[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

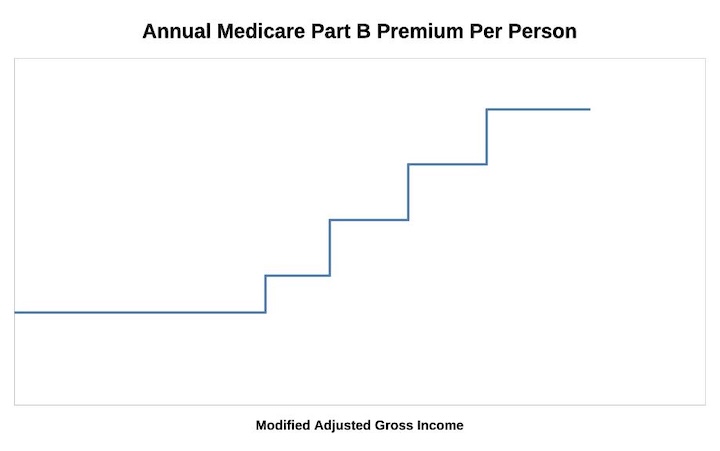

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

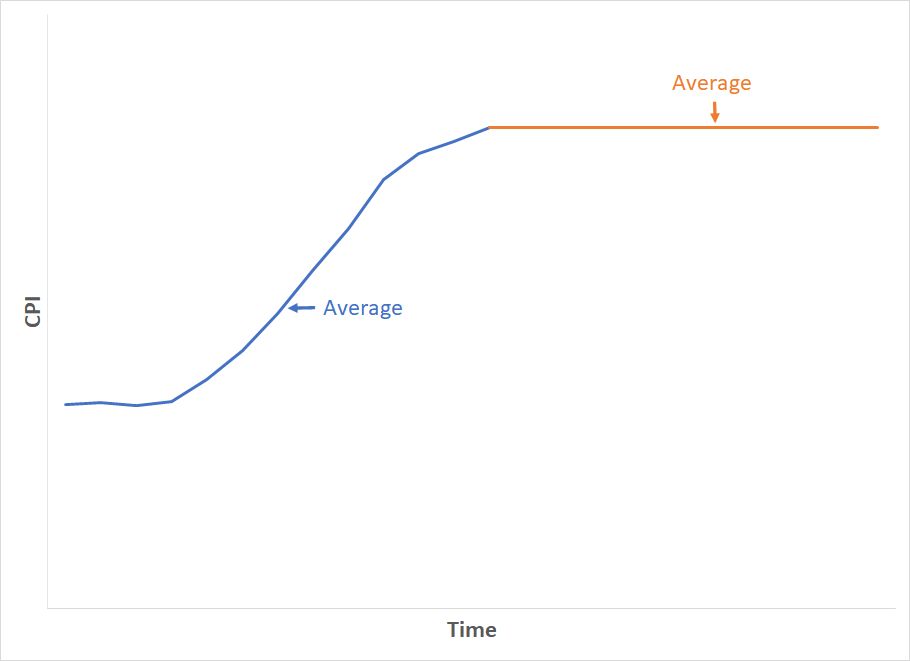

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

JoeTaxpayer says

The QCD works when one is going to make the donations regardless.

My in laws were generous, but they didn’t have enough to itemize. The QCD let me donate from their IRA, in effect “not” paying tax on that money. In the case of IRMAA, an itemized deduction doesn’t help. But the QCD avoids the tax return altogether.

Since the SALT deduction was capped, I don’t itemize. When I can use QCD, I’ll happily do so.

Teresa D says

This is what we are doing. We have been giving after tax to our church, but giving the QCD, before taxes, gives us the extra money in our checkbook, that we used to give as after taxes.

Terry says

This also reduces state income tax since even if you itemize, charitable deductions don’t reduce state taxable income. However, taking a QCD reduces your AGI and thus your state taxable income.

Jim M. says

Terry,

It depends on the state. In some states, QCD distributions are not excluded from income as is the case at the Federal level. NJ is one of the states that taxes QCD distributions.

Terry says

Jim, I live in IL where taxable income is based on federal AGI and there is no addback for QCD. I thought that most, if not all, states treated it pretty much the same way. How does NJ tax QCD since it really doesn’t even appear anywhere on the US 1040?

Jim M. says

Terry,

New Jersey Gross Income does not mirror Federal Adjusted Income. QCD distributions are included in NJ Gross Income and are treated the same way as any other retirement income from pensions, annuities, and IRA distributions. Social Security benefits not included in NJ Gross Income.

NJ has rules for fully or partially excluding up to $150,000 of retirement income from NJ Taxable Income when NJ Gross Income falls below certain thresholds. Taxpayers with lower NJ gross income end up having none of their retirement income taxed, while NJ taxpayers with higher gross incomes end up having all of their retirement income taxed.

Terry says

Jim, Since NJ doesn’t mirror Federal AGI, is doing the NJ 1040 (I assume that it is a 1040) almost like starting from ground zero – the same as doing the US 1040? If so, that’s a real bummer.

Jim M. says

Terry,

Its not a big deal. I use HR Block tax software which knows how to handle the differences between the NJ and Federal tax returns. In the case of IRA distributions, it simply includes the full distribution amount shown on the 1099-R as NJ income and ignores the QCD exclusion amount entered on the Federal 1040.

The most challenging part of preparing a NJ return is calculating the tax cost basis of an IRA. NJ doesn’t allow IRA contributions to be deducted from NJ income as is permitted on Federal returns. IRA contributions increase the NJ tax cost basis of an IRA which can then be recovered and reported as non-taxable income as IRA distributions are made.

Wizard,

NJ does not allow a deduction for charitable contributions.

Teresa D says

I think Michael is confused about what a RMD is. Required “minimum” distribution, not just a distribution of funds,

Ros says

Was something done differently to this site. When I get an email to a post it

now shows just Aug 15 and one from Aug 14?

Michael Winnick says

I’m getting the same issue as Ros.

Harry Sit says

Ros and Michael – This post has over 1,200 comments now. It isn’t practical to load all of them on one page. I break them up to show 50 comments per page. Please click on the “Older Comments” link above “Leave a Reply” if you’d like to read and reply to previous comments.

Glenn says

I’m not able to access the older comments from about July 10 – Aug 14. Seems like that page is missing now.

Ros says

Harry thank you for your reply but when I have been

hitting for the past comments I get 27 from July 10 4:57 am to

July 18th at 11:35 am.

This is what it did when I first posted and still what it is

doing now. I use duck duck go and private browsing but it

does the same not in private browsing and with google

The Wizard says

Regarding QCDs and various state income taxes: I assume most states allow a deduction for charitable contributions.

So you could do a QCD for your Federal return and a deduction for your state return…

Mike W says

Jim M,

Actually I took my entire RMD on January 3rd, 2024. If I read you and others right the IRS expects then that I paid 25% of that, and 25% of all the Pension and Social Security received from January thru March, on April 15th and the same amount for the next three payments. The fact that my first payment was 110% of 2023’s tax won’t save me.Nor will the total 2024 tax being paid on September 15th.

Do I understand right? That 8% is going to add up.

Nancy Memmel says

If you took a distribution before March 30 then a quarter of 90% of the tax due because of this distribution is due April 15th, June 15th,Sept 15 and the next Jan 15th. If you have other income on which there is no withholding, those amounts also are included.

At the beginning of form 2210, determining if you actually have to file the form, the total tax due has the withholdings subtracted to give the amount still owing.

If that result is an amount that is less than 90% of the total tax due, you’re golden.

Next you look at the prior year’s tax (and multiply it by 110% if last years income was > 150 K). If your withholdings for this year are >= this amount your golden.

If you’re not golden you have to file the form, but you can choose to count the taxes paid, including the amounts paid in estimated taxes, as of the dates paid rather than as an average over the year. They look at how many $s you are deficient in a quarter times the number of days deficient; against that they look at how many $s in excess you’ve paid in a quarter times how many days in advance you paid. The sum of the parts is the penalty.

If you paid 110% of 2023’s tax liability mid year and the whole 2024 liability in Sept (but how do you know what that number is in Sept?) you won’t pay any penalty

Michael Winnick says

Nancy,

I paid 111% of my 2023 taxes on April 15th. I know what my taxes will be because my only income is RMD, Pensions and Social Security and I estimate what my cash dividends will be in my Brokerage account using whatever Fidelity’s rate was last month. I am normally within $100 of the actual amount. If an emergency requires me to have more cash I go to my Roth. If we buy a new car I get the cash from the Roth so as not to incur and additional income by withdrawing more from the IRA’s. I have never owed additional taxes on April 15th.

You said “If you paid 110% of 2023’s tax liability mid year and the whole 2024 liability in Sept (but how do you know what that number is in Sept?) you won’t pay any penalty.”

In fact, when my September 15 estimated payment is made I will have paid my entire 2024 tax liability PLUS about $500 which covers any extra interest on the cash left in my Brokerage account. So, I am clean? Do I have to still fill out the 2210, or do I wait to see if they ask me? I have never had to fill it out, they never asked me, and I have always taken my full RMD the first week of January and never paid exactly equal estimated payments, though again, I never owed any money on April 15.

Michael Winnick says

I forgot to add this. While I am retired my full time job is trading in my IRA and Roth’s only. I don’t trade in my Brokerage account to avoid generating taxable income. Obviously too, every trade in my IRA means a bigger RMD. Roth trades are free.

Nancy Memmel says

The IRS may inquire, but if you’ve paid all your tax due early you clearly haven’t “underpaid” your taxes since you are supposed to pay 90 % or more-as-you-go; you’ve paid in advance! If they do inquire you will be able to show that you did, and maybe the IRS computers have calculated that for the IRS and that is why you’ve never heard from them so far.

We made a late-in-year conversion and sent in 1 estimated payment in Jan of the next year. IRS sent a demand letter for underpayment penalty and I sent documentation showing the timing of the conversion and the estimated payment in a reply letter and they accepted it. I hadn’t ever looked at the 2210 before that; I guess we were supposed to file it, but the IRS just wanted to know we paid the required tax as income was accrued. I certainly would wait for them to contact me if I were you, since you’ve operated this way for years.

Nancy Memmel says

Your system seems to suit you fine, but I am just curious as to why you wouldn’t arrange for covering the taxes you expect to owe by means of withholding from the pensions/ social security. In order to do that you’d necessarily have to do the work of estimating in advance what you’re going to owe just like you have to do for estimated taxes, but after that it would be on auto, and your income and withholdings would be attributed by the IRS on the same basis.

Michael Winnick says

Nancy, Regarding the issue of withholding from my Pensions and SocSec. Basically it’s an idiosyncrasy in my psyche. I like getting my full amounts, makes me feel better than seeing less show up monthly in my checking account. Granted getting a payment 10% lower, or having the IRS take it out90 days later, is a wash. But, I’m probably going to do something like that next year because if my wife ever has to take over she is not as anal as I am. I’ve considered the option of even having 50% out since the way I operate I already use the RMD to live on and that would mean a lower amount in actual quarterly outflow which offsets the lower SocSec and Pension inflows.

Right now I am relooking too at the QCD option which is looking more like a viable way to put off IIRMA a few more years but also have a positive impact on my total taxes.

Nancy Memmel says

Well, we all have our little idiosyncrasies. Best to you

Michael Winnick says

Can’t reply directly to your last comment as I and up here like you. I think the site is going to have a problem as it takes a lot of going back and forth to try to get to the post you’re responding to.

I think I agree with you on redoing or undoing RMD’s. May be a next year thing. But you should be seeing the post I made to Wizard and basically it looks like it only pays to try to stay in your same IIRMA payment, like 1.4. Or if you donate lots of money then QCD will benefit you. Or if you just feel you should donate and the cost is not an issue. But if so then paying the IIRMA probably isn’t a big dea. Wiith me it’s the principal and my gut feeling that the government is just looking for more money as opposed to trying to live on a sensible budget. But that another political issue.

Michael Winnick says

Nancy,

Just completed the QCD analysis. Ignoring that I already took out my RMD and will have to talk to Fifelity to see if I can put $100k back, or maybe all of it and start over, it’s not worth it.

Taking $100k out of my taxable income reduces my taxes due by a bit over $25k. If I add in the savings of not paying IIRMA this year, which is 1.4 x 174 for each of us of saves $69x12x2, or about $1600. So now the QCD saves me about $26,670. Giving away $100k to save $26k does not seem a good economic decision. Plus, I have to do this every year to push off IIRMA. That gets pricy.

Do you, or anyone reading this see any flaw in my reasoning?

The Wizard says

Michael W. asks if any flaw in his reasoning.

Yes, QCDs need not be all or nothing. You should probably first decide what your comfort level is for charitable contributions, year after year.

Then put together a spreadsheet with your estimated AGI for the year, minus those QCDs which would have been taxable RMDs. Your QCDs might only be 10% or 20% of your RMD, depending.

Remember, the goal isn’t to totally avoid IRMAA, it’s to avoid being just barely into the next higher IRMAA tier.

So then do a properly computed Roth conversion in late December to bring your MAGI up close to but not over the next higher IRMAA threshold.

With proper planning, you can likely remain in the same IRMAA tier indefinitely, as the numbers increase from year to year…

Michael Winnick says

Wizard,

OK, I understand the objective. Right now I am about $13,000 below the $276,000limit projected for 2026 IIRMA based on 2024 AGI. I’d have to do a QCD of $63k to get below the $223k limit to escape IIRMA. So you’re saying forget getting to zero, accept the 1.4 multiplier and going forward do QCD’s each years to keep below $276k or whatever it goes up to in following years.

The next breakpoint doubles the Medicare premium and adds another $104 a month in IIRMA. I understand that, even accept it. And it might even pay because I’d save an additional IIRMA of 105x12x2 or $2520 plus a tax reduction of about $240 per thousand.

But let’s say my RMD’s go up enough that I need a $10,000 QCD. $2520 plus 24% of $10k, or $2400 means avoiding that next bracket means spending $10k to save $4920. Not good economics.

But, there’s light at the end of this tunnel.

In fact if I just needed to lower my RMD by $2420 to avoid that bracket move I could do a $2420 QCD and I would save an additional $580 in addition to the avoidance of the $2420 IIRMA.

So I need to forget about avoiding any IIRMA and instead target the 1.4 multiplier level as where I want to stay. As long as my QCD requiement doesn’t grow over $2420. Or until I’m over 90 and the divisor is down at 12 or less.

Ros says

My husband I started to gift our children after they graduated from college

in the early 90’s. I still continues it being a widow for 12 years. I gift every first week of Jan so to help pay less income taxes, have less income so I can convert more to a Roth also and in case I die that year it is already done and less to have to pay for the last income taxes for that year when they do my return.

After next year I will start to take my RMD in Jan so they will not have

to take it for that year and pay taxes if I have not put it all into the Roth.

Hopefully they will not be in the IRMAA mess because of any IRA they

inherit and then will have count for their income.

Nancy Memmel says

Michael; I got your comment on the QCDs in my e-mail, but when I click the link to reply I wind up here, and not after your QCD comment.

I don’t think that Fidelity can reverse distributions, legally. QCDs are useful only to the extent that they’re a more tax efficient way to make contributions that you’d be making anyhow. Probably the best you can do is use them going forward.

Calwatch says

The QCDs can also be used as a charitable gift annuity to refund you some money back. You can buy up to $53k one time in your life so best to use that bullet when you absolutely need to and have a suitable charity you want to be extremely generous with.

The Wizard says

Here’s how I approach the whole QCD and Roth conversion thing nowadays, having started RMDs a few years ago.

Note: I’ve been doing my own income taxes for decades and am good with math.

So let’s assume your projected MAGI for 2024 around this time of year is around $185K, filing single, as I do. Or double that if MFJ.

Next higher IRMAA threshold, per Harry’s table is $202K (double that for MFJ) conservatively which allows me to do a modest Roth conversion in December of around $15K or so without getting into the next higher tier.

But if I do $5k charitable contributions as QCDs, now I’ve increased my headroom and can do maybe $20K Roth conversion without getting into higher IRMAA tier.

Note2: I do QCDs as I want during the year but wait until December to do my modest Roth conversion nowadays. By then I have a really good idea what my AGI for the year will be, including taxable dividends.

I’m 90%+ in stock funds in my tax-deferred accounts, so doing these modest Roth conversions after completing my RMD for the year are simply an attempt to keep future RMDs from growing too much…

Nancy Memmel says

Wizz, my approach is like yours. QCDs are useful for creating headroom in the IRMAA bracket to facilitate conversions and for those subject to RMDs, especially while we’re in the TCJA enhanced standard deduction tax regime. Since we are not subject to RMDs yet my preference is for conversion and paying charity out-of-pocket . A dollar to a charity for a quarter of tax relief isn’t, as Michael says, “good economics”.

Jim M. says

Nancy Memmel,

It seems to me that a dollar paid to a charity using a QCD from pre-tax funds would be better economics than paying a charity out -of pocket from after-tax funds. The latter uses funds on which taxes have ben paid and provides no additional tax benefit unless one can itemize in excess of the standard deduction. QCDs are Federally tax free and have the added benefit of reducing future RMDs. I don’t perceive that doing QCDs would limit the size of Roth conversions unless one is converting their entire IRA.

Nancy Memmel says

Jim M,

What I said was ” Since we are not subject to RMDs yet my preference is for conversion and paying charity out-of-pocket .”

A dollar of QCD charity contribution is a dollar NOT available to convert.

Ros says

When I retired you could have 25% taken out for federal income taxes in the SS check. Now I think the limit is 22%. I have everything taken out for federal taxes out of my pension but $14 and nearly 50% of my husband’s pension for state and federal taxes. I don’t have to send anything in. I take nothing out of the RMD. I never have to pay anything except a small amount to the state twice when they changed the law and I had a lot of interest. I can change the federal and state amounts in my husband pension any time during the year. Not sure about SS and I have nothing to change with mine. I just don’t want any bills.

Nancy Memmel says

And it isn’t even a straight 22%, it’s 22% if what’s left after Medicare & IRMAA deductions!

I think you can change the SS withholding but if you are at the top of the allowed % there is no point and it did take mine awhile for the withholding to start.

Teresa D says

Concerning the comment on QCD’s. We give over $14,000 charity to our church, after tax. so if we can do our Rmds as Qcds to the church, this helps us keep the after tax money to put into short turn savings. Win, win..

The Wizard says

It’s too bad that QCDs are only permitted for folks older than 70.5 and only from traditional IRAs.

When I am elected Emperor, I will change the law to allow QCDs starting at 59.5 and from all types of tax-deferred accounts…

Ros says

The messages again no longer have numbers in them.

I am searching for one message and I cannot find it even by

searching for the name.

I use a Mac in private browsing and duck duck go but even with google

chrome and leaving private browsing I still have no numbers by the messages.

Nancy Memmel says

I saw Jeff Enders reply to you (Ros) via my e-mail and looked for it on the site since I hadn’t seen your post that he was apparently responding to, but cannot find it here.

The Wizard says

Harry should probably switch over to using a more robust forum software, similar to what Bogleheads or the Early Retirement forum uses…

Harry Sit says

I made a fix. Let’s see if it works better now. The previous reply from Jeff Enders to Ros is here:

https://thefinancebuff.com/medicare-irmaa-income-brackets.html/comment-page-11#comment-34923

Nancy Memmel says

Thanks, Harry.

Ros says

So amazing that whether you are on vacation or on a holiday weekend you that the time to accommodate your readers. Thank you.

Nancy Memmel says

Dear frustrated; clicking the e-mail to reply gets me here, so here goes.

Our brokerage seems to process cash conversions more quickly than in-kind position conversions ( since they don’t have to consider the share prices in order to effect the precise dollar amount of the conversion, I would guess). While this might frustrate your purposes in doing the conversion, to have to generate cash in advance and then maybe re buy positions in the Roth, for a last minute play it might be worth it. You should probably ask your Fidelity guy ….

joeTaxpayer says

You may be 100% right, but I suspect in this day and age, no human intervention is required, it transfers and the system detects the value of the conversion.

Frustrated by IRMAA says

Hi Jim and Wizard,

I chatted with Mitch, a Service Rep at Fidelity. He agreed with both of you that a Fidelity client can easily do an online Trad IRA to Roth IRA conversion, without the intervention of a Fidelity representative, But, Mitch said that a client cannot process a Roth conversion and tax withholding in the same action without the intervention of a Fidelity Representative. Jim said he prefers to execute separate transfer requests for tax withholding. Are there benefits to doing a separate request for tax withholding? Mitch said whether the taxes are withheld at the time of conversion by an agent or done at a separate event it would be considered a tax withholding journal from the T-IRA. We now understand there is a difference if taxes are withheld from the IRA or estimated taxes are paid. We have not withheld any estimated taxes so far this year. For 2025 we will likely do four quarterly estimated tax payments to pay federal and state taxes, based on paying at least 110 percent of our our 2024 taxes in 2025 to avoid a tax penalty when doing a Roth conversion at the end of 2025. But, if we process our Roth Conversion for 2024 with estimated taxes in the fourth quarter (so the entire 2024 withdrawal portion would go into the Roth) we could get a tax penalty in 2024 unless we did an IRS form 2210. So for this year, for simplicity, as well as avoiding hassles with the IRS we will likely have the taxes withheld from our T-IRA. In prior years we had TSP accounts which we rolled over to Fidelity IRAs in June of this year. Each year along with tax withholding from our fed pensions we made partial withdrawals and tax withholding from our TSP accounts and larger TSP withdrawals and taxes in December, based on Harry’s IRMAA calculations. We had no idea about underpayment penalties, we were just lucky as we withheld enough taxes to avoid penalties. We made a TSP to Fidelity IRA rollover in June of this year, to allow us to consider making Roth Conversions and possibly QCDS. Thank you, Harry and all the knowledgeable people on this site for simplifying a rather complicated interplay between IRMAA brackets, tax brackets, Medicare part B and D premiums, Medicare MAGI, RMDS, QCDS, Roth conversions, the effect of estimated vs withheld taxes, avoiding tax penalties, and leaving less of a burden for our children. We have gotten a lot smarter due to the sound financial advice provided by the friendly financial gurus on this site. But it is like peeling an onion since every time I think I have mastered this topic something new comes up. Today, I was about to transfer some money to a NY Municipal money market fund ( yes I know tax-free interest gets added to MAGI) to lower taxable interest, thus reducing IRMAA, but then I became aware of the possibility of being affected by an Alternative Minimum Tax. To be addressed tomorrow.

Here is a new comment on 2024 2025 2026 Medicare Part B IRMAA Premium MAGI Brackets on The Finance Buff blog. If you’d like to reply to this comment, please use the reply link below.

Harry Sit says

Frustrated – You’re making withholding versus paying estimated tax a much bigger deal than it is. You said you prefer to have more money in your Roth. Don’t withhold taxes in that case. Just pay estimated taxes. You’re going to start paying estimated taxes next year anyway. Just get an earlier start and do it now. Q3 payment is due on September 15. Catch up to 3/4 of your estimated taxes now.

The IRS doesn’t always assess penalties based on the timing of estimated tax payments. Form 2210 isn’t that difficult in TurboTax but if you don’t feel like doing it, you don’t have to do it. Doing it may preempt the penalty but it’s not strictly required. See Opt Out of Underpayment Penalty in TurboTax and H&R Block. If I must bet today, I’d say you won’t get a penalty if you start paying today and don’t owe taxes when you file in April 2025. If the IRS does assess a penalty, it’s only interest. Yes, 8% is higher than the 5% you earned in a money market fund, but if you start paying today, it’s only on 1/4 of your taxes for 5 months and another 1/4 for 3 months. It’s not that much in the grand scheme. Having more in your Roth IRA will likely overcome it in the long run.

Nancy Memmel says

Frustrated:

You said you were looking to transfer money to a NY Municipal money market fund to lower taxable interest, to reduce IRMAA, but the tax exempt interest would just be added back to get to the income used for assessing IRMAA, so wouldn’t that be a wash?

(I suppose you’d save on state tax via the muni substitution, if your state income determination starts with the federal income values, though.)

Harry Sit says

Nancy – A muni money market fund has a lower yield. $5,000 in taxable interest raises MAGI by $5,000. $3,000 in tax-free interest raises MAGI by $3,000. Your MAGI is $2,000 less when you switch from a taxable fund to a muni fund but if your tax rate is lower than 40%, you’ll have earned less interest after tax in this example.

Jim M. says

Frustrated by IRMAA,

I do separate IRA withdrawal transactions for Federal and State tax withholding in order to simplify the math and the tracking of my tax withholding payments. At the time of year I start updating my income tax forecast to arrive at a tax withholding goal which I set at 95% of my projected Federal tax obligation for the current year. I have found that paying 110% of my prior year tax obligation results in too much of an overpayment to the IRS. I prefer to owe money to the IRS when I file my tax return on April 15. Paying at least 90% or more of my tax obligation for the current year satisfies IRS safe harbor rules. Paying 95% gives me a margin of safety.

I pay my Tax Withholding and QCDs out of my RMD in order to maximize the headroom available for doing Roth IRA conversions without exceeding the ceiling of my target IRMAA income bracket. If my goal is to pay $9,900 in tax withholding, I will execute a $10,000 transfer withdrawal from my T-IRA and direct 99% ($9900) of it to tax withholding with the 1% ($100) balance going to my taxable account.

One observation about your tax withholding plan for the current year: I suspect you would come out ahead financially by using your IRA withdrawals for Roth IRA conversions rather than for tax withholding. Based on what you have written it seems unlikely that you will have much of a tax penalty if you filed estimated taxes. Tax software can help complete the forms required to avoid the penalties and I suspect corresponding with the IRS about any penalties is likely to be a fairly routine matter rather than a traumatic event. It worth remembering that any unused headroom for doing Roth IRA conversions is an opportunity lost forever once the tax year is closed.

Action Jackson says

Hi Jim, I just stumbled onto the Finance Buff and love it, especially this blog on IRMAA. We are retired and only 66/67, so no RMDs yet. Because I’m a newbie, I’m a bit confused with a few of the strategies in your post, but it looks like I might benefit from them (once I understand!).

Specifically, I don’t quite grasp the benefit of doing Tax Withholding from RMD to give you more Roth conversion head room. In your example, you execute a transfer withdrawal of $10K from tIRA, with 99% for Federal taxes. How does this give you more head room for Roth conversions? Is this only for when you are doing RMDs, or can someone like me, pre-RMD realize this benefit for additional Roth conversion head room?

Our current situation: We’re still whittling down our taxable account for living expenses, and paying for Roth conversion taxes from taxable account (not from the converted amounts). In 2026, our taxable accounts will be exhausted and then we will draw mainly from tIRA to meet our expenses.

Thanks in advance for your help!

Jeff Enders says

Jim M. Please explain ‘headroom’ with a dollar example.

any distribution (whether RMD or Roth Conversion, excluding QCDs) from the tIRA is going to impact IRMAA as it’s taxable income.

If you are suggesting that taking a $10,000 distribution and using $9900 to pay federal withholding taxes somehow increases how much to put into a Roth WITHOUT affecting the IRMAA tier you don’t want to pierce, I don’t follow that at all. In your example, $10,000 would be reported as taxable income (which affects IRMAA), even though $9900 is sent to the IRS as withholdings.

If you are simply stating that you use after-tax dollars (and that would include proceeds from the RMD) to pay all federal tax, including the tax on any Roth conversions and that leaves more money that can go into the Roth, then that i understand. That is what most advisors suggest – pay the tax on the Roth conversions with available after-tax funds and not from the Roth Conversion itself. Is that ‘headroom’ to you???????

Nancy Memmel says

Jeff Enders; The advantage of using RMD money (that you’re going to have to withdraw in any case and which counts as “after tax” money) and directing it into withholdings is that you’d simplify making sure the taxes are covered so you don’t have to file a 2210 and simplify the calculation for how much conversion is possible to stay within an IRMAA tier. Using outside money from a bank or brokerage account would require making timely estimated tax payments . But either way you’d have to figure out how much tax you are going to ultimately owe for the year

Jim M. says

Action Jackson and Jeff Enders,

“Headroom” is just my way of describing a potential amount of income available for doing Roth IRA conversions. “Headroom” describes the difference between the ceiling of IRMAA income bracket being targeted and the amount MAGI income that would occur if no Roth IRA conversions were done.

Keeping MAGI income as low as possible makes more headroom available for doing Roth IRA conversions.

Prior to reaching age 70, one might create headroom by deferring Social Security until that age. Doing so might reduce MAGI income before age 70.

After reaching age 70, there a fewer opportunities for creating headroom. QCDs, which are excluded from MAGI, can be used to take tax non-taxable distributions from T-IRAs if one is charitably inclined. Once RMDs start, less headroom becomes available for doing Roth IRA conversions. At that point, my goal is to limit Non Roth IRA conversion distributions to the RMD amount. I withhold taxes and take QCDs from the RMD amount in order to accomplish that. I want to maximize the headroom available for doing Roth IRA conversions by making sure that tax withholding and QCDs are not taken after the RMD is satisfied. Doing so would reduce the headroom available for doing Roth IRA conversion. Tax withholding is taken from RMDs to avoid having to make quarterly estimated tax payments. No harm is done by transferring the RMD to a taxable account and making estimated tax payments from the taxable account if one prefers that.

ros says

Jeff Enders of Aug 22,

I pay the taxes on the conversion out of taxed money so I don’t make as much interest and the conversion gets the whole amount. And this way I also have less income for a bigger conversion the following year except the last 2 years the interest income has been high again.

I also gift the children the first week of Jan for the same reason.

I do not want to mess with my Medicare as I have a great plan with my husbands union but it does cost $6,500 a year. I have no doughnut hole, no co-pays for any type of doctor that I go to. I can go to Cleveland Clinic or Mayo etc. It will give you a ride home from a hospital or nursing home in a van or special vehicle if you are in a wheel chair.

The insurance policy paid 100% for my experimental heart surgery. I was suppose to have 6 months of rehabilitation but passed it all in 3 weeks. I spent 8 hours in ER before Christmas and it was paid 100%. It paid 100% for 5 1/2 hours surgery putting my wrist back together after slipping on the ice. When I was too aggressive doing the therapy at home and had to have more surgery I was not charged anything. We get paid for the tests they recommend us to receive yearly or periodically, including our physical which it covers up to $1,000 plus any tests the doctor may want us to have. We get paid if we exercise, or get the bone density, mammogram, colonoscopy etc. We have dental, eye care, and pays up to $2,000 each year for each ear for hearing aid if needed. Also pays for a exercise program we may want to join. Pays for delivered hot home meals for 30 days after a hospital or nursing home stay if wanted or needed or someone will come in and cook for you if wanted or needed. If someone is needed for bathing, dressing or anything it is covered for at least 30 days. More if required. No charge. I have never used or asked for most of this stuff. The employees vote for which plan they want from the choices the committee they voted in that does the research and then chooses 3 or more plans and gives the hourly cost for each and then it is explained with a written notebook with benefits of each plan and they can ask questions and then the following week they vote on which plan they want. They also can call with more questions during that week before the vote. They are self insured. What ever plan has the most votes is the one everyone gets. They also choose the people that counts the votes and they can watch the count if they want. My husband was on 100% disability insurance since 1995 and I was on the insurance since he started this job in 1966 and I don’t ever remember having to pay one penny for anything medical since he started this job.

He passed 12 years ago and I still am able to stay with the insurance plan.

Jeff Enders says

Jim M: seems complicated, but if it works for you, great!

However, hypothetically, let’s say Congress abolishes IRMAA, but instead adds 2% to each tax bracket (so for example, the 22% tax bracket is now 24%, the 24% tax bracket is now 26%, etc). How does your strategy change (if it does at all)?

Jim M says

Jeff Enders,

If Congress were to abolish IRMAA then, I would probably be targeting the top of one of the marginal tax brackets as my MAGI income ceiling. I am not able to do that now without moving in a higher IRMMA bracket which I have been trying to delay / avoid.

Roth IRA conversions make sense to me as long as the marginal tax rates for doing them are unlikely to be higher than what my long term marginal rate might otherwise be. In other words, I would do Roth Conversions at a 24% rate to avoid or delay the time it might take to move into the 26% marginal tax bracket. I would not do Roth conversions at 26% marginal tax rate, if I thought my long term tax marginal bracket would be 24%.

To clarify my response to one of your earlier posts: I agree with you that it makes sense to pay the tax on the Roth conversions with available after-tax funds and not from the Roth Conversion itself. However a Roth IRA Conversion can still make sense when the taxes get paid from the conversion itself. It just means that any taxes paid will reduce the amount of funds being converted. Somehow taxes need to be paid on the amounts distributed from a T-IRA. I don’t see much harm in using an IRA distribution to generate after-tax funds that are needed to pay taxes. This becomes easier to do once RMDs start.

The primary reason I mentioned tax withholding in this discussion was to point out that withholding taxes after the RMD is taken has the effect of reducing the headroom available for doing Roth IRA conversions. It is far better to withhold taxes and take QCDs from the RMD than to withhold taxes or take QCDs after the RMD is taken. The reason for this is that QCDs and tax withholding can be used to satisfy the RMD. Withholding taxes from an RMD does not increase the headroom available for doing Roth IRA conversions.

JoeTaxpayer says

Now that the pretax retirement accounts have to be emptied by a non-spouse beneficiary within 10 years, there’s a bit more math to consider. It’s not just your marginal tax bracket, but potentially that of your beneficiaries. Just dropping this quick comment here for your consideration.

Nancy Memmel says

We inherited traditional IRAs; Roths did not exist at the time the accounts were amassed; and the tax effects are what engendered our “Rothifixcation” push.

Jeff Enders says

JoeTaxpayer: that is exactly what begs my question to Jim M.

I truly think many are trying to save the nickel by avoiding the next tier of IRMAA, which are causing more dollars to be paid out later.

for the 77% of Americans who consume their tIRA for living expenses (or QCD) before they die, Roth’s make no sense. But for the remaining 23%, maximizing the Roths gives the next generation 10 years of tax free investing compared to leaving them a higher tIRA balance.

If you believe that your children’s tax bracket will be higher than yours’ as they inherit your tIRA during their high earning years and that tax bracket is exacerbated by the need to distribute part of the inherited IRA each year for 10 years, then are you really saving any tax by limited the Roth Conversions to the next IRMAA tier?

Alternatively, if the tax rates bounce back to the 2017 configuration in 2026, it’s the same issue – higher tax rates in the future.

Also, while my spouse and I are alive, we mitigate the ‘spousal tax’ after the first to die.

IRMAA is the equivalent of about an extra 2% to the marginal tax rate if we just think of it as an income tax and nothing more.

Personally, my approach is complete Roth conversions to the top of the marginal tax bracket I am comfortable with and let IRMAA fall where it may – the overall tax (income + IRMAA) is still lower than I expect occurs in 2026 (or my children eventually pay)

The Wizard says

My approach differs from Jeff’s in that I’m not going to pay excess income tax to Roth convert even more of my tax-deferred accounts. Filing single, my rule has been to convert to the top of the 24% bracket or close to the next higher IRMAA threshold which is close to the 24%/32% tax boundary but varies from year to year.

With any luck, I’ll likely still have around $1M left in tax-deferred at the end of my run, in addition to growing taxable and Roth accounts.

My heirs will figure a way to deal with this…

jimdog says

Great comment Jeff! Makes a ton of sense to me what you have said. I now will go ahead and move up to a higher marginal tax rate due to my situation. Everyone’s situation is different! I have a large T-IRA balance, children and a younger wife that compels me to make large Roth conversions. Thanks for the clarity on this issue.

Dennis McFall says

A couple of things I never see addressed.

1. The theoretical point of the IRMAA is to charge a higher Medicare Part B premium to those who have more income. However, those who withdraw from a Roth as opposed to a Traditional IRA, don’t have to account for the income in the IRMAA calculation. If two parties each have an RMD of $100,000 the Roth is excused even though his/her income is the same as the one with Traditional IRA. The Roth already gets an income tax break so why aother one? So much for “means testing.”

2. States where Social Security is not taxed do not have to include this in income for the IRMAA calculation. Eight or nine states still tax Social Security so we (yes I live in one of those stingy nasty states that tax us on money already taxed that put money above everything else) get hit on IRMAA.

3. All earnings on Roth are tax free. Earnings on my non-taxable IRA contributions, are taxed. There is no pro-rata exclusion. The deduction is worthless because in the computation the numerator stays the same while the denominator grows larger, severely reducing any tax benefit.

Yes, I know that’s the breaks for not converting to ROTH years ago, but I had a large Traditional amount and the tax would have been horrible. Also, who knew we were going to have something as bad as an IRMAA hit our Part B? Everything promised disappears in a tax change with no grandfathering clause. This is “Changing the rules after the game is in the 9th inning.” Treating two classes of income, really the same RMD dollars, differently for Roth vesus traditional in the IRMAA calculation, when there was no way to ever anticipate such, is wrong. My first IRA contribution was in 1975 so I was not in a position to convert later on. Very inequitable in my opinion, as it applies to IRMAA and to the taxing of earnings on non-deductible contributions to a Traditional IRA.

The Wizard says

Sounds like somebody is WHINING without just cause.

I already paid 24% Federal tax on my Roth conversions, so you want me to pay more, via IRMAA, if I withdraw some of my Roth money this year? No thank you.

And your state taxes SS income? Well that’s too bad…you can move. What does that have to do with your Federal MAGI and IRMAA? Absolutely nothing.

You misinformed billionaires make me sick…

Mike D says

I think we need a clarification – it most information I have seen :: the amount of your Social Security income that is taxed on your Federal Income Tax is included in the MAGI and therefore is used to determine the IRMMA.

Anyone have factual information from Medicare??

Jeff Enders says

this is the SS definition of MAGI – it is simply your AGI (line 11 of form 1040) plus tax exempt interest (line 2a). That is it!

whether a state taxes SS is immaterial as it does not impact federal AGI.

https://secure.ssa.gov/poms.nsf/lnx/0601101010#:~:text=Modified%20Adjusted%20Gross%20Income%20(MAGI)%20is%20the%20sum%20of%3A,2a%20of%20IRS%20Form%201040).

Jeff Enders says

Dennis – in response to your post;

2) you are misinformed. Whether SS is taxed or not taxed by a state is immaterial as it has nothing to do with AGI on the federal tax return. Whatever is on line 6B (taxable SS) is part of AGI and that is true in all 50 states.

1) and 3) contact your Congressman. It’s the way the tax law was passed by your representative!

Nancy Memmel says

2. States where Social Security is not taxed do not have to include this in income for the IRMAA calculation.

How are you figuring? The IRMAA calculation uses items from the Federal 1040, it doesn’t matter what state you’re in, the amount of SS income federally taxable for you is what contributes to IRMAA income.

You pay tax when you distribute or convert; you get to figure out what works best for you, but declining conversions because you’d have to pay tax then is not going to get you sympathy when you later complain that not converting set you up for IRMAA charges later and so everyone should have to pay the same as you.

As to ‘”who knew” something like IRMAA existed, well, it’s been a thing for awhile now. Before one is liable for it, generally one is not paying attention. Understandable, but not anyone else’s fault.

Nancy Memmel says

Treating two classes of income, really the same RMD dollars, differently for Roth vesus traditional in the IRMAA calculation, when there was no way to ever anticipate such, is wrong.

They aren’t the same RMD dollars, though; one set has already been taxed and the other has never been taxed. Would you be offended if someone used savings for living expenses instead of IRA distributions and feel that not having to add the savings to income to figure IRMAA liability is “wrong” , too? How about if the savings came from an IRA distribution years ago? Income from more than 2 years back doesn’t figure into IRMAA assessments. Is that also “wrong”?

And claiming that something you did not pay attention to, and therefore did not know in advance, was something that was UNKNOWABLE is ridiculous. You really couldn’t possibly have imagined that a pre tax pot of assets and a tax free pot of assets would effect your income taxes differently?

The Wizard says

Medicare has nothing to do with it.

85% of my SS benefit is included in my AGI because I’m a wealthy bastard.

Whether my state taxes my SS or not has nothing to do with it…

The Wizard says

Nancy makes an excellent point. No one cares more about your financial situation than you do, so PAYING ATTENTION to what the rules are, as they evolve and change, is a most excellent idea, starting from a younger age if possible…

Ros says

You don’t have to be wealthy to pay federal tax on 85% of your SS benefits.

I am single, not wealthy and pay tax on 85% of it.

This is from an article written in the spring of 2024.

https://smartasset.com/retirement/is-social-security-income-taxable

Action Jackson says

I totally agree that we are the ones primary responsibility for our financial IQ. That said, the whole IRMAA puzzle is not very well reported. I’m a daily reader of the Wall St. Journal and the financial section of the NY Times and never seen a single mention of it.

Yet the first time I heard of IRMAA was when we got a letter in the mail from the government in late 2022 telling us what our IRMAA premiums were going to be for the next calendar year. To make matters worse, we had a CFP (the owner of the firm) that never brought it up or (God forbid) planned for it in our quarterly meetings over a span of eight years.

Also, the CFP did not bring up Roth conversions early in our retirement when our marginal tax rates were 10 and 15%. This CFP is now our former CFP as we let them go this past January. Can’t do anything about the past, now just looking forward.

I am back to doing our finances DIY, saving a lot of $$ in fees and feel like I have a much better handle on our near term and long financial term plans. Now we pay for CFP input by the hour as needed, and for an annual check up once per year to ensure we are not missing anything.

Now that I’m DIY, I spend a lot of time on several financial websites. Of these sites there is seldom, if ever a mention of IRMAA, even when the conversation gets deep into the topic of Roth conversions. Again, we are all responsible to know and plan for this stuff, but for some reason the topic of IRMAA is off the radar.

Our CPA recommended this website, and in particular this article as the best place to get information on IRMAA. I agree 100%.

The Wizard says

They discuss IRMAA over at Bogleheads quite often.

But what’s rather perplexing is the 128-page “booklet” that gets sent to us every year: Medicare and You.

Nowhere in those 128 pages is IRMAA mentioned…

Tom P says

Actually, IRMAA is mentioned 8 times in the 2024 eHandbook and 10 times in the 2025 eHandbook.

MTG says

Hey Wizard: 2025 Handbook

Income Related Monthly Adjustment Amount (IRMAA) 23–24, 82

Jeff Enders says

Action Jackson – it could be that many don’t know any IRMAA (and I didn’t either until I was Medicare eligible myself) is that it just began in 2007 and even today only affects 8% of the Medicare population.

I also wonder if the heightened awareness of Roth Conversions caused by the changes in Secure2.0 didn’t help bring IRMAA to the forefront. Those Roth Conversions increase AGI which can have the unintended consequence of putting a Medicare recipient into IRMAA. (Heck, I began these Roth Conversions and didn’t learn about IRMAA until after the fact myself.)

When this whole topic comes up with contemporaries who are in the early 60s, they have NO IDEA there is such a thing called IRMAA. Haven’t had a conversation yet with this cohort that is aware of this “tax”.

Nancy Memmel says

Just a guess, but was your CFP maybe decades away from Medicare age? And is your CPA closer to Medicare age?

If you’re not DIY there’s a tendency to figure the person you’ve hired is taking care of it, and nod off.

You’d think that financial people focused on Roth conversions would be touting threading the IRMAA needle, though. It’s a selling point.

James says

To aid some of you with perspective. Back in the Early 1980’s We were in the 43-44% tax bracket, and felt lucky that we had a 2K-3K loss on a rental property to drop our tax bracket to the 37-39% range. We Felt LUCKY!!. The Regan Tax reforms dropped our rate to 35% by 1987. And miracle of miracles, the Federal rate fell to 28% in 1988! So even with the loss of IRA deductibility from gross income which changed in 1986, we felt grateful. So the 40% penalty on the 1st IRMAA Tier, It’s just not that significant.

Action Jackson says

Yes, I think you are right about Secure 2.0 being the catalyst. Secure 2.0 plus the upcoming expiration of the current tax rules at the end of 2025 are prompting a lot of folks to do Roth conversions. That is definitely the case for us as we are making big conversions in 2023-25.

Gary says

Action Jackson, we are in the same mode on Roth Conversions, having jumped 2 IRMAA tiers for a few years now and will do again next year. Recently saw where Roth Conversions referred to as “Tax Insurance”, paying a small amount to hedge against larger taxes/penalties later. In our case, we are hedging at least 3 possible events: 1) 2026 sunsetting lower tax rates; 2) Higher single tax rates if one of us passes away early and; 3) Higher rates if our son inherits everything early. I am sure there are more possible that one can envision. So we are spilling over into the 24% tax bracket and paying tier 2 IRMAA penalties even though our baseline planning model does not show this as the best EXPECTED results unless we both survive into our 90s (which is less than 25% chance because we are both age 71).

Jeff Enders says

Gary – perfect! My rationale for large Roth Conversions is exactly the same as yours…..

The Wizard says

Nancy is correct but you certainly don’t need to use QCDs for your entire RMD. You can QCD any amount you like, up to the maximum of around $105k per person…

D. Hanson says

Hello Finance Buff

I found this website and its links to the tools very helpful as we “hedge” future tax implications against RMD, IRMAA and the possible end to TCJA in 2025.

We are not unique, but we are in a small group where we, as a married couple, have a greater than 5-year difference in age which allows us to determine if converting IRA monies to Roth now and taking the single IRMAA hit in 2 years is more beneficial than waiting for RMDs. (I am under 60 & hubby is under 70- we determined we can do higher IRA to Roth conversions with known tax implications in 2024 & 2025 and not double the impact on IRMAA once we are both on Medicare. Waiting to determine numbers for 2026 as tax rates will most likely change following election.)

Your website gave me the information I needed to have more detailed conversations with my financial planner and tax advisor, and I think this will save us quite a bit in the future!

Thank you!

The Wizard says

Roth conversions are good to a degree but it’s almost never the best idea to convert all tax-deferred funds. In my case, for instance, at age 74, only about 20% of my AGI comes from my RMD…

Action Jackson says

Interesting comment. Can you expound on examples when it would not be best to covert all tax deferred monies to Roth? Thanks.

The Wizard says

Yes. For practically everyone, it’s best to leave some in your tIRA to allow you to do QCDs to deserving charities, assuming you are so inclined. Charities pay no tax on those funds and neither should you.

And for higher income retirees with good-sized tax-deferred amounts, you need to watch your marginal tax bracket. I’ve been in the 24% marginal bracket for years now and if I Roth converted beyond a modest amount, I’d get into the 32% bracket and I’m just not interested in going there…

IRMAANeedsToGo says

Action Jackson, if you read the comments (yes, there are hundreds of them), you will find one scenario that I have listed before where keeping some tax deferred funds makes sense: health care expenses. If you or spouse require significant care, possibly running $100K or more per year, you can deduct a lot of those expenses above the 7.5% threshold and thus take distributions from your tax-def accounts and avoid federal taxes on the money. If instead, you had converted all of your funds to Roth along the way, you will have paid income tax on the money that you really didn’t need to pay. It could be 30%+ that you lose by choosing the Roth approach in total. No right answers, but balance seems to be prudent to deal with situations like this, plus future tax law changes.

Cheers.

Nancy Memmel says

IRMAAneedstogo,

I guess this is true if your income is all going to be coming from you retirement accounts.

If you will have income other than retirement account draws (e.g. pension or annuity or operating business ) you would get, and be able to use, the same deduction for medical expenses, only getting the taxation benefits against that income at the time the expense is incurred. Or have I missed something here?

IRMAAneedstogo says

Your observation is correct. Many of the “all in on Roth” commentors seem to imply they want totally income-tax free living once they complete their Roth conversions, which leads me to my comments about balance. If, as you point out, you will already have sufficient taxable income from other sources to pay all the medical bills to achieve maximum deduction benefit, then having the tax-def IRA funds isn’t any real value relative to this issue. I do have to say if people already are planning on $200K+ of taxable income in addition to their IRA/QEP distributions, then they are going to be fine in any event. Thanks for the addition to the discussion.

Nancy Memmel says

Many of the “all in on Roth” commentors seem to imply they want totally income-tax free living once they complete their Roth conversions.

Lower taxes are a plus but maybe the attraction is predictable taxes ; for me the thing is more like one-less-thing (read RMDs)-to have-to consider-regarding-taxes. And if you need to pull a big slug of money out, to replace a roof, for example, not having to calculate the amount extra to cover the (surprise!) taxes due. (And you just know that roof is going to fail right after the tax rates get jacked up…)

JoeTaxpayer says

But, “All in Roth” misses an opportunity. At retirement, you still have a standard deduction and the first tax brackets.

And – in the final years, assisted living and/or memory care can easily put someone back into the zero bracket. (i.e. taxable income that gets wiped out by standard deduction). In which case, a Roth conversion can be used as well.

Nancy Memmel says

If you are in memory care in your final years isn’t it likely that you’d be consuming rather than converting, and would it even occur to you to convert in that scenario? Even if you did convert then, you’d have given up years (and maybe decades) of growth potential as a Roth.

Michael Winnick says

Would you rather have $5 million in a Roth, or $5 million in a TIRA, or $2.5 million in each?

I don’t understand the Roth issue. If all my money is in a Roth what am I missing out on. Before RMD’s my tax return was real simple. Pension+ Social = AGI, and that was always less than the IIRMA brackets.

Nancy Memmel says

Michael,

I would say having money in a Roth is ALWAYS better than in a t-IRA, but it is the process of getting it there that’s the sticking point.

If you are close to consuming it (time-wise) and close to bracket ceilings with other income it may turn out to be a cost and effort sink; you can convert and hop brackets and pay higher taxes now to avoid mandatory distributions making you hop brackets and pay higher taxes later. You can calculate how much higher tax if you do it now; you have to project how much if later.

If you’re expecting NEVER to consume it but are positioning it for heirs you can currently expect they’d have a minimum of 10 years of growth potential.

I read an academic paper where the conclusion was that if you have 7 years or more of growth you’re almost always better off converting than not, but it is a theoretical analysis that assumed growth rates and assumptions are not guarantees…

GeezerGeek says

One strategy does not fit all. Either “All in Roth” or “No Roths” can be an appropriate strategy, depending on one’s financial situation. I’ve done Roth conversions every year since 2011 except 2013 when I was in an employee buy-out that greatly increased my annual income. Even with 12 Roth conversions over the last 12 years, 65% of my IRA funds are still in traditional IRAs. I only did Roth conversions for an amount that seemed right at that time for my financial situation. Now I’m to the point in my life where time is more important to me than money. I’d rather spend more time with my family than with my money. I don’t want to spend a lot of my time optimizing my finances and I’m fortunate that my financial situation allows me that freedom. So, I may spend less time doing Roth conversions in the future. No one else’s financial situation is identical to mine (maybe similar but not identical) so I don’t expect others to have the same financial strategy that I do. The bottom line is to be tolerant of other folk’s financial strategy because their financial situation is different than your own.

Nancy Memmel says

Harry ,

I have a question about the married filing single 2026 projection of IRMAA brackets. The table says MFS with IRMAA income over 107 K will pay 3.2X the standard charge if income is below 393 K if inflation is 0% , but if inflation runs at higher 3% they will pay that rate on income above 109 K only below 391 K . Seems backward to me that the ceiling would drop if the inflation rate rises.

Thanks for all you do.

Harry Sit says

That’s what the law says. As inflation pushes up the brackets, those married filing separately with a higher income get a bigger penalty by going into the 3.4x bracket.

Ed says

I just got an email from Social Security about the COLA adjust for next year. A portion states “This year, millions of people who receive Social Security Disability and Retirement benefits and do not pay Income Related Monthly Adjustment Amount (IRMAA) will receive a newly designed and improved COLA notice”. Is this saying that anyone who pays IRMAA will NOT receive a COLA?

Harry Sit says

I read it as saying people who pay IRMAA will only receive the same ol’ COLA notice without the new design.

Nancy Memmel says

Does rather beg the question as to why SSA needs to have 2 different COLA notices, though.

We will be in the phalanx of IRMAA of payers next year so will not be getting the “new and improved’ notice. Just for curiosity sake, would someone who does please let the rest of us know what that was all about?

Jeff Enders says

Nancy – it is possible this is part of a “multi-generational plan”. Get the simpler notices redesigned in Phase I, and then redesign the more complicated notices (with IRMAA information) in Phase II.

Steve says

Harry, thanks for updating this. Always helpful when I do end of year income adjustment and tax planning for current year and next.

Teresa Furden says

The new design just puts everything on one page, including deductions. Sort of plain looking to me. You can go to utube and see the new design.

Tom P says

Here’s the link [from Social Security Administration showing the new COLA notice]: https://www.youtube.com/watch?v=loiaU0trOtQ

Jim Eggen says

From prior experience I already do not like IRMAA and I fear that any future distributions I take from Roth iras might trigger more IRMAA surcharges like the ones I already experience with T-ira distributions (both RMDs and voluntary excess distributions).

I think what I am asking is: under what circumstances, if any, can ROTH distributions adversely affect an IRMAA MAGI so that I pay more IRMAA. I like to think the answer is “none”? My spouse and I are MFJ, both 76 years old and well into retirement/medicare. All of our ira distributions have been and will continue to be “qualified”

I really appreciate all the good info you create, but I am slow to advance up the learning curve as suggested by this simple Q.

Terry Koch says

Congress can obviously do anything that it wants, but if they made Roth IRA distributions taxable, then that income would be taxed twice since there is no deduction for making Roth IRA contributions as there is for Traditional IRA contributions. I don’t know if that is illegal, but it should be.

Jeff Enders says

JIm Eggan – practically, Roth distributions don’t affect IRMAA because they are normally after-tax distributions. MAGI for IRMAA is simply line 11 of Form 1040 plus tax-exempt interest on line 2a, so after-tax Roth distributions wouldn’t affect line 11 and therefore would have no impact on IRMAA.

Academically, it is possible, however unlikely: if your oldest Roth account has been open for less than five years and you distribute the earnings from the Roth accounts (and distributions liquidate all contribution dollars first, all conversion dollars second and only then are earnings distributed), then the earnings are taxable and would be added into Line 11 of the tax return.

Nancy Memmel says

“From prior experience I already do not like IRMAA and I fear that any future distributions I take from Roth iras might trigger more IRMAA surcharges like the ones I already experience with T-ira distributions ”

The point of Roth distributions is that they WILL NOT trigger IRMAA as they are not included in taxable income that forms the basis for assessing IRMAA charges.

JoeTaxpayer says

Indeed. Roth withdrawals don’t count now for IRMAA calculations.

But, I assure you, if I convert to Roth and pay extra, top IRMAA for those conversions, they’ll decide to use Roth withdrawals in future IRMAA calculations. Literally every change to the tax code has impacted me negatively. This one won’t be different.

MTG says

Although I don’t think they will change, Congress could decide to tax Roth investment gains.

Jeff Enders says

MTG – based on the current scheme, earnings take low priority when distributing from an Roth IRA. All original contributions dollars are distributed first, all original conversion dollars are distributed next and only once all those dollars are distributed are earnings distributed.

Nancy Memmel says

I know the feeling, but Congress is probably not paying that much attention to you. (Your surname isn’t Trump, is it?)

If Congress were to do that, then they would be making Roth distributions taxable. They have been nudging people to move to Roth contribution ( so that the tax revenues are larger NOW, for current politicians’ use) the pool of taxpayers who have Roth’s is expanding. The larger the number of taxpayers with Roths , the more problematic it would be for a future Congress to bill changing the deal and taxing Roths as “making the rich pay their fair share”, which is how these things are always done. Not impossible, I grant you, but much more dangerous for the politicians to do.

MTG says

My post above went to wrong comment

Although I don’t think they will change, Congress could decide to tax Roth investment gains.