[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

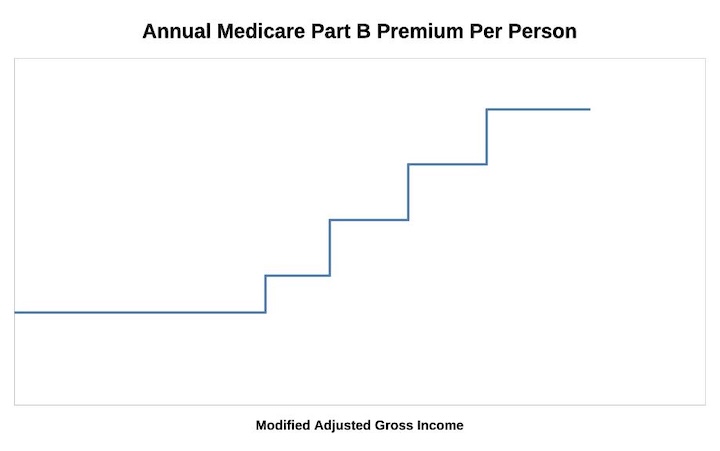

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

JeffdelRey says

I was introduced to IRMAA the hard way: while executing my Roth conversion plan to save on future taxes, I kept a close eye on my current tax bracket and was ignorant to IRMAA tiers. Imagine my surprise when I found myself and my wife in the 2.4 tier and paying thousands per year more to Medicare. I re- ran my projections and found my Roth conversions (a government plan) will save me over $500k (if I make it to 89, and my other projections are right). But those d**n IRMAA surcharges (also a government plan), will reduce my tax savings by a whopping $25k. I call that a good deal, but apparently some here think I’m getting scr***ed.

Terry says

You must have a whopping big IRA to be able to save $500k. Keep in mind that the increased Medicare premium due to the conversion will only affect your Medicare premiums for one year – 2 years after the conversion. I made a bonehead move myself when doing a Roth conversion. I thought that my converson was an amount that would keep me just under the income point to go to the next tier. Unforturnately, I forgot about my muni bond interest which is included in MAGI. That was just enough to put over the ncome point and into the next tier. ugh.

JeffdelRey says

Double income, no kids. Fortune 100 employers, max contributions to 401k’s for 30 years. Living slightly below our means. Merely average investing acumen.

Vic says

So far I have been able to stay below the 1st IRMAA threshold while still doing some Roth conversions. However, this year is the first year I started collecting social security and while the market is down I’m tempted to convert more money but I’m concerned about how my SS earnings would impact IRMAA, especially considering my wife will also be on medicare by then. I would have to assume the worst case, that 85% of my SS income would count toward my MAGI for 2022. Is that a good rule of thumb? I may either have to forgo doing any conversions or reduce my monthly income withdrawals by the conversion amount to stay below the threshold.

The Wizard says

Yes on the 85% of SS.

I did similarly the past several years, but in the middle of the IRMAA brackets, making sure to keep my MAGI below the next higher IRMAA threshold.

So my Roth conversion amount was initially a bit more than my projected age 70 SS plus my age 72 RMD. Now that I’m 72, I’ve stopped doing Roth conversions so I can stay in the same IRMAA tier, with any luck.

I may end up doing a smallish Roth conversion of a few thousand dollars in December, depending on where my AGI for the year stands…

Ally says

Does IRMAA income include I bond interest?

Harry Sit says

IRMAA income includes I Bond interest when you cash out I Bonds. It isn’t income when you only hold I Bonds unless you go out of your way to report interest each year.

J J says

I am surprised that it is possible to come close to the first IRMAA threshold and not already be paying tax on 85% of your social security benefits. I shall have to run some scenarios in tax software to model it.

Vince says

I’ve always tried to do Roth conversions when the investments are down and it has

worked out well. One benefit of the terrible inflation we are having is the upward

movement of the IRMAA brackets. Thank goodness for Harry’s great work on predicting

the brackets.

Tom P says

Vince, I would appreciate it if you could comment on why doing Roth conversions when the markets are down is a good thing. Is it simply because as the Roth funds (hopefully) recover their value all the future gains are tax free? Thanks.

GeezerGeek says

I agree with Vince that a Roth conversion while the market is down is a good thing. The amount of a conversion is a constant. For example, you might be able to do a Roth conversion of $35,000 and still stay under the IRMAA limit. If you do that conversion during a time that the market is down, you will be able to convert a larger percentage of your IRA to a Roth. When the market comes back, more of the comeback gain will be in the Roth rather than the IRA.

Normally I do my Roth conversions at the end of the year when I have a better idea what the IRMAA limit will be. However, in 2020, I did most of the conversion in March when the markets were down by about 20%. When the market came back, more of the recovery gain was in my Roth than the IRA. Bottom line is that a down market gives you an opportunity to convert a larger percentage of your IRA to a Roth.

I was conservative in the amount I converted in March 2020 because I was unsure of what the IRMAA limit would be. At the end of 2020, I did an additional conversion to get me closer to the limit when I had a better idea what the limit would be.

AnnaC says

Yes Vic using 85% of SS benefits as taxable is correct. Good luck!

R E Janes says

I too have used down turns to do ROTH conversions. I have transferred individual stocks rather than cash thereby eliminating transaction cost. I moved several securities during the pandemic and have seen significant upside in all of them. And yes the benefit is to have the recovery in those names tax free.

Anna C says

Also info at this link will be helpful re taxable SS:

https://www.ssa.gov/benefits/retirement/planner/taxes.html#:~:text=between%20%2425%2C000%20and%20%2434%2C000%2C%20you,your%20benefits%20may%20be%20taxable.

**File a joint return, and you and your spouse have a combined income* that is

–between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

–more than $44,000, up to 85 percent of your benefits may be taxable.

**Are married and file a separate tax return, you probably will pay taxes on your benefits.

Your adjusted gross income

+ Nontaxable interest

+ ½ of your Social Security benefits

= Your “combined income”

Vince says

Tom P,

Hopefully you have access to Geezer’s reply because it’s very good.

If you don’t I will try to explain why I think it’s better to roth convert during a down

market.

If you have a mutual fund with a lowered NAV you need to convert more shares to

get to the same dollar amount as before the crash. When the additional shares are in

the roth hopefully the market will go up and you have more shares participating in

the increased NAV.

IRMAA Needs To Go says

Folks, the arithmetic shows the net effect is identical for doing Roth conversion versus not, assuming marginal tax rates are the same now and in the future. Whether the investment drops or not is irrelevant. What does matter is “side effects” such as bumping you into a higher marginal bracket — here, converting a smaller amount thanks to a market decline in asset value favors doing the conversion when the asset value is reduced. Other side effects include AMT considerations, social security taxation, etc. Each of these “non-linearities” in the taxation scheme have to be considered on their own and then in aggregate. One often missed is access to certain situation/time-qualified tax credits, such as the American Opportunity Tax Credit for those paying college expenses….doing a TD-to-Roth conversion in a tax year when you are incurring college costs can easily disqualify you for the “free” first $2K per college-attendee tax credit, for instance.

While it may make some of us feel better to convert a smaller amount due to a market downturn, the arithmetic does not bear it out unless you consider all the side effects/non-linearities such as those listed above (and many others, I’m sure).

Tom P says

My main reason for considering Roth in-plan conversions is to have a bucket of money that could be used to keep from exceeding an IRMA threshold when the inevitable occurs and either myself or my wife passes and the survivor then drops into the single income bracket. But even then I’m not sure it’s worth paying the taxes now.

Vince says

Roth conversions aren’t for everyone but personally I’d like to have different buckets of retirement money to pull from. Having only been able to convert 25% of my traditional roth, I’m still planning on doing some converting in the future until I start taking SS.

Ally6770 says

Tom P,

When my husband passed suddenly, I disclaimed all of the traditional IRA’s, 401k’s etc. My children were able as contingent beneficiaries to inherit all of them and a large savings that I took my name off from days before he passed.

They were able to take the traditional IRA’s for their lifetime instead of the 10 years as now required. Everyone tried to talk me out of it. Actually it has been 10 years and I still think it was a great idea for me and for them.

I am still trying to convert my traditional IRA’s to a Roth as much as I can without paying a higher Medicare premium as the children are also near retirement. I am planning part of their retirement for them so they will not have to pay taxes on the RMD’s nor will it count in their IRMAA for higher Medicare premiums.

Rick Brown says

When will the May information about inflation be published with resultant Harry projections for IRMAA tables?

Tom P says

Rick, the CPI-U information is published per the following schedule. I wouldn’t expect any significant changes to what Harry already projects:

May-22 on 10-Jun-22

Jun-22 on 13-Jul-22

Jul-22 on 10-Aug-22

Aug-22 on 13-Sep-22

Sep-22 on 13-Oct-22

Oct-22 on 10-Nov-22

Nov-22 on 13-Dec-22

Harry Sit says

The 0% inflation table and the 7% inflation table already look pretty much the same. There won’t be much change from now till August when the inflation numbers fall into this range. The window to influence the 2021 MAGI already closed. You can’t do anything anyway with a $1,000 change in the brackets here or there.

GeezerGeek says

You can find the release dates at this URL: https://www.bls.gov/schedule/news_release/cpi.htm

Here are the dates from that site:

Reference Month Release Date Release Time

October 2021 Nov. 10, 2021 08:30 AM

November 2021 Dec. 10, 2021 08:30 AM

December 2021 Jan. 12, 2022 08:30 AM

January 2022 Feb. 10, 2022 08:30 AM

February 2022 Mar. 10, 2022 08:30 AM

March 2022 Apr. 12, 2022 08:30 AM

April 2022 May 11, 2022 08:30 AM

May 2022 Jun. 10, 2022 08:30 AM

June 2022 Jul. 13, 2022 08:30 AM

July 2022 Aug. 10, 2022 08:30 AM

August 2022 Sep. 13, 2022 08:30 AM

September 2022 Oct. 13, 2022 08:30 AM

October 2022 Nov. 10, 2022 08:30 AM

November 2022 Dec. 13, 2022 08:30 AM

Lincoln says

Over what months of inflation data are the IRMAA brackets based? Is it from September of the prior year to August of the current year, in order for Medicare to calculate the brackets for the next year?

Tom P says

Yes, that is correct. To make your own calculations you take the average CPI-U of those 12 months and compare to the average of the 2017-2018 months (249.280) and then adjust the base year brackets from 2019.

Example: if the CPI-U was to stay fixed at the April rate of 289.109 value (fat chance!), the average for 2021-2022 would be 283.797. Divide that by 249.280 and you get a multiplier of 1.13847. Use that number to adjust the 2019 SINGLE brackets to get the 2023 brackets, which are then rounded to the nearest $1000. The married is then 2x the single bracket. So, for the lowest tier, multiply $85,000 x 1.13847 = $96,769.95, which then rounds to $97,000 for the lowest single bracket; married is $194,000 projected.

Clark says

Thank you again for your calculations and I enjoy your books.

Is it safe to assume that the actual Medicare premiums in say 2024 will scale with inflation relative to what they are in 2022?

Harry Sit says

The actual Medicare premium is determined by the expected costs of the Medicare program itself. Whatever it is, the standard premium is set to 25%. There was a big increase in 2022 ($21/month) because Medicare expected a large cost increase due to the new Alzheimer’s drug. The 2023 premium may come down because Medicare won’t pay as much as they originally thought. Who knows what comes up in 2024. In any case, the increase in Medicare premium ($10-20/month) is much less than the effect of IRMAA.

Johnny Roland says

So, it appears that there are only 3 levels of IRMAA for MFS?

1. Less than $91k

2. Between $91k to 409k

3. Over $409k

Can you confirm? Any source in POMS for this reasoning?

Thanks!

Harry Sit says

That’s correct. Congress wrote the law that way.

Terry says

I am confused by your post. I assume that MFS is Medicare Fee Schedules which are the fee schedules used to pay providers for procedures performed. Are there different fee schedules used to pay providers based on the patient’s income — i.e. a patient with a higher income will pay more for a specific procedure than a patient with a lower income? I always thought that the fees paid for procedures were the same for all Medicare beneficiares. Can you elaborate.

The Wizard says

Married

Filing

Separately…

Jane Jacobs says

MFS is married filing separately

Terry says

Thanks. Too many acronyms. 😊

bev lolr says

Wondering what the MFJ tiers are estimated to be?

Braden says

The married filing jointly is double what the single filing is.

bev lolr says

Aren’t there more tiers for MFJ? Trying to figure out new tier ranges with inflation estimates.

RobI says

See top of thread post for estimated MFJ and single tiers by year

RobI says

See top of thread post for estimated MFJ and single tiers by year

Bill C says

With June CPI-U Index I now have Tier 2 MFJ now rounding to $246,000 (Individual Filer $123,000) (with no increase in the index for July and August. It is very hard to imagine a drop in the index in the next two months.

Tier 1 Individual Filer is at $97,000 but with a good possibility to round to $98,000 by August.

Tier 1 MFJ now $194,000 and with probability of $196,000 by August.

Tier 3 Individual Filer has recently reached $153,000 and not likely to increase.

Tier 3 MFJ stands at $306,000.

Tom P. and GeezerGeek do these values match your spreadsheets?

Tom P says

Thanks Bill. I (and Harry) agree with your calculations. I guess a couple of “good things” about inflation are I can easily see the I-Bond rate going over 10% in November if we just get a 2-point increase in the CPI-U number each month for the next three months; it could even hit 11-12% if inflation stays high. Also, with no inflation from now through September the CPI-W number from June will yield a SS increase of 9.0% next January. That alone is going to create issues for SS funding.

Ed Fogle says

Please clarify these numbers determine MAGI limits for this year that determine IRMAA premiums in 2024.

Thanks

Harry Sit says

Bill was talking about 2023 numbers (based on 2021 income). I have two tables for 2024 (based on 2022 income) in the main post. Please scroll up to the top to see them.

Tom P says

Ed, to clarify, Bill’s numbers are for the MAGI limits for 2023 based on 2021 income. See Harry’s info at the top of this thread. He also has predictions for 2024.

Jim M says

A 9.0% increase in Social Security benefits for Jan 2023 should also mean a substantial percentage increase in the Federal income tax brackets for 2023. I don’t know if CPI-W is used to index the Federal tax brackets, but more federal income should end up being taxed at lower bracket rates. Unfortunately, the tax brackets $200,000 Single ($250,0000 MFJ) used to calculate the 3.8% Surcharge on Net Investment Income are not indexed for inflation, which will subject more people to that tax.

Harry Sit says

I have preliminary projections for 2023 federal income tax brackets in 2023 Tax Brackets, Standard Deduction, 0% Capital Gains, etc..

Paula T says

Just suprised, for lowest bracket for 2023, with no inflation, it’s 97000. But, it’s only 98000 with 9% inflation (and no changes in higher brackets).

GeezerGeek says

Paul T, that is because most of the data for 2021 income limits is already in the calculation so the 9% projected inflation rate is only applied to the inflation increase for July and August. The data for September 2021 thru June 2022 is already fixed and the projected inflation rate will not change those numbers.

GeezerGeek says

Paula T, It is pretty confusing what data applies to what year. The IRMAA income limits for year 2021 is calculated from the inflation data from September 2021 thru August 2022. If you exceed those income limits in 2021, you will be assessed an IRMAA penalty in 2023. Frankly, I find it kind of hard to keep all dates straight when trying to figure that out.

Jim M says

To help minimize my own confusion, I just focus on the projected IRMAA income brackets for the current tax year (e.g. 2022) that will determine Medicare Premiums two years hence (e.g. 2024) The IRMAA bracket forecasts for the current tax year (e.g. 2022) are the most useful in terms of controlling one’s MAGI income for the current tax year to avoid exceeding the next highest IRMAA bracket and having Medicare Premiums taxed at a higher IRMAA bracket rates two years hence. The Medicare Premiums for next calendar year (e.g. 2023) will be based IRMAA income brackets for the prior year (e.g. 2001) which the IRS will publish in the fall of the current year (e.g. 2022). For most people, income for the prior tax year is no longer controllable and is water under the bridge. So I don’t pay much attention to it.

Thank you Harry for this most useful blog and your estimates for IRMAA and other tax brackets.

The Wizard says

I totally agree with JimM.

I can only tweak my 2022 AGI at this point, thru the end of December, via Roth conversions.

I suppose in hindsight it’s interesting to see how accurate last year’s projections turned out to be even though we can’t make any changes to our 2021 AGI…

GeezerGeek says

DItto to Jim M’s comment. 2021 is closed out so 2022 income management is my focus and I’m not even looking at the 2021 income limits. Like “The Wizard”, I do Roth conversions up to the “expected” IRMAA threshold. Looks like I could have converted an additional $6,000 in 2021 but who knew inflation would return to the level of the early 1980’s after having been so low for so long. Still, thanks to Harry, I have a much better handle on the “expected” IRMAA threshold than I did before I found this site.

Devorah says

I am too wondering about the IRMMA brackets

2023 income for 2025

2024 income for 2026

I like jumbo CD’s . I don’t want to be “just a ittle over” Boom!

Any CMS/ Soc Sec places we can look. The online stuff is so basic or dated technical.

Terry says

Dont’t buy CD’s. Treasury Bill interest rates are much better than any CD.

The Wizard says

We’re worrying about 2022 income for 2024 at present. We’ll worry about 2023 income next year…

StanW says

I really appreciate your projected IRMAA for 2023 and 2024.

With 0% inflation from July 2022 to August 2023, the first tier IRMAA is projected to increase from $194,000 for year 2023 to $202,000 for year 2024. Up $8000 with 0% inflation. Please elaborate a little of the calculation methodology. Thanks

Harry Sit says

I tried showing it with that chart. Take a series of 12 numbers that are increasing, say 1 to 12. The average is in the middle, closer to 6 or 7. Take a second series of 12 numbers that start at 12 but stay flat at 12. The average of this second series is 12. The average of the second 12 numbers is still higher than the average of the first 12 numbers even when the numbers stop increasing.

Stanw says

Thanks

I also just read your answer #146.

Here is the calculation as I understand it

2019-2020 1.0146

2020-2021 1.03

2021-2020 1.00 (No inflation)

1.0146×1.03×1.0=1.045

$97,000×1.045=$101,000 ($202,000 for married couple filing jointly)

Correct?

Braden says

This is what I have at #146 on my Mac. Is this still wrong? None of Harry reply’s are numbered. Is this something that can be fixed?

Braden says

AUGUST 27, 2021 AT 3:38 PM

The only computer I use is a desktop Mac. IOS and use Safari with Google Chrome as the browser.

Thank you for trying to help. Where near the comment is the number? I would assume it is by the name

REPLY

Ken says

AUGUST 27, 2021 AT 8:41 PM

#79 comment was by CARL and dated October 7, 2020 at about 5pm. Harry’s reply is after it.

Harry Sit says

AUGUST 28, 2021 AT 6:04 AM

I fixed the comment numbers. They show up on my iPad and phone now. Please delete browser cache and refresh if you still don’t see the comment numbers.

Thank you for bringing it up. I learned that Safari on Mac behaves differently from Chrome on Windows because Safari uses a different rendering engine.

Stanw says

Sorry. It is # 164 and not # 146

Davidk says

Well I got screwed for 2023. I just barely crossed the line above $91,000. If that rises to $101,000 for 2024, then I’m safe. What a nasty surprise though for 2023. I never head of this tax until August 2022.

Paul says

Davidk,

Harry’s projection for start of the second MAGI tier in 2023 is $97,000 (for 2021 income). That is with no increase in the CPI-U in the final month (August, reported in September) of 2022 that is used for 2023.

If the CPI-U increases at a 4.1% (or higher) annualized rate in August, I project the second MAGI tier will start at $98,000 in 2023. Harry uses a 9% future inflation rate, and gets the same result.

Looking forward to 2024, if the annual inflation rate is 6% during the measurement period (9/22 – 8/23), I project the second MAGI tier in 2024 (for 2022 income) will be $105,000. Harry gets the same result with 5%.

over65 says

David K:

I don’t think you are reading the tables correctly – and this process is somewhat confusing.

The $91k is for 2020 MAGI to be used to determine 2022 IRMAA – that is already reflected in your 2022 medicare deductions.

You state that just above $91k is your 2021 MAGI, so you have to look at the table where the the 2021 MAGI limit of $97k determines your 2023 IRMAA tax. Sounds like you are fine going into 2023 based on your 2021 MAGI.

click here:

https://thefinancebuff.com/medicare-irmaa-income-brackets.html#htoc-2023-irmaa-brackets

ros says

Davidk

MAGI or IRMAA?

Vince says

Paul,

Thanks for your continued work. So happy Harry started this in 2019. Can’t believe how inflation has changed since the first adjustment in 2020. Not sure yet on how high I will go on Roth conversions this year but it’s nice knowing how high the estimates for 2024 have gone up. Wish I had a crystal ball!

RobI says

In the 2023 estimates table using 2021 income and 0% inflation, second bracket shows single as $123k. However married limit shown as $244k, not double the single number =$246k. Is this correct?

Harry Sit says

Sorry, it should be $246k. I’m traveling outside the country right now. I will fix it when I return.

Ros says

If I understand your table above, I can assume that the minimum income for 2022 for single at the lowest bracket can be up to $101,000 guaranteed without the medicare premium going up in 2024 because of 2022 income. I plan to purchase more long term CD’s after the Sept Meeting but must stay below $101,000 to guarantee that my 2024 Medicare premium will not go higher. Trying to prepare for my Roth conversion also in 2022 and for 2023 if I am able with the new interest . When will the final projections be made for 2022 income? Can these figures change after the final projection is made this fall for IRMAA or after we have filed our income tax? I also want to sort of get a good idea for the SS increase so that I can include the interest for the CD’s I have now and ones I hope to purchase and still make a Roth conversion as my children are near retirement. I have no maturing CD’s next year.

Tom P says

What Jim said… plus the SS increase is currently sitting at 8.9%. July was odd in that most items ticked up, but energy went down quite a bit, which led to approximately 0% increase for July. The SS Cola is based on the average of the CPI-W of July, August, September of this year compared to last year’s average. So far, we have one month for 2022 at 292.219. Last year’s average was 268.421. You can find the data here: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm

Jim M says

ROS,

The IRS won’t finalize and publish the IRMAA income bracket levels for 2024 Medicare Premiums based on 2022 income until the fall ( mid Oct) of 2023. The final levels for 2022 income will be based on the actual inflation that occurs between now and August 2023. The $101,000 number in the table you are looking at assumes there will be zero inflation between now and then.

The income brackets in this thread get updated as the government publishes monthly inflation updates. Between now and mid Dec 2022 updated estimates of IRMAA brackets for 2022 income will get posted here. You can use those numbers for 2022 income tax planning and then make an educated guess about how much inflation you want to allow for between January and August 2023.

Vince says

So frustrating that the government uses a 2 year lookback period to calculate IRMAA.

We should be able to know December 2022 what the income levels will be for 2024.

It does help that Harry can give us an estimate but the system is messed up.

It forces us to be conservative with Roth conversions.

Paul says

Vince,

The two-year lookback is required because they use the MAGI from your tax return, and your tax return isn’t due until April in the following year. With extensions, it could be even later.

However, the MAGI brackets are determined by the CPI increase from August to September in the previous year. It would be nice if they used the CPI increase from a year earlier, but that would reduce the IRMMA revenue.

The net effect would be to increase the base Medicare premium to make up the difference.

Jim M says

The two year income lookback is quite reasonable. It would not be practical to base someone’s Medicare premiums on a on a shorter one year lookback. For example, it would be difficult for Medicare to set premiums starting in January 2023 based on 2022 income when most people will not a have filed their 2022 tax returns until April 15, 2023 with return filing extensions allowed until Oct 15, 2023.

The lookback period is not the issue. It is the delayed calculation of the inflation adjusted income brackets that makes tax planning more difficult. The inflation adjustments are not calculated until 8-9 months after the income tax year is closed. I was surprised the IRS / Congress decided to do it this way. It would be nice from a tax planning perspective if the IRS would finalize and publish 2024 IRMAA income brackets based on 2022 income in the fall of 2022 before the 2022 tax year is done. However, that would mean that income brackets based on 2022 income would not be adjusted to include an additional years inflation during 2023. The additional years delay in calculating the IRMAA income brackets would appear to benefit most taxpayer’s since more taxpayer income ends up being taxed below higher inflation adjusted IRMAA income brackets. So I am not going to complain about the benefit that delayed IRMAA calculations are likely to provide.

Vince says

Paul,

Yes I understand but I still wish there was a way for the government to tweak the system

so we have a better way to get our planning to be more accurate and not have any guesswork at all when we do our conversions at the end of this year.

Thanks for your work.

Marty says

Personally, I don’t think our federal gov’t gives a jot about our financial planning. Get maximum revenue is the game plan.

Stanw says

Based on your forecast, It is pretty sure that the 2023 IRMAA will be around $97,000 or $98,000 for individual or MFS

for 2024 IRMAA, your forecast is $101,000 with zero inflation from now till August 2023.

Following your calculation method, if inflation is -2%, the 2024 IRMAA will be $100,000

Naturally by year end 2022, we still have 4 months of data.

Question: What inflation figure (0%? -2% or +5% inflation till August 2023) would you recommend I use for filing 2022 return?

Paul says

I haven’t been able to find an answer for this, but maybe I just can’t come up with the right search terms. I think the folks on this thread know more about IRMAA than anyone!

I start Medicare soon. I enrolled the first day it was possible (3 months before 65th birthday), so I could get the process started. I got a letter saying that I owed IRMAA, and stated the higher premium amount. I expected this, as I did a Roth conversion two years ago.

I haven’t started Social Security yet, so I have to pay the premiums myself. I got a bill for the STANDARD premium ($170.10/month), and I paid 3 months in advance so I could use a credit card (and get the rewards!). So, my next premium isn’t due for a while.

The Medicare.gov site now includes an IRMAA addition to my premium, and I don’t think it was there earlier (but I might not have looked in exactly the right place). But, there’s no demand for additional payment. It even implies that my next premium isn’t due for 3 months.

I only expect to owe IRMAA for the last part of this year. I’ve carefully managed our MAGI for the past two years to be sure I don’t owe it next year.

My question for anyone that has gone through this as they turn 65: do I need to make an additional payment for IRMAA, even though they haven’t billed me for it?

RobI says

The first payment is an estimate. If they overcharge they will eventually fix it but you may have to make a claim if your MAGI changed. There is a claim process for that on the site. It may take few months to sort out but I had good experience with them sorting things a few years ago.

Good luck

Tom P says

Paul, you didn’t specify this but if your income for 2022 has dropped or filing status changed compared to 2020 due to one of the qualifying “Life-Changing Events” you can file form SSA-44 to base your 2022 IRMAA on your 2022 income. I did that when I retired in mid-2020 and it saved us quite a bit.

Paul says

RobI, thanks for the info. My first payment was actually an undercharge. I wanted to be sure I wasn’t supposed to “correct” it myself. If I’ll eventually be billed for it, I’ll pay it at that time. I’ve been budgeting for it all year.

Tom, none of the life-changing events apply to me. This was a one time event that I planned: we converted IRA assets to Roth one last time, as it would only cause an IRMAA surcharge for a few months.

Gary says

Don’t pay extra. My first 6 months were nonsensical, but I tracked it carefully and in the end they got it right.

David says

Harry and others,

You may find this information useful about the number of persons paying IRMAA and the amount of IRMAA paid per year along with estimates for the future.

2022 ANNUAL REPORT OF THE BOARDS OF TRUSTEES OF THE FEDERAL HOSPITAL INSURANCE AND FEDERAL SUPPLEMENTARY MEDICAL INSURANCE TRUST FUNDS

Table V.E3.—Part B Income-Related Premium Information Page 199

Harry Sit says

David – Thank you for pointing to the Medicare Trustees Report. I added the stats to the post.

The Wizard says

Link to that report doesn’t seem to be working…

☹️

Harry Sit says

Here’s the link to the Medicare Trustees Report: https://www.cms.gov/files/document/2022-medicare-trustees-report.pdf

Table II.B1 on page 12 (page 18 in the PDF) shows that 58.4 million total beneficiaries paid $111 billion in total Part B premiums, and had $406 billion in total expenses for Part B in 2021.

Table V.E3 on page 199 (page 205 in the PDF) shows 4.8 million beneficiaries paid $10.5 billion in Part B IRMAA in 2021, which was 8.2% of the total beneficiaries and 9.5% of the total premiums for Part B.

IRMAA reduced the government’s share of the total expenses by 2 percentage points, which is more trouble than its worth in my opinion. Simply rolling it into the tax rates on high-income households would’ve been more effective. The prevailing allergic reaction to higher tax rates brought us this convoluted IRMAA gymnastic.

Songbill says

Harry,

Thanks for your highly informative post about those two tables. Your pointing out that IRMMA only offset 2% of total Medicare expenses ($510.4 billion) gives pause for reflection. I immediately thought of those TV ads (“Dynomite!”) encouraging eligible people to call about possibly getting their standard Medicare deduction put back into their monthly SS payment. I wonder if those of us paying for IRMMA are currently providing all of the $$ to offset this relatively new program of returned Medicare premiums derived from SS payments. I am wondering what would the $128 billion total premium amount be if that SS deduction repayment program was not in effect?

Harry Sit says

The Medicare Part B Giveback benefit comes from certain private Medicare Advantage plans, not the government. Those private plans say enrolling in them costs less than the full Medicare Part B premium. So they’re giving the difference back as an inducement to enroll in their plans. The government still collects the full Medicare Part B premium. Your IRMAA premium doesn’t pay for the giveback.

Paula Thompson says

Actaully, the income limits on “Dynomite” are quite astrict and quite low. Very few people end up qualifying for the offset (to get whole amount, generally need income below $16000/year).

GeezerGeek says

Thanks David! This is great information that I haven’t seen before.

I had read on the internet some time ago that when the bill that created the IRMAA premiums (Medicare Modernization Act of 2003) was enacted, it was intended to affect no more than 5% of the Medicare participants. I used the tables on pages 181 and 199 to calculate what percentage of Medicare participants have paid IRMAA for the years available in the report and here they are:

Year Percent

——- ———–

2010 4.3%

… …

2015 5.7%

2016 6.3%

2017 6.5%

2018 6.8%

2019 7.7%

2020 8.2%

2021 8.2%

Prior to 2011, the IRMAA brackets were adjusted for inflation, as they are now. However, the ObamaCare act (Affordable Care Act) froze the IRMAA inflation adjustments for the years 2011 to 2019. That is why you see the percent of Medicare participants paying IRMAA increasing during that time. Fortunately, the average rate of inflation was rather low during those years. Many more Medicare participants would be paying IRMAA today if inflation had been at the historical average. Still, as you can see from the above numbers, the percentage of Medicare participants paying IRMAA increased during the freeze from 4.3% to 8.2%.

Braden says

I thought when the new laws were written for Medicare that when 8% of retirees paid higher Medicare premiums the income number would raise every year for IRMAA.

GeezerGeek says

Braden, Could be but all of the articles that I’ve seen on this referred to the freeze being on specific years, 2011 thru 2019. Here is a link to an article published in 2014 that stated the freeze would last until 2019. https://www.kff.org/medicare/issue-brief/income-relating-medicare-part-b-and-part/

gary says

I am trying to match my numbers up so i can calculate estimates, yours are spot on but want to ask you about the formula. please correct me if i am wrong.

Aug 2021 cpi-u = 273.567 is this used as the base for 2023 or was it the average of the prior 12 months? if it was the prior 12 months as the base can you tell me what that base cpi-u was? . 273.567 does not add up when i do the average which is why i think it was the average month cpi-u from sep-20-aug-20 which is used

gary says

went back and did more math. lol i added the cpi-u from sep2020-aug2021 summed the 12 months cpi-u and divided by 12 to get a monthly average cpi-u of 265.4466

using that as the base. and then adding sep-2021-july2022 and using same july cpi-u of 296.276 for august it would give an average monthly cpi of 285.8571,

285.8571-265.4466=20.410 /265.4466 = 7.69% increase in irmma for 2023. =91000*1.0769 =97,997 rounded down( i believe it is not rounded to nearest ,000 but may be wrong) $97,000. is that calculation correct?

Tom P says

Gary, close, but no cigar. What you need to do is divide the 2021-2022 average of 285.857 (using July’s number for August) by the 2017-2018 BASE year average of 249.280, which yields 1.14673. Then you multiply the BASE year first bracket ($85,000) by this number to get $97472, which rounds down to the nearest thousand to yield $97,000. The higher brackets are adjusted similarly. I think the August cpi-u could continue to drop a bit, maybe 8% increase over 2021 instead of 8.5% for July, but that won’t be enough to change the predicted numbers.

gary says

so they always use the 2017-18 base year average and 85k , instead of the prior years average, good to know

thanks

RobI says

Just a comment on the 2022 Married couple tier 2 income limits. Since its already estimated by Harry at $254k in 2022 income, with 0% inflation, its already above the $250k joint income threshold above which a further 3.8% NITT tax on investment income kicks in.

For some, NITT could be an even bigger reason than IRMAA to manage RMDs and Roth conversions etc carefully!

I’ve not read of any plans to increase these thresholds.

Harry Sit says

To be clear, NIIT only applies to the amount above the $250k threshold. If your income goes to $254k after RMD and Roth conversion, the 3.8% NIIT only applies to $4k in investment income, which comes out to about $150. It’s not on your entire investment income.

RobI says

Thanks for the clarification Harry

Paul says

Harry, have you recalculated the IRMAA thresholds based on today’s CPI release?

What source do you use for the CPI-U? I’ve been getting it from here:

https://data.bls.gov/timeseries/CUUR0000SA0

However, the CPI-U at this source actually went down slightly from July to August, contradicting the BLS press release saying it increased by 0.1%:

https://www.bls.gov/news.release/cpi.nr0.htm

Is there another authoritative source with different CPI-U’s?

Harry Sit says

I already updated everything in the post. You have the correct numbers. The press release uses seasonally-adjusted numbers. We need to use not-seasonally-adjusted numbers.

Paul says

Thanks, Harry. I was wondering if “seasonal adjustments” were the culprit. I appreciate the clarification.

One thing I’ll note: I’ve been tracking the difference in the IRMAA thresholds calculated per the US Code and the CFR (they are slightly different). It appears the beginning of the second IRMAA bracket will start at $97K per the US code, and $98K per the CFR. The other thresholds are the same.

I wrote my Congressman about the discrepancy earlier this year, and they forwarded my calculations to the Social Security Administration (I think that’s who is responsible). But, neither of us have received a response. I guess we will find out soon which method they use.

If they use the CFR (without changing it), it might require a lawsuit to force them to follow the SCOTUS precedent: the US Code supercedes the CFR, as long as it is clearly stated and not left to “interpretation”.

Tom P says

Paul, you can get the CPI-U and CPI-W (for SS COLA) here: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm, or https://www.bls.gov/news.release/cpi.t01.htm if you just want CPI-U. Sometimes the historical table lags the release update by a day or two, but lately it’s been updated the same day as the release.