[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

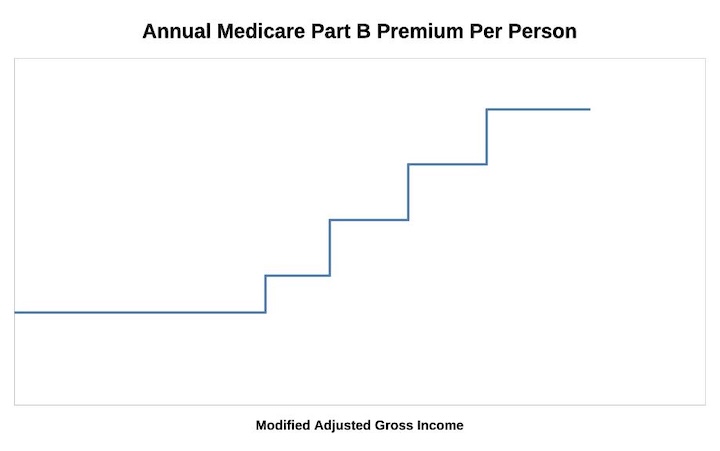

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Thomas says

I read this article every month to see how the 2025 IRMAA is projected to change, so that we don’t inadvertently get whacked by the Medicare surcharges. Until I found this article, I was trying to do the math myself, and found that it wasn’t very easy to do. I thank Harry for keeping this updated. It is one of the more useful tools that I have found to navigate this subject. Thanks again for making this information available to me.

Tom P says

Thomas, I agree that Harry’s site is fantastic, it’s how I learned how to do the math calcs, which really aren’t that involved. If you can use Excel, check out my post #228, which provides a link to an Excel file I made.

Rosemary says

Tom P,

I only have the date and time of a post. Not a number on the Mac desktop with Safari Ventura in Duckduckgo and private browsing. Can you give me the date and time.

Thank you for your help.

Rosemary says

Tom P,

I now see that the numbers are not posted on every post.

Thank you for your post

Rosemary

Tom P says

Thomas, just search this thread for ‘onedrive’ and you’ll find it.

Tom

Jeff Enders says

Tom – please see post # 406

Al B. says

Thank you so much for this exceptional article. The information and insights you’ve provided are valuable (the Nickel and Dime section is excellent commentary!). Also, many thanks to Tom P. for the direct link to his OneDrive Excel spreadsheet – very kind of him to share (for us nerds).

In doing some tax planning I’ve discovered a new wrinkle that will impact my 2023 and future joint returns – the nefarious Net Investment Income Tax (additional 3.8%). So, now in addition to trying to avoid the 2.0x IRMAA tier, I also want to avoid (if possible) the NII tax on income over $250K (it’s annoying that it appears this threshhold IS NOT indexed to inflation). My only hope is (possible) tax loss harvesting . . .

Harry Sit says

Look on the bright side – not adjusting means it’s easy to remember. 🙂

Jeff Enders says

Tom – I reviewed your very well laid out spreadsheet and wonder if there is VERY small technical rounding error?

I believe the tranche multipler should be applied to the base number prior to rounding to the nearest 10 cents.

as an example, please look at 2023 (2021 income), I know the 4th tranche (filing joint) is $527.50, yet your spreadsheet displays $527.70 (cell G64).

If the spreadsheet used the $164.85, multiplied that by the tranche multiplier of 3.2 and rounded to the nearest dime, the result is correctly $527.50.

As currently programmed, the spreadsheet uses the $164.90 (already rounded to the nearest 10 cents) of the first tranche and then multiplies THAT by 3.2 to get to $527.70 which doesn’t result in the correct premium.

Again, a minor rounding issue….but you did request feedback on any errors! thoughts?

Tom P says

Jeff, thanks much for the inspection and correction. I’ve updated all the years to the updated formula. This discrepancy only showed up because the 2023 base Part B was not an even 10 cents number at $164.85. The “published” number on medicare.gov was $164.90 and as I recall I had to do some digging to find the actual base number, and I thought I had reflected that in my formulas… but alas, I had not. Thanks again.

Joe says

Harry,

I haven’t yet seen any official announcement of what the IRMAA thresholds are going to be for 2024. Have you seen anything?

Harry Sit says

Medicare just announced that the 2024 standard Part B premium is $174.70/month, up $9.80 from $164.90 in 2023. The 2024 IRMAA brackets in this post are officially confirmed.

https://public-inspection.federalregister.gov/2023-22823.pdf

Joe says

Harry,

Are those IRMAA thresholds officially confirmed?

As I read that link, the things announced in that link wont become official until Tuesday October 17.

Maybe I’m mis-reading it?

Harry Sit says

Yes, they’re officially confirmed.

https://www.cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

Harry Sit says

Also on Medicare’s website (click on the link “Who pays a higher Part B premium because of income?”):

https://www.medicare.gov/basics/costs/medicare-costs

Joe says

Harry,

Last year I asked if you thought that forgiven PPP loans, while not taxable, would still be required input on tax returns. Your response was that you didnt think so.

I asked a number of other people, financial advisors, etc., and they all had the same response as you.

Well, FYI, a few months back I ran across a number of articles that stated that forgiven PPP loans WERE REQUIRED input on tax returns. If I remember correctly, to be input as tax free interest, and a statement added to the return explaining the details of the PPP loan amount forgiven.

They did offer a choice of years to input the forgiven loan on tax return. If I remember correctly, they gave a choice of 3 years.

As tax free interest, I would think this would impact peoples’ IRMAA situation.

Just FYI to you and the community. I’m not a tax pro, so I’m not offering advice or stating this as gospel. Just something that I read in several articles. People should contact their own tax advisor to see if this is real and how it impacts them.

Harry Sit says

Although IRS Rev. Proc. 2021-48 made the forgiven PPP loan tax-exempt income and the 2021 Form 1040 Instructions (page 23) required a statement with regard to this tax-exempt income, it wasn’t tax-exempt interest income. MAGI for IRMAA adds tax-exempt interest income to the AGI. It doesn’t add all tax-exempt income.

Joe says

Harry,

Do you know what they are saying in 3.01(1) of RP-2021-48?

Are they saying that if you incurred eligible expenses in 2020, that they should be reported on 2021 tax return (instead of 2020 tax return)?

Harry Sit says

RP-2021-48 is about forgiven PPP loans to businesses during the pandemic. PPP loans were given to cover certain eligible expenses. There was some confusion in the beginning about whether the expenses covered by a PPP loan were deductible to the business. At first the IRS said the expenses weren’t deductible (“no double dipping”). Then Congress changed the law to make the expenses deductible. 3.01(1) just says if the business didn’t deduct those expenses in 2020 under the previous guidelines, the business can deduct those expenses in 2021 even though the expenses were actually incurred in 2020. If the business already deducted the expenses covered by a PPP loan in 2020, then those deductions stay in 2020.

Wren says

I feel like I hit the jackpot of specialists when I stumbled on this page! Thank you all for taking your time to post advice. Here is my situation: I need advice on “timing” my income to save on taxes (leaving more for donations and family). I am almost 66 years old, single, retired, live where there is no State income tax, and I pay the minimum premium for Medicare ($164.90/mo in 2023). I am not taking Social Security yet. I own four rental homes outright (no mortgages) that provide enough income to have a nice lifestyle while still sharing and saving money. I’d like to sell the four rental homes. With that income and my current investments, I can continue enjoying life, sharing with my favorite organizations and still leave a nice inheritance for my family. I sold a rental home earlier this year – I still have four left to sell. My rental income for 2023 and the income from sale of the rental home (Ordinary Income from the recapture of 8 years of depreciation and Capital Gains tax from a $200K profit) will bump my taxable income for 2023 high enough to qualify for the IRMAA Medicare premiums in 2025 when the two-year look-back period kicks in (mine will go from $174.70 to $559/month using 2024 amounts, so even higher in 2025). I will be almost 68 years old in 2025. The highest IRMAA premium for 2024 is $594. Selling all of the rental homes in one year would take advantage of the IRMAA cap, but it would be impossible for 2023. I have tenants whom I treasure and I want to give them plenty of notice. I could stagger the home sales from 2023 through 2025 which will raise my monthly IRMAA Medicare premiums by about $5K per year for each year – probably not enough to worry about. Another consideration – I can take Social Security benefits beginning in 2025, 85% of which will be taxable income and with the sale of any rental homes will raise my tax bracket even higher (I can take $2575/mo at age 66.5 in 2025, or $3296/mo at age 70 in 2028) – yet another layer of income to consider for tax purposes. Finally, I have a significant Traditional IRA ($1.2m, mostly tax deferred) and I’ll be forced to take RMDs at age 73. I never converted my Traditional IRA to a Roth IRA but doing that during the years of the increased income from the sale of the rental homes would likely bump me into a higher tax bracket (not sure how high). So, I am fairly confident that as long as I am selling off the rental homes, I should not convert any of the Traditional IRA funds (mostly tax deferred) into Roth IRA funds. I could slowly convert the Traditional IRA funds to Roth IRA funds between ages 68 (after the sale of the rental homes) but before age 73 (year required RMDs begins), but the Social Security benefits starting at age 70 and income from my investments will likely keep my income high enough that I’ll be in a higher tax bracket (not sure how high). Maybe I should leave the Traditional IRA funds in place and just pay income taxes on the RMDs at age 73. Even if I held off on selling the remaining four rental homes, combining my rental income from owning the homes with the taxable income from the conversion of Traditional IRA funds into Roth IRA funds would result in a large tax bill. At the moment, I have created an Excel spreadsheet only to calculate taxes due for the sale of the rental homes and I can plug this info and other info for IRAs and SS benefits into last year’s H&R Block tax software just to play with numbers. But there must be software or a spreadsheet already created to estimate the taxes due for these few factors rather than giving the same exact numbers to an advisor who will simply plug them into their own software. Any advice and links to calculators or spreadsheets are greatly appreciated!

Jeff Enders says

this is the situation many middle class people face – all the issues of timing you surfaced in your post.

My best recommendation: decide what is the highest marginal tax rate and highest IRMAA you can stomach…. and then lay out a plan to get to the top of that marignal tax bracket and $1 under that IRMAA tranche you chose each and every year.

it is a complex set of variables and I can’t fathom anyone gets it right.

other things to consider and contemplate:

1) the current tax brackets will revert to the 2017 brackets in 3 years, unless Congress acts otherwise.

2) RMD probably means very little given your income stream and Trad IRA balance. it’s a MINIMUM requirement and not a maximum requirement.

3) you mentioned donations. Have you considered QCDs once you are 70.5? Making QCD’s from your Trad IRA a) can be used to satisfy the RMD requirement and b) does not impact the taxable income on your tax return. So if you are going to make significant donations, this could solve some of your income issues. And since a QCD is not part of income, it is not part of the determination of IRMAA, so that is another positive.

Jim M. says

Wren,

Here are 4 retirement income planning tools that can project your long term income tax obligations based the input of “what if” financial assumptions:

https://www.i-orp.com/Plans/extended.html – Free, but handling of real property is limited.

https://pralanaretirementcalculator.com – Annual fee – 2023 requires Excel, converting to web /cloud based for 2024. This is the software I use.

https://maxifiplanner.com – Annual subscription – Web / Cloud based.

https://www.newretirement.com – Annual subscription – Web / Cloud based.

Also see:

https://www.bogleheads.org/forum/viewtopic.php?t=403975

https://www.thebalancemoney.com/retirement-calculator-reviews-4061796

Comments:

The most tax efficient strategy may be to retain your rental income properties. Let them pass to your heirs at a stepped up cost basis and never pay capital gains taxes on them while you are alive. However, that may require you to find a trustworthy property manager as you age.

If you want to sell your properties, it may make sense to do so before commencing Social Security or the RMDs from your T-IRA. Whether to stagger the sales would depend on the size of capital gains on your properties. The maximum long term capital gains tax is 20% plus a 3.8% surcharge on the net investment income exceeding $200,000 (for Single filers) of your Modified Adjusted Income (MAGI). The 3.8% surcharge does not apply to the first $200,000 of Net Investment income. Staggering your sales over multiple years would allow you to pay a lower capital gains rate of 15% and avoid the 3.8% surcharge if you can keep your MAGI below $200,000. This would be partially offset by incurring higher Medicare IRMAA surcharges for several years. The maximum annual IRMAA surcharge is about $5000 for Part B and $1000 for Part D, or about 3% of $200,000 single filer’s MAGI income.

After that, you may want to look at smoothing your income over your remaining life expectancy based on your available assets and income sources and as a means to avoid spikes in your income that would be taxed at higher marginal rates.

Jim M.

Wren says

@Jeff Enders and @Jim M. – I want to thank you both very much for responding. You’ve given me new things to think about as well as new tools to explore! If I come up with anything phenomenal, I’ll report back to this thread!

Travis says

You are exactly who should want the FAIR TAX Act passed in this country!

mentally sliding says

What day is the last update on 2025 IRMAA projections this year? I currently read a 264k to 268k Irmaa 1.4x magi limit for 2023 income. Roth conversion planning. Irmaa vs marginal tax bracket plus over 250k 3.8% investment tax.

Harry Sit says

December 12.

Tim says

Would it be a safe bet to use the 2025 Coverage (2023) Income 3% Inflation brackets for determining a 2024 MAGI limit to avoid crossing into the next higher IRMAA tier for 2026 or just stick with the 0% amounts?

Harry Sit says

This post shows brackets for 2023, 2024, and 2025 right now. It’ll roll forward to 2024, 2025, and 2026 in January. We’ll have a full year to figure out 2026 just as we’re doing now for 2025. It’s always going to be a guess but we’ll have a better handle as we get more data. If someone asked about 2025 a year ago, I don’t think we would’ve had the same numbers as we do now. If you must have a number for 2026 at this moment, you can use the 2025 3% number as a wild guess.

Vince says

Harry does a great job trying to help us reduce some of the guesswork every year with this IRMAA regulation! It’s still frustrating calculating our Roth conversions at the end of 2023 for what may happen in 2025. You would think there would be 1 government official smart enough to figure out a solution to this yearly problem.

Tim says

Thank you Harry.

JonK says

For someone eligible for Medicare in 2025, will 2025 thresholds apply to the 2023 income, or do they use the 2023 thresholds? It seems to me they should use the 2025 thresholds when looking back at 2023 income. Maybe this is obvious to everyone, but it just occurred to me now that I can manage my income this year (2023) to the expected 2025 thresholds (or at least to the known 2024 thresholds) vs trying to stay under the 2023 thresholds.

I think the article and table make that clear but can someone verify my interpretation?

Harry Sit says

2025 thresholds for both new and existing Medicare beneficiaries.

The Wizard says

Yes, but the 2025 Medicare IRMAA tiers are based on…….(wait for it)……….. your 2023 MAGI…

barry says

In the current projection, you state “you can make some preliminary estimates and give yourself some margin to stay clear of the cutoff points’.

With all of the talk of 2024 food deflation etc, what dollar amount of margin do you recommend to stay under the projected $210,000 income bracket?

Thank you Harry!

BF

Harry Sit says

If you’re concerned about deflation, using 2024 numbers for 2025 should cover it.

BF says

Is the 2024 nos for 2025 at $206,000?

or ???

Thanks again Harry!

BF

Tom P says

BF, with the two data points we have so far (will get another one next Tuesday, Dec 12), the 2025 number is $210,000, but that could drop if inflation continues to drop, so $208,000 might be a safer bet, or if you are really conservative, stick with the 2024 number like Harry said.

The Wizard says

What talk of 2024 food deflation?

Shirley you must be jesting…

JOHN SLOGICK says

… and don’t call me Shirley 😉

HARVEY SPECK says

I am a federal government annuitant covered by National Association of Letter Carrier (NALC) health insurance (high option) which includes drug coverage (equivalent to Medicare Part D). NALC advised that it was not necessary to purchase Part D insurance because of this equivalence. I pay a yearly premium to NALC. Last year (2023) NALC members with high option could enroll in an Aetna Advantage plan without losing any of the NALC privileges(no co pay, no deductibles) but gaining some benefits such as dental, vision and a reduction in the cost of Part B premium).

For 2024, Social Security advised that I would also have deducted from my social security payment $12.90 for Medicare Part D IRMAA. My 2022 MAGI was $125,103. I question whether I should be paying for Medicare Part D coverage when I am already paying for it under my NALC coverage. Is it possible Medicare is unaware of my drug coverage under my NALC program? Should I appeal to Medicare?

John says

Harvey. I’m in the same situation as a GED annuitand with FEHB. I chose to do a FEHB Medicare Advantage Plan , which is great, but the health insurer (UHC in my case) signed me up automatically for Part D, when we’ve been told all along that with FEHB it’s not needed. I questioned it too, but was told it’s just part of the deal with the Medicare Advantage Plans. There’s no impact in the base Part B IRMMA bracket, but does creep in as you land in the higher IRMMA brackets when doing Roth conversions.

Jeff says

Harry, this article is fabulous and it is superb that you update it monthly. To further enhance it though, could you also please include charts for the additional IRMAA surcharges for Medicare Part D (or maybe add a column for the extra charges for Part D with the current Part B charts)? Even though Part D costs are relatively smaller, they are not insignificant and it would be helpful to have more specific info included here. Although the link to the Medicare website in comment #19 contains current year and the following year information, it lacks the projections for 2 years in advance (which is crucial for tax planning in the current year). Thanks!

Tom P says

Jeff, the Part D surcharges don’t really change much year to year as they are only based on the Part D Base Premium amount, which is published yearly around the end of July. The 2020 base was $32.74, 2021 was $33.06, 2022 was $33.37, 2023 was $32.74, and 2024 will be $34.70.

The actual Part D Adjustment is calculated by multiplying the base amount by a factor associated with each tier. These factors are calculated by the percentage amount each tier pays, ranging from 25.5% for the no adjustment tier to 85% for the top tier. The acutal factors are: 0.0, 0.3725, 0.9608, 1.5490, 2.1373, and 2.3333. Thus, for 2024 the top tier will pay 34.70 x 2.3333, rounded to the nearest 10 cents, which equals $81.00. In 2023 that amount was $76.40.

In the grand scheme of IRMAA, you could just pick some reasonable adjustment amount for your planning and shouldn’t be too far off.

Jimdog says

Suppose inflation drops hard in the last 3 months of the 2024 calculation by .25 percent each month. Would that cause the 110,000 bracket for the Married Filing number to drop based on what we know now? Doing some big roth conversions in the next few days so just trying to be conservative.

Tom P says

I assume you meant $210,000 MFJ predicted bracket. If inflation is 1.5% year over year for Nov 2023 through Aug 2024 the $210,000 still holds. If inflation is 0.0% year over year the bracket will stay at $206,000, so maybe $208,000 would be a good number to be very conservative? But seriously, if you are able to afford big Roth conversions why are you worrying about a few thousand potential IRMAA charge?

jimdog says

Tom, the 2025 number for MFJ is $210,000 rather than $206,000 if inflation is 0 percent, right? Not worried much about an IRMMA charge but just trying to be a prudent planner.

Tom P says

Well, I guess that depends on how you define “0 percent” inflation. If that means holding the CPI-U at the current October value of 307.671 through August 2024, then yes, the MFJ is $210K. But that’s not realistic as that means the year to year inflation for August 2024 would be down to 0.2%.

On the other hand, if you define ” 0 percent” inflation as no CPI-U change year over year for all the upcoming months through August 2024, then the MFJ stays at $206K.

Personlly, I think $210K is still a pretty safe number, and $208K would be conservative. We’ll have another CPI-U number on Tuesday 🙂

James says

JimDog. The width of the 1st bracket for MFJ is from 210,000 at 0%, rising to 212,000 if inflation is at 3%. Harry gives two estimates…..0% and 3%. If inflation really falls to 2% in 2024, we should all be happy, But some of us will be sad if we have a MAGI of 211,500, and we trigger IRMAA, or if you are single like me, the width of the bracket is only $1,000. So YES, not much of a margin for any error. As mentioned above if you are worried, take the lower number and keep your income below $210.000, and don’t worry. You will drive yourself nuts if you fret about marginal brackets and incremental brackets…. IN my case $1 extra triggers a 5% marginal increase. But it only triggers that If i don’t increase the IRA conversion. If I double my IRA withdrawal, then the is only a 2.5% marginal increase.

So step back and look a the big picture.

Harry Sit says

This is the last update in 2023 for 2025 Medicare IRMAA (based on 2023 income). No change to the standard tier from last month. Some upper tiers are lower because the CPI went down last month.

Gary says

It is challenging to optimize Roth conversions, given the two year MAGI look back for IRMAA surcharges. I currently project IRMAA MFJ brackets (thanks to Harry’s blog) and then manage our MAGI income with a $6,000 cushion before the next projected bracket. I can see that many are struggling with this too, yet almost all advice says it’s wasteful not to top off your full bracket. I use my $6,000 cushion to be conservative and because MJF brackets jump in $2,000 increments as inflation projections adjust over time. If inflation drops materially in 2024, I might still spillover into a higher bracket. What strategies do you folks used to conservatively manage your projected IRMAA penalties?

Ed Fogle says

I feel your pain. You are struggling with what is possibly the most ridiculous thing thought up by bureaucrats and that’s saying something. The concept of budgeting is difficult to apply when you can’t define the budget until sometime after the budget period. Bureaucrats don’t think like normal people., though. I can’t emphasize how little I think of them.

Alan A. says

I feel like I am at the horse races, trying to guess where IRMAA will land so I can max my 2023 MAGI this year without going into the next IRMAA tax bracket in 2025. I will probably end up with a $6k cushion (MFJ, based on Harry’s calculations), though I know an $8k cushion would be safer a safer bet.

Terry B says

I’m in the same situation, trying to make a conservative estimate of the 4Q23/1-3Q24 CPI numbers in order to set my Roth conversion amount. I’ve decided to just set my conversions in 2023 to hit the now-known 2024 threshold. I realize this may be way conservative (implies a month-on-month CPI decline of about 0.5% for the next 12 months), but I’m concerned about our economy may experience a period of disinflation. We’ve seen it in the past (2009, 1950) after a rapid run-up in CPI. I suspect I’m being too conservative, but worst case, I miss out on the last 10-15k of conversions, but I’ll have avoided a potential 20-30% additional IRMAA tax (MFJ) on the incremental conversion.

Gary says

Thanks for your thoughts folks! I think I will be adjusting my approach for 2024 to using a $8K cushion. It’s too late for 2023 as I have already finished my Roth conversion. Just hoping my remaining interest, dividends for this year and future bracket projections work out well.

Rosemary says

I always try to stay below the amount not for the income taxes but for medicare increase.

Also Ed Fogle the law is the way it is because of all the late filers, because of storms and the people given extra time to file and for the rate of inflation. I still like that we can do this.

There was a time we could not and even a time there was no such thing as a Roth IRA let alone a conversion. Thanks to Bob Packwood who introduced the Roth and to Bill Roth who created it.

I remember when there were NO IRA’S AT ALL.

Ed Fogle says

Don’t follow your rational. What does late filing have to do with setting the IRMAA brackets during the year they apply to?

Gary says

Ed, I read her late filing comment as meaning that Medicare uses 2 year old tax returns to avoid folks that file late not having a return by the time they do the penalty calculation.

Ed Fogle says

I’m not talking about when a given year’s income is used to calculate IRMAA. I’m concerned with the fact the IRMAA thresholds for a given year aren’t known until after the year is over. Thus all the gymnastics of this website. So much for budgeting. Ridiculous in my opinion.

Terry B says

Can the IRMAA thresholds be reduced year-to-year if we have a period of disinflation? For, example, if 2024 CPI flattens out and falls a bit, could the 2025 thresholds (for 2023 income) be reduced from the 2024 thresholds (for 2022 income)? Has this been addressed in the original ruling?

Paula Thompson says

Yes, they can be reduced. They have alreay bewen slightly reduced for some of the higher up levels. Ya can’t win in this horrible exercise.

Michael Butler says

I did a quick spreadsheet using the calculation from the explanation here: https://thefinancebuff.com/medicare-irmaa-income-brackets.html#comment-27661

Here’s a link to the Google sheet. I get the same estimated (0% inflation case) values – except for the 2.0x bracket which my calculation rounds up to $165,000.

I’m using the CPI-U numbers found in the bottom of the BLS press release (here’s the one for Nov: https://www.bls.gov/news.release/pdf/cpi.pdf). Dec-Aug 2024 use the Nov index (so 0% inflation).

Am I doing it right?

Michael Butler says

Missing Google sheet link: https://docs.google.com/spreadsheets/d/1qak6gtJ6d8tp_y-cjv5cCecjX_A_JLyu_qexB8Qx-Ng/edit#gid=0

Harry Sit says

Close, but not exactly. When you start from the previous year’s numbers, those were already rounded. When you round the results again, they may happen to match the correct calculation due to rounding, but not always, as you see in your 2.0x number. If you want accurate calculations, you’ll have to follow the described method exactly and pay attention to the “To reiterate” part.

Michael Winnick says

We are looking at IRMAA the wrong way. It exists only because Medicare is expensive and the politicians don’t want to raise taxes to cover an impossible promise. IRMAA is designed to get more money to the government. Period. When you say $1700 extra is a small amount when your income is $206,000, that’s a populist statement. That $206,000 is a GROSS Income number. No one pays taxes on Gross. Everybody has some kind of deduction, whether a standard one or an itemized one. IRMAA is like a dollar level that never gets adjusted for inflation. Politicians love those because given enough years EVERYBODY will exceed that level and be drawn into the grasp of the tax collector. Politicians who push a fixed level, like the existing $3,000 deduction maximum for loss carryovers, are dishonest people. IRMAA is a cancer on retirees, and a pre-cancer on workers.

Tom P says

Michael, it’s not true that IRMAA “never gets adjusted for inflation.” It gets adjusted every year. Back in the base year 2019 the MFJ first bracket was $170K, and now it’s $206K and probably moving to $210K for 2025. With my current retirement income ~ $200K I’ll never pay IRMAA as long as we can file MFJ. If that changes, IRMAA will definitely raise its ugly head.

I still think that if you are making enough money in retirement to pay MFJ IRMAA you are doing darn good, and shouldn’t be complaining as you are head and shoulders above the vast majority of retirees.

jimdog says

Michael Winnick, well said. IRMAA especially hurts single people since they get hit at the 103,000 level. It’s prudent and just good financial planning to try and not go over that IRMAA bracket by $1.

Ed Fogle says

“ I still think that if you are making enough money in retirement to pay MFJ IRMAA you are doing darn good, and shouldn’t be complaining as you are head and shoulders above the vast majority of retirees.”

Oh how I love it when has this attitude for me. Please, speak for yourself next time.

Michael Winnick says

Tom,

Actually you will get caught by IRMAA if two things happen. First, you live. Every year you live your RMD divisor goes up. Eventually if will get below 18.5 and later 15.2. And if you live to 93 it will be 10.1. Second, you invest wisely and your IRA grows. Your RMD will go up forever and it will go up MORE percentage wise than the IRMAA brackets do.

Also, I didn’t say the brackets didn’t, I only referred to the other things in taxes and phaseouts that are not indexed.

Last, I may be head and shoulders above other, but since when does that mean anything. It’s because of the governments refusal to deal with the cost of Medicare, and where the money comes from, and the continual piling on of what the government should or will pay for, that has got us to where we are. Sooner or later someone will be told they are too old to be worth spending money on just so they can live a while longer. All government health care survives only if we don’t spend money on the oldest and sickest. Look at the British situation.

One other thought, imagine living your life with the goal of never making more than $200k + inflation. Especially sine true inflation is not what the government inflates anything by. I want to make a million, and then increase it by 6% or 8% or 10% every year.

The Wizard says

I’ve been paying IRMAA since I started Medicare at age 65.

I’m in the third IRMAA tier lately and always will be most likely, under current law.

I have plenty of extra income each month so I’m in good shape. Whining about IRMAA probably isn’t going to make it go away…

kenneth says

Duuuuude,

First, you complain about how the government has ACTUALLY “dealt with the cost of Medicare, and where the money comes from”, and then you complain that the government is not doing it. Your complaint is a catch-22 wordsalad, as it usually is from those well-to-do idealogues who claim they don’t want the Social Security and Medicare programs, at least until they are up in arms about perceived threats to their own use of those benefits.

The Wizard says

Also, my RMD went DOWN for 2023 compared to 2022.

The idea that RMD dollar amounts go up year after year is fake news generated by folks who can’t do either math or Roth conversions…

Michael Winnick says

Wizard,

Agree on first post. I too expect to be in next tier. Next year will be my first year that my AGI put me into IRMAA land because up to now I could manage my income, which since I’m retired is zero, and my withdrawals, and my wife had no required RMA since she was not 72. Luckily her RMD got pushed when they changed the age to 73. But next year she will be 73 and we will have two RMD’s. And her RMD is double mine because the trading I do in our accounts resulted in hers growing more. I have also done Roth Conversions in the past. But, I am limited to about $50k in total because more than that, plus the RMD on the remainder in the IRAs, puts me over the IRMAA trigger level. By the way, I am 82, she is 72 so my divisor keeps dropping every year and is pretty low, hers not so low but her IRA is large and thus the RMD pretty big. So, bottom line, with the exception of the 2021 market reducing my IRA, I have never had a lower RMD. This year both of our IRAs have grown. They are up significantly. So my AGI in 2024 will be bigger than 2023’s, and in 2025 will be even bigger. I have calculated that we will be in the 3rd bracket in 2027 (based on 2025 AGI). And again, barring market crashes, my RMD will not go down.

One option I do have is to do Roth conversion on the entirety of each of our IRAs. I will pay taxes at 37% or higher but never again be in IRMAA. Of course the question is why would I ever pay all my taxes that would occur over the next 10 year, or however long I live, in a lump today.

It’s a matter of the best of all the options, all of them being bad.

Paul Thompson says

Well, I have done both math and Roth converasions. RMDs do go up every year (the factors decrease each year). My guess is that the total valuation of your accounts subject to RMDs was lower at the end of 2022 (which determines the amount of your 2023 RMD) than it was at the end of 2021. The valuation at the end of 2022 could have been lower due to market fluctuations and Roth conversion.

The Wizard says

I’m 73 and started doing moderate Roth conversions back when I retired age 63.

The size of those conversions was based mostly on my projected AGI when I started SS and RMDs at age 70. I have decent pension/annuity income so it didn’t take much Roth conversion to push me well into IRMAA territory but I felt it had to be done.

I was able to convert around 30% of my tax-deferred account before my RMDs started last year, age 72.

Nowadays, I do a much smaller Roth conversion around this time of year, after completing my RMD, with my goal being not to get into the next higher IRMAA tier or to get into a marginal Federal tax rate higher than my 24% rate.

And if you are charitably inclined, a good way to keep your MAGI under a particular IRMAA threshold is to do QCDs…

Michael B Darroch says

The charitable contribution from the IRA’s is a great way to reduce your taxable income so that you have lower taxes, can have a way to do the IRA RMD’s, keep the IRMA in a lower bracket AND have the pleasure of giving to those charities that you prefer and can see the benefit while you’re still alive.

Terry says

I agree 100%. Each year about this time, I figure out how much I need to make in QCD’s to reduce my RMD to keep it under the desired IRMAA threshold based on the estimated brackets from Harry’s website. I am fortunate in that I have farm rental income/expenses that I can play around with to delay until following year or take in current year to help with IRMAA decisions. I am SO glad that that I came across this website a few years ago before I had to start taking RMD’s and when I was still doing Roth conversions. Harry does a great service to retirees like me.

The Wizard says

Ed is right. I forget the exact number, but 85-90% of folks on Medicare have low enough AGI that they get fully subsidized Medicare.

Still, it can be rather annoying to be just a few dollars over one of the IRMAA thresholds. So it’s better if you can manage your AGI to be toward the top of a particular tier…

Ed Fogle says

“ Still, it can be rather annoying”. What an understatement.

Ed Fogle says

The “cliff is one of the biggest abominations of IRMAA. It can cost around $1600 if you accidentally have $1, that’s $1 too much in MAGI. Why isn’t it like income taxes where every dollar of income in that bracket is taxed at a marginal rate? I’d ask a bureaucrat but I don’t speak their language.

Jeff Enders says

are posters looking at this through the wrong lens? What is the end game?

if trying to avoid IRMAA is managed by the size of any Roth Conversions (or not doing Roth conversions) that infers that a traditional IRA is otherwise growing / not being reduced fast enough.

And if a traditional IRA owner lists children as beneficiaries, upon the owner’s death those children will inherit the IRA and will have just 10 years to liquidate that IRA at their then current tax bracket, which is likely to be during their high earning years, which could also be higher than the owner’s current tax bracket.

So avoiding IRMAA now can significantly increase the tax burden of these children as they liquidate their inherited IRA – and that tax burden can be higher than the IRMAA payment these threads suggest individuals are trying to avoid.

My approach is to attack the size of my traditional IRA and do Roth conversions and let IRMAA fall where it may. I think of IRMAA as additional income tax, so it adds about 2-3% to my marginal tax rate.

It’s pay now or pay later. My belief is that it’s fool gold to think avoiding IRMAA is a good strategy. Secure 2.0 made attempting to avoiding IRMAA a bad strategy for many. Look at the bigger picture: what will your children pay in income tax to liqudate your remaining trad IRA? More or less than it would cost you?

Terry B says

The strategy is not to avoid paying IRMAA at all, but to manage IRA distributions or Roth conversions so as to avoid paying an exorbitant tax on incremental distributions/conversions. Many people choose to make conversions within a target tax bracket because they believe that they, their surviving spouse, or their heirs will be in a higher bracket when required to take those distributions. But if the last small increment of distribution/conversion puts you above an IRMAA threshold, the IRMAA penalty is effectively an additional tax on that conversion. If your distribution/conversion amount, based on a target ordinary income tax bracket alone, puts you over the IRMAA threshold by $5000 for example, you will incur an additional ~$3000 in IRMAA premium (FMJ), adding an additional 60% IRMAA tax on that last conversion. That’s on top of the ordinary income tax rate you are also paying. This additional $5000 increment of conversion is almost certainly not justified. You need to understand the total impact of ordinary income tax plus IRMAA premium when calculating the marginal rate on the last increment distributions or conversions.

Gary says

When managing Roth conversions we try to max out our bottom line net worth thru age 100. We care less about the particulars of individual taxes, penalties, etc. Happy to spend a little more now if it increases our overall financial standing longer term.

Second, we focus on not being a burden to our son while we are alive, with any inheritance a bonus for him. We know that many folks are more focused on maximizing the family fortune over time, and so may act very differently.

Third, we are both age 70 and have begun to lean into Roth conversions even more heavily. This does hurt our medium term net worth projections, but saves a surviving spouse from their newly lowered single tax & IRMAA brackets. Our upfront additional costs now are like buying some life insurance for the surviving spouse. It’s a judgement call, but we know that actuarial tables show a 25% chance that one of us is gone by roughly age 85.

Any feedback on any of the 3 issues greatly appreciated. There are lots of discussions on the math online, but not much guidance how to make these judgement calls.

The Wizard says

At age 73, I don’t really worry about my net worth projections for future years. I have excess income most months, so my Investible assets have been increasing since starting SS at age 70.

I’m single nowadays but completely understand the idea of decreasing the tax burden on the surviving spouse, to a degree. But it depends on your various income streams, now and in the future.

A portion of tax-deferred money can always be willed to offspring or charity instead of going 100% to survivor.

Least of my concerns is the impact over ten years on the eventual non-spousal beneficiaries of my tax-deferred money.

They can deal with it…

Rosemary says

We started gifting our children in the 90’s and I still do. I have been retired and on SS 16 years and a widow for 11. I have converted to a Roth every year staying in the lowest IRMAA bracket.

People complain when the market is low and or interest rates on CD’s are low, but also complain when they make more and have to pay more if they get out of the IRMAA. Not sure what people want. I disclaimed my husbands 401K and IRA’s when he passed and the children can take their RMDs until they die. In the meantime I still gift them every first week of Jan and make my Roth conversion every year keeping below the lowest bracket. Because they are in their 60’s I do not want them to pay more taxes and maybe even affect their IRMAA when I died and they retire.

There are laws and you do what you can to figure out what is best for you and your family. I have never broke the first tier of IRMAA.

James says

Judgement: Hmmm, the formation of an opinion, after the consideration of evidence. Approach this with the heart of a teacher. Even if the son is in his late 40’s, there are still things to learn, you cannot stop teaching just because you are 70 and he is an adult. But you approach it differently. But I digress, you are probably looking for those intangible things that help you make the decision in the face of “unknowns.” The future interest rates and changes in tax rates, when is the next bubble in the market, when is the next crash. You want an all weather type of portfolio, that can withstand anything the market throws at it. You are entering an area where there is no clear cut “right” or “wrong” answer. So yes conversion of some Tax deferred assets at a measured pace above the RMD could make sense. These converted funds could go to a Roth, but upon your death, they still must be withdrawn within 10 years. The Roth has not taxes upon withdrawal.

But now what do you do with them? Oh my, many folks forget that ultimately, your assets become taxable and you also need to know How to manage taxable funds to generate the lowest tax obligation. Tax advantaged muni-bonds are one method, but the method means nothing if the person lacks judgement. What you are really asking is how to teach your son judgement about life and personal financial management so that they can be even more successful than you.

Does your son have a philosophy, or approach to life that lets him live within his own means? Does he keep friends around him that are additive and supportive, or do they suck the life out of him? Parenting never stops.

But to get back to factors bearing on the decision of how much. You need predictions of future tax rates. I find that in many cases, exceding an effective tax rate of 15% is a break even point. Above that rate, folks hesitate, below that rate, they say sure. So even if I pay a marginal rate of 22% or 24% on some of the last dollars earned, if the overall effective rate is close to 15%, then I am ok with that. The first tier of IRMAA is a 40% increase, the 2nd tier is a 100% increase in the IRMAA. For ease of computation if IRMAA is about 1000, and you have pulled an increment of 30,000, then that is about 3.3%. But that is the rate on the last segment. Look at your overall effective rate. It could be 24% + 3.3% or 27.3%. Hmmm, back in the 1980’s before the Regan Tax cuts I was in the 31% marginal tax bracket. So do not lose sight of the big picture. It is about the return of your money, not the return on your money. Taxes are just another investing expense.

Hope this helps….Good Luck

Michael Winnick says

Try going to your Brokerage website, I use Fidelity, and access the Roth Conversion advice page. This page will want to know how much your want to convert, what your current tax bracket is, how you will invest it (that is, leave as cash, or follow some Conservative, Moderate or Aggressive investment strategy), where will you get the money to pay the taxes on that conversion, and what tax bracket you expect to be in when you may want to remove funds. Basically they will be looking at how much that money will grow over the next x years if left in the IRA, versus how much it will grow in the Roth. In my case, using a moderate strategy (assuming 7% growth), and that I will live to 100 and my wife to 110. Current ages are 82/72.

It’s advice was not a good idea. That we will have more money available leaving it in the IRA. My calculations said the same, even with increasing IRMAA.

Conversions sound really good, but only if you start doing them way before you retire, and maybe only having a Roth (I’ll grant you need to look at the maximum you can invest in each to determine the best way to build a million or more).

It’s really important to look at how long it takes to make back those early taxes on conversions and how long you expect to live.

As for QCD’s, if you love giving money away and can live frugally, give it all away the year before you start RMDs keeping just enough to survive on, preferable in a Roth. You’ll have NO RMDs and NO IRMAA and super low taxes.

I like to see my IRA, both types, grow every year, even if the government insists on figuring out ways to extract more of my money in taxes, surcharges and fees, and force me to buy an EV in 2040 or 2050

Michael Winnick says

I’ve got a question. Since IRMAA is based on AGI, jut how fair is that when you consider a family of 4 or six, maybe with high medical bills for an autistic or Downs child? To qualify for IRMAA this year you only need an AGI of $194,001. Two people earning $97,001 each is all it takes.

Jeff Enders says

If this is a real situation (and not a hypothetical – how many families exist where the size is 4-6 individuals listed on the tax return and both taxpayers are over 65)?

IRMAA is a ‘means testing’ methodology…. if you are well off, you can afford it is the thinking :-). It is as simple as that.

AGI’s of $194,000 (filing Joint) and at least 65 year old is still a quite limited population set. Only 7% of Medicare beneficiaries pay IRMAA as stated on this website.

Further, if the children in this family are under the age of 17, they qualify you for up to a $2000 tax credit, any one else in the family would qualify you for up to $500 other dependent tax credit. You did say we were dealing with 4-6 family members! Those medical bills would be eligible for a deduction on Schedule A (assuming you itemize.) So is the thinking that these benefits are not enough to compensate for IRMAA for a couple that reports over $194,000 of income?

Michael Winnick says

There are families with children at home in their 60’s. But, there are also families whose children are unable to live by themselves because of developmental issues and live with their parents until death. All you need is one child like that and your expenses skyrocket.

As for the tax credits, depending on how your income hits the tiers it at best is a wash. Wash sounds good except it really wipes out the IRMAA by a tax credit, and if you don’t pay taxes then that doesn’t happen.

In all honesty, $194,000 is not a lot of money if you live in NY or California, or take care of your parent, or have high medical bills.

My main issue here was the decision to use AGI. Why is the tax code focused on deductions before calculating taxes rather than on AGI? Why didn’t Medicare/Social Security do the same?

Jeff Enders says

The whole idea of IRMAA is means testing: the wealthier you are, the less your medical premiums are subsidized by taxpayers. Adjusting your income by your itemized deductions (and the wealthier typically are the ones itemizing), would be subsidizing the same population that IRMAA says are not to be subsidized.

RobI says

I’m a bit surprised not to have seen more discussions on the issue of expiring tax law starting in 2026 . By current law, these changes could trigger a far bigger impact on total ‘tax’ than higher IRMAA brackets would on Medicare premiums.

Besides the return to prior tax rate changes of about +3-4%, we could also see a lot of 24% tax rate income move up into a 33% tax bracket. And there is the possible return of AMT. Also, switching back to lower standard deduction levels (even inflation adjusted) may not offset SALT deductions, especially if you have downsized where you live in retirement.

All of this is good reason for me to push hard on Roth conversions and other sources to bring income forward, even if it pushes IRMAA up for 2024-2025. I’m not sure Congress will act in ways that I can plan around, so better to try to get ahead of this now.

Harry maybe you have in mind a separate post on this tradeoff. Meanwhile here is one simplified articles (that totally ignores IRMAA effects). https://www.kiplinger.com/taxes/avoid-paying-higher-taxes-in-2026-what-you-can-do-now

Terry says

Letting the 2017 tax cuts expire would be hugely unpopular. Members of both parties , including many Democrats, recognize this and consequently, I believe that most people expect the tax cuts to be extended or even made permanent.

Michael Winnick says

Off-topic comments deleted.

The Wizard says

With the $10k limit on SALT, I didn’t really see a decrease in the dollar amount of my Federal taxes in 2018 compared to 2017.

But my AGI changes every year, so it’s tricky.

Assuming we do revert back in 2026, those brackets from 2017 will be adjusted considerably upward due to COLAs the past eight years…

Michael Winnick says

I saw a big decrease due to the effect of the Standard Deduction change. And a decrease in the time I had to devote to getting every last itemized deduction collected and records kept.

My major deductions were Mortgage Interest, Property Tax and Donations. But with the increase in the Standard Deduction I stopped itemizing and still had a higher deduction in 2018 than 2017.

I no longer have a mortgage, Texas just cut my Property Tax 50%, in fact they cut statewide property taxes about that on average, and come 2025/26 my taxes will be going up, probably at least $2000, maybe $3000 depending what the Standard Deduction gets set at.

Mark Steinman says

Terry – au contraire! it’ll be an opportunity for both parties to deal with the deficit. And it may be the opportunity to deal with the SS and Medicare shortfalls at the same time. Even IRMAA premiums could rise (or the point at which they begin could be lowered) . To think taxes may not rise is short sighted.

Rosemary says

Off-topic comments deleted.

Harry Sit says

Let’s keep on the topic of IRMAA please. Whether the tax cut was good or bad or whether it’ll be reversed or how belong somewhere else.

Michael Winnick says

My apologies. Sometimes I get caught up.

Rosemary says

Thank you. I should not of replied.

James says

Harry…..

MERRY CHRISTMAS to your and yours, and all who frequent this website. The info you provide is very helpful in planning for life in retirement. It is difficult to find unbiased information about a Medicare and IRMAA. Thanks for simplifying a complex program. And thanks to the family and friends behind you that make this website function.

Ya’ll have a wonderful New Year

Harry Sit says

Merry Christmas to everyone! Thank you for taking the time to write this note. I’m happy to hear this has been helpful. We’ll start tracking 2026 in January.

Jim M says

Many thanks to Harry for a most useful website.

I am curious about how much deflation (negative inflation) we would need between Dec 2023 and August 2024 to reduce the 2025 IRMAA brackets (based on 2023 Income) by $1000 for Singles, and by $2000 for Married Filing Jointly.

Has anyone done such a calculation?

Jeff Enders says

If deflation ran at about -1.0% over the next 9 months, each SINGLE tranche would drop by $1,000 (and each JOINT tranche would drop by $2,000) from what Harry is displaying for 0% inflation.

specifically:

$105k becomes $104k with -.8% deflation

$132k becomes $131k with -.9% deflation

$164k becomes $163k with -2.0 deflation (yes -2.0%!)

196K becomes $195k with -1.1% deflation

for Joint, deflation would be the same by tranche as listed here.

I took the deflation numbers listed, divided by 12 and applied that monthly percentage to the CPI tables that are the basis of the tranches. So this level of deflation would need to occur beginning NOW for deflation to cause the tranches to drop by $1000 over the remaining nine months of the analysis period.

RobI says

A simple assumption of ZERO future change to YtY CPI by using the monthly CPI from the prior year for every month December 2023 to August 2024. The resulting brackets were all very close to a rounded $1k drop vs Harry’s post which assumes zero CPI change vs Nov 2023 number.

$104k

$130k (rounded down from $130,433)

$163k

$195k

I ran the numbers with the spreadsheet downloaded from Thomas Pultz earlier post. His calculator takes the exact CPI and correctly rounds up or down to determine income breakpoints. (Note that monthly CPI raw BLS reported number is not seasonally adjusted, so the annual calculation excluding 3 prior months can be imprecise).

Brett Swartz says

Not sure I understand the new 2025 calculations. I come up with at least 107K$ if inflation is 3% for the next year and 8 months?

Jeff Enders says

for 2025, the inflation is simply measured through August, 2024 (not through 2025);there are only 8 data points left to add, not 20 data points.