[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

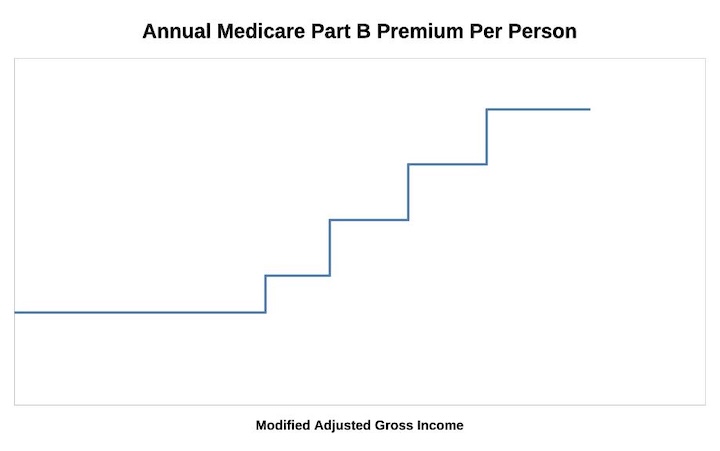

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

James M says

December 2023 CPI Indexes

The governments numbers for CPI indexes can be found here: https://www.bls.gov/news.release/cpi.t01.htm

The government reports 12/22 = 296.797, 11/23 is 307.051 and 12/23 is 306.746 which calculates to 3.4% for 12/22 to 12/23 and -0.1% for 11/23 to 12/23.

Yet the press reported the number as 3.4% for 12/22 to 12/23 and 0.3% for 11/23 to 12/23.

What am I missing with respect to the 11/23 to 12/23 percentages. Government says inflation went down -0.1% but the press reported it went up 0.3%

Harry Sit says

Trust the government, not the press. The 0.3% number reported in the press is a seasonally-adjusted number, which isn’t useful for the purpose of IRMAA.

Jeff Enders says

see the first line, right most column.

https://www.bls.gov/news.release/cpi.t01.htm

Paul G says

For the 2025 Standard Premium, why is there no difference in the 2023 income levels between the 0% and 3% inflation numbers?

Jeff Enders says

it has to do with the rounding requirements.

for Single filing:

Without rounding, the 0% forecast limit would be $104,660, which rounds to $105,000

Without rounding, the 3% forecast limit would be $105,448, which rounds to $105,000.

Joint is simply double SIngle (Single is rounded first then double to get to the Joint limits)

the two forecasts do converge over the 12 months and since Harry began with only 3% inflation on the high end, they can converge quite quickly, given the rounding requirements.

(some may come up with slighly different unrounded results, but the jist is the same)

nicolaas rykhoff says

Harry, thank you for doing this .. splendid updates, and prompt!

One thing I don’t get, and I know you mention 12 months of averages vs the next 12 months averages. But showing the 2025 column 3% average, how can your Nov/Dec/Jan #’s drop from 200/199/198. Why aren’t they fixed at 200 ? (but my calc gets 204.7, see below)

( if 2023 was 193, so 3% is 199 rounded for 2024, and a further 3% would be 204.7 in 2025.)

No ?

Harry Sit says

CPI has gone down in recent months. The 0% and 3% projections are based on the latest number. When the latest number is lower, the projected numbers for all future months are also lower, which brings down the average. If you’re referring to the 2.6x standard bracket for single, you’re off by one year. It’s $193,000 in 2024, not 2023.

Gene Lawson says

Thank you so much for this informative and understandable article. Just finished doing my 2023 taxes and inadvertantly went over the IRMAA limit as you predict for 2025 putting me in the 1.4 penalty zone, but like you say, it really isn’t all that much. My calculations, which included a Roth Conversion, for my predicted IRMAA-MAGI for 2023 were fatally flawed due to operator error, won’t make those mistakes again.

Ed Fogle says

“It isn’t really all that much money”. Perspective. It’s a lot to me..

Ros says

This site is amazing it allows me to manipulate my interest income and Roth conversions to stay below the lowest mark for single. My children are in or near their 60’s and I want them to inherit the IRA’s etc with no income tax on them when they retire or pay a higher medicare premium because of anything they inherit from me. That 10 year rule is not good for them. At least I am happy that I disclaimed my husband’s IRA’s in 2012 and the children have the rest of their lives to take their RMD’s. I have about 1/2 of my mother’s IRA left and she passed in 2006.

I share this site with all my friends, though few convert to Roths.

JP says

I will be 65 in 2025. I had high income in 2023 and 2024 but due to layoffs in January 2024, there is a chance I will retire. If I do; can I file for appeal at the first time I sign for Medicare in 2025, to prevent IRMAA?

John J Sullivan says

yes,

see https://www.ssa.gov/medicare/lower-irmaa

for instructions, but recent retirement is one of the acceptable reasons for an IRMMA adjustment exemption.

jack allen says

For any given tax year when is the official IRMAA tax bracket information announced for that given tax year?

As an example…….

I am currently trying to do 2024 tax planning and income adjustments to avoid an IRMAA medicare Part B surcharge in 2026. What is the best strategy for keeping my income within the unknown IRMAA income brackets? Is this Mission Impossible?

Thank you for your help. I look forward to clarification from anyone.

Jeff Enders says

Jack – the best strategy is to follow the forecasts that Harry describes at the top of this website. IRMAA will adjust by inflation.

The dilemma is that while your AGI for 2023 was “locked in” on December 31, 2023, the IRMAA tranches for 2025 are not “locked in” until Sept, 2024.

Likewise, your 2024 AGI will be “locked in” on December 31, 2024, but the IRMAA tranches for 2026 will not be”locked in” until September, 2025. Look at Harry’s forecast above using a 0% inflation rate and a 3% inflation rate. That will guide you.

jack allen says

Jeff-Thank you for the information and quick response. I will monitor IRMAA projections on the website as you suggested.

Zachary says

This site has proven extremely useful over the last several years in staying out of IRMAA territory for my wife (I am currently 62). I’ve also managed to keep us in the 22% income tax bracket (my refund was $16 this year, so I know my planning is sound). Given that the current historically low tax brackets are set to expire in two years absent congressional action, I am inclined to make as large a Roth conversion as I can this year this year and “eat” the first IRMAA bracket for 2026, while also bumping into the 24% bracket, and depending on the political winds at the end of this year, repeat the process next year and “eat” my own IRMAA bracket when I turn 65 in 2027. Thoughts from the peanut gallery on this approach?

GeezerGeek says

I hope that is a sound strategy because it is what I’ve done the previous two years and plan to do again this year. Next year, I’ll have to start RMDs so I will have to include that in my future plans.

I’ve been doing partial Roth conversions for more than 10 years, primarily to reduce RMDs. When I started doing that, I only did a conversion up to the top of my tax bracket but after the 2017 Tax Cuts and Jobs Act, I started taking Roth conversions to the start of the IRMAA bracket, thus moving into a higher tax bracket but avoiding an IRMAA penalty. However, in 2022, I decided to do a Roth conversion up to the top of the first IRMAA bracket, incurring a 40% IRMAA penalty on future Part B payments and an additional Part D penalty of an unknown, but smaller magnitude. I did the math, assuming that the future IRMAA penalty would be the same amount as the current penalty, and the IRMAA penalty caused about a 4% additional tax on the incremental income above the bracket, provided that the incremental income was all the way up to the bottom of the bracket. That may sound like a wash to most folks but as Powell said “In the long run, the U.S. is on an unsustainable fiscal path.” I expect that tax rates for folks at my income level will increase in the future and will be higher than they were before the 2017 Tax Cuts and Jobs Act.

Jeff Enders says

Zachary – things to think about

1) do you think will consume your entire TRAD IRA in your lifetime? meaning will your rollover strategy plus the money you may need to live on come from the TRAD IRA over your life leaving very little remaining in the TRAD IRA when you pass. If so, sounds like you have a great plan. And I agree that best to be aggressive in 2024 and 2025 as it may be cheaper to pay IRMAA than pay whatever additional tax increases come in 2026.

2) but if you don’t think you will consume your entire TRAD IRA in your lifetime, what is your plan for the rest of the money? if you are going to leave it to your children, they are likely to inherit it in their high income earning years and only have 10 years to distribute it. It may turn out that their tax bracket when they are forced to distribute it is even higher than your tax bracket plus IRMAA. (IRMAA to me is just additional income tax paid via Medicare). And if you leave more for them in a ROTH IRA (which means being more aggressive with rollovers during your life time), then they get 10 years of tax free appreciation / earning on that money. Something to think about

jimdog says

Zachary,

I believe your approach all depends on high big your tax deferred acct. is and how much taxable income you have. If your IRA is under 750M you likely do not need to convert that much over the next two years. However, if you’re lucky to have several million in a taxable IRA, that sounds like a plan.

Ed Fogle says

Am I correct in my understanding that a ROTH conversion is not like a rollover in that ROTH conversion amounts are considered the same as IRA distributions and included in MAGI for IRMAA purposes?

Jim says

You are correct, if you mean “not like a rollover” to another Roth IRA. Also, your RMDs must be taken before you do a Roth conversion.

Hans Heijmans says

Very useful site. I wonder if a typo has slipped in. Some of the amounts in the 2025 and 2026 coverage columns under the 3% inflation assumption are smaller than the corresponding amounts under the 0% inflation assumption.

Harry Sit says

For married filing separately? That’s just how it works. See this previous reply for the explanation.

https://thefinancebuff.com/medicare-irmaa-income-brackets.html/comment-page-8#comment-32775

Hans Heijmans says

Thank you Harry. Still bizarre that it works like that.

Teresa Durden says

Love the comments. I’m doing the same thing over the next few years. Converting a 403b to a traditional IRA to a Roth IRA. Having to pay the next level IRMAA fees. However, with the Roth interest being tax free, this is the way to go, before I have to take RMDs in 4 yrs. And if money left over when I die, my spouse or kids will get money tax free.

FrustratedbyIRMAA says

My wife and I are each 71, living in NYC, both retired fed CSRS employees. Unfortunately, we were a little slow to become aware of IRMAA and higher medicare premiums. We are Fidelity customers. We met with one of their financial advisors asking for any further advice to avoid IRMAA. He did not think a G fund conversion to a Roth was worth it at this point. Last year, due to inflation, we had a lot of taxable interest from regular taxable bank MM funds, which raised our IRMAA. The fidelity adviser recommends we take a large chunk of the bank MM funds and place the proceeds into a deferred annuity. It pays about 4.9 percent for either 3 or 4 years and then goes down to 3 percent. He thought it was wise as the interest is not taxable nor does it add to MAGI on tax return (AS LONG as you don’t ask for withdrawals). It allows only 10 percent withdrawals in each of the first 3 years, After 3 years you can withdraw any amount which is taxable and raises IRMA. The annuity would end when we were 90 if we were still here. I would love to hear from others, in a similar situation who learned the best way to adapt to IRMA. Our RMDS will start in 2025 when we reach age 73. It is hard to adapt to IRMA as the RMDS in the G fund will rise each year. At the end of each year, we have been taking an additional G fund distribution that would keep us from going into the next IRMA bracket. We would love to hear any constructive advice. Thanks

Harry Sit says

I don’t like the deferred annuity idea either. I would consider the NY muni money market fund instead of the taxable money market fund. The tax-free interest still counts toward the MAGI for IRMAA but the yield is lower because it’s tax-free. Suppose you’re getting $5,000 interest from a taxable money market fund and the tax-free money market fund only pays $3,000, you’re getting $3,000 added to MAGI as opposed to $5,000. See Which Fidelity Money Market Fund Is the Best at Your Tax Rates.

jimdog says

Conversions are worth it only if you feel your taxes will be higher in the future than they are today. Taxes will indeed be higher since starting in 2026, all tax brackets jump about 3-4 percent! I’ve been converting my large IRA since I don’t won’t to pay 3% higher taxes. It’s likley a good time for you to convert if your deferred accts are greater than $750,000 and you are not working and not taking RMDs. I don’t think the Fidelity advice was that great. Also, the IRMMA surcharge is adjusted year to year so it’s not a permanent hit. I’m convinced due to higher rates ahead you likely pay lower taxes in the long run by doing some conversions now before RMDs hit.

Jeff Enders says

I will take Jimdog’s post one step further.: Conversions are only worth it if you DON’T believe you can spend / QCD your entire TRAD IRA is your lifetime. if your TRAD IRA is large enough that you can’t spend it all, then attempting to avoid IRMAA or INCOME TAX is a TERRIBLE strategy. Why? because you are letting the TRAD IRA grow which means more money is subject to tax down the road (and income tax rates could be higher on top of that). As you age the amount you must distribute annually continues to increase (figure 4% at age 73 but around 10% at age 90). And then if your children inherit what remains of the TRAD IRA, it is likely they will pay even more in taxes than you would in your remaining lifetime as they are likely to inherit during their high income earning years and then only have 10 years to liquidate the entire TRAD IRA. So any strategy to DEFER taxes further, including avoiding IRMAA and distributing just the required minimum each year related to TRAD IRAs (as taxed can not be AVOIDED can be “fools gold”.

Mike says

Following on to Jim Ender’s comment. I trade in my accounts. A lot. I trade in my Roth’s and in my TIRA’s. I have had years where after I took my RMD my IRA’s, mine and my wife’s, were bigger the following year than the prior year even with the RMD’s because my trading profits exceeded my RMD’s PLUS my Roth conversion amounts. I was losing the war. The question became do I stop trading, or even move to 100% cash, to avoid paying more taxes by allowing the IRA to go to zero. Even going to cash, which means no growth when the market goes up, isn’t perfect because I still get interest on the MM Fidelity keeps cash in. My conclusion was that even if I could never spend it all before we both died I didn’t want to stop something I enjoyed, wanted to be absolutely sure that no unforeseen incident or need cropped up, and I had the money to pay the taxes. We have no children to pass it on to and our wills pass everything to charities. So I stopped Roth conversions. And though I may rail at the IIRMA concept and growth I have less wasted effort to avoid the inevitable rise in taxes.

FrustratedbyIRMAA says

Thank you all for your constructive advice. Jimdog, you said it would not be worth a TSP to IRA to Roth conversion unless the TSP balance was greater than 750K. Our balance is approx. 600K. The fidelity advisor also felt it was not worth a conversion. So far this is how we approached the TSP withdrawals considering IRMAA: In 2022 we each withdrew about 16K to be within 5K of Harry’s basic IRMAA threshold and as a result we have standard Medicare premiums in 2024. Thank you, Harry! However, in 2023, due to high inflation, the 60K we made in bank-taxable MM, plus our CSRS pensions bumped up us up to around 230 K (to the 1.4 IRMAA level). We withdrew about 15k each from each TSP to keep within the top tier of the 1.4 level. As a result, we reduced the total balance in our TSPs, reducing future RMDs (which start at age 73 in 2025). We will have to each pay higher Medicare premiums at the 1.4 IRMAA tier in 2025. I think the biggest cause of future IRMAA will be rising RMDS from the TSP. We can mitigate that by placing our taxable MM into the Fidelity NY Municipal MM fund per Harry’s recommendation but to be certain we have no IRMAA, to reduce the odds of going into higher RMDS at the TSP, and to consider the effect of a very significant tax increases in 2026 unless Congress reverses them, I think the best approach is to each move 100K to a Fidelity IRA and then to our Fidelity Roths. Here is Harry’s predicted IRMA bracket for 2026 based on 2024 income.

1.4x Standard Single: <= $133,000

Married Filing Jointly: <= $266,000 Single: <= $137,000

Married Filing Jointly: <= $274,000

2.0x Standard Single: <= $166,000

Married Filing Jointly: <= $332,000 Single: <= $171,000

Married Filing Jointly: <= $342,000

Here is the tax table for 2024 vs 2026:

2024 2026 2024 Brackets* 2026 Brackets** 2024 Brackets* 2026 Brackets**

10% 10% $0-$11,600 No change $0-$23,200* No change

12% 15% $11,601-$47,150 No change $23,201-$94,300 No change

22% 25% $47,151-$100,525 $47,151-$114,200 $94,301-$201,050 $94,301-$190,325

24% 28% $100,526-$191,950 $114,201-$238,250 $201,051-$383,900 $190,326-$290,050

32% 33% $191,051-$243,725 $238,251-$517,875 $383,901-$487,450 $290,051-$517,875

I think it would be wise to withdraw 100K from each TSP to Fidelity IRAs and then to Fidelity Roths. We would have double Medicare premiums in 2026, but afterward, I don’t think we will have to worry about IRMAA, and the Roths can grow tax-free, and less preoccupation about this entire topic. I don't want to convert more as that would place us in a higher tax bracket What are your thoughts? Does this make sense? Jimdog, since you said it was not worth converting unless your IRA was greater than 750K would it be worth partial conversions of 100 K for each of us, since our balance of 600K is below your threshold?

Jeff Enders says

Frustrated by IRMAA: Please read my comment above. With a large TRAD IRA that is not expected to be distributed in your lifetime, is attempting to avoid IRMAA the tail wagging the dog? The primary strategy should be to reduce the size of the TRAD IRA before it grows and grows, which is what can otherwise occur with a good investment strategy. If the investment strategy results in 7% annual growth, then RMD will not require a 7% distribution until you are 88 years old! Meaning, the trad IRA and hence “the problem” just gets bigger and bigger! and if you are leaving your TRAD IRA to your children, you have passed on this tax liability to them and it can be even worse for them if they inherit in their high earning years, resulting in a higher tax rate than you are experiencing today. IRMAA only adds up to 2%-3% to the overall tax rate. Recommendation: if you have a large Trad IRA, don’t focus on IRMAA, focus on how to convert dollars to a Roth. (p.s. in the “worst case scenario, convert 100% of the Trad to Roth now, and for many IRMAA will never surface again – not recommending this, but just making the point).

Terry says

I don’t understand why $750,000 balance or any specific balance for that matter only makes it worthwhile to do a Roth IRA conversion. I am 74 and did some much smaller conversions than that before I reached Medicare age. Doing so allowed me to have lower RMD’s than I otherwise would have plus any earnings are tax free rather than just tax deferred — not only for me but for my heirs. I wish now that I had done more conversions back then and had not worried so much about moving into a higher tax bracket. The higher tax bracket only affects the income over the bracket level.

RobI says

Jimdog and others. I appreciate all your thoughtful ideas here. I now wonder if there is limit on how much you’d choose to convert in a SINGLE YEAR to prepay taxes in anticipation of future higher tax rates?

Taken to extremes, how high an IRMAA or Tax band would you choose when in converting large retirement accounts to Roth in order to cut future Trad IRA/401k RMD growth? Would you max out marginal income tax to 32% (or even 35%?) and IRMAA to the x3.4 level in years 2024/2025?

(Also worth noting it’s not just tax rates going back up in 2026, but the prior steeper income tax bracket steps above 28% in in the pre 2017 tax code that may hit us hard).

FrustratedbyIRMAA says

Hi jimdog, Thanks again for your very helpful recommendations. I will attempt to summarize your recommendations and Harry’s, to see if my understanding is on target with yours. I believe Harry, based on his earlier remarks to me, recommends transferring our FDIC-insured MM fund assets should be transferred to Fidelity® New York Municipal Money Market Fund – Premium Class. Harry like you is not a fan of deferred annuities. I am a little concerned that putting all this in one non-FDIC MM fund is secure enough, but I think Harry’s advice is very sound. Jimdog, I believe you recommended converting our traditional TSP G fund into our individual Fidelity Roths. The TSP complicates that transfer in that we would first have to roll over our TSP traditional accounts to Fidelity IRAs Then we could transfer the proceeds to individual Fidelity Roths. We already have Fedelty Roths that include the Fidelity Contra Fund and Small Cap Growth fund. I wish to clarify we will attain age 73 in 2025 so if I am correct the RMDS will start in 2025 (probably in April 2025 but I think we should start them earlier in 1/2025 for simplicity) Am I correct? If I am I don’t have much time to make this conversion. Since our TSP funds are approx 300 K each I thought, a 100K transfer would be sensible for each of us for 2024. We could make another transfer in 2025 but I am not sure if doing so in the middle of RMDS starting is smart or not. As of 2036 with much higher taxes likely I think our best option is to avoid transfers in 20236 and try to make them in 2024 and 2025 (if possible in 2025 during RMD distributions. I’m angry at myself for not starting this earlier. I guess my excuse is that the low-interest rates before 2023 kept my eyes off the ball. In any case, I am trying to rectify the situation now, and it is a lot harder than I realized. The fidelity advisor did not recommend the conversions as he felt the TSP treasury G fund is extremely secure with no risk to the principal and he thinks interest rates will soon drop. Even though the G fund is currently relatively high at approx 1.5 percent, he thinks it will drop, and if it does down to let’s say 2 or 2.5 percent then the RMDS would be lower and there would not be the need to make the conversion. In my mind, I don’t think I can count on those rates dropping and it would be sensible to at least make the conversion on about 100k each for my wife and myself and maybe do the same next year if possible during RMDS. While the deferred annuity has no RMDS, the fact I would lose nearly all control of such an investment vehicle and would just add more delayed income that would add more taxable income to a later required withdrawal date makes it a scary choice that I am not comfortable with either. I think it is too based on short-term thinking. Thanks again for your support. FrustratedbyIRMAA

LizaBBBB says

Can get better rates on annuities, if you really want to do.

Jeff Enders says

ROBL – because it is becoming very evident that taxes “remain on sale” for 2024 and 2025, I’ve rationalized myself to the top of the 32% tax bracket and let the IRMAA fall where it may (it adds 2.5% to the tax rate). IRMAA is the tail to this dog. If I can convert my Trad IRA to a ROTH (with some help from QCDs) over the next 8-10 years, I won’t have IRMAA to worry about after that (as Trad IRA balance will be zero) – either my income will be much lower or I am dead! Also, my kids won’t have to pay even higher taxes when the inherit what is left. I am being more aggressive each day I think about this dilemma, fearing Congress will be forced to raise taxes due to budget deficits or they are so evenly divided they will simply permit the 2017 tax cuts to expire. “RMD” is no longer in my vocabulary as my plan is to convert at much higher rates than RMD.

Gary says

Jeff, I find that the answer to Roth Conversions seems to vary for everyone. Not necessarily because their math differs, but because we all seem to have a different objective in mind. Some are minimizing taxes, some are avoiding IRMAA’s, some have inheritance as their main priority.

For us, we start out projecting our net worth over time to age 100, trying different Roth conversion strategies. We include spending, investment returns, taxes, IRMAAs, etc. We are age 71 right now and our optimal Roth conversions produce lower net worth thru age 85 when the tax free investment returns begin to produce increasing net worth values.

While this optimization produces marginal improvements, the real reason we continue to push our conversions is twofold. 1) USA looks like it will need higher tax rates in near future and 2) A surviving spouse will benefit from avoiding their single tax rates as much as possible. So conversions now are kind of like an insurance policy against future contingencies.

Hope this helps!

The Wizard says

jimdog is partly correct on the tax rate arbitrage issue for Roth conversions. But there are additional considerations.

Doing Roth conversions up close to the top of your current IRMAA tier helps lower your RMDs in future years and keep you from going into the next higher IRMAA tier.

Having a good sized Roth IRA gives you flexibility when buying a new car or similar. You don’t necessarily need to incur higher taxable income for the year.

Married couples often like Roth conversions so that eventual surviving spouse won’t be paying way higher taxes…

jimdog says

Frustrated by IRMAA: I too am generally against annuities because of the high fees and loss of flexibility. When I said I didn’t think it was worth it to convert to a Roth if your balance was under 750M, I was assuming you had a more normal taxable balance and smaller level of income. Based on your latest reply, indicating you high taxable income balance, it definitely makes sense to start conversions, before your RMDs and future IRMMA levels kick in. You’re really in the sweet spot for the next several years, if not working, to do those conversions before the RMDs start. Converting up to your highest tax bracket and/or IRMMA level is the way to go to reduce that IRA and have lower taxes in the future. Also, since you have a high balance of MM funds available, pay as much conversion tax directly to the IRS and don’t hold it out of your conversion. That way, you get a much bigger Roth conversion amount. Everybody’s situation is a little different based on income and IRA balances. Good luck

The Wizard says

Roth converting at a higher rate than current or past year sounds like a noble exercise, but it is not.

You could die this year, then what?

So stay the course and just convert enough to levelize your AGI.

Thank me later…

The Wizard says

Also, there’s nothing wrong with paying a little IRMAA to help subsidize poor people; lots of we wealthy retirees pay it to some level.

I’d like to be in the highest IRMAA tier forever (AGI > $500K filing Single) but that’s not gonna happen.

🙁

So anyway…

Terry Koch says

There’s also nothing wrong with trying to save on your taxes.

Ed Fogle says

I already paid a heavy subsidy for Medicare while working. Most anyone possibly subject to IRMAA did as well. It’s a double whammy and extremely unfair.

The Wizard says

Absolutely!

I always strive to pay minimum income taxes, averaged over a few years…

The Wizard says

Extremely unfair?

I’m pretty sure that the basic cost of Medicare doesn’t come anywhere close to paying 100% of what the average cost of healthcare for Old People comes to.

If you’re happy to keep yourself on welfare for low income people, that’s fine.

I’m happy to be paying a healthier percentage of my true healthcare costs.

I’m just glad I’m a wealthy bastard, basically…

The Wizard says

An important point for younger folks who haven’t retired yet is that you need to view your tax-deferred tIRA and 401(k) for what they are: Deferred Compensation, NOT wealth accumulation.

As such, you REALLY want to begin withdrawing some of that deferred compensation in starting the first year of your retirement. In the years prior to your age 73 or 75, those withdrawals can be some combination of money to spend and Roth conversions.

Once you begin RMDs at 73 or 75, those withdrawals will have to go into a taxable account until you complete your RMD for the year.

With proper planning, including QCDs after age 70.5, you can “levelize” your AGI, meaning annual increases of maybe 3% per year, thus staying in roughly the same tax bracket and IRMAA tier indefinitely…

Mike says

Well said. If I had known when I wasn’t yet 65 what I know now, and I am 83, I would have put my money in Roth’s only. But wanting to live a good life I wanted to put as much as I could in any savings and growth vehicle. That is how we get to this point. But now that we’re here the trick is to make the most of the good position we are in. Can you imagine a billionaire, or multi-millionaire, fretting about paying IIRMA? Spending even one minute trying to figure out how to avoid paying 40% or 60% more on Medicare premiums? My view now, since I doubt I will ever have a year where my IRA gets to zero, or even goes down below last year (granted if the market crashes 30% as it has my IRA will go down, but it will be back up a year later, two at most), it’s a losing battle, I’m fortunate, and I’ve got other things to do in the short time Ive got left on earth. This is the kind of thing you need to address when you are 40 and not 60.

Teresa Durden says

In response to Mike’s comment, you can always have your RMD from your financial institution sent to a charity. We give money to our church, so next year we will start having the IRA financial institution send a check and donate pretax dollars to the church. That way, we don’t pay taxes on that money and don’t count it as income. Win, win. Of course, you can’t count it on your taxes as a gift, but we’re not worried about that.

The Wizard says

That’s what’s called a Qualified Charitable Distribution (QCD) Teresa.

I’ve just started doing them myself.

QCDs count toward your RMD if you have one but aren’t included in your AGI. And of course you can’t deduct them on Schedule A, that would be double counting…

Mike says

That’s true, but I live on my RMD and add to it from withdrawals from my Roth.

jimdog says

Based on your age, the amount of your trad. IRA and you taxable income, I would not convert higher than the 24% bracket. Likely converting to the top of the 22% bracket and taking IRRMA brackets into consideration, you will be fine. Do this over the next 5-7 years and you will be in good shape. You can over do it on conversions, so don’t fall into that trap.

Rosemary says

Mike,

I am 80 and was not offered the Roth until 1998. 2012 was the first I could convert to a Roth. I am still doing it as much as I can with out raising

my Medicare premium. My husband passed in 2012 and I disclaimed all of his traditional IRA’s that I have funded for him since 1978. One of the smartest things I could have done. The children are now in their 60’s and can also use it for their retirement and take out more if they choose or continue to take the RMD’s until they die. When I pass they will have mine if any left and a lot in the Roth from my husband’s and my Roths but have to spend it in 10 years but it will not count for IRMA. I have funded the IRA’s yearly for both of us until I had to retire in 2008 to care for him. Only had 10 years in the Roth. My husband was put on 100% disability in 1995 but I continued with the spousal IRA.

I have signed papers for the kids to convert everything if there is any traditional IRA left if I am in hospice and mail it before I die and my medicare premium will not go up. I have enough to pay the taxes on it. It is their choice. My oldest is a doctor and my youngest works in finance as I did. Best of both worlds for me. The bad thing is that interest rates are so high on my savings that I could not convert any last year and probably won’t be able to this year without paying more in Medicare. I gift to them each year and purchase I bonds to keep income down. I am 100% in CD’s and cannot sleep when I was in the market in the late 90’s when making 20-30 and 40% in mutual funds. Balance sheets were not any better and it was all momentum buying. I got out with 8-9-and 10% CD’s and went out as long as I could and still do that. I do not have the income that many of the readers in the blog have but we built a new home in 2010, and bought everything new and I have everything I could ever want, and do everything I would like to do. I am sure that with all of the information given you have a lot to think through but you can’t make a good choice without good information .

FrustratedbyIRMAA says

Hi jimdog,

Thank you for recommending a Roth conversion and not a deferred annuity. I thank Harry for recommending the NY municipal bond money market fund and also advising the avoidance of a deferred fixed annuity. We are now closer to making an educated, smarter decision with the help of people like yourself on this site.

Please see the attached correspondence with our Fidelity advisor, influenced by your advice, and his response. Jimdog, When converting to a Roth can we take our converted assets and place them in a Roth established years ago or must we open a new Roth? I am also getting conflicting opinions on the possible taxation of converted assets for 5 years following conversion. What is your opinion?

Hi *******,

*****and I just found out about the substantial personal tax increase slated for 2026 when the current lower rates expire unless Congress extends them.

The TSP G fund is now at 4.37%. Although it may go down somewhat, we’re concerned we’ll end up with high RMDs each year if the principal stays high. We’re thinking maybe a partial TSP to traditional IRA to Roth conversion, perhaps 100,000 or more each, may make sense. We will incur high taxes and IRMAA, but this may be the time to do it rather than 2026 or later when taxes could be substantially higher. Would we be able to add these amounts to our currently existing Roth IRAs?

We don’t feel that comfortable with the deferred annuity idea, because we would have much less liquidity and we would be subject to additional taxes and IRMAA whenever we withdraw from the annuity. We also prefer to keep more assets in cash because we plan to spend more going forward.

Moving a substantial amount of cash into the Fidelity New York Municipal Money Market Fund – Premium Class or similar fund may make sense even though the interest would count towards IRMAA (but less than if we left it in our higher yield taxable bank money market accounts). Do you think our assets would be secure enough there?

Summary:

Our ultimate goal is to reduce our RMDs, taxes, and IRMAA while maintaining full access and control of our assets. We’re willing to pay increased Medicare premiums and taxes in the short term if they can then be reduced as quickly as possible. We want to keep things simple and as stress-free as possible while maintaining or even enhancing our lifestyle in retirement.

We look forward to speaking to you at our next meeting to further refine our investment plan.

Thanks for all your help!

Regards,

*******

———————————————-

His response.

Yes if the potential increasing RMD is a concern- rolling portion to Traditional IRA will allow you to strategically make Roth conversions to lower future RMD. Existing Roth IRAs can be used for this. You would first need to roll over to a Traditional IRA and then convert to a Roth.

As for the annuity, this would be the only way to defer taxes to avoid IRMAA. If liquidity is most important to you, then we can use a NY municipal money market where the interest is federal, state, & local tax-free. I agree, at the very least this would put you in a much better position than being at the bank.

You also have your NY Municipal Bond option that I believe made sense to you for some longer-term tax-free interest payments & potential growth as rates move lower.

In summary:

If the annuity terms (3,4,5 years) make you uncomfortable, then I would keep things very simple with fully liquid options like a tax-free money market & the option of buying NY Municipal Bonds which can also easily be converted to cash at any time (if this is still something you are comfortable with). This will give you plenty of liquidity you need to be comfortable, lower your taxes, & provide some potential to get higher tax-free rates for longer with flexibility and some growth potential. The only concern this will not address is our IRMAA issue as they still recognize tax-free income as income. However, we can try the Roth conversion over time to lower future RMDs as a way to try to bring income down in the future.

If this makes sense to you both, I would recommend coming in for the next meeting where we can start the consolidation process and start getting you in the right money market position to lower your taxes for this year. Let me know what would work best for you! Hope this is helpful!

Regards,

———–

Jeff Enders says

FrustratedbyIRMAA –

once you turn 59.5 years old AND you have had a ROTH established for five calendar years (so opened prior to 1/1/20), NOTHING in the ROTH can be taxable. Doesn’t matter if you have multiple Roth accounts or just one – it’s the oldest one that satisfies the five year requirement on behalf of ALL YOUR Roth accounts.

When taking a distribution, the IRS assumes that all contributions are distributed first (no tax since it is all contributed to the Roth after tax), then all conversion dollars are assumed to be distributed 2nd (also after tax money, so no tax possible) and then the earnings are distributed last.

There is a 10% penalty on those conversions that have not been in the Roth for 5 years, but the penalty is 0% once you are 59.5 year old and ANY Roth in your name has been opened for 5 years.

The earning (the last bucket to be distributed) is subject to tax only if the Roth has not been established for 5 years. And it is subject to the 10% penalty if you are younger than 59.5 years old.

Harry Sit says

Traditional and Roth IRAs are in one individual’s name. If one spouse has a Roth IRA and the other doesn’t, or if one spouse has had a Roth IRA for at least 5 years but the other hasn’t, you should also pay attention to whose IRA you’re converting to Roth. The spouse without any Roth IRA now should convert $100 to get the five-year clock started.

FrustratedbyIRMAA says

Hi Jeff and Harry,

Both of you explained the 5-year rule in simple and easily comprehensible language. Very impressive!

–Harry, both you and the Fidelity advisor recommend the Fidelity NY municipal bond fund. While the rate is low the tax equivant yield is high and the amount of IRMAA is lower. Do you think it is safe to move almost all our FDIC bank higher yield MM accounts into this one fund or would you break it up into several similar funds? And if so what names would you recommend?

–The fidelity advisor recommended a portion of the money be placed in a NY municipal bond fund as he thinks rates will drop giving us capital appreciation ( would this make sense as it also raises IRMAA?). If yes which fund? For simplicity maybe a Fidelity fund would be best.

The Fidelity advisor recommended a Deferred fixed annuity sold by Fidelity but is the product of USAA, NY Life, or Mass Mutual. We don’t like the restrictions, the lack of access. We like that it does not pay RMDS, but dislike that the withdrawals are taxable and create IRMAAi, and it would create a tax headache for our son when we pass. Nevertheless, do you think a portion should go into one of these funds? I’m pretty sure the answer is no.

–Before we create the Roth conversions, Harry said Turbo tax can figure out if the conversion is worth it. We did our taxes on Turbo tax. but is there a special version of Turbotax that allows this calculation, or perhaps a spreadsheet?

–Lastly, we want to do the conversion this year and maybe next, to avoid the big tax increase in 2026. However, in 2025 we both attain age 73. I read we could start our RMDS in April 2026, the year after we attain age 73. So can we and do you recommend we make a sizable Roth conversion in 2024 but also in 2025 to try to spread out and thus reduce the amount withdrawn from our Trad IRA, that is from higher tiers? I think the conversion will be easier in 2024. What is the best way to do the conversion in 2025?

You guys are fabulous. Thanks for your assistance!

The Wizard says

While you can postpone your first RMD until April of the following year, you cannot legally do any Roth conversions until your RMD for each year is completed.

So no, that plan won’t work…

Harry Sit says

I suggested that you might consider the NY muni money market fund because it gives you more room for IRMAA. You still effectively pay the regular tax in the form of a lower yield but less income is counted toward the MAGI for IRMAA. If you’re concerned about it being 100% in NY muni money market instruments, there are also national tax-exempt money market funds. These national funds are taxable for NY state income tax but they’re more diversified.

I get the impression that your Fidelity advisor wanted you to buy individual NY muni bonds not a NY municipal bond fund but maybe I read his reply wrong. Either way, whether doing so raises or lowers IRMAA depends on where the money is right now. If it’s in a bank savings/money market account, the income from individual NY muni bonds or a NY muni bond fund may be lower or higher. Both have a higher risk than a bank savings/money market account though. I’m not a financial advisor and I don’t know your overall asset allocation or risk tolerance. I can’t say whether it’s a good idea to buy individual NY muni bonds or a NY muni bond fund. Maybe you should take a higher risk, maybe not.

The “What-If Worksheet” in TurboTax helps you figure out the extra taxes when you convert to Roth. See how to use it in Tax Planning with TurboTax What-If Worksheet: Roth Conversion. Only the TurboTax downloaded software has it. If you used (and already paid) TurboTax online, sometimes TurboTax support can give you a copy of TurboTax download software to import your data from TurboTax online.

jimdog says

FrustratedbyIRMAA, While the turbo tax is great for a current year ahead look there is another tool I find to be very helpful for multiple years out, especially the next 3-10. That is the newretirment.com planner. You can get a 30 free trial to this software or buy it for a year at $120. It takes about an hour to input everything and then start running the various modeling outputs. I think if you plug in all of your income, assets and deferred accounts, based on the size of your IRA, you will see the software will indicate you need not take such a high amount of conversions these next two years. If you do make those 100,000 conversions, I think you possibly will likely pay more tax than stringing out the conversions for the next 7-10 years, even at the higher rates starting in 2026. I say this because your current tax deferred acct of 600M is not all that large to make such big conversions. It will just through you into a higher bracket than you need. The software allows you to choose the higher rates starting in 2026 or to stay with the current lower rates. Some believe if Trump is elected, the rates will stay unchanged. If that were the case, you would have converted way too much. Just food for thought. I encourage you to input your numbers in the newretirement planner and see how much it tells you to convert in the next 7-10 years to pay the lowest amount of tax.

Mike says

Postponing to April of the following year will mean taking two RMD’s in that year which could put you into a higher tax bracket plus maybe putting you into the next IIRMA tier.

Assume your IRA is $1,000,000. At 73 your divisor is 24.7 and at 74 it’s 23.8.

If you take the RMD at 73 your RMD is $40,485.83. At 74 it’s $42,016.81 or $1,530.92 more. But delaying into next April means also taking one in December. Using the same million, assuming your IRA didn’t grow bigger, your total RMD would be $84,033.62. And that’s just on one of your IRA’s. The IRS likes people who let it slide to April.

Depending on your other income, Social Security and Pension, maybe some interest from investments in a taxable account, that extra income could push you into a higher IIRMA level.

Frustrated by IRMAA says

Hi Jimdog,

We were about to try a 14-day trial subscription to the newretirement.com planner, the $120 version, as it seems like the ideal Roth conversion planner. We watched part of a DIY Roth Conversion Planner with New Retirement, which seemed easy enough at the beginning but soon felt like it was more geared toward professionals. Any chance you know of a concise DIY online tutorial that would lead us to make reasonably smart conversions for the next 2- 7 years? Larger conversions for 2024-2025 seem smart but only if 2026 taxes return to pre-trump tax levels. It seems to me that Dems and Repubs are avoiding this issue. Thanks! Frustrated by IRMAA.

Frustrated by IRMAA says

I have a question for Jeff. I may have misunderstood him. I was under the impression he said earnings withdrawn from a converted Roth in less than 5 years do not have penalty or taxation if the Roth owner is over 59.5 and the owner had an earlier Roth established many years ago as we have. We are close to doing Roth conversions (TSP to IRA to Roth) now. We are each age 71. Fidelity says Roth IRAs must meet the 5-year aging rule before withdrawals from earnings can be taken tax and penalty-free. Failing to meet the 5-year rule can result in taxes and penalties. I’m not certain it is worth it for us to do Roth Conversions at this point in our lives if we must wait a minimum of 5 years before we can withdraw earnings from Roth Conversions. But it appears that withdrawal of contributions is tax and penalty-free. Any clarification would be most welcome. Thanks, Frustrated by Irmma

Harry Sit says

If by “Fidelity says” you mean the Fidelity advisor who first suggested a deferred annuity and then suggested individual munis, I have a bad feeling about this advisor. Maybe you should stop asking him for advice. The rules are in Roth IRA Withdrawal After 59-1/2.

Jeff Enders says

Frustrated by IRMAA: Look at the definition of a “qualified distribution” on page 31 and then the chart on page 32. If the distribution meets the definition of a “qualified distribution”, there can be no tax.

Page 31:

Per rule #1, if the money is distributed 5 calendar years after the Roth was opened and, per rules #2, you are over 59.5 years old, it is a “qualified distribution”. And if it is a “qualified distribution”, it is tax free and penalty free by definition of a “qualified distribution”. Follow the chart on page 32.

https://www.irs.gov/pub/irs-pdf/p590b.pdf

So let’s say I am over 59.5 years old and my Roth IRA was established over five years ago. I do a conversion today, invest the money in a stock that ‘shoots the moon’ tomorrow. I sell and distribute the money from the Roth IRA the next day. Since the distribution occurs when I am over 59.5 year old and after my Roth IRA existed for five calendar years, that distribution is a “qualified distribution” and by definition not subject to tax or penalty. Conversion to distribution is three days! No TAX!

What do you mean Fidelity said differently? even their web site is consistent with my explanation:

https://www.fidelity.com/learning-center/smart-money/how-does-a-roth-ira-work#:~:text=If%20federally%20tax%2Dfree%20retirement,open%20at%20least%205%20years.

the 10% penalty disappears once you are 59.5 years old – that is true whether a Trad IRA distribution, a Roth distribution, 401k distribution, etc.

If you are 71 and just now establishing a Roth, then here is what occurs. Those conversion dollars are tax free to distribute whenever you want; they were after tax contributions to begin with. And the IRS assume that distributions occur in this priority order: 1) Contributions (all after tax), 2) Conversions (all after tax), 3) earnings.

But until the 5 years passes the EARNINGS are indeed subject to ordinary income tax (since they don’t meet the definition of a “qualified distribution” There is no 10% penalty since you are over 59.5 year old. But think about it: what are the chances in this scenario that within 5 years, you decide to distribute all the conversion dollars (which are tax free) and would be facing distributing the earnings? Remember the earnings are only distributed after all the conversion dollars are distributed.

does that help?

Frustrated by IRMAA says

Jeff, I was surprised today when an email from our advisor informed us, ” Note that in order for earnings in Roth to be tax free, amount converted must stay in Roth for 5 years.”, as he was aware our earlier contribution-based Roths were established more than 5 years ago. Perhaps he forgot. I should have reminded him first before contacting you. In any case thanks for taking the time to provide the IRS flow sheet documenting that any earnings from Roth conversions at this point, at our age, are free from taxation and penalty due to the earlier Roth established more than 5 years ago. That was very comforting. Thanks, to you, Harry, and the other very informed participants on Harry’s site. Frustrated by IRMMA.

FrustratedbyIRMMA says

Hi all,

Jimdog, thank you for your recommendation to try the new retirement planner.

Our total TSP balance for both of us is approx 600K. We will both be 75 in 2025, the date RMDS begins. We crunched the numbers, and using the software we think the following conversions are sensible for us, so half these amounts would be for each of us. We would appreciate constructive feedback, pros and cons. We realize we should have done this at ages 60-62, but better late than never. The results assume the tax cuts sunset at the end of 2025.

Roth conversions: 2025 – 308K, 2026- 257K, 2026- 46K Most importantly, we would not be leaving my wife and son a big tax headache by dealing with this problem now. Yes, we will have high taxes and IRMAA for a few years, but hopefully in the long run it will be worth it. Regards, Frustrated by IRMAA.

jimdog says

I’m surprised the new retirement planner models you make that high of Roth conversions, especially in these next two years. Apparently the model sees you have large excess cash flows over expenses that makes the model do this. Again, in the long view, conversions are only worthwhile if it allows you to pay lower taxes today than you will in the future. You will be pushed into an extremely high tax bracket these next two years, plus IRRMA, resulting in significant tax. Therefore, be sure that not taking those conversions over the next 8-10 years will give you a lower tax burden. Good luck.

Jeff Enders says

Jimdog – I guess I would extend your comment that “conversions are only worthwhile if it allows YOU to pay lower taxes today than YOU will in the future”. Rather, it would be better to state that “conversions are only worthwhile if it allows YOUR FAMILY to pay lower taxes today than YOUR FAMILY will in the future”

if YOU do not consume the trad IRA for living expenses over YOUR life, then typically it would be inherited by the adult children, who could be in their higher earning years. In that scenario, liquidating the TRAD IRA over 10 years could push the children in a much higher tax bracket than you would be in today. And leaving the money to these beneficiaries in a Roth would eventually come with 10 years of tax free appreciation that an inherited TRAD IRA does not afford.

thoughts?

Gary says

I have always been uncomfortable with the criteria that lower taxes is the goal. For example, Taxes for heirs has been discussed as another consideration. Surviving spouse is another.

But I would generalize the criteria to be improved future net worth as a more encompassing criteria. Lower taxes is nice, but only if your net worth improves when considering things like time value of money, etc.

JimM says

jimdog,

Roth conversions can make sense if the tax rate paid on the conversions is not higher than the tax rates the taxpayer would pay in the future. The future tax rates do not have to be lower than the conversion tax rates. A Roth conversion can make sense when the conversion tax rate will be the same as future tax rates. There is no tax advantage or disadvantage when the tax rates are the same. However, having funds in a Roth account provides future income tax flexibility to the retiree allowing them to make tax free with withdrawals without increasing income tax rates.

Paul G says

If you’re both going to be 75 in 2025, won’t you have to take RMDs prior to 2025? Is there some special rule for TSP that doesn’t apply to other retirement plans?

Frustrated by Irmma says

Sorry, we will be 73 in 2025.

IRMAA Needs to Go says

Why going all Roth doesn’t

always lead to tax savings:

Let’s take the example

of a couple with $70K in

tax-deductible medical expenses

(above the 7.5% threshold and

above their standard deduction).

These expenses could easily be

home-care expenses not covered

by medicare or other plans,

and assume they don’t have a long-term

care insurance plan (or one that

actually pays benefits when needed) either.

This is NOT very unusual.

Assume they are in 30% marginal

(federal and state) bracket

for any traditional IRA

distribution. In fact, doing

a Roth conversion might

actually push them into

a higher federal (and/or state)

marginal bracket but here I will

assume they stay at 30% combined

for any funds distributed

from the trad IRA.

They start with $100K in

a traditional IRA. If they

converted the $100K to

a Roth IRA in a previous

year, they will have paid $30K

in taxes, so will be left

with $70K in a Roth IRA.

The medical expenses will consume

the entire Roth IRA.

If instead, they had left

the money in the traditional IRA,

they could take only $70K as

a distribution to pay for

the medical expenses, leaving

$30K in the traditional IRA.

If desired, they could take

the distribution, pay $9K

in taxes, and have $21K

spendable (or convert it

to a Roth IRA and have $21K

in the Roth IRA).

Chasing every last dollar

out of traditional IRAs

may seem rewarding to those

who despise taxes, but as I

have shown, there are real

situations later in life

where having a balance

of Roth and traditional

IRA funds to tap provides

potentially greater net

benefits.

Yes, IRMAA needs to go. It’s

not going anywhere, and if I had

to guess, I’d say it might

actually increase as they search

for ways to shore up Medicare.

But no one “knows”. So

be careful out there when it

comes to going all-in on Roths —

it could end up costing you or

your heirs real money. Moderation.

Jeff Enders says

Frustrated by IRMAA – remember that you must satisfy your RMD before you can do a Roth Conversion. At your current age, your RMD is zero, but once you turn 73, your RMD is approx. 4% of your TRAD IRA balance and the percentage will increase each year (will be around 10% at age 90).

Ed Lavallee says

Just want to say I find your website invaluable. I have been coming here for information for many years now. Its the most current in terms of IRMAA. Thank you!!

Joe Taxpayer says

Excellent info.

For me, it’s less about the actual dollars than it is how these cliffs work. Most of us look at marginal rates and choose to convert to Roth, or just withdraw, amounts aimed to top off a bracket. Go over? Ok, so the last $1000 or 2 gets hit with 24% instead of 22 (for example).

With IRMAA, the effective tax on the amount in excess can be greater than 100%. Go over the line by $10, but pay an extra $1700? Yikes.

Jimdog says

I hear your concern , but rest assured, inflation is here to stay. The government is spending trillions!

RobI says

IMHO not worth taking out a few thousand too much to what I’d call achieve unnecessary precision.

I play it safe until December of current year then make and end of year catch-up withdrawal for conversion to maximize vs this years brackets. I’m typically under by a few thousand in follow on year but that doesn’t bother me in long run .

Ros says

Just a comment to plan ahead for when there is a death. I don’t know why I did it but I had a feeling and took my name off from a large joint account 5 days before my husband passed. The kids were able to inherit it. A surviving spouse can do as I did. In 2012 when he passes I also disclaimed his retirement accounts. I was counseled against it by everyone and it was one of the smartest things I did both with the large account and his retirement accounts. The kids are going to get it anyway and they were in their 50’s and are able take out the retirement accounts during their lifetime. Now the timeline in affect is 10 years

The kids were in their 50’s.

I only have to convert mine now each year. There will be a lot less for them to pay taxes on if I don’t get it all converted. I retired in 2008 and was only offered the Roth for 10 years. Now they will not have a lot if any to count for IRMAA.

Bruce C says

Hi

I love this website but I am scared to literally use even the 0% projected values for 2024 income planning. In the past year, i used the 0% numbers to provide a buffer beyond using the existing, published IRMAA brackets. Missing the IRMAA bracket by $1, causes increased Medicare premiums of $100/person/month or $2400/yr. Ouch!

Question –

How have these projected IRMAA brackets tracked vs reality in the past 10 years. I like your methodology, but I would be a bit more aggressive using them if I understood how close you have been.

Ros says

I figure my income in July. Then again the first of Dec. The first 10 days of Dec I take my RMD and then figure out my yearly income adding the Dec.’s interest that will be posted the end of the month and do my Roth CD the 3rd week of Dec. Because I do mostly CD’s and am able to add the conversion to an existing Roth IRA the first of the year and they are quite high at this time, if rates are not higher I add it an existing Roth IRA or get all new ones. Most Credit unions will allow closing of a Roth IRA without penalty if you are over 59 1/2 even if you are closing it to get a higher rate. So the first of Jan I have a choice to make. Just ask the bank or credit union if they will allow it or match rates someplace else. I spit a Roth IRA a year ago in July because it was no longer going to be insured when the next interest rate was added. As soon as it was added I split in 2 and both the other places had higher interest rates One matched the first credit union. So I went out and got as many years that I could. I have done this since 2012 ( but have always chased CD rates since my first Christmas club in 1950 while in first grade) and I have never gone over what Harry has put on his site and never paid over the normal Medicare charge. The middle of Dec Harry will publish the final numbers if it changes. Harry’s numbers have always been very accurate.

J J in Texas says

I am sure that author Harry Sit could look back at previous iterations of this post to see how close his past predictions were. I have only one year’s experience of following his predictions very closely when we wished to realize a large amount of taxable income. That was in TY 2021, looking forward to 2023. We file MFJ and wanted to come in below the 1.4x bracket. I was aiming for MAGI of $244,000 (and came in just under), I don’t remember if that was Harry’s prediction at that time or not. In actuality, that 2023 bracket came in at $246,000. All was good. I was able to fall pretty close to that cut-off, and was delighted not to go over by a few dollars. A big, big thank you to Harry Sit for his website. It’s one of the best financial resources on the internet.

Harry Sit says

The IRMAA brackets were hardcoded by law between 2011 and 2019. No projections were necessary during those years. They started adjusting again in 2020. Using the same methodology to project at 0% with the latest CPI number known as of December two years prior, we have these results (only showing the first bracket for single):

2020 (2018 income): projected $86,000 actual $87,000

2021 (2019 income): projected $88,000 actual $88,000

2022 (2020 income): projected $89,000 actual $91,000

2023 (2021 income): projected $95,000 actual $97,000

2024 (2022 income): projected $101,000 actual $103,000

2025 (2023 income): projected $105,000 actual ?

2026 (2024 income): in progress

Because inflation has been positive in these years, the projected numbers at 0% were higher than the published numbers for the previous year but lower than the actual numbers announced 9 months later.

Gary says

Jim, you mentioned that one needs to take RMDs before taking Roth Conversions. I will be in this situation next year, planning to do both actions.

Question: Does this mean I cannot move the Roth Conversion funds to a Roth until after I have completed taking my RMD money? Or does the IRS simply want you to classify the two amounts correctly for year end filing?

Left to my own devices, conversions early in the year with RMDs late in the year. Thanks!

The Wizard says

Jim is correct.

So complete your RMD for the year however you please and then do whatever Roth conversion you want before 12/31…

jeff says

You MUST satisfy the RMD prior to a Roth Conversion as stated in the IRS publications! See IRS publication 590-b (page 6 – lower left):

https://www.irs.gov/pub/irs-pdf/p590b.pdf

“Distributions not eligible for rollover. Amounts that must be distributed (required minimum distributions) during a particular year aren’t normally eligible for rollover

treatment.”

Since the RMD obligation is created on January 1 and that minimum must be distributed, then there are no dollars eligible for rollover treatment (and a Roth conversion is a form of rollover treatment) until the RMD is satisfied.

Gary says

Jim/Wizard/Jeff….Thanks so much for making me aware of this before I begin my first RMD year in 2025. It is very helpful as I can managed my 2025 maturities better when my CDs renew this year.

Just another example of the deep learning curve for retirement these days. This is our 18th year of retirement, and even with a lot of research beforehand, we are still discovering new things. Both of our parents lived off social security & pensions and filed easy tax forms. Life has gotten more complex.

Nancy Memmel says

But your devices would have the effect of lowering your tax bill- and we wouldn’t want THAT…

Mack says

Quick question regarding the SSA-44 form. If you retire mid-year (say 6/24), does the income cap for IRMAA in 2024 have to meet the 2022 cap? I’m assuming my 2024 needs to capped at $206k, and then 2025 needs to be capped at whatever the 2023 top is before being able to move 2026 income to your calculated 2026 limits. Am I confused?

Tom P says

Mack, when I retired mid 2020 my income from 2020 had to meet the IRMAA cap from 2018, so your statement is correct about 2024 income meeting the 2022 cap.

However, since my income dropped significantly in 2021 due to 2020 retirement I filed form SSA-44, and doing so my 2021 income was used for IRMAA calculations for 2021, 2022, and 2023, which saved a lot since my income was much higher in 2019 and 2020 (IRMAA years 2021, 2022).

The Wizard says

Jeff is correct about RMDs and rollovers.

Aside from Roth conversions, the other type of rollover is a nontaxable one from one tax-deferred account to another, often from a 401(k) to a tIRA, or between tIRAs at different custodians…

Mack says

Right Tom P. Originally, I was targeting $214K-$220K per the articles’ guidance, and then realized that the SSA-44 form may impose the $206K threshold. Thanks for confirming my suspicions.

Teresa Durden says