[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

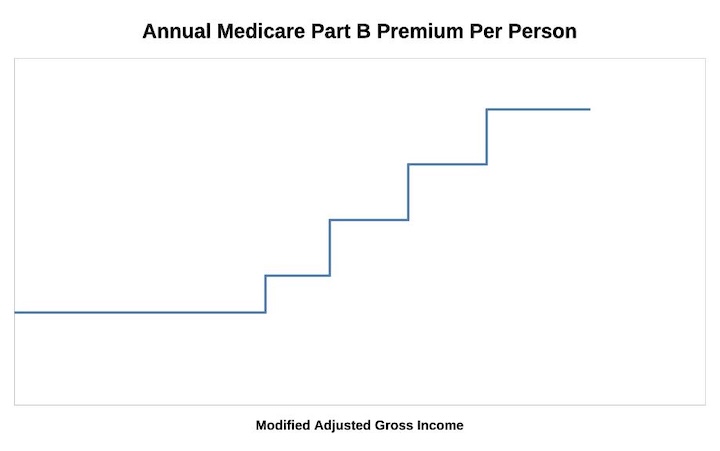

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sara Holt says

I think you may have a type-O under the – 5% Inflation Assumption for 2025 – heading. I think you meant to say “……. January 2023 through August 2023 …..”, not August 2024.

Harry Sit says

Not a typo. 2025 brackets need inflation data through August 2024.

RobI says

Harry

Have you written anything on potential if tax rates increase, tax bands are reset and higher standard deduction all expire in Dec 2025. It could impact IRMAA planning. Most of what I’ve found online financial advice surrounds things like accelerated Roth conversions, but seems to ignore retirees and the impact of higher IRMAA bands.

I’m looking at the tradeoff of taking higher income in 2023-25, while accepting the 40% uplift on IRMAA costs in those years in order to reduce effects of potentially higher taxes in 2026 onwards.

My quick calculation shows its potentially worth taking a higher IRMAA hit now?

Appreciate any thoughts

GeezerGeek says

Robl, last year, I came to the same conclusion: Take the IRMAA hit now before the Trump tax cuts expire. I increased my Roth conversion to what I hope to be the upper limit of the first IRMAA bracket (1.4). I am planning to do the same this year. Prior to last year, I limited the Roth conversions so that I would stay below the IRMAA threshold. I now think that might have been a mistake.

The other thing that drove my decision was the dip the market took last October. The best time to do a Roth conversion is when the market is down so that when the market comes back, the gain is in the Roth instead of the conventional IRA.

If we do have a major recession this year, that would be a great opportunity for another big conversion. I feel kind of bad about hoping for a recession because I know the pain that a recession will cause so many others. I don’t think the tax savings opportunity that a recession would give me is worth all the pain that a recession would cause others but if it happens, I’d be a fool not to take advantage of it.

GeezerGeek says

Robl, One more thing: Although I thought that moving my income above the IRMAA threshold made sense for me, I think that it may not be the best thing for everyone. I’ve been very fortunate financially and I would afford to pay the taxes for the conversion with ordinary income. That are several factors one must consider before you can determine if such a move makes sense. It sounds like you have done the math, like I did. Everyone else needs to do the math to determine if such a move is good for them.

Harry Sit says

Rob – To be clear, the expiration of the Trump tax cuts in 2026 doesn’t affect how much income will put you in which IRMAA tier, which is the main topic of this post.

The factors you mentioned affect how much Roth conversion you’ll want to do while accepting a higher IRMAA surcharge. I wrote about a tool that aids in that decision in Roth Conversion with Social Security and Medicare IRMAA. The tool displays a chart of the tax rate you’ll pay on incremental Roth conversions, including the effect on IRMAA. You can compare that chart with the anticipated post-2025 tax rates and decide where to stop in your Roth conversion. Let’s move the discussion on Roth conversion in general to that post and keep this one narrowly focused on IRMAA itself.

RobI says

Thanks Harry. That’s the post I was searching for

BurtP says

Great topic to explore and think about (paying some IRMAA in exchange for lower tax brackets, before the 2025 expiration).

Another factor to consider is any other credit or rebate one might be interested in using. For example, the Inflation Reduction Act rebates on various home electrification projects. For those persons inclined to such things, one can suppress taxable income and arrive int the rebate range, securing considerable benefit.

While not for everyone, worth considering.

The Wizard says

I’ve been paying more than first tier IRMAA since I started Medicare at 65, so will continue using Harry’s projections for my very modest Roth conversions now at age 73 and up.

When the Trump TCJA(?) tax change went into effect, my marginal federal rate changed from 28% to 24% but the DOLLAR amount of my federal income tax stayed about the same due to the $10,000 deduction limit on state and local (property) taxes.

If they remove this $10k limit in a few years, I expect my federal tax dollar amount to be similar when tax brackets revert…

GeezerGeek says

To The Wizard: In my case, I didn’t lose anything by the change in the cap because I don’t have any local or state taxes. Your situation is a great example of why everyone needs to do the math to see what is the best strategy for them.

Terry says

IRMAA is based on adjusted gross income (actually modified adjusted gross income), not taxable income. Credits wouldn’t affect taxable income anyway, only tax liability.

BJ says

I need to confirm the calculation process. The 2024 IRRMA surcharges are based on your 2022 income and the corresponding IRRMA bracket. If I understand it correctly, the 2024 IRRMA brackets are calculated using the Sept 2022 thru Aug 2023 CPI numbers. Is this correct?

You would think the government would use Jan-Dec 2022 inflation numbers for the 2024 IRRMA bracket calculations. This would make it easier to determine Roth conversions and lower the chances of exceeding your desired IRRMA income bracket…..

Jeff Enders says

your understanding is correct

Jimdog says

Harry, thank you much for tracking the upcoming 2024 IRMMA bracket. I see you just updated the numbers slightly upward due to the CPI post today. Looks like it’s 204M now for a married couple, if inflation stays at zero the remainder of the year.

Steve says

Harry, thanks for the 2025 numbers. Useful for 2023 income tax planning.

Ros says

I have been stocking up on CD’s and just totaled the interest up with my income for 2023.

I am at less that $300 below the $102,000 projected for 2023 for a single filing for 2025. I can forget the Roth conversion but wondering if you can foresee a scenario where the $102,00 will be lowered? Will even a slight recession make the number lower?

Jimdog says

The 102 figure you mentioned is what the est. 2024 IRMMA bracket is for a single. This will be based on 2022 income, not 2023 income. Do you have your year’s straight?

Jeff Enders says

Even if the inflation rate was CONSISTENTLY reported at -.1% for each of the remaining 7 months of the measurement year, the threshold would still be $102,000. Stated the other way, there would have to be deflation of AT LEAST -.1% each month to tip the threshold back down to $101,000.

Ros says

Jim Dog

I do have my years straight. Scroll down further. I have been a widow for many years and single is the bracket that I have to follow. The new rates are now posted at $103,000 up from $102,000 for 2023 income for 2025 premiums at this moment with no inflation. But there still may be a slight downturn or slight inflation and if there is it may change even further before 2025 one way or the other. I am very risk adverse and $102,000 or 103,000 are the figures I will be using and if it goes below and I may choose to close or withdraw a lot from a high interest CD because my CD’s are near the limit for 2 beneficiaries and I will decide in Oct. because I am so close to $102,000 or $103,000 already. I already am not able to make a Roth conversion this year.

Ros says

Jimdog

copy and pasted from this site.

0% Inflation Assumption for 2025

If inflation is 0% from February 2023 through August 2024 (prices staying flat at the latest level), these will be the 2025 numbers:2025 Coverage (2023 Income)

Standard Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000 Single: <= $102,000

Married Filing Jointly: <= $204,000

Married Filing Separately <= $102,000

Ed says

This is confusing. You have Married Filing Jointly down twice with different numbers. Please explain.

AnnaC says

Looks like she copied data from the table ‘0% Inflation Assumptions 2024’ that contains two years of info side by side but did not copy well. The first number is for 2023 Coverage (2021 income) & the second number is for 2024 Coverage (2022 income).

Scroll to the top of this thread to see the tables being referenced.

Jimdog says

I’m a little confused as to why the 2025 IRMMA brackets based on 2023 data, show the same as the 2024 IRMMA brackets.

Harry Sit says

The 0% inflation assumption means prices freeze at the latest levels. There hasn’t been much inflation since last September. Naturally the brackets will stay the same when prices stay the same.

AnnaC says

I believe it’s due to assuming 0% inflation / no change. It’s a bit early for 2025 as not data points / only assumptions.

Harry can verify.

AnnaC says

If you look at the 5% assumption chart you will see a change in the numbers.

Ros says

Thanks Harry.

I will watch the numbers are through August and I should have a pretty good idea what it will be and will have time to close or withdraw some from a CD to stay below what I hope will be the number. Right now I will be about $400 less than $102,000. Purchased too many CD’s. I do ladder long term Cd’s but it is 2 Roth’s that will mature this year.

jimdog says

Anyone have the latest calculation on the single 2024 Irma number as a decimal to see how close we are to rounding up over the est. married est. of 204M? I understand the single number is rounded to the nearest 1M then doubled to calc. the married number.

Paul says

Without rounding:

0% future inflation: $204,270

5% future inflation: $205,742

Jeff Enders says

take the single number, round and then double. (you can get an incorrect result if you take the single number, double and THEN round).

Appears if inflation simply averages 3% from February – August, we’ll move from $204,000 to $206,000.

0% – $102,135; $102,000; $204,000

2% – $102,435; $102,000; $204,000

3% – $102,585; $103,000; $206,000

4% – $102, 737; $103,000; $206,000

5% – $102,888; $103,000; $206,000

Jimdog says

Thx for that good info. Since we already have the Feb. number. It appears that if it avg. 2 1/2 percent from March to August, it might just barely round to 206M. Would that be a correct assumption? Thanks!

Tom P says

I think inflation will average more than 2.5%. February was 6% year-to-year, so next month might drop to 5.5% or maybe not drop at all. Who knows? But if Mar-Aug are all 2.5% year-to-year, we’ll still be at $204,000. However, if the year-to-year rate drops 0.5% each month so we are down to 3% in Aug, the bracket will be $206,000.

Jeff Enders says

You can’t think of it as ‘year to year’ – it has to be ‘month to month’. the historical inflation is already baked in the IRMAA calcuations – it is only the future inflation that is not in the numbers.

So if you want to state the “annualized expected inflation from March to August is 2.5%” that works, but that is not the same thing as the “year to year inflation as being 2.5%”. The former implies 6 expected data points; the latter implies 12 data points, six of which duplicate what is already in the IRMAA calcuation.

Tom P says

Jeff, you can think month to month if you want and I’ll do it year to year. What I’m saying is if you drop year to year inflation by 0.5% each month from the 6% we had in Feb, we’ll be down to 3% by August. This gives CPI-U monthly figures from Mar-Aug of 303.317, 303.564, 305.449, 308.163, 306.646, and 305.056 based on the previous year’s known CPI-U. Using these numbers with the 6 we already have yields a single value bracket of $103,000; married of $206,000. If the Feb CPI-U holds steady at 300.840 the results will be $102,000 and $204,000.

Terry says

Tom P, you can do it year to year if you like, but the actual calculation to determine IRMAA uses the month to month CPI numbers.

jimdog says

Thx so much. My income in 22 was just barely under 204M, so I’m sweating it a little bit on IRMMA, ha. Too close for comfort.

Tom P says

Terry, obviously IRMAA uses the published monthly data, but if you look up the data at https://www.bls.gov/news.release/cpi.t01.htm the first data point listed other than the current CPI-U is the year to year change, which last month was 6%. It’s listed this way because that’s how the media report the change… and how most consumers understand the data… on a year to year basis. You can’t calculate the current month’s CPI-U from the prior month based on the previous month’s change listed as that’s a rounded number. The ONLY number that matters for IRMAA calculations is the actual monthly CPI-U. All I’m doing is trying to make some kind of projection what the next 6 months might be, and I’m choosing to do it on a year to year basis. Not sure why this is so hard to comprehend. Look at this table, which lists all the historical data and the year to year changes: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm. I’m just extending that table by adding 5.5, 5.0, etcl down to 3.5 in Aug.

Jeff Enders says

Tom – your approach is not hard to comprehend…. the reason i suspect you are getting the ‘push back’ is it not the method this site uses to project the inflation in its 5% forecasts.

Your approach may be the way the media reports it and most consumers understand it, but it’s not the approach this community has been conditioned to understand.

This site uses a 5% ANNUALIZED projection over the remaining period of time until August reporting, so it simply uses 5%/12 or .41667 for each remaining month in the measurement year.

If someone wants to use 3% ANNUALIZED, then the consistent approach to the way this site calculates it would be 3%/12 or .25% increase for each month remaining in the measurement year.

Buickman says

First time poster here, but a long time reader of this website. Thank goodness for this website and thanks to its many contributors.

One thing I don’t understand is how the monthly CPI-U can actually go up in a month when the year-to-year inflation goes down. For example, from January 2023 to February 2023 the CPI-U went up from 299.170 to 300.840 (up by 1.67) when annual inflation went down from 6.4% to 6.0%. I would have thought CPI-U would have also gone down.

Conversely, from November 2022 to December 2022 when annual inflation went down from 7.1% to 6.5%, the CPI-U also went down from 297.711 to 296.797, which to me seems logical.

Obviously, there is something I don’t understand. Any help would be appreciated. I am using the Excel model and am trying to run projections for 2022 MAGI /2024 IRMAA. I still have the ability to reduce my 2022 MAGI though an IRA contribution and may have overdone my 2022 Roth conversion. Thanks.

Paul says

Buickman,

The CPI-U is an index that starts at 10 in January, 1914. More recently, it was approximately 100 in July, 1983. As long as the prices that comprise it increase, the CPI-U will increase. CPI-U won’t decrease unless there is deflation (i.e. prices decrease) during the period.

Further, the annualized inflation rate is based on the change in the CPI over the past 12 months. So, the basis for calculating the inflation rate advances each month, and the rate of change in the CPI 12 months ago will affect the most recent month-to-month change in the annualized inflation rate.

Buickman says

Paul,

Thanks you for your reply. I think what I’m having trouble understanding is Tom P’s reply above when he indicates that if inflation decreases by .5% per month for the next 6 months the CPI-U monthly figures for Mar-Aug would be 303.317, 303.564, 305.449, 308.163, 306.646, and 305.056. All of these are higher than the 300.840 reported for February.

So, maybe what I’m missing is that this still represents inflation, albeit at a decreasing level, and not deflation from a CPI-U perspective. I tend to agree with Tom P’s assumption regarding a .5% monthly decrease in inflation and was pleasantly surprised to see that, if true, the third IRMAA bracket for 2024 married couples would actually increase from $320K to $324K.

Paul says

Buickman,

I can’t speak for Tom, but I think what he meant was that inflation would be something like:

February 6%

March 5.5%

April 5.0%

etc….

Jeff Enders says

Buickman – that is why it is best to use Harry’s approach and use the current month reported index value of CPI-U and only project foward. It is much easier and simpler to understand that way.

best to use Harry’s analysis at the top of this webpage and especially the section titled “2024 IRMAA Brackets”. He gives you what occurs to 2024 IRMAA cutoffs if the MONTHLY inflation over the remaining 5 months of the measurement period is zero and what occurs to IRMAA if the MONTHLY inflation over the remaining period is 5% ANNUALIZED (i.e. 5%/12 or .416667 per month.

it’s really a simple method; it is so simple, it doesn’t require any bandwidth to understand what occured in the past!

Buickman says

Jeff,

So are you then saying that if MONTHLY (the month over month) inflation actually declines by .5% each of the remaining 6 months that the CPI-U, which is currently 300.840, would also go DOWN each month? By how much, I’m not sure how to calculate. If I understand Harry’s zero inflation scenario correctly, it is assuming that the CPI-U remains unchanged at 300.840 for the next 6 months, correct?

Jeff Enders says

Buckman – that is correct. And you would multiply 300.84 times (1-.5%/12) and the result by the same formula each subsequent month if you believed there would be 6% annualized DEFLATION. The August data point would be 291.93. The threshholds would be (single) $101,000; $127,000; $159,000; $191,000… double them for joint filings.

And it is correct that Harry’s 0% scenario assumes CPI-U remains at 300.84 for the next 6 months.

Jeff Enders says

Buckman – that is correct. And you would multiply 300.84 times (1-.5%/12) and the result by the same formula each subsequent month if you believed there would be 6% annualized DEFLATION. The August data point would be 291.93. The threshholds would be (single) $101,000; $127,000; $159,000; $191,000… double them for joint filings.

And it is correct that Harry’s 0% scenario assumes CPI-U remains at 300.84 for the next 6 months.

Jeff Enders says

sorry about that: – 300.84 times (1-6%/12) or 300.84 times .995

Buickman says

Jeff,

Thank you very much for your replies and clarification. I think I now understand the calculation much better. Without creating a firestorm, am I correct in understanding that you do not agree with Tom P’s 3/15 analysis wherein he projects that the CPI-U would increase from Mar-Aug to 303.317, 303.564, 305.449, 308.163, 306.646, and 305.056 respectively, if month over month inflation decreased by .5% per month? This may be contributing to my previous confusion.

Harry Sit says

It depends on what you mean by “month over month.” Tom was talking about March over the previous March, April over the previous April. If these numbers drop at a moderate pace, the CPI numbers in the coming months will still increase. Jeff was talking about March over February, April over March. If these are negative, the CPI numbers will drop (by definition).

Buickman says

Harry,

Thank you! That clarifies things. Now I understand the difference between the two approaches. And thank you for hosting this website. I have referred friends to it who are also fighting the IRMAA battle.

Jeff Enders says

Buicken – it’s not a matter of agreeing or disagreeing – it’s a different method of coming up with a forecast, but not the one normally used by this site. Tom’s was using a forecasted INFLATION of 6% while you were asking about a 6% DEFLATION.

just stick with Harry’s forecast of 0% and 5% and the resulting analysis… life is simpler that way!

Buickman says

Jeff,

What I was trying to ask about, perhaps unsuccessfully, was gradually decreasing inflation, from 6% to 3%, at .5% per month, not deflation. This is what I believe Tom was forecasting. Based on what Harry just said, that would still result in increasing CPI-U numbers over the next 6 months. Based on Tom’s calculations, the third IRMAA bracket for 2024 would increase from $160K/$320K to $162K/$324K. Harry’s 0% inflation scenario shows the third bracket remaining at $160K/$320K. And assuming .5% month over month deflation for the next 6 months still only reduces that third IRMAA bracket to $159K/$318K.

So, I’m personally comfortable at $318K as a worst case scenario. And I have to believe that $320K is the real bottom, and $324K is a reasonable expectation.

Thanks again for your responses.

Lisa says

I’m seeing $258,000 for 2.0 times if we have 0% inflation as well as for 5% for 2024. Am I reading this correctly?

Harry Sit says

That’s correct. It happens when one number rounds up and the other rounds down.

Lisa says

I should add greater than $258,000

Lisa says

How close to it being round up to $259,000? What is the actual #? Thanks!

Tom P says

Lisa, it can’t be $259,000… it’s either $258K or $260K since MFJ is just double the single rate, which is rounded to the nearest even thousand.

LIsa says

Thank you, Tom, good to know. So What is the actual number for single for 1.4 times?

Tom P says

Lisa, here are some “what if” numbers.

With the data we have so far, the Single 1.4 unrounded bracket is: $128008.38, so $256K MFJ since the Single rate is first rounded to the nearest $1000 and MFJ is double that.

If you extend the Feb CPI-U number (300.840) through Aug (no monthly change in inflation number, which IMO is virtually impossible since the number always changes based on historical data, we get: $128570.13, so $258K for MFJ.

Using the projected year-to-year inflation adjustment method and dropping the yearly rate by 0.5% each month (6.0% Feb, then 5.5% Mar, 5.0% Apr, etc.) we get: $129540.62, so $260K for MFJ.

If you want to be ultra conservative, use $256K, middle of the road, $258k, optimistic, but easily within reality, $260K. Data from the next 2-3 months will help solidify the direction.

The Wizard says

For most of us, the main importance of the projected IRMAA tiers for 2025 has to do with controlling our AGI/MAGI for 2023 to be a thousand dollars or so UNDER the particular tier threshold of interest.

We control our AGI by deciding how big a Roth conversion to do or possibly how big a capital gain to take.

But there is very little we can do in late March of any year, aside from monitoring the CPI. But by late NOVEMBER, we have a good handle on what our income for the year will be AND a much better idea what the safe IRMAA tier projections are.

So most people should wait till November/December before sweating the deets…

Jeff Enders says

Wizard:

but even in Nov/ Dec there is uncertainly.

While the 2023 MAGI ‘locks in’ on December 31,2023, the 2025 IRMAA threshholds do not ‘lock in’ until the August, 2024 CPI-U is announced.

Jeff Enders says

Lisa – I would think about it a little differently. Based on Harry’s appoach, the reported inflation rate is going to have to average slightly MORE THAN .42% per month (5% annualized) over the remaining 6 months of the reporting year for the IRMAA bracket to adjust to $260k.

look at the chart on at the bottom of the first page of this link and consider the likelihood that the next 6 data points AVERAGE slightly MORE THAN .42%:

https://www.bls.gov/news.release/pdf/cpi.pdf

If Jay Powell gets his way, inflation would be expected to average BELOW .42% over the next 6 months, meaning the bracket would NOT adjust to $260k. That is the risk you are facing. Good luck!

Lisa says

Thank you so much, Tom, for taking the time to provide me with the information. Much appreciated!

@The Wizard, I agree with you. The reason I’m “sweating” it now is because I just picked up my 2022 taxes and my AGI is $258,673! Unfortunately, for some of us, projecting AGI is not as clear cut as it’s for others. I guess it’s going to be a case of wow, I did such a great job in estimating or I messed up big time. Wish me luck!

Thanks again, Tom!

jimdog says

Lisa, have you considered lowering your 2022 AGI by making a tax deductible trad. IRA contribution before 4/15? Of course you can only do this if you have wage income, so I don’t know your situation.

Lisa says

Jimdog, thanks for the suggestions. Unfortunately, or fortunately, I’m retired and do not have any wage income.

Years ago, on my very first cruise, I placed my first bet ever, $5 on snake eyes at the crap table. My husband laughed at me. I walked away with $150! Maybe it’s a very slim chance, but I still have a chance. The half full part of this is, I turn 65 Aug 24, so I will only have to pay the extra for 5 mos plus the 12 mos for my husband. Let’s see, how else can I make myself feel better? Oh, the premium is being deducted from our SS check, so I won’t miss something that I never received? Just like 401K deductions, right? 🙂

I left $ on the table for 2021, that’s why I got a little too aggressive in 2022 with Roth conversion. Maybe I’ll get it right for 2023. This Cliff and two year look back stuff is too much for this old lady!

Thanks everyone for your comments!

Marty Y says

Lisa,

If misery loves comfort, we are in the same boat with AGI of 258,914. I’ve been following this blog for years, and thought we would be safe after arranging charitable gift distributions. The truth is, with the variation in inflation it has been a very difficult year to predict the AGI cut off for IRMAA. Sigh.

George Young says

Well, it looks like I may have overdone it with a 2022 Roth conversion. Depending on inflation remaining to be experienced for the next six months, I very possibly may be exceeding the next year’s IRMAA threshold for going to the next higher bracket. My solution strategy is as follows: Pay the taxes due now (by April 18th) and then request a filing extension to take me out to October 15th. By then maybe we’ll know what the 2024 IRMAA brackets will actually be. In any case, I’ll file a paper return on October 15th. I can’t believe the IRS will then process my paper return and learn my 2022 IRMAA MAGI before the time they (IRS) and Medicare are due to be determining 2024 IRMAA premiums. So whether or not I’ve gone over, it will be too late and they’ll have to use my 2021 MAGI. Do you think this will work?

Jeff Enders says

no; i doubt it will work, just my hunch.

People file back taxes and amendments for prior tax years all the time. You mean they all avoid IRMAA?

I can’t imagine the IRS and SSA ‘snap a chalk line’ late in the year in a “once and done” fashion and anything received up until that date gets billed IRMAA and everyone else is Scot free. It incents paying the tax, but not filing the return.

if your stategy really had legs, I have a better way to do it. 1) Just underreport your income, so you are below the appropriate IRMAA threshhold, but pay enough to cover what you underreporterd. 2) wait for the IRS and SSA to ‘snap the chalk line’. 3) submit an amendment to report the income that was under-reported; since you overpaid the tax originally (and did not request a refund in anticipation of the amendment), there is no penalties or interest.

I gotta believe that after the initial report from the IRS to SSA, there are ongoing follow up analysis to catch those that filed late, those that amended their tax returns, etc.

as someone else posted, can you make a 2022 TRAD IRA contribution prior to April 18 to lower your MAGI? You would need earned income to pull this off, but it is a quite legitimate way to lower MAGI at this late date.

Joe says

George, Marty,

There is a 2 year lookback on tax returns for IRMAA purposes.

Joe says

Jeff,

When you under-report your income in step 1, you will get a big refund.

Thus, when you add in (via amendment) the previously under-reported income in step 3, you will owe a bunch of tax, plus a big penalty.

James says

No, see post #332 from Dec 13th, 2022. What happens is around fall (Oct / Nov) the IRS transfers the updated master file to Social Security. This filed includes any Form 1040x’s that were filed that changes (increase / decrease) MAGI. And you can get a retro active bill!

Marty says

George, I think when the IRS catches up with your paperwork, they will calculate and retroactively deduct any IRMAA payments due from your SSA payments. You either pay them now or pay them later.

Keith says

Harry,

We will get the August 2023 inflation numbers about Sept. 10 or 12. So at that time, we can make a pretty accurate, but UNOFFICIAL, estimate on the 2025 brackets.

But when, EXACTLY, do the 2025 brackets get OFFICIALLY announced?

The Wizard says

The IRMAA tiers and monthly amounts for this year, 2023, were announced on September 27, 2022.

So we can expect the numbers for 2025 to be announced around 9/27/2024…

Tom P says

Keith, the August 2023 CPI-U will determine the *2024* IRMAA brackets, not the 2025. You’ll have to wait another year for the 2025 brackets, which is what makes estimating them so challenging. Once the August CPI is announced on September 13, 2023, we’ll know with 100% accuracy what the brackets will be. The official announcement should be later in the month.

Ally says

I have been following this site for 2 years now. I have been retired since 2008 and am a widow. I convert to a Roth for my kids in Dec after I add up my income, interest etc. I am so risk adverse I am only in CD’s. But I get Harry’s numbers in Nov and then convert the 2nd or 3 rd week of Dec and have that money put in a Roth IRA savings and then add it to a CD the first of the years where many places will allow it that I already have unless they or someone else offers a higher rate. I have to split one of the Roths in July and one in Jan. because with the last interest that is added to it it will be just over the limit for insurance.

Some of my children are in their 60’s and near retirement so I want them to use the Roth’s and it will not count toward IRMAA. Now that the IRA’s have to be spent in 10 years this helps a lot.

I hope Harry knows how much he helps people with this blog.

Also prepare because only businesses will keep the lower tax rates. Most of will be paying higher income tax after 2025 with the trump tax cut, unless Congress changes the laws again.

Michael Darroch says

I have tried following your calculations and now think I understand how the calculations are done. I tried doing my own and come close, but don’t end up with the same numbers.

These are my numbers for 2023 2023

$193,511 $194,000

243,596 244,000

303,926 304,000

364,256 364,000

Where the three highest brackets are all $2,000 lower than your calculations.

The numbers I am using are – Average CPI-U 283.74; Difference 34.468 and percentage increase of 13.83%

Any idea of where I am going wrong?

RobI says

I get 299.532 avg for 2022/23 using zero change from now until August. CPI-U has not been lower than 296.797 in this period. Are you maybe using the 2021/22 period data?

Harry Sit says

The average CPI-U from September 2021 to August 2022 was 285.848.

Tom P says

Michael, one issue you have is you are rounding the wrong number. You must calculate the single filing number first and round that to the nearest 1000. For 2023, the single filing number is calculated by first dividing the 2021-2022 CPI-U average by the average from 2017-2018. So, 285.848/249.280=1.14670.

Then you take that number and multiply what the single filing bracket was in 2019. The tiers were $85,000, $107,000, $133,500, $160,000, and $500,000. So, for the 1st tier in 2023 you get $85,000×1.14670=$97,469.5 which rounds to $97,000. Multiply that by 2 to get the MFJ number of $194,000. The other tiers are done in an analogous manner, except for the top tier, which is fixed at $750,000 for MFJ.

The same method is used for any year going forward, except the top tier starts adjusting in 2026-2027, effective year 2028.

Michael Darroch says

Thank you for clarifying the calculation – REALLY appreciate your work and giving us the tools to help minimize the impact on the Medicare IRMAA Premiums. It has save us in the past and sure will help in the future. Looking forward to getting into some of the other tools you have.

Layne Z says

Harry, I’ve found your work to be really useful. I think I understand the approach and usually agree with your numbers. But with the Mar 2023 inflation adjustment, your bracket (for %5 Inflation Assumption for 2025, Single , Standard*2.0) <= $169K differs slightly from mine. Could you please review my approach and point out where I've gone wrong?

– Mar 2023 CPI-U of 301.836

– assumed monthly inflation factor = 1 + 0.05/12 = 1.0041667

– resultant CPI-U's for 2025 IRMAA bracket:

Sep-2023 (309.461) , Oct (310.750), … , Aug-2024 (323.945)

– with an average CPI-U = 316.653

– 2018 base year

Average CPI-U = 249.280

Standard*2.0 Single bracket = 133.5

– so, I would project a Standard*2.0 Single bracket of

= 170 (rounding 169.581 = 133.5*316.653/249.280)

Where have I gone wrong?

Tom P says

Layne, FWIW I get the exact same numbers as you if you round each computed monthly CPI number to 3 digits before applying the next month’s increase. The only number that differs from Harry’s is the 3rd tier being $170K instead of $169K. Based on recent inflation numbers it seems doubtful that inflation will hold at 5% for this long, but it could be in the 3-4% range, so the 0-5% bracketing does seem like an effective way to put some bounds on the numbers considering we have zero data available for 2025 brackets.

Harry Sit says

A 0.4167% increase per month compounded for 12 months would be over 5%. I use a 0.4074% monthly increase for the 5% annual inflation estimates.

Layne Z says

Tom – yes I agree that assumed inflation of 0% and 5% are effective for bounding the 2025 IRMAA brackets.

Harry – the monthly inflation factor as 1.0040741 (so that yearly [compound] inflation factor is exactly 1.05) clears up my confusion, thanks.

Greg S. says

This is a great website that I have found to be very useful. For IRMAA 2024 (2022 Income) the expected thresholds for Standard and Standard * 2.0 are slightly higher with 5% inflation than with 0% inflation, as one would expect. But the thresholds are identical for Standard * 1.4 with 0% and 5% rates of inflation. Why? I would appreciate any clarification that can be provided.

Harry Sit says

Rounding. Both $128,500 and $129,499 round to the nearest $1,000 at $129,000. 0% inflation puts it at the lower end of this range and 5% inflation puts it at the higher end. They become the same after rounding.

AnnaC says

GregS:

Per Harry comment # 351 back in January:

2025 brackets need inflation data through August 2024.

Can scroll up to read all comments.

AnnaC says

GregS:

sorry…see comments 335 & 344

Greg S. says

Thanks Harry and Anna. I thought that rounding might be the case. I just finished our taxes, and we are right on the cusp. This gives me some hope. 🙂

Jim Wisneski says

Hi, I really appreciate your information on IRMMA. It has been extremely helpful in managing AGI to the extent possible!!!

I would like to make a suggestion that going forward for projected 2024 and 2025 brackets that you consider revising the 5% inflation number to a more likely scenario of 3%???

Or add to your 0% and 5% forecasts a 3% forecast. Perhaps I can just make that calculation by adjusting the 5% forecast – as an example: if I assume that inflation is 3% then I would use 60% (3/5) and set the bracket at 60% of the amount between 0% and 5%.

Thanks,

Jim

jimdog says

Yes, I agree, a 3% forecast seems appropriate now that inflation is starting to slide back down these last several months. However, I’m not complaining and do appreciate all the free advice and info given by Harry Sit!

Harry Sit says

I give two sets of numbers to provide a low estimate and a high estimate. The 2024 numbers are converging. There isn’t much difference between the 0% and the 5% estimates now. Changing the high estimates from 5% to 3% won’t make much difference to the 2024 numbers.

It will make a difference to 2025. The month-to-month CPI changes since July 2022 were 0.0%, 0.0%, 0.2%, 0.4%, -0.1%, -0.3% in the first six months (average about 0%) and 0.8%, 0.6%, 0.3%, 0.5% in the recent four months (average about 0.5%). I’m not sure whether the 0% changes in the first six months or the 0.5% changes in recent four months represent the path forward. We’re still early for 2025. I’ll wait and see for another few months and reevaluate.

Jeff Enders says

Harry – while you think about that, any chance of re-organizing the presentation? it would be so much easier to see the convergence of the 2024 0% and 5% increase (as well as the same two charts related to 2025) if they layed side x side. If I could see the 0% table for 2024 on the left and the 2024 5% increase directly to its right, it would be much easier to assess the ‘bookends’. the current format creates a lot of scrolling and memorizing to understand the convergence

Harry Sit says

That’s a great idea. Done. Thank you for the suggestion!

Jeff Enders says

Harry – that is EXACTLY what I meant! Thanks for adjusting so quickly – – gold star!

Jeff Enders says

Harry- hmmmm, and now that the charts are sitting side x side, is there a typo on the 2025 MFS limits? – at the 3.2 and 3.4 level – for 0% it states $397,000 but for 5% it states $392,000. How could 5% be lower than 0%?

Harry Sit says

That’s how it works for Married Filing Separately. The limit for 3.2x is set to $500,000 minus the limit for standard. You can see this effect in the 2022 and 2023 brackets. As the limit for the standard premium goes up, the 3.2x limit for Married Filing Separately goes down, which pushes MFS filers at the higher end to the 3.4x bracket.

jimdog says

Yes, I agree, a 3% forecast seems appropriate now that inflation is starting to slide back down these last several months. However, I’m not complaining and do appreciate all the free advice and info given by Harry Sit!

Anna C says

Great suggestion Jeff & many thanks to Harry for the reformatted tables: priceless!

Harry Sit says

I updated the numbers with the latest inflation release and a 3% inflation projection for a more conservative estimate. I also added a P.S. at the end for next year’s Social Security COLA projections.

Dale A. Zuck says

This data is extremely helpful. PLEASE, keep up the good work.

Jimdog says

Just curious as to what the inflation rate for the last data point would need to be to drop below the $206M est. for 2024 IRRMA MFJ bracket. Appears that would be highly unlikely with 11 data points to drop below $206M.

Harry Sit says

It has to be -2.6% in one month. The usual month-to-month change is in the 0.x% range. If we have -2.6% every month for a year, the annual inflation would be -27%.

Dan says

Thanks for all of the valuable information. I wonder if a 2% inflation rate should be used for the 2025 estimated IRMAA brackets since that is the Fed’s goal and we seem to be headed in that direction.

Jeff Enders says

Dan – please take a look at the charts above. for SINGLE, there is only a $2,000 gap assuming 0% and 3% inflation, and of course double that for JOINT. (2025)

Giving how the rounding formula works, what would be the benefit of forecasting 2% when using 3% only creates a $2,000 gap to begin with? (ps if the forecast used 2%, because of the rounding methodology, it would not change the $2,000 gap in any event)

What Harry is saying is be conservative since going even $1 over the tranche limit can be very expensive. Given that and given the gap between assuming 0% inflation and 3% inflation is so small to begin with, why not just assume 0% and move on? is worrying about a $2,000 delta worth the risk of going $1 over the limit?

Remeber, when 2023 ends and your 2023 AGI income is locked in, you will only have 3 data points locked in for the 2025 IRMAA tranches, so it might be better to assume 0% inflation on the last 9 data points and not worry about whether Harry uses 2% or 3%.

Just a thought……

Ron says

Harry;

I’ve just discovered your analysis re MAGI and IRMAA and have a simple question. Does MAGI of $200,000 in 2023 appear to be safe as regards any 2025 IRMAA adjustment?

Harry Sit says

Assuming you’re talking about the standard tier for married filing jointly, it’s already at $206,000 in 2022 MAGI for 2024 IRMAA. A MAGI of $200,000 in 2023 should be safe for 2025.

Steve says

Thanks for all the good work on this topic Harry

Confused why your latest 2025 IRMAA at 0% inflation is $210K for couples when the 2024 final IRMAA number is $206K.

Harry Sit says

It’s already explained in the post. Please scroll to the top and read the whole post.