[The next update will be on January 13, 2026, when the government publishes the CPI data for December 2025.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2023 MAGI determines your IRMAA in 2025. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes untaxed Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

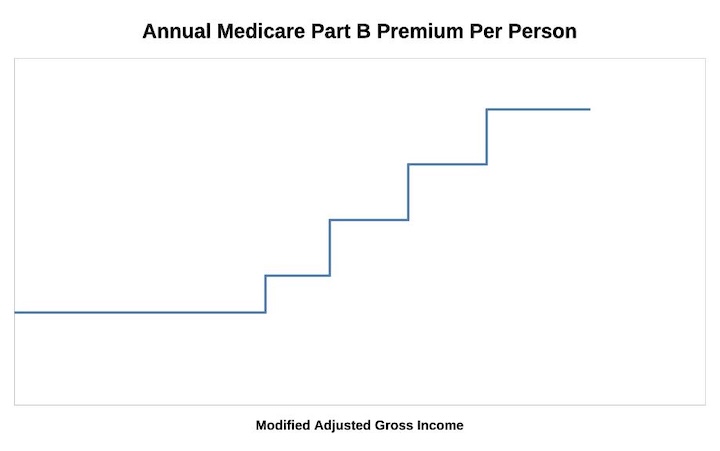

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2025 IRMAA Brackets

The standard Part B premium in 2025 is $185 per person per month. The income on your 2023 federal tax return (filed in 2024) determines the IRMAA you pay in 2025.

| Part B Premium | 2025 Coverage (2023 Income) |

|---|---|

| Standard | Single: <= $106,000 Married Filing Jointly: <= $212,000 Married Filing Separately <= $106,000 |

| 1.4x Standard | Single: <= $133,000 Married Filing Jointly: <= $266,000 |

| 2.0x Standard | Single: <= $167,000 Married Filing Jointly: <= $334,000 |

| 2.6x Standard | Single: <= $200,000 Married Filing Jointly: <= $400,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $394,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $394,000 |

Source: Medicare Costs, Medicare.gov

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

If you’re married filing separately, you may have noticed that the bracket for 3.2x goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have two data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from December 2025 through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $112,000 Married Filing Jointly: <= $224,000 Married Filing Separately <= $112,000 |

| 1.4x Standard | Single: <= $139,000 Married Filing Jointly: <= $278,000 | Single: <= $141,000 (or $140,000*) Married Filing Jointly: <= $282,000 (or $280,000*) |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $208,000 Married Filing Jointly: <= $416,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because they didn’t collect the necessary price data during a government shutdown. It’s unclear how Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

The Wizard says

Doing Roth conversions early in the year gets the money out of tax-deferred sooner and allows growth for the rest of the year to happen in your Roth, assuming same investments.

Problem for me at age 75 is that I want to avoid having my AGI get me into the next higher IRMAA tier. So I do my annual Roth conversion in December after I have a good estimate of all my other income…

Mike W says

Jeff,

Some philosophy mixed with opinion.

Barring other reasons to convert at the beginning of the year, or end, or monthly, I think statistically the market will go up in any given year. My rationale is that we are at new highs right now and that means that anyone who invested at any time in the past 50 years made money. It does not matter how much, only that the prior 49 years were good years to invest in if you are alive today.

The next question to ask is which month or quarter is the best to invest in and my opinion is that it may be slightly better to buy in May (because some pundits say to sell in May so there may be a slight statistical effect that increases the chances of buying in a buyer’s market).

Since 1960, so my research with AI bots tells me, there have been more up markets than down. Many more. So to save a lot of time and work, any year you decide to invest in has a good chance of being an up year. Some may not but look at those down years. Like a year in which a bear market went down 30%. On average it has taken 2 1/2 years to recover from a bear market and in the 31st month after you are at a new high for you, and you are an example of why buy and hold has worked out.

I am bullish on the United States. I have never sold in a bear market. And today I’m paying for that bullheadedness by having no way to avoid increasingly higher IIRMA’s. Though that also means I have no worry about having to eat cat food.

All the rest is trying to find tweaks to increase your gains from, lets say 18% annually, to 19%, or whatever number you have achieved so far.

For me personally I invest when my cash on hand exceeds the level of cash I want to have available to buy good stocks that have had a bad time.

Lynne says

I’d love to do Roth conversions at the beginning of the year but don’t know what my financial situation will be until near the end of year. Hopefully in future years it’s not so unpredictable so I can do at least some of it in January, then do the remainder near year’s end. In the past few years, the market has increased so much that with conversions I’m somewhat treading water where the pretax funds are at least not getting higher than the year before, in spite of conversions. No doubt this will change soon.

Bev L says

Lou –

I feel your pain. Calculating income brackets for IRMAA is a nightmare. The system is convoluted. One never knows the true tier number until one year hence. And while I am expressing frustration, Social Security has already been taxed once and paid to the government. Since 1993, 85% of SS can be included in income. It is retaxed along with the additional social security revenue source of IRMAA penalties (uh, they call it an adjustment), basically another tax on social security. A 2.9% Medicare tax on earned wages is shared by the employee and employer on all wages. There is no wage limit for this Medicare tax.

We have lived frugally and tried to save wisely. Our income is from social security and investments. The investment piece could be gone tomorrow. Initially, Social Security was funded with 1% from the employee and 1% from the employer on income up to $3000. In my view, Social Security has been mismanaged along with federal budget.

Ken says

Imagine what your SS income would be today if it were still based on 1%-employee/1%-employer up to $3000.

Mike W says

I don’t have a problem with increases in taxes. Costs rise because we want and need improvements in products, or we want new products. Imagine living in the years before there were ways to deal with Glaucoma, clogged arteries, cataracts, etc. People just went blind or died. But, what I object to is cutoff points for tax deductions or any other trigger points that are not adjusted for inflation. Our governments know that it is dishonest and sneaky robbery but they still allow it when they write new laws as well as allow old laws to exist. There is no excuse, absolutely none, to have any fixed trigger level that does not adjust to inflation. It is not OK to say that you can deduct up to $3,000 in loss carryover situations and leave that stay in effect for 30 years. That’s just an example. When I started working hitting a salary of $10,000 was an accomplishment. Today its $100,000 and more. My first apartment in New York City was $150 a month. I don’t know what it is now but I’m sure it’s over $1000. But for years on end my loss carry over has stayed at $3,000 and the calculation for when 85% of my Social Security is taxed has never changed either.

Gary says

Mike, I am with you on the need to inflation-index all provisions of the tax code. I do have moments of frustration and stress in things like estimating my yearly income and IRMAA brackets. However, I may be one of the lucky ones who is living a fairly easy retirement and should not worry about every dollar (or thousand dollar of costs). Wonder what Rockefeller would have paid to live my life today?

My secret is that I love working with spreadsheets, so it is a kind of a game to optimize my net worth this year and the next 27 (he says hopefully at age 73).

The ones I feel sorry for are less fortunate folks, for which this is not a game, but food on the table and heat in the house.

Mike W says

Gary, when I look at the income distribution stats and the estimated average Joe’s IRA balance I am reminded how fortunate I am and cannot understand how 50% of the population can look forward to an easy retirement.

As for 73 just keep fit and calm. I celebrate 85 in March and the divisor then will be 16. And when I reach 110 (I tell my wife I want to celebrate her 100th with her. We’re 10 years apart.) it will be 6.4. The really good thing about a 6.4 divisor is it signals that pretty soon my RMD will be zero. There’s always a silver lining.

My spreadsheets do run out to 2051. It’s my way of keeping a positive mental attitude.

The Wizard says

I’m just glad that I’m a wealthy bastard at age 75.

My QCDs for this year will be roughly double what they were for 2025, so that’s good…

Gary says

Just keep in mind to reflect in your spreadsheets the possibly for assisted living or nursing home costs. They are tax deductible (over 7.5% AGI threshold), so your RMDs might have a big offset. If you are still healthy, you can pay more tax but are still ahead of the game by keeping the rest of your RMD. 😀

Bev L says

Just wondering if the IRMAA subsidy paid is deductible under medical costs when itemizing rather than taking a standard deduction?

Mike W says

They are considered a premium payment so yes as long as you meet the normal requirements for deducting, like over 7.5% of AGI etc. Just query your friendly AI.

LiftLock says

IRMAA surcharges can be claimed as an itemized deduction on IRS Form 1040 Schedule A for medical expenses that exceed 7.5% of AGI. However, a reduction in a taxpayer’s taxable income only occurs for the amount of itemized deductions of all types that are in excess of the taxpayers standard deduction.