[Last updated on January 28, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving the money to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. If you’re looking for the regular backdoor Roth, where you contribute to a Traditional IRA (not a 401k-type plan) before converting to Roth, please see How To Report Backdoor Roth In TurboTax (Updated).

A mega backdoor Roth is a great way to put additional money into a Roth account without paying much additional tax. Not all employer plans allow non-Roth after-tax contributions, but some estimated that 40% of people can do it.

Suppose your employer plan allows it, and you executed a Mega Backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return. Here’s how to do it in TurboTax.

Use Desktop Software

You should do it in TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

If you use other tax software, please see:

- How To Enter Mega Backdoor Roth In H&R Block Tax Software or

- How To Enter Mega Backdoor Roth in FreeTaxUSA

Convert Within the Plan or Roll Over to a Roth IRA

You can do the Mega Backdoor Roth in two ways: convert within the plan or roll over to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Rolling over to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within the Plan or Out to a Roth IRA? for some minor differences between the two approaches.

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). Your contributions earned $200 before you converted to the Roth account within the plan or rolled over to your Roth IRA. You converted $10,200 to your Roth account.

I’m using 401(k) as shorthand. It works the same in a 403(b).

Split Rollover

A split rollover means rolling over the money to two different destinations. A split rollover is useful only when the non-Roth after-tax contributions generate substantial earnings before you convert to Roth. Most people don’t do a split rollover because the earnings are insignificant or zero when they convert soon enough.

You can skip this section and go directly to 1099-R entries if you converted entirely within the plan, or if you rolled over both the contributions and the earnings to a Roth IRA without splitting.

If you did a split rollover by rolling over non-Roth after-tax contributions to a Roth IRA and the earnings to a Traditional IRA, and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R and enter two 1099-R forms in TurboTax. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block for how to split the 1099-R form.

If you imported the single 1099-R that covers both rollovers, delete it and manually enter two 1099-R forms. The first 1099-R shows rolling over the non-Roth after-tax contributions to a Roth IRA, for example:

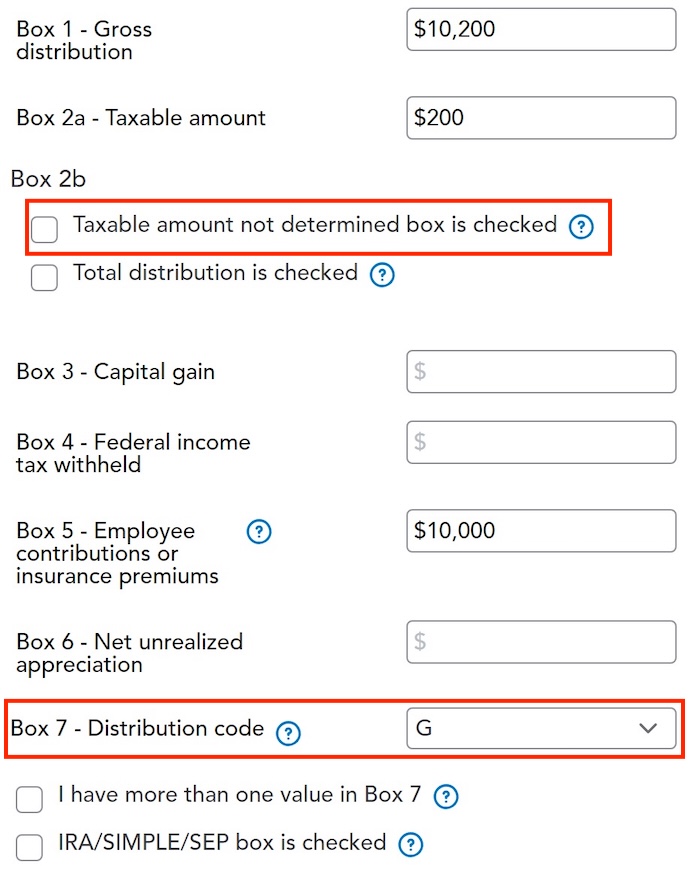

| Box 1 Gross Distribution | $10,000 |

| Box 2a Taxable Amount | $0 |

| Box 2b Taxable amount not determined | not checked |

| Box 5 Employee contributions/Designated Roth contributions or insurance premiums | $10,000 |

| Box 7 Distribution code(s) | G |

| Box 7 IRA/SEP/SIMPLE checkbox | not checked |

The second 1099-R shows rolling over the earnings to a Traditional IRA, for example:

| Box 1 Gross Distribution | $200 |

| Box 2a Taxable Amount | $0 |

| Box 2b Taxable amount not determined | not checked |

| Box 5 Employee contributions/Designated Roth contributions or insurance premiums | $0 |

| Box 7 Distribution code(s) | G |

| Box 7 IRA/SEP/SIMPLE checkbox | not checked |

The rest of this post shows what to do with the first 1099-R (after-tax to Roth IRA). The second 1099-R (earnings to Traditional IRA) is a straight Traditional-to-Traditional rollover.

You don’t need to split the 1099-R if you converted entirely within the 401(k) plan — everything to the Roth 401(k), or after-tax contributions to the Roth 401(k) and the earnings to the pre-tax 401(k).

1099-R Entries

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

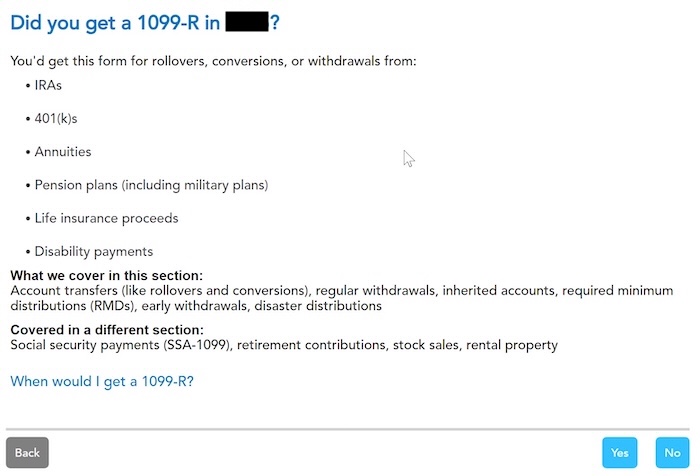

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan. Import the 1099-R if you’d like. I’m skipping import and entering it manually.

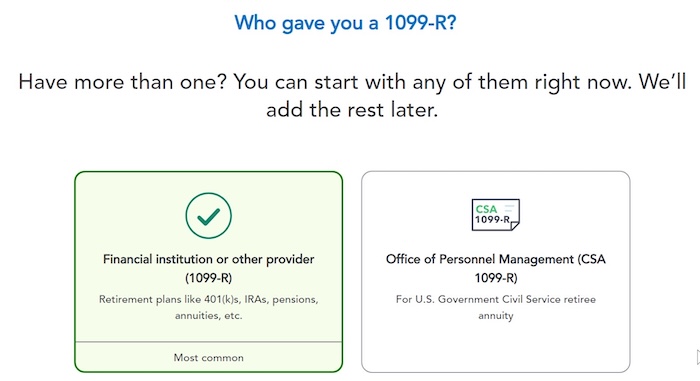

The 1099-R is from a financial institution. Enter the payer information as shown on your 1099-R.

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly.

The earnings portion should be in Box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The non-Roth after-tax contributions (the “principal”) should be in Box 5. Box 7 should show a code G. Finally, “IRA/SEP/SIMPLE box is checked” should NOT be checked.

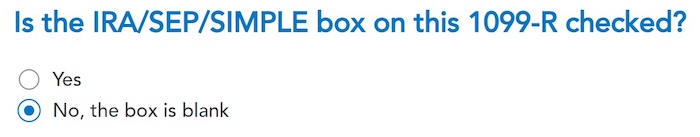

TurboTax wants to confirm that the IRA/SEP/SIMPLE checkbox is not checked.

Rollover Destination

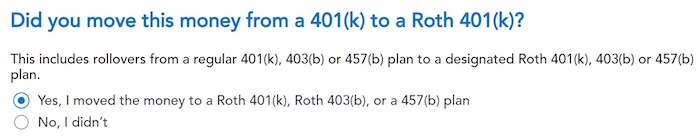

If you converted to Roth within the plan, answer Yes here. If you took the money out of the plan to a Roth IRA, answer No.

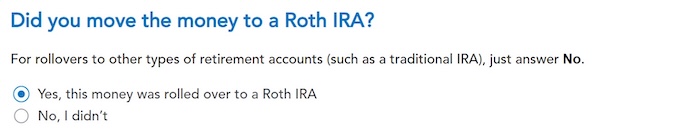

If you answered “No” to the previous question, confirm that the money went to a Roth IRA.

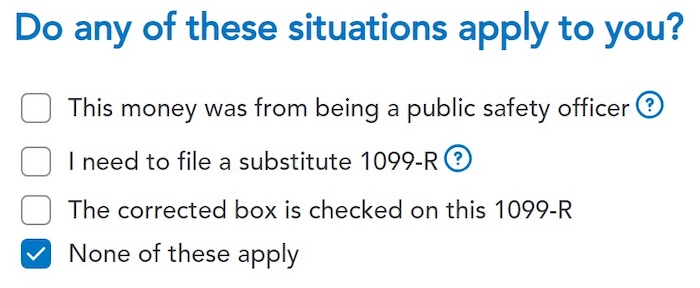

We don’t have any of these special situations.

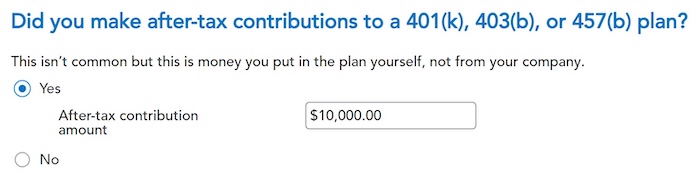

After-Tax Contributions

Answer Yes to confirm that you made non-Roth after-tax contributions to your plan. TurboTax automatically pulls up the amount from Box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

You’re done with this one 1099-R. Enter more if you have them. Click on “Done” on the 1099-R summary screen.

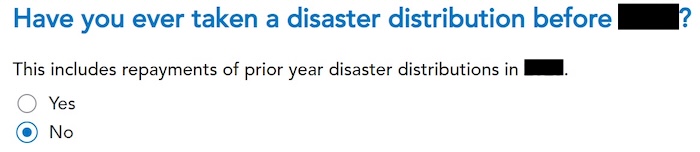

We haven’t taken any disaster distributions.

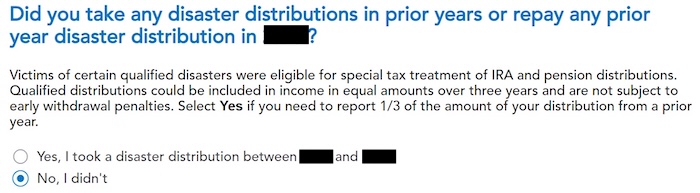

We already said no, but TurboTax wants to ask in a different way.

Verify on Form 1040

Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 non-Roth after-tax contributions.

Click on Forms on the top right.

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. It shows zero if you don’t have any earnings. The “Rollover” box in Line 5c may or may not be checked. TurboTax checks it when the taxable amount on Line 5b is positive. It doesn’t check it when it’s zero.

With a Mega Backdoor Roth, you put an extra $10,000 into your Roth account. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Shaina says

Thanks Harry!

All checks were sent to me in Jan 2022. I did speak with the plan administrator this morning – they’re looking into that 1099-R and my options, as I hadn’t yet deposited the $1157 check made to me.

Paul says

Hi Harry:

I have questions about the following planned scenario:

I contribute $10,000 as non-Roth after-tax contributions to a 401(k). By the time I roll over the money to a Roth IRA, the contributions have a LOSS of $200. I roll over $9,800 to my Roth IRA.

– Is it favorable to orchestrate the rollover during the time of the year that results in a loss? This scenario assumes that my assets are transferred in-kind and that I remain perpetually invested.

– Do I report a (negative) taxable amount of -200 (1040 line 5b)?

Thank you!

Harry Sit says

You don’t get to enter a negative number on line 5b of your Form 1040. It’s favorable to do the rollover when you have a loss versus a gain because you’re not paying taxes on a gain. Some plan administrators will remember the loss and bank it to offset any gain when you do a rollover next time. Some plan administrators won’t, but you’re still not any worse off than waiting to do the rollover when you have zero gain or loss.

Scenario A: $10,000 contribution, rollover when it’s worth $9,800. No tax, value comes up to $10,000 after some time.

Scenario B: $10,000 contribution, value drops to $9,800. Wait until it comes up to $10,000. Roll over $10,000, no tax.

Both scenarios have the same end result.

Alex says

Problem with this field (Word “Rollover” does not appear next to Form 1040 Line 5b) is well known problem with Turbotax for years. Here is the latest post: https://ttlc.intuit.com/community/retirement/discussion/word-rollover-does-not-appear-next-to-form-1040-line-5b-in-turbotax/00/1805932

I got the same problem with Turbotax online as well with Turbotax for windows. Such a shame for overpriced soft. Time to go with FreeTaxUsa or Cash App Taxes

alan says

When I entered my 1099-R (code G) details into turbotax (Premier for 2021 tax year) as two 1099-R (code G) forms (as detailed in https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html#comment-29367 ) I *did* get the word “ROLLOVER” between the label on line 5b and the zero amount in 5b value field.

Jim says

Hello- 2 questions:

1. For the megabackdoor, do you also enter anything in the >Deductions&Credits< Traditional IRA and Roth IRA seection (as you would in a regular backdoor)?

2. My 1099-R also included a significant distribution from 401k to Traditional IRA at another institution. I’m 60, so that withdrawal should have no penalty… how do I document that, as the rollover and mega backdoor were on same 1099-R?

Harry Sit says

1. Nothing in the Deductions & Credits section as you would in a regular backdoor. Everything you need is in this post.

2. You need split it into two 1099-R’s. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

Srini says

Hi Harry,

happy new year! long time reader, first time commenter here.

I was reading through this and I realized I never got a 1099R for any of my mega-backdoors. over the years, I have been getting them for the backdoors and filing the 8606s.

is this an issue? if yes, I can reach out to the custodian to issue one but would you have any thoughts on how to record/file the years of mega-backdoor conversions?

thanks for your inputs in advance.

Harry Sit says

Maybe they have the 1099-R ready for you to download but you just didn’t know? If your workplace plan is administered by a large broker such as Vanguard, Fidelity, or Charles Schwab, the 1099 forms for the workplace plan are in a different place separate from the 1099 forms for the retail accounts.

First find the forms and see if they reported any taxable income. If the taxable income isn’t zero, you should amend your tax return and add it to your income. If it’s zero in all years, maybe you don’t have to amend. Just hang on to the 1099-Rs in case you get a letter from the IRS.

Adam says

This is a great article which answered a lot of my questions – I really appreciate it! I’m a little confused about when to report on form 1040 though.

I made a voluntary after-tax contribution in early 2022 for the 2021 tax year, and then also made the conversion into my roth IRA in early 2022.

As the plan administrator for my solo 401k, I am completing my 1099-R this year since the conversion was done in 2022.

I’m not sure if I was supposed to fill out lines 5a and 5b on my 1040 for 2021, or if I’m correct to fill them out on my 1040 for 2022.

Harry Sit says

You’re reporting a distribution from a retirement plan, which happened in 2022. The taxable income in 2022 goes on your 2022 tax return.

Joe Bousquin says

Hi Harry,

I’m in the same situation as Adam above — I am the plan administrator for my solo 401k, and I am completing my 1099-R this year for the Mega Backdoor Roth conversion I executed in early 2022.

I contributed 22,261.00 after tax to the Solo 401k, but by the time it rolled into my Roth, it had earned another $9, for a gross distribution of 22,270. It’s not a total distribution, since the pre-tax funds from previous years are still in the Solo 401k.

I am trying to follow the example in the article to backwards engineer how I fill out the 1099-R which I will send to myself and the IRS. Here is what I have so far:

Box 1, Gross distribution – 22,270

Box 2a, Taxable amount – $9

Box 2b, Taxable amount not determined and Total distribution — NOT ticked.

Box 3, Capital gain (included in box 2a) — Should this be $9? In your example above, it’s BLANK, but I’m a little confused on its purpose here.

Box 4, Federal income tax withheld – BLANK

Box 5, Employee contributions – 22,261

Box 6, Net unrealized appreciation in employer’s securities – BLANK

Box 7, Distribution code(s) – G

Box 8, Other – BLANK

Box 9a, Your percentage of total distribution – BLANK

Box 9b, Total employee contributions — Should this match Box 5 or be left BLANK?

Boxes 10-19 — All BLANK

Does this look right to you? I’m the most curious about Box 3 and Box 9b. Thanks Harry, excellent article that I use as a reference at this time every year.

Harry Sit says

Both Box 3 and Box 9b should be blank as shown in the example. If you’re really curious about what those boxes are for, you can find the information in the IRS 1099-R Instructions.

Mark says

Is there somewhere in our tax return where we are supposed to report the amount that we contributed to our after-tax solo 401k for tax year 2022?

Harry Sit says

After-tax contributions don’t show up on the tax return.

Mark says

Thanks for your reply. So how does the IRS know that we are doing it correctly and not overcontributing?

sam says

Hi folks. i have total 6 1099-r files.

1) 1 file is 6000 traditional ira roll over.

2) 5 files are the megabackdoor contribution from 2 employers

I know the total contribution for megabackdoor is 61,000. I contributed 20500 to 401k myself. i don’t have employee match i think (The company match doesn’t vest since i didn’t stay over 2 years)

out of this 5 1099-r files.

Employer #1.

1. box1(total): 32709.45, box5(employee contri): 32709.45, box7: code “H”, the rest are all 0

2. box1(total): 60718.90, box5(employee contri): 31819.44, box7: code “G”, the rest are all 0

3. box1(total): 0.00, box5(employee contri): 109.99, box7: code “1B”, the rest are all 0

Employer #2.

1. box1(total): 2235.73, box5(employee contri): 2187.50, box7: code “H”, the rest are all 0

2. box1(total): 4879.81, box5(employee contri): 4879.81, box7: code “G”, the rest are all 0

How do i calculate the total contribution for 2022? is my mega-backdoor overcontributed? could someone help me list the formula? do i just look at the 1099-r with code having H only? or code having G only?

I am too confused… Thanks!

Harry Sit says

The total contribution limit is $61k per employer. You don’t have to worry about overcontribution. Assuming all these 1099-R forms are correct:

Employer #1:

– Code H is Roth 401k to Roth IRA. Enter as-is. No tax.

– Code G: Where did the rest of the money go ($60,718.90 – $31,819.44)? A Traditional IRA? Employer #2’s 401k? You may need to split this into two and enter them separately. See One 1099-R Form for Two Rollovers in TurboTax.

– Code 1B: Zero gross distribution in Box 1. Ignore.

Employer #2:

– Code H is Roth 401k to Roth IRA. Enter as-is. No tax.

– Code G: Follow this post.

sam says

Oh Sorry, it should be 32819.44 and yes it’s the traditional IRA since i left the company and i rolled over all the 401k money to traditional IRA (pre-tax) . so it’s 60,718.90 – $32,819.44 = 27899.46 rolled over to traditional IRA. It seems this roll over contains 401k contribution in 2021 also. So this 60,718.90 doens’t make much sense. thanks i will check the post to try to split into two.

From your explanation, i feel i should use the 1099-r. (code G) files. so it will be total :

20500 (401k) + 32,819.44 (employer 1) + 4879.81 (employer2) = 58199.25 ? i didn’t over contribute?

Harry Sit says

The total contribution limit is $61k per employer. That means you have a $61k limit at Employer #1 and a separate $61k limit at Employer #2. You didn’t over-contribute.

sam says

OMG, Just confirmed you are right! i thought i can only contribute 60k per year with all employers combined. I feel i missed BIG! Thank you so much for letting me know!

So i am definitely not over contributed. What i did is to submit total 6 files 1099-r to Turbotax. For the

1) 1099-r files with code G. If i selected “Yes, this money rolled over to a designated Roth 401(k) or 403(b) account”. and choose i made this contribution myself. Then the Federal refund number doesn’t change. but if i select the No, then the federal returns -10k which is definitely wrong since this is the after-tax money, right?

2) The remaining files with Code H and code 1B, i can just put the 1099 in and the Federal return number doesn’t change.

Am i right for (1)? Thanks again!!!

Harry Sit says

How to enter the 1099-R forms with the G code is in the body of this post. Please scroll to the top and follow along.

SS says

Hello,

I know it seems that the “ROLLOVER” word not appearing in 1040 Box 5b isn’t a big deal since code G indicates it’s a roll over, but what’s the reason for not manually override the space in Box 5b and adding “ROLLOVER” there so that it conforms to the 1040 Instructions? I don’t see that suggestion here or in the Intuit thread above documenting the “ROLLOVER”-not-printed bug? Not sure if overriding the the 1040 can cause other issues with efile or something else? Thanks!

Harry Sit says

TurboTax included the word “ROLLOVER” on Line 5b for the example in this post. The software controls when to print it or not. I don’t bother forcing it. If having that word on the form is important to you, try adding it yourself. The software will tell you if it has an issue with it when you e-file.

Eric R. says

Hello Harry,

I’ll preface my question by saying that your website has been invaluable to me over the years in filing my taxes. Thank you for this incredible resource.

Having said that, I started after-tax contributions to my company’s 403(b) in 2021. They (Vanguard) perform an in-fund “roll-over” to my Roth account for me as soon as the deposit hits the account so I don’t have to worry about any earnings which has been great.

Unfortunately, Vanguard never sent me a 1099-R last year and I never thought to look for one. Thankfully, I stumbled across this article on your website and now I realize that I not only need to include this year’s 1099-R (2022) but also the 2021 edition as well (which I received after calling Vanguard).

Do I need to amend my tax return for 2021 to include the information on that year’s 1099-R? For reference, the taxable amount (block 2a) was $0 for 2021 and for 2022?

The only non-zero values on the 1099-R are Blocks 1 and 5 (the Gross Distribution and the Employee contributions/Designated Roth Contributions) boxes. The distribution code in Box 7 is “G.”

If an amendment is required, am I still ok to proceed with filing my 2022 return while I simultaneously amend the 2021 return?

I’m pretty frustrated with myself for missing this last year(and with Vanguard for not sending it to me) but I’m hoping the plan to fix it won’t be too painful.

Thank you for your time.

Very Respectfully,

Eric R.

Harry Sit says

If you have both a workplace retirement plan account and a retail account with the same institution, the 1099 forms are in two different places. You may not realize that you need to look at both places if you signed up for paperless delivery. Amending the return doesn’t change your taxes when the taxable amount was zero. You can amend if you don’t mind the work but I wouldn’t bother adding workload to the IRS. If you get a letter from the IRS about this, you can show the 1099-R with a $0 taxable amount.

Leah says

Hi Harry, it looks like there is a new form W-4R about tax withholding rate since 2023. Do you know if this form would be required to fill out when we’re doing mega backdoor Roth conversion? Thanks!

Harry Sit says

Tax withholding is not required when you roll over to the Roth account within the plan or to a Roth IRA. If the plan offers optional voluntary tax withholding, decline.

Jennifer says

I filed my taxes with the turbo tax 2022 software. I forgot to include my 1099-R for mega backdoor 401K. I do not think it impacts my taxes owed, as my taxable is $0. Do I need to amend my federal and state taxes if it does not impact my return? Is there any benefits to amend? Thanks in advance!

Harry Sit says

You can amend if you don’t mind the work but I wouldn’t bother adding workload to the IRS. If you get a letter from the IRS about this, you can show the 1099-R with a $0 taxable amount.

Mark says

Hi Harry, do you have a spreadsheet to calculate the maximum contribution to a mega backdoor Roth? Am I correct that it’s (annual maximum employer and employee 401(k) contribution limit) – (maximum employee contribution limit – employer match)?

So for me for 2023, if my employer match is $9000, the maximum I can contribute to my after-tax solo 401(k) is: 66,000-22,500-9,000=34,500?

Does it matter if the employee and employer 403(b) contributions are pre-tax or Roth after-tax?

Mark says

Hi Harry, I realize that my above question may not be clear:

I have a W-2 job with a 403(b) to which I am making the maximum annual employee contribution, and an employer match.

I have a 1099 job and have a non-prototype solo 401(k) that lets me do the mega backdoor Roth–I make after-tax contributions to the solo 401(k) then convert the contributions to my Roth IRA.

What is the annual limit that I can contribute to the non-prototype solo 401(k)? Is that amount affected by whether my 403(b) contribution is before-tax vs. Roth after-tax?

Harry Sit says

This post has a link to a calculator: Solo 401k For Part-Time Self-Employment. The post was from 2008 but I have kept the linked spreadsheet up to date.

Mark says

Thanks Harry, that spreadsheet works beautifully.

I read in one of your replies above that the $61,000 415(c) limit is per employer. Since the 1099 job is for my own business, separate from my W-2 employer, is the limit that I can put in my solo 401(k) $61,000?

Mark says

The calculator, “Solo 401k For Part-Time Self-Employment”, has a line for “salary deferral in day job 401k, 403b.” Does the calculation change if the 403b contribution is made on a Roth after-tax basis, rather than as a salary deferral (before-tax)?

Harry Sit says

It doesn’t change.

Quyen LaMorte says

Hi Harry – You are a wealth of knowledge and subject matter expert that no one at Fidelity where my 401k and IRAs can help confirm my tax implications. Can you please help?

I am planning to do a Mega Backdoor 401k Roth in-plan conversion:

EMPLOYER 401K

Current Balance

Pre-tax contributions $30,000

2023

Pre-tax $22,500 Represents 10% bi-weekly payroll match

Employer match (25% match) $5,625

After tax contribution $37,875 If annual, needs 15% bi-weekly payroll match but will need to make it 30% for semi-annual catch up

Total contributions $66,000

Make after-tax contributions

Automatic in-plan conversion feature in 401k to Roth

The conversion to Roth is only with the after-tax sub-account within my 401k (not from my pre-tax sub accounts within my 401k)

Issue: I curently have a separate pre-tax contributions IRA approximately $500k. If I do an automatic in-plan conversion to Roth in my 401k:

1) Do I need to consider the pro-rata rule which factors in my pre-tax IRA funds into the calculation?

2) Regarding the pro-rata rule for Roth conversions, does the mix of pre and post tax contributions include both 401k and IRAs or is that separate?

3) If I receive a 1099R for the automatic in-plan conversion to Roth in my 401k, this represents any earnings from the time the after-tax contributions are converted – this should be negligible since it is automatically done by Fidelity?

4) Do I need to complete a Form 8606 for this in-plan conversion to Roth in my 401k?

Thanks so much!

Quyen L.

Harry Sit says

1) No, you don’t need to consider the pro-rata rule that factors in your pre-tax IRA funds into the calculation.

2) The pro-rata rule for Roth conversions is separate between 401k and IRAs, and it’s separate within the 401k when you only convert non-Roth after-tax contributions and the earnings on those contributions.

3) The earnings on automatic in-plan conversion to Roth in your 401k should be negligible, and possibly zero.

4) You don’t need to complete a Form 8606 for this in-plan conversion. This post shows everything you need to do if you use TurboTax downloaded software.

Ravin says

Hi Harry,

I contributed after-tax money to 401K and then converted to Roth IRA as in-plan conversion. In Turbotax downloaded software, it shows amounts that match 1099-R, however, it does not show ‘ROLLOVER’ on form 1040 line 5b. I followed steps outlined in this post… wondering if I did anything wrong. I gather since I did a conversion to Roth IRA as a in-plan conversion and since contribution was after-tax money, ROLLOVER categorization is not applicable here. Can you pls confirm?

Thanks

Harry Sit says

The money didn’t go to a Roth “IRA” if you did an in-plan conversion. If you otherwise followed everything it’s not important whether the word “rollover” shows up on Line 5b or not. TurboTax controls when to print it. See my reply to comment #18.

Andrei says

Hi Harry. Thanks a lot for the detailed guide. My situation in 2022 was a bit different from what is described in this guide and I’m trying to figure out how to report it properly.

For no good reason, I did both in 2022, in-plan roth rollover and rollover to a roth IRA. So some after tax amount went into Roth 401(k) and the rest of it went into Roth IRA.

I have only one 1099R , which shows the total amount rolled over.

So when TurboTax is asking me where did I rollover to, what should I choose?

Does it even matter for tax reporting purposes which of the two accounts (Roth 401(k) or Roth IRA) the money where rolled over to?

Harry Sit says

It doesn’t matter this year but TurboTax may be tracking something for the future. You can break the one 1099-R into two by the amount that went to different accounts. It works as long as all the amounts in each box add up to the one 1099-R you actually received.

Kris says

I have been contributing to After Tax Mega backdoor Roth 401K for past 4 years. And i have been using Turbotax for tax filing so far. After going through this article, i realized that except for 2022 return, my previous returns from 2021 to 2019 didnt have the After Tax returns entry in the 1044. Do i need to amend my tax returns for those years? I do have the details of how much i contributed for all those years.

Harry Sit says

It depends on whether your 1099-R’s for those years showed any taxable income. See replies to comments 55, 64, and 66.

Santiago says

Hello, I am filing my 2023 taxes. I’m working through the paper work for a Mega Backdoor Roth. I am using this guide. In the section “Rollover Destination” I answered as instructed.

I compared the resulting 1040 to previous years and noticed that line 5b did not show a “ROLLOVER” word on this most recent one, while the old ones do. This is making me realize I have answered this question incorrectly for Tax Years 2020, 2021 and 2022. Nothing is different between 2023 and those years other than the amount contributed. I should have answered all those previous years like I answered for Tax Year 2023.

Any clue what the implications of this mistake is? Is it worth filing an amended return? Can I even file one for 2020?

Harry Sit says

TurboTax controls whether to put the word “rollover” on Line 5b or not. It seems that it puts the word there when the taxable amount isn’t zero and it doesn’t put it there when the taxable amount is zero. I’m not sure whether that word is transmitted to the IRS when you e-file. Don’t worry about it.

Santiago says

Thanks, Harry. Really appreciate it your prompt response.

Gurmit says

Great post btw. Thanks

after-tax 401k contributed in 2023 – $25000

rolledover after-tax 401k to my own Roth-IRA – $26000 (may be it was growth)

Received 1099-R (G and H).

Followed your step by step for Turbotax. So two entries for both 1099-R

Now 1040 Line 5a shows $51000 rollover (sum of G and H).

Is that ok? Because in fact my aftertax contribution for year 2023 is only $25000. Won’t $51000 sends a signal to IRA as if I have contributed/rolled over almost double? TIA

Harry Sit says

So you did two rollovers. First $25,000 from after-tax 401k to Roth 401k. Then $26,000 from Roth 401k to Roth IRA. It’s OK to have $51,000 on Form 1040 Line 5a but it wasn’t necessary to do two rollovers when you’re still working at the same employer. If the plan offers automated rollover from after-tax 401k to Roth 401k at each payroll, just leaving the money in the Roth 401k works well. If you have to request the rollover yourself, just roll directly from after-tax 401k to your Roth IRA. You don’t have to make an extra stop at the Roth 401k.

JT says

Hi Harry, Thanks for your help in the past, it is much appreciated. I’m doing 2023 taxes with downloaded TurboTax software. I’m 63, retired in 2018. I had a $2K ROTH nontaxable distribution in 2023. I think my original Vanguard ROTH was established in 2014, a Schwab 401k ROTH rollover added in 2017, and funds added from a linked bank account after that while I was working. In retirement, I did a ROTH conversion in 2020, 2021, 2022. Also in 2021, I moved the entire ROTH balance to Personal Capital (now Empowerment).

I got disenchanted with PC, so I ported the ROTH back to Vanguard a year later in 2022. Of course the ROTH now has a different account number than it had previously. I can no longer look up any history prior to the move to Personal Capital in 2021 on the old ROTH account number. The software asked me if I had had the ROTH for 5 years, I said yes, it then asked me to take all my contributions, subtract the distribution, and enter the remainder. I have little documentation for all those years, so I left field blank for now (not filed yet). What is their purpose? To determine that I’ve had it longer than 5 years and that my contribution basis (non-conversion funds) was larger than the distribution? I can TRY to determine this from previous tax records, but I only have 7 yrs of records. Is it better to leave field blank or take a stab at the total basis of contributions and subtract the distribution and enter that? I don’t want to get the basis wrong and have them use that for future years, is my worry.

Harry Sit says

Your question isn’t related to Mega Backdoor Roth. It’s addressed in Roth IRA Withdrawal After 59-1/2 in TurboTax and H&R Block.

Ravin says

Hi Harry,

I did Mega Backdoor Roth 401k in 2023 before turning 59 1/2 and contributed max possible for 55+ age i.e., $73,500. I turned 59 1/2 in 2024 and the Mega Backdoor Roth 401k limit for 2024 is $76,500.

Question is can I still do max $76,500 in 2024 after turning 59 1/2? Is it worth doing after 59 1/2?

Thanks

Ravin

Harry Sit says

Age 59-1/2 is only relevant when you take money out of a 401k or IRA. It has no effect in any way when you’re putting money into a 401k or IRA.

Kristin says

Just wanted to say thank so much for these instructions! I agonized over how to enter my mega backdoor Roth correctly in TurboTax online. When I couldn’t figure it out, I called Turbotax support. After an hourlong call, which included a lead being pulled in, we still hadn’t figured it out. I found this page, got the desktop version of TurboTax, and now I can finally file!

William says

Hi Harry

Wow, what a fountain of knowledge. I just read through all the comments and I think I know the answer to most but not all of my questions (re: Adam’s question) but want to double check.

Solo401K, for tax year 2023

1. Max’d out employee pre-tax contribution for 2023 of $30,000 (includes catch-up) on 2/3/24

2. Made employer pre-tax contribution of $20,000 for 2023 on 2/15/24

3. Calculated the after tax contribution for 2023 up to the limit of $73,500 (includes catch-up) which is $23,500 that I plan to do shortly

4. Will do a in-plan conversion of (3) to a Roth 401K at the same time as (3)

I see how to enter (1) and (2) in TurboTax 2023 so far but where is (3) entered ?

For (4), will that be entered in my 2024 taxes since it occurs in 2024 even though it is applied to 2023 after tax contributions ?

Harry Sit says

(3) isn’t entered anywhere on the personal tax return. You need to issue a 2024 1099-R for (4) on behalf of the plan to you as the plan participant. You then report the 1099-R on your 2024 tax return as this post shows.

William says

Harry – thank you for your ultra speedy response! I’ll sleep easier now. I’ll check with the investment company managing my Solo 401k to ensure they will issue the 1099-R for 2024 per the post.

Darrell S Ryan says

Hi Harry! Excellent summary. Mega BDR, Voya to Fidelity, using TurboTax. Question for you:

I did the Mega backdoor Roth at work (Voya). When I asked for the distributions, I asked for 2 separate checks 1) for AT contributions ($18K) and another 2) for the earnings on those AT contributions ($1K). #1 goes to Roth and #2 goes to my traditional IRA.

TT worked fine for the AT contrib to Roth. But for the $1K to the Trad IRA, after saying “No” to the Roth questions, TT never asked about where this was going (to the Trad IRA).

1) Do I report this $1K as a Trad IRA contribution? (in the TT deductions & credits section?)

2) In the “deductions” section under Trad IRA & Roth IRA…do we enter anything for the Roth IRA? I think not. Do I enter anything here for the Trad IRA? I think this is where I need to enter the $1K. Is that correct?

Thanks!

Darrell

Harry Sit says

The $1k was a rollover to a Traditional IRA. You don’t report this $1k as a Traditional IRA contribution in the Deductions & Credits section. You don’t enter anything for the Roth IRA in the Deduction section either unless you contributed to a Roth IRA separately from these two checks from Voya. The $1k rollover doesn’t create a new deduction. It’s included in the gross distribution number on Line 5a of Form 1040 but it isn’t taxable.

C says

I contributed to a megaback door, X dollars aftertax. My company only allows for in service distributions once it has been held in you account for 24 months. Because of this I have gains on the aftertax contributions. When performing the mega backdoor roth conversion via fidelity I convert the after tax dollars direct to a ROTH, and the gains went straight to a Trad IRA. This is a 100% tax free doing it this way. The problem is turbotax online only looks at the difference between 1 and 5 and shows that difference as a taxable amount on the 1040. My 1st question is am I correct in this being 100% tax free, and if so how do I force line 5b to be zero. In the past I have done this through a CPA and they enter zero for the taxable amount.

Harry Sit says

See One 1099-R Form for Two Rollovers in TurboTax.

C says

Thank you Harry for your guidance and great article.

Navin says

A very last minute question about this. I was able to follow the instruction to enter the mega backdoor Roth conversion on the Federal section and it was correctly marked as non-taxable. However on my state return (NJ), the distribution was marked as taxable. I was not aware of any NJ specific rule that disallowed such a rollover without taxes. Any idea why TurboTax online would capture the rollover as non taxable in Federal but taxable in State?

TT Live was not very helpful at all with this.

Harry Sit says

Look for a question about “contributions previously taxed” in the state program and enter your contribution amount.

Ana says

Hi Harry,

I received a distribution check from my non-Roth after-tax account today due to an audit. Looks like they took the tax out, I don’t have a break down of the after-tax contribution, the earnings, or the tax they took out… I was thinking to just put both the earnings and after tax amount into my Roth IRA. Do you have the instructions for that in turbo tax? The above is for a split and I don’t have the breakdown, I don’t have any idea what the 1099r will look like next year. This is the 1st time I received this kind of ‘forced’ distribution. Do you have any suggestions? Thanks in advance!

Harry Sit says

You’ll need to get more information about this distribution. If it was a “corrective distribution” after the plan failed a test, it’s not eligible for rollover, which means you can’t put it into your Roth IRA. You can only deposit it into your regular checking account, wait for the 1099 next year and pay tax on the earnings reported on the 1099 (to be offset by the tax withheld from the distribution). It’s a different story if it was to correct an administrative error because they shorted you on a previous distribution request. So first find out why you received this distribution.

Rit says

Hi

I had invested via Mega backdoor roth in 2022 but forgot to show it in my returns. I did not have taxable amount in my 1099. I have heard it’s good to declare the amount so that I would not face problems from IRS when I withdraw the tax free gains in the future.Can I amend the 2022 return to show it as part of pensions and annuities and how do I do it?

Harry Sit says

You can if you’d like but I wouldn’t bother when it doesn’t change your taxes owed or refund. The tax-free gains in the future will be indicated by the 1099 forms your get for your withdrawals from your 401k plan or Roth IRA.

Joe Bousquin says

Hi Harry,

It’s that time of year again! My wife participates in my solo 401k since she does my books and IT administration.

In 2024, for the first time, we had enough income for her to make a voluntary after-tax contribution to the solo 401k, which we rolled over to her Roth IRA via a mega backdoor. This was in addition to my own mega backdoor.

My question is on the 1099-R. Should I file two — one for me, and one for her — or just one, since the distributions are coming from the same overall plan?

Thanks!

Harry Sit says

Two 1099-R forms, one for each participant.

ABrost says

Thank you!!!

I’ve been following your backdoor roth tutorials for years. This is my first year contributing to the Mega and this guide is an excellent resource. I followed along and had no issue with the fed portion. TurboTax correctly taxed me on the very small amount of taxable not the gross distribution.

Since I am in NJ I get presented with an additional question.

“Select the source of this distribution and enter any other New Jersey Information”

-Military pension or survivor’s benefits

-Disability benefits (under age 65 only)

-Three-year rule pension of 401(k) benefits

-General rule pension of 401(k) benefits

-None of the above

I chose none of the above and TurboTax reduced my NJ refund by a couple dollars which I am assuming is correct? Is that correct?

Thanks again for all the great guides!

Harry Sit says

That sounds correct to me. The earnings should be taxable on both federal and state returns.

Pascal Coon says

Please add screens for Taxact also.

Harry Sit says

Sorry, I’m already covering three software – TurboTax, H&R Block, and FreeTaxUSA. Adding more requires too much work.

Frank Lee says

Hi Harry, could I get your opinion if I have the Mega Backdoor Roth steps correct?

I have a Schwab solo 401k account and Roth IRA ($0 balance)

1. Move pretax money to Schwab 401k

2. Request Schwab to move money from 401k to Roth IRA

3. Use Turbotax and follow steps above to fill in 1099-R manually.

Is that correct? Thanks

Harry Sit says

That’s not correct. I’m not clear on what you’re trying to accomplish. Here are Backdoor Roth: A Complete How-To and The Elusive Mega Backdoor Roth.

SS says

Hi Harry,

I planned for my 2024 total income to be less than $146k (ended up being about $144k) so I could contribute $7k to the Roth IRA without the backdoor. I was also able to get about $5.5k into the mega backdoor Roth (after tax 401k → Roth IRA, with about $37.81 taxable on the 1099-R), along with maxing the personal contribution to the 401k.

I followed your steps for TurboTax and it looks like they included the $5.5k mega backdoor Roth amount as an additional amount to my total income (although only $37.81 is taxable). But it makes my total income look higher ($144k + $5.5k = $149.5k). Since the $5.5k is part of my W2 already, it’s included twice?? What did I do wrong? If this is my new MAGI, that I would have overcontributed to my Roth IRA (since I didn’t use the backdoor), unless this total income amount is NOT my MAGI.

Thank you in advance!! I really appreciate the help!

Harry Sit says

Enter your $7k Roth IRA contribution in TurboTax under Deductions & Credits -> Traditional and Roth IRA Contributions. You’re good if it doesn’t say you have excess contribution or create a 6% penalty. The total income on a summary screen isn’t your MAGI.

Charles says

Hey Harry,

Thanks for the thorough blog post. I found it very insightful and helpful. So I did a megabackdoor roth 401k conversion (after tax 401k -> Roth 401k, with after-tax gains to traditional pre-tax 401k). I read this post as well as your other post (One 1099-R Form for Two Rollovers in TurboTax and H&R Block) and had a question about the Split Rollover described. Correct me if I am wrong – but it seems like the split rollover only needs to be done if one rollover is not taxable and the other is, but not if both are non-taxable.

My specific situation is this: I received a combined 1099-R form from my plan administrator. The taxable amount for both rollovers in my case was 0. Part of my rollover was from after tax 401k to Roth 401k, and the other portion was for gains in the after tax 401k (very minimal, couple of dollars) to pre-tax 401k, which is also not taxable.

I actually used TurboTax online which seemed to process this appropriately. I double checked on Form 1040 and Line 5a was my combined rollover amount, and line 5b said “ROLLOVER” and then “0” which seems right.

This is my first time doing the Mega Backdoor Roth and I just wanted to make sure I’m filing this correctly. Does a split rollover still need to be done on Turbotax?

Thanks for your time,

Charles

Harry Sit says

The Split Rollover section refers to splitting the rollover from the 401(k) to Traditional and Roth IRAs. It requires splitting the combined 1099-R into two. You don’t need to split the 1099-R when you did the split rollover all within the 401(k). I added a small paragraph to distinguish the two cases.

Darrell says

Hi Harry! Excellent summary. Mega BDR, Voya to Fidelity, using TurboTax. Question for you:

I did the Mega backdoor Roth at work (Voya). When I asked for the distributions, I asked for 2 separate checks 1) for AT contributions ($18K) and another 2) for the earnings on those AT contributions ($1K). #1 goes to Roth and #2 goes to my traditional IRA.

Both Checks were made out to FID (FBO me).

I received two 1099R’s and they both show “taxable Amount” = $0. So in TT Personal Income section, “Enter your 1099’s,” in both I enter $0 in Taxable amount…correct? This is different than what you show in your example.

Thanks,

Darrell

Harry Sit says

The example showed the taxable amount was $200 on the 1099-R form for the rollover to the Roth account. The steps are the same whether the taxable amount on your 1099-R was $0, $5, or $134.

Mike Woods says

Hi Harry,

You mentioned that you were manually splitting the 1099-R and your TurboTax example was for the first (manually created) 1099-R. How come it then went from $10k (with $0 taxable) to $10.2k (with $200 taxable)? I thought the $200 will be taken care of by the second 1099-R.

Thanks,

Mike

Harry Sit says

The example scenario didn’t split. The Split Rollover section only says how to handle it if you did a split. It’s not worth splitting for only $200 in earnings.

Kris G says

Hi Harry – Thanks for this great website. I do have a question about mega back door Roth contributions that I contributed to via my employer.

I performed a Roth in place conversion after contributing after tax dollars and immediately converting the money to a Roth 401k. Then performed a roll over to a Roth IRA. I received 2 1099-R forms -one with code G (these capture my after tax contributions) and one with code H (roll over of Roth 401k to Roth IRA).

My question is related to your section called “Rollover destination” in which there are 2 Yes/No questions – the question below is for code “G”

First Question for the Code G form:

Is this 1099-R reporting a rollover of funds from a 401(k), 403(b), or governmental 457(b) plan to a designated Roth 401(k) or Roth 403(b) plan?

I think the answer is “Yes” – since I performed RIPC and converted the after tax dollars to the Roth 401k. Is this correct ?

Second Question for the code G form:

Was this Money Rolled Over to a Roth IRA?

I think the answer is “No” – since I have a separate 1099-R form with code H that handles the rollover of money from Roth 401k to Roth IRA.

Is my understanding correct ?

Harry Sit says

That’s correct. This entire post is about the 1099-R with code G. What happened after the money went into the Roth 401k is totally separate and out of the scope of this post.

Avi says

In the article you say:

“You can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Transferring to a Roth IRA also works.”

Do you also discuss the “convert within the plan” way to report in TurboTax? Is it the same as roll into Roth IRA?

Harry Sit says

The steps to report in TurboTax are mostly the same whether you convert within the plan or withdraw to a Roth IRA. You only answer one question differently. It’s in the Rollover Destination section.

Joe M says

Thank you for the great information! I just wanted to confirm if I did an in-plan conversion from 401k after-tax funds all to 401k Roth. My 1099-R shows the same amount in Box 1 and 5, and $0 in Box 2. It seems as if there were no earnings on the converted amount and thus no taxable amount – I think this could be that my 401k after-tax contribution ended up losing some money overall when it was converted to 401k Roth since the market happened to be lower on the conversion days.

You wrote that we don’t need to split the 1099-R if the split rollover happened within the 401k plan. Even though I did not have a split, I assume that this in-plan conversion still applies to me and I can just input the one 1099-R form exactly as it is?

And in the future, in case there is a taxable amount, I would still input the one 1099-R form as is if the after-tax 401k and any earnings was all converted to 401k Roth (and not split earnings).

Thanks!

Harry Sit says

A split rollover goes to two destinations. Most people don’t send the money to two different destinations. They avoid the complication of having to split their one 1099-R into two. Just follow this post with your one 1099-R. It doesn’t matter whether you have taxable earnings or not.

Andrew L says

Harry, have you ever looked into how one would handle the last step of splitting the mega-backdoor rollover to Roth IRA in Turbotax, namely the roll-in of the trad IRA rollover from aftertax back into 401k? It seems so complicated if you use the software.

If you just fill out the raw tax forms (like Free Fillable Forms), it’s not complicated at all. You don’t have to enter/submit 1099R, let alone split it, if there were no taxes withheld on the distributions. You just enter a couple of numbers for total 401k and IRA distributions on 1040, put “ROLLOVER”, and, if you split earnings to IRA and basis to Roth, 0 of it is taxable, so it doesn’t affect any numbers further down. If you finally roll-in the earnings back to 401k before year-end, they don’t complicate the regular $7K backdoor Roth reporting with pro-rata on 8086, and 0 tax is paid. If instead you roll everything over to Roth and pay the small conversion taxes, it later can become a big headache in tax reporting with basis calculations and sequencing if you ever need to withdraw some basis money from Roth. Of course, if you are certain your taxable accounts will cover all your liquidity needs till retirement, you can just stick with in-plan conversions.

I was trying to use tax software for the first time because of complicated state move situation, but it seems the time cost to figure out the jamming all the backdoor Roth stuff into Turbotax overrides the benefit from the state return time savings.