[The next update will be on March 11, 2026, when the government publishes the CPI data for February 2026.]

Seniors 65 or older can sign up for Medicare. The government refers to people who receive Medicare as “beneficiaries.” Medicare beneficiaries must pay a premium for Medicare Part B, which covers doctors’ services, and Medicare Part D, which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the remaining 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to a Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

History of IRMAA

IRMAA was added to Medicare by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Republican Congress under President George W. Bush passed it in November 2003.

IRMAA started with only Part B. The Patient Protection and Affordable Care Act, passed in 2010 by the Democratic Congress under President Obama, expanded IRMAA to also include Part D.

The Bipartisan Budget Act of 2018, passed by the Republican Congress under President Trump, added a new tier for people with the highest incomes.

IRMAA has been the law of the land for over 20 years. Different congresses and administrations from different parties made small tweaks, but its structure hasn’t changed much since the beginning. IRMAA has become a bipartisan consensus. There’s no impetus for major changes.

MAGI

The income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2024 MAGI determines your IRMAA in 2026. Your 2025 MAGI determines your IRMAA in 2027. Your 2026 MAGI determines your IRMAA in 2028.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes 100% of the Social Security benefits. The MAGI for IRMAA includes taxable Social Security benefits, but it doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits. The new 2025 Trump tax law didn’t change how Social Security is taxed. It didn’t change anything related to the MAGI for IRMAA. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law.

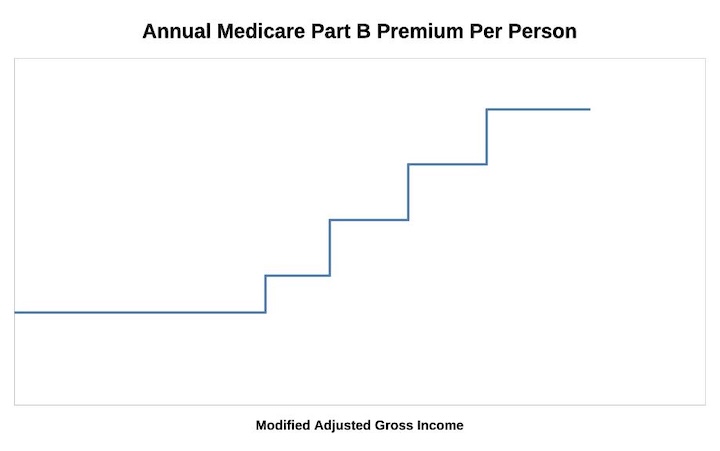

As if it’s not complicated enough, while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can result in a sudden increase in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden, your Medicare premiums can jump by over $1,000 per year. If you are married and filing a joint tax return, and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

If your income is near a bracket cutoff, try to keep it low and stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2026 IRMAA Brackets

The standard Part B premium in 2026 is $202.90 per person per month. The income on your 2024 federal tax return (filed in 2025) determines the IRMAA you pay in 2026.

| Part B Premium | 2026 Coverage (2024 Income) |

|---|---|

| Standard | Single: <= $109,000 Married Filing Jointly: <= $218,000 Married Filing Separately <= $109,000 |

| 1.4x Standard | Single: <= $137,000 Married Filing Jointly: <= $274,000 |

| 2.0x Standard | Single: <= $171,000 Married Filing Jointly: <= $342,000 |

| 2.6x Standard | Single: <= $205,000 Married Filing Jointly: <= $410,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $391,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $391,000 |

Source: CMS news release

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The IRMAA income brackets are the same for Part B and Part D. The Part D IRMAA surcharges are relatively lower in dollars.

I also have the tax brackets for 2026. Please read 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD if you’re interested.

2027 IRMAA Brackets

We have four data points right now out of the 11 needed for the IRMAA brackets in 2027 (based on 2025 income).

If annualized inflation from February through August 2026 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2027 numbers:

| Part B Premium | 2027 Coverage (2025 Income) 0% Inflation | 2027 Coverage (2025 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $111,000 or $112,000* Married Filing Jointly: <= $222,000 or $224,000* Married Filing Separately <= $111,000 or $112,000* |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $140,000 Married Filing Jointly: <= $280,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $175,000 Married Filing Jointly: <= $350,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $210,000 Married Filing Jointly: <= $420,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $388,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $388,000 |

If you’re married filing separately, you may have noticed that the 3.2x bracket goes down with inflation. That’s not a typo. If you look up the history of that bracket (under heading C), you’ll see it went down from one year to the next. That’s the law. It puts more people married filing separately with a high income into the 3.4x bracket.

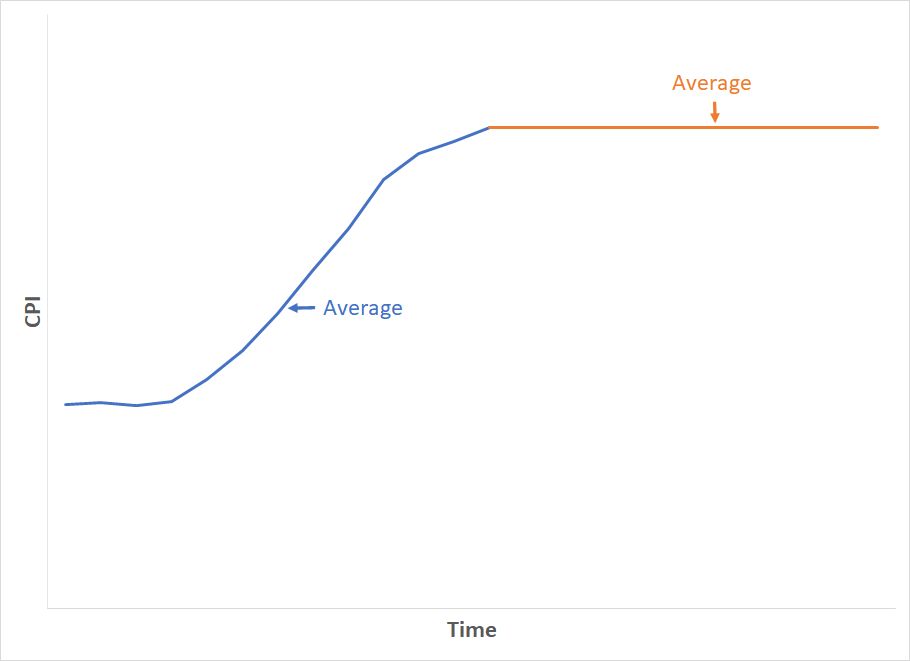

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

The Missing October 2025 CPI

The government did not and will not publish the CPI number for October 2025, because it didn’t collect the necessary price data during a government shutdown. It’s unclear how the Social Security Administration will calculate the 12-month average with only 11 data points.

The Treasury Department uses 325.604 as the October CPI to calculate interest on inflation-indexed Treasury bonds. The Social Security Administration won’t necessarily use the same number for IRMAA. I calculated the projected 2027 brackets in two ways: (a) using a straight average of the projected 11 monthly data points, omitting October 2025; and (b) using 325.604 for October 2025. The projected 2027 brackets are largely the same under the two methods due to rounding. I put an asterisk where they differ.

2028 IRMAA Brackets

We have no data point right now out of the 12 needed for the IRMAA brackets in 2028 (based on 2026 income). We can only make preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from February 2026 through August 2027 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2028 numbers:

| Part B Premium | 2028 Coverage (2026 Income) 0% Inflation | 2028 Coverage (2026 Income) 3% Inflation |

|---|---|---|

| Standard | Single: <= $111,000 Married Filing Jointly: <= $222,000 Married Filing Separately <= $111,000 | Single: <= $115,000 Married Filing Jointly: <= $230,000 Married Filing Separately <= $115,000 |

| 1.4x Standard | Single: <= $140,000 Married Filing Jointly: <= $280,000 | Single: <= $144,000 Married Filing Jointly: <= $288,000 |

| 2.0x Standard | Single: <= $174,000 Married Filing Jointly: <= $348,000 | Single: <= $180,000 Married Filing Jointly: <= $360,000 |

| 2.6x Standard | Single: <= $209,000 Married Filing Jointly: <= $418,000 | Single: <= $216,000 Married Filing Jointly: <= $432,000 |

| 3.2x Standard | Single: < $500,000 Married Filing Jointly: < $750,000 Married Filing Separately < $389,000 | Single: < $514,000 Married Filing Jointly: < $771,000 Married Filing Separately < $399,000 |

| 3.4x Standard | Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $389,000 | Single: >= $514,000 Married Filing Jointly: >= $771,000 Married Filing Separately >= $399,000 |

Roth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with TurboTax What-If Worksheet and Roth Conversion with Social Security and Medicare IRMAA.

Nickel and Dime

The standard Medicare Part B premium is $202.90/month in 2026. A 40% surcharge on the Medicare Part B premium is $974/year per person or $1,948/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $218,000 in income, they’re already paying a large amount in taxes. Does making them pay another $2,000 make that much difference? It’s less than 1% of their income, but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income, and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time, and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

You file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you have a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. The IRMAA surcharge goes into the Medicare budget. It helps to keep Medicare going for other seniors on Medicare.

IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, your IRMAA will come down automatically when your income comes down in the following year. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Joe Taxpayer says

Whining? Is that what you call people strategizing about how to optimize their finances?

If that’s the case, please share how you feel about the tax cut for billionaires making the lower 50% far worse off.

Hans Heijmans says

Nothing wrong with strategizing about tax planning around the existing rules. That’s what this site is for. The “whining” comment refers to the incessant complaining about the existing rules. That gets tiresome and does not add anything useful for this site.

And on tax cut for billionaires: those are ridiculous, and I am with Warren Buffett on that.

Nancy Memmel says

I didn’t write the post, so I could be dead wrong, I suppose, but I don’t think he meant the strategizing part, just the opining about how the structure “should” be in individual people’s ideal worlds. In a system where revenue is raised to subsidize some people it necessarily is at the expense of other people, and everyone has an opinion; all of which are irrelevant to the strategizing issues.

Paul says

When reading or commenting about the distribution of federal income taxes, I suggest that interested readers refer to this IRS data:

https://www.irs.gov/pub/irs-soi/22in41ts.xls

It has information about the total income, total federal income tax paid, average tax rate, the share of total income, and the share of total federal income tax… for successively larger cohorts, starting at the top 0.001%, to the top 50%. Note that each column is inclusive of the taxpayers in the columns to the left, but if you have any skills in Excel, you can easily create a similar table that separates each percentile into brackets.

Data is provided for tax years 2001 – 2022. A new version including tax year 2023 should be published soon.

If you want to consider all federal taxes (individual income, corporate income, social insurance, excise), the Congressional Budget Office has published that data, broken into quintiles, from 1979-2020:

https://www.cbo.gov/publication/59509

The Supplemental Data section has the Excel workbooks that back up the report. I will caution that it is not easily comprehended unless you are skilled in Excel, specifically with Pivot Tables.

If you are really interested in this subject, I recommend taking the time to look at this data. You will likely be surprised, as it belies the usual consensus.

TwoGeez says

It saddens me to see Harry’s excellent site being hijacked by these arguments. It sounds more like a Reddit thread (which would better be held there). Can we PLEASE get back to comments and explanations that can help us all manage against the IRMAA thresholds? /offmysoapbox

Deb says

Am I understanding that the income threshold for my 2027 IRMAA (calculated based on my 2025 MAGI) will be higher than $212K? I am close to that now and would like to know that I have some breathing room. You think it will be over $218K. Thank you

Henry Waldron says

The 2026 IRMAA threshold, referenced to 2024 MAGI, will likely be $218,00 for a couple filing jointly, half that amount for a single taxpayer.

It could be slightly higher or lower if something calamitous happens to inflation between now and October. Since the single taxpayer number is rounded, I’m not sure how crazy the changes would need to be. I’m also not sure what might happen if we suddenly don’t get monthly updates, or if some alternative formula is suddenly introduced.

The 2027 IRMAA threshold, referenced to current (2025) MAGI, would normally be higher than the 2026 threshold. How much depends upon the inflation over the next year starting in October 2025. At 2% inflation, the $218,000 applied in 2026 MAGI would go to ~ $222,000 applied to 2027 MAGI

The Wizard says

As you can see from the chart for 2025 income, the first IRMAA tier is projected to start for MFJ MAGI of $220k if zero inflation for next 13 months, or $224k if 3% inflation.

We’ll know a bit more by mid December, which gives folks time to figure their Roth conversion amount for the year or, in some cases, their QCD amount…

GeezerGeek says

After we get the November CPI reports, which is due to be released on December 10, I will create an IRMAA bracket inflation threshold report that will show what rate of inflation will be needed for a bracket limit to change. A hypothetical example of this would be it would take 3.15% inflation rate for the bracket limit to change from $212K to $214K. It will show you how much or little breathing room you have for 2025 income that will determine the 2027 IRMAAs.

I wish this Comments section would support images or tables. That would make it easier to post the report but I’ll probably have to provide a link to an image so that everyone can view the report.

LIftLock says

GeezerGeek,

If you post the inflation sensitivity thresholds like you did last year, I will put in a spreadsheet and share it with everyone like I did last year.

GeezerGeek says

Liftlock,

Thanks for offering to help, but I copied the numbers out of a spreadsheet to paste them into Comments and then tried to format them into something readable in the Comments section. So, it is no more work for me to publish the spreadsheet that I initially created. I’ll probably also save a CSV of the spreadsheet and paste that into Comments so that others who are too cautious to click on a link can paste that into their own spreadsheet.

LiftLock says

GeezerGeek,

Back in August, you mentioned the possibility of creating an IRMAA bracket inflation threshold report that would show the rate of inflation needed for a bracket limit to change.

I am especially interested in knowing how much inflation would be required between now and August 2026 to move the 2.0 IRMAA bracket cutoff from $278,000 to $280,000 for Married Joint Filers.

I image others would be interested in the report for other IRMAA brackets. The report you created last year was very helpful. Thanks in advance for anything you are able provide.

GeezerGeek says

Liftlock,

I did create the sheets after the CPI numbers were announced on December 18. Since we don’t know how the brackets will be calculated, I followed Harry’s methodology and did two calculations: one with an assumed October CPI rate of 325.604, that the government had used as the CPI for other inflation calculations, and another omitting an October number from the calculation and just using calculating the CPI average on the 11 remaining months. The problem I encountered was that at an inflation rate of 3%, both of my calculations gave the 1.4 Standard Bracket as <= $141,000 while Harry's published numbers showed that bracket as <= $141,000 or $140,000, showing a different number for the two methods. I couldn't account for any reason that Harry's numbers should be different than mine, so I was hesitant to publish the breakpoints I calculated. Harry's math is usually better than mine, though previously my numbers had never differed from his.

Harry Sit says

GeezerGeek – I’m using a geometric average of a 3% annual inflation, which comes out to 0.246627% per month. If you’re using an arithmetic average of 0.25% per month, it might account for the difference in our results.

GeezerGeek says

Harry, I was using an arithmetic average for incrementing the CPI for each month but after I changed it to a geometric average, the 1.4x bracket still ended up as 141,000 for both calculations. Are you averaging the 12 months differently than I am? I’m using the Excel formula ROUND(AVERAGE(B42:M42),3) where B42 thru M:42 are the 12 calculated month values. For the October in the cell, I either leave it blank for the 11 month average since the Excel doesn’t average missing numbers.

What is interesting is if I use an inflation rate of 2.99% instead of 3.00%, I do get the same brackets that you calculated. Maybe somewhere we are just rounding off differently.

Thanks for the insight about geometric average.

GeezerGeek says

Harry, if your calculation shows the 1.4x brackets to be the same for each method at 3.01% inflation or even 3.1%, then I think we can attribute the difference to round off.

Jerry says

Thank you for the article, it helps to plan to avoid IRMAA premiums.

Ron says

I would like to know who authorized the IRS to disclose our confidential tax information to Medicare and Social Security who acts as Medicares collection agent. If another agency came to the IRS and said that their fees are tied to income, would the IRS provide this information to them also? Where would it end?

Harry Sit says

Congress authorized it. They passed a law and the President signed it. Both the Secretary of the Treasury and the Commissioner of Social Security are tasked to implement the law. It’ll happen again if Congress passes another law that requires payments based on income and the President signs it. It would end when Congress stops passing such laws.

Harry Sit says

I added a new History section to the main post to outline how we got here. From the summary of the original law that brought us IRMAA:

“Subtitle B: Income-Related Reduction in Part B Premium Subsidy – (Sec. 811)

… …

Amends the Internal Revenue Code to direct the Secretary of the Treasury, upon written request from the Commissioner of Social Security, to make appropriate disclosure of tax return information to carry out the Medicare part B premium subsidy adjustment.”

There you go. Congress explicitly mandated the disclosure.

The Wizard says

The US Government allowed that.

Please relax and get off your high horse…

James says

I am looking for feedback on a strategy to safely stay below the 2025 limit for the predicted standard amount of $220K (MFJ, 0% inflation). I have yet to take my RMD for 2025. Let’s say that I accurately track my income for 2025 and determine that I would be approximately approximately $500 over the $220 limit at the end of the year.

Could I simply take $1,000 less than my 2025 RMD required amount in 2025 and push that $1,000 of income off until 2026 by taking the $1,000 RMD amount before April 15,2026? In other words, would the IRS let a person split their total required RMD for a particular year so that a portion of that RMD could be pushed into the following years income? Thoughts on this strategy?

Harry Sit says

Only your first RMD can be postponed to April 15. The deadline is December 31 for all subsequent RMDs.

Teresa Durden says

You could do a QCD for $1000, for that part of your RMD to Charity. That way, no tax to pay and you don’t count it on income. Plus it helps charities.

Nancy Memmel says

Assuming that 2025 is NOT the first year you have an RMD, Theresa’s QCD suggestion is about the ONLY way I can see you undercutting the IRMAA threshold.

QCDs are a tax efficient way to give what you would have given to charity anyhow. In this specific case, giving a 1,000 that you hadn’t intended to give would still be less money than paying the IRMAA charges in the first tier for a single person!

You could always pray for inflation, I suppose..

Jeff Enders says

James – beyond all the great suggestions from others, the other thing to consider is just “time”. Are you being ultra conservative to make this decision in August when you have until Dec 31 to execute a QCD (or the numbers change)? It’s also QUITE conservative to believe inflation is magically going to drop to zero next month and stick there for an additional 12 months.

if inflation stays at 2.5% for August – November (which you will know before making decisions in December) and then magically drops to 0% for the remaining eight months of the reporting year, the IRMAA limit would be $222,000 and you’d be fine.

Alternatively, if you have ANY cash sitting in an interest earning bank account, I’d move that to a non-earning account to help reduce that $500 overage in the months remaining in the year.

Worst Case – contributing $500 via a QCD PRIOR TO YEAR END is less expensive than the 40% penalty on $220 (2027 projected premium) for 12 months times 2 or $2,112. The QCD will reduce your AGI by the same $500 while still satisfying your RMD. It also reduces you tax based on your marginal tax rate, so a good outcome given the situation can be had.

Mike says

If you haven’t taken your RMD yet I’m just curious how you will avoid any underpayment penalties, unless you’ve been making quarterly payments from other funds.

In the same vein, if I do not have any taxes taken out from pensions and Social Security, can I take my RMD in December and have my total tax due taken out by Fidelity (I would tell them to take 80% or whatever of the RMD to cover my total taxes due)?

Harry Sit says

Mike – Yes, you can tell Fidelity to withhold a large percentage of your RMD for federal income tax. I think they do it up to 99%.

Jeff Enders says

Mike – you may misunderstand how under payment penalties work (and it is not easy).

In a nutshell, the IRS requires you to calculate your income and deductions quarterly. Look at form 2210.

So if you take your RMD in late December, the related taxes are not due until January 15, 2026 and there could be no under-payment penalties are due. Again, work yourself through form 2210 and form 2210AI. The IRS is only expecting you to pay 90% of your YTD tax liability by January 15, 2026; the rest is due by April 15, 2026

You could either have Fidelity withhold at the same rate as your marginal tax bracket or make that same payment no later than January 15, 2026.

When you do your taxes in April, the IRS presumes that all your income was earned evenly throughout the year in which case, you may owe underpayment penalties. The way to resolve that is to complete form 2210 which reports to the IRS that your income was ‘lumpy’ during the year and it will minimize / eliminate the underpayment penalties.

LiftLock says

Mike,

Fidelity allows up 99% of a IRA withdrawal to be directed to tax withholding when a distribution is requested online. Fidelity can direct 100% of a IRA distribution to tax withholding when requested via the phone.

Terry says

Jeff — Good explanation on the IRS penalties. Just to add one point. Taxes withheld are also considered to have been withheld evenly throughout the year and not on the actual withholding dates — unless a person elects to do so on Form 2210 because it would be to their advantage.

The Wizard says

The QCD method works assuming at least part of your RMD comes from a tIRA. You can’t do QCDs from a 401(k) or 403(b)…

James says

Thanks to all for your thoughts on my question and the input about using the QCD strategy. The other way of moving income from one year to another is to purchase Tbills where interest is paid at maturity but this requires implementation throughout the year. You can’t wait till the end of the year to make much of a difference.

Tom Tran says

Hi Harry,

Thank you so much for the works over the years. I’m planning on Roth conversions over multiple years. I’d like to estimate the affects of the conversions to the income taxes as well as IRMAA. I would need to adjust the brackets — income tax brackets and IRMAA brackets — for each year to come as “close” to the actual numbers as possible.

For planning purposes, I’d like to adjust and have the brackets increased every year by 2% (the Fed target inflation). When you yearly publish the final numbers for IRMAA brackets and IRS for income tax brackets, I’ll make an update for the year accordingly. What would you suggest?

Thanks, Tom

The Wizard says

It’s easy to make broad planning estimates for income tax and IRMAA for the next five years or more based on estimated inflation.

But what really matters is what you do each December that determines your MAGI and your Taxable Income for the year.

Income taxes are easy and if you get your TI a few hundred dollars into the next higher bracket, it’s no big deal.

IRMAA is trickier so it’s best to adjust the Roth conversion amount you do each December to keep your estimated MAGI safely below the next higher IRMAA threshold per Harry’s estimates.

“Safely” could be $100 below if you have good estimates of your MAGI for the year.

But if you hold managed stock funds in your taxable account that have Capital Gains Distributions, that can upset your plan. Only hold index funds in your taxable account…

Jeff Enders says

James – a few thoughts:

1) decide what is your appetite for the highest tax bracket you can muster is as well as the highest IRMAA tier you can muster. It has to be part of a strategic decision. Depending on what happens to the money in the end (donate to charity versus leave it for your children or something in-between) is a big part of that decision.

2) are you funding the tax from other after-tax money or from the conversion itself?

3) Might be better to assume a higher inflation rate than 2%. At least in the short term doesn’t appear that the Fed is going to get to 2% as they haven’t gotten there yet and they are now prioritizing lower unemployment over lower inflation. Higher inflation mean more flexibility to do more conversions (since the tax bracket end point will be higher) which drives more cash needs if you are funding the tax from after-tax investments.

4) To the extent you have both bonds and stocks holdings across your Trad IRA and brokerage account, the Trad IRA should be where the bonds should be priorized and the brokerage account should be where the stocks are prioritized. If there are stocks and bonds in the Trad IRA, the stocks sholud be the priority for conversion over any bond holding in that Trad IRA.

just my two cents

LiftLock says

Tom Tran,

You could build a spreadsheet to project your future income, income taxes and IRMAA brackets / surcharges.

Retirement planning software can be used to accomplish the same thing, with much less work, and will likely provide a much greater insight into your long term financial picture.

Check out:

PralanaRetirementCalculator.com

Max-FiPlanner.com

Boldin.com

https://numbercrunchnerds.systeme.io/taxplanningtemplate

https://www.getrichslick.com/2024/05/23/review-the-retirement-nerds-tax-planning-template/

Harry Sit says

2025 and projected 2026 tax brackets are in 2025 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD. My favorite tool for Roth conversion planning is in Roth Conversion with Social Security and Medicare IRMAA. I updated that post today to use the latest version of the tool.

Michele says

Thank you so much for doing these calculations and updating regularly. I handle my elderly mom’s finances and greatly appreciate your work.

Allyn Zerby says

I’m not reproducing your estimated 2027 IRMAA brackets for 2025 income where you say “If annualized inflation from September 2025 through August 2026 is 0% (prices staying flat at the latest level)”. I must be entering my estimates differently. What CPI-U estimates are you calculating for prices staying “flat”?

Thanks for all your information on this web page. It’s helped considerably.

Tom P says

Allyn, what Harry means is you hold the CPI-U constant at the current level of 323.976 through August 2026, which yields a multiplier of 1.29965 times the base 2017-2018 values, which are then rounded to the nearest $1000 to yield $110K, $139K, $174K, and $208K single income brackets.

Allyn Zerby says

Thank you. I had an error in the way I was calculating the breakpoint which didn’t show up until this projection was calculated. Fixed now.

susan says

Please provide how IRMAA exactly is calculated by showing what on the 1040 line by line is added in such as SSI, tax exempt income, etc.

Jeff Enders says

Line 11 plus Line 2a on Form 1040 is “MAGI” for IRMAA purposes. It’s that simple.

David S says

Hi Harry,

You report that to avoid IRMMA increases for Medicare Part B and D in 2026, your MAGI (for 2024) must be $218,000 or less (for MFJ). I have read, in another place, that the maximum income is $214,000. Which is correct?

Jeff Enders says

David S – in fairness to Harry, it would be nice if you posted the links to other places you have read that $214,000 is correct. Otherwise you are asking him to justify his numbers against a ghost! Not fair.

p.s. this website is correct 🙂

Harry Sit says

My numbers are correct. I have many knowledgeable readers here. They’ll point out any error in no time if I ever mess up my calculation.

Nancy Memmel says

David;

various sites report 3rd parties’ projections, sometimes projections made very early in a calendar year, and don’t update the projections as time goes by. The data through the end of the compilation period is what matters, and that is what Harry is using.

Burt Peterson says

Does one use the filing status and income reported in the two year’s prior returns, regardless of current filing status?

For example, if two person are single filers in 2024 but married one another in 2025, is the 2026 IRMAA based on the two 2024 income and filing status of each person (versus adding the two together)?

The Wizard says

SSA will use your 2024 tax returns, Single. It knows nothing about 2025 yet.

But if one of you would be paying IRMAA for 2026 and the other not, then you can file form SSA-44 showing your marriage and that your combined AGI is below the MFJ threshold and then they will remove the one person’s IRMAA…

Jeff Enders says

Wizard – can you please provide a link to the advice?

The instructions at the top of the form SSA-44 state:

“if you had a major life-changing event AND your income has gone done”

Those TWO requirements must be met to use the form. Getting married is a life-changing event, but if there is no income change, the form can not be used.

Can you please provide a link that a post 2024 life changing event (e.g. marriage) permits the couple to used the joint table instead of the single table for 2026 IRMAA charges? I can’t find any authoritative source that supports that.

Otherwise, 2026 IRMAA is based on the 2024 filing status and AGI reported by each spouse respectively.

Harry Sit says

You can file an appeal. They may or may not approve it. It must be permitted if they approve it.

Nancy Memmel says

Jeff;

On the SSA-44 form, “marriage” is one of the limited number of life changing events that allow for filing an appeal, so it must be that you can use the MFJ brackets for the later year, otherwise there’d be no point to having that listed as a LCE.

The other necessary component is that income is decreased BECAUSE of the marriage (since that is what is claimed as the event); but going from a single income to the sum of two incomes measured against the doubled-as-married IRMAA brackets might or might not result in a reduced IRMAA liability.

The Wizard says

Yes, I agree with Nancy’s logic. I would guess it’s very likely that a properly documented SSA-44 would be approved.

But OP should run the numbers first to be sure there’s a financial benefit to doing this.

In years beyond 2026, assuming they file MFJ and are both on Medicare, both of them will pay the same IRMAA amount whether zero or nonzero…

The Wizard says

Alternately, if one’s MAGI is well into IRMAA tier 1 and the other’s MAGI is just below the tier 1 threshold, then your MFJ MAGI would put you both in tier 1.

So don’t file SSA-44 in that case…

Harry Sit says

CMS announced that the 2026 Medicare Part B standard premium will be $202.90 per person per month. All the 2026 IRMAA brackets in this post are officially confirmed. BLS is working on a revised schedule for the October inflation number. I will update the 2027 projections when they announce it.

Henry Waldron says

Harry, On your IRMAA page, when you updated the 2026 Medicare monthly cost to $202.90 you inadvertently updated the 2025 Medicare cost to $202.90 as well. The 2025 cost should remain at $185.00.

Harry Sit says

Henry – Thank you for catching it. I corrected the 2025 cost to $185.

RobI says

Anyone looking for the Part D IRMAA adjustment numbers can find them here at foot of the page

https://www.cms.gov/newsroom/fact-sheets/2026-medicare-parts-b-premiums-deductibles

Tom P says

Does anyone know the actual formula to calculate the different tiers? I can’t get the 5th tier correct. I calculate $649.30, but CMS says it’s $649.20. If you just multiply $202.90 by the tier multiplier of 3.2 you get an unrounded $649.28, which when rounded to the nearest 10 cents is $649.30. All the other tiers round to what CMS published using $202.90.

In the past I’ve had to adjust the standard Part B value and use that unrounded number to calculate the other tiers. For instance, last year the standard Part B cost was $185.00, but I had to use $184.98 to get all the correct numbers. So far, I haven’t found a combination that works this year. Personally, I think someone made a mistake and they published the incorrect number for the 5th tier… not that I care (except the engineer side of me does) as I’m just a poor retiree, ha, ha.

Harry Sit says

Tom – The longer, more detailed official notice says the $202.90 includes $0.20 as repayment for lost revenue when the premium wasn’t allowed to go up as much as they should have in some previous years. The repayment amounts in higher tiers are $0.30, $0.40, $0.50, $0.60, and $0.70, respectively. If you multiply $202.70 by the tiers and add the repayment amount, you’ll get the matching amounts after rounding.

Liftlock says

Increases in 2026 IRMAA premiums and surcharges over 2025:

Part B – Basic Premium and IRMAA Surcharges: +9.7%

Part D – IRMAA Surcharges: + 5.8 – 6.2%

Social Security Benefits: +2.8%

Tom P says

Thanks for getting into the weeds with me Harry, ha, ha.

Paul says

Harry, I thought you might find it interesting:

If I search for “Medicare IRMMA 2026” on duckduckgo, the AI “search assist” gives a brief explanation and links to this page.

Tom P says

There’s a possibility that the October CPI won’t be released due to the shutdown. If that happens I suppose the average CPI will just be based on the known 11 months. This hasn’t happened since IRMAA was created.

Harry Sit says

I believe they will still release a number as the official CPI for the month, even if that number is derived administratively without actual data gathering. Every time they publish a number, we’re just trusting that’s the CPI. We don’t know how correct it is anyway.

Harry Sit says

BLS has officially canceled the October CPI release. It says “For a few indexes, BLS uses nonsurvey data sources instead of survey data to make the index calculations. BLS is able to retroactively acquire most of the nonsurvey data for October. Where possible, BLS will publish October 2025 values for these series with the release of November 2025 data.” I suppose this doesn’t include the main CPI-U index.

https://www.bls.gov/bls/2025-lapse-revised-release-dates.htm#cpi_note

The next update will be on December 18.

Tom P says

BLS will release a cobbled together report for October based on non-surveyed data when it releases the November data on a delayed 18-Dec date (was 10-Dec).

Steve says

If the October CPI report is not released, do you have any idea how the IRMAA thresholds will be determined. Currently they are based on the average of the 12 monthly CPI numbers. But what if there are only 11?

Harry Sit says

I’m not sure what exactly they’ll do but it likely won’t matter anyway. If they use the average of 11 numbers, it treats the October CPI as the average of the 11, which overstates it a little bit. Because of rounding, a slightly higher or lower number for one month rarely affects the final outcome. We usually see the brackets converge several months before all the numbers are known. I’ll run the numbers two ways: using the average of 11, and using the same CPI number Treasury uses for inflation-indexed bonds. I doubt it makes any difference but I’ll call it out if it does.

Jim says

Harry,

Are you assuming that the 2027 IRMAA average CPI-U number (Sep 2025-Aug 2026) will use only 11 data points since the Oct 2025 CPI-U is apparently not going to be reported?

Happy Thanksgiving! Jim

Jim says

Sorry, missed previous comments

Paco says

I disagree with the statement that “The government pays the remaining 75%.”(of medicare costs).

I paid 1.45% of my wages and my employer matched 1.45% so 2.9% of my wages were taxed for Medicare over 40+ years of working. Some high income earners also pay 0.9% more so 3.8% total.

The Government does not really “pay” for anything in society- as they are merely redistributing taxes collected from citizens and corporations.

Jeff Enders says

This link explains how Medicare is funded.

https://www.medicare.gov/about-us/how-is-medicare-funded

There has been general agreement (see prior posts) that this forum is not a political sounding board for opinions.

John F says

Does anyone have the Joint tax Return estimated IRMMA brackets for 2025 and 2026 that show the 0% and 3% inflation numbers? The final brackets are shown above but I was curious how they compared to the estimates that Harry provided.

Harry Sit says

The Internet Archive’s Wayback Machine takes historical snapshots of this page from time to time.

December 2024, with projections for 2026: https://web.archive.org/web/20241223192814/https://thefinancebuff.com/medicare-irmaa-income-brackets.html

October 2023, with projections for 2025: https://web.archive.org/web/20231028020813/https://thefinancebuff.com/medicare-irmaa-income-brackets.html

John F says

Thanks Harry

John Magill says

I am trying to gain clarification on this question. It concerns the details of the MAGI calculation. Most people describe MAGI by starting with the AGI, then adding Tax-Exempt Interest, 50% Social Security, etc. etc. My question about this is, since AGI already INCLUDES the taxable Social Security amount, isn’t the correct treatment of this to REDUCE one’s Line 11 AGI by the Line 6b taxable Social Security amount before applying the other rules? I am trying to forecast my IRMAA risk and want to make sure I am doing this calculation correctly. Thanks

Jeff Enders says

it’s neither. MAGI is simply Line 11 plus Line 2a. No other adjustments are necesssary.

https://secure.ssa.gov/poms.nsf/lnx/0601101010

Go back to the top of this website and under the section titled “MAGI” the calculation is also so described.

Lou says

I would appreciate if Harry or anyone else who is good with these numbers can answer this question. I am trying to figure out my MAGI for 2025 and also how much of a QCD I am going to make this year. I am going to be in either the 2.0 or 2.6 IRMAA tax bracket for 2027. The threshold according to Harry’s numbers is $348,000 for 2% inflation and $352,000 for 3% inflation. My question is what would be the MAGI if inflation is 2.5%? Would it be $350,000 (split the difference) or something else? Thank you in advance for whatever help I can get in answering this question.

Tom P says

John, right now we have 1 data point for 2027; we’ll get another 1, maybe 2 on December 18th. With the data we have I’m showing $348,000, which to me would be a safe number. I’m not sure why you need to cut it so close, but that’s up to you to decide.

Terry B says

At 2.5% Sep 2025 to Aug 2026 inflation you’re at $350k. You hit $350k at just a little over 2.0%. Even so, I agree with Tom P – Not a lot of incentive to risk going over the cliff for such a small incremental conversion/distribution.

Lou says

Terry and Tom, the reason why it matters is because the only real way to control my MAGI for 2025 (this late in the year) is through my QCD. However, if the MAGI cutoff is $352,000 , then the QCD would be at an amount so the savings in my IRMAA payments would be greater than the after tax payment to the charity. Anything lower than $352,000 and I am losing money. The only real way this works is if the MAGI threshold is $352,000 or higher. The IRMAA cliff is causing this problem unfortunately.

Terry is saying 2.5% inflation results in a $350,000 threshold while Tom is saying $348,000. I could see maybe making the QCD if the IRMAA threshold is $350,000, however definitely not at $348,000. I was hoping 2.5% inflation would result in a $352,000 threshold. Maybe Harry could offer his estimate at 2.5%.

Lou says

Last question: what is the lowest inflation number we can get below 3% to give us a $352,000 MAGI threshold? Terry do you know (or anyone else)?

Jeff Enders says

the methology has a rounding factor, so it is possible that changes in inflation assumptions do not change the result.

While I understand the tradeoff you are stating between a higher QCD and IRMAA, I beleive the others (and I will agree with them) are suggesting there is a risk / reward tradeoff. If you are so tight to the cutoff and inflation magically drops dramatically between now and August, you are sunk. Remember, the 2027 IRMAA tranches are not cast in stone until after the August 2026 CPI is released.

different expected inflation rates from October, 2025 to August, 2026:

at 1.75%, I get $175,346 which is rounded to $175,000 and then doubled to $350,000

at 2.00%, I get $175,547 which is rounded to $176,000 and then doubled to $352,000

at 2.25%, I get $175,749 which is rounded to $176,000 and then doubled to $352,000

at 2.50%, I get $175,952 which is rounded to $176,000 and then doubled to $352,000

at 2.75%, I get $176,153 which is rounded to $176,000 and then doubled to $352,000

at 3.00%, I get $176,356 which is rounded to $176,000 and then doubled to $352,000

does that help?

Lou says

Thanks, Jeff. So you differ from Terry who says 2.5% gets you $350,000. You’re saying it is $352,000 all the way down to 2%. I am not sure I am understanding what you are advising however. Are you saying I should adjust the QCD to go below $350,000 even though that would lose me money. Can you explain in greater detail what you mean?

Terry B says

This is the formula…

2027 Threshold = 2019 Threshold x Avg CPI-U (Sep 2025 – Aug 2026) / Avg CPI-U (Sep 2017 to Aug 2018), rounded to nearest $1000

2019 Threshold = 133.5K (single filer, Tier 3 – 2.6 multiple)

CPI-U (Sep 2017 – Aug 2018) = 249.280

CPI-U (Sep 2024 – Aug 2025) = 319.205 (already known)

CPI-U (Sep 2025 – Aug 2026) estimated at 2.5% above known CPI-U (Sep 2024 – Aug 2025) = 1.025 x 319.205 = 327.185

Therefore, 2027 Threshold = 133.5k x 327.185 / 249.28 = 175k

For MFJ, $175k x 2 = $350k

Vary your inflation assumption to test threshold breakpoints.

Terry B says

(I meant to post this to Lou’s thread)

One thing that causes a lot of conflicting results is the inflation basis assumption. Is your inflation assumption go-forward from now, for the calendar year, or for the calculation basis year (Sep to Aug)? It makes a difference, so if we’re trying to be precise with thresholds, we need to be precise in what we mean wrt inflation.

Lou says

Terry, I am assuming the same time frame that Harry uses in his calculations. This is very confusing since you and Jeff are disagreeing with your calculations. Any reason why you two are disagreeing? It would be interesting to see what Harry has to say.

Jeff Enders says

Terry B:

I follow you and agree with you through this point:

CPI-U (Sep 2024 – Aug 2025) = 319.205 (already known)

However, the next part is not accurate. Look at Harry’s curved chart at the top of this website and the impact of one year to the next. You can not simply increase 319.205 by 2.5% as the prescribed methodology takes the average of one year over the average of the prior year. 319.205 is the average of the prior year.

A 2.5% inflation rate over the next 11 months would mean that year over year, the average for the next year is 328.548 which is 2.93% (and not 2.5%) higher. That is why our results vary.

I stand by my calculations.

Lou says

Terry, if you used the same time frame as Jeff and Harry (Oct 2025 to August 2026) would your numbers be the same as Jeff? $352,000 at 2%.

Lou says

Or $352,000 at 2.5%? Jeff seems pretty sure his numbers are accurate.

Terry B says

Yes, if you use my formula with Jeff’s inflation basis, we get the same number. Jeff’s calculation applies an annualized inflation rate of 2.5% to the next 11 months from Sep 2025. If you do that, you do indeed get a $352k threshold. I applied a 2.5% inflation rate to the average annual CPI-U of Aug 2024-Sep 2025, essentially an annualized rate of 2.5% from Aug 2025. If you do that you get $350k. Annualized inflation for the single month of Sep 2025 was 3.0%, which gave Jeff a higher number for the formula input variable of average CPI-U Sep 2025-Aug 2026. You can see how sensitive the threshold calculation is to your inflation assumption. As Jeff says, this is a consequence of the rounding function which introduces breakpoints into the results.

I prefer not to use the go-forward inflation numbers because a threshold inflation rate posted today will be obsolete when someone sees the post two months from now after updated monthly actuals are published. The important thing to remember is to estimate your expected 12-month average CPI-U (non-seasonally adjusted) for the period Aug 2025 to Sep 2026. This is the input variable required by the CMS calculation.

Lou says

I know this is an exercise in futility but any quesses what you guys think the inflation rate is going forward from Oct 2025 to August 206. Any reputable forecasting sites on the internet that try to estimate it based on reasonable assumptions?

Terry B says

Your inflation assumption is a risk based decision. You’ll need to assess the cost/ benefit of over or undershooting your target. I don’t rely on a 3rd party inflation estimates because they’re not typically being generated for this type of decision. I make very conservative assumptions regarding inflation. If you exceed the threshold by even $1, you’ll get burned with a $3k of additional IRMAA ( MFJ). For me, it’s just not worth risking that to squeeze an additional $2k into my Roth. Your calculation and risk tolerance may be different.

Lou says

I agree but my situation is dependent on how much of a QCD I should make. I have no other way to lower my MAGI. The problem is if my QCD exceeds a certain amount I end up losing money even though I saved on my IRMAA. I really can’t go below $352,000 if I want my IRMMA savings to exceed the after tax QCD. It makes no sense to lose money on a net basis just to avoid the cliff. Even at $352,000 the savings from IRMAA payments is not all the great after netting out the money I lose from making the QCD. I hate being this close to the cliff but I really have no good options other than having inflation exceed 3% next year.

Harry Sit says

Lou – We’ll have a better picture come December 18 with the November CPI. If you must make a decision today, I’d say chances are good that it’ll be $352,000 for that tier, with the caveat that people normally shouldn’t cut it that close, but it sounds like this number is important specifically to you.

Jeff Enders says

Lou – it’ll take inflation of ~3.25% for the cliff to move to $354,000.

Your risk is whether the Fed is going to tolerate inflation that high and doesn’t raise rates and your risk assets are at risk to tank even more than the few thousand dollars of IRMAA we are talking about!

Suggest thinking of this as more than a financial exercise and whether doing a QCD is a winning or losing bet.

QCDs are done to donate money to a charitable cause – because you have a heart and want to see good done in a certain area by a non-profit.

if you are that close to the IRMAA cutoff, so do the QCD and live the better life! Are you describing a 1st world problem? do you have a heart and are you a mensch? You can’t take this money with you to present at the Holy Gates. Why are you quibbling about a few thousand dollars when the mere fact your AGI is ~$350,000 suggests there is an asset base most every American would envy.

think about it. Be a “big picture” guy.

Lou says

I hear you, Jeff. I have already made my annual charitable donations this year. This QCD is in addition to what I have already done. I don’t know you have heard of this but it is now possible to set up a QCD to include a Charitable gift annuity ( CGA). You can only do this once up to $54,000 per person, and like a QCD it will reduce your MAGI and offset your RMD. It must be contributed directly from your IRA account and unlike a QCD, you will receive an annual lifetime annuity from the charity. It’s pretty interesting, however like I said it is available to the taxpayer only one time. So you got to be pretty sure you want to do it since you don’t to do it ever again.

Tom P says

Terry B, one minor correction to your posted numbers: the average CPI-U for the base period 2017-2018 is 249.280, not 249.380.

Terry B says

Tom P – you’re absolutely right. I mistyped the number in my post. Anybody know if there’s a way to edit the post so as not to mislead future viewers?

Harry Sit says

I corrected that typo in your comments.

Joe Taxpayer says

I saw your note about QCD to Charitable Annuity and find it to be pretty interesting. The numbers are too small to be useful as a big part of one’s retirement plan, but a great opportunity to give a large gift to a charity, at a very low cost. I am seeing an age 71 benefit of $3,456 per year on the $54,000 donation. A withdrawal in a high bracket would net just over $40,000 and this $3456 is over 8.6% of that number.

I pay attention to tax news, somehow I missed this.

Lou says

Jeff Enders,

On Dec 7 you said that at 2% inflation going forward, the cutoff for 2027 is $352,000 . However, after the latest CPI release in Dec, Harry changed it to $350,000 from $352,000 for 3% inflation from Dec 2025 to August 2026. Do you agree with this and are you no longer thinking the number is $352,000 at 2% inflation?

Lou says

Harry, before the release of Dec CPI, you were projecting a cutoff of $352,00 for 3% inflation in 2027. After the release, you changed it to $350,000 for 3%. Was the Dec inflation number so different that it could of caused this drop in the cutoff. Seems kind of strange. Any explanation? Are you certain that at 0% inflation from Dec 2025 to August 2026, the number is still $348,000?

Harry Sit says

The November CPI released in December showed a drop of 0.2% from the September CPI. A 3% annualized increase from September would’ve been an increase of about 0.5%. So yes, it was so different, -0.2% versus +0.5%.

A 3% forward projection depends on the starting point. When it starts from a low number, all projected numbers for the future months are also lower. If the CPI freezes at the low November number, it will be $348,000 for that tier.

Whether the November CPI was unusually low is the question. I don’t know the answer.

Jeff Enders says

Lou – based on the November CPI number, a 2% inflation rate through next August would yield IRMAA of $350,000.

Lou says

Harry, Just out of curiosity, what would the CPI have to be from Sept 2025 to August 2026 to give you a cutoff of $348,000. What would have to happen (CPI) for the entire 12 months to get a cutoff less than $348,000.

Lou says

Harry, didn’t inflation increase (not drop) 0.2% from Sept to Nov 2025?

Harry Sit says

It depends on whether you look at seasonally adjusted or unadjusted numbers. IRMAA uses unadjusted numbers.

Lou says

Harry, last question. If CPI was 0% from Sept 2025 to August 2026, would the cutoff be $348,000.

Jeff Enders says

Lou – your last question is somewhat illogical since we have data stating that inflation was not 0% from Sept – November.

if your question puts aside the fact that we have data post August, 2025 and is answered in any event, then 0% inflation from Sept 2025 – August 2026 would yield $348,000 at 0% inflation.

If I turn your question a little sideways and re-state is as “what would the inflation rate be from now until August, 2026 to yield $346,000?”, then the answer is DEFLATION of .1% would need to occur for the tranche to land at $346,000.

One of the problems here is how believable the reported November CPI and did it distort everything.

Why all the questions? You got a Roth converstion decision to make in the next few days? don’t be Icarus and fly too close to the sun!

Lou says

Jeff, I went with $348,000. If we have deflation for the first time in many, many years, then I lose. I guess I am willing to take that risk.

Terry B says

One thing that causes a lot of conflicting results is the inflation basis assumption. Is your inflation assumption go-forward from now, for the calendar year, or for the calculation basis year (Sep to Aug)? It makes a difference, so if we’re trying to be precise with thresholds, we need to be precise in what we mean wrt inflation.

Terry B says

Your inflation assumption is a risk based decision. You’ll need to assess the cost/ benefit of over or undershooting your target. I don’t rely on a 3rd party inflation estimates because they’re not typically being generated for this type of decision. I make very conservative assumptions regarding inflation. If you exceed the threshold by even $1, you’ll get burned with a $3k of additional IRMAA ( MFJ). For me, it’s just not worth risking that to squeeze an additional $2k into my Roth. Your calculation and risk tolerance may be different.

Lou says

I agree but my situation is dependent on how much of a QCD I should make. I have no other way to lower my MAGI. The problem is if my QCD exceeds a certain amount I end up losing money even though I saved on my IRMAA. I really can’t go below $352,000 if I want my IRMMA savings to exceed the after tax QCD. It makes no sense to lose money on a net basis just to avoid the cliff. Even at $352,000 the savings from IRMAA payments is not all the great after netting out the money I lose from making the QCD. I hate being this close to the cliff but I really have no good options other than having inflation exceed 3% next year.

Mike says

Lou, I’m in the same boat and will never get our of it. With the IRA’s fairly large and our ages advancing every year our RMD grow each year . Right now We’re at the 2x bracket. Just using the $202 premium, plus the $38 Part D average premium we’re looking at an additional $2880 each in IIRMA, or $5760. To get below the 0% inflation limit (I try to avoid risk) I have to reduce our MAGI by $60,000+ in the next 23 days. I don’t mind and we do give to charities of our interests but $60,000 to save $5760 makes no sense unless you think you must give away your money until you have no more than the the average Joe. I am not a Saint. And I want to make sure that when we need to go to Long Term Care that I will maintain our current standard of living. I fully understand the other view on the joy of QCD’s.

Liftlock says

Taxpayers having difficulty staying within a particular IRMAA bracket ceiling may want to consider targeting a higher IRMAA bracket ceiling as means to avoid or delay the future point in time when higher IRMAA surcharges and marginal tax rates may permanently apply. It is quite common for surviving spouses to have more of their income taxed at higher marginal single rates following the death of a spouse.

$394,600 is the top of the 24% taxable ordinary income bracket for joint filers in 2025. The 32% marginal tax rate starts to apply to taxable ordinary income above that.

Adding a combined standard deduction of $34,700 ($31,500 + $3,200 senior) means senior joint filers can have a maximum of $429,300 (394,600 + $34,700) of gross ordinary income taxed at 24% marginal rates before the income above that is taxed at 32% marginal rates.

The $429,300 gross ordinary income ceiling for 2025 excludes income taxed at special rates (e.g. long-term capital gains and qualified dividends) and tax-exempt interest which need to be included in MAGI calculations for Medicare IRMAA.

RobI says

Mike. Looking at the incremental increases in IRMAA between band and adding 5% for next years premiums I get the following deltas

Moving from 1-4x to 2.0x – $1207 per person extra

Moving from 2.0x to 2.6x – $1822 per person extra

Moving from 2.6x to 3.2x – $1822 per person extra

Not sure how you came up with ~$2800 incremental IRMAA

Gary says

Mike, you may not be aware, but it seems like nursing home and assisted living costs are tax deductible (above the 7.5% exemption). So if/when these costs kick in, they could be used to offset large IRA withdrawals to fund them. Just another consideration when doing your financial planning (e.g. maybe not Roth convert 100% of your IRAs and then have large tax deductions after that ?)

Paul says

Also, besides QCDs, people wanting to reduxce MAGI might look at QLAC (I know, horrors–but ck out this type of annuity).

Mike says

Gary, Yes, I did know that but I was just interested in looking at the current year and what I would spend on the QCD versus what I would save.

Liflock, to continue, I used the base premium of today versus next year in the 2x level and being married, and filing jointly, we each would be paying at least $202 more in 2027 (this is close enough to make my point without guessing what the actual premium might be then). So $202×2, plus $38 (Part D average premium used my IIRMA) x2 = 404+76 = 480. Times 12 = $5760. I should have subtracted the base premiums. So $5760 minus $2880 lowers my actual increased IIRMA cost to $2880. That makes a $60,000+ QCD to avoid that extra $2880 even worse.

Lou says

I just made a charitable gift annuity donation from my IRA account. The economics was just too good to pass up. By doing it, I lowered my RMD by the amount of the savings, thereby giving me a tax savings of 37% (federal and Ca state). I also avoided a $3,600 IRMAA surtax and to top it off, I am going to receive a 7.5% annual return on the donation for the rest of my life. If you take into account the tax savings of the donation, the IRMAA savings and the 7.5% return, the payback or breakeven is less than 5 years. In addition to all of that , I was able to support a worthy non-profit .

The Wizard says

Explain the 7.5% annual return on this donation, please.

Is this taxable as Ordinary Income to you?

Lou says

Yes, it’s taxable.

Robert H says

Type in the question “is income from a charitable annuity taxable”? in your Chrome browser and you will see an excellent answer.

GeezerGeek says

I think the answer to that question is different if the CGA is funded from an IRA.

Jeff Enders says

Tom –

No it does not. All the newly introduced changed (Senior $6000, no tax on tips, etc) do not affect AGI – Line 11 of the tax return. They are reported on Sch 1a which gets subtracted from AGI.

James says

Can I make a QCD from an inherited IRA, or only my own IRA

Jeff Enders says

James – doing a QCD is predicated on YOUR age, not whether the IRA was inherited or not. As long as you are 70.5 years old, you can do a QCD from your inherited IRA.

GeezerGeek says

I thought that the Fed would publish a quasi CPI number for October when they published the November CPI but they just left it blank. Are they going to use the November number as the October number when they calculate the IRMAA brackets?

Harry Sit says

I added a small section for how I’m dealing with the missing data.

https://thefinancebuff.com/medicare-irmaa-income-brackets.html#htoc-october-2025-cpi

Brett says

They did, 325.604. It based on some calculation I didn’t review. That number will be part of the 12 month average calculation that sets the levels for 2025 income.

Big-Pops61 says

325.604 for October is for TIPS refcpi calculations and is based on a documented formula that has existed at the Treasury for a while. It’s described and referenced here: https://www.bogleheads.org/forum/viewtopic.php?p=8564361#p8564361

I haven’t seen any documentation that anything else that is inflation indexed will be using this number for calculations.

Cheers.

Steve says

Harry:

Thanks for the IRMAA update on December 18. I use it to make final income adjustments in 2025. I appreciate your diligent work.

John Lopez says

Is it fair to assume that if my 2025 MAGI remains under $111,000 (Single: <= $111,000), I will not incur an IRMA surcharge in 2027?

Jeff Enders says

John – It is fair to assume that, as long you also assume that deflation does not kick in between now and August, 2026.

JM442123 says

GeezerGeek or anyone else that has created an IRMAA bracket inflation threshold report that would show the rate of inflation needed for a bracket limit to change.

I am interested in knowing the rate of inflation that would be required between now and August 2026 to move the 1.0 Married Joint Filers IRMAA bracket cutoff from $222,000 to $224,000. Thanks in advance for anything you are able provide.

Jeff Enders says

JM – as long as the inflation rate average exceeds 2.6%, the cutoff will be at least $224,000.

This is risk / reward – what is the cost of betting the cutoff is $224,000 and it turns out to be $222,000? if you are deciding how much of a Roth Conversion to do in these last few days of the year, ask yourself, is it worth taking the risk? or just taget $222,000 and just sleep better at night.

Nancy Memmel says

Using round numbers, the 1st IRMAA bracket will cost you ~ $100 per person X 12 months or around $ 2400 to have guessed wrong if the threshold is 222 K instead of 224 K. You’d have to have an investment return greater than 20% on that 2 K of converted money for the increase in your Roth to match the cost out of pocket.

Liftlock says

Nancy Memmel,

That’s an interesting analysis. I believe the investment return would need to be 120% ($2400 / $2000) to breakeven on the 2 K of converted money for the increase in the Roth to match the $2400 out of pocket incremental IRMAA cost. 20% looks like a typo.

Nancy Memmel says

Liftlock-

I was looking at the idea that you assumed the threshold was going to be 2 K higher than it turned out to be, and converted accordingly.

After the conversion you would have 2K in the Roth from the conversion itself, a minimum of 20% growth in the first year makes the added value in the Roth about equal to what you paid out for only the IRMAA-threshold-wiff penalty.

To analyse for break even you’d have to consider the tax cost of the conversion, also, wouldn’t you? And balance it with how many years the Roth would get to grow tax free… gets complex fast.

Jeff Enders says

Nancy – not understanding your math either……

if the cost of wiffing is $2400 of additional IRMAA charges and the amount that goes into the Roth is $2,000, where does 20% come from?

if I pay out $2400 in additional IRMAA, I would need to earn $2400 (not $400) to breakeven. The $2400 is paid out and gone. the $2000 is just moved within the IRA world and still in my posession. Apples and Oranges?

Mike says

Harry, I just accidentally hit the wrong link, the one that says not to send me any follow-up comments for this thread. How do I cancel that as I want to receive the follow-ups.

Mike says

I just retrieved from my SocSec account the letter that says what my 2026payments will be and the IIRMA numbers. After the premium increase and the Part D increase my net will be down from last year. No surprise. But when I retrieved my wife’s data it did not show the same letter just a notice of what her numbers would be and, real strange, did not show any Part D add on. Any idea why this might have occurred? I’m sure that’s an error and I can wait until next week to see what her SS is but I’m not used to SS making a mistake.

RobI says

My part D IRMAA is not being deducted from SS income in 2026. I got a letter about this. It’s not yet clear how I can pay as the Medicare site has no outstanding bills to pay . I assume this will get sorted soon.

MikeG says

My wife also did not receive document that indicates Part D RMAA like I did. Talked to local SS Office and they indicated records show that IRMAA will be deducted. They sent us a letter with all correct numbers and said the “official” letter might not be posted til the end of December. Definitely strange!

LiftLock says

Mike and Robl,

I have gone long periods of time where Social Security has deducted incorrect and different amounts for Medicare IRMAA Parts B and D premiums for my spouse and I. I have no idea why.

The first time the deduction error occurred, Medicare came along did a catch up deduction after 18 months time to claim what they were owed. The second time the error persisted for 4 years after which the deduction was corrected for the 5th year. The catch up deduction for the 4 years has not yet occurred.

I keep track what I my deductions should have been so that I know what to expect the catch up deduction to be when if and when it ever occurs.

Mike says

Jeff, Harry,

Let me explain precisely what I want to do and tell me if I am correctly understanding the IRS rules.

In March of 2025 I took enough of my RMD and had Fidelity withhold an amount equal to 110% of my 2024 actual taxes. So this year I will be getting a large refund which I will have applied to my 2025 taxes when I file them in April 2026.

I want to change that in 2026 and delay paying any taxes as well has putting off taking the full RMD until December 2026.

In 2026 I will receive Social Security and Pension income every month. I will not withhold any of it for taxes.

I will take some RMD distributions to live on every month or so. Some months I do not. I will not withhold any of it for taxes.

In December I will take the remaining RMD funds necessary. At that time I will have Fidelity withhold a % that will equal at least 100% of my estimated taxes due.

So at the end of the year I will have fully paid all my taxes through withholding. Barring winning the lottery I know within $1000 exactly what they will be and that is exactly what I have withheld.

So by December 31st I will have paid 100+% of the taxes due and all of it by Fidelity withholding it.

Am I correct that I will not have any penalty? If you think it’s safer I have no problem paying 110%, but from what I read as long as line 6 in Part 1 of 2210 is greater than line 9 I have paid my taxes due and I should be fine.

Jeff Enders says

Mike – the IRS assumes that withholdings are spread evenly over the course of the year – that is not true for estimated payments.

on Form 2210, as long as your withholdings (line 6) is within $1000 of your 2026 tax liability (line 4), there can be no penalty (line 7- STOP). There isn’t even a need to provide form 2210 (as the IRS would know from Fidelity how much the withholding were).

Steve says

Mike I just went thru some spreadsheet and matlab modelling for taxes. I’ve assumed some reasonable tax bracket & market returns.

// If you are only doing a Roth conversion (no RMD) then the optimal strategy is to do the conversion on Jan1, and pay equal estimated taxes of 22.5% (90%/4) of your total tax bill at each quarterly date, then the remaining 10% on Apr15 of the following year. This means your conversion grows in the untaxable Roth all year, and you pay your taxes at the last possible moment to avoid penalties – so you keep the partial-year gain on that tax-money. You will likely have to fill out the 2210 partIII justify this.

// If you are doing an RMD with no Roth Conversion, then the optimal time to take the RMD is Dec31 !! In this strategy you avoid a penalty and delay tax payment by making no estimated payments and instead *withhold* at least 90% of your total taxes due from the RMD on Dec31. This method has the advantage of being able to estimate your taxes pretty accurately on Dec31, keeping your tax money all year, and only needing the trivial (no) penalty calculation of 2210-partI.

// If you are doing an RMD and a Roth Convesrion in the same year, the Federal rules require that you take the RMD first. Unless your Conversion is about 2.5 times larger than the RMD, then the late-RMD strategy is best. So you take the RMD and the Conversion on Dec31 and *withhold* 90% of total taxes due from the RMD.

It’s perhaps a loophole of sorts, but you can use this late-RMD-withholding strategy to keep your tax money growing in your accounts much longer, while still avoiding penalties.

hope that helps

Lou says

Steve, you should do the opposite of your strategy if you think the stock market is going down next year.

Steve says

You are correct. Withholding is counted as though it was spread over the year. You can make one adequate withholding on December 31st and have no penalty.

Ideally you’d pay 90% of total taxes due (enough so 2210-line 9 is a “NO”) then gain interest on the other 10% till April 15th. Whether the interest on 10% of taxes for 3.5 months is worth the hassle is your decision.

Steve says

Lou – yes! If returns are negative for the year, then the best strategy seems to be to RMD&Conv on Jan1 and pay taxes early. Assuming the market will have a negative return falls outside of my “reasonable assumptions”. ;^)

Jeff Enders says

I never believed in “timing the market” when I originally contributed and invested in my IRAs; I do not believe in “timing the market” when doing Roth Conversions (or RMDs) either. Rather, I do 1/4 of my annual Roth conversions on the first day of each quarter – regardless of market conditions.

Just a thought.

Steve says

Jeff, you’re not timing any market – you are paying your taxes later, so keeping more of your money working for you. Put it in bonds if you want – you still win by paying later. I estimate this will save me ~$7000 over the worst strategy for 2026 when I will pay a staggering 6 figure tax bill. Maybe that’s ignorable money to you, not me.

Jeff Enders says

Steve:

I wonder if the fallacy with the argument is the assumption that stocks rise smoothly and religiously.

1) Let’s say we each own 100,000 shares of the same stock at $10 / share in a Trad IRA. We both open Roths with objective of converting $200,000 by year’s end. We are in the same tax brackets.

2) You convert on 12/31. I convert $50k per quarter.

3) Stock price drops to $8 by 3/31 and then recovers over the rest of the year: $9 on 6/30, $10 on 9/30 and $11 on 12.31.

4) On 12/31, you have $900k in Trad and $200k in Roth. I have $865k in Trad and $235k in Roth. Same $1.1 million in total. (My trad balance is less because I was able to convert more shares at a lower price).

5) Am better off in the long run as my remaining tax liability on the Trad balance is less than yours’, even though we converted the same amount of dollars and paid the same amount in tax this year?

6) Is the interest you earned by delaying the tax payments better than the pure tax savings I would achieve?

7) how is more of my money working for me?

Mike says

Jeff, – Thanks. That’s what I thought.

Now I need to call SS and find out why my wife hasn’t gotten her letter on next years SS payments and hopefully, as Liftlock noted he had to, I won’t have to pay them her Part D surcharge years from today.

Mike says

Nancy, Lifelock, Jeff,

Assume the tax on moving $2000 from an IRA to a Roth (about $440 in 22% bracket) is done with funds from another account. If the Ira started with $10000 and the Roth zero then added together the total of both, IRA plus the Roth still are worth $10000 but the IRA has $8000 and the Roth $2000. But you will be out $2400 from other funds to pay the IIRMA surcharge.