[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

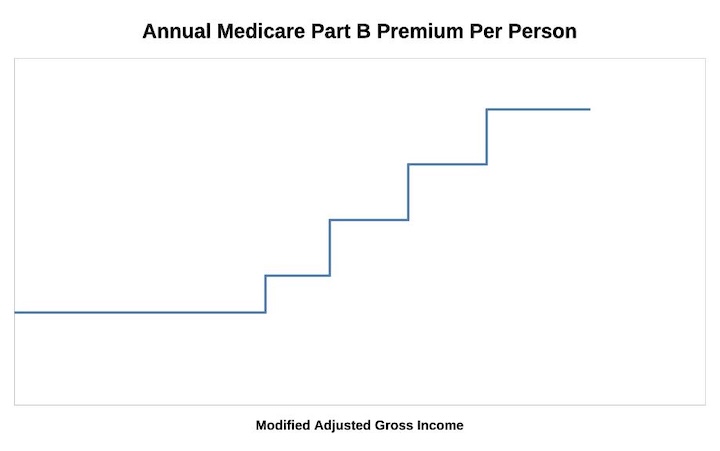

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mary Tully says

Thanks, Harry, for this useful information!

I thought that untaxed Social Security benefits were included in the income for determining IRMAA. I went back and read the other comments regarding this, and now I see I’ve been in the dark about this. Thanks for enlightening me!

Steve says

Harry, thanks for the post. The 2024 estimates (based on 2022 income) are helpful for my end-of-year 2022 tax and income planning.

Looking forward to your upcoming guidance for preparing that pesky Form 1116 (foreign tax credit) in 2022.

David Schaeffer says

This is by far the best and most useful analysis of IRMAA I have found. I hope that by subscribing I get occasional updates. Even better would be a specialized calculator to help manage this year’s withdrawals.

Regarding public policy, IRMAA should be replace with something like income tax brackets which have no “cliffs”. Consideration of Medicare fees should not drive financial decisions.

Ed Fogle says

Totally agree. As much as I believe there shouldn’t be such a thing as IRMAA the “cliff” issue is totally ridiculous. Only a bureaucrat could have come up with it. They don’t think like normal people.

powderriver says

Income tax brackets have no cliffs??? That’s not what my form 1040 instructions indicate. The % of taxable income you owe certainly hits “cliffs” at the tax-bracket upper-limits.

GeezerGeek says

While I don’t think the IRMAA cliffs are fair, I can understand why they were implemented in that manner. As it is now, the Part B premium can be any one of five different amounts, depending on which which IRMAA bracket you are in. If the IRMAA penalty was implemented as an percent of the amount over the bracket, then the amount of the Part B could be any amount within the range of the brackets, which would be a real nightmare for CMS to manage, especially with the systems they had back in 2003 when IRMMA was implemented. IRMAA is an income tax but it isn’t administered by the IRS. I think it would be better if IRMAA was implemented as an income tax surcharge administered by the IRS but that would probably mean that the IRMAA would be paid as a lump sum as part of your income taxes rather than spread out as 12 monthly payments. Once again, I’m not in favor of the cliffs and would like for it to be modified so that it is more fair but that is my take on why it is what it is.

Terry says

Income tax brackets do not have cliffs. If you reach a higher bracket, all income from the lower bracket is taxed at the rate for the that bracket. Only the income over the threshhold is taxed at the higher rate. For IRMA, if you go over the threshhold, your entire premium goes up substantiallly. Not the same animal at all.

Harry Sit says

The 2023 standard Medicare Part B premium will be $164.90 per month (versus $170.10 in 2022). All the 2023 IRMAA income brackets in this post have been officially confirmed. See page 11 of the PDF below:

https://public-inspection.federalregister.gov/2022-21090.pdf

Paul says

Thanks, Harry! Looks like they decided to use the algorithm in the US Code, instead of the (erroneous) algorithm in the Federal Register.

However, I do see an error in my calculations for start of the fourth tier: it starts at $153K instead of $155K. I’ll go back and figure out why.

Paul says

Sorry, I had a brainfade: CFR is “Code of Federal Regulations”, not “Federal Register”.

Tom P says

So, what formula do they use to produce the total premiums? They differ from my calcs by 10-20 cents. I’m using the same methodology I used for 2022 that gave the correct results. I thought the 1st tier adjustment was the base premium x 1.4, rounded to the nearest 10 cents, then the 2nd was x 2.0, the 3rd x 2.6, the 4th x 3.2 and the final x 3.4. If the 2nd tier adjustment is x 2.0, there’s no way you can get $329.70 as shown instead of $329.80 ($164.90 x 2.0).

Harry Sit says

The $164.90 must have been rounded already (from $164.85?). The introduction in the PDF has more information.

GeezerGeek says

Did I overlook seeing the Part D premium IRMAA adjustments in this announcement or are they still pending? I Googled it and found from another CMS news release (https://www.cms.gov/newsroom/news-alert/cms-releases-2023-projected-medicare-basic-part-d-average-premium) that “the average basic monthly premium for standard Medicare Part D coverage is projected to be approximately $31.50 in 2023. This expected amount is a decrease of 1.8% from $32.08 in 2022.” Since the release said “projected”, I don’t know if that is the actual number they will use to calculate the Part D premium adjustments. If it is, the additional Part D premium will be $11.70, $30.30, $48.80, $67.30, and $73.50 according to my calculations.

Tom P says

Geezer, the actual Part D Base Beneficiary Premium is $32.74, see: https://www.cms.gov/files/document/july-29-2022-parts-c-d-announcement.pdf, which can be obtained from this page: https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Ratebooks-and-Supporting-Data. This data is posted on or about July 29 of each year.

This produces Part D adjustments of $12.20, $31.50, $50.70, $70.00, and $76.40, which is the same as 2020, coincidently.

GeezerGeek says

Tom P,

I’m was a bit perplexed by these numbers since the press release I referred to and the publication you referenced were released on the same date, Jul 29, 2022. However, I did find another CMS press release that confirms the IRMAA numbers you provided(https://www.cms.gov/newsroom/fact-sheets/2023-medicare-parts-b-premiums-and-deductibles-2023-medicare-part-d-income-related-monthly) and it was just published yesterday, 2022/09/27. So it is official, the Part D adjustments for the 2023 brackets are as you stated, $12.20, $31.50, $50.70, $70.00, and $76.40. Thanks.

Tom P says

Yeah, that would explain it as the numbers work out if the premium amount is $164.85.

David P says

It appears to me that if as a two person household, income was something like $180,000 you would be in good shape to not advance a bracket with a little more income in the next few years but that if you were to become a single household through death or divorce you would leapfrog into the under $500,000 bracket and have a significant increase in premium even though you reduce to one premium.

Ed says

Yep, now you understand bureaucrat logic. Welcome to the club.

Celia says

Hands down the best explanation I have ever found on the subject and, being an over 65 tax preparer, numbers wonk, investor and on Medicare myself, I’ve read many. It’s a highly important and little understood subject and not all information found is accurate and most is not written in an understandable way for most people. Kudos on a great article.

Marc says

I am trying to fine tune my 2022 income to stay below the 2024 IRMAA limits. The 0% inflation results in 202,000 income while the 5% results in 208,000 income; I am trying to calculate what inflation would have to be for a 204,000 income limit. Please check my methodology. The 2023 IRMAA single income is 97,000. The average of CPI-U for 9/21 – 8/22 was 285.848. To get to 204,000 for 2024 the average for CPI-U for 9/22-8/23 needs to be 101,501/97,000 x 285.848 or 299.283. Is my methodology correct? Given that 9/22 CPI-U was 296.808 it would seem that a 1% increase in next few months followed by basically flat should get to that average , is that also correct?

Tom P says

Marc, you need to go back to the base year, 2017-2018, which had a Sep-Aug average of 249.280. The first single tier back then was $85,000, so you need the 2022-2023 average to be 249.280 x 101,501 / 85,000 = 297.673. I think it’s a pretty safe bet the 2024 tier will be $204,000 or higher for MFJ as I’ve seen some predictions that inflation may go HIGHER next year. If every month from Oct 2022 through Aug 2023 is 5% higher than the previous year the number will be $206,000. I think Harry compounds month-to-month at a 5% annualized rate.

bev lolr says

No one can reliably predict IRMAA tiers for 2024. Even Tom and Harry come up with different numbers for MFJ. Tom’s is a range of $204,000 to $206,000 and Harry’s is $208,000 with 5% inflation.

I would do another QCD rather than go over the cliff for IRMAA. I think Congress needs to address the tiers especially now with the added 3.8% investment tax over $250,000.

What are the verified tiers for 2023?

Ed Fogle says

So, does this mean I’m very safe budgeting $200,000 MAGI this year? I think Tom and Harry are good enough in their calculations I won’t lose any sleep with this number.

Tom P says

Bev, Harry and I do get the same numbers, which is what I implied but didn’t specifically state. If I increase the CPI each month by a factor of (1.0 + 0.05/12) from Oct through Aug 2023 I get $208,000. What I said above was that each month was 5% higher than the previous year, so no compounding. Harry lists the 2023 tier numbers at the start of this discussion.

Paul says

Bev,

To add to Tom’s comment, if you vary the projected inflation rate and recalculate the threshold for 2023, you’ll find that a range of inflation rates results in the same threshold for any given tier.

An annualized inflation rate of 5.0% – 7.1% will result in a $208,000 threshold for the second tier. That gives you a target to shoot for. Watch this article as September, 2023, approaches… Harry’s projections will become more accurate as fewer and fewer monthly CPI reports remain.

However, the inflation rate range(s) will be different for the other tiers, due to the methodology.

Paul says

Tom,

Here’s the calculation I use to avoid compounding the inflation rate monthly, so that the annualized rate isn’t slightly higher:

CPI = X*((1+Y)^(1/12))

X is the previous month’s CPI

Y is the projected annual inflation rate

I think you could accomplish the same thing by applying adding 5% to the same month in the previous year and repeating for each month, but I haven’t tried that.

Ros says

Does that mean that it would be $100,000 for the first tier for 2022 income for 2024 Medicare premium to not change from the bottom tier?

bev lolr says

Thanks Tom! This is totally overwhelming to figure out. Next year we will be paying next to the highest IRMAA tier subsidy due to a “forced” sale of long held real estate. Typically I convert traditional IRA monies to a Roth a little less than the cliff amount.

One cannot reliably plan since the tiers are not known until very close to the year the subsidies are garnered. I’ m not poker player :)/

I am very humbly grateful to folks like you and Harry who try their darndest to help neophytes like myself :(/

Jean Jones says

Reading this has made for the most entertaining and informative evening in a long time! The big takeaway is that there is a lack of communication, esp for older people who don’t get online! I would never have known about the possible increased Medicare premium if it hadn’t been for my sister. Then found this article while looking online and was able to get lots more information! So now trying to juggle to keep income under the threshold!

Terry says

I agree. I found this site a few years ago and the information provided here is invaluable.

Bev Lolr says

Having the 3.8% extra tax on investment income over $250,000 adds another layer of confusion to me in figuring IRMAA.

Tom P says

Bev, the 3.8% tax on investment income is not part of your Modified Adjusted Gross Income (MAGI) calculation so it has no effect on IRMMA. MAGI includes your AGI plus any Tax-Exempt Interest.

Mary says

I just found this site and its been helpful. I have been using some of my IRA required minimum distributions (RMD) to make direct donor charitable contributions that I would have donated anyway. I still have IRMMA , but stay out of the top tiers and higher tax brackets. Just be sure to follow Direct Donor regulations. Its not a break-even process though.

Bev Lolr says

Tom, thank you for your help. I understand the 3.8% does not affect IRMAA. It does make one pay more in taxes along with the IRMAA hit. Staying under $250,000 even if tier is projected to be $256,000 MFJ with 5% inflation seems safer. I always learn something on this site. BTW, I never liked math or algebra so these amazing calculations are over my head.

Jeff Enders says

and remember, the 3.8% is only on the divends/ capital gains / interest that is over $250,000.

If you have more than $6,000 of these income types and your AGI is $256,000, you tax is 3.8% times $6,000 or $228.

if you have less than $6,000 of these income types and your AGI is $256,000, your tax is the total of these income types times 3.8%, so somthing less than $228.

Jeff Enders says

also, my approach is to determine the a) highest marginal ordinary tax bracket I am willing to pay and 2) the IRMAA tier I am willing to pay. Then I target my 2022 MAGI that yields the lower of the two. The NIIT 3.8% tax is the tail of this dog as is any state income tax.

Steve says

Thanks for all of this great info and, I have a question. My wife and I are turning 65 at the end of this year and we got IRMAA notifications today for our 2023 premiums based on our 2021 tax returns. Our letter said we are in the second IRMAA bracket. I stopped working in 2021 and I can get a determination to put us in the lowest bracket based on the 2021 return. However, our 2022 income reported to the IRS in 2023 is likely to be in that higher bracket because of a one time capital gain. Will they look back when they get out 2022 return and re-increase our IRMAA for all of 2023?

Thanks.

Harry Sit says

The SSA-44 form asks for the date of the life-changing event (2021 in your case) and your income in the next two years (2022 and 2023). Just fill out the form truthfully with the income from your one-time capital gain in 2022.

Steve R says

Thanks Harry,

When do you think we should file the SSA-44? Any advantages/disadvantages to filing now with a rough idea of our 2022 income vs. early January when I’ll have a good idea of our 2022 income vs. mid-April when we will have the 1040 available.

Thanks, Steve

Tom P says

Steve, I’m not following why you think filing an SSA-44 form will reduce your IRMAA for 2023. From what you said, the SSA sent you a letter that said your 2021 income puts you into the 2nd tier for 2023, but you also said you quit working in 2021. That’s fine, but if your income wasn’t actually reduced that year, I’m confused why you think filing the SSA-44 form will help.

However, what I think you could benefit from is filing the SSA-44 for 2024, when your income will (I assume) be reduced due to work stoppage in 2021. That way, any IRMAA associated with 2024 will be based on the actual or projected income for 2024, not 2022 when you had the capital gain.

In many cases it’s best to call your local SSA office and discuss. We had to do that after we filed our SSA-44 and didn’t get the expected results.

Hang in there, it can be frustrating.

Steve R says

Hi Tom,

Thanks for your reply and indeed, it is frustrating and very hard to comprehend. I have talked with people at Medicare twice, and still have no idea about the concepts, rules and even the process involved. In the last call the other day, the person said I am not actually appealing, rather I am asking for reconsideration. So, let me start with what I thought was a common sense example and then get more specific for my case.

Someone retires in October 2021 after making $50,000 in wages that year. He and his spouse had $150,000 in other income for a total of $200,000 MAGI on the 2021 tax return. He and his spouse just got a letter that they are in level 1 (for lack of better term) IRMAA for 2023. Since work stoppage is one of the allowed life-changing events, it makes sense that he and his spouse would file for a reconsideration (or is it an appeal?) indicating that he is no longer working and their 2023 income is likely to be $150,000 and so shouldn’t have to pay IRMAA for 2023. Is this too simplistic? Does 2022 income or the 2022 tax return have anything to do with the reconsideration/appeal in this case? I’m just trying to wrap my head around some of the basics here.

Our case:

My wife just turned 65 and I am turning 65 next month so this is our first go round with IRMAA. We just received our IRMAA letters saying we are in level 2 IRMAA for 2023 based on our 2021 tax return. I retired in June 2021 and had enough wages in 2021 that if that amount were not included, we would drop one IRMAA level. However, in 2022, one of the stocks we own was bought out for cash resulting in an unexpected one-time capital gain (which I see is explicitly excluded as an acceptable life-changing event). That gain would keep us in level 2 IRMAA if somehow 2022 income were germaine. In 2023, hopefully without an unexpected capital gain, we will be in level 1 IRMAA. Do we have a path to have our IRMAA reduced for 2023?

Harry Sit says

The form is simple enough. It doesn’t matter in which month you file it. If they deny it for 2023, you will file it again next year for 2024.

Tom P says

Steve, I would file the SSA-44 now and input your expected 2023 income. If things don’t get straightened out before your 2023 SS payment the SSA will refund what they owe you when it’s all settled. That happened to us. Based on your 2022 income you will have to pay IRMAA in 2024.

Steve R says

Thanks, Harry and Tom, I appreciate it.

James Abbott says

My income for 2020 and 2021 was over the IRMAA limits, but I never got a letter from social Security telling me this. Since I mail in paper returns, I am guessing that the IRS was/is still so far behind that they have not processed my 2 most recent returns. When they eventually get around to doing this are they going to send me a lump sum bill?

The Wizard says

You should be getting a letter in late November detailing your SS and Medicare monthly amounts for 2023 based on your MAGI from your 2021 tax return.

No idea if they will bill you for 2022 IRMAA in arrears after they process your 2020 return. It could be exciting…

Tom P says

James, login to your SS account (you do have an online login, correct? If not, get one!) and check your Benefits and Payments, which will include your SS payments and Medicare deductions.

Keith says

1. Have you checked to see if they processed your 2020 and 2021 tax return? I’m speaking about processing the tax returns, not the IRMAA bill.

2.Maybe they already have been billing your for IRMAA surcharge. Have you checked your monthly social security check or direct deposit amount to see if the amount reflects your gross social security amount minus your medicare payment amount or gross social security amount minus your medicare payment amount plus IRMAA surcharge?

James Abbott says

Medicare A & B cost is 170.1, no IRMAA, in fact, they miscalculated my monthly payment and this month sent an extra $48.00!! Yes, know about the IRMAA letter that is supposed to show up in November. After entering retirement I successfully appealed the IRMAA letter for 2 years in a row as my income fell so much after I stopped working full time. Without getting into the IRS COVID tax snafu, and the amended returns I am working on for 2020 & 2021, I am just trying to figure out how Social Security handles it when the make the mistake, and then send me an IRMAA letter 2 years late!

Andrew Morris says

Can you define MAGI as it relates to IRMAA – specifically what gets added back to AGI to determine MAGI.

I keep reading that tax exempt interest (e.g. interest from Municipal Bonds) is added back from to AGI to calculate MAGI but then I read (on some web sites) the list of items added back to AGI and tax-exempt interest is not included.

From the Social Security Handbook (Notice the last revised Feb 1, 2008):

2501.

What is Modified Adjusted Gross Income (MAGI)?

Modified Adjusted Gross Income is the sum of:

The beneficiary’s adjusted gross income (AGI) (last line of page 1 of the IRS Form 1040 (U.S. Individual Income Tax Return)), plus

Tax-exempt interest income (line 8b of IRS Form 1040)

2501.1

How Is MAGI Used?

MAGI is used to determine if an Income-Related Monthly Adjustment Amount (IRMAA) applies. It is provided by IRS and is generally information that is two years prior (but not more than 3 years prior) to the year for which the premium is being determined. We will use the appropriate sliding scale table (�2503) to determine the IRMAA.

Last Revised: Feb. 1, 2008

——————————————————————————————-

From a non-IRS web site called IRS.com (a privately owned website that is not affiliated with any government agencies):

Deductions Not Applicable to MAGI

Your MAGI is determined by taking your AGI and “adding back” certain deductions. These are items which can be subtracted from your AGI, but must be included in the calculation of your MAGI:

• ½ of self-employment tax (self-employed individuals are required to pay “payroll” taxes that an employer would otherwise take; these extra taxes can be deducted from AGI, but are included in MAGI)

• Student loan interest

• Tuition and fees deduction

• Qualified tuition expenses

• Passive income or loss

• Rental losses

• IRA contributions and taxable Social Security payments

• Exclusion for income from U.S. savings bonds

• Exclusion for adoption expenses (under 137)

For me the following would apply to my calculation of MAGI:

1/2 of self employment tax

tax exempt income

But I’d like to get accurate information as to how MAGI is calculated in regard to IRMAA and I haven’t been able to find a consistent source of that information.

Are there different flavors of MAGI as it applies to IRA contribution limits versus as it applies to IRMAA? Or is there only one MAGI?

And one last question:

Are contributions to a Solo 401k added back to AGI for calculating MAGI in regard to IRMAA?

GeezerGeek says

What is confusing is that there is more than one definition of MAGI and which definition is used is dependent upon what it applies to. The definition quoted in the first part of your email is the MAGI that is used IRMAA: “The beneficiary’s adjusted gross income (AGI) (last line of page 1 of the IRS Form 1040 (U.S. Individual Income Tax Return)), plus

Tax-exempt interest income (line 8b of IRS Form 1040)”

Jeff Enders says

this may be the best source of the definition of MAGI in this case. it also explains the difference calculation of MAGI for a variety of federal medical programs

https://sgp.fas.org/crs/misc/R43861.pdf

it was written in 2018…..

Jeff Enders says

another source, probably more definitive:

https://www.ssa.gov/OP_Home/handbook/handbook.25/handbook-2501.html

The Wizard says

Once you’re familiar with IRMAA details, that particular MAGI is very simple to understand…

John EP says

I am planning to do Roth conversion in 2022 up to near the maximum for tier 1 of IRMAA, which for joint returns in $246k MAGI in 2023. IRMAA in 2024 (for 2022 returns) is unknown but will likely go up if we have inflation. It will only drop if there is negative inflation which is rare. I want to be sure to stay in the first IRMAA tier. What is a relatively safe MAGI for that?

I am thinking around $235k.

Jane J says

I was in the same position in 2021 and kept our MFJ IRMAA MAGI just below $242k. As it turns out I could have gone $4k higher. But I was happy we didn’t go over the cliff into the next band. If it were me I would go to at least $246k this year. Of course, there is always the risk that extra bits of unexpected investment income will trickle in right up to the end of December. I made a conservative guess in early December making the bulk of the Roth conversion then (some had already been done earlier in the year) and then ‘trued up’ within a few days of the end of the year.

Jim M says

$235,000 seems safe but too low for me.

For 2022 MAGI Income (2024 Medicare Premium) the bottom of the first IRMAA bracket for Married Filing Jointly is estimated to be $256,000 assuming 0% annualized inflation from November 2022 through August 2023. This is up from $254,000 a month or two ago. The estimate is $260,000 if inflation is 5% annualized from November 2022 through August 2023.

The November 2022 CPI inflation data should be published before year end. That will leave 9 months (December 2022 through August 2023) of going forward inflation to guess before 2022 year end.

I expect the inflation rate to slow but it seems unlikely that it would fall to zero or less in the next 9-10 months. Staying below $250,000 AGI avoids the 3.8% surcharge on net investment income.

Jeff Enders says

The 3.8% is only on investment income and only on the part that is above $250,000 of AGI ($200,000 for a single filing return). So if your non-investment income is let’s say $216,000 and your investment income (interest, dividends, capital gains) is let’s say $37,000, then the 3.8% is only on $3,000.

Jim M says

Correction: I meant to say “top”.

For 2022 MAGI Income (2024 Medicare Premium) the top of the first IRMAA income bracket for Married Filing Jointly is estimated to be $256,000 assuming 0% annualized inflation from November 2022 through August 2023. This is up from $254,000 a month or two ago. The estimate is $260,000 if inflation is 5% annualized from November 2022 through August 2023.

Ken W says

Questions about 2024 IRMMA brackets:

Hi all, We are a retired CSRS couple who file jointly. Questions: 1. What is the last day we can make supplemental thrift plan distributions in December 2022 to ourselves that shows up in 2022 income? Is it 12/28/22?____________ 2. The 2022 income estimate affecting 2024 IRMMA for couples filing jointly is $204,000 (as shown above assuming 0% inflation), $208,000 ( as shown above assuming 5% inflation). But inflation is obviously higher this year. What is a conservative estimate of the actual limit of 2022 income to prevent IRMMA in 2024 considering the higher inflation this year___________ ?

3. I will attain age 72 in August of 2024 and my wife in November of 2024 . We understand that RMD distributions will start in the year we attain age 72, and might make supplemental Thrift plan distributions trickier. So far, except for one year, when we did not pay close enough attention, we have avoided IRMMA, but we may not be so fortunate when the RMDS start. Any recommendations?

Jeff Enders says

1) check with your thift plan

2) the conservative plan is using the 0% factor – that is why is it provided with the caveot that if inflation goes negative (it can happen!), the conservative limit could be less than $204k. Remember, that of the 12 months used to calculate the limit for 2024, 2 months are already ‘baked in’ and is incorporated in the $204k-$208k range; a 3rd datapoint will be available before December 31st.

3) this is the whole problem with attempting to avoid IRMAA – once SS and RMDs kick in, that income stream is ‘locked in’, making it more difficult to avoid. You may just have to accept the first tier of IRMAA and enjoy life…… (and remember as you age, RMDs continue to increase)

barb H says

I don’t like but can live with higher part b payments. What I think is crazy is the stepping stone aspect of it along with needing a crystal ball to guess what size and where the steps will be. Each of the first 3 steps have the same tax/magi-amount-in-the-step so has anyone thought to just make the tax a straight percentage of the magi amount that is above a certain line with an upper cap? That would eliminate the stepping stones. It would make the tax payers’ lives much less stressful and would not be any harder for Uncle Sam to calculate.

Ed Fogle says

Sorry, it’s been suggested but makes too much sense. It wouldn’t be ridiculous enough for the bureaucratic brain.

Bev says

Can someone explain what the 101,501 is representative of for the IRMAA calculation referenced in post 310? Thank you.

Harry Sit says

101,501 is the lowest integer number that rounds up to the nearest 1,000 to 102,000. Inflation must push the number to at least $101,501 before rounding for the threshold to hit $102,000 after rounding.

Ken W says

Hi Jeff Enders, Thank you for your sound advice.

Yes, you are right I checked with the AARP calculator and RMDS keep rising for at least 20 years, more than we will likely still be around.. We might avoid IRMMA for a couple of years but first tier seems inevitable.

However, I just just learned that selling ones house, even with the exclusions for home ownership for over 2 years, can result in some very significant IRMMA. We are getting older and we have been giving a great deal more thought to downsizing and moving to something more manageable. I knew we would likely have to pay capital gains taxes on the sale of our house but I was not expecting very significant IRMMA, two years later as a result of that sale.

Ken W

Guy says

Opened my mail from SSA dated December 7, 2022, and big surprise. Got a retroactive bill for IRMAA covering the 2022 year. It seems that the IRS did not have the 2020 MAGI tax numbers and SSA used the ones available for 2019 to figure the IRMAA for 2022. It sucks as it around the Holidays.

Harry Sit says

The last inflation number before the end of 2022 came out this morning. It was negative month-to-month. I updated the 2024 brackets with 0% and 5% inflation assumptions accordingly. Scroll up to the main post to see the updated numbers.

RobI says

Thanks. Looks like monthly a CPI drop of -0.1% in Nov (led by energy costs) was just enough to move the 2022 first IRMAA bracket (married joint) down from $204000, to $202,000. Its right on the edge, so it would take a big drop in prices to fall for the bracket to below $202k. I’m taking your current table as the target for 2022 income.

Terry says

I am seeing a rise of 0.1% month to month in CPI. Am I looking at the wrong number?

RobI says

Unadjusted for seasonality it fell 0.1%, and the adjusted number went up 0.1%

Not sure which one is used for the IRMAA calculation

Tom P says

You can look at these tables for the numbers:

Monthly:

https://www.bls.gov/news.release/cpi.t01.htm

Historical:

https://www.bls.gov/regions/mid-tlantic/data/consumerpriceindexhistorical_us_table.htm

To me, it’s the year-over-year numbers that matter. If we assume that number drops by ~0.5% per month through August 2023 the year-over-year would be down to 2.5% in August assuming December 2022 drops from 7.1% to 6.5%, January to 6.0%, etc.

Plugging these numbers into the equation yields a MFJ number of $206,000 for 2024. I’m hoping it’s at least $204,000 as I got blind-sided by a change in how PayPal reports payments, and that is going to put me just over $202,000 for the year.

Vince says

Thanks Harry for all the work you do throughout the year.

Inflation figures are confusing because the built in affects of price increases are painful even with declining Inflation.

Dave Ganser says

I have a question regarding methodology to estimate 2024, based on partial 2022/2023 CPI data. The relevant section of article makes the statement: “If inflation is 0% from December 2022 through August 2023, these will be the 2024 numbers:”

It appears to me a clearer statement would be: “If inflation from December 2022 through August 2023 remains at the November 2022, these will be the 2024 numbers.”

My reasoning is with November 2022 inflation at 7.1%, your estimated IRMAA numbers for the ‘0% inflation’ case are correct only if inflation Dec 2022 through August 2023 remains at 7.1%, not zero.

Am I correct or an I missing something?

Paul says

Dave, the projection is zero inflation for the remainder of the year of measurement (Sept thru Aug), i.e. no further change in the CPI. There is already some increase baked into the projection, from September until now.

Harry Sit says

The 7.1% is looking backward. November 2022 CPI number was 7.1% higher than November 2021 CPI number. We’re looking forward. How will CPI numbers increase from the current level in the upcoming months? 0% inflation means the CPI number in each of the following months will be exactly the same as the latest CPI number. 5% inflation means the CPI number in each of the following months will increase slightly above 0.4% over the previous month.

Jeff Enders says

Ken W – while it may not be a panacea, think of your IRMAA as no different, it’s just the capital gains rate is higher than 15%.

Capital Gains on house sale is: Selling price LESS sales expenses (which includes any sales commission) LESS what you originally paid for it LESS all the improvements while you owned it.

Then less $500,000 exclusion (assuming joint filing status and lived in the home at least 2 of the last 5 years) to determine what is taxable.

Also, if your reported income in that year exceeds $250,000, there is an NIIT tax of 3.8% on the lesser of a) capital gains+ dividends + interest or b) total reported income – $250,000

Allan says

-If the next nine CPI numbers come in at -0.1%, does the $256K number for married couples stay at $256K or will it move down to $255K or $254K?

-How about if the next nine CPI numbers come in at -0.2%, what does that do to the $256K number for married couples?

Harry Sit says

-0.1% or -0.2% every month for the next nine months will knock it down to $254,000. It can’t be $255,000 because it’s in $2,000 increments for married filing jointly.

Bill says

If the CPI is widly negitive for the remainder of the year, can the 2024 number go below the final 2023 number? Just trying to leave myself some margin of error.

Tom P says

Bill, if the CPI-U stays at the November number, 297.711 through August 2023 that would mean that year-to-year inflation would be down to 0.52% by next August. Does anyone see that happening? Don’t think so since the Fed is planning to keep rates high through 2023.

If you really want to be on the safe side a single income of $100K ($200K MFJ) would be very conservative IMO since a fixed CPI-U of 297.11 through August still yields $101K ($202K).

RobI says

Bill

By my estimate is that the $100k level would only be reached if the average monthly inflation until August was -0.3% EVERY month making it -2.1% YtY vs August 2023. Highly unlikely in my view.

Bob W says

Is there a reliable estimate for IRMAA brackets for 2025 based on 2023 income?

Next year (2023) I must take my first RMD from my IRA and I want to try to guess how much I should give to a qualified charity via a QCD and how much I can receive myself to avoid Medicare surcharges.

Jeff Enders says

Assuming no inflation, which is the conservative approach, then the number posted for 2022/2024 can be used to determine the MINIMUM IRMAA tier levels. Determining RMD can’t occur until after the first of the year since that requires the 12/31/22 IRA balance.

What year were you born? Secure Act 2.0 passed by Congress as part of spending bill this week, changes first year of RMD to 73 years old effective 1/1/23. Born in 1950, first RMD requirement is 2022 (or no later than April 1, 2023) which is no change, but if born in 1951, first RMD requirement is 2024 (or not later than April 1, 2025). That could change things for you if you are a 1951 baby.

GeezerGeek says

Any IRMAA estimate will become more accurate as more monthly cost of living data is available. The last monthly COLA data that be available in 2023 will be published on 12/12/2023. I would wait until then to determine the amount of the charitable contribution. However, I’ve read that setting up a charitable from a IRA account can take several days, maybe weeks, so I would work on the logistics of the transfer before then.

GeezerGeek says

Just a few thoughts about what inflation rate we might expect for projecting the IRMAA brackets for 2022 income (2024 IRMAA adjustments).

1. Although there was a drop in the CPI from October to November, it is unusual for the annual inflation rate to be negative. The last time the U.S. had a negative annual inflation rate was in 2009 (-0.4%) during the Great Recession. Prior to that, the last negative annual inflation rate was in 1955 (-0.4%).

2. You also have to consider the dynamics of the inflation rate. The biggest year over year drop in the annual inflation rate was also in 2009, when the inflation rate dropped from 3.8% in 2008 to -0.4% in 2009, a absolute change of -4.2%.

We don’t have the inflation data for December yet, but the annual inflation rate for 2022 will probably be at least 7%. If there was an absolute drop of 4% in the annual inflation rate, the inflation rate for 2023 would be 3%.

That said, I think that assuming an annual inflation rate of 3% for 2023 is a very conservative estimate. Since many are anticipating a recession in 2023 and the economy is presently in a slump, I don’t think that we can expect in 2023 anything similar to the drops in the inflation rate that we saw during the Great Recession.

MMP says

Harry, I just wanted to thank you for maintaining this website. Obviously many of us are kind of in the woods here trying to determine how to calculate our income for the current year in order to not be penalized for it two years later. How ridiculous is it that we have to do this!

While you give good calculations (and some of your readers are more interested in reproducing the calculations than others), for now I’ll rely on your numbers, more or less, and go from there.

It’s telling to me that whenever I look up this topic, your website is the most frequently referred to.

Once my other end-of-the-year tasks settle, I’m going to review some of your other topics in order to receive more good un-biased information in plain English.

Thanks again Harry and Happy New Year!

Don says

Great article. This is the only link I found offering definitive do-it-yourself info about the process and inflation timing Medicare uses to calculate income targets. Thank you so much for publishing this.

Please note that the 2024 assumptions should be adjusted or relabeled. (I recommend relabeling – I prefer to use the income levels as posted.) The 0% assumption uses a ~4% annualized inflation rate from Dec. ’22 – Aug. ’23. The 5% assumption uses a ~6.5% annualized inflation rate from Dec. ’22 – Aug. ’23.

Terry says

I am no expert on this (far from it), but the description for the 2024 0% assumption states that it is based on prices staying flat at the latest level. How does that equate to a 4% inflation rate from Dec 22 – Aug 23? I am confused.

Harry Sit says

Please see replies to comment #335. Different people seem to see inflation in different ways. Some people look forward – how much will prices go up from today? Some people look backward – how much will prices have gone up from a year ago? It’s just different ways of looking at things.

I use the forward view. If prices freeze at today’s level through August 2023, that’s 0% inflation to me. To people looking backward, flat prices from the latest number would be 6.8% higher than a year ago in December, 5.9% higher than a year ago in January, …, all the way down to 0.5% higher than a year ago in August 2023. The forward-looking way is more straightforward to me but the backward-looking way matches news headlines.

I’ll continue to use the forward-looking view. 0% inflation means flat prices from the latest CPI number. 5% annualized inflation means a steady increase of about 0.4% every month from the latest CPI number. The backward-looking numbers will be different.

Paul says

Don, the IRMAA calculation is based on a specific period: the average CPI from September to August in each year. That is compared to the average CPI from Sept-2017 to Aug-2018.

For the period ending Aug-2023, we already know the CPI for 3 months (Sept, Oct, and Nov of 2022). Those won’t change. The unknown: what will be the CPI in each of the remaining 9 months (Dec-2022 thru Aug-2023)?

There’s no point in looking backward, as those CPI’s are already published. The question is how the CPI will change in the next 9 months. Harry projects the IRMAA thresholds if the CPI does not change, as that is likely the lowest possible values. That’s a 0% increase, independent of how much it has increased in the past 3 months.

If the CPI increases at an annualized rate of 5% for the remaining 9 months in this period, that’s about 0.41% each month (the exact calculation is a bit more complex than dividing by 12, due to compounding), or about 3.7% over the next 9 months. But, that is looking forward, and independent of what happened in the past 3 months.

Gary says

The BLS is changing the CPI calculation method in January, 2023. Any thoughts on how this will affect the IRMAA brackets for 2024?

“Starting with January 2023 data, the BLS plans to update weights annually for the Consumer Price Index based on a single calendar year of data, using consumer expenditure data from 2021. This reflects a change from prior practice of updating weights biennially using two years of expenditure data.”

BJ says

I’ve worked the recent CPI-U numbers and been able to verify (I think) how Harry comes up with the $101,000 IRRMA income number using 0% base inflation for the remainder of the 2024 IRRMA calculation period. My number was $101.263.25.

Monthly inflation change for Dec to Nov was -0.1%, annualized inflation change was -0.6% (7.1 to 6.5%), CPI-U change was from 297.711 to 296.797.

I am trying to estimate the 2024 IRRMA using negative monthly inflation (say -0.1% or – 0.2% per month) and need to know how to estimate the CPI-U when this happens.

GeezerGeek says

BJ, Having a negative annual inflation rate is very unusual. That has happened only twice in the last 70 years. In 2009, during the great recession, the annual inflation rate was -0.4% and in 1955, the annual inflation rate was also -0.4%. Assuming a negative monthly inflation of -0.1% would result in an annual inflation of almost -1.2%, which is almost 3 times the highest deflation rate of the last seventy years.

We also have to consider the dynamics of change. It would be very unusual for a year of historically high inflation to be followed by a year of historically low inflation.

Of course, no one knows what extreme events can happen in the coming year, but I’m thinking that an inflation rate of 2% is a conservative estimate of the lowest inflation rate that we expect for 2023. If inflation did drop that much from 2022 to 2023, it would be the largest year over year drop in the inflation rate that the US has ever experienced in the last 70 years.

Paul says

BJ, the key is to use the actual CPI values, not the annualized percentage rate. That’s how the law specifies the calculations, and how Harry does the calculations.

If you scroll back through the history of comments, you’ll find a post that explains it. Look for post #164 by me.

BJ says

I used the actual annualized CPI-U numbers and did my estimate calculation like Harry recommends (no change in CPI-U for Jan-Aug 2023) and came up with $101,263 or $101,000 rounded for 0% inflation through Aug 2023. I’m trying to estimate the CPI-U number for Jan if there is a 0.1% monthly inflation decrease so I can determine its effect on the annualized CPI-U. The CPU-I number will go down, question is how much. I don’t you can multiply the CPU-I by 0.999 (a 0.1 % decrease) as one is an annulized number and the other a monthly.

Jeff Enders says

BJ – take the CPI-U value from December of 296.797 by .999 to get an estimate for January (296.5) then multiple THAT number by .999 to get February and keep going. That is a .1% drop (1-.001= .999) each month.

Tom P says

If you multiply each previous month’s CPI-U by 0.999 that will result in vastly underestimating inflation and will result in negative year over year results for several months. That’s not going to happen.

My approach was to pick an amount the CPI-U might drop each month. I chose 0.006, which resulted in an estimated rate for December of 6.5%. The actual was 6.45%. Doing the same for each following month brings inflation down to 1.7% by August, which seems unrealistic, but that still pushes the Sep-Aug average high enough to bump the MFJ to $204,000. Holding the value at the current 296.797 is also unrealistic as that brings inflation down to 0.0021% by August.

As usual, YMMV.

Tom P says

Sorry, my last percentage should be 0.21%.

Jeff Enders says

Tom P – while I agree with your that it is ‘unlikely’ to happen (and I can’t guarentee is CAN’T happen)l what the OP asked was simply how to calculate a .1% deflation each month for the rest of the year. My response to THAT question remains multiply each value by .999, which is 1-.1%, for each month remaining in th year.

Dale T says

The 127,000 figure for the Single 1.4 bracket for 2024 seems incorrect. My calculation after the Dec 2022 CPI comes out to $127,625. (Thank you post #164!). Rounded to $128,000. Correct?

RobI says

I think one difference may be an adding in an assumed CPI rate for the remaining 8 months. Using Tom Ps’ great Excel model, I looked ahead and added the same 296.797 Dec 22 CPI number for each of the months Jan to Aug 2023, then recalculated the 12 month average (this reflects zero monthly inflation).

This makes the 1.4x number come out at $127,472. (I’m not up on the official calculation methodology, but it appears rounding down to nearest 1000 may come into play in this case).

(That stated, there is good chance your higher number will be ok since zero monthly inflation for rest until August 2023 is pretty conservative as it also implies annual inflation rate falls below 3% by April!)

Jeff Enders says

I get the same result as RobL – $127,472 and since the result is rounded to the nearest $1000, the result is $127,000

Tom P says

FWIW, I get the same $128,000.