[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

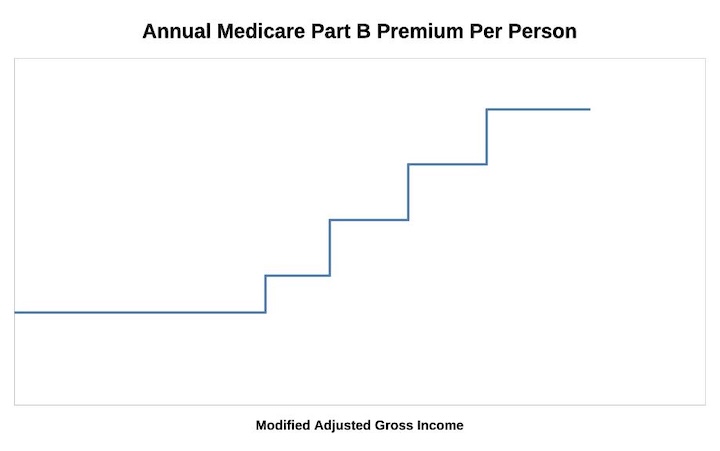

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Action Jackson says

I agree 100%! I used to focus on IRMAA, but now I look at it as the temporary price of admission for our permanent Roth conversions.

The Wizard says

I’m not sure who you’re agreeing with but my plan has me staying in the middle IRMAA tiers “forever”.

And while Roth conversions are great fun, it’s best not to pay tax on them at at higher rate than you pay afterwards…

Harry Sit says

CMS officially announced the 2025 Medicare Part B premiums. The standard premium is $185.00/month in 2025. All the 2025 IRMAA brackets in this post are officially confirmed.

https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles

Action Jackson says

Hi Wiz,

I was agreeing with paying IRMAA is the price of admission for Roth conversions.

I get that we don’t want to pay more taxes in future than now. I’m likely at 24% for RMDs, so we’ll plan on filling the 24% bracket.

But we will keep our eyes open for a large market drop.

For example if market drops 50%, we will fill the 32% bracket. When the market recovers our effective tax rate will be 16%.

Gary says

Harry, thanks for posting the link to the CMS 2025 update.

Is it me? It appears that the IRMAA table for “2025 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:” is missing from the release (its suppose to be the first table ). It’s normally the first table listed in the release.

Very confused!!!!

Gary says

Update on the announcement…..Kiplinger says Part B IRMAA amounts are still outstanding.

https://www.kiplinger.com/retirement/medicare/medicare-premiums-2025-irmaa-for-parts-b-and-d

Interesting, since IRMAA amounts were straight percentages of the base premium.

Harry Sit says

Kiplinger’s isn’t the best source. It was wrong before and it’s wrong again. The Part B table was inadvertently left out of the CMS news release but it’s not outstanding. It’s in the official document scheduled to be published in the Federal Register together with everything else.

https://public-inspection.federalregister.gov/2024-26474.pdf

Nancy Memmel says

I noticed this too, but we know the 1st IRMAA bracket over threshold is an addition of 0.4X basic( @ 185.00) to the cost; 2nd is plus 1.0 X basic, plus 1.6X basic, plus 2.2 X basic & plus 2.4 X basic so you can calculate them.

The part D additions are more opaque since they aren’t multiples of the basic part d amount ( but close, maybe rounded?)

Tom P says

Nancy, the Part D adjustments are based on the Part D Base Premium (announced by CMS at the end of July each year: https://www.cms.gov/medicare/payment/medicare-advantage-rates-statistics/ratebooks-supporting-data) and the “adjustment factors” for each tier. These factors are based on the standard tier (no adjustment) covering 25.5% of the cost, and the 2nd thru 6th tiers covering 35, 50, 65, 80 and 85% of the cost.

The factors are then calculated like this:

Tier 2: (35-25.5)/25.5 = 0.7325

Tier 3: (50-25.5)/25.5 = 0.9608

Tier 4: (65-25.5)/25.5 = 1.5490

Tier 5: (80-25.5)/25.5 = 2.1373

Tier 6: /85-25.5)/25.5 = 2.3333

For 2025 the tier adjustments are calculated by muliplying the $36.78 base premium by these factors, so for instance the 2nd tier results in an adjustment of $13.70 and the 6th tier is $85.80 rounded to the nearest 10 cents.

I guess I should post as GeezerGeek2 from now on, ha, ha.

Gary says

Harry, Thank you! I love getting the original source documents for numbers. I am a retired actuary and kinda enjoyed seeing the sections on how rates are determined.

How do you find these Federal Register documents or the CMS Press Releases every year. Do you monitor the sites? Are you on a mailing list? Do you just watch for a news stories?

Harry Sit says

I’m on a mailing list for Federal Register. Then I checked the link to the CMS Newsroom Tom P posted a week or two ago. As I mentioned before, whether the standard premium is $185 or $183 makes little difference for budgeting. You won’t be too far off if you assume the 2026 standard premium will be $196. We already know the 2025 IRMAA brackets for some time by now. The official documents only serve as a confirmation.

GeezerGeek says

Also, if you want to estimate the Part D IRMAA penalty for 2026, you can assume that the Part D Average Basic Monthly Premium increase will be 6% because the Inflation Reduction Act capped the premium increase at 6% and the increase has been 6% for the two previous years. That would result in Part D IRMAA penalties of $14.50, $37.50, $60.40, $83.30, and $91.00 for each of the brackets from bottom to top respectively. Of course, generally, the Part B IRMAA penalty is about 5 times more than the Part D IRMAA penalty so it isn’t a big impact on your budget.

Tom P says

The actual Part D adjustments are: $13.70, $35.30, $57.00, $78.60 and $85.90. They are based on the Part D Base Premium of $36.78.

Now I need to figure out why my spreadsheet is off by 10 cents on the upper three tiers of Part B. Hmmm.

GeezerGeek says

Tom P: Yes, the numbers you listed are the actual numbers for 2025. Since Harry had provided an estimate of $196 for the 2026 Part B standard premium, I thought I would provide a corresponding estimate for Part D IRMAA premiums for 2026. I’m posting this clarification so that folks will understand why the numbers you posted are different than what I posted. Tom’s numbers ($13.70, $35.30, $57.00, $78.60 and $85.90) are the actual numbers for 2025 and the ones I posted ($14.50, $37.50, $60.40, $83.30, and $91.00) are an estimate for the 2026 Part D IRMAA penalties. Which bracket you fall into in 2025 is already set in stone, so to speak, since that was determined by 2023 income. Folks can still manipulate their 2024 income and the estimated 2026 IRMAA penalties for both Parts B & D may assist them in determining the consequences of that manipulation.

Tom P says

OK, it looks like when CMS calculates the Part B total they must use ROUNDUP(*,1) function in Excel, which rounds up to the nearest 10 cents. And the actual base premium is something other than the quoted $185.00. If I use $184.96 as the base I get all the correct results. For instance, ROUNDUP(184.96*2.6,1) = 480.90 for the 4th level.

I went back to 2024 and used the same methodology, but with $174.68 for the base premium instead of the quoted $174.70, and that gives the correct results also. Darn math 🙂

Tom P says

Sorry, that didn’t post correctly. It was supposed to be:

ROUNDUP(base premium * tier factor,1)

Tom P says

Upon further review, the correct Excel function is ROUND. A 2025 Base Premium value of $184.98 yields the correct results for all tiers when rounded to the nearest 10 cents.

Happy Veteran’s Day to all.

Robert Hoppe says

Harry. The Department of Health and Human Services doc per the website you provided indicates “The Part B deductible for 2025 is $257.00 for all Part B beneficiaries.” I assume this is the finalized amount for 2025. I had previously read somewhere about a month ago that it would be $240.

Harry Sit says

Yes, $257 is the official Part B deductible for 2025. It’s $240 in 2024. $17 difference for the whole year hardly makes any difference though.

Nancy Memmel says

Tom P;

my problem too..

If the 2nd tier is 1.0 X the base, how come the addition is 35.3 but the base is 36.78 .

I looked at Harry’s reference listed above as a link.

https://public-inspection.federalregister.gov/2024-26474.pdf

Which goes into the weeds including allowances for a repayment amount of the advance from the general fund to repay the fix so that new Medicare recipients did not have a gargantuan increase to cover the increase that the ongoing recipients wouldn’t cover due to the hold harmless provision (in 2018? I recall hearing abut it, but it didn’t apply to us then so I didn’t pay that much attention) So I tried calculating per this report and found out that a) I couldn’t match the results, and b) Medicare is going to charge what they publish, and they tell us ahead of time so c) I’ll take their word for it because life it too short. Good luck to you.

Nancy Memmel says

Thanks , Tom (I mean GeezerGeek2…

GeezerGeek says

It was from the postings that Tom P, Paul, and a few others made to this site that I learned how to build a spreadsheet to calculate the IRMAA brackets. So, if anything, I should be Tom P2. 🙂

James says

Anyone know when Social Security mails out the IRMAA notice letters for 2025?

The Wizard says

Probably before too long…

LizaBBBB says

Usually toward v end of November. (If you have a SS acct, you can see the notices about past mailings.)

TwoGeez says

Thanks, Wiz, for the insights. /eyeroll

Mike says

Slightly off topic question. My 2024 AGI has me in the 1.4x bracket for MFJ. Though this year, 2024, I am not going to avoid the 3.8% surtax on investment income any longer as I am above the $250k limit for MFJ. But I was looking to do a Roth conversion of $50k which I think is a bad idea because my guidance over the past years was I was too old, 83 and wife 73, to achieve any big savings unless I lived to 100. But if I did that conversion I would pay $10,500 in the 24% tax current bracket where I would still stay. If I did that again next year then I’d go to the 32% bracket because our RMD’s are going to go even higher and easily shove us into the 2x IIRMA bracket, or higher.

So, quick question, am I right that doing any Roth conversions is just moving taxes up a year earlier even ignoring that my life expectancy ( I am aiming for 110 to celebrate my wife’s 100th) is probably less than my dreams.

By the way since I cannot spend our RMDs’s I will have to invest them in my taxable Brokerage account (or just leave them in cash as I really do not need any more income) and my 3.8% gift to the government will start to get significant.

Liftlock (aka Jim M) says

Mike,

Here are a few suggestions after reading your posts and the follow up comments by others:

1. T-IRA. I would retain sufficient funds in your T-IRA to cover your potential long term health care expenses. T-IRA Distributions for health care expenses are currently tax deductible as excess itemized deductions to the extent they exceed 7.5% of your AGI. That may make it possible to withdraw large future expenditures for health care from your T-IRA at a reduced tax cost. Then at the end of life, any unused undistributed T-IRA funds can be donated to charity at a zero tax cost.

2. Roth IRA funds. I would let your Roth IRA grow and only withdraw funds from the Roth that can’t be taken from other sources without adding to your tax cost. e.g. Funds needed to purchase access to a long term retirement facility comes to mind.

3. Taxable Accounts: You can consider consuming a portion of your taxable account to reduce future taxes on investment income to the extent it does not push you into higher tax brackets for your other income.

4. Roth IRA Conversions. I suggest you evaluate where your income and Medicare IRMMA tax rates are headed based on your estimated RMDs over the remaining life expectancy for you and your spouse. I suggest doing Roth Conversions now if doing so will help you avoid or delay paying taxes in future years at higher marginal rates for income and IRMAA surcharges while you and spouse are alive. Paying taxes early for doing a Roth IRA conversion now will provide a long term benefit if avoids paying taxes at higher rates for withdrawing the same amount later on. I would avoid doing Roth IRA conversions if you thought you thought your future tax rates for taking your RMDs might decline. Roth conversions can still make sense if the conversion rate is not different from the future expected rate. Roth funds provide tax flexibility that T-IRA funds do not.

5. Longevity and compounding of investment returns. I think you can ignore any potential longevity benefit / compound time advantage for doing Roth IRA conversions unless the expected investment return rate on your Roth IRA will be greater than your T-IRA. If the investment return rate on your T-IRA is higher then there would be an advantage to retaining funds in the T-IRA. If the return rates are the same, there is no compounded investment return advantage of the Roth versus the T-IRA.

I am working on updating an Excel spreadsheet I developed to analyze the cost benefit of doing Roth IRA conversions for myself. I am also trying to quantify the marginal tax rates for IRMMA surcharges. I hope to be able to share these with this forum before too long.

Nancy Memmel says

Mike

Converting 10,500 in 2024 would only drop your 2025 RMDs by ~$600 (assuming it was the elder individual’s RMD.)

If 600 less of income next year would keep you under a 2025 threshold It might be worth it , and you wouldn’t pay 32% on that 600 in 2025 by paying the 24% in 2024, so I guess it wouldn’t hurt, but it doesn’t look like it would help that much, either.

If you use un needed RMDs to buy municipal bonds, that would reduce you NIIT exposure, but might not make much of a difference with IRMAA exposure, depending on what rate you actually get on the muni s vs what you could have gotten in taxable.

Mike says

Nancy,

I screwed up my calculation. The $50k at 24% would be $12,000 in taxes this year. I understand that converting $50k means my RMD would be $2,824 less income in 24% bracket. Of course I’d have $50k more income on the conversion which would net out to (50000-2824=47176). And that $47176 at 24% would be an increase of $11322. I’d still be at 24% but I’d also be at 2x on IIRMA when 2026 comes..

Plus, next year, that $50k after dividing by 17.7 means I’d have $2824 less income and save $677 in taxes at 24% on 2025. I start IIRMA in 2026..

So I pay $11,322 today to save $677 next year. Worse in my IRA’s I expect will rise again and my RMD will be even more next year than this.

Sometimes it’s too much work for little to no gain.

As a side comment I cannot convert enough to get my IRA’s to zero (the downside of doing well in the market). Thanks for the reply.

Nancy Memmel says

Well, you could look at it as the extra $11,322 in tax paid now getting you $677 ( tax free return in 2025 by virtue of simply being tax you don’t pay then). Your brokerage would do most of the work on a conversion.

Again, couldn’t hurt, but probably not worth getting a brain cramp over.

If you do charitable contributions, doing them as QCDs could help IRMAA exposure, but only if you are close to a threshold ; if your income puts you in the middle of a bracket you’d have to give a lot away to save on IRMAA charges. That still could work if you were going to donate it anyhow; in that case you might as well be tax efficient.

Good luck to you.

Jeff Enders says

Mike: I assume you do not expect to consume your Trad IRAs during your lifetime since you are just taking RMDs each year. There may be an overlooked benefit in your analysis.

Who is going to inherit your Trad IRAs? If they are expected to be in a higher tax bracket than you, then doing Roth conversions would save THEM income tax down the road. And then they get 10 years of tax free earnings and appreciation on that money while sitting in the Roth IRA.

Better to have equity investments sitting in a Roth where it can appreciate tax free versus those same investments sitting in a Trad IRA where the appreciation will eventually be taxed at ordinary income tax rates upon distribution.

Something to consider.

Mike says

Jefff,

Good point. My wife will be the sole beneficiary. And yes, we don’t expect to consume the IRA’s. Other than the fact that the RMD’s grow every year we can’t possibly spend it all. If I were to do a Roth conversion of both IRA’a and pay the humongous taxes, even if I paid them out of the conversion, my projections show that my wife will leave a lot of money to various charities. I understand the end game, but paying taxes today that won’t be due until 2041 (after I’m gone) doesn’t seem beneficial. But I agree with your point and I think about that every November.

Jeff Enders says

Mike – in my view, consuming your T-IRA would include charities, so if the end game is to give the remaining money to charity, I do not see the value of a Roth. Why pay taxes when the charity won’t?

Best to consider QCD’s now. You can reduce the tax related to the RMD and charities get more earlier than they would have after you both pass. You are not paying taxes that aren’t otherwise due until 2041; rather you are doing good to these charities now with more money than they would get later (because the tax bill is reduced via QCDs)

the QCD limit is $105,000 PER SPOUSE for 2024; in 2025, the limit is $108,000 PER SPOUSE.

Teresa Durden says

Mike, why don’t you do QCD’s every year? You don’t report the money as income, it pays down the money in your IRA to help future RMds and it helps charities now.

Mike says

The short answer is that I don’t like giving money away. The QCD would have to be very large to offset my RMD. And since I live off my RMD (with some of it not spent) by doing the QCD I would still have to take out cash to live on. An extreme solution would be to give away all my money and not have any tax worries.

Nancy Memmel says

Mike

The point is not that your whole RMD is given away as a QCD, but that whatever you do give to charity , if given as a QCD, will not be included in your income and therefore not add to income tax or IRMAA exposure.

It is also possible that the difference from using QCDs will make no practical difference to you, because of where you happen to land within the marginal and/or IRMAA brackets.

As to the advantage of paying taxes today that won’t be due until after you’re gone, consider that as a single filer your survivor wife will pay tax on a larger distribution ( barring a market crash) at a higher rate than you do as a couple.

Gary says

Roth strategy is decision making with big uncertainties. Sure, there is some basic math to optimizing a plan over a 30-40 years (we retired early, so hoping for 48 years). However, the uncertainties are a bit overwhelming to manage, including:

1) Taxes – Where are rates going? Are Roth IRAs going to be taxed or require RMDs? Generally, how will we get more revenue from the tax system (yes, I think it will be come to pass)

2) Spouse Inheritance – When will one of us pass away and subject the survivor to higher tax rates and lower IRMAA brackets (though, only for one of us)

3) Son’s Inheritance – With 10 year payout limits on IRAs and Roths, his tax rates will increase significantly more than ours.

4) Nursing Care – When we look at future possible nursing home or in home care, we see large, but deductible expenses. This lowers our tax rate for future RMDs, but does not affect MAGI for IRMAA penalties.

5) Combinations – Hey, these don’t happen in isolation.

So the overall strategy becomes a probabilistic game. We model these scenarios with different Roth conversions, giving us a range of outcomes. As a result, we are leaning into greater Roth conversions as a hedge. How do you to handle these uncertainties?

Mike says

All real issues. Here’s my view.

1. Taxes always trend up. Overall government will switch from Democrat to Republican randomly. There are always people who think no one should make too much money and taxes are how they rob the rich to pay the not rich. There is no definition of ‘fair share’ as ‘fair share’ is an emotional, and dishonest tactic to get more money for government to fritter away. I don’t debate this and am not open to seeing any other viewpoint. Based on that thought I am sure Roths will go away, not in next few years but there is someone somewhere thinking how to do away with them.

2. My spouse will outlive me, obviously since she is 10 years younger than me. My plan has always been to grow the nest egg to as high a value as I can. That is why our RMD’s are humongous and why I cannot stop trading is my TIRA and Roth even knowing I can never spend it all. I don’t trust the cost of living, inflation, and greed from trying to grow faster than my nest egg will.

3. Heirs. We have no children.

4. Nursing Care is an issue but I take the same view as you. We do not have a Long Term Care policy and have ignored the pleas to get one for the past 55 years. Imagine the wasted premiums for 55 years.

So yes, it’s a game of probabilities. I opted to keep our lives simple. I try not to worry about things I cannot control, and those that I can I ask why. I don’t own a bomb shelter, I don’t buy food to last me through a nuclear war. Though as of this morning the news isn’t real good about peace in our time.

We are fortunate to pay the taxes we do, but that doesn’t mean I like them. But as long as I can wake up each morning and find I’m still alive, and prepared as best that I can, or am willing to, for the unknown future, that’s the start of a good day.

The Wizard says

You can QCD as little or as much as you want, up to the $104k per year max…

Bev L says

Mike – I share your sentiments. Thank you for the clear explanation. To my way of thinking, giving to a charity via QCD’s whose mission and history I agree with is much more palatable than handing it over to the government to Waste.

Mike says

Wiz, Bev, Nancy,

I agree with your input and I understand what my wife will have to deal with once she is single. I may have to just bite the bullet and start hitting the max QCD for both our IRA’s and then take some combination of cash from the IRA’s and Roth’s to live on. More from the Roth’s than the IRA’s. We have more than enough available in the Roth’s to last most of our lifetimes. I have only used the Roth’s for funding the occasional new car or other major cash need to avoid any taxes that would generate by the IRA withdrawal. Appreciate your comments.

Mike says

Let’s say you do a QCD for the full $105k. My divisor is 17.7. So my RMD goes down by $5932. My taxes due in the 24% bracket go down by $1423. if we do two QCD’s then tax savings is $2846. But I now have to find $207,154 to live on. My choice it to take it out of the Roth’s, and pay no taxes or the IRA’s and pay $2846 in taxes. So, effectively, I took my normal RMD and gave away an additional $210,000. While I may give to charity I do not consider it in my financial decisions.

Nancy Memmel says

Mike ; Well, you’re the one who brought it up.

Moving IRA funds out by QCD or conversion ( or by spending it going on a world tour !!) reduces the RMD in the next year, and also every subsequent year. Since the divisor decreases yearly and you clearly expect that value of the IRA ( including any increment removed ) will increase also, the first year’s RMD savings would be the smallest and @ give or take a few thousand might not move the needle on helping tax or IRMAA liability but going forward a few years , give or take 20 K might. Or might not , depending on where you fall in the appropriate brackets.

Mike says

I should have been clearer maybe. In the end all the balances will go to charity. I just don’t let getting money to charity faster, or its size, enter into my planning. It will happen whenever our time is up. The rest of your comments are true too. It’s all a guess. Someone decides Roth’s will end, or only be tax free until 2050, or the surcharge rise from 3.8 to 5.0, or that phantom gains are taxable. Frankly if I won the lottery I would convert every IRA to a Roth and if it were big enough put everything in cash in a non-interest bearing account. Then live the dream of no taxes ever….big smile.

Mike says

Wizard, I’ve noticed that while you can reply to some posts (they have a REPLY link) other posts do not have that ability which means the thread gets broken and the reply is placed later in the blog . For example, Liftlock replied to a post I made on 11/18 at 7:34am (it’s proceeded by a 12.) but cannot be replied to which means my reply will be a new post appearing at the end of the blog as of this morning). Why is that?

The Wizard says

I’ve noticed the same thing. Somehow, the forum software isn’t the best and probably hasn’t been updated recently.

But I don’t think TFB is trying to be a full-function financial forum like Bogleheads or Early retirement ..

Harry Sit says

I set up the comments to nest only one level deep to avoid making the n-th reply very narrow and difficult to read. If you’re replying to a comment that’s a reply to a previous comment, scroll up and click on the reply link under the original comment. That’ll keep your new reply under the same thread. Basically you’ll have one original comment and all the replies under it, including replies to replies to replies.

Mike says

Harry, that makes sense. The only downside is sometimes, where there have been a lot of replies and one addresses a unique item then it’s hard to find the actual post that the reply was directed at. A possible solution would be if it was important for the intended recipient to know that he had a directed reply to put his name at the start, like I did here.

Mike says

Liftlock, Appreciate the advice. I currently do your items 1 to 4, and Roth Conversions is where the complications are. Our IRA’s are big and within two years, in 2026, we’ll be in 32% and on my death she will be in 37%. There is no reasonable amount that I can convert to Roth’s to avoid that. Also, within that same range we’ll be in the 2x or 2.6x IIRMA bracket. On top of which I believe that tax rates will rise but, at best, stay where they are through Trumps administration. The good news is that there’s no good news.

On Investment Returns there is no difference between the two IRA’s, other than one is non-taxable. I currently keep about 30% cash and the rest in mutual funds, stocks and bonds though the bond portion is less than 10%. I trade using the cash and I do that wherever I have cash. So no one account has a better return and they all are invested in the same funds and they all have returns that reflect how good a trade, or trades, performed. The only difference is that this year certain trades did better than others and depending on which account the trade was in that account may have had a better % growth. The accounts I had an NVDA and PANW position in did great compared to those that had Healthcare or Financials.

But, all that said, I do see the potential benefit of any conversion done prior to me dying. The unfortunate side is not having had the foresight to see 20 years ago the downside of a T-IRA versus a Roth.

Jeff Enders says

Mike: one strategy – be sure all your bond investment are prioritized to be in the T-IRA and all your equity investments are prioritized to be in your Roth and non-qual investment accounts.

Returns on bonds are ordinary income and normally little appreciation. And so is the T-IRA. So you’ll pay the same tax rate on the income generated by the bonds, whether it is in a T-IRA or a non-qual account. So load the T-IRA up with your bond allocation first.

But if you put equity investments into the T-IRA, you will pay ordinary income tax (eventually) on the distributions where it would be tax free in the Roth, and only 18.8% in a non-qual account (and zero if you never sell and it passes through your estate via the step-up). So load up your equity investments in the Roth first, the non-qual accounts 2nd and the T-IRA last.

if you “shoot the moon” on an investment, best case it was in the Roth (or non-qual account) and worst case it was in the T-IRA.

and I wouldn’t beat yourself up so much on what you should have done 20 years ago. Roths were first authorized in 1998 and there were no conversions permitted if your income was over $100,000. The cap wasn’t eliminated until 2010. And if you were working making “big bucks” in 2010, it probably would not have been an effective trade, given your tax bracket while working. For most the conversion trade only becomes a good idea immediately after retirement and prior to SS and RMDs kicking in.

Gary says

Mike, we are in similar boat of wishing we had done Roth contribution 20 years ago. However, I take some solace in that we were not eligible back then to do Roth contributions (income restrictions) or Roth conversions (age restrictions). Hopefully, we did not miss some Roth path at that point. If so, please don’t tell me! 😀

Mike says

Gary, there are a lot of us in that same boat. I remember the restrictions and limits and when I look back at the limits they were so low compared to today’s salaries you cannot help but conclude that our politicians never look out for us. All they want is a way to get more money for more of their favorite giveaway programs without blatantly raising taxes.

Ron Varley says

I have been doing Roth conversions for several years. However, I think I am in a bit of a pickle now as my spouse passed away this year and her portion of our total income was 6.6% of our AGI. It is my understanding I can file as a single head of household for two years. However I do not see how this fits into IRRMA Brackets. Appears to me at first blush I will pay a heavy price to continue Roth conversions, or am I missing something?

Robert Hoppe says

Ron. You can file as Married Filing Jointly for the current year. You cannot file as Head of Household for subsequent years unless you can claim dependents. Therefore, you must file as Single starting with tax year 2025. If you’re selling your house within 2 years of her DOD, you can take the $500,000 gain exclusion on the sale, even though you file as Single. If you sell the house beyond the 2 years, you’re gain exclusion will instead be $250,000.

Ron says

Robert, thanks for the info. Not sure where I read a widow or widower could file as head of household for two years after the death of a spouse. I did know about the sale of property. Looks like I will be itemizing next year and subsequent years. Trying to decide if it is worth doing a larger Roth Conversion this year and eating the higher Medicare rates, especially since it will be harder next year with the lower MAGI and the fact that my deceased spouse will not be paying for any Medicare. I have been using QCD’s from my IRA to reduce income taxes and lower MAGI. Ron

Jeff Enders says

Ron – there is a filing status called “qualifying surviving spouse” or QSS. It requires your spouse to have died in one of the PRIOR two years (because you could still file Joint this year) AND you must have qualifying children (with some additional stipulations). It’s really a filing status for young parents who spouse dies with underage children. You probably did read about it, but unlikely to pertain to the retired crowd, except in very unusual circumstances.

Also, on the explanation of the benefits of selling a home. Yes, the exclusion remains at $500,000 for two years from the date of death as Robert explained but 1/2 your cost basis “steps up” based on the market value on the DOD. So there are two benefits that occur: step on half the cost based AND maintaining the deceased spouse’s $250,000 exclusion for two years beyond DOD.

Nancy Memmel says

I don’t think you’ve missed anything except the head-of-household thing. Assuming that for you, like us, family income is going to be about constant, next year your marginal rate will be higher.

I’ve been looking at scenarios for our conversions and have concluded that the year one of us becomes a sole survivor is the last year we would be able to make any case for conversions being a good idea.

2025 and subsequent years you will have to file Single, but the SSA will be assessing your 2025 IRMAA based on your 2023 MFJ tax return and 2026 IRMAA based on your 2024 MFJ tax return (because that is all the data they have to make the assessments).

If you don’t do an appeal for “death of spouse” it should be 2027 before your IRMAA hit is based on single thresholds.

Robert Hoppe says

Ron. Thanks for also mentioning about the stepped-up basis for the surviving spouse when the primary home is sold. However, my understanding is that the stepped-up basis does not apply if the home has been transferred to a revocable living trust. I transferred our home to a trust earlier this year so that our sons do not have to go through probate (which oftentimes takes at last a year) for the house when they inherit it after both of us are gone. Our sons will get the stepped-up basis when they inherit the house. However, neither my wife or I will get a stepped-up basis if one of us dies and the other then sells the house. The cost basis will be the original purchase of the house + capital improvements prior to the sale closing date.

Nancy Memmel says

Robert

We, too have a revocable trust. I was unaware of the basis step up provisions. My understanding is that to remove assets from the trust requires the consent of all parties to the trust, but at the point where only one of us survives, that person could remove the house from the trust if he wished to sell it.

Would that person then get the stepped up basis from the decease of their spouse or would it depend on your state of residence?

Robert Hoppe says

Ron. You can avoid having your Medicare Part B and Part D premiums increase in 2026 by 40% {i.e., 1.4 factor, based on 3% inflation} as long as your 2024 MAGI does not exceed the $218K threshold (for married filing jointly filing status). Given that you will be filing as Single for 2025 and each year thereafter, your 2025 (and each year thereafter) MAGI threshold will be cut in half. Therefore, you won’t be able to do nearly as much of a Roth IRA conversion in 2025 as compared with 2024. Therefore, it does make sense to do the maximum Roth IRA conversions in 2024, as long as you stay within the MAGI threshold mentioned above for 2024 to avoid the 1.4x factor with respect to 2026 Medicare premiums.

Liftlock says

Ron Varley,

I agree with Robert Hoppe’s advise. I suggest you also look at what your marginal income tax rates will be when you file using the Single status next year. It sounds like you are going have 93.4% of your Married Filing Jointly income taxed at Single Filing rates next year. The single brackets are lower and narrower than the MFJ brackets and the standard deduction is cut in half. This means that more of your income will be taxed at higher rates. I suspect there may be benefit to accelerating your Roth IRA conversions this year.

Jeff Enders says

Liflock – 100% of the income would be taxed at the SINGLE rates. Presumably, a surviving spouse inherits the deceased spouse’s assets and therefore any income that is generated. It is possible some of the income disappears (e.g. some SS, pension that was not a joint annuity) but otherwise, any income resulting would simply shift to the surviving spouse.

LiftLock says

Jeff Enders,

I agree that 100% of of Robert Varley’s 2025 income will be taxed at the SINGLE rates. I wrote 93.4% because he indicated that 6.6% if his current MFJ income was generated by his spouse. I was assuming the 6.6% would disappear. I00% of her taxable Social Security income is likely to disappear if her benefits were lower than Roberts. The surviving spouse normally retains the higher of the two SS benefits.

RobI says

My 2025 Medicare Premiums letter, including IRMAA, just posted on MySocialSecurity site SSA.gov. Look under ‘messages’ if you have an account.

GeezerGeek says

Mine isn’t there yet.

Mike says

Robl, How did you know to look for it? Did they email you that it was there? The last letter I received was in 2023 telling me what my 2024 payment would be but I don’t remember if they emailed me to look there.

RobI says

Mike – I turned on email notification for changes in MySocial Security ‘Message Center’. Got an email this morning so they must have started uploading millions of letters!

GeezerGeek says

I have email notifications turned on too, so now I know I just have to wait until I get the notification email. Thanks!

Robert Hoppe says

Nancy. My description relates to a revocable living trust. I believe the type of trust you are referring to is a Medicaid Asset Protection Trust (MAPT) which is an irrevocable trust, wherein to add or remove assets from the trust requires the consent of all parties to the trust. I believe the same rule applies for a MAPT with respect to the surviving spouse not getting the stepped up basis. In other words, whether the home is in a revocable living trust or a in a MAPT, my understanding is that the surviving spouse does not get the stepped up basis (i.e., relating to the 1/2 ownership of the deceased spose), since the home is no longer in the name of the joint owners — i.e., it’s in the name of the trust. I’m certain that the inheritors get the full stepped up basis relating to a revocable living trust, but I’m not really sure about the inheritors getting a stepped up basis relating to a MAPT. You would have to consult an expert on MAPT who is a CPA AND an estate planning attorney with experience in MAPTs. I have been a NYS CPA since 1978 (I retired in early 2000), and I’m certainly not an expert on trusts at all other than having a working knowledge of revocable living trusts, since I had one created for my wife and I for our home and for a brokerage account that does not support the naming of beneficiaries. With a revocable living trust, either grantor (husband and/or wife) can add or remove assets from the trust without the consent of the beneficiaries of the trust. The only reason I believe why one would create an irrevocable trust is so that the underlying assets are not includable in the gross estate for estate tax purposes, wherein I believe the inheritors do not get a stepped up basis. Since the federal estate tax exemption is extremely high ($13.61 million), I doubt that too many people would consider creating an irrevocable trust unless there is some other underlying reason to do so.

Jeff Enders says

Ron – did you have a typo early in the post. I think your point was the IRRECOCABLE trusts do not get step-up, but revocable do, even after the death of the first spouse.

Nancy – a good, in-depth article on the topic:

https://www.halaw.com/news/irs-revenue-ruling-step-up-basis-irevocable-grantor-trust

Nancy Memmel says

Robert;

No, I am talking about our trust , a revocable family trust.

My disband and I are the trustees of the trust that will receive and convey our property upon the demise of the last of us. As trustees we can change that at will, but if we cannot agree on a change the trust would be dissolved. (We would have to agree, the beneficiaries consent wouldn’t be an issue, unlike an irrevocable trust.) The way the house is titled would result in it being transferred to the trust at the death of the second of us. It wouldn’t be in the name of the trust until both of us have died.

When we are at the point of a single survivor , that survivor, as the lone trustee, has full discretion to alter anything about the trust; it becomes chipped in stone only at the second death.

Real estate basis step up is largely theoretical for us, since our house enjoys gains well under one exemption at this time, but I thought it was an interesting point, and one I hadn’t had a single thought about.

Thanks, Jeff I think that was a good catch.

Robert Hoppe says

Nancy. What you are describing sounds more like a “testamentary trust” rather than a “revocable living trust”. I have heard of family trusts, but I’m really not familiar with them. A testamentary trust is a legal document that specifies how a person’s assets will be distributed to beneficiaries after their death. It’s created as part of a person’s last will and testament, and the terms of the trust are outlined in the will. I assume that you and your husband each have this testamentary trust feature included in each of your wills. I believe this is entirely different than my trust which is a revocable living trust. I have no idea whether the stepped up basis concept applies for the surviving spouse when one spouse dies (since the home’s title will not be transferred to the name of the trust until the first spouse has died) for a testamentary trust, or whether the inheritors get the stepped up basis after both spouses have died. I suggest contacting a professional who is both a CPA and an estate planning attorney to discuss this. But I do know that for my situation (revocable living trust where our home ‘s title was transferred from our names to the name of the trust at the county property records office), the surviving spouse does not get a stepped up basis because the house is no longer in our names as owners (but we are named as the trustees in the home’s title), but our sons will get the stepped up basis when both of us are gone.

Frustrated by IRMAA says

Happy Thanksgiving to all!

I have two questions:

Background for question 1: “2026 IRMAA brackets: We’ll have the maximum three data points out of 12 needed by mid-December 2024.”

Question 1: I know it is a bit early to ask but maybe you can now predict if the 2026 IRMAA brackets are likely to change next month? If yes, what is the approximate December date they will be updated on this site?

Question 2: How do you expect the TCJA income tax rates, which were expected to sunset at the end of 2025, will be affected by the 2024 election results?

Thanks!

Jeff Enders says

1) Next update will be Dec. 11. It’s noted on at the top of this website. Given where inflation continues to be reported (around 2.5% annually), the 2026 tranche projections could only tighten, meaning the tranches estimated with 0% could only rise and the brackets estimated with 3% could only fall.

2) still early to tell, but the Republican controlled Congress would attempt to maintain the same tax brackets as currently exist (i.e. extend TJCA tax brackets). It will not affect 2024 tax season and is unlikely to affect 2025 tax season.

Nancy Memmel says

Frustrated;

I expect the TCJA to be extended, but I wouldn’t count on it staying exactly the same as it has been. I’m still making my 2025 conversion plans AS IF it will sunset.

Frustrated by IRMAA says

Thanks Jeff!

Mike says

Harry,

Your website is great. Your math and analysis is outstanding.

I respectfully disagree with your “nickel and dime” section. While you are correct the extra IRMAA is small compared to the total tax bill, the point of Roth conversions is to fill lower tax brackets like 22% and 24% to avoid higher brackets when RMDs are in force. As a married couple, both over 65, the cost of moving from one IRMAA braket to another is about $3,000 today. It’s actully a pretty stiff tax bill to incur an extra $3,000 if you’re just trying to fill the 22 or 24 tax bracket with an additional $30,000 to $60,000 of Roth conversions. I think tax on the slightly higher RMD in my 70s (because I didn’t do a Roth conversion today) will be lower than the higher IRMAA tax I face today if I try to fill the lower tax brackets.

Mike

Jeff Enders says

Mike – I will respectfully disagree with you. We have been living with the prospect of the end of the TJCA tax laws from 2017, which expires at the end of 2025. Further, there is little indication how the federal government plans to pay for the mounting deficits. The risk is that tax brackets rise, making the future cost of taxes greater than the current cost. If tax brackets are static or known to be static into the future, then your argument has more validity.

I look at IRMAA as a 2% percent increase to my marginal tax bracket. Over the past few years, paying that additional 2% in “tax” avoids paying what may be even higher taxes in the future should Congress raise the current tax brackets in some way.

Further, the argument doesn’t consider the benefit of a rising stock market. In retrospect, I am glad I paid that extra 2% in tax in the form of IRMAA and was aggressive with Roth Conversions. That 2% penalty was a small price to pay for all the ordinary income tax I am now avoiding FOREVER that my appreciated investments are sitting in a Roth account and not a Trad IRA.

The cost of IRMAA is the tail that wags the dog. It is nickels and dimes.

Mike says

Jeff,

I agree with your observations about future tax rates – that’s a driver for many of us to make Roth conversions today vs risking higher tax rates in the future.

I was attempting to point out that, at the margin, IRMAA taxes are not inconsequential and are higher than 2%.

The gap between IRMAA brakets for married filing jointly is about $60,000. To minimize IRMAA taxes, you’d do Roth conversions to “fill the IRMAA bucket” to just below the next bracket. So, as you’re filling up your federal tax buckets at 22% and 24% for Roth conversions and managing IRMAA taxes, the “best” additional marginal tax rate is 5% ($3,000/$60,000). If your Roth conversions put you in the middle of an IRMAA bracket (a $30,000 increase over the break point) the marginal rate is 10% ($3,000/$30,000).

I’m not sure that 5%-10% increases in marginal tax rates today is nickels and dimes compared to what it might be in the future.

It would be so much easier if we just knew everything about future tax rates!

Mike

Nancy Memmel says

Mike;

for what it’s worth, in my conversion strategizing for our situation, I looked at the effect of anticipating future inflation for the purposes of deciding on conversions, and having that inflation NOT come to fruition vs. conservatively limiting conversions to the known (current year) brackets and losing out on a higher conversion amount if inflation conformed to my expectations. Since $1 over the threshold incurs a big additional bill, I concluded the down side was much more significant than the meager up side of an additional thousand or so converted a year earlier.

I also looked at scenario’s of biting the bullet and just paying a year of enhanced IRMAA and then converting up to near the next threshold and that seemed to work better than avoiding IRMAA at all costs (all based on my projections, of course, which are not guaranteed). But my criterion is whether we will have the cash flow to pay the extra tax(es) without having to disrupt productive investments.

FYI We will be able to finish our conversions this next year or so, but if you are looking at more conversions spooling out over time , you might decide differently.

Gary says

Jeff, I am in a similar situation, having done 13 years of conversions and loving the tax free ROTH appreciation.

I struggle assuming that ROTHs will be safe forever, given our growing deficits. This may not come as direct taxation of ROTHs. However, It’s easy to envision RMDs beginning, at least for larger accounts (e.g. $10M, $20M or more). While the RMDs would still be tax free, they would create greater future taxable income.

This might happen for two reasons. First, all of us Lemmings are pushing Roth conversions, creating growing pots of non-taxed money. Second, some folks have huge ROTHs (WSJ article described a $2 Billion ROTH a few years ago). I would agree that it makes no sense for that much of a tax subsidy.

Robert Hoppe says

Gary. What exactly do you mean by “While the RMDs would still be tax free, they would create greater future taxable income.” Since Roth IRA withdrawals are and more than likely will always be tax-free, how would that increase taxable income? RMDs are required only for inherited Roth IRAs (i.e. they must be fully withdrawn by the 10th year following the death of the Roth IRA owner as per the SECURE 2.0 Act), but they will still be tax-free. If in the future the IRS were to start taxing Roth IRA withdrawals, I think that would relate only to relatively high income individuals.

Jeff Enders says

Robert – I think the point is that if Congress can find ways to cause money to flow out of Roth IRAs, then the money ends up in taxable vehicles.

In Secure 2.0 the time most beneficiaries could maintain an inherited Roth was reduced from their lifetime to 10 years. That moves money into taxable accounts. There is no tax upon exit from the Roth, but the dividends / interest and appreciation is now subject to tax.

Likewise, there was an amendment that did not pass in Secure 2.0 to limit the size of Roth accounts to $5 million. That would force money out of Roth’s into taxable accounts. That would be a form of RMD that is based on size and not time.

So Congress could limit how LONG money sits in an ROTH or limit the AMOUNT of money that sits in a Roth. Forcing the money out in either case causes “greater future taxable income”

Gary says

Robert….Jeff is a great job of answering your question for me. The future income would be from the funds now being in taxable accounts.

Jeff ….I think a workable approach to forced Roth withdrawals would be something like “if prior year Roth account is over $10M, then following year Roth RMD employs the RMD life expectancy factor to calculate a required RMD”.

Mike says

“Forced Roth Withdrawals”. New acronym. FRW! I’ve got to stop reading this stuff until the holiday is over and enjoyed before I raise my blood pressure. It’s nice of the government to tell me exactly how much they will allow my savings to grow to before they will exact their pound of flesh. As I said in my post below, I am fortunate that I thought to only trade in my IRA’s years ago. The downside is that my RMD’s keep growing, the upside is that they provide me, after taxes, what I need to live on without generating any additional taxable income except minor interest from the cash I keep in my taxable brokerage account. Though as my RMD’s grow and I find it difficult to spend it all my cash in the brokerage earns more interest. I have thought of telling Fidelity to sweep my cash into a non-interest bearing vehicle.

Jeff Enders says

Gary – depends how much Congress is seeking to reduce the deficits… how about a more draconian approach: “if the Roth balances exceeds $X on December 31, all dollars above $X need to be distributed no later than April 15 of the following year (i.e. 3.5 months after year end).”. The penalty for not distributing the money is 25% of the balance. :-).

Mike says

The job of government is to tax any money that anyone has, or will have, as soon as possible so that promises made when the money didn’t exist will exist when it is needed to be spent to buy votes. Shortly before I retired I accumulated some losses which, since I traded only in my IRA’s, became carryover losses. For the past 20 years I have been deducting $3000 each year from those substantial carryover losses as my government sees no need to apply any kind of inflation factor to that $3000 limit. Just as no inflation factor has been applied to the $400,000 ceiling, the one where they say “No one earning under $400,000 will ever be hit with this new money grab”. Pardon my annual outrage.

Robert Hoppe says

Jeff. Thanks. I wasn’t aware that Secure 2.0 limits the balance that one can hold in a Roth IRA to $5 million. Does this mean that a retiree (starting at age 73) who has a Roth IRA which exceeds a $5 million balance must start RMDs against that Roth IRA to bring the balance below $5 million? If so, I have to assume that those RMDs are non-taxable. I honestly doubt that Secure 2.0 would require a Roth IRA account owner to do RMDs against the account (which has a balance exceeding $5 million) prior to attaining age 73.

Mike says

Robert, Secure 2.0 does not limit the size of your Roth IRA. You can contribute to it over the years or trade in it. It can grow to a billion dollars if you do well and you never have to take out any money. Same for your spouse if they are the beneficiaries. The only thing that Secure changed was for non-spousal inheritors who must empty it within 10 years. That’s it. If you reread what Jeff said some idiot of a politician tried to get that disaster of a rule into Secure but failed. That shows you how dishonest some politicians are that supposedly look out for our well being. So for now, until we get some other dishonest money grubbing pol trying to put limits on how rich one can become, the Roth remains untouchable. It looks like saying the rich don’t pay their fair share isn’t enough to vilify them. Having the 1% pay 40%+ of our governments budget apparently isn’t enough. Next we know is someone will try to pass a law saying that no one can be richer than the poorest person in the country. Wait until that happens and watch how fast there is no income to tax.

Robert Hoppe says

Mike. I’m not following regarding carrying over losses that exceed $3,000 with respect to trades you have done in your IRA. The $3,000 maximum net loss you can deduct on your tax return in any one year has nothing at all to do with losses incurred from trades within your IRA account. The $3,000 annual cap relates to taxable brokerage account trades, not IRAs.

Mike says

Robert, sorry for not writing more clearly. Before I retired I traded in my brokerage account. It was those trades in that taxable account that accrued the losses. When I retired I began to trade more and it became a real full time job for me. It was then that I stopped trading in the brokerage account and started trading only in my IRA’s. The result off that is that I no longer had any Capital Gains to report on my return but at the same time no gains to offset against the losses as all my gains (or some other losses) were in the IRA’s. So I had a very large loss carryover in the brokerage that couldn’t be used to offset anything. I could only take a $3,000 offset against Social Security and Pensions maximum in addition to any offsets against any gains, of which there were none. That’s what I meant to say and didn’t write clearly enough.

Robert Hoppe says

Nancy. The Roth IRA conversions you do in 2025 will fall within the TCJA tax brackets which were set in late Dec 2017 and will automatically sunset after 2025. Trump (with approval from Congress) may modify the TCJA tax brackets in 2025 to be effective starting in 2026, but I doubt it. I think his intentions are to keep the TCJA tax brackets as is for his entire Jan 2025 – Jan 2029 term in office. No doubt that with a Republican majority in both houses of Congress, they will approve whatever he wants.

Nancy Memmel says

Robert;

Trump’s intentions might well be to just extend the TCJA ( BTW I don’t think that that is technically true, as at this point he is not so enamored of the SALT caps, for example) but he only gets to sign into law what Congress hath wrought.

So I do not expect any retained TCJA regime to be just a matter of “let’s do it again”. Since I don’t know what differences there might be, I elect to operate on what I do know, and complete as much of my conversions as I can in 2025, as I said , AS IF the TCJA was going to sunset with the close of 2025, rather than counting on tax terms that I would prefer to still be in place in 2026.

If I am wrong we will have paid a little more IRMAA for one year, but gained one year of growth in the Roth for the conversion, and reduced the amount potentially left on the table if we, as as a couple, wind up as a single survivor before our conversion program is completed.

Robert Hoppe says

Mike, thanks for clarifying. I had read Secure 1.0 and Secure 2.0 regulations, as well as subsequent additional clarifications on 2.0 with respect to IRA inheritors , which is why I was surprised to see it mentioned in the comments in this forum that a Roth IRA balance cannot exceed a $5 million balance in order stay within the IRS rules, which I then interpreted to mean that RMDs would have to start at age 73 for the original Roth IRA account owner if the balance exceeds $5 million. Therefore, the original account owner does not need to do RMDs for a Roth IRA, at least until Congress changes the law in the future to the contrary.

Jeff Enders says

Robert – please re-read what I wrote:

“there was an amendment THAT DID NOT PASS in Secure 2.0 to limit the size of Roth accounts to $5 million.”

there is currently NO limit on the size of a Roth IRA. But if Congress tried once to limit it, it could try again.

JoeTaxpayer says

I viewed the SALT cap as a shot against Blue states. We typically have higher costs as we have higher spending on education. 2/3 of my property tax goes to the schools.

I hadn’t heard that Trump wasn’t happy with the SALT cap, it would be great to see that gone.

Jeff Enders says

JoeTaxpayer – what would you see as the replacement so that the budget deficit doesn’t get even worse?

Why should citizens of lower taxed states in effect pay for the decisions your state makes on educational spending?

Also, and I wonder if this is understood, if a taxpayer was subject to AMT prior to TCJA, I fail to see that any benefit was lost due to the $10,000 SALT limit that now exists.

Robert Hoppe says

Joe. Effective for tax year 2025, the total standard deduction for married couples (MFJ) age 65 and over will be $33,200 ($30,000 + $3,200). For simplicity sake, if the couple does not have any other itemized deductions other than SALT taxes (property taxes + state and local income taxes), the SALT taxes would have to exceed $33,200 in order for it to be beneficial to itemize deductions. If a couple over age 65 still has a mortgage with interest and/or medical/dental expenses that exceed 7.5% of their AGI, they are likely to have total itemized expenses greater than $33,200. Of course, Roth IRA conversions and/or RMDs will increase the AGI which impacts the 7.5% threshold for a medical/dental expense deduction. Granted, there are quite a number of couples in the blue states with SALT taxes that exceed this amount (I can tell you that is the case for many Long Islanders), especially if they are still working and paying state and local income taxes in addition to property taxes. Congressmen (the House reps) are fighting to eliminate the SALT $10,000 cap. If the IRS eliminates the SALT cap going forward, this would mean (with respect to many residents in blue states paying high SALT taxes) reverting back from taking the standard deduction to itemizing deductions on their tax returns.

JoeTaxpayer says

My property tax and state tax easily exceed the standard deduction.

My charitable donations are enough that I use a Donor Advised Fund so that every other year, I’m able to itemize.

And yes, the SALT cap changes the math of Roth conversions. So, IRMAA and my own state tax are problematic. It all adds up.

I don’t see a ‘reply’ to respond to Jeff Enders. All I can say is that (a) I suggest you look at cash flows from Blue states to the federal government and the flows from the Government to Red states. Blue have been ‘donating’ to Red for as long as the data show.

(b) If you raise my taxes and feed the poor, house the homeless, etc, I’d happily pay far higher taxes. When I watched a proposed tax code in ’17 screw the upper middle, give pennies to those at lower incomes, but a windfall to the wealthy, that’s where I have an issue.

It was remarkable to me that a $50K earner was so heartbroken that a couple worth $25M might have to pay some tax on their passing that they supported raising the estate exemption, now just under $14M in 2025, but got virtually nothing for themselves.

G2 says

Re: Robert’s itemize comment: If I have to itemize does that mean I can no longer file my taxes on a postcard, as promise under TCJA?

Gary says

JoeTaxpayer…I read your comment on Donor Advised Funds and tax deductions. We have been donating from our IRAs using the QCD approach. I had thought this was more tax efficient, since it is effectively a tax credit from what have been my RMD, instead of a tax deduction.

Always willing to learn a better approach. Any thoughts on this?

The Wizard says

QCDs are the best way to donate, for those of us who can do them. They are not a tax “credit”; they simply do not add to your AGI in the first place.

And, of course, they count toward your IRA RMD once you are old enough to have that…

Mike says

JoeTaxpayer, regarding your comment “(b) If you raise my taxes and feed the poor, house the homeless, etc, I’d happily pay far higher taxes”, you know that if you have extra cash with nothing to spend it on you can always pick a tax rate you would like to see, recalculate your taxes at that rate, and send the government the additional money.

Our tax code allows anyone who feels he pays too little to donate the necessary amount to feed the poor or house the homeless, though you can’t force them to use it that way. After all, they do have their own priorities and favored businesses and donees, like EV manufacturers and buyers and solar panel buyers.

kenneth m says

Mike:

In your list of “favored businesses” you seem to have left out a pretty big one: fossil fuel subsidies (at around $15 billion a year). I’m left to wonder why such an obvious “favored business” was left off of your list. You might just have a point when EV and solar-panel businesses start making profits in the multi-trillion-dollar-per-year range.

kenneth m says

To JoeTaxpayer:

Amen brother.

It seems “remarkable” to you only because you apparently still think most $50k earners support policies based on logic and information, and not based on trickle-down policy and other low-information fantasies.

Mike says

Kenneth, Couldn’t get this right under your post so hopefully you’ll see it here. I left out a bunch of favored businesses only because there are so many and I didn’t want my post to go on and on. But we agree on the issue, I think. I think the fact too that the rich benefited more than the poor is a no brainer. If you cut taxes by some percent then the guys who pay 40%+ of all taxes collected will benefit more than the free-riders and those who pay 1% or 2%. The only way out of that is to say we will cut the poor’s taxes by 96% and we will raise the 1%er’s taxes, those who pay 40%, by 90%. Screw the rich. They can give up some caviar. Obviously I am being sarcastic. But that’s the way politicians and the media and Democrats portray the rich. Our taxes are progressive in the sense that the rich pay some more as they get richer. But it’s never enough. It never approaches a ‘Fair Share’ that no one defines, can define or wants to define. I’ve said this in another post : when they get to telling the rich you can’t earn so much they won’t, and tax income to the government will go down. As for SALT, why am I subsidizing residents of a crummy state like NY or CA who give away money to the less fortunate by taking it from the rich, who set building standards that cause houses to cost thousands more and of course taxes rise so high. And school taxes are so high because they manage the schools and teachers so poorly. I’m just mad and SALT just rubs more salt into my wounds. I’ll stop here.

kenneth m says

Mike:

I am amused that you worry so about how the “democrats” supposedly portray the wealthy…..and yet then you go on in the same post to verify that very portrayal.

Cummy states, crummy democrats, crummy media….apparently its all crummy. Well, maybe all except for the subsidies those crummy blue states overwhelmingly pay to the red states, all because those crummy blue states are the crummy economic engine of the county. Let me explain in terms you might find familiar: when they get to telling the crummy states that they can’t earn so much and benefit from the tax breaks available to the other states, they won’t, and the tax income to the government will go down along with all those subsidies which help keep part of the country from joining the 3rd world.

I too will stop here. Sorry to anyone offended by the off-topic discussion.

kenneth m says

JeffEnders:

You asked JoeTapayer: “JoeTaxpayer – what would you see as the replacement so that the budget deficit doesn’t get even worse?”

That’s “rich”. A bunch of politicians who either are wealthy, or are beholden to people who are, created a tax policy that screwed the middle class for the benfit of the wealthy, while raising the national debt by $2 trillion. And now you think it is up to the middle class to bite the bullet on that screwing because fixing it might raise the deficit??!!! Please think back: that “$debt” train left the station 6 YEARS AGO! Why weren’t the politicians who passed that tax policy held accountable and forced to answer your question about raising the deficit back then?