[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Fidelity Investments is best known as an administrator for workplace retirement plans and an online broker for retail investors. In addition to 401k/403b accounts, Traditional and Roth IRAs, HSAs, and taxable brokerage accounts, Fidelity also offers accounts that can be used for the same purpose as a checking account and a savings account.

Because Fidelity is interested in having a full relationship with its customers for both banking and investing and its primary focus is on the investing part, it’s in a good position to offer better rates and features than banks in the banking part.

This is not a sponsored post. Fidelity isn’t paying me to promote it. I’m only writing as a satisfied customer of over 20 years. Here are two ways to use a Fidelity account to manage day-to-day spending and savings.

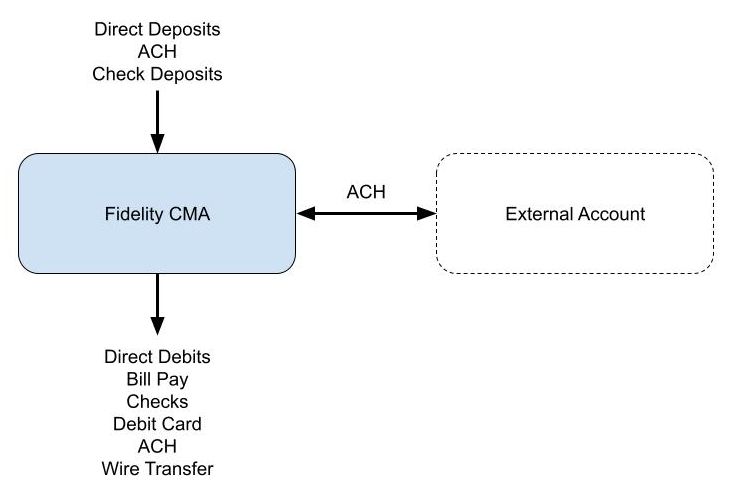

1. CMA as Checking

Fidelity Cash Management Account (CMA) is a separate account type from Fidelity’s regular taxable brokerage account officially called “The Fidelity Account.” You have to choose the account type when you open the account. A Cash Management Account can’t be changed to a regular taxable brokerage account after you open the account. Nor can an existing regular taxable brokerage account be changed to a CMA.

Included Features

The Cash Management Account is specifically designed to meet banking needs. It has pretty much everything people need for a checking account and nearly everything is free.

– FDIC-insured balance (2.72% APY as of June 19, 2024) or a money market fund (4.95% 7-day yield as of June 19, 2024).

– No minimum balance. No maintenance fee. It does not require direct deposit.

– It provides a routing number and an account number for direct deposits and direct debits.

– It accepts check deposits by mobile app or in person at a Fidelity branch.

– Free checkbook. No minimum amount for writing a check.

– Free Visa debit card for purchase, ATM withdrawal, and teller cash advance. No foreign transaction fee on the debit card when you always transact in the local currency. It does not require using the debit card a minimum number of times per month.

– No fee to use any ATM worldwide. Reimburses the ATM fee charged by the machine.

– Free Bill Pay service with eBill.

– Free same-day ACH. Push $100,000 per business day out of Fidelity and pull $250,000 per business day into Fidelity by online self-service. Call customer service to transfer a higher amount.

– Free wire transfers. Same $100,000 per business day by online self-service. Call customer service to wire a higher amount.

Choose Core Position

The “core position” in a Fidelity account is the default holding in the account. Money coming into the account lands in the core position. Money going out of the account is withdrawn from the core position first.

You have a choice to keep your core position either in FDIC-insured banks or in the Fidelity Government Money Market Fund (SPAXX). The money market fund isn’t FDIC-insured but its underlying holdings are short-term government securities. I’m comfortable keeping my money in the money market fund for a higher yield. See No FDIC Insurance – Why a Brokerage Account Is Safe.

To switch the core position from the FDIC-Insured Deposit Sweep Program to the Fidelity Government Money Market Fund (SPAXX), log in on Fidelity’s website, click on the “Positions” tab, and select your cash balance. You will see a “Change Core Position” button.

Your chosen core position stays effective until you change it again. If you make Fidelity Government Money Market Fund (SPAXX) your core position, your existing core balance and all future deposits will automatically go into the money market fund.

The 4.95% yield from the money market fund is higher than the yield on many high-yield savings accounts as of June 19, 2024. For example, Ally Bank pays only 4.2% on its high-yield savings account, which doesn’t have all the checking features such as Bill Pay.

Routing Number and Account Number

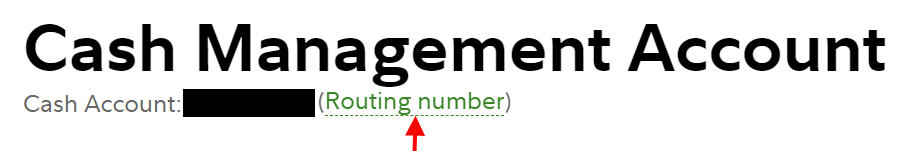

You see the routing number and the account number for direct deposits and direct debits when you click on the routing number link below the account name.

Choose “checking” as the account type if you’re asked to select one.

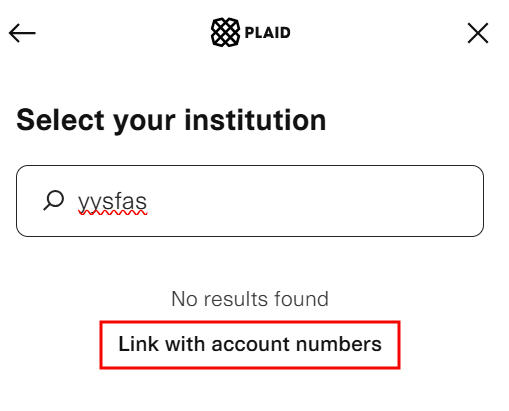

If your bank uses Plaid to add a Fidelity account as a linked bank account, search for a non-existent bank and then click on “Link with account numbers.” It will make Plaid use a micro-deposit to verify your Fidelity account.

You go back to verify the link after you receive the micro-deposit in your Fidelity account.

Limitations

Fidelity Cash Management Account has some limitations that aren’t a deal-breaker to me.

– It does not accept deposits of physical cash or money orders.

– It does not support Zelle in the account. You can link the debit card in the Zelle mobile app (through March 31, 2025). See How To Use Zelle App With Debit Card on YouTube. The sending and receiving limits may be low when you use the Zelle mobile app with a debit card. Venmo or Cash App are better alternatives.

– It does not link instantly through Plaid (see screenshots above for how to link with account numbers in Plaid using micro-deposits).

– It does not offer sub-accounts for tracking separate goals.

– It does not provide cashier’s checks.

– Recurring ACH pushes out of Fidelity only support monthly and annual frequencies. Recurring ACH pulls into Fidelity only support weekly, biweekly, and monthly frequencies.

I use my otherwise dormant Bank of America checking account on those rare occasions when I need to deposit physical cash or a check, get a cashier’s check, or set up recurring transfers on an odd schedule. I don’t use sub-accounts to track separate savings goals.

Transfer Money by Push

Fidelity may hold ACH pulls and check deposits for up to three weeks. The money still earns interest. It’s just not available for withdrawal while it’s on hold. When you ask Fidelity to transfer money from your external bank account, you see this warning before you hit Submit:

Stop, read, and take it seriously. This applies to mobile check deposits as well. You won’t be subject to the hold if you use the right way to transfer money. When you transfer money out of Fidelity, initiate the transfer at Fidelity. When you transfer money into Fidelity, initiate the transfer at your external bank. When you have a check to deposit, deposit it at your external bank account and then initiate a transfer at the external bank.

I make all deposits by an ACH push. Following this simple rule avoids holds or getting the account restricted for fraud.

Secure Your Debit Card

The account comes with an optional Visa debit card. The debit card can be used for purchases without a PIN when it’s run as a credit card. This creates a problem in case your debit card is lost or stolen. A user posted on Reddit that he or she was having a hard time getting the money back after thieves bought $6,000 worth of gift cards with the stolen debit card.

It’s better not to carry the debit card with you in your wallet. If you prefer to use a debit card for purchases, put the debit card in Apple Pay or Google Pay and tap your phone to pay. It’s more difficult for criminals to crack a phone than to tap your lost or stolen debit card everywhere. Keep your debit card at home and only take it with you when you anticipate needing to withdraw cash at an ATM.

You can also lock your debit card on Fidelity’s website or in the Fidelity mobile app. Locking the card makes it decline all transactions. I previously used the debit card in Venmo to pay friends for shared expenses. Venmo also works with a bank account. I added the Fidelity account as a bank account in Venmo and removed the debit card. Now my debit card is securely locked at all times. I’ll only unlock it when I need to use it to withdraw cash.

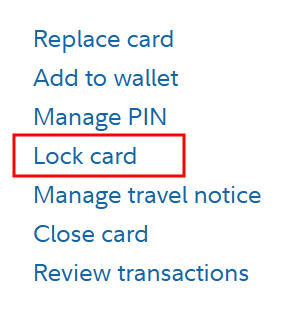

To lock the debit card online, open a new tab in your browser after you log in to Fidelity and go to fidelitydebitcard.com. Find your debit card and click on “Lock card.”

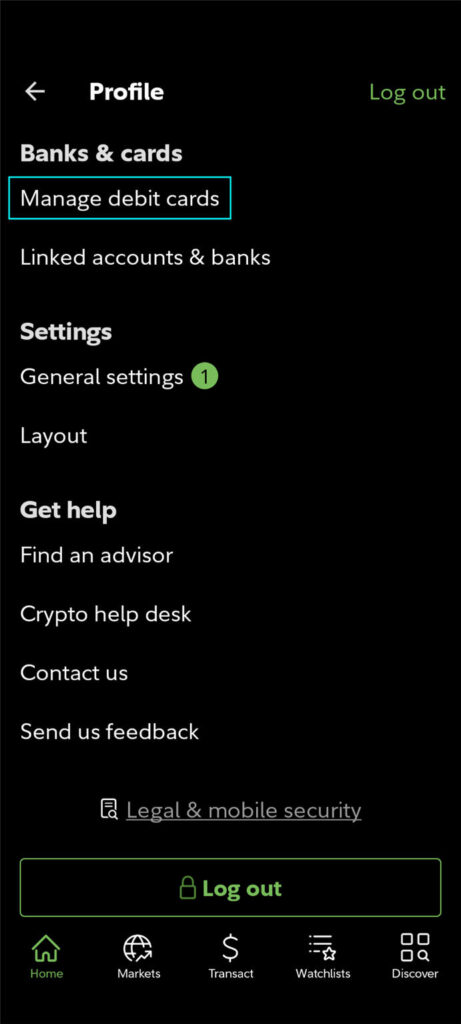

If you install the Fidelity mobile app on your phone, you can unlock the debit card right before you need to use the card to withdraw cash and lock it again when you’re done. Tap the head icon on the top right to find “Manage debit cards” in your profile in the Fidelity app. Tap “Lock or unlock card” on the next screen to lock or unlock the card.

Link to External Account

When you use a Fidelity CMA as your checking account, you can link it to an external account as you normally do with a checking account. For example, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You can use Vanguard as your savings account to earn a slightly higher yield while using the Fidelity CMA as your checking account. The bulk of your cash earns 5.27% at Vanguard while the amount you need for spending earns 4.95% in the Fidelity CMA.

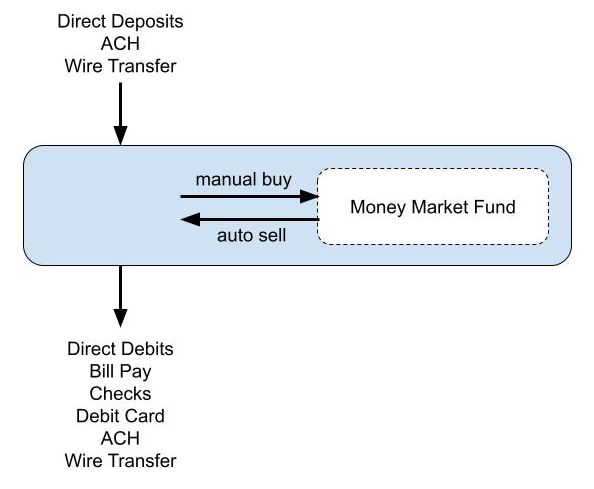

2. CMA as Checking/Savings Combo

Instead of linking to an external account as the “savings” part, you can keep both “checking” and “savings” in the Cash Management Account. This earns less interest but it avoids having to transfer back and forth between two accounts. I do it this way because it’s simpler and it doesn’t forego that much interest.

Buy Another Money Market Fund

Although the CMA is designed for banking needs, it’s still a brokerage account. With some exceptions (no margin or options), you can buy in the CMA pretty much everything available in a regular brokerage account. This includes stocks, bonds, brokered CDs, mutual funds, and ETFs.

The CMA becomes a checking/savings combo when you buy a different money market fund in it. The core balance in the CMA serves as the checking part and the manually purchased non-core money market fund serves as the savings part. Fidelity will automatically sell from the non-core money market fund when your core balance in the CMA is insufficient to cover a debit. This is like having free automatic overdraft transfers from savings to checking.

Some people prefer to buy Fidelity Money Market Fund (SPRXX) or Fidelity Money Market Fund Premium Class (FZDXX). Their yields were 5.02% and 5.14% respectively as of June 19, 2024, which were slightly higher than the 4.95% yield on Fidelity Government Money Market Fund (SPAXX) in the core position. Some people prefer to buy Fidelity Treasury Only Money Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 but more of the income is exempt from state income taxes. None of these funds can be set as the default core position but you can buy them manually. See Which Fidelity Money Market Fund Is the Best at Your Tax Rates.

Because Fidelity will automatically sell from the non-core money market fund to cover debits, if you’re so inclined, you can be aggressive in keeping the core balance in the CMA low while keeping the bulk of your account in a non-core money market fund earning a slightly higher yield. Or you can set a maximum target balance alert with the Cash Manager to buy more shares of the non-core money market fund when you have excess cash in the “checking” part.

Some people prefer to just keep everything in the default Fidelity Government Money Market Fund (SPAXX) because the extra yield from a non-core money market fund is quite small.

Cash Manager Not Needed

You may have seen some convoluted setups using the Cash Manager overdraft feature in the Fidelity CMA. It’s unnecessary and undesirable.

The only thing remotely useful in the Cash Manager is the maximum balance alerts. An alert only tells you that your CMA core balance exceeded the maximum target balance. It doesn’t automatically buy a non-core money market fund in the CMA for you. You still have to buy it manually if you want.

You don’t need an alert for the CMA core balance dropping below a minimum balance when you have enough savings in a non-core money market fund held in the CMA. Selling from the non-core money market fund held within the CMA to cover debits works out of the box. It happens automatically anyway even if you don’t set up anything in the Cash Manager.

The Cash Manager has a “self-funded overdraft protection” feature to link the CMA to another Fidelity account. This is unnecessary and undesirable when you want the CMA to stand by itself. You don’t want unauthorized debits to affect your other accounts.

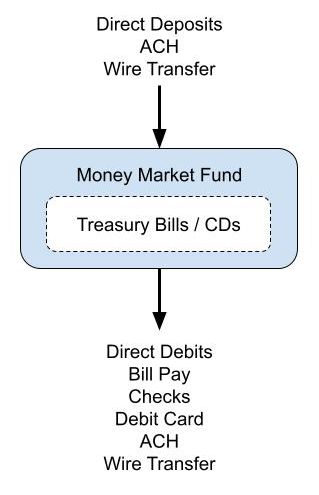

Add Treasury Bills or Brokered CDs

If you’d like to take it one step further, you can also buy Treasury Bills or brokered CDs in the CMA when you have money that you know you won’t need for some time. The CMA then becomes a checking/savings/CD combo. The money automatically goes into the “checking” part when the Treasury Bill or brokered CD matures. For example, the amount set aside for the next property tax bill can go into a Treasury Bill or a brokered CD. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy CDs in a Fidelity Brokerage Account.

Please note if you enable the “auto roll” feature when you buy new-issue Treasury Bills or brokered CDs in the CMA, the amount for the next roll reduces your “available to withdraw” number for a few days during the roll. A debit may fail if you don’t have enough available to withdraw. It’s not a problem if you don’t use auto roll or if you keep a substantially higher amount in a money market fund than the amount for the next roll.

Using a Fidelity CMA for spending and savings becomes truly set-and-forget. All deposits automatically earn about a 5% yield as of June 19, 2024. All debits come out of this money market fund. It’s like using a savings account as a checking account. You can manually buy a non-core money market fund but you don’t have to. The yield on the default Fidelity Government Money Market Fund (SPAXX) is close enough to the yield on another Fidelity money market fund.

You can still buy Treasury Bills or brokered CDs to set aside money for specific bills in the future. Please note the caveat on “auto roll” and “available to withdraw” mentioned above. It’s better to do it in a different brokerage account if you prefer to use “auto roll.”

***

The biggest draw of using the Fidelity CMA for spending and short-term reserves is the checking features. You effectively use a savings account as a checking account and earn a good yield from the first dollar. Everything is seamlessly together.

A Vanguard money market fund and some less well-known high-yield savings accounts pay more but they don’t offer checking features. When you pair it with a checking account that pays close to zero, the blended yield on all your cash goes down. For example, if you have $5,000 in a checking account that pays 0.1% and you have $50,000 in a Vanguard money market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You might as well put the whole $55,000 in a Fidelity CMA earning 4.95% and eliminate the need to watch your checking account balance and transfer back and forth between two accounts.

Transitioning a checking account takes some time and effort. Banks know it. That’s why they pay you close to zero in checking accounts. They bet that you think it takes too much work to switch. Don’t fall for it. It’s easier than you think when you take your time to make the move.

The most frequent problem I see when people use a Fidelity CMA is an unexpected long hold on check deposits and ACH pulls. You won’t have this problem when you do all your deposits with an ACH push. In other words, initiate the transfer into Fidelity outside Fidelity. See 3 Lessons Learned From a Botched Money Transfer.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

TJ says

You stated that you’re moving to a different set up. You’re simply replacing your CMA with a brokerage account because of the higher yield and because you are private client?

Harry Sit says

Primarily to automate and eliminate manual work. I can get the higher yield in the CMA by buying into a money market fund manually. I figure the one-time effort to make the switch beats the ongoing work to buy the money market fund. I would still make the switch even if I don’t get ATM fee reimbursement because I don’t use much physical cash.

TJ says

But the Core mutual fund options are different than the ticker you referenced buying in the CMA, so don’t you still have to buy the specific fund you want?

Harry Sit says

It’s a different share class of the same fund, with only a 0.1% difference in the expense ratio. When I must buy manually I buy the cheaper one but I don’t worry about the 0.1% when it’s automated.

George VW says

As a user of these types of accounts, do you know if they offer mobile deposits, via phone app, as a service?

Harry Sit says

“Accepts check deposits by mobile app or dropoff at a Fidelity branch” is among the included features.

Scott P says

Thank you for explaining your cash management techniques in the Fidelity accounts. I will strongly consider making this type of change to be more efficient and effective with my cash.

David says

I use the Fidelity CMA for years, as well. But the problem I encountered is that the checking transactions will not download into the Quicken Mobile App. Quicken Mobile recognizes the CMA as an investment account, not a banking account. I have spoken to both Fidelity and Quicken tech support. Fidelity says it’s Quicken’s problem to solve. Quicken says it’s a known issue. Period.

That sent me into the hunt for a bank with a checking and savings that works with Quicken Mobile and offers a high yield savings account, plus automation, and Zelle. There are a few good options.

My guess is you aren’t using Quicken Mobile. What are you using for budgeting and cash flow management?

Thanks!

RobI says

Great article yet again.

I’m using Quicken PC with Fidelity Brokerage and was able to make the core money market fund holdings display separately as a cash account while all other holdings (including other money market funds), still show as investments. It’s helped me ring fence the spending accounts from others money.

I’ve just recently started using the brokerage account for cash mgt and bill payment so haven’t quite gone cold turkey on my checking account but expect to use it infrequently going fwd. I’m already spending far less time moving short term funds around.

Wayne S says

I assume the transactions can be downloaded in some form. Can you tell me what the download options are?

Harry Sit says

I don’t download transactions because I only have a handful per month (< 10). Manual entries are easy enough. Fidelity's website supports downloading in CSV format. Quicken apparently downloads in OFX or QFX. If you use other software, see if Fidelity is in the software's list of supported financial institutions for downloading.

Randy says

As Robl hinted at, there is an account setting in Quicken for Windows which allows you to separate the cash from the investment account into a bank account. This account does download banking transactions.

pop says

Is who is currently using Quicken with Fidelity also using Symantec’s authentication for two step verification? If so, is it causing any issues with automatic downloads? I currently have Google Voice text as authentication option but am thinking of changing it to Symantec (may be more secure)

Ann says

Thanks for this! I’ve been considering ditching my credit union because they are so lame, and I just opened a Fidelity CMA “by accident” while opening a brokerage account.

Scott Williamson says

I prefer to keep a small balance in the CMA and manually move money to and from brokerage as needed. I keep the brokerage account in lockdown. By isolating brokerage from transactions with the outside world I hope to reduce the chance of someone fraudulently draining most of my assets. See

https://www.mymoneyblog.com/fidelity-money-transfer-lockdown-block-fraudulent-acat-transfer-brokerage-scams.html

always_gone says

Agreed. I have a separate checking account for Zelle, that I just keep $1 in. When I make a Zelle transfer, I first move money from our main checking account to the checking account linked to Zelle. In this way, if fraud happens, I’m only out a buck. It’s worth the small hassle, imo.

Tom says

Harry, thank you for your insights. Very helpful information, presented quite clearly.

JT says

This is what I did 3 years ago to protect 100% from ACAT fraud and minimize the impact of ACH fraud.

Create CMA as a separate FDIC account not as a brokerage account.

Set up auto transfer rules to sweep portfolio income to cover expenses to CMA.

Lock down all eligible accounts including CMA.

Put all living expenses on Fidelity’s 2% cash-back CC auto-deposited to and auto-paid from CMA.

Keep no more cash in CMA than I can afford to lose.

CMA does NOT have overdraft protection.

CMA is NOT linked to a brokerage account.

All ACH pull requests from outside entities must be honored in cash.

As I understand it, Fidelity WILL NOT automatically liquidate any securities in your account for an ACH/Debit/Check transaction – only cash is vulnerable to these withdrawals”

TJ says

My understanding is that they do auto-liquidate money market funds.

Craig says

Fidelity will auto-liquidate certain money market funds (most if not all Fidelity money market funds, at a minimum) to cover withdrawals. They will not auto-liquidate stocks, ETFs, and other mutual funds.

Craig says

Would love to just use a brokerage account at Fidelity, however, this risk is why I do all my banking transactions at a different institution. In essence a burner account to firewall my wealth from the transaction account. Even the USPS advises to not send checks in the mail any longer.

Harry Sit says

The “Spending Account” is a separate account from the brokerage account that holds long-term investments. The two accounts aren’t linked. Being at the same institution doesn’t jeopardize the wealth account. Unauthorized checks and ACH pulls are fully reversible in 60 days. The ODFI is liable for them. See ACH Push or Pull: The Right Way to Transfer Money.

Marcus says

Hey Do you use the brokerage as your only account or do you use the cma as well and how do you use them. Do you invest spend and save all with the brokerage?

Harry Sit says

Some people use only one brokerage account for everything. I recommend using two accounts — a brokerage account plus a CMA or a brokerage account plus another brokerage account — to separate long-term investing from short-term savings and spending. This post covers three ways to use a second account. Follow either of the first two ways if you choose to use a CMA. Follow the last setup if you choose to use a separate brokerage account for short-term savings and spending.

Craig says

I have a similar setup with just the Fidelity brokerage account, which I pay all my credit card bills out of using auto-liquidation of money market funds. I hold my cash in FZDXX which has a slightly higher yield. The minimum initial purchase is $100k but once you manage that the minimum holding is only $10k, and in practice they don’t seem to enforce it. Overall it’s a phenomenal customer experience. Just wish I could make FZDXX my core account and it would be perfect.

Bob Burgers says

You can actually automate conversion to a non-core money market fund at Fidelity. The process is discussed in the boglehead’s wiki for Fidelity as a one stop shop.

https://www.bogleheads.org/wiki/Fidelity:_one_stop_shop#Automating_conversion_to_a_non-core_money_market_fund

Dave says

Thank you this is very helpful! I am also a long time customer but need to learn more about all the features available to me. You have prompted me to inquire about the premium service. You also prompted me to exchange my core position for a money market fund with a higher yield. The choices were FZFXX and SPAXX. They seemed almost identical for yield, so I went with the larger one (SPAXX). Any thoughts on their old vs. new UI? I went back to the old one to exchange my core position. Thank you again!

Bruce Sunderland says

This is a very useful post. I have most of my accounts at Schwab maily because of the easy connection with Schwab Bank and little benefits like free wire transfers, ATM fee return, etc.

But I have soured on Schwab for other reasons and have been contemplating moving everything to Fidelity. Your post is nudging me. Note a Fidelity negative, a foreign currency transaction fee on its credit card ( although you get 2% cash back on the card that has no annual fee if you put it in a Fidelity account.)

Harry Sit says

The Fidelity co-branded credit card isn’t a Fidelity product. It’s from Elan, which is a subsidiary of U.S. Bank. Elan sets the terms of the card including the foreign transaction fee. The negative falls on Elan. Fidelity is only paid by Elan to market the card. See The Anatomy of a Co-Branded Credit Card. I don’t have the Fidelity credit card.

J says

In the last example, how would you handle billers who require pulling money from your account? My mortgage is like that and more business are requiring it to get discounts. I set up a second account with just enough money to cover the mortgage. I give them that and my main checking account isn’t touched. I think a CMA account could be used for this.

Harry Sit says

Those fall under direct debits, the opposite of direct deposits. I set up autopay with the billers. The debits come out of that same spending account for everything else. I never had any problem in 20+ years. Layering accounts adds more work to juggle the right amount to the right place.

DPO says

I’m in similar situation and considering moving my CMA to brokerage account. I have stocks in CMA. How do I transfer the stock from CMA to brokerage account? Can I do it online myself? or I need to call customer service?

Harry Sit says

You can do it online. There’s a “shares” option (versus cash) after you select the accounts on the transfer page.

Wade says

Great article. I moved a pretty significant portion of our investments to Fidelity in the last year. Im still learning all of the offerings they have, which are quite extensive, so this review of the benefits of their CMA is very helpful.

Im not sure if you’ve done this topic but one thing Im currently working through is balancing assets between my wife and my trust (Revocable living trust). We hold most of our accounts/assets in trust (with exception of IRAs) but there is now an imbalance of assets that I need to deal with. One of the reasons the imbalance came to be is that I tend to transact most of our after tax in one brokerage account under my Trust. That account has now become so large that its created an imbalance of assets. Our attorney suggested just creating a new brokerage in my wifes trust and just moving assets to that brokerage via ACATS. While this addresses the near term imbalance, in the past I always found it very difficult to move funds via ACH between differently titled accounts, which is why I’ve avoided this two different titled brokerage accounts set up. Love your thoughts if you have any.

Harry Sit says

You have to determine whether it’s legal and desirable to move assets from one trust to another trust and whether it triggers any taxes. Logistically, if you have control over both accounts, transferring shares within Fidelity doesn’t go through ACATS. You can do it online and the transfer completes instantly.

Ann says

Don’t know whether your trusts have some special limitations, but my spouse and I can transfer funds freely between our revocable living trusts. We were told that for all intents and purposes we could treat the funds in the trusts as if we held them in our own names, as before.

Java says

Thank you for another great article.

I would add: funds in CMA are FDIC insured while MMF(such as SPAXX) in brokerage account is not. MMF could “break the buck” — meaning loss of principle (it is a low probability event).

One might ask: does the additional after tax interest worth the additional risk?

Please refer to Fund Overview – Risk section

https://fundresearch.fidelity.com/mutual-funds/view-all/316067107

“You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity Investments and its affiliates, the fund’s sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. “

Bob Burgers says

I think some context though is necessary. Harry said he’s buying a MMF whose investments are backed by the government. I think it’s extremely unlikely it would break the buck. It’d basically be suggesting the US Government would not pay back its debts.

The most recent money market mutual fund that I’m aware of to ‘break the buck’ was the Reserve Primary Fund in 2008 which held commercial short-term debt (specifically subprime mortgages) from Lehman Bros and other financial-sector debt. It went from $1/share to $0.97/share. Ultimately, the fund was liquidated, and investors received $0.991/share.

Harry Sit says

If a Fidelity money market fund becomes another Reserve Primary Fund that breaks the buck, you lose 3%, but you make it up in two years by earning 2% more than the FDIC-insured balance in the CMA. By the time it breaks the buck you already made so much more than the loss.

If you look at it from an inflation-adjusted angle, FDIC insured bank accounts break the inflation-adjusted buck all the time. Losing less to inflation in a money market fund is better than losing more to inflation in FDIC insured bank accounts. Ultimately we only spend inflation-adjusted dollars. Giving much importance to the nominal dollar value is called money illusion.

Lorraine says

This article is very timely. Just a few weeks before I was chatting with Fidelity to confirm whether or not bill pay would auto-liquidate my money market funds as needed since it counted towards the amount available to withdraw and was advised to manually liquidate. Good to hear that isn’t needed. Also I had not realized I could enable Bill Pay for my brokerage account, but personally I don’t like mixing stocks and “checking” so I’ve set up a 3rd account for bill pay. Shame you needed to manally add each payee again.

I’ve only been using Fidelity cash management in the last year for bill pay. Was the APY still generally competitive before all the interest rate hikes? I used to use CapitalOne 360 for bill pay (hold over from when it was ING) because it was my only checking account that gave anything (0.1%) and I only kept enough to cover my monthly expenses. Curious when the 7-day yield returns to earth if the APY of cash mgmt would >1%.

Harry Sit says

You only need two accounts in the end: an investment account that holds your long-term investments, plus a “spending account” that can be a CMA or a separate brokerage account depending on which of the 3 ways you like in this post.

The yield on the money market fund is set by the market. The yield on the CMA and other bank savings accounts is set administratively. Just like investing in index funds, I’d rather go with the market than hoping that someone will set an above-market rate.

Bob Jones says

The limitations and rules on this account are too much cognitive load for me. And up to 4 days for an ACH transfer?

Harry Sit says

The point of the account is that you can dump all short-term money in there and shed all micromanaging whether you have too much or too little in this account or that account. Every dollar earns good interest. Every dollar is available for everything.

The limitations don’t matter to me. I don’t have physical cash to deposit. I don’t need a cashier’s check. I don’t use Zelle.

ACH transfers complete on the same day. The hold is only on pulls. No hold on money pushed in. The money pulled in still earns interest. I don’t need to withdraw immediately the money transferred in when I have other money in the account to use.

WK says

Question

Great article and comments. I have two questions I am researching, and any feedback from this knowledgeable group would be great.

1. Wire and ACH limits? I use Raisin as a savings vehicle and to move to move to another bank, I need to send to external checking. That checking has a limit on amount that can be moved, so transfers can be a pain. Any thoughts?

2. No instant link via Plaid as a negative. Can someone expand on this? I did not know where this might be an issue unless trying to see data in Empower/Mint type of tools.

Harry Sit says

$100,000 per business day for online ACH and wire transfers. A higher amount can be transferred by calling customer service.

When you add the Fidelity account as a link in another bank account, some banks use Plaid to verify the ownership instantly by asking you to log in to Fidelity. It doesn’t work for Fidelity — and I don’t want to do it even if it works. Plaid usually has an alternative path to use the random deposit process to verify. So you just do that. It won’t be instant but it’s not a big deal.

MF says

Is $100,000 limit daily limit enforced for ACH pulls from Fidelity account? Or only for the push?

Harry Sit says

If the pull is initiated outside Fidelity, Fidelity can reject only if the account has insufficient funds.

Craig says

According to Doctor of Credit, the transaction limit for a pull from Fidelity is $250k: https://www.doctorofcredit.com/hub-accounts-ach-transfers-capabilities-fees-limits-across-financial-institutions/#Fidelity_Investments.

Harry Sit says

It’s not clear on which pull we’re talking about. A pull initiated outside Fidelity to pull money from Fidelity to the external account? The external bank sets the limit. Fidelity will comply if the amount is “available to withdraw.” A pull initiated by Fidelity to pull money from an external account into Fidelity? The limit is $250,000 per business day online and a higher amount can be done by calling customer service.

Craig says

You’re right, it means a pull from an external account to Fidelity.

WK says

Thanks again for fast and detailed info. This really helps.

Dave says

“ The ATM fee reimbursement is also included when you have Premium Services or Private Client Group status, which generally requires having $250k or more with Fidelity outside workplace retirement plans. It doesn’t matter whether you have an assigned advisor.”.

Based on what I see on the Fidelity website and it also says I’m not eligible when I try to apply for Fidelity Rewards+, doesn’t Premium Services or Private Client group require you be Fidelity’s Wealth Management plans at .5 to 1.5% fees? I have over 250K in a brokerage account, do you know how I can get Premium Services? Thank you!

Harry Sit says

Premium Services or Private Client Group does not require you be in Fidelity’s Wealth Management plans. Look at the top right when you log in to Fidelity’s website or on your PDF account statement to see whether you’re already in Premium Services. If not, call customer service and ask them to put you into Premium Services.

Dave says

Thanks for the quick replay and for the great information in the article. I don’t see anything when I login or on my statement. I will give them a call tomorrow. Again, thank you.

Indydave says

Rob

Very helpful post…well done!

Be well and be happy!

Mike says

I’m actually in the process of transferring my Schwab accounts to Fidelity Investments where I already have duplicate accounts and have been a customer for decades.

I’m getting conflicting information from Fidelity when I discussed your article with them to verify my standing. My concerns.

1. Foreign ATM withdrawals MAY INCURR a foreign transaction fee. He read it right out of the written instructions he had.

2. My monthly automated transfers of dividends accumulated in my Merrill Edge accounts will not be available for a few days.

Is he correct?

Harry Sit says

The customer service rep you spoke to apparently doesn’t use this account to take international ATM withdrawals or receive automated dividends transfers. Please see my real-world test of Fidelity Debit Card Foreign Transaction Fee on ATM Withdrawals. Your automated transfers of dividends are pushed out by Merrill Edge, not pulled in by Fidelity. Received pushes are available immediately just like payroll direct deposits. See the difference between push and pull in ACH Push or Pull: The Right Way to Transfer Money.

As a side note, you’ll need to e-sign a new Funds Transfer Enrollment form with Merrill Edge when you change the destination account that receives the automated dividend transfers. I just did that last week.

Patrick says

Harry,

I just looked up the form in ML website. Is this the one that asks you to esign but also asks you to attach a copy of the check? Looks like there is an option to transfer to dividends and interest on a daily basis, that should be a better option given that in SPAXX you earn dividends daily. Do you see any downside to the daily option?

Harry Sit says

Yes, that’s the one. It’s called Merrill Funds Transfer Service Enrollment Form. Enter the shorter account number on the check to match the scanned voided check you’re attaching. No downside to the daily option when you’re not reinvesting dividends. The dividend automatically shows up in the Fidelity account the next day. Merrill doesn’t charge any fee for the transfer.

Patrick says

Thanks! Appreciate it.

Mike says

Thanks Harry!

I’ve found that most people in customer service have never used their products and have to rely on looking things up and on what they are actually able to find varies.

I’m enjoying your site.

Patrick says

Great write up Harry. Very detailed. One quick question, how good is Fidelity bill pay. I currently use BOA for all bill pay as most of my credit cards are from boa. Even for citicards, BOA allows me to receive the bill through ebill and autopay in full just before due date (you once wrote an article about setting it up for BOA). Can I mimick this for BOA cards from fidelity brokerage account?

Harry Sit says

I prefer direct debit set up at each biller but one centralized bill pay service as the middleman also works if you prefer it that way. Fidelity’s bill pay also has eBill. It looks similar to Bank of America’s bill pay. The two of them may very well use the same bill pay provider under the hood. If you’re getting eBill from Citi at B of A, chances are you’ll also get eBill from Citi and B of A at Fidelity.

RobI says

Patrick

I recently started using Fidelity billpay and it works as expected. One issue I’ve encountered is setting up ebill and auto pay for utility payments. First you need to disable the ebill on the other side or Fidelity side wont accept the request. Even after that I’ve still not achieved success so far.

For National Grid, eBill is set up ok but autopay has yet to work.

For Eversource, I’ve requested eBill 3 times but still not active after a few weeks.

I’ll give it another billing cycle to see if its working.

Harry Sit says

This is part of the reason I use direct debit set up at the biller. You have more moving parts when you bring a third party into the chain. It’s much easier to go to the utility and give them a bank account to debit automatically.

Patrick says

Thanks Harry and Rob. For Eversource, I use my CC. It cannot be automated when you use CC, so I set reminders to pay. If Fidelity does not provide a centralized way, I may have to set this up as direct debit from CC companies. Ideally I would like every payment I make go through my CC and the only payments I need to make from bank should be for those CCs.

R E A says

You mentioned that you don’t use the debit card for transactions. Is the reason related to an account feature? Or maybe you use a different card (rewards card?) for transactions?

Harry Sit says

Correct, no rewards if I use the debit card. Nothing wrong with the debit card otherwise if you prefer to use it for purchases. I have the debit card in Venmo for person-to-person payments. Venmo charges a fee if I use a credit card to pay a friend.

Phil says

Thank you for this very informative article Harry. I’m on the lookout at the moment for a joint savings account for my wife and I. We’re looking for somewhere to park some funds for 12-24 months and get a decent rate of return. The options you describe seem to be suitable, though we’re not going to use it as a checking account. Having said that, now I’m wondering if we should replace our joint checking too and go all in on one of these Fidelity scenarios. It would be great to hear your thoughts on this. Thanks again.

Harry Sit says

My thoughts are at the end after the three asterisks. If you’re only looking for a better savings account, Vanguard money market fund and some other savings accounts pay more. However, with separate checking and savings accounts, you always have to watch the balances. You move money from checking to savings when you have more money than you need in checking. You move money from savings to checking to meet a large bill, say when property tax is due. When your checking account pays close to zero, your blended yield in checking and savings combined is lower than having just one account with Fidelity. You do more work and earn less. The distinction between checking and savings goes away in the last setup. The account self-adjusts automatically. Excess money dropped into the account is automatically saved. Large bills are automatically paid out. No more watching the balance in checking and transferring back and forth. I find it liberating.

Yes, moving a checking account requires re-setting linked accounts and bill payments. Banks take advantage of people’s inertia by paying zero in checking. To me, a one-time effort is worth it to save the ongoing workload in watching balances and transferring back and forth.

Chip Treen says

Thanks for this article. I have also been using Fidelity as my primary checking and investment account for close to 20 years. It is very convenient and mostly works well. Foreign transactions are a challenge however. While they do not charge direct transaction fees, they make up for this with poor exchange rates. This may be do the need to use a “real” bank for foreign transactions. Nonetheless this can be expensive. It is probably better to use another resource for these type of transactions.

Its interesting – as you noted – that they do not charge a transaction fee for foreign ATM machines.

Harry Sit says

What types of foreign transactions are you referring to?

Chip says

I received a refund in British pounds from a trip vendor. It was sent to my Fidelity account through their 3rd party bank. The exchange rate was very poor. For a $25,000 transaction the poor rate was worth about a $800 fee.

Harry Sit says

Fidelity has international trading. You could’ve enrolled in international trading under Account Features and had the vendor send British pounds to you without currency conversion via Fidelity’s bank in London. Once you have the British pounds in your account, you can exchange it to USD with Fidelity at a 1% fee. That’ll avoid having the bank convert the currency at a poor rate.

Mike says

I opened a new account at Fidelity Investments and I’ve set the alerts for the account. I’ve done trial EFTs deposits to the account. The money shows up Monday morning and I get an alert that it has showed up sometime on Tuesday. technical support tells me that’s how it’s designed to work. I find it very hard to believe and I can’t use this account if that’s how it’s going to work. Is that what your experience has been? My schwab account notifies me sometimes in the early hours of the morning on the 1st of the month that might pension check has arrived. during that business day I get another alert text message letting me know that my mortgage has been withdrawn. I’ve come to rely on these alerts.

Harry Sit says

Only the deposit alerts are sent the next day. Direct debit withdrawal alerts are sent in the early morning on the same day. Debit card usage alerts are sent in real time.

I don’t really need deposit alerts because deposits are either on a known schedule or made by myself. No surprise there. I also don’t rely on the new deposit to pay bills when I have a buffer in the account. There’s always enough to pay bills even if a deposit comes late by a day. When the deposit earns good interest on day one, I don’t need to do anything with the deposit either. It doesn’t matter whether I know about the deposit today or tomorrow.

Randy says

What is a typical ATM fee? I’m getting ready to move from my credit union to my Fidelity brokerage account.

Harry Sit says

I usually see $3.

Peter says

Hi Harry, thanks for the nice post. I am in the process of switching my checking activity to Fidelity based on this (just using broker account). Could you post a screen shot of “service level” indicator.

“You see your service level at the top right when you log in to Fidelity’s website. Contact customer service if you have more than $250k with Fidelity outside workplace retirement plans but you’re not given a premium service level.”

Harry Sit says

The screenshot is immediately below the small paragraph you quoted. The service level is also printed on the top of your PDF account statement.

Andre says

Great article. Thank you. I am setting it this week. Now you mentioned Harry you left your Bank of America account open. I want to do the same. Do you pay a monthly fee? Have a direct deposit? Or leave a high cash balance to avoid fees? Thanks!

Harry Sit says

My fees are waived because I qualify for the Preferred Rewards program by having investments with Merrill Edge.

RobI says

Have you any experiences using Fidelity money transfer lockdown to limit prevent unauthorized cash movement. Will it stop me from paying bills set up on the biller end?

Their web site indicates this

https://digital.fidelity.com/ftgw/digital/security/lockdown/info

‘ *Previously scheduled electronic fund transfers from your account may still be processed.’

Harry Sit says

You have to log in to read the info on that link. It says:

“Transactions not affected:

– Deposits or Transfers into your Fidelity accounts

– Checkwriting and Direct Debit

– Debit card/ATM transactions

– Trading

– Scheduled Required Minimum Distribution (RMD) or Personal Withdrawal Scheduled Plan

– BillPay”

The note “Previously scheduled electronic fund transfers from your account may still be processed.” refers to transfers you initiate in your Fidelity account, not transfers initiated by a biller. You won’t be able to initiate new transfers in your Fidelity account if you turn this on but the previously scheduled transfers may still be processed.

Paying bills set up on the biller’s end falls under direct debit, which isn’t affected. Unauthorized ACH pulls or altered checks won’t be stopped by this setting either. The money transfer lockdown doesn’t stop unauthorized charges to the debit card. You can lock the debit card under a separate setting but you’ll have to remember to unlock it before you use it.

I activated money transfer lockdown on my retirement accounts but I don’t have it activated on my spending account.

JT says

All my billers charge the Fidelity VISA card which is auto-paid from CMA.

All my accounts including the CMA are money transfer locked.

Portfolio income is auto swept into CMA daily by rules established before money transfer lockdown was enabled.

CMA is FDIC only. No MM. No links to brokerage acct. No overdraft allowed.

Its my understanding that this still leaves the CMA exposed to fraudulent ACH but none of my accounts can get ACATed away.

JT says

I carry the CMA &HSA debit cards therefore they aren’t locked but I try very hard to use the VISA instead.

Mark says

Harry, thanks so much for this article. I think I may do what you are suggesting in the article. I’ve had a bunch of problems with Vanguard this past year, so I may transfer my accounts to Fidelity. I have an HSA at Fidelity so hopefully it would be an easy task, also have checking and savings and credit card with Alliant, I’d like to keep the credit card because it pays 2.5 % cash back, but that would mean I’d have to still have a checking account with direct deposit and $1000 balance to get the benefit of the card. Any suggestions for a better card to replace the one at Alliant? Again thanks for this article it’s a great way to simplify, and Fidelity at least so far has great customer service and reputation.

Harry Sit says

I had checking and savings accounts with Alliant Credit Union too before I consolidated to Fidelity. I didn’t have its credit card. I see that “transfer from another financial institution” counts as “at least one electronic deposit posted to the account each calendar month.” So you can easily keep a $1,000 minimum balance plus a $10/month automatic transfer from Fidelity if you’d like to keep the Alliant credit card.

I use Bank of America’s Travel Rewards card that pays 2.625% but that requires having a free checking account with Bank of America and holding $100,000 worth of investments in a Merrill Edge account. The difference between 2.625% and 2.5% isn’t large enough if you don’t have or want Bank of America and Merrill Edge accounts. See Bank of America Travel Rewards Card Pays 2.625% on Everything if you want to exit Alliant completely.

Chip Treen says

Fidelity has a 2% cash back on everything credit card (Elan) which I use as my default. It’s less than 2.5% but has no annual fee and there are no separate categories with different rebate amounts.

Mark says

I did consider this Chip, but the Alliant card pays slightly more and there is no annual fee or foreign transaction fee with the card.

always_gone says

Mark, just FYI, the Fidelity card also has no annual fee and as of September 1st, no longer has any foreign transaction fees either. Cheers.

Mark says

Thanks Harry, I think I will keep the Alliant account mostly for the credit card but also as a backup for checking. This was a great article!

Samuel says

Harry,

I just saw this article in the monthly WCI newsletter. Your comment about Merrill Edge is what I was wondering about. I use BoA Credit Cards and appreciate the cash back bonus for being Platinum Honors. Merrill has a MMF you can purchase that pays similar to what Fidelity does. So couldn’t you just do this exact same thing there with only 1 login in BoA/Merrill? They said transfers occur the same day when made, so it seems like an easy compromise.

Harry Sit says

You can do something similar to a checking/savings combo when you pair a B of A checking account with buying a money market fund in a Merrill Edge account. Compared with the Fidelity checking/savings combo setup, (1) B of A checking account pays close to 0% versus 2.7% in Fidelity CMA; and (2) You have to watch the checking account balance, sell the money market fund in Merrill Edge manually, and transfer to the B of A checking account manually, whereas Fidelity automatically liquidates the money market fund in the CMA as needed.

Patrick says

General question, If you have locked down the account with ACAT transfer, is there a reason you should have two brokerage accounts (one for cash management and one for investments). I do not see a need for it, if you have alerts and two factor verification set up.

Any insights are appreciated.

Harry Sit says

I have two brokerage accounts to have mental separation between short-term cashflow and long-term investing. Some people want them separated because the lockdown for ACAT still doesn’t lock down unauthorized ACH debits. They don’t want temporary problems with one account to affect the other account.

Steve O says

I was looking into this as the current yield on SPAXX is 4.97% which is higher than online savings accounts I use such as CapitalOne 360 Savings (4.3%) & Ally Savings (4.4%). But interest rates obviously change, and for most of the past decade+ the yield of SPAXX/FDRXX was lower than both of those Savings accounts. For example, from 2012-2015, and most of 2020-2022, SPAXX had a 0.01% yield, while C1 & Ally paid around 0.5%. So, migrating to using Fidelity for banking takes on the risk that when (not if) interest rates fall, you lose the yield advantage over (some) banks. Something to consider.

Harry Sit says

You can always fall back to using it as only checking (the first diagram) if that happens.

Mak says

Thanks very much for the great write-up, Harry.

I’m confused about how to properly configure the cash manager option. My goal is to keep a bare minimum in the core position and have any overdrafts go to the linked MMF (in my case the treasury only FDLXX fund as I have state taxes to worry about). I’d also like any incoming monies hitting the core position to move over into the MMF above a relatively low threshold (say $500).

When I tried to use the cash manager options it said I had no eligible accounts. And when I spoke with the first fidelity rep she claimed there was no way to automate this and I’d still have to manually buy the MM position each time. That doesn’t seem right based on your article. Or did I misunderstand and does the cash manager feature at most give you an alert when you hit a certain cap, requiring you to still manually buy the MM position? That would really defeat the set-it-and-forget-it features.

Another possibility is that I just can’t set this up yet because the MM position is <24 hours old. I'll try again next week, but if you have managed to get the MMF purchases fully automated I'd be very curious to know how you accomplished this.

Much obliged.

Harry Sit says

Selling the money market fund to cover debits happens automatically for everyone. You don’t need to do anything in the Cash Manager. When you want a non-core money market fund such as FDLXX, you always have to buy it manually or set up automatic investments on a schedule. The Cash Manager only gives you an alert. It doesn’t buy the fund for you. I didn’t use Cash Manager for anything when I used the CMA.

Ann says

I think having the MMF as your core cash account is only available in the brokerage account. For the CMA, the core is a regular bank account (2.7%) and you have to manually buy a MMF if that’s your preference, but it will then be automatically redeemed to cover your disbursements. I just opened an account myself so I haven’t confirmed this in practice.

Lorraine says

FYI Fidelity has updated their reoccurring transaction option so you can do weekly/biweekly, etc.

Ann H says

In a Fidelity investment account, are funds for (e.g.) a bond purchase debited from the money market account immediately, or not until the settlement date?

Harry Sit says

On the settlement date. You’ll see a pending debit that reduces the amount available to trade and withdraw but the money stays in the money market fund until the settlement date.

RH says

Just want to better understand CMA and Cash manager with a mortgage direct withdrawal. I have read their FAQs and your article but still have questions.

Let’s say CMA paying ~2.5% as core position, MM funds 5%. say mortgage is $5,000 per month. Normally would keep $10k balance in account to cover mortgage and more, but clearly would rather make 5% than 2.5% on this $10k. Do I have it right that if this $10k is all invested in non-core money market fund e.g. FDLXX, inside CMA account, zero cash balance, and mortgage payment hits, then the account pays mortgage and auto-covers any deficit through cash manager? (selling some MM automatically later that night)?

e.g. $10k invested in FDLXX inside CMA, zero cash in account, mortgage $5k payment hits

– does Fidelity cover the $5k and Cash Manager auto-sells some FDLXX later that night, or does the mortgage payment just bounce?

I have seen a lot about bill payments but not much about direct debit / mortgage. Probably leaving $100-200 on table keeping funds in CMA cash vs MM, and trying to move more to a set it and forget it approach like you outline, so if CMA will let lender payment go through without bouncing and then liquidate MM afterward that would be handy. Thanks.

Harry Sit says

The account automatically sells the necessary amount from a money market fund held within the CMA to cover debits but it’s not the Cash Manager doing it. I added a new section “Cash Manager Not Needed.” I hope that makes it clear.

RH says

This clarification helps, I have not seen this mentioned elsewhere (or spelled out as clearly) that CMA will auto-liquidate MM *held within the same CMA account* to meet debit obligations as they come in. Most of what I read talks about the ‘self-funded overdraft protection’ linked to other accounts, or Cash Manager verifying balances later that night, etc., both of which had raised timing concerns for me. I want to ensure the account will meet payment obligations when the mortgage payment hits it – not try to juggle things later that night or wait for outside linked overdraft funding etc. Ultimately I am fine so long as the lender is made whole and Fidelity figures things out just don’t want an NSF because I did not understand the auto-liquidating/overdraft situation properly. Thanks again.

Dan says

Thank you very much for this article! I switched my primary checking account, which I’ve had for at least a decade, to Fidelity and love that it’s an all in one savings/checking and more that pays a good return. I got tired of constantly checking my balances and moving money back and forth between my checking and savings, making sure I didn’t go over 6 withdrawals per month on the savings, etc. Fidelity makes it seamless. Even though it was kind of a pain to switch all my credit card auto pays to Fidelity, I can see this move was worth the hassle. Only annoying thing is that money hold thing, it actually caused a credit card autopay to get rejected since Fidelity hadn’t released the hold, and I got slapped with a $29 penalty from Amex (but they waived it after I called them). But I won’t run into this issue once the account is fully funded and I have my paycheck going into it. Thanks again.

Barbara says

Can you provide any add’l info on the change in CMA money market fund slated for June, 2024? Not sure if I should wait until this comes online or go ahead and set up everything in the CMA checking account, like auto deposits and debits.

Harry Sit says

The upcoming change in June will make the CMA behave more like a separate brokerage account (the third way in this post) except:

(a) You need to actively choose the money market fund as the core. It isn’t the default. This only requires a one-time change in your setup.

(b) Everyone automatically gets the ATM fee rebate, not just those with large accounts in Premium Services or Private Client Group status. This is already the case in the CMA and it will stay that way.

When the change happens in June, “3 ways to use Fidelity as a bank account” will become “2 ways to use Fidelity as a bank account” because the 3rd way is no longer necessary. There’s no reason to wait. You’ll use either of the first ways before June and it will become the 3rd way after you make a one-time change in your settings to switch the core to a money market fund in the CMA.

Dan says

In regard to the upcoming change on June 15, did I make a mistake opening a brokerage account last month instead of the CMA? I chose the brokerage account after reading this article because it included SPAXX as core position. Seems like the CMA will be the superior account now as it will now offer SPAXX as core position but that account also offers ATM rebates whereas a regular brokerage account doesn’t. And I just got done changing all my payment accounts on my 19 credit cards over to my new brokerage account. 🙁

always_gone says

Just open a CMA for debit card use, link overdraft to your brokerage account if you want, order a CMA debit card, and you’ll be fine. Enjoy the ease of a one stop shop at Fidelity.

Harry Sit says

The upcoming change doesn’t affect the regular brokerage account. I suppose you opened a separate brokerage account because you don’t use an ATM that much or you have Premium Services or Private Client Group status. If I didn’t switch to a separate brokerage account, I would welcome the news and stay with the CMA. Since I’m already using a separate brokerage account, I’m not switching back to the CMA. It wasn’t a mistake. As I wrote in the post, I used an ATM only twice in a full year. It’s not a big deal even if I had to pay $6 in ATM fee. I also found out recently that a small bank close to my home is in a no-ATM-fee network with Fidelity’s debit card issued by PNC. It doesn’t charge an ATM fee anyway. You can find these no-fee ATMs by using PNC’s ATM locator.

JT says

Everyone with a CMA account that opts in for overdraft coverage must realize that fraudulent ACH transactions can take as much as $250k out of the covering brokerage account.

Jess says

Hi Harry, thanks for the update that we can switch core option to SPAXX money market fund around June 15th. You noted “Fidelity announced that a money market fund will be available as the default option in the Cash Management Account on or around June 15, 2024.” Could you please share the source? I called Fidelity to verify, and the Representative responded that after checking with their team, they have not heard of this announcement and they don’t believe this change will take place. I read in a forum someone mentioned this is noted on March statement, but I cannot locate it. Thank you for your time. Appreciate your blog!

Harry Sit says

It was in the March statement for the CMA and confirmed by Fidelity personnel in its official support channel on Reddit. I added the link in the first paragraph.

Jess says

Thank you, Harry. I’ve also just located/read the notice on my statement under section “Additional Information and Endnotes”.

Ann H says

Is there a way to view/print canceled checks online in the CMA?

Harry Sit says

I don’t write checks much but I remember seeing check images in my online account. The images may come a few days after the debit from the check is posted to the account.