[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

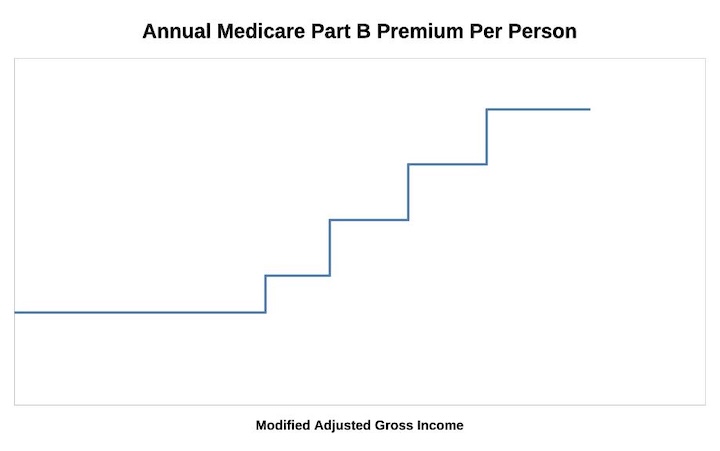

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jeff Enders says

As a long time Turbo Tax user myself, there is nothing special or unique about the answer to your question. Simply enter the 1099 you receive as you normally would.

Turbo Tax will ask you what you did with the money and that is where you will respond that some went to satisfy QCDs and then the dollar amount.

There is no tax reporting requirement to confirm that you satisfied the RMD prior to doing a Roth Conversion. In fact, if both come from the same Trad IRA account, there may not even be separate 1099s as both transactions are taxable events.

Further, I would suggest that since this is a IRMAA Community Board that questions about tax reporting be posted on the Turbo Tax community board – I suspect you’ll get better responses from tax experts that way.

https://ttlc.intuit.com/community/home/misc/03/en-us

Gary says

Jeff, that’s the way I understand the 1099 reporting too. I did some research with my brokers, because 2025 will be my first RMD year. It appears that the only enforcement of the RMD before Roth Conversion requirement, is your conscience and your next IRS audit. There is no reporting to the IRS of the dates of these events, only their published 1099s.

Ros says

I have done Roth conversion since 2012 except for last year. It is mentioned in a 1099 as a distribution and taxable amount. You have a choice of them paying the tax or not. You have a choice with your RMD if you want taxes withheld also when you start that.

Jeff Enders says

Gary, that would be correct- it is your conscience and if the IRS audits you.

Because you may have IRAs at different firms, all an IRA Trustee can do is a) remind the client that RMDs must be satisfied prior to doing a Roth Conversion each year and b) ask their client whether they have satisfied the RMD prior to executing any Roth Conversion request.

Gary says

Jeff, that’s the way my brokers described it too. In fact, their form for requesting a Roth conversion will have a check box for you to sign, designating that you have already met you RMDs. 😀

Ros says

If they took the taxes out that amount will be in the box.

Ros says

Best not to have the taxes take out of the conversion. Pay they separately and put of the conversion in the Roth. Use TAXABLE FUNDS IF YOU CAN. Don’t defeat your purpose.

Paula says

Well, my IRA trustee won’t let me do an Roth conversion before I take my RMD. I suspect this is common.

ros says

Before you do a conversion or move your traditional IRA to another place you have to take

the RMD.

I take my RMD in the 2nd week of Dec and the next day or week I do the conversion. They put the conversion into a Roth Savings and the first week of the year I put it in a existing Roth CD if the interest rate is good with the them that they allow in Jan otherwise I shop for a better rate. I am in my 80’s, and doing it for the kids who are in their 60’s.

Nick says

Harry, I always look forward to your monthly updates. Timely and accurate.

The only suggestion I would have is to add a decimal to the data once 8-9 data points are in

This might provide a clearer picture of where the average might fall after 12 data points.

for example, is 200 for the 2.6X standard really 199.5 or 200.4 ? Just to see where the margin is at on the plus or negative side of 200

Thanks

Nick

Jeff Enders says

Nick – I am just curious…. why would it matter? 2023 MAGI is “locked in”. So whether the final 12 month number for 2025 is $199,000 or $200,000, what action can individual take to change the 2025 IRMAA tier they land in? I don’t think there is one.

again, I am just curious what one would do with that additional information.

The Wizard says

Jeff,

Correct about 2023 income and 2025, so we’re not looking at that. We’re looking at 2024 MAGI and how it will impact IRMAA in 2026…

Jeff Enders says

The Wizard, the $200k that Nick asked about is the 2023 income / 2025 tranche for 2.6x…..where there are 10 actual datapoints.

we have no “locked in” 2024 MAGI and no datapoints for 2026 IRMAA … so that isn’t the 9-10 actual datapoints Nick is asking about.

At the 2.6x tranche for filing Single, Harry currently projects $200k / $200k for 2025 IRMAA (10 actual datapoints) and projects $202k / $206k for 2026 IRMAA (-0- actual datapoints).

Nick says

To Jeff, you are correct about 2023 income being locked in but, the 2025 IRMAA is not.

So I use the 2025 IRMAA estimate at 10 data points to best gage how much room I have now (lets say Q3) rather than wait till the Oct/Nov final official release from Medicare. For example, might prefer to do another Roth conversion now rather than wait till October, since my stocks or bonds might trade at a higher value in 3-4 months

So knowing whether Harry’s number (estimate) is 199.5 or 200.4, that is $900 of ‘spread’, and could be useful to know now.

The other reason is Medicare rounds off to the nearest $1000. Lets say it was $200.3, and Medicare rounded to $200. Knowing it was 200.3 vs 199.5 gives me greater certainty for the following year’s IRMAA estimates, if I just assume a 3% increase on both values for the next year ( 200.3 gives 206.3, whereas 199.5 gives 205.485 which in Medicare’s eyes would yield 206 rounded, or 205 rounded. (assumes Medicare’s starting point is decimal based and not rounded, that I do not know !).. I know, a little picky, but am borderline at the 200 level, so try to maximize my Roth conversions, and maintain income at < 200K

The Wizard says

Nick,

It seems like you might not understand how your MAGI for various years impacts your IRMAA for various years.

While it’s true that we have just ten of twelve monthly inflation numbers as of today for 2025’s IRMAA adjustments, there’s nothing actionable that you can do at this time to tweak your 2023 MAGI; that ship sailed a while ago.

You mention doing Roth conversions in the next few months. That’s fine but that will impact your 2024 MAGI and eventually determine your 2026 IRMAA tier.

What I do is wait until mid December once we have the first three monthly inflation data points for the next IRMAA adjustment cycle. I then have a good handle on my income for the year and then do a modest Roth conversion to get my MAGI up close to but not over Harry’s 0% projection.

This is the best that we can do under the circumstances…

Jeff Elders says

The Wizard – exactly my point. Thx for articulating so clearly!

Chris says

IF you are needing to know whether the number is 199.5 or 200.5 you are just playing with fire and will get burned eventually. Spend your time on something more productive and just stay under the 0% estimate.

Nancy Memmel says

I guess it depends on just how critical it is to you to remain below that threshold. We, too, are strategizing to convert but are targeting for an income that is a couple thousand below where we think inflation is going to take the tier values. If we turn out to be wrong when the the values a re announced in fall, it isn’t a disaster, being for 1 year, and we may just increase conversions to fill more of that tier. (If you land in a tier, you may as well be near the top of the tier as just a dollar over the threshold!) More important to get the conversions done than avoid all IRMAA, though ideally we’d like to do both, and this is the project of only a couple of years more, not something we’ll have to work at for decades.

The Wizard says

In reply to Nancy:

When the new IRMAA tiers are announced this October, they are the tiers for 2025 based on your MAGI in 2023. So if you were $10 over a tier threshold, you can’t just go back to 2023 and do additional Roth conversions to get up close to the next threshold.

Instead, you’ll need use Harry’s estimates this December to get your 2024 MAGI up to where you want it based on reasonable projections of where 2026 IRMAA tiers might be…

Nancy Memmel says

My strategizing is for 2025 conversions, using the soon to be announced 2025 tiers as proxies for eventual 2027 tiers, assuming minimal inflation, and allowing for a couple thousand in surprise LT capital gains distributions.

Nancy Memmel says

I do see your point.

My “filling up the tiers” comment was for 2025 , assuming the 2025 thresholds announced are lower than we had anticipated at the beginning of 2024; then 2026 & 2027 thresholds would also be lower than we expected at the beginning of 2024 (when inflation was really roaring ) and assuming minimal inflation past 2025. Since we want to get the conversions done through 2027, we may bite the bullet and get more moved in 2025 , even incurring some IRMAA, since we would be in a better position to pay the extra taxes from converting from cashflow before an expected retirement. The retirement itself would be a basis for an appeal, in which case it would be really handy to have that 2027 appeal income at ongoing retirement levels, below the IRMAA threshold.

Frustrated by IRMAA says

The Wizard waits until mid-December “once we have the first three monthly inflation data points for the next IRMAA adjustment cycle” to process a Roth conversion. We have traditional IRAs with Fidelity who suggest calling their service department to make Roth conversions earlier as they are incredibly busy at that time. Any suggestions for making it easier to get this done with Fidelity at that time?

Gary says

My approach is somewhat conservative. I do a partial Roth conversion earlier in the year, saving the remainder of my planned conversions for December. At that point, I have a little better handle on future IRMAA brackets as well as current year tax income. I then execute my last Roth conversion leaving myself a buffer for additional surprises. With rate of inflation decreasing, I use a $8K buffer so I sleep well at nights. Your buffer and sleep selections may vary. 🙂

The Wizard says

In reply to Frustrated, I would be almost certain that Fidelity has an online form for doing a Roth conversion from a Fidelity tIRA to a Fidelity Roth IRA.

That’s how I do it at TIAA and it works fine, no phone call required…

Jim M. says

Frustrated by IRMAA,

The Wizard is correct. Fidelity.com has an online function that makes it easy to transfer of funds or in-kind shares of securities between your Fidelity accounts. I have used it multiple times and it works well for requesting transfers from a T-IRA to another T-IRA , to a taxable account, or to a Roth IRA account for Roth IRA Conversions. When requesting a transfer from a T-IRA to a taxable account or to a Roth IRA account, Fidelity will advise you that you are requesting a taxable distribution, and ask you if you want to have income taxes withheld. Fidelity allows up to 99% of the transaction amount to be withheld. I do not have taxes withhold when doing Roth IRA conversions . I prefer to execute separate transfer requests for tax withholding.

The online transfer request function will ask you if you want to transfer cash or shares. Fidelity will display a list of the shares you own if you want to transfer shares. You can select the securities you want to transfer and request that all shares or specific number of shares be transferred.

Transferring in-kind shares are executed and valued at the market close on the transfer date. I always execute transfers of in-kind shares just before the market close so that I have a good estimate of what the closing price will be. Entering a transfer request after the market close will delay it’s execution until the market close on the next trading day.

.

James A says

To amplify what Chris said on 14 July, Don’t play with fire, remember the big picture.

Yes the tax on the increment is important, but look at your overall rate on the total Income to. Anything Below 15-16% on the total is ok in the big picture.

Jeff Enders says

and the way I look at the ‘big picture’ is to determine the highest tax bracket I am willing to absorb. I think of IRMAA as an additional 1-2% to that marginal tax bracket. That 1-2% is small potatoes to the larger strategy of doing Roth conversions.

I determine the ordinary income that gets me to the top end of the tax bracket I am willing to pay taxes on, and then let the IRMAA charges fall where they may.

Something to ponder :-).

JoeTaxpayer says

The real issue is that Irma and the marginal tax brackets don’t quite line up, unfortunately. It’s possible to top off your marginal rate but only be in the next Irma bracket by a couple thousand dollars with a phantom tax can be over 50% or even over 100% depending how much she went over. If an extra dollar in taxable income cost you over $1000 a year in Medicare expenses. Something went wrong.

Nancy Memmel says

The IRMAA levels were frozen for a number of years, (2018-2020, I think) while the marginal rates continued to adjust for inflation. IRMAAs are increasing with inflation again ,now.

Frustrated by IRMAA says

My wife and I have transferred our TSPs to Fidelity Roth IRAs . Thank you Jeff and Harry for explaining that Turbo Tax (we assume Deluxe) can easily handle the tax issues that will arise when we start Roth Conversions. We will have Fidelity withhold Federal and NY State taxes from our core account to have maximum go into the Roth Conversions.

Honestly, the simplest approach and most sensible approach to Roth Conversions is to follow the approach suggested by Jeff Enders:

• Jeff Enders says

October 23, 2022, at 12:52 pm

“Also, my approach is to determine the a) the highest marginal ordinary tax bracket I am willing to pay and 2) the IRMAA tier I am willing to pay. Then I target my 2022 (2024 now) MAGI that yields the lower of the two.” !

Jeff, question: In 2024 and 2025 (before the tax law sunsets at the end of 2025) would you recommend biting the bullet and raising our highest marginal ordinary tax brackets one two tax brackets?

Question: Any recommendations on how and when to best use QCDS? I guess that it becomes apparent as we use them. We know they can replace IRA RMDS when they start next year. Probably it is financially more effective in the beginning when we first do Roth Conversions and less so as the balance gets lower. Thanks

Frustrated by IRMAA

Jeff Enders says

my approach still holds: determine the highest tax bracket and IRMAA tier you can stomach. As far as 2024 and 2025, Ed Schlott writes about this a lot (his columns are about IRAs) and he says might as well convert while taxes are on sale (meaning the current tax law sunset at the end of 2025)

it certainly is a personal financial choice and also depends on what you expect occurs to the IRA over your life time. Will you spend it all anyway? Will you aggressively give it to charity (QCDs)? What is the tax bracket of your children (presumably who will inherit). It is higher or lower than yours?

It also depends on how the election transpires. If the Republicans sweep, it is more likely the current tax brackets get extended beyond 2025.

bottom line: everyone’s financial situation is different so everyone will approach this dilemma differently.

TwoGeez says

“We will have Fidelity withhold Federal and NY State taxes from our core account to have maximum go into the Roth Conversions.”

Unfortunately, this is not as easy as it would seem to be. It is *not* possible at Fidelity to do an electronic conversion and have them withhold the taxes unless you increase your T-IRA withdrawal to cover the taxes…*not* what you want to do to maximize your Roth conversion. If you want Fidelity to withhold taxes on the conversion you will need to make your T-IRA withdrawal in cash where you can specify whatever withholding you want. Then you will need to write them a check with a deposit slip specifying that it is a Roth conversion.

Of course you can also convert the entire amount from T-IRA to Roth electronically and pay the taxes with your estimated taxes. But taxes will not be paid via withholding and you will likely be subject to IRS form 2210 to demonstrate you paid sufficient estimated taxes throughout the year.

Joe Taxpayer says

To add to my last comment – IRMAA is based on MAGI, not on taxable income.

This means the IRMAA number don’t align with Tax brackets, but worse, depending on one’s deductions the numbers can be very different.

The impact of ‘going over’ is also far different. For federal tax, the extra $1000, in the next bracket, may be taxed at 24% vs 22%. Not going to lose sleep over the difference, $20. But, the next IRMAA cliff may be a $70/mo ($840/yr single, $1680 couple) jump in cost for going over by any amount, no matter how small. An example of a situation in which one’s margin tax is greater than 100%. Looking at average tax burden ignores this phantom rate.

In my case, my wife is older, and I’m trying to convert with both factors in mind knowing the IRMAA hit is a double whammy starting in 3 years, when I go on medicare as well.

Frustrated by IRMMA says

Hi Two Geeez.

Thank you for noticing my mistake and pointing us in the right direction. Fidelity is not able to withhold taxes from a cash non-IRA core brokerage account to pay the taxes on a Roth Conversion even though four different reps said we could. So either we withhold the taxes from the IRA but get a significantly lower net Roth Conversion or do what my wife did, set up an account with the IRS to electronically debit taxes from a money market fund that goes directly into the IRS. We already had such a debit account that goes directly into the NY State Dept of Taxation. She keeps very good records in case we are audited. So hopefully we will be okay, and legitimately end up with more in our Roth IRA. Thanks again, Frustrated by IRMMA

TwoGeez says

Frustrated by IRMMA,

Yes, you can set up an EFTPS account to pay the taxes directly to the IRS. I have done this, as well. The difference in withdrawals vs paying directly is that withdrawals come off the top of your overall tax liability and anything remaining needs to be paid via estimated taxes @ 25% per quarter. Paying directly when you do the conversion skews the 25% per quarter and then requires you to complete IRS Form 2210 to show that you paid your estimated taxes consistent with your income by quarters. Form 2210 is a pain in the butt. (California has a similar requirement under Form 5805 and I suspect New York has something similar).

When my Roth was with a different broker it was simple…I took the T-IRA distribution into my brokerage account and told Fidelity how much I wanted them to withhold. I then sent the total distribution amount to my different broker covering the tax withdrawal with other money from my brokerage and specified it as a Roth conversion. Done, and reported properly to the IRS. I moved my Roth to Fidelity to avoid the additional step of transferring to a different broker and then learned that I made my life harder!

Gary says

Glad everyone is struggling with the same issues that we do. We have a baseline plan with both of us living to a 100. However, we also see other scenarios (tax rates sunsetting, early spouse death, nursing homes, child’s inheritance, etc.). All scenarios need assumptions for timing, costs, odds of occurring, etc. It’s a classic case of decision making under uncertainty, even if our baseline Roth conversion strategy were perfect. However, we push this somewhat further, moving somewhat into a higher tax bracket and IRMAA tier. It is NOT optimal for our baseline, but is kind of an insurance hedge against the other scenarios. It’s a personal judgement call that easily could differ for you. Heck, many folks don’t believe in flood insurance for beachfront homes!

David Swanson says

I want to calculate my MAGI so I don’t run into the IRMAA income limit to avoid a surcharge on mt Part B and D Medicare. You say that tax-exempt interest and dividends from Municipal bonds must be added back in, but not non-taxable social security benefits. But I have also read that contributions to a IRA must be added back in. Is this true for calculating the IRMAA MAGI? What else must be added back in?

Jeff Enders says

Use Line 11 of Form 1040 and add back in Municipal Bond interest. it’s that simple….

The Wizard says

Incorrect.

This MAGI is your AGI plus tax-exempt interest…

Jim M says

You can see how Medicare MAGI is calculated by referring to you 2023 Federal Income Tax return.

Form 1040 Line 2a (Tax Exempt Interest) + Form 1040 Line 11 (Adjusted Gross Income) = Medicare MAGI.

Tax deductible contributions to IRAs are reported as an IRA deduction on Line 20 of Form 1040 – Schedule 1 – Part 2 (Adjustments to Income). The total adjustments to income reported on Schedule 1 – Part 2 are carried over to Form 1040 Line 10 and reduce the adjusted gross income reported on Form 1040 Line 11.

David Swanson says

But my real question is, do I add back any IRA contributions to my AGI to calculate my MAGI?

Jeff Enders says

please review your tax return and what is part of Line 11 as that should answer your question. The only thing to add to that is the Tax-Exempt interest.

did you really mean “contributions” or did you mean “distributions”? either way, review Line 11 of your tax return as that is what matters.

David Swanson says

Hi Jeff,

I mean contributions. Depending on my W-2 income for this year, I will probably contribute about $2,000 to my IRA for this year (2024).

But from what you said (and Jim M. agrees), I add only my tax-exempt interest (line 2a) to my AGI (line 11).

I don’t know why some people say IRA contributions, non-taxable Social Security benefits and other things like adoption expense and foreign-earned income and housing exclusions, all have to be added back to AGI to get your MAGI. Confusing!

Jim M says

The term “MAGI” is confusing because the government uses it for several different purposes and the calculations for MAGI differ depending on where and how it is used.

Medicare MAGI might be a better term for the government to use, but the left hand of the government doesn’t always seem to know what the right hand is doing.

Frustrated by IRMMA says

We will have Fidelity process a traditional IRA to Roth Conversion without tax withheld for each of us between now and the end of the year. This is a first-time experience for us. My wife set up IRS and NY State online accounts to pay estimated taxes during the same quarter to ensure we make timely payments that significantly exceed the required taxes. Is there anything else we need to do to avoid tax penalties?

Thanks, Frustrated by IRMMA

TwoGeez says

Paying that way will avoid the penalties. You just need to demonstrate that you paid the estimated taxes consistent with the quarterly income. This is where IRS Form 2210 comes in. (And IT-2105.9 in NY) It’s required whether you get a refund or need to pay at years end. It’s basically there to make sure taxpayers pay throughout the year as opposed to paying all of their estimated taxes in Q4.

The Wizard says

You may not need form 2210, I’ve never used it. It depends on how big your fourth quarter Roth conversion is compared to your other income. I’m not immediately sure what the threshold is.

Nowadays, with RMDs, I only do small Roth conversions in December, $10k to $15k depending. I do send in 24% of the converted amount via EFTPS, but usually get a refund.

Anyway, if IRS sends you a penalty notice, you can file form 2210 in response at that time…

Nancy Memmel says

The IRS attributes your income and withholdings linearly through the year , as a first order approximation so if >= 90% of your tax gets withheld over the course of the year you’re fine. If some comes from estimated taxes then you’d have to show timeliness. If you are planning ahead and happen to make 4 equal quarterly estimated tax payments, that will also save you having to file another form.

We’ve gotten demand letters for year end conversions and have sent back an explanation that the Dec 18 conversion was followed by a Dec 28 estimated tax payment at the marginal tax rate, and it was accepted.

Ed L says

I seem to recall seeing somewhere that tax withholding

from an RMD will be considered as having been paid

throughout the year. For example, one large distribution

made at end of year with sufficient withholding can

cover additional income received throughout the year.

However, I can not seem to find the confirmation of this

in any IRS pubs that I searched. Can anyone verify?

TwoGeez says

Yes, ANY withholding is considered to having been paid throughout the year. But going back to the issue that started this sidebar discussion, Fidelity DOES NOT allow you to pay the taxes via withholding UNLESS you take the tax $$ out of the IRA that is being converted…which we don’t want to do. That leaves 2 options: 1) Pay via estimated taxes that will then be uneven payments and required justification to the IRS that you paid consistent with income; or 2) Take the IRA withdrawal and have them withhold the taxes…you can specify the amount you want withheld. You can then supplement the amount paid in taxes from other funds, but this deposit into the Roth needs to be done by check with a deposit form specifying it is a Roth conversion.

My beef with this isn’t with the IRS…it’s with Fidelity making the process so difficult. When my Roth was with a different broker I could process it as described in #2, but all electronically. I transferred my Roth to Fidelity to presumably make the process easier, and actually made it more difficult.

Nancy Memmel says

tax withholding

from an RMD will be considered as having been paid

throughout the year.

Yeah, because it is a withholding as opposed to an estimated payment. You’ll note that

withholdings and estimated payments have their separate lines on the tax form.

GeezerGeek says

https://rodgers-associates.com/blog/pay-taxes-once-instead-of-four-times-using-your-iras-required-minimum-distribution/

https://financialducksinarow.com/1663/ira-trick-eliminate-estimated-tax-payments/

https://www.kitces.com/blog/estimated-tax-penalties-withholding-retirement-account-required-minimum-distributions/

https://financialducksinarow.com/1663/ira-trick-eliminate-estimated-tax-payments/

Need more?

Terry says

Any withholding, from an RMD, payroll check, etc is considered as having been paid throughout the year.

Ros says

I take my RMD and then do my Roth conversion in the middle of DEC. I take

deductions out of my pension and my SS monthly and always get a refund even with

the RMD and the conversion. In 67 years of paying taxes I never had to write

a check to the IRS but twice to the state.

jimdog says

To TwoGeez, No need to write a check to Fidelity for the Roth conversion. You can use the transfer between accounts feature. Just transfer from you traditional to roth acct. It’s simple and I’ve done it for years. You can specify how much tax if any you want withheld from the Trad. Ira conversion.

TwoGeez says

You are correct. You can do this transfer directly, but if you specify withholding those funds must come out of the T-IRA – not what you want to do to maximize the Roth conversion.

Michael Winnick says

I have read or heard that if I take out my full RMD on January 2nd (because I want to invest it, or just have lots of cash in my Brokerage account) then my first Quarterly payment on April 15th must be a minimum of the taxes due on that amount. But I have always taken my full RMD just to get it out of the way, and then paid my estimated taxes quarterly. The IRS has never gotten back to me saying I paid too little in April.

Any thoughts on that?

Harry Sit says

Four equal payments are OK even if you generate all your income in January.

Frustrated by IRMAA says

Hi all,

We are trying to avoid the dreaded forms IRS Form 2210 and IT-2105.9 in NY, and a tax penalty. It appears we can avoid this if we have the taxes withheld when directly converting from a Fidelity IRA to a Fidelity Roth. However, doing this will result in a much lower net amount going into The Roth IRA. If we pay the taxes via estimated Federal and NY taxes, we can have the entire Roth Conversion amount go into the Roth IRA, but there is a good chance that IRS form 2210 and NY form IT2105.9 will have to be completed, which we are trying to avoid, and we might get a tax penalty. It appears we may be able to skip these forms if our estimated taxes cover at least 90 percent of the taxes required for this year. Is that true? Does the IRS document this rule? It just seems like there should be an easy way to do a Roth Conversion, avoiding a penalty and those dreaded forms without the need to hire a CPA.

The Wizard says

You could increase your withholding amounts on other income streams.

Alternately, you could send in equal amounts on the four quarterly estimated tax payments…

TwoGeez says

Yes, this is true IF you pay your quarterly estimated taxes in equal installments.*

Or, as I mentioned in a previous post, you can take the T-IRA withdrawal into a CMA/brokerage account and specify whatever withdrawal amounts you want. You can then use other funds to cover the tax withholding and make the entire T-IRA withdrawal amount as a Roth contribution by check. You need to include a deposit slip specifying it is a Roth Conversion: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/customer-service/deposit-slip.pdf

* In CA, the requirement is not actually four equal installments. We are required to pay 30/40/0/30%. Confirm requirements for your state.

Jeff Enders says

There is no need to complete form 2210 if the amount you owe on April 15 is less than $1,000.

here is any easy approach (not foolproof) to avoid the form. Just make an estimated payment of the Roth Conversion times your tax bracket in the same quarter as you make the conversion*. That infers that without the Roth Conversions you would have enough withheld to cover all your other income sources.

*technically the April 15 payment includes Roth conversions through March, the June 15 payment includes Roth conversions in April and May, the September 15 payment includes Roth Conversions in June, July, August and the Jan 15 payment includes Roth conversions made in September – December.

Michael Winnick says

I’ve seen the comment “If you pay your estimated taxes in equal installments” stated a lot, but I think it means pay at least 25% or more on your first and then each quarter pay the same as the previous quarter or less for the 2nd, 3rd and 4th payments. And obviously if you pay all your taxes due via a withholding taken from your December RMD withdrawal four equal payments is out the window.

I typically pay between 30 and 40% on 4/15, and an equal or somewhat less amount on 6/15 and depending how I feel the balance on 9/15. Every payment is less than the prior so no IRS lawyer can tell me I underpaid one quarter , and in any case I pay a bit more, maybe $250 just to make sure any extra interest or unknown income won’t surprise me. I try to not leave anything for the January payment simply because I want all my payments for s year to actually fall in that year. I also like entering the new year owing nothing. But, now that my wife and I both have RMDs, and the amount is getting obscene, for next year I may my pay some of the estimated taxes in January just to keep my quarterly payments and blood pressure down. For 2024 when EFTPS.GOV takes my September 15 payment my taxes will be fully paid and the excess will carry to the 2025 cycle.

And I know, I’m losing interest I could earn on the excess.

Nancy Memmel says

The equal installments makes it easy for the IRS computer to attribute your estimated payments to quarters to confirm that tax has been paid uniformly throughout the year

Michael Winnick says

OK, I’m still unsure of what the IRS will do. If I pay MORE than 25% in April & June and the Balance in September do they care? And what if I pay 30,30,25 and 15? Basically they don’t want you paying 10,10,10 and 70 or 20,20,20 and 40.

Am I getting this too complicated?

Harry Sit says

Look at Form 2210. The excess from the front-loaded payments is carried forward to the next quarter as a credit. 30, 30, 25, and 15 is OK.

Estimating your income and taxes for the current year and playing with the timing of estimated taxes are getting unnecessarily complicated. If you don’t have a source from which to withhold taxes or if you don’t want to withhold taxes from Roth conversions, the simplest way is to use last year’s taxes. Look at it after you file your taxes for last year in April. Multiply it by 110% if your AGI is more than $150,000. Divide it by 4 and schedule 4 payments through EFTPS. Done. End of story. It doesn’t matter how much you’ll have in dividends and capital gains this year. It doesn’t matter how much you’ll do Roth conversions. See Paying Taxes On Your Own: Amount, Timing, and Mechanics.

Jeff Enders says

to follow up on Harry’s comment, review line 24 on your 2023 tax return. that is the line you want to divide by 4 (and multiply by 110% if line 11 exceeds $150,000) As long as those are the quarterly payments you make, you will meet the minimum IRS requirement to avoid any underpayment penalties.

Nancy Memmel says

The default approach is for income and withholdings to be allocated as if they happened linearly over the year, If all of your tax payments are withholdings and you paid in enough to cover at least 90% of the tax liability then there is no issue. But your income and payments (if estimated taxes are involved ) may not be have occurred linearly and you can use form 2210 to figure what you actually earned for each quarter and what you actually paid by the estimated due dates and thereby, maybe, reduce any underpayment penalty. If you pay more , earlier, that will help to reduce any penalty, if you have any.

There’s a short form that you use to find out if you even have to file 2210 and it allows you to add estimated taxes in with your withholdings IF (and only if) you paid the same estimated amounts in each of 4 payments., all on time vis-a-vis the estimated due dates. If you pay more , earlier that will help to reduce any penalty, assuming you have one, but form 2210 it is still another form you have to deal with( and it is a very involved form at that!) so the path of least resistance is to arrange to do enough withholding from other income streams so that it doesn’t come up.

Michael Winnick says

Harry,

Great explanation, and all I really care about is not being on the wrong side of the law. Appreciate your detail.

Frustrated by IRMAA says

Two Geez was suggesting an alternative way to do a Roth conversion. It sounds like a method mentioned on another site:

” A rollover, in which you take a distribution from your traditional IRA in the form of a check and deposit that money in a Roth account within 60 days”

If that is the case can someone provide me with an example of the steps required to do that that is acceptable to Fidelity Investments? Thank you.

Jeff Enders says

frustrated by IRMAA – why would you want to take the money and then redeposit over to the Roth account? that introduces risk into the situation. What if the check gets lost? what happens if you get sick in the mean time and don’t send the money back to the Roth during those 60 days? Also, your money is not invested in the Roth during those 60 days, so whatever you do have the money invested in (even if that were a money market), that is taxable income to you where if the same money was sitting in the Roth, waiting on investment, the interest is not subject to tax.

if you really want to understand the process, suggest calling Fidelity. that is what their customer service agents are there for.

TwoGeez says

See my Aug 5 comment and the link to the Fidelity deposit slip. Fill it out. Done.

David says

I see now what everyone seems to be discussing: On my 2023 return, that I prepared with TurboTax, I saw that they complete form 2210. Although the bottom line was that no penalty was imposed, I called TurboTax and asked why they had to file this form. I spoke with a CPA that worked for them for years and he was puzzled also. It seems that I converted a portion of my Traditional IRA to my Roth IRA all in the month of December and paid all the tax due in December. The CPA couldn’t figure this out too. He said he thought this was fine, make the conversion at in the last quarter and pay all the taxes due then. Well, I guess it was not a problem, I got the exact amount of refund they calculated and I haven’t been called in for an audit (yet).

GeezerGeek says

There is no mystery about that. As has been stated earlier, the IRS treats IRA distributions as if they were taken evenly throughout the year. That works in your favor for any taxes withheld (taken in December but credited evenly over the year) but works against you for the actual distribution itself because the IRS treats that income as if you received it throughout the year, not just in December. Completing form 2210 shows them the income was not evenly distributed through the year. The CPA should have known that.

Nancy Memmel says

We did the same (late in the year conversion followed by a single estimated tax payment) and got a demand letter for the “underpayment penalty we owed” but sent a letter explaining the late in the year conversion with a copy of the cancelled check sent to pay the estimated tax and it was accepted. It took the IRS a year and a half to send the demand letter.

John says

I’m wondering if I don’t do estimated tax payments on mid year Roth conversions, and keep the money (I would have given the IRS early in the year) in a high yield savings account (currently about 5% apy) at the end of the year, would the savings, minus taxs paid on the savings, be more that the IRS underpayment penalty? I don’t know how how to calculate how much the penalty would be.

RobI says

IRS penalty interest rate for underpayment is currently 8%

https://www.irs.gov/payments/quarterly-interest-rates#2024

I asked a related scenario question on another thread and here is Harry’s reply

https://thefinancebuff.com/estimated-taxes-how-to.html#comment-34772

Nancy Memmel says

Harry’s strategy outlined Aug 6th regarding paying 100% of LAST year’s tax liability (if last year’s taxable income was 150K) by estimated, withholding or a combo of both will put you in a “safe harbor”.

That will work as long as the last year’s tax liability was not extra high from having done a big conversion LAST year. The estimated payments have to be timely, though.

Frustrated by IRMAA says

From this site, we learned there are two ways to avoid tax penalties: 1. by withholding taxes from pension, W2s, etc., if you pay your taxes by April 15 to within a $1000.00 or 2. by paying your estimated taxes quarterly based on the taxes paid in the prior year.

We may wait until 2025 to start Roth Conversions (paying the taxes from quarterly estimated taxes starting in January 2025). We are not able to significantly increase tax withholding from our pensions at this time to process the larger Roth conversions we had anticipated.

Nevertheless, we will likely do traditional IRA withdrawals with tax withheld from the IRA withdrawals and maybe process small net Roth conversions this year.

Ros says

You may be able to withhold more taxes by calling the company that you get your pension from. I have increased mine in the past beyond the first quarter when they send the paper to refill for changing withholding. Life happens. You probably have a phone number on your pension statement you receive each month or on their website on line with someone to contact.

Jeff Enders says

frustrated by IRMAA – there is a 3rd way:

pay quarterly, based on the current year income. if that is “lumpy” income, it does require completing form 2210 to show that you paid the estimates in the same cadence as the income was generated.

further, there is no “PENALTY”; simply there is interest due (the daily interest is currently based on an 8% interest rate) on the underpayment of the estimate versus what should have been paid for that quarter.

if completing a large Roth conversion in the 4th quarter and paying the related estimated tax no later than January 15 of the following year, it’s unlikely there would be interest due. But of course, completion of form 2210 (and form 2210ai) is necessary. Turbo tax handles this fairly easily.

Nancy Memmel says

By paying 100% of LAST YEAR’s tax liability ( prior year income 150K) you’d be in a “safe harbor”. And it wouldn’t have to be via estimated payments it could be by estimated, withholding or a combination, its just that if you are aiming to match last years payments you might as well do it by estimated so you don’t have to parse how much comes via withholding and therefore how much you have to pay by estimated each quarter, and then you’d have the same quarterly payments that would allow you to side step filing the 2210.

The 2210 is tedious, but having to file it isn’t the worst thing that could happen.

Frustrated by IRMAA says

Jeff and Nancy thank you for your help. We were planning on relatively large Roth conversions in 2024 and 2025, as we at least know that taxes will remain relatively low in those years. At this time I think no one knows how the election will go or what the taxes will be in 2026. Up until the end of last year, we withheld taxes from our CSRS federal pensions and traditional TSP distributions. The taxes withheld were sufficient to avoid penalties and in fact, resulted in tax underpayments. We tweeked our TSP withdrawals to be within Harry’s IRMAA brackets But the TSP did not offer Roth Conversions or allow QCDs which are allowed with Fidelity. So we transferred our IRAs to Fidelity. So now we have some new complexity that we thought we could avoid. But new complexity is good for our aging brain cells with the support we receive on this site. Thank you Jeff for letting us know there is a third way to do a Roth Conversion that will likely not involve interest as well as reassuring us that Turbotax can do all the calculations. We did not pay the estimated tax for the first two quarters. We did raise our CSRS annuity tax deductions starting September and will pay estimated taxes in the fourth quarter to match our Roth Contribution at that time. Starting in January 2025 we will make quarterly estimated taxes based on Harry’s recent recommendations. Your knowledge of IRMAA, tax penalties, RMDS, QCDS, Roth conversions, and general financial information is quite impressive. Thank you for sharing it with those on this site.

Frustrated by IRMAA says

On 08/11/24 Jeff provided a helpful 3rd alternate suggestion to my posting made on the same day (posting no. 34). In rereading my posting I apologize for leaving out important information: we have not made quarterly estimated tax payments so far this year. Jeff, would that alter your 4th quarter Roth Conversion suggestion? Thanks

Jim M. says

Frustrated by IRMAA,

Keep in mind that any tax payment you make in January 2025 will be the last quarterly estimated payment for 2024 Income. April 15, 2025 is the due date for the first quarterly estimated tax payment for 2025 income.

The April 15 due date makes it easy to calculate 4 equal estimated tax payments for 2025 income taxes that will satisfy IRS safe harbor rules and avoid underpayment of estimated taxes. Paying 110% of your 2024 tax obligation (or 100% for lower income taxpayers) through a combination of tax withholding paid anytime during 2025 along with 4 equal estimated tax payments starting April 15 will avoid underpayment penalties by satisfying IRS safe harbor rules.

The alternative way to satisfy harbor rules is to pay 90% or more of your 2025 income tax obligation or owe less than $1,000 on your 2025 tax return through a combination tax withholding and 4 equal estimated tax payments. This latter option is more difficult to estimate by April 15, as 2025 income, including Roth conversions, may be unknown so early in the year. However I find the 90% option usually results in my paying less tax before the April 15 tax return filing deadline. My personal approach has been to pay 95% of my current year income tax obligation thru tax withholding during the current tax year.

See IRS pub 505 for more information on tax withholding and estimated tax payments.

https://www.irs.gov/publications/p505

Gary says

I have been looking into our future costs for assisted living and/or nursing homes in the future (we are 71, so hopefully not for while yet). I see average costs like $75K for assisted living and $180K for nursing homes. While doing this research, I discovered that most of these costs are tax deductible (excess of 7.5% AGI). My planning models show the deductions reducing future taxable income, federal taxes and IRMAA penalties materially. Under this scenario, doing current ROTH conversions might not be desirable. Have any of you encountered this planning consideration already? How do you incorporate the possibility of these future costs into your action plans for ROTH conversions?

Jim M says

Gary, I plan to retain funds in my Traditional IRA for long term care while continue doing annual Roth IRA Conversions to prevent or delay my income moving into higher MAGI brackets. I see value in having both types of accounts. It’s not one or the other.

Gary says

Jim M, thanks for your reply. With my new learning about the medical costs tax deductibility, I see a lot of value in your strategy of leaving enough IRA funds for future medical care. It’s almost like you can withdraw them when you need it most and it can be almost tax free (ignoring NIIT and IRMAA as they are based on AGI not taxable income). I am struggling with the thought that aggressive Roth conversions now could be taxed at higher rates than future medical cost withdrawals. So I think I am left navigating by judgment under uncertainty for just how hard to push Roth conversions.

Jim M. says

Gary,

There is no way to know with any certainty what the future holds. All we can do is evaluate the potential outcomes and take action to hedge our bets and mitigate the potential risks of different outcomes.

Having enough money to fund long term care seems like a high priority and more important goal than trying to minimize future income taxes. Retaining funds for long term care in tax deferred accounts provides a way to maximize the availability of funds. As you point out, withdrawals of tax deferred funds for large health care expenses are partially tax deductible and likely to reduce tax costs of withdrawals and increase funds available for health care. So my first priority has been to retain a sufficient sum in my IRA to fund the potential costs of long term care.

If funds are never needed for long term care, than I, or my heirs, may have higher tax long term tax costs than would be the case if I were more aggressive in doing Roth IRA conversions. However, I would rather run the risk of paying higher future taxes than having insufficient funds for long term care.

Beyond that, I use financial planning software to evaluate the impact of smoothing my annual income over my remaining life expectancy based on my available assets and income sources. Smoothing annual lifetime income can help smooth and minimize lifetime income taxes by avoiding periodic whipsaws in marginal income tax rates. This has helped me in establishing Roth IRA conversions amounts that are consistent with my estimated annual lifetime smoothed income. One of my goals has been to maximize my probable lifetime marginal income tax bracket and avoid paying taxes on Roth IRA conversions at marginal tax rates that may exceed the marginal rates on my annual lifetime smoothed income. This has led me to accelerate IRA withdrawals early in retirement and do Roth IRA conversions beyond what the IRS requires.

Mark Cummins says

Yes, I already addressed this at https://thefinancebuff.com/medicare-irmaa-income-brackets.html/comment-page-10#comment-34251

Gary says

Mark, thanks for the link to your prior post. I must have missed it. It seems very consistent with my new awakening! 😀

John Sullivan says

Great summary on how IRMAA works.

My question is how can we lead a retiree revolt and get Congress to change the MAGI formula for Medicare to exclude retirement saving distributions as income for MAGI Medicare purposes?

Who’s Interested? ( I’m a retired fed with some history of working with congressional committees, albeit on different subjects.)

Which Congressional Committees should be approached?

How can entities like AARP help in bringing attention to Congress as the whole next tax rate battle heats up? What public comment processes should be targeted?

Changes I’d like to see:

Taxation:

1. Untaxed money we put in 401/k or IRA should be taxed as ordinary income when we take that money out (or convert to Roth)

2. However, the Realized gain on our 401/k- IRA should be taxed at capital gains rates (not ordinary income) when we take it out or roll into Roth.

3. Medicare PART B&D IRMAA can retain its income rackets, for true ‘income’. However – MAGI for Medicare should exclude retirement saving distributions as income. Yes we should pay taxes on this, but using our retirement savings is not Income.

The way it works today, IRMAA penalizes the very people who have put the most into the program, and acts as a deterrent to encouraging anyone to work hard, live modestly, and save for retirement.

I realize this is quite an uphill battle, as there are desires to increase capital gains to equal ordinary income rates, tax rates overall are set to change in 2026, and others want to tax ‘wealth’ including unrealized gain.

DM me if interested in a discussion.

Paula says

I agree. Perhaps Elizabeth Warren and Bernie Sanders would assist with this.

The Wizard says

I think John has an uphill battle. Tax-deferred retirement savings are basically Deferred Income. So yes, they’ll be taxed as Ordinary Income once you take them out.

I’m a Wealthy Bastard and have no problem

paying a bit more for Medicare so that poor, destitute folks who didn’t plan ahead so well can catch a break on Medicare costs.

You can easily put aside $$$ in a taxable account during your working years for retirement if you choose. The basic rules on taxation have been unchanged for decades now, so it’s simply a matter of Paying Attention during your working years…

Jim M. says

John Sullivan,

I suspect it would be difficult or impossible for most retirees to calculate realized gains on their 401K – IRA accounts. I imagine that most taxpayers have not kept 40 – 50+ years of their tax deferred account records that would be required.

IRMAA is a tax that only impacts the wealthiest 8%-10% among us. The same group of people are the primary beneficiaries of lower tax rates on capital gains. I think the tax system would be fairer if all types of income, including capital gains, were taxed the same as ordinary income at graduated rates. Lower tax rates on capital gains results in higher marginal rates on ordinary income. I doubt any of this will ever change as the wealthiest have the most political power, and they are interested in preserving their wealth just like every one else.

Everyone wants to pay the lowest taxes possible and not have their tax dollars wasted. At the same time taxes seem necessary for government to exist. Most taxpayers should be happy to pay higher taxes because it is largely a reflection of their success.

kenneth mitchell says

To The Wizard:

Do you really think that poor, destitute folks are that way merely because they “didn’t plan ahead so well”??

It does seem to be a popularly held grievance amongst those who are clearly “better planners”.

Jeff Enders says

John – I think the fundamental problem is most all of us Baby Boomer were conditioned to save, save, save and defer, defer and defer without understanding the consequences of those actions when we were young. Now the ‘tax bomb’ is upon us and it’s time to pay the piper.

Given the state of the federal deficits, I suspect there would be quite the uphill battle convincing enough of the right people, that the tax benefits derived over the past 30-40 years (which were always touted as ‘deferral’ and not ‘absolution’) should somehow be memorialized forever in the form of tax relief.

if anything I suspect Congress would lean going in the other direction as evidenced by Secure 2.0, i.e. the effective elimination of the ‘stretch’ IRA so that tax receipts come in quicker! There were proposals (defeated) to limit Roth IRA balances to $5 Million or so – again devices to force more money back into taxable accounts.

Even Bernie Sanders has proposed increasing taxes on the near wealthy, e.g. significantly increasing the net investment income tax from 3.8% to at least 12.4%.

In the next few years, Congress is going to have to figure out how to cover Medicare shortfalls, so IRMAA could rise even more!

Congress did create a way to avoid all this tax burden and do something good for society at the same time: QCDs! Give the money to charity and the related tax is eliminated and that could include the IRMAA as well!

We all made a pact with the devil when we were young by deferring money into 401ks and IRAs; now it’s time to pay the piper. I don’t like it either (and my tax payments are five figures each quarter to cover my Roth Conversions) so I feel your pain.

Michael Winnick says

Jeff, regarding your comment “Congress did create a way to avoid all this tax burden and do something good for society at the same time: QCDs! Give the money to charity and the related tax is eliminated and that could include the IRMAA as well!”.

While that suggestion is elegant it further leads to the question of “What is my Fair Share that I am accused of not paying” that we see in the media all the time. I can see the answer being “Any AGI over what the average AGI is is too high and the Safe Harbor from IIRMA is to give away to charity all of your AGI over that average”.

Personally any money I give away will end up causing my net to be lower than if I just paid the IIRMA taxes. Which is what they are, taxes. When I deduct $100 charitable donation I save $24, or $32, but I still end up with $100 less savings.

jimdog says

I truly believe that taxes ahead are going to go up and they may go up in a big way. If the current administration stays in power, they will increase spending programs and taxes will need to be raised significantly! Roth conversions make sense to me and that’s what I’m doing. You do know we already have over 35 trillion in debt!

The Wizard says

Michael says $100 less savings when doing a $100 QCD. Umm, no. In my case, for example, my marginal tax rate is 24% + 5% = 29%, so I have $71 less in my tIRA after a $100 QCD.

More to the point, everyone needs to determine their own level of comfortable charitable contributions, somewhere between zero and “a lot”.

I use both QCDs and modest Roth conversions (after RMDs) to control my MAGI for IRMAA purposes. With a MAGI close to $200k, filing single, I’m well into the IRMAA tiers but would prefer not to get into the next higher one.

YMMV…

Mike Hazuda says

Harry,

For the 2025 IRMAA bracket for the 1.4x Married Filling Jointly bracket, for the 3% estimate, why did it suddenly jump down to $266,000?? It was at $268,000 for months and the CPI was at about 3% for this update

Harry Sit says

Math. It needs approximately 0.25% per month to maintain the 3% estimate. The monthly changes were 0.17%, 0.03%, and 0.12% in the last three months.

Terry says

Will the 2025 IRMAA brackets be finalized after next month’s CPI?

Harry Sit says

The 2025 IRMAA brackets will be finalized on September 11. Many readers already shifted their attention to 2026.

Ros says

Do you think that the 2024 income for 2026 that is now $107,000 will go down more than $1,000 before the Medicare premium is due for the 2026 yr

premium? Is it prudent that I drop down another $1,000 to $105,000 by getting lower interest before the end of the year for my 2026 premium?

Harry Sit says

I don’t think the 0% estimate for 2026 will go down. It usually goes up as it progresses.

Ros says

I didn’t ask for the correct year. This is what I meant to ask.

The 2024 income in the lowest bracket for the 2026 Medicare premium is now $107,000.

Do you expect that to change before the 2026 yr. premium is announced? Is $1,000 below that amount to $106,000 enough to stay at or should I go for another $1,000 to $105,000 income for this year?

Ros says

Michael Winnick,

You did not figure in that your Medicare premium would not increase.

Harry Sit says

Ros – I don’t think the current $107,000 estimate for the 2026 premium (based on 2024 income) will go down. It usually goes up slightly. At this time last year, the 0% estimate for 2025 was $104,000. It inched up to $105,000 by last December. Now it’s $106,000. The $107,000 estimate may go up slower but I don’t think it will go down.

Jeff Enders says

Ros – maybe there is some confusion on what the charts says. Let me re-state it:

for 2026 IRMAA charges, if you assume AT LEAST ZERO inflation for the next 13 months and your 2024 income is less than $107,000, you would incur no IRMAA charge in 2026.

if you believe there will be deflation (inflation would be negative), inflation would need to be -1.2 percent (yes, negative) over the next 13 months, then the cutoff to avoid IRMAA charges would drop to $106,000.

so whether anyone expects the $107,000 to drop to $106,000 depends on one’s outlook for inflation (or in this case deflation). what is YOUR expectation?

does that help?

Michael Winnck says

Ros,

I was just illustrating the effect, that any contribution, after the tax deduction, always leaves you with less funds than if you did not make the donation. In my case, because of the large RMD’s I must take, I would have to give away, via QCD for example, over $5,000. As you point out I might save $350 a month for my wife and I or $4200 annually, but still see a net loss of $800.

Michael Winnick says

It’s too late for me to do any four equal estimated payments. I paid 110% of last years taxes in April, I paid the same amount in June (which brought me up to 81% of this years taxes due, and I will pay the balance on September 15th. That will put me about $250 over which I will carry to next year. Based on all I’ve read and questioned I’m going to start withholding from Pensions and Social Security. So the only thing I’ll have to calculate is the right estimated amount from the RMD’s which made up 60% of my AGI this year.

But, if I pay 110% of 2024’s actual tax for the April 2025 payment, and the rest in June and September payments, am I still in Safe Harbor territory?

Jim M. says

Michael Winnick wrote:

“If I pay 110% of 2024’s actual tax for the April 2025 payment, and the rest in June and September payments, am I still in Safe Harbor territory?”

I am not an expert on how the IRS handles estimated tax payments when the 4 amounts are not the same. However, I think you should be fine as the amounts you have cumulatively paid will exceed the required quarterly payments. Beyond that, unless your income was accelerated early in the year, your tax payments will exceed the rate that your income is being earned.

The IRA wants estimated taxes to be paid quarterly as income is earned. Paying ahead of time is ok, but paying late may result in an interest penalty on the amount that is paid late.

Ros says

Jeff Enders and Harry Sit,

Thank you.

I am so risk adverse. I check and double check everything.

I have most everything figured out before the end of every year with IRMAA with all of the help from Harry’s blog and his contributors. I want to stay below the first tier. Interest rates are so high this year I am just a little below it and for 2 years could not do a Roth conversion. I want to leave it my kids tax free. They are in their 60’s. I even have a paper signed for the kids to mail my last year alive to convert the rest of it if they so desire and I have enough set aside to pay the taxes on it. I am in a much lower tax bracket than they are.

Jeff Enders says

Ros:

I believe some of us are so fixated on not paying IRMAA, we fail to see “the forest through the trees!”

Based on your comments, I’ll assume your AGI (filing SINGLE) is $106,000 (highest AGI that avoids IRMAA).

Let’s say you did a Roth conversion for $62,000 which takes you right to the estimated top of the 2nd IRMAA tier. The sum of the tax and the IRMAA charges would be around $19,900. Your Roth balance would be $42,100 higher because of the conversion, net of the money used for taxes and IRMAA.

You state your children are in a ‘much higher’ tax bracket than you! Once they inherit, they only have 10 years to liquidate the entire IRA, so let’s say that pushes THEM into the 32% tax bracket. They don’t pay IRMAA, but that $62,000 is going to cost them the SAME $19,900 in tax (by coincidence) when they take the distribution.

So it appears it doesn’t matter whether you do the Roth conversion or they distribute after your passing as the tax plus IRMAA impact is the same. But it does matter!

There is another hidden benefit of doing the conversion! When you do the Roth conversion, they inherit that and can enjoy 10 more years of tax-free benefits on that same $42,100 investment.

Alternatively, If they distribute the $62,000 that remains in the IRA (because you didn’t do the Roth conversion), and then invest the same $42,100 that remains after paying the income taxes, they will have to pay capital gains tax on the profits! (unless they themselves pass and the investment is stepped up in their estate) which are avoided if the money was in a Roth!

Most don’t consider the 10-year benefit created for your children when money is converted from a Trad IRA to a Roth versus just leaving the money in the Trad IRA to avoid IRMAA!

Think about it (or see a financial planner – your children will be glad you did as it will save them money!)

Jeff Enders says

Michael – the safe harbor rule is if you pay 110% of last years tax burden (basically Line 22 of last year’s tax return, but it is more complicated than that) over 4 quarterly estimate payments, you are in “safe harbor”.

However, if I read your post correctly, you are making that payment three times (April, June and September, but not January), then you do NOT meet the safe harbor rules based on last year’s tax; however, that doesn’t necessarily mean you underpaid and are liable for interst penalties for underpayment (as it appears your 2024 tax is less than your 2023 tax) as you state you overpaid by $250 with just the three payments.

please review form 2210 and the flow chart; it’s not that difficult to follow. (this is the 2023 version, so where it states 2023 in line 1, use 2024 data).

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.irs.gov/pub/irs-pdf/f2210.pdf

Ros says

I forget what the law was now but the IRMAA rate was $85,000 for 11 years and I remember $85,000. My first year of converting was with 2012 income.

Michael Winnick says

I wasn’t clear enough. We live on the money from our RMD’s. If I do a QCD to eliminate my RMD then there is no money to live on. Our RMD’s provide 60% of this years AGI.The RMD supplements what I get from Pensions and Social Security. So If my RMD is $60,000 and my Pensions and SocSec are $40,000, then doing a QCD of $60,000 means I have to live on $40,000.Those numbers are an example.

Or am I missing something on being able to do a QCD and still have money to live on. Unless maybe I deplete my Roths ?

Nancy Memmel says

Michael,