time I checked, having Cobra doesn’t extend the initial Medicare sign up window. Permanent premium surcharges may apply if Medicare sign up is delayed. Guaranteed coverage in a Medicare supplement plan is not assured when the initial signup window is missed. Be sure to check the rules.

Robert Hoffman says

I haven’t been able to get a response from the feds, which is frustrating, but I thought you should know that the 2022 IRMAA is based on 2019 income, not 2020 income. At least that’s what my statement said. So both my 2022 IRMAA and my 2021 IRMAA were based on my 2019 income. I’m not complaining, because my 2020 income is higher than my 2019 income, but Medicare needs to be honest with the American public and explain why this is the case and how it affects IRMAA going forward. For example, will the 2023 IRMAA be based on 2020 income (3 year gap going forward forever) or will the 2023 IRMAA be based on 2021 income and income for 2020 will basically be “skipped.”

Ken says

Robert, My new IRMAA statement for 2022 used our 2020 income, but I e-filed our 2020 taxes before the April deadline in 2021. I am guessing you may have filed with an extension, and that they will fix yours once the 2020 tax return works it way thru and they figure out they have newer info and that your bill will be bigger. If you filed on time, that is a bigger issue.

Robert Hoffman says

Filed on time. It’s inexcusable that we are kept in the dark regarding what they are doing.

Rob I says

I filed for an adjustment on the Medicare web site right after receiving the notice letter sending them a copy of my 2020 tax return which was lower than 2019. It took about 4 weeks to get my lower IRMAA corrected. I had paid one month of medicare premiums at the higher rate but expect the amount due will be adjusted in the Jan billing cycle.

Jim M says

Robert,

Your Social Security Awards you is simply informing you of the tax year they actually used to calculate your Medicare premiums for 2022. However, that doesn’t meant that the amount due won’t eventually change. Social Security has a process to periodically check for the latest tax returns and use them to charge the correct Medicare premiums due. In my experience, it can take them several years for them to make the corrections, but they eventually get to it.

If you file your tax return for 2021 on time, chances are it will be used for calculating your 2023 Medicare premiums. However, there is no guarantee of that. My wife and I file a Joint Tax return. For the past 2 years and for 2022 she is being charged the correct IRMAA amount while I am charged none. Who knows why that might be. But I expect Social Security eventually the correct IRMAA amount I owe and deduct it from a future Social Security Deposit. That how they corrected the same issue when it happened 4 or 5 years ago.

The Wizard says

I file my IRS tax return in February most years lately.

Some folks do an extension and don’t file till October.

Those late filing folks are going to be more likely to have issues with their IRMAA numbers not being correct…

Paul says

FYI to all: The new CPI-U for December 2021 was just published by the BLS: 278.802. That is an annualized inflation rate of 7.04% for the past 12 months.

With no inflation through August, 2022, the second IRMAA bracket (single) will be $95,000. With a remaining average inflation rate less than 2.8% until then, the second IRMAA will still be $95,000.

With a remaining average inflation rate in the range between 2.8% and 6.8%, the second IRMAA bracket will be $96,000. At 6.9%, it will increase to $97,000. I didn’t calculate it with higher average inflation rates.

Double all these amounts for the married IRMAA brackets. One important caution: the inflation thresholds will be DIFFERENT for the higher IRMAA brackets, due to how the brackets are calculated.

Paul says

I forgot to add: these IRMAA brackets will be for 2023, based on AGI from tax year 2021.

GeezerGeek says

Paul,

I got the same results in my spreadsheet. You do math just like me so we must have had the same math teacher… Mr. Hershel Hipps, right? 🙂

Actually, it was largely from your earlier post (164) that I learned how to calculate the brackets so it is not too surprising that our calculations are identical.

Thanks!

Paul says

Geezer,

I didn’t “invent” it. I dug up the actual US code that specifies how to do it. I wish I had saved the URL.

Bev Lolr says

Paul ~ Can you calculate what the third tier bracket might be for 2023IRMAA with AGI from 2021 by chance?

Paul says

Bev, I can only try to predict it at this point.

Presuming that you mean the tier that currently starts at $114,000 for single taxpayers, I get the following Modified AGI thresholds with these average inflation rates through August, 2021:

0% – $119,000

1% – $120,000

4% – $121,000

7% – $122,000

I hope that 7% is the upper limit!

Tom P says

Paul, Bill, or anyone else. If you’d like a copy of the Excel Spreadsheet I use to calculate and predict IRMAA adjustment brackets, including the Part D adjustment, you can download from this MS OneDrive link (please let me know if you find any errors):

https://1drv.ms/x/s!AtHS0jWEezJSyB1kfmMGZzzUtuSN?e=H5UQfW

AnnaC says

Wow Tom: thanks for sharing! Now to get down & dirty & nerdy…..so much better than reinventing the wheel.

Thanks again for generously sharing! Cheers, AnnaC

Ian M says

Hi Tom,

I have only just come across this file in your OneDrive, this is really cool. Thanks for sharing. Can I ask if you are keeping the data current, as when I open the file, the last CPI-U data is 297.711 for November 2022? Is that correct and what you expect us to see? If not, is there some setting you could change which would allow us to always view the latest updated version?

Thanks again, Ian

Tom P says

Hi Ian. I haven’t been keeping the spreadsheet up to date since there haven’t been any comments that anyone was using it 🙂 However, I just now updated to the latest info through April. Tomorrow I’ll update again when the May data is published.

The intent was for users to download this file (click File, Save As and Download a Copy to save to your computer). Then you can use the links to update with the latest information when it’s published.

You can use this file to make “what if” calculations. For instance, for the 2023–2024-year column, I pasted in calculations for a 2% year over year inflation for each month to try and gauge how low the IRMAA brackets might be for 2025.

Enjoy.

Bill C says

I just did a calculation of how the first three IRMAA bracket tiers are effected by CPI inflation rates for the remainder of the SS year (Jan to Aug 2022) with the following results for single income filers. The “from” amounts assume 0% inflation for the January to August period. Outside of monthly deflation, these amounts are “in the bag”, These are the inflation rates that will cause a round up the the next higher amount in the bracket. This is a snapshot made in mid January, future monthly actual CPI data will modify the amounts.

Tier 1 will increase from $95,000 to $96,000 with a CPI increase 2.76 % annualized (.23%) per mo.

Tier 1 will increase from $95,000 to $97,000 with a CPI increase 6.84 % annualized (.57%) per mo.

Tier 2 will increase from $119,000 to $120,000 with a CPI increase 0.34 % annualized (0.028%) per mo. This increase will happen with the Feb data.

Tier 2 will increase from $119,000 to $121,000 with a CPI increase 3.66 % annualized (.305%) per mo.

Tier 3 will increase from $149,000 to $150,000 with a CPI increase 1.42 % annualized (0.118%) per mo.

Tier 3 will increase from $149,000 to $151,000 with a CPI increase 4.08 % annualized (.34%) per mo.

Perhaps I should have determined the inflation rate for the next higher increase for each bracket but thought I would wait to see how rates respond to the first FED interest rate move.

Bill C

Vince says

Thank you for the very detailed work. What is scary for me is that if you unfortunately lose

a spouse you are really penalized for having the same investment income. You can go up multiple tiers quickly. You lose some social security but the RMD remain the same as do your dividends.

Doug Miller says

Vince, that is absolutely true. If there are any substantial IRA savings at all, after one spouse dies not only will the survivor jump at least 1 tier (but probably more), but federal income taxes will also sky rocket. I witnessed that happen in my mom’s life and now see it coming in my own. I am planning to separate my IRA accounts out leaving some to pass directly to our kids, while making sure my wife has plenty to live the lifestyle she is accustomed to. The Roths will, of course, stay with my wife before eventually passing to the kids. The message to younger people saving for retirement: focus on funding Roths. The Roth 401Ks are a wonderful thing that weren’t available to me through most of my earning years. I fully funded Roths for my wife and I for most of the 17 years they were available to me, and am glad I did. But the funding limits were pretty small. In any event: Roths are the best thing going for now!

Vince says

Doug,

Yes Roths are great but I was never eligible to fund one while working. Between the time I retired and until I start taking social security I’ve been doing Roth conversions but not enough to make a big difference. Working hard and saving instead of goofing off and spending will make Uncle Sam happy.

Russ S says

Hello,

Have a question about the Tax Year to use on an IRMAA appeal SSA-44 form in Step-2. For premium year 2022, I received my initial determination stating my IRMAA amounts based on my 2020 income. I retired in mid-2020 and my income has since been reduced below the threshold amounts for any IRMAA for 2021 income and will continue to be lower in 2022. I submitted the SSA-44 form asking them to use 2021 MAGI instead. It’s been over 3 months with no change. I filed the form also last year for 2021 premium year which was based on 2019 income but used 2021 estimated income in Step 2 and they eliminated the IRMAA with no issue. Should I be using 2022 estimated income for the appeal again this year rather than actual 2021 income? I wondering perhaps if this is why they won’t seem to process the SSA-44 for this premium year (2022).

Any insight is appreciated.

Tom P says

Hi Russ,

Your situation mirrors mine exactly. I retired mid-2020, but my income didn’t actually go down until 2021 since I got severance and layoff benefits. Thus, my 2021 IRMAA was initially based on 2019 income and I didn’t find out about the SSA-44 until October 2021, at which time I filed the forms with my local office using projected 2021 income. It only took 2 weeks and we received a major adjustment refund for IRMAA paid to date in 2021.

However, like you, when SSA informed me of my 2022 benefit they again included IRMAA based on 2020 income, even though I had indicated on the SSA-44 that my 2022 income would be less than 2021. I called my local office, but had to leave a message. I followed up with a letter outlining all this and faxed it to my local office. A few days later I got a call and the SSA person told me they would eliminate my 2022 IRMAA. For us it was too late to change the IRMAA for January 2022 but we quickly received a credit refund for that month and IRMAA moving forward was eliminated.

You don’t need to refile SSA-44 as I think that may just cause confusion. Just call your local office and see if can speak to the “IRMAA person” to clarify your situation. Good luck.

Russ S says

Thank you Tom, really appreciate the insight. I will try and call them yet again. I get the run around every time I speak with them. 🙁

Tom P says

I actually didn’t know if SSA would adjust my 2021 IRMAA based on projected 2021 income (which, BTW was $494 below the 2022 threshold… so I was cuttin’ it close), I thought they might just adjust 2022 moving forward. Getting a hefty 2021 refund was a nice surprise.

Stephen Sammarco says

QUESTION Why is my medicare part premiums $3,920.40 and my wife’s deduction is $1,782.00 on the 2021 1099-SSA? Should both deductions be equal?

GeezerGeek says

Hi Stephen, From your description, I’m not sure what numbers on the 1099-SSA you are referring to. $1,782.00 would have been the amount Medicare Part B premiums deducted from your benefits for 2021. In addition to the Part B premiums, there may be other deductions from SS including cost of a Medicare supplemental plan (Part D or any other supplemental plan) and Federal income tax withholding. The deductions are different on my wife’s 1099-SSA than mine because she has a Part D deduction and has less Federal income tax withheld than I do.

Keith says

I dont know much about this stuff, but the ratio of those two deductions is 220%.

So as a guess off the top of my head, I’d guess you and your wife file separately and you are paying IRMAA and she isnt.

Just a WILD guess.

GeezerGeek says

It could be that Stephen is paying for IRMAA and his wife isn’t but that doesn’t completely account for the number he quoted, $3,920.40. If he was paying the Part B penalty in an IRMAA bracket, his cost would have been $2,494.80 in the first bracket, $3,564.00 in the second bracket, and $4,633.20 in the third bracket. Since none of those numbers exactly match the number he quoted, there must some other factor that is at least causing part of the difference other than the IRMAA penalty.

Jim M says

$1782 is the basic Medicare premium for 2021 ($184.50 X 12 months) without any surcharge. So that appears to be what your wife was charged.

I would call Social Security to obtain an explanation for the amounts you were charged.

$3,920.40 does match the Medicare premium surcharge of $326.70 per month. ($326.70 x 12 = $3,920.40). However, that surcharge does not include the $1782 basic Medicare premium amount. It seems old that you would be charged a surcharge without the base amount.

For the past few years my wife an I have not been charged the same Medicare surcharge amount even though we file a joint tax return. She is charged the correct premium surcharge while I am not. I expect Social Security will eventually come along and deduct the correct surcharge amount that I owe. They did that a few years ago.

DrewMcG says

“$1782 is the basic Medicare premium for 2021 ($184.50 X 12 months) without any surcharge.”

— your annual amount is correct, but you transposed two digits in the monthly amount. It was $148.50/mo. (not $184.50)).

Jim M says

DrewMcG

Thanks for catching my error.

Jim M says

One more thing. Check your Social Security benefits letter. Medicare deductions are detailed there.

Harry Sit says

Updated the two tables after the February CPI release. Most brackets for 2023 based on 2021 income increased by $1,000 (single) or $2,000 (married filing jointly).

Scott says

If you can Roth convert incrementally from a regular IRA within an IRMAA bracket, you can later use this Roth money to keep yourself below future bracket thresholds. You could save substantially penalties. You will pay the IRA taxes anyway when you withdraw, so this method won’t hurt much.

GeezerGeek says

My problem is that my traditional IRAs are growing at a faster rate than I can incrementally convert them. I’ve been doing conversions every year since 2011. Normally, I had been doing my conversions at the end of the year, when I had a good idea of how large of a conversion that I could do and remain under the IRMAA limits or next tax bracket, but during the COVID sell-off around March 2020, I did a conversion at that time because the lower value of the portfolio allowed me to convert a large percentage of my holdings. Most investors dread market downturns but I’ve been hoping for one for many years just so I could convert a larger percentage of my traditional IRAs to Roths and still stay under the IRMAA limits.

Joe W says

Even if you support a higher premium for Medicare based on your income, the IRMAA adjustment is poorly structured. Having a premium increase of thousands of dollars per year kick in when you jump brackets by $1 is a crime. Although this is labelled as a premium increase, it is effectively a huge marginal income tax rate increase.

For a married-filing-jointly couple both on Medicare, it creates sub-brackets within the income tax brackets that range from 4%+ (if your income approaches the full IRMAA bracket) up to 2,900% (for a $2,900+ premium increase on $1 of additional income). If you’re income is in the 3rd or 4th IRMAA tier, instead of having income tax brackets of 22% and 24%, you pay 28% and 30%.

A graduated premium based on a percentage of income would be more logical. But even this is questionable considering that higher income people already paid more than their fair share in Medicare payroll taxes (with no cap on the income base) while working.

Songbill says

Well said. Couldn’t agree more. Unfortunately, nobody cares about the unfairness and craziness of the structure….. not Congress nor the public at large. Vast majority of people in Congress are not on Medicare. Most taxpayers are not on Medicare and even if they are they’d consider IRMAA brackets being “very rich” or “wealthy” retirees to whom they can’t relate. The IRMAA rules are irrelevant to them. Bottom line: It is highly unlikely Congress will modify the rules to be more fair and sensical. As the years go by though, more and more retirees will be snared by IRMAA. So there is room for hope that eventually the rules will be modified.

Ed Fogle says

Well said. Especially the point that people subject to IRMAA probably were high income earners while working and paid far more than average in Medicare payroll tax. It’s a double whammy.

And the $1 cliff is ridiculous. Only a stinking bureaucrat could have come up with something like that. Bureaucrats don’t think like normal people.

Like your said “a crime”.

Paul says

Ed, you can’t blame bureaucrats for this one. It’s in the US Code, as enacted by Congress:

https://www.law.cornell.edu/uscode/text/42/1395r

There’s a roundabout path into a regulation, but it originates in the US Code.

Ed Fogle says

Paul, I’s sure bureaucrats came up with the stupid $1 cliff concept and write the bill. I doubt seriously the representatives and senators who sponsored it wrote the bill. Heck, I fought they even read it.

Ed Fogle says

Let me try this again:

Paul, I’m sure bureaucrats came up with the stupid $1 cliff concept and wrote the bill. I doubt seriously the representatives and senators who sponsored it wrote the bill. Heck, I doubt they even read it.

(I do my best proofreading after I hit send.)

Paul says

Ed, Congressional bills are usually written by staff that work either for individual congressmen or committees.

Whether they are considered bureaucrats will depend on your view. However, unlike most government employees, they answer directly to the congressmen they work for, or the head of the committee. They also don’t have the typical civil service protections, as they can be (and have been) easily fired for personal misconduct.

In this case, IRMAA was enacted by the Medicare Modernization Act in 2003, effective 2006.

Ed Fogle says

Paul,

I knew that.

Brandon says

If you find a solution there will be a lot of happy people. It works the same for those who missed out the COVID checks, food stamps, unemployment, tuition help, medical insurance subsidies, rent subsidies, child care help etc. At least your problem is not something that will cost you to lose your home and job because you can’t pay the $15,000 for childcare and transportation to get to your job. Please post with your solution.

powderriver says

I’m curious. Just how does one “miss out” on covid checks, food stamps, unemployment, etc.?? Did you qualify, but didn’t apply? These are the very things that help people not to lose their homes, and to transition to new jobs.

drew says

Powerdriver: If you convert too many 401K funds to Roth in order to avoid future IRMAA penalties, your AGI could exceed the threshold for the 2021 $1,400 Covid tax credit, even though you actually earn less than, e.g., the $75K threshold for single filers. Hope this answers your question.

powderriver says

Drew — Yes, that attempted to address one special case. The person who is converting a 401k to a Roth had to make a CHOICE in 2021: did they want to do a Roth conversion, or did they want the 2021 covid check, or could they do a smaller conversion and still get the covid check? Choices.

It seems to me that those people in a position to be wary of future IRMAA charges (because they have so much excess in their IRAs/401Ks) are pretty well-to-do….if not now, then certainly when they will be retired. Is not qualifying for a covid check all that much of a misfortune for these people?

Should there have been no means testing for the covid tax credit? I’m sure Bill Gates could have used the extra $1400.

Ed Fogle says

Paul,

Jew all that.

Ed

Brandon says

powderriver

None of it affected me. But I have neighbors that were affected. I am a widow, retired, planned and lucky not to have to needed any benefits.

The Wizard says

I don’t see “more and more” retirees being snared by IRMAA in coming years. The IRMAA tiers are adjusted for inflation now, you see…

Marty Yeager says

Well, unfortunately most elderly become a widow or widower, and RMDs are taxed under the single rate, and the single IRMAA category applies. A double whammy of taxation just at the age when caregiving needs accelerate and there is no longer a spouse to help out.

CapeRetiree says

Powderriver,

The Covid stimulus checks were income related. Many of us that worry about IRMAA issues had income that was in a phase out region, or simply exceeded the limits, so they got a partial check amount, or no check, respectively. There were not something we forgot to apply for. This article explained the Spring 2021 payment rules. https://www.cnbc.com/2021/03/12/1400-stimulus-checks-are-on-the-way-heres-who-qualifies.html

powderriver says

Ok then. People didn’t really “miss out”, they just didn’t QUIALIFY for the benefit, by the RULES established by our representative gov’t. I wonder if the “miss out” mischaracterization was motivated by: (1) a belief that the well-to-do should have also gotten covid checks, food stamps, etc.; or (2) a belief that the not-so-well-to-do should not have gotten any covid checks, or any food stamps, and that those whose jobs went away should not have gotten any unemployment?

If its (1), is there a rational explanation why the already well-to-do need extra support to help pay for the basics of life? If its (2), as an example, check out the history (financial and otherwise) of the 1846-47 Irish potato famine, and specifically what gov’t support meant for the lives of the poor, VERSUS what it meant for the deaths of the poor before it was established and then after it was cruelly taken away.

Either way, for people to to label a mere cumbersome, inefficient bureaucratic rule (like the IRMAA limits) as a “crime”, I guess goes with the times, where the drama of being recognized as a victim outweighs any attempt to argue rationally for a fix to the problem.

Drew says

My ancestors immigrated from Ireland 9 years before the potato famine, but I take your point. Federal tax policy for many years has encouraged employees, employers, and the self-employed to save money for retirement by delaying taxes on IRA and 401K contributions. Good policy. But I doubt very many appreciate before they reach near-retirement (or after) the complex impacts of those choices on their retirement planning. I have no issue with a progressive tax structure, and favor it generally speaking. From each according to his/her ability. But in the case of Medicare premiums, there’s a sense among many that its been paid for through employment taxes over the years. Accordingly, when you’re asked to pay significantly more for the same coverage it provides because you withdraw (too much) money that the government encouraged you to save (and that you’re paying the taxes on separately upon withdrawal), I can see how people think its unfair even if its not a crime (I think he really meant “silly” or “stupid”).

I also think its natural for near-retirees and retirees to be nervous about their retirement funds, and want to preserve them, and to reduce expenses: no employment income, rising inflation, inadequate social security payment, rising Medicare deductibles and Part B premiums, rising Rx costs, rising real estate taxes if the own a home, rising rents if they don’t, etc., etc. For this reason, I’d prefer to raise or eliminate the cap on income that is taxed for Medicare, instead of this IRMAA nonsense. More progressive and less anxiety-provoking.

I don’t think someone in their mid 60’s with $70K income and couple of hundred thousand in a 401K or IRA is necessarily “rich”, except of course vis-a-vis those starving and unsheltered due to famine, etc. But you’re right: they could forgo the Roth conversion in 2021, take the $1,400 Covid relief, and pay the penalty down the line in potential IRMAA surcharges depending on their situation.

powderriver says

Drew — I am also in the group of people described in your 2nd paragraph. The concerns you note there are natural for this group of people. And I agree with just about everything you said throughout your comment.

Your comment on the medicare payroll taxes was already corrected by someone else.

Like you, I also “don’t think someone in their mid 60’s with $70K income and couple of hundred thousand in a 401K or IRA is necessarily ‘rich'”; but let’s face it, people in that financial condition will also not likely have to deal with high IRMAA costs because of large RMDs from their retirement accounts.

But my overall point is that there is a difference between being diligent about retirement issues and recognizing bureaucratic imperfections VERSUS claiming to be a victim of government.

The Wizard says

Folks are making way too much of IRMAA. We higher income retirees paying IRMAA can easily afford it.

I’m single and have paid extra since starting Medicare seven years ago and not in the first IRMAA tier either.

I expect to be paying IRMAA forever under current law and still have thousands of excess retirement income leftover that goes into my taxable account most months…

Paul says

Drew, there is no cap on earned income subject to the Medicare tax. That cap was removed in 1994.

Additionally, if your earned income exceeds $200K (single) or $250K (joint), an additional 0.9% Medicare tax is imposed on earned income above those thresholds.

Finally, if your AGI exceeds the above thresholds, a THIRD tax of 3.8% is imposed on net investment income above the thresholds. This tax is known as the “Unearned Income Medicare Contribution”, but the revenue goes into the general fund, instead of directly to Medicare.

The last two taxes were enacted by the Health Care and Education Reconciliation Act of 2010, and took effect in 2013.

Vince says

Paul,

You are correct! The IRMAA surcharges are additional penalties on hard working Americans. Of course many people are always in favor of taxing the same successful individuals.

Drew says

Paul, thanks for the correction–my bad. (I was thinking about the social security tax.) The 1994 change makes IRMAA even less sensible! Also, I should not have suggested that this change would make the Medicare tax progressive. It doesn’t; it just removes it’s previous regressive nature.

powderriver says

Vince — Perhaps you could explain for us how a tax system would work if it didn’t tax “successful individuals”.

Ed Fogle says

Vince, “tax successful individuals”? Perhaps you should say tax or overtax. Influenced by your point of view, mainly perceived victimhood status.

Vince says

In 1945 they used to tax any income above $200,000 at 94%. In Illinois we have a flat tax of 5% for everyone.

Personally I think a flat tax is more fair but when 61% paid no federal income taxes in 2020 you have to soak the middle class and higher.

There are help wanted signs all over the place because people are being supported by the government and don’t have to work. I think every able bodied man should work and pay some taxes to society but many disagree with me.

powderriver says

Overall, that is quite a different tune than the complaint that “successful individuals” are taxed.

But I agree: “I think every able bodied man should work and pay some taxes to society” — in a perfect world. However, in general, the world is not perfect: most of the time there are not enough jobs for everyone; there are even fewer jobs that pay a living wage; who is to judge what ‘able bodied’ is; how to judge ‘able minded’; there is a cost to properly oversee that the rules are followed; how to balance the needs of those who are properly on gov’t assistance with the need to incentivize work, etc. etc. Platitudes are fine, but the devil is always in the details.

I wonder what you would find worse: the poor paying no taxes, or the rich paying no taxes? Because there a quite a few of both who don’t.

A flat tax is no more perfect than the tax system/rules we have now. A flat tax of say 10% is much more burdensome to the family finances of the working poor than for the rich. And besides, if your claim is correct that the poor are not working because of gov’t handouts, then a flat tax would get no revenue from them anyway.

Brandon says

Vince,

The highest rate of federal income tax was 91% and it was also 91% in 1945 during the war.

Actually what ever benefit is paid out there is always a cut off and 1¢ over it can affect the benefit payout. It isn’t just IRMAA.

But with IRMAA, people are usually in a position to manipulate their income to stay out of a higher bracket. Just like with income tax. Just add up your income regularly whether working or retired and manage RMD’s, Roths, and Roth conversions, interest, cashing in stocks or bonds etc. Read the laws and rules. When it was legal we managed our house payments and paid a year in advance at a savings and loan being able to deduct 2 years of interest, paid our high winter tax in Jan and Dec in one year in the same year, bought our car tags early in Dec so we could deduct 2 years etc. and took the automatic deduction the following year. When you could change the names on inherited savings bonds we did that and our oldest child did not owe taxes but it paid for his first year of college.

Vince says

Ed,

I don’t consider myself a victim because I worked hard.

Ed Fogle says

A victim of a confiscatory government, perhaps?

powderriver says

But as you see, Ed does feel like a victim.

One wonders just what it would take for Ed to feel that the gov’t was not “confiscatory”. One is left to merely wonder, because the communication is centered on being recognized as a victim VERSUS exploring workable, constructive ideas/opinions/alternatives.

Perhaps the gov’t should not tax Ed at all, and then he could just continue to magically benefit from the economic infrastructure in this country that exists, in part, due to those taxes.

Ed Fogle says

Rationality. That’s all.

Steve says

Thanks Wizard, that’s a refreshing view. I too have been fortunate enough to have to contend with IRMAA. I worked hard, but I was also lucky to have a long well paying career, medical insurance, a pension and a 401K. I do what I can to minimize taxes, but try not to complain because I have to pay more than others or don’t receive the assistance that others get.

Braden says