[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

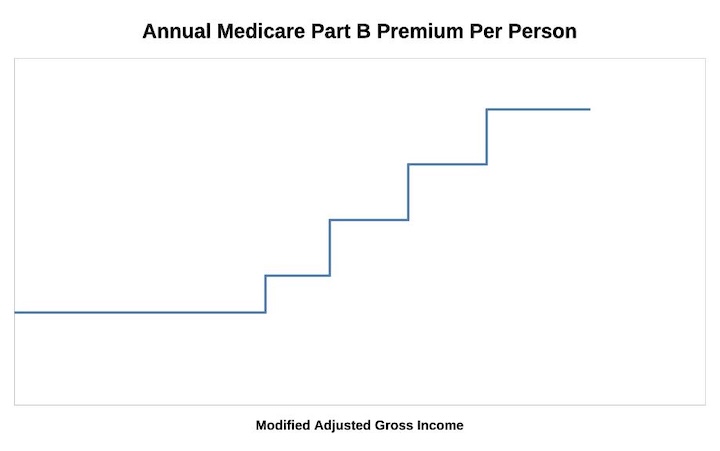

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

David Swanson says

Your article says that for 2026 IRMAA brackets (based on 2024 income), will be (for MFJ) $214,000 or $218,000, depending on the 12 month average inflation value. While we don’t know all the inflation data yet, are those IRMAA brackets exact? If not, when will they release the exact IRMAA brackets?

Thanks,

Dave

Jeff Enders says

they are exact (which I take you mean they are rounded to the nearest $1000) because the law requires rounding to the nearest thousand dollars for the SINGLE limit and then doubling it for the MFJ limit……..

Nancy Memmel says

David

2026 brackets would be known near the end of 2025 since August 2025 inflation data is the last data point and that will come out in early Sept 2025.

Not particularly helpful for regulating income realized in 2024 for the purpose of undercutting thresholds for 2026 IRMAA, but it takes time for the income data the SSA uses to assess IRMAA to become available to it, so IRMAA is determined by prior incomes.

Robert Hoppe says

I’m not understanding the huge gaps between IRMAA MAGI brackets (based on 2023 income). The website shows the following:

These will be the 2025 numbers when the Medicare website publishes them in a couple of months:

Part B Premium 2025 Coverage (2023 Income)

Standard:

Single: <= $106,000

Married Filing Jointly: <= $212,000

Married Filing Separately <= $106,000

1.4x Standard Single:

<= $133,000

Married Filing Jointly: <= $266,000

What is the multiple of standard if the year 2025 MFJ MAGI falls between $212,000 and $266,000?

Harry Sit says

It’s 1.4x. The symbol before the number means “less than or equal to.”

Robert Hoppe says

Thanks Harry. I think it would be clearer if the site were to show > $212,000 and < = $266,000 for the MFJ category (i.e., 2023 MAGI for 2025 premiums) rather than just < = $266,000, so that readers can see that the 1.4 X standard category falls in the $212,000+ – $266,000 MAGI range.

Harry Sit says

You read the table from top to bottom and you stop at the first row your income falls in.

Frustrated by IRMAA says

Hi Harry,

Any chance you may revise 2026 IRMAA brackets based on 2024 income within the next two months. Thanks!

Jeff Enders says

the ranges are revised monthly based on new inflation data. so the answer to your question, is ‘yes’. But your further question may be will the ranges change? that depends on the actual inflation reported and its impact on the underlying calculations.

Harry Sit says

I follow the CPI release dates. The next update date is shown at the very top of this post. The last update in 2024 will be on December 11. The brackets may or may not change in each update depending on the data.

The Wizard says

Frustrated,

Harry tends to update his IRMAA projections monthly based on actual inflation data plus a few projected future inflation scenarios.

This allows folks to compute a safe Roth conversion amount each December, on top of other income, to stay in their chosen IRMAA tier two years hence…

Paul says

Harry as already posted the next CPI-U release date. The future schedule is here:

https://www.bls.gov/schedule/news_release/cpi.htm

I will also note the IRMAA brackets are calculated from the average CPI from September to August. To calculate IRMAA for any given tax year, the final monthly CPI you need will be published in September of the following year.

While this is really inconvenient for tax planning, the reason IRMAA “looks back” so far: your final version of your tax return isn’t due until October of the following year. Of course, if the legislation had specified IRMAA brackets to be set based on the CPI increase in the previous year, it would have been a lot easier.

Mary says

Just to be safe I usually try to keep income below the previous year’s IRMAA amount . A safety measure just in case something unexpected happens.

What I’m wondering now is what will happen to the amount when/if the TCJA goes away? Will the IRMAA revert back to 170k or less?

GeezerGeek says

Mary,

Brief History of IRMAA: Was first implemented as part of the Medicare Modernization Act of 2003 and was initiated in 2007. The brackets were initially lower but were indexed to increase so that only about 5% of enrollees would pay the penalty. For joint returns, the maximum income without a IRMAA penalty was $160,000 for 2007, $164,000 for 2008, and $170,000 for 2009 & 2010 (no price inflation for 2010). The ACA (Affordable Care Act) froze the brackets at the 2010 level where they remained until 2020 when the brackets were again indexed to increase based on inflation. In 2018, the income for the top bracket was dropped to the previous next lower bracket and a new middle bracket was inserted. In 2019 an additonal higher bracket for income $750k and above was added. Initially, the IRMAA only applied to Part B premiums but in 2011, the Affordable Care Act extended IRMAA to also include Part D premiums.

So, as Robert Hoppe pointed out, nothing in the TCJA changed the IRMAA brackets.

Audrey says

Was there supposed to be an update to this article on Oct 10 after the September 2024 CPI report? I really appreciate these forecasts for 2026.

Audrey says

Never mind. For some reason I kept getting a link to the stale version of this article from any web search and didn’t see the October comments even until I posted my own. Weird. Thanks!

Robert Hoppe says

Hi Mary. I don’t see how an expiration of the TCJA could possibly have any impact on the MAGI IRMAA thresholds. The MAGI IRMAA thresholds will have the same effect on Medicare Part B premiums regardless of the IRS income tax laws. The MAGI IRMAA thresholds are determined by Medicare, not the IRS. BTW – I have been taking the same approach as you with respect to keeping our MAGI for the current tax year at the same level as the MAGI IRMAA thresholds from 2023, just in case Medicare decides not to increase the IRMAA thresholds for 2024.

Mary says

Thanks Robert. It’s reassuring to hear that the IRMAA magi will not be reduced.

Jeff Enders says

Robert:

<>

Medicare has no control over this – they can’t just decide not to adjust the IRMAA tiers. Congress controls that decision. And currently, IRMAA will adjust each year based on inflation.

Paul Koehler says

I appreciate the information on the 2025 IRMAA brackets. Is there any way to

know what the Part B & D premium increases(penalty) will be based on

MAGI?

Mtg says

not until 2025 rates are announced.

Harry Sit says

We won’t know the standard premiums until Medicare makes the official announcement but the incremental changes from year to year aren’t that big. You won’t be too far off if you just add $10 to the current year’s Part B monthly premium and a dollar or two to the Part D monthly premium used to calculate IRMAA. Whether it’s exactly $185 or $183 for Part B or $34 or $35 for Part D doesn’t make a big difference for budgeting.

Robert Hoppe says

Thanks Jeff. The problem for all of us is that Congress has to wait until after October to decide on the MAGI IRMAA threshold amounts for the current year, since it’s based on inflation factors through October. That doesn’t give Medicare recipients enough time to adjust for their current year’s MAGI, since 10 months of income have already transpired. It would be better if they announced the threshold amounts in June based on published inflation factors through May.

Nancy Memmel says

Robert,

Congress isn’t deciding IRMAA thresholds on a year-by-year basis: the inflation indexing is in the law they passed (in the past) and the thresholds for next year ( 2025) are based on the inflation data for the 12 months that started with Sept 2023 and ended with August 2024 . The data is in . Harry has done the calculations using the same data and the same methods the agency will use, but being a govt bureaucracy, SSA has yet to formally announce.

The current year ( 2024) IRMAA thresholds were announced in late 2023 and apply to 2022 incomes.

2024 incomes will interact with the thresholds effective in 2026, and those thresholds will be announced in late 2025. Your 2024 income will be chipped in stone > a year before you will know the thresholds for 2026, because the SSA will not have income data available to it until > a year after the applicable calendar year has ended.

We’re also waiting for the 2025 Medicare premium amounts to be announced.

Robert Hoppe says

Thanks Nancy. The timing of the MAGI thresholds justifies my point in that we don’t know the threshold level until 83+ % of the year has already passed. BTW – the Medicare Part B monthly premium for 2025 (for those in the lower tier MAGI threshold) has already been determined to be $185.00, up from $174.80 for 2024 — i.e., a 5.84% increase which is not unreasonable. The annual deductible for Medicare Part B in 2025 is projected to be $240. This is an increase of $14 (6.19%) from the 2024 annual deductible of $226.

Nancy Memmel says

“we don’t know the threshold level until 83+ % of the year has already passed.”

Since the income year that interacts with a set of income thresholds is for 2 years prior to when the thresholds apply it wouldn’t matter if the announcement came out in Jan of the prior year or in November as it does; the income that you have to consider in a given year for that years IRMAA assessment was set 2 years ago. You cannot go back and change it.

I wasn’t aware that the premium values had been announced. Last I looked there were myriad projections on sites that are not Medicare, but nothing from that actual agency.

Paul says

Robert,

I think you are misunderstanding the IRMAA thresholds and the tax years for which they are applied.

The thresholds for tax year 2024 were set back in October, 2022. And, the thresholds that were finalized last month are for tax year 2026. The reason for this delay: your MAGI is not “set in stone” until we pass the last day for filing a tax return without late penalties: 10/15. (unless you amend your return, which can create some complications).

I have seen several ESTIMATES that the base 2025 Medicare Part B premium will be $185. But, CMS has not officially announced it. It was announced on 10/12 last year, so we are a bit past that precedent.

Robert Hoppe says

I fully understand that there is a 2-year lookback on MAGI levels to determine the IRMAA Medicare Part B and Part D premiums for the current year. My comments regarding timing of issuance of the MAGI thresholds has to do with not knowing the MAGI thresholds until after October each year. In other words, we don’t know the 2024 MAGI thresholds for 2024 until after Oct 2024 which, in turn, determines your premiums in 2026. The Medicare Part B monthly premium of $185/month for 2025 and $280 annual deductible for 2025 was announced recently, not last year.

Paul says

Robert,

The IRMAA thresholds for MAGI in tax year 2024 won’t be official until October, 2025. The only question at this point is: what will your premiums be in 2025? That’s determined by your MAGI in 2023.

Harry has posted the IRMAA thresholds effective in 2025 for 2023 MAGI, and once the base premium is confirmed, the rest can be derived with known multipliers.

Would you please post a link for the CMS announcement of the Medicare Part B premium in 2025?

Tom P says

Not sure where you are getting your (incorrect) information since CMS hasn’t yet announced premiums and deductibles for 2025. You can check https://www.cms.gov/about-cms/contact/newsroom for updates.

Jeff Enders says

Robert Hoppe – are we making a “mountain out of a molehill” and not leveraging Harry’s estimates? Please review the potential for the MAGI thresholds in 2026 given inflation is zero or 3%.

Harry’s projection is that the standard (SINGLE filing) threshold is either $108,000 (0% inflation) or $109,000 (3% inflation) and we won’t know the true outcome until October, 2025.

What MATERIAL difference if that going to make in your approach to manage your MAGI in remaining 60 days that you can manage your 2024 MAGI? Can you please help us understand?

Nancy Memmel says

“… we don’t know the 2024 MAGI thresholds for 2024 until after Oct 2024 …”

But we DO know the MAGI thresholds for 2024 as we are going through 2024 ; we’ve been paying IRMAA premiums based on those thresholds throughout 2024.. We don’t know the thresholds for 2025 until late in the year of 2024, and we’ll pay in IRMAA in 2025 based on those thresholds and 2023 MAGI.

Nancy Memmel says

To Jeff;

If you wanted to do a conversion in 2024 and still be reasonably sure your 2024 MAGI would be below a specific IRMAA tier in 2026, knowing the income for the top of that same tier in 2025 and staying below it with your 2024 income would probably get you there. But knowing what the 2025 thresholds were by Nov of 2024 should still leave ample time to effect the conversion. That’s kind of what I’m looking at doing.

RobI says

$185 premium for 2025 being quoted by some is an actuarial ESTIMATE taken from the 2024 Medicare Trustees Report (page 87). The estimated number is not final and is often adjusted up or down to account of latest data projections, before it is officially announced by CMS

Rocco says

I’m new to retirement and didn’t know a thing about IRMAA until my wife retired last year. I’ll be filing this month. Will We be using the 2024 or 2025 IRMAA schedule and where can I find them.

Thank You In Advance

Nancy Memmel says

The 2025 tier brackets will be used with your 2023 MAGI ( as defined for IRMAA assessment) and charges in 2025. I don’t follow what it is you will be filing this month, but if your wife retired last year and that decrease in income will bring your MAGI down to less than it was in 2023 you might have grounds for appealing any IRMAA you’re assessed based on 2023 income.

Nancy Memmel says

Sorry; gave only 1/2 an answer. The brackets haven’t ben officially announced yet, but Harry has calculated them from the same data the agency uses and they are listed @ 2025 IRMAA Brackets in the article above. You don’t file for this if that ‘s what you were referring to. but if SSA levies an assessment, then you can file an appeal, based on a limited number of what they term Life Changing Events.

Rocco says

Another question…If my retired wife is subject to IRMAA am I also subject to the same amount? Married filing jointly. Wife is a homemaker.

Robert Hoppe says

Hi Nancy. Yes, I’m aware of the 2-year look-back feature. We’re in a situation (at age 71) where I need to maximize our Roth IRA conversions (which I started in 2022) each year through 2025 in order to reduce the RMDs each year from 2026 onward (i.e., we will both be 73 in 2026 and therefore have to start taking RMDs in 2026) . Therefore, not knowing the MAGI threshold each year until after October limits my ability to know how much Roth IRA conversions I can do each year without exceeding the MAGI threshold for the year. I just wish that Congress would instead have Medicare publish the MAGI thresholds in mid-year rather than after October. The way it stands now, I have to wait until after October to finalize the maximum level of Roth IRA conversions I can do for the year.

Robert Hoppe says

Hi Nancy. Not sure what you mean by “But knowing what the 2025 thresholds were by Nov of 2024 …”. The MAGI thresholds announced around November 2024 are for 2024, not for 2025. Yes, I understand that the 2024 MAGI thresholds impact 2026 Medicare premiums (i.e., 2 year lookback). But the thresholds announced in Nov 2024 are for 2024, not for 2025.

Jim M. says

@Robert Hoppe,

I suggest you focus on what can control based on how 2026 MAGI Brackets are going be calculated rather than how you would prefer they be calculated.

Between now and the end of 2024 you can control your 2024 Medicare MAGI income by the amount of Roth conversions you complete in 2024. Your 2024 MAGI income will be used to determine your 2026 Medicare IRMAA surcharges based on the 2026 IRMAA brackets that won’t be published or known until the fall of 2025.

You have no control over what the 2026 IRMMA brackets will be. Planning your 2024 income requires estimating what they will be. Harry estimates for 2026 are based on there being 0% and 3% inflation between now and when the last inflation data point will be published in September 2025.

What I do is look at Harry estimates and decide what 2026 IRMAA bracket ceiling I want to target for my 2024 MAGI income. I then decide how conservative I want to be when estimating what inflation may be between now and Sept 2025. I typically use the 0% inflation estimate to target my 2024 income. The 3% inflation gives me a cushion in case I am off in estimating my 2024 income.

Jim M.

Robert Hoppe says

Hi Tom. The CMS website you provided results in Page Not Found. The correct website is https://www.cms.gov/search/cms?keys=IRMAA.

Tom P says

Well, the link I provided works for me 🙂 It just takes you to the list of latest news articles, which I have assumed will be updated when CMS releases the new rates. Medicare will also publish the rates: https://www.medicare.gov/basics/costs/medicare-costs

Nancy Memmel says

My search engine found the page…

Robert Hoppe says

Thanks Paul. When I refer to MAGI thresholds, I’m referring to total MAGI for the current year which will impact Medicare premiums two years from now. I’m aware that Harry has posted MAGI for year 2023 which impacts year 2025 Medicare premiums. 2023 is past history as far as I’m concerned. I’m more interested in the 2024 MAGI threshold (current year) which will impact 2026 Medicare premiums. My point is that Congress doesn’t publish this until at least the end of the year, which is already too late for my purposes. Harry’s projections are certainly helpful, but we won’t know the official MAGI threshold amounts until the year has ended. I think Congress should publish the MAGI thresholds for the current year at mid-year rather than at year-end (i.e., based on inflation factors from May of the previous year through April of the current year), so that we’re in a better position (knowing the MAGI thresholds at mid-year for the current year) to control our total MAGI for the current year. Knowing what the thresholds are at year-end is water under the bridge.

Jeff Enders says

@robert Hoppe – while this all can be very confusing, and others have attempted to post how this works, let me take a shot at this as well, because I am not confident you have the cadence correct from what you wrote.

Above, Harry has posted the 2024 thresholds and has titled them as “2024 IRMAA brackets”. Those were finalized and “locked in” in September, 2023 and use your 2022 MAGI from your tax return to determine what your IRMAA premiums were in 2024.

Harry has also posted the 2025 thresholds and titled them as “2025 IRMAA brackets”. Those were finalized and “locked in” in September 2024 and will use your 2023 MAGI from your tax return to determine what your IRMAA premiums will be in 2025.

Harry has also posted 2026 thresholds and titled them as “2026 IRMAA brackets”. Those are NOT finalized as they are dependent on the inflation rate from now until August, 2025. Only one of the 12 datapoints are known. Harry has provided an estimate of what these 2026 IRMAA brackets may look like if inflation is zero over the next 11 months or 3% over the next 11 months. You will use your 2024 MAGI from your tax return to determine what your IRMAA premium will be in 2026. So there is some time to ‘manage’ your MAGI before December 31 gets here so that you get to the bracket you want to be in (e.g. do more Roth Conversions, sell investments at a loss, etc.)

lastly, the thresholds that Medicare announced in November, 2024, will match what Harry posted as the “2025 IRMAA brackets” and along with your 2023 MAGI will determine your 2025 IRMAA premium.

Robert Hoppe says

Yes, if filing status for 1040 tax return is Married Filing Jointly. The MAGI is combined income for both of you.

Jim M. says

Rocco wrote:

“If my retired wife is subject to IRMAA am I also subject to the same amount? Married filing jointly. Wife is a homemaker.”

You and your wife will be subject to IRMAA surcharges if you are both on Medicare.

Nancy Memmel says

Robert wrote

“The MAGI thresholds announced around November 2024 are for 2024, not for 2025. Yes, I understand that the 2024 MAGI thresholds impact 2026 Medicare premiums…”

Robert,

I think you are using terms differently than everyone else. When you read “20XX thresholds” what is being communicated is ” the thresholds which will be used IN 20XX to assess IRMAA charges that will have to be PAID IN 20XX, based on ( 20XX-2) MAGI. ”

2024 MAGI THRESHOLDS won’t impact 2026 IRMAA premiums, but 2024 INCOME (MAGI ) will.

The thresholds for the next calendar year are calculated and published near the end of a current year.

Hence, 2025 thresholds are the levels announced in late 2024 that will be used IN 2025 to set 2025 IRMAA CHARGES payable IN 2025 based on 2023 MAGI.

In 2026 there will be new thresholds, only knowable near the end of 2025, because they will be be established by the inflation we experience between now and Sept of 2025, that will determine what, if any, IRMAA you’re liable for in 2026, based on your 2024 MAGI..

The Wizard says

Yes Jeff, it appears that Robert was off by a year in determining when we get official notice of IRMAA thresholds applicable to current year income. Good that you clarified it for him, and others.

This is why it’s rather important for some of us to wait until December to finalize our Roth conversions and thus, our MAGI for the year, in conjunction with Harry’s PROJECTIONS on what IRMAA thresholds for the current year might eventually be.

Also important not to hold any managed funds in your taxable account so that possibly large Capital Gains Distributions don’t upset your MAGI prediction…

Robert Hoppe says

It appears that my comments were misunderstood. I fully understand the government IRMAA process and what Harry’s projections mean. My comments were aimed at the methodology applied by the federal government in terms of the timing of official publication of MAGI threshold amounts which impact Medicare premiums 2 years later. Having Harry’s projections are certainly helpful, but it’s of no use for the government to publish MAGI thresholds almost a full year after the year has passed — e.g., publishing 2024 MAGI amounts in late 2025. All I was trying to say is that the government ought to modify their methodology in terms of the TIMING of publishing MAGI threshold amounts which impact Medicare premiums two years later. I understand that the timing relates to the selected 12-months date range for inflation, but that should be revised so that MAGI amounts can be published in the 4th quarter of the current year (for the current year) rather than almost a year later.

Jeff Enders says

@Robert Hoppe – please think through the cadence again; it does make sense given the timing limitations of data availability.

Taxpayer’s MAGI for 2023 is not known to Social Security (and the IRS) until Oct, 2024 since that is the filing deadline if you have an extension! And those with large incomes, who are impacted by IRMAA is the population most likely to extend – because their tax returns are more likely to be complicated.

At the same time (well, Sept 2024, one month prior), the IRMAA brackets are adjusted with the most recent inflation data, so they are the most accurate given they have been adjusted for inflation and those are adjustments are beneficial to impacted IRMAA taxpayers.

Then Medicare is able to update its computers for the new year. Remember, that new IRMAA premium is netted from your JANUARY, 2025 Social Security payment. But if you are NOT yet taking social security, that IRMAA payment (along with the normal Medicare payment) is due in DECEMBER, 2024!

That gives about Medicare 60 days from the release of the September inflation data to update their billing files so that the Medicare bills for those not on Social Security can drop on November 25.

If you were Congress how would you do it for 2025? Please be specific with dates.

You need to know the taxpayer’s MOST RECENT MAGI, which is based on the most recent tax return, which is the 2023 tax return, which is due April, 2024 and with extensions, October 2024 (which is NOW!!). You need to give the benefit of inflation to taxpayers, and the current process adjusts for inflation right through August (reported in mid September).

it does appear that Congress is creating this two year lag, but not really. MAGI is “locked in” in December, 2023, but not reported to the IRS for 10 months (Oct, 2024.) And taxpayers get the benefit of all the inflation that occurred during those 10 months since the brackets are not “locked in” until September. And the new brackets and premiums go into effect just two months after the IRS has everyone’s MAGI. Sounds pretty efficient to me.

Harry Sit says

The methodology is what it is. It’s been in place for 20 years. While we all can have an opinion on whether it’s good or bad and why, we can only operate under the current methodology. That’s the purpose of this post and my updating it monthly.

Jim M. says

Robert Hoppe,

I suspect many on this board agree with you that it would be nice if the IRMAA tax brackets for two years hence (e.g. 2026) could be finalized and published before the MAGI income year (e.g. 2024) is over. That would greatly simplify income tax planning for the current year by making the IRMMA brackets a certainty rather than an future unknown.

But ask your self this:

Would your prefer to have the IRMAA tax brackets for 2026 reflect no inflation adjustment for the 12 month period ending in August (or it is Sept) 2025?

I suspect most taxpayers would prefer to have the inflation adjustments for the cushion it provides in helping to maximize income within an IRMAA bracket income without exceeding it.

Each year I have been too conservative in estimating what future IRMAA income brackets will be. This has resulted in my having unused bracket income every year since I retired.

The possibility of deflation creates a risk that IRMAA income brackets might decline from a prior year, but that seems like a low risk possibility. The more challenging question for for me is how much inflation is likely be a safe bet for the 12 month period ending in August (or it is Sept) 2025.

Bill says

According to the article “2024 2025 2026 Medicare Part B IRMAA Premium MAGI Brackets”, the upper limits for the 2025 IRMAA brackets (based on 2023 income) and 2026 IRMAA brackets (based on 2024 income for married filing jointly are:

2025 brackets ($) 2026 Brackets with 0% inflation* ($)

<= 212,000 <= 216,000

<= 266,000 <= 270,000

<= 334,000 <= 338,000

<= 400,000 <= 404,000

<= 750,000 <= 750,000

The values posted for the 2026 brackets with 0% inflation reflect zero inflation for the months October 2024 through August 2025. Those values seem too high.

For example, the 2026 with 0% inflation bracket is $4,000 (1.88%) greater than 2025. The CPI-U for September 2024 was 0.2% (2.4% annualized). 2.4% for September 2024 plus 0% for the remaining eleven months of the “IRMAA base year” would yield a 0.2% average annual increase (2.4%/12 = 0.2%). That 0.2% increase would increase the 2025 upper limit from $212,000 to $212,424 for 2026 with 0% inflation.

Please explain the calculation for the 2026 brackets with 0% inflation that yields $216,000, $270,000, $338,000, $404,000, and $750,000.

Harry Sit says

Bill – It’s explained under the 2026 table starting with “Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, …” along with an exaggerated example of $3 gas going to $3.50 and a graph.

Jeff Enders says

Bill – remember that the IRMAA brackets are rounded to the nearest thousand – that is the law. But the underlying data series is not rounded and that is where we have to begin.

The underlying dataset has an value of $106,030 for the prior year. And with one known datapoint for this year and projecting zero for the remaining 11 months would yield a value of $107,512 (1.4% increase), which rounds to $108,000 and doubles to $216,000 for a Joint filing. The other tranches follow the same logic.

how can zero for 11 months yield such an large increase? – look at Harry’s explanations above where he has the line chart with last year’s average rising as a blue line and this year’s average rather steady as a mustard colored line. He explains this phenomenon right after the 2026 IRMAA brackets.

does that help?

Tom P says

Jeff, it doesn’t matter what the prior year un-rounded result is because the calculations are not done on a year-to-year basis. All calculations refer back to the 2019 base effective year, which uses Sep 2017 to Aug 2018 data, which has an average CPI-U of 249.280. To get the brackets for 2025 one uses the average of the Sep 2023 to Aug 2024 data, namely 310.955. Divide that by the base 249.280 to get a multiplier of 1.24741. You then take this result and multipy the Single Income Bracket back in 2019, which was $85,000, yielding $106,029.85, which rounds to the neareth thousand as $106,000, or $212,000 MFJ.

If you want to play around with the numbers you can use my spreadsheet located at this linke: https://1drv.ms/x/s!AtHS0jWEezJSyB1kfmMGZzzUtuSN?e=6974Eu

Download and save so you can edit.

Jeff Enders says

Tom P – yes, I know but I was trying to respond to the way Bill crafted his logic…. it would have been too confusing (at least I thought so) to reference back to 2017-2018 when he was trying to understand the percentage adjustment from last year to this year.

Bill says

As Tom P. points out, the 2025 IRMAA brackets are based on the 12-month average CPI-U for the period September 2023 through and including August 2024 which equals 310.9337. That value is then compared to the 12-month average for September 2018 through and including August 2019 which equals 249.2802, the value used to determine the 2019 brackets. The ratio of those two values (310.9337/249.2802) equals 1.2473. The 2025 brackets are the product of that ratio and the values for the 2019 brackets, e.g., $0 to <= $85,000 for a single filer in 2019 is increased to $106,020 (1.2473 x $85,000) which is rounded to the nearest thousand of $106,000. That amount is doubled for those filing married, joint.

The CPI-I for September 2024 is 315.01. Assuming there is no change for the months October 2024 through and including August 2025 (aka 0% inflation for those eleven months) then the 12-month average CPI-U for September 2024 through and including August 2025 is 315.01. That value and the 2019 12-month average of 249.2802 are used to determine the 2026 brackets with the 2019 brackets increasing by the ratio of 1.2648 (310.01/249.2802), e.g., $0 to <= $85,000 for a single filer in 2019 is increased to $107,508 which is rounded to the nearest thousand of $108,000. That amount is doubled for those filing married joint.

Using the calculus above and under the assumption of 0% inflation for the period September 2024 through and including August 2025, the upper limits of the 2026 IRMAA brackets will be $216,000, $270, 000, $338,000, $404,000, and $750,000, identical to the values published at this site.

Thanks, Tom P., for your clarification.

Jim M says

Tom P,

Thanks for sharing your IRMAA calc spreadsheet (link below). It is very helpful and very well done.

https://1drv.ms/x/s!AtHS0jWEezJSyB1kfmMGZzzUtuSN?e=6974Eu

Tom P says

Thanks Jim H. If interested… I made a bunch of formatting changes to the spreadsheet.

https://1drv.ms/x/s!AtHS0jWEezJSyB1kfmMGZzzUtuSN?e=sOg5xy

The Wizard says

Clearly one way to improve the timing on IRMAA threshold announcements is for the IRS to ELIMINATE the six month extension on tax returns. All return are henceforth due by April 15 at the latest.

And if the 15th is on a weekend then they’re due prior to that, the 14th or 13th.

Note: for past several years, I’ve filed by the end of February…

Vince Pellettieri says

I remember when 2024 income for 2026 premiums went from 214,000 to 216,000 after Harry had more inflation info and I was surprised it went up that much but I’ve been following Harry for a long time and he’s been very good. I hate to throw another wrench into the MAGI mess but here’s something that affected me in 2019 until I figured it out. I have international stock mutual funds with Fidelity in our taxable accounts and I always calculate all our dividends and capital gains for the year in December before I do my roth conversions. The 1099 forms released in January always were higher by around $5000 but they never could tell me why. I went back and figured out that Fidelity increased the amount of the yearly dividends by the amount of foreign taxes they paid. I now try to guess how much foreign tax Fidelity pays on my accounts (no way to figure it out in December according to Fidelity) and add that to tax-free interest to get MAGI for Medicare. You can deduct the foreign tax on your return but Medicare doesn’t use that lower amount to calculate MAGI. Unfortunately I haven’t found a good way to get an exact amount of income threshold to use in December 2024 to get my 2026 premiums where I want them. I want to thank Harry Sit and all the posters on this blog for their work. The other confusing calculation is the tax ramifications on different roth contributions and future tax brackets. Not sure my wife will worry about this like I do when I’m gone. Haha

Nancy Memmel says

Robert, you say

“the government ought to modify their methodology in terms of the TIMING of publishing MAGI threshold amounts which impact Medicare premiums two years later”. Your comments were misunderstood because you are asking for the impossible.

Since the threshold inflation calculations use inflation data from the calendar year immediately preceding the year for which they adjust the MAGI threshold amounts, the government CAN’T publish them on your preferred schedule, because they can’t KNOW what inflation is going to be, before it occurs, but only in retrospect.

Nor can we.

The SSA uses the 2 year prior MAGI figure for assessing IRMAA because that is the nearest term tax info it can expect to routinely have.

And you have now turned me into an apologist for the government.

Will wonders never cease?

Nancy Memmel says

Wiz,

if you get 1099’s from mutual funds they can revise dividends to include those hitting in the first quarter to the prior year’s total, so frequently you won’t even get final documents before the April deadline. I’d assume there other issues that caused the Oct deadline to be enacted, also. So while I suppose the drop dead date could be changed to convenience IRMAA strategizers and result in an avalanche of amended returns, I doubt that is in the cards.

The Wizard says

Well then, the IRS needs to inform all brokerage houses, Vanguard in my case, that henceforth, screwing around with creative accounting for dividends will no longer be tolerated.

Final 1099’s for the year must be in taxpayer’s hands by January 30.

Increase penalties for non-compliance.

No more Mister Nice Guy for the IRS…

Nancy Memmel says

This mutual fund accounting is allowed by law. No mister nice guy involved.

Nancy Memmel says

Vince,

if the Foreign tax amount is fairly consistent, year to year, just assume it is going to be there next year, too, and give yourself a cushion ? The amount your accounts earn is taxable although you only get in hand the amount net of foreign tax paid.

I assume the amount of earnings credited on your periodic statements would the earnings before withholdings.

(Can anyone else confirm or dispute this assumption)

Nancy Memmel says

Vince;

sorry, I take that back. If fidelity doesn’t show the tax withholdings on your periodic statements then they are crediting you with the net of dividends minus tax. (They certainly aren’t going to credit you with amounts they didn’t collect from the source because it went to some govt. for withholding)

Robert Hoppe says

@Wizard. Sorry, but what does filing for a 1040 tax return extension have to do with not knowing the official MAGI threshold amounts for the current year until the end of next year? It’s great having Harry’s projections, but filing for an extension doesn’t help in terms of not knowing the final official MAGI amounts (issued by the federal government) until the end of next year. The horse has already left the barn!

Jeff Enders says

Robert – please go back and read my other post. I do not think you are tracking the cadence correctly.

We are getting the benefit of WAITING for the MAGI thresholds to be established because they are adjusted UPWARDS for inflation; on the margin LESS taxpayers are caught in the IRMAA mess this way.

You would prefer the thresholds be established at an earlier date when they would not have the inflation adjustment???????

Event though YOU may know your 2023 MAGI on December 31, 2023, the IRS doesn’t know it until as late as Oct 15, 2024 which is the extension filing deadline. And by that time, the thressholds are adjusted UPWARDS for inflation; that inflation adjustment ends just the month prior in Sept, 2024. Two months later the results are used for our 2025 IRMAA charges which go out on the November 25, 2024 invoice for Medicare recipients who are not on SS.

And suggest all STOP thinking it is a two year lag! It is ONE MONTH lag: October, 2024 when the IRS knows your MAGI until November, 2024 when Medicare recipients not on SS receive their first monthly IRMAA charge for 2025.

Lastly, and I’ll stop the ranting…. how could Medicare use 2023 MAGI for 2024 IRMAA charges if they don’t even know what that is until you file you tax return and you have (with extensions) until Oct, 2024 to do that??????

?????/ – they don’t know what it is until you file your tax return!

Vince says

Nancy,

Yes the foreign taxes paid only vary by 25% so you can add that to the guessing with inflation numbers and how aggressive you want to be with your closeness to the limits with your income. Unfortunately $1 over makes a difference so I’m conservative and usually have too much of a cushion. Mutual fund companies have to get us the accurate dividend income by January 30 but that is too late for us who do their roth conversions by December 30.

Robert Hoppe says

Jim & Jeff. Thanks for your replies. Simply said, if it were not for Harry’s IRMAA / MAGI projections, we would have no guidance in terms of determining whether we would exceed the current year’s MAGI threshold in order to stay within the first MAGI tier range, so that we don’t pay higher Medicare premiums 2 years down the road. I too have been conservative by aiming to keep our MAGI for the current year below the upper limit (within the basic tier) projection by Harry, just in case the final government-published MAGI limits are below Harry’s 0% inflation projections. I do realize that the IRS does not know our actual MAGI until our 1040 return is filed (whether it be filed by 4/15 or 10/15 with an extension), but again that in itself doesn’t help in terms of the government not publishing the current year’s MAGI thresholds until next year. I mentioned in a prior comment, if the government bases the MAGI thresholds on inflation factors that run from September of the previous year through September of the current year, why can’t they publish the MAGI thresholds for the current year in Oct or Nov of the current year (based on those inflation factors) rather than publishing them in the next year (after the horse is already out of the barn).

Jim M. says

Robert Hoppe wrote:

” if the government bases the MAGI thresholds on inflation factors that run from September of the previous year through September of the current year, why can’t they publish the MAGI thresholds for the current year in Oct or Nov of the current year (based on those inflation factors) rather than publishing them in the next year (after the horse is already out of the barn).”

They could. In fact, that is exactly what the government does when determining the MAGI thresholds for the very next year. In other words, in the fall of 2024, the government calculates and publishes the MAGI thresholds (IRMAA brackets) for determining 2025 Medicare IRMAA premium surcharges based on 2023 MAGI income. These calculations reflect actual inflation through August (or Sept?) 2024.

The MAGI thresholds (IRMAA brackets) for determining 2026 Medicare IRMAA Premium Surcharges based on 2024 MAGI income are not determined until the fall of 2025 when inflation through August (or Sept?) 2025 is known.

The actual inflation cut-off date is either August of Sept. I can never remember which.

Nancy Memmel says

Robert, when you say “why can’t they publish the MAGI thresholds for the current year in Oct or Nov of the current year ”

Is what you mean ” why can’t they publish the MAGI thresholds which actually will be used in conjunction with the current year’s MAGI to determine IRMAA liability two years from now, so we know how to limit income in 2024″?

If it worked that way, then in 2026 you would have the IRMAA brackets adjusted for inflation experienced in Sept 2023 through Aug 2024 instead of brackets that are cumulatively adjusted for inflation through Aug 2025 . The thresholds adjustments would be ignoring 2025 inflation, and you would be liable for IRMAA at a lower income.

Robert Hoppe says

Nancy. Yes to your first question. I’m suggesting that the government publishes year 2024 MAGI thresholds (which will determine year 2026 Medicare premiums) within the 4th quarter of 2024, based on inflation experienced from Sept 2023 through Aug 2024. Having said that, I agree what you’re saying that my suggestion for 2026 Medicare premiums would then have the IRMAA brackets adjusted for inflation experienced from Sept 2023 through Aug 2024. Yes, I agree that this approach would not take advantage of inflation factors experienced from Sept 2024 through Aug 2025. However, again, publishing MAGI thresholds for 2024 in late 2025 (for 2026 Medicare premium purposes) doesn’t help in terms of knowing how far we can go with MAGI in 2024 until 2024 is long over. Hence, we need to rely on Harry’s projections for this purpose, rather than on published MAGI thresholds after the year is long over.

Nancy Memmel says

No it doesn’t but if you have been around the block enough times to be looking at IRMAA charges it surely hasn’t escaped your attention that the tax code is not arranged for your convenience.

Yes we do have to rely on projections ( and maybe pure dumb luck) in making decisions on realizing income.

Consider that the purpose of the IRMAA charges is to shore up the Medicare system by extracting more money from those judged to be “able to afford it”.

Do you then think it would be engineered so as to help the targets efficiently skirt the attempt?? But at least you get the benefit of inflation relief.

If you would be satisfied with the brackets for any year NOT reflecting the last prior year’s inflation, but knowing the brackets, then just realize your 2024 income up to the 2025 tier you would want to be in in 2026, AS IF it were the operational 2026 tier. Then you won’t go into a higher bracket in 2026 . Problem solved.

Vince says

Bill,

Thanks for showing the calculations. What would be the worst case situation with negative inflation and the $216,000 figure? I remember Harry saying something about this a long time ago for people who want the most conservative figure to use.

Nancy Memmel says

Vince;

How negative did you want to model inflation?

2026 projections @ 0% inflation would be 216 K, 270K, 338 K,404K

At -2% (annual) inflation for the next year the threshold for the 1st 2026 IRMAA bracket would be 214 K , and the next threshold would be 268 K

@ -3% (annual) 212 K, 266 K, 334 K, 400 K = back to 2025’s Brackets

@ -4% (annual) 212 K, 266 K, 332K and 398 K

@ -5% annual inflation 210 K, 264 K, 330 K, 396 K

But deflation would cause other bad things, like investment values cratering , so you might be more worried about things other than IRMAA thresholds…

Bill says

I will leave it to experts to comment on the impact of negative inflation/deflation on IRMAA brackets.

However, I will point out that for the period 1917 through 2024 there were only thirteen years when the September through August 12-month average CPI-U decreased year over year: 1954, 1949, 1938, 1932, 1931, 1930, 1929, 1928, 1927, 1926, 1922, 1921, and 1920. Every year since 1954 the September through August 12-month Average CPI-U has increased year over year.

Jim M says

Nancy Memmel,

Thanks for sharing the deflation calculations. I am impressed how quickly you were able to calculate the IRMMA thresholds for a wide range deflation outcomes.

I would be interested in what the calculations show for inflation at +1% and +2%.

I think the risk of deflation is low. The Fed is likely to act forcefully to prevent it. I agree with you assessment that markets wont like it.

Bill,

Thanks for sharing the years with negative inflation. The list appears to include the roaring twenties and the years following the great crash.

Nancy Memmel says

Jim;

0 %annual 216,000, 270,000, 338,000, 404,000

1% 216,000, 272,000, 340,000, 406,000

2 % 218,000, 274,000, 340,000, 408,000

3 % 218,000, 274,000, 342,000, 410,000

I set up a spreadsheet with the CPI figures published and was gratified to see my 0% and 3% inflation predictions matched Harry’s.

Jim M. says

Nancy Memmel,

Thank you for the additional inflation estimates. They are very much appreciated. You are very fast.

I have been thinking of targeting 1% inflation as I have been a bit too conservative in my targeting MAGI income in the past.

It is interesting to observe that at 1% inflation, the threshold for the first bracket does increase above the 0% inflation estimate, while the higher brackets do. It makes sense that rounding will impact the way the lower brackets change relative to the higher brackets.

Nancy Memmel says

Yeah, Jim , I noticed that too and it bothered me; it reflects how the Year to Year inflation factor multiplied by the threshold value that is the historical basis causes it to round up or down to the nearest 1,000 for single rates.

Going from a modeled 0% inflation to a modeled -0.1% takes that ratio of current CPI-U to the reference point CPI-U from 1.2648 to 1.2643 and that is enough to change the calculation from 107,512 (which rounds to 108 K) to 107,463(which rounds to 107 K) and after doubling it for MFJ the threshold for any IRMAA assessment at all moves from 216 K to 214 K with such a tiny change. Geeky stuff indeed.

Vince says

Nancy,

Thanks for the calculations. So I assume we need at least -2% inflation to make a change to the joint $216k levels? Inflation at -1.75% for a year won’t make a difference? I can live with that and assume that’s unlikely to happen and stay with the $216k level of income for 2024.

thanks

Nancy Memmel says

Well, according to the calc I did, at -2% annual inflation the 216 K threshold would drop to 214 K, (up a mere 2 K from the 2025 1st threshold instead of up 4 K with no inflation).

The next threshold would go from 266K in 2025 to 268K in 2026 with -2% annual inflation, or to 270K with no inflation.

Actually, (must be ) due to the rounding to nearest 1000 step, with anything less than 0% ( until -3% ) inflation you saw the same calculated drop to 214 K / 266 K

214 K might be better if you want to be safe, depending on how much you want to roll the dice .

I doubt, also, that we’re going to be seeing deflation but if we did I would expect our income from investments to drop and also the value of those conversion-fodder funds, too, but I have no direct experience with deflation, so I could be wrong. As retirees we wouldn’t have to worry about job loss, but if you have children who could be impacted by a job loss, that might affect your cash flow

Vince says

Nancy,

If -0.01% inflation for one year causes a drop to $214,000, I might use that income level.

Personally, I don’t think inflation has been conquered especially if the fed lowers rates

a lot in the next year but 2k isn’t that big of a difference. And it might help if Fidelity surprises me with a large foreign tax figure in January.

thanks

Gary says

Vince, I have a similar problem with figures reported in January but are taxable events for the prior year.

For example, the SPY ETF pays their dividends on 1/31 even though declared in December. Fortunately, I have learned that you can find the SPY dividend per share declared and calculate the $$ early.

However, I cannot find a source yet for determining my non-qualified dividend portion for some of my ETFs. Fortunately, this only affects my tax bill a small amount but not my AGI. So no consideration as to IRMAA penalties. If anyone knows how to determine NQ dividends early, please let me know.

Nancy Memmel says

Since qualified dividends can only be paid out of a company’s profits, if the profit for the year doesn’t cover the dividends paid out, the company has to designate those in excess of profit as non-qualified.

Company only knows this after the end of their fiscal year, if it is a calendar year reporter, that is after year end.

GeezerGeek says

Gary, I also end up with some non-qualified dividends that I don’t know about until I get the 1099DIVs but what I’ve found is that they were reported as part of the earnings before the previous year’s end. One example of that is a muni bond ETF that I have. Since you also have to add the muni bond earnings to calculate the MAGI, I’ve already included the NQ dividends as part of the non-taxable muni earnings. I think that money market fund earnings are also reported as NQ dividends. So, I don’t know what the amount of the NQ dividends were until I get the 1099DIVs, but the amounts were reported as income in the accounts before the end of the year.

Eileen says

If you have a stock mutual fund that paid out short term gains and long term gains, this is also a source of NQ dividends. I had two funds do that in 2024. There is a process with mutual funds that is called “factoring”; in short, all of the distributions have to be sorted as to their taxability. There are qualified dividends, non-qualified dividends, short term gains, and long term gains that CAN happen. But only qualified dividends and long term gains that occur within the fund are eligible for preferential (typically 15%) tax treatment. Short term gains from mutual funds do not go on Schedule D, the way short-term gain from a single stock would. Instead, they are re-characterized as non-qualified dividends and show up on the lower section of Schedule B. It is this “factoring” process in mutual fund accounting that slows down the receipt of your tax reporting when you hold such things (old-style mutual funds rather than exchange-traded funds).

Robert Hoppe says

The topics of muni-bond interest and NQ dividends have no bearing on MAGI for IRMAA threshold purposes, since MAGI includes both muni-bond interest and qualified dividends. The topic of qualified dividends comes into play with respect to the calculation of federal income tax in that there is a 0% tax on them if your combined (joint) taxable income is under $94,050 ($47,025 for Singles) for 2024. MAGI (for purposes of IRMAA thresholds) includes all dividends received, both qualified and non-qualified, as well a non-taxable muni-bond interest and the taxable portion of Social Security benefits.

Gary says

Geezer, as Robert mentioned, the fact that some dividends are non-qualified doesn’t affect my IRMAA penalties. I was just complaining that I cannot seem to find a source for the NQ portions before year-end.

As an aside, I own a few different S&P 500 ETFs (I have taken risk management to an extreme). Some pay quarterly and some pay biannually. SPY creates problems at year-end because they declare in December but pay in January. For tax purposes, it’s considered as taxable in the prior year!!!!!

Note: MDY is another ETF doing the same thing. MDY & SPY are managed by the same firm, evidently they are looking for another cash flow advantage. Another example of Wall Street picking up the nickels and dimes!

Robert Hoppe says

Gary. All individual taxpayers are on the cash received basis, meaning you are taxed on the income when received. Therefore, I don’t see how dividends declared in December, but paid out in January, can possibly be taxed in December. You are not credited for the dividends until they are actually paid.

Nancy Memmel says

Maybe because since you owned the shares at the record date and the dividend was declared before year end it counts as being credited to you. (its money you’re going to get, it can’t go to anyone else.)

I do know that if you are issued a paycheck in the waning days of the year but don’t actually get it until the new year ( because your employer’s office is closed so you cannot pick it up) that is taxable in the year issued.

I think it might be similar, as I have experienced this too

Nancy Memmel says

If you think about it, if they don’t use the declared date, but the date when you got your hot little hands on the payment, then the company issuing the dividends ( or the employer doing the last payroll of the calendar year) would have to be sure everyone got hands on the disbursements before the company could deduct it as paid on their tax return. That would complicate things.

Gary says

Robert, all I can say is that Fidelity’s 1099’s have included the December declared dividends even though SPY & MDY is not paid until 1/31 of following year. But I agreed with your thought, and was shocked the first time I realized this.

I would be selling these ETFs, but have owned for many years. Its not worth getting the realized capital gains hit for a small improvement in expense ratios and cash flows, so I just sadly bear with it.

Eileen says

Fidelity only reports what is told to them by the fund sponsors. Those do not look like Fidelity-sponsored funds to me (also a Fidelity customer). Further, they look like ETFs, which could have a different set of rules on taxability. I remember reading about this issue, but too long ago to be of help here; I just know that it isn’t locked in stone that cash that a fund distributed in January 2025 (say) will always be taxed in 2025.

Robert Hoppe says

Yes, for paychecks issued in the current year with a pay date in the current year. The annual W-2 will include that gross pay for the current year as long as the pay date falls within the current year, regardless of when the physical paycheck is deposited in the bank. I don’t believe it’s the same for stock dividends that are declared in December, but not actually credited to your brokerage account until January. Again, all taxpayers are on the cash basis which means the income is taxable when received.

RobI says

Same results as Nancy with TomP excellent spreadsheet. The 0% inflation threshold is right at the round down tipping point. The rounding differences are magnified even more for higher IRMAA tier limits, since the multiplier applies to the rounded single filer number.

For kicks, I modeled 2 more months of +2% annual CPI, then turning negative in 2025. This scenario still feel pretty conservative, but it becomes a lot tougher for rounding down of the IRMAA band to happen.

I’m going with the lower $214k (MFJ) threshold number until we see the remaining 2024 CPI readings. Then make end of year income adjustments.

Bruce says

Hi All,

I just read the past 2+ months of comments on this site and I am surprised no one commented/griped about how the IRMAA brackets do not match the tax brackets. I want to maximize the MFJ 24% tax bracket (up to $383K) through IRA to Roth conversion but the IRMAA brackets are $338K then $404K (into the 32% tax rate, above $383K). So it looks like I am leaving $45K Roth conversion on the table since I do not want to pay the next IRMAA bracket cost of ~$125/month x 2 people for MFJ. That’s $3000 extra IRMAA fees for $45K extra Roth conversion or an “additional tax” of 6.6%. Am I looking at this wrong?

Thanks for everyone’s comments. I have learned a lot from this forum in the past couple of years.

Nancy Memmel says

Hi Bruce;

I read an article by a couple of investment advisors a few years ago, and of course I don’t remember their names or where it was published, but I do remember their conclusion was that conversions were almost always advised if the term for further growth was at least 7 years. (This was based on projected growth and I didn’t think at the time that their assumptions were extraordinary (but I also can’t tell just what they were assuming, either). So by their reckoning, any relative advantage of converting would depend on when you were planning on ultimately using the funds Vs when you converted.

Under the current rules, if I convert , and get hit by the beer truck immediately after signing the conversion form at the brokerage, my heirs have 10 years of potential growth, so then it comes down to the level of patience of my heirs as to whether it would be a good move to convert or not.

I’d look at it more as a matter of what you can do.

If I had the cash flow to cover it easily, I wouldn’t worry about the extra 3K of one time IRMAA charges. If not, I might withhold the last 3,000/32% = $9,375 of the conversion (only leaving that much “on the table”) and save 3K in regular Federal tax to offset the IRMAA hit. Maybe also save a bit of NIIT tax. We live in a state that has an income tax, so I’d save a bit there, too.

The Wizard says

Back when I was in my 60s, I did Roth conversions large enough to “levelize” my AGI over the next decade. Those conversion amounts were roughly equivalent to my SS starting at age 70 plus my RMD starting at 72. But I tried not to go over the next higher IRMAA threshold with those conversions.

This has the additional benefit of keeping me in the same tax and IRMAA bracket indefinitely, no big jump once both SS and RMDs are active.

Now in my mid 70s, I don’t “need” to do additional Roth conversions but I’ll probably do a small one next month anyway up close to the next IRMAA threshold of $202k, filing Single…

JoeTaxpayer says

I think that’s exactly the point of this effort.

If IRMAA matched up perfectly with tax brackets, one simple article pointing out how each bracket is higher for those on Medicare, and it would be over.

Each persons situation is unique and Roth conversions require a bit more math than just the impact on IRMAA. One major issue is that non spouse beneficiaries have 10 years to empty traditional accounts. If the kids are working in high paying jobs, they may already be in the 24% bracket and higher after withdrawals.

Action Jackson says

We recently had the same conversation with our advisor. They said our long term benefits of maxing out the 24% bracket outweighed the one time tax/ IRMAA hit. Have you calculated your marginal benefit to this “additional tax?”

As a related aside, our advisor said we also need to be prepared to go deep into the 32% bracket if there is a market correction of 30% or more.

GeezerGeek says

Action Jackson, I had previously tried to time my Roth conversions when the market was down but I was still trying to remain within my brackets. However, I think your advisor is right: the reduction in price of the conversion when the market is down 30% outweighs the additional tax incurred by the higher brackets. I will keep that in mind for future conversions. Thanks for sharing that strategy.

Jeff Enders says

Action Jackson – look at it this way. if the marginal tax rate was 26% and there was no IRMAA, would we be having this conversation? I suspect not.

We all get so hyped up about IRMAA tranches but in the long run it’s a minor tax related to the bigger picture. To me, determine the marginal tax bracket you can stomach (appears you have landed at 24%) and just let IRMAA fall where IRMAA falls.

I am much better off that I was aggressive the past two years and forced my MAGI to the top of the 32% tax bracket….the few additional pennies I am paying in IRMAA for the next two years is far outweighed by my stock market gains that are in a Roth and not in a Trad! Had I been focused solely on IRMAA, I may not have been as aggressive.

IRMAA is the tail to the Tax Bracket dog!

The Wizard says

That 7 year period that Nancy mentioned makes little sense. You are not trying to earn back the money you paid in tax for the Roth conversion.

What DOES make sense is paying the same or less tax for Roth conversions as you would for additional RMDs if you did not convert. For example, I’m in the 24% marginal bracket, so it makes zero sense for me to do conversions that push me into the 32% bracket…

Nancy Memmel says

Wiz;

You might not be trying to earn back the tax cost of converting but apparently a whole lot of other people are, and they are convinced that the opportunity cost of paying tax earlier than necessary is insurmountable.

The take-away of the article was it’s not, with a sufficient time line. Since the devil is in the details, I wish I had printed that article , so I cold look at the assumptions they made in light of current reality, but I didn’t .

Action Jackson says

The other strategy our advisor recommends is to DCA your Roth conversions. For example, if your target conversion for the upcoming year is $120K, then plan to convert $10/ month. If there is a market correction of 10-20%, you can accelerate your conversions. Starting your monthly conversions still allows you to adjust your final 1 or 2 conversions once you have a solid understanding of your income.

Jeff Enders says

Action Jackson – since we were all schooled to average into the market, it would make sense to average out from a Trad to a Roth by spreading the conversions evenly over 12 months.

The Wizard says

32% is a fairly high tax bracket to be doing Roth conversions in, but if you’re in that bracket or higher after conversions are done, then it makes sense…